Dow Just Cut Its Dividend

Here’s How You Could’ve Seen It Coming

Dow Inc. reported earnings on July 24, and the stock dropped from around $30 to $25.

Usually when I start an article like this, I’m asking is this an opportunity?

Today that isn’t the case. Today I’m asking what can we learn?

Why the price drop?

Dow’s recent earnings report was ugly:

Negative income

Negative cash flow

Falling sales

And this wasn’t a one-off.

The last several quarters all showed the same trend - shrinking revenue, shrinking margins, and red ink.

So a dividend cut shouldn’t have been a surprise.

Today we’ll learn about

Dow’s business

How things were going

Why they cut the dividend

And if investors could have seen it coming

Dow’s Business

This is an American company that makes chemicals, plastics, and other materials that go into everyday products.

Their products are used in packaging, construction materials, automotive parts, and even coatings like paints.

Dow is one of the world's leading suppliers of basic materials to many different industries around the world.

How was business going?

The short answer - not well.

Let’s look at a some highlights from the past few quarters.

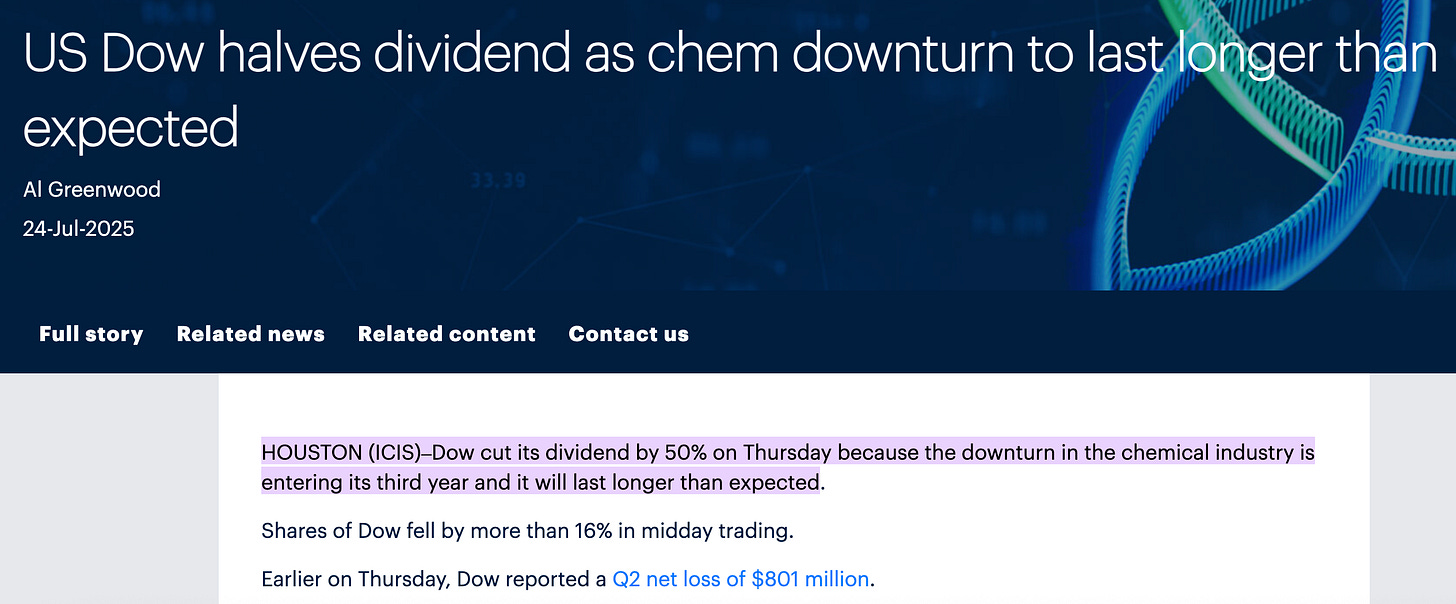

Q2 2025

Here’s the report from Q2 2025 (the most recent):

Negative income, negative EBIT (Earnings Before Interest and Taxes), negative Cash flow.

Also note that everything was lower than in Q2 2024:

Sales

Income

EBIT

EBITDA

Cash flow

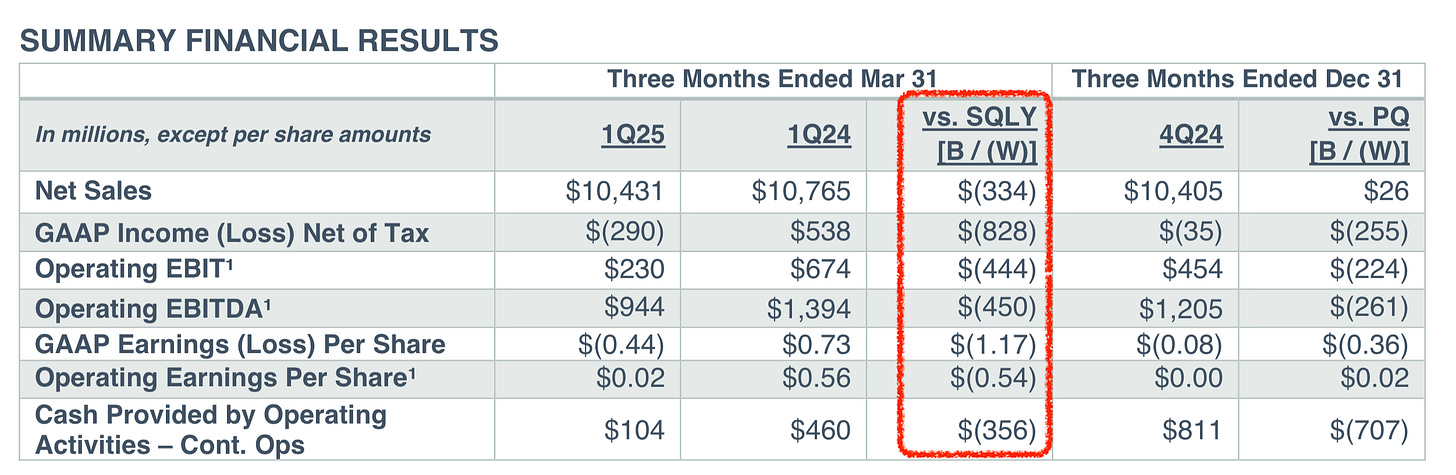

Q1 2025

A quarter before:

Negative net income again, but more importantly sales, earnings, and cash flow were all down from a year ago.

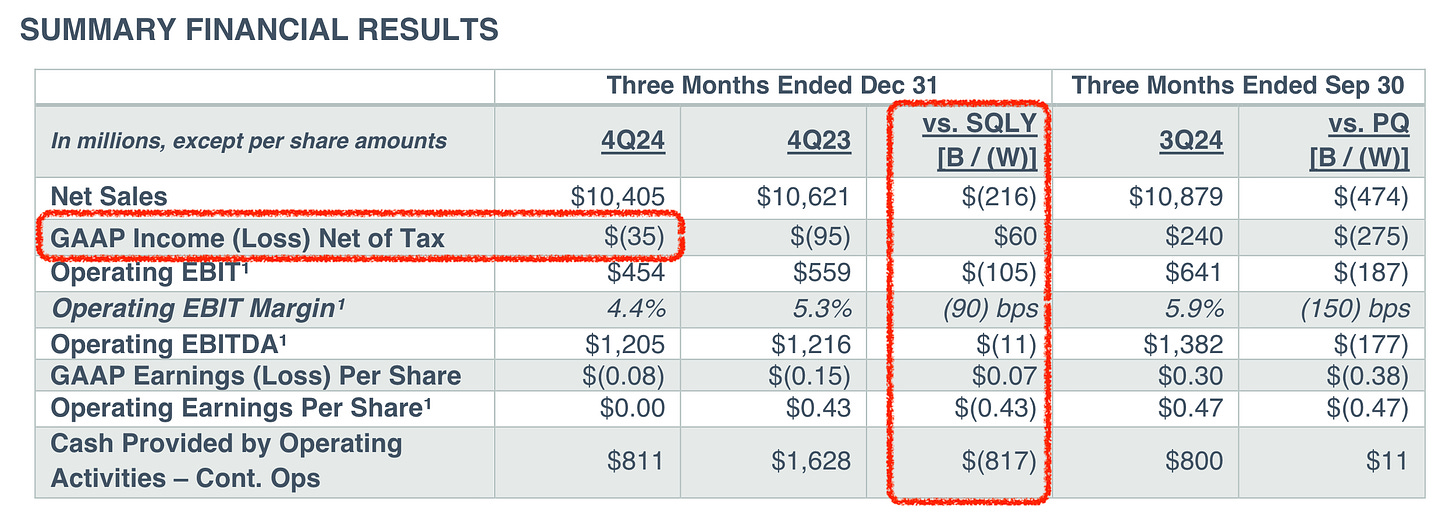

Q4 2024

Going back another quarter:

Another loss. Sales, profitability, margins, and cash flow were all still shrinking.

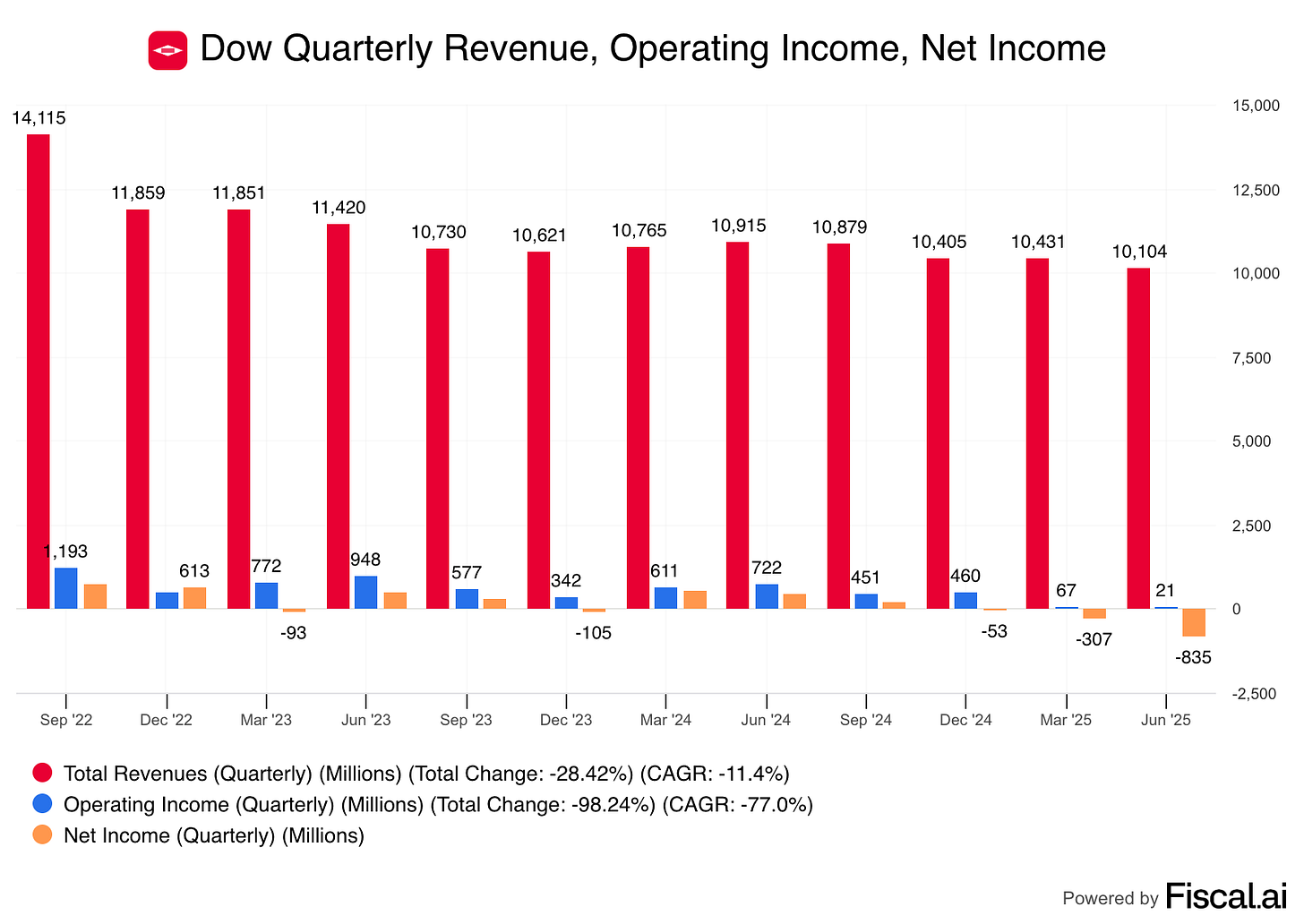

A Complete View

We can easily see this downward trend if we chart quarterly Revenue, Operating Income, and Net Income:

Why was the dividend cut?

This should be obvious - because the business was making less money.

A dividend is your share of the profit - if the profits go down, expect the dividend to follow.

Quarterly Payout Ratio

Here’s the payout ratio by quarter:

Since December 2022, Dow either lost money, or paid out more than they earned in every single quarter except for March of 2024.

That can’t go on forever - eventually the money runs out.

Could investors have seen it coming?

I hope by now you realize that if investors didn’t see the dividend cut coming, they weren’t looking.

Here’s the annual payout ratio, charted with the share price.

Dow spent 2 years (2023 and 2024) with a Payout Ratio well over 100%, and the share price stayed flat.

Investors had 2 years of declining business results and unsustainable dividend payments telling them to sell the company.

And during that time, the share price traded between $50 and $60. It didn’t drop until the dividend cut was announced.

How to avoid buying a company like Dow?

Good investing is all about finding reasons to say ‘no’ to an idea as fast as possible.

I’ve looked at Dow (briefly) before the dividend cut and I’ll show you exactly why I’ve never taken a deeper dive on it - and why it’s never been considered for our portfolio.

These images are from the Fiscal.ai overview page for Dow.

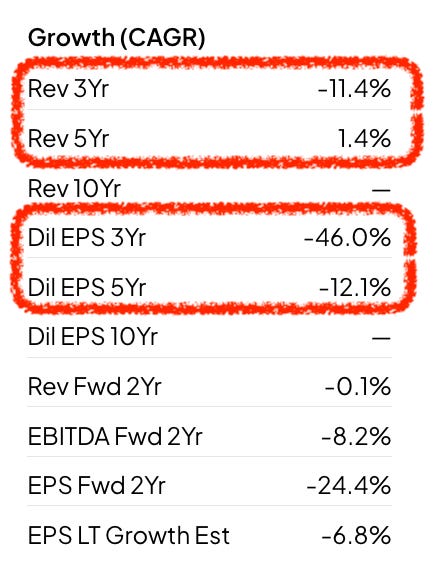

Growth

One of the first places I look is at the summary of growth.

To grow dividends, profits need to be growing too. I want to see some kind of stable trend here. Let’s see how Dow’s looks.

Negative revenue growth over the past 3 years, and growth that didn’t even keep pace with inflation over the past 5

Negative EPS growth in the past

Negative projected growth going forward in revenue and earnings

That’s enough to stop me from looking any deeper, but let’s see what else we can find.

Financial Health

The next place I usually look is the financial health section.

A strong balance sheet is important - it’s what lets companies survive tough times.

Here’s Dow’s overview:

More red flags.

EBIT/Interest of 1.2 means Dow is spending almost all of their earnings on interest

$15B in Net Debt compared to an $18B Market Cap shows us why - Dow has massive debt levels.

A bad business and a bad balance sheet. I don’t care what the dividend yield was during that time - that’s not a business I’d want to own.

Conclusion:

Why Dow Cut the Dividend—and What You Can Learn

Dow cut the dividend because the business wasn’t making money.

Revenue was shrinking, earnings were negative, and cash flow couldn’t support the payout. For years, Dow paid more than it earned.

Eventually, the math stopped working.

The key lesson for dividend investors:

A dividend is your share of a company’s profits.

If you want consistent and growing dividends, you have to own companies that are consistently profitable and well run.

Dow wasn’t. And it was obvious long before the dividend got cut.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

The chemicals market is indeed going through a rough time. Eastman Chemical got whacked down recently and LydondellBassell can't seem to catch a break either.

The goofy tariffs and subsequent global slowdown of trade has put a lot of pressure on these commodities. ☹️ On the plus side, these companies are down, cheap, and out of favor. There could be some bargains here. Those that survive this chaos may have steep rebounds in a few years!