ETF Update: 5% Yield. Stronger Balance Sheets.

And What It Means for Global Income Investors

Our international dividend ETF went through its annual reshuffling - and the changes reveal interesting opportunities for global investors.

If you're only focused on U.S. stocks, you're missing out on a world of opportunity.

The ETF is based on one of my favorite international dividend indexes.

And when it goes through what’s called a reconstitution, it drops weak links. Adds stronger companies. And rebalances based on cold, hard numbers.

This year?

The moves were powerful.

And they’re telling us one thing:

Smart money is going international.

📈 What Changed

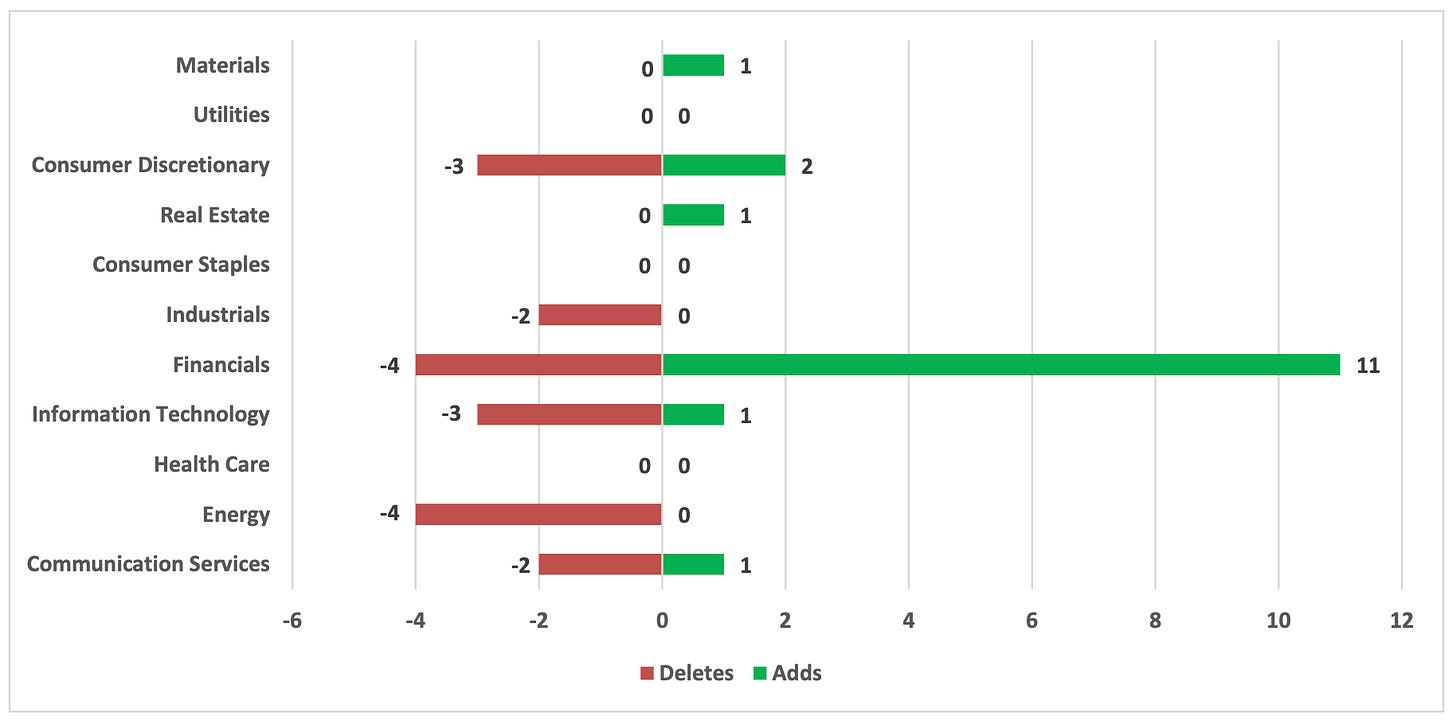

In total, there were 35 moves:

✅ 17 new companies added

❌ 18 companies removed

🔁 13.3% turnover

Portfolio Fundamentals Improved

From a fundamental perspective, the reconstitution strengthened the portfolio:

Dividend yield increased from 4.98% to 5.13%

Free cash flow to debt jumped dramatically from 247.81% to 338.59%

Return on equity improved from 19.43% to 20.10%

Dividend growth rate increased from 6.68% to 6.92%

In short: better yield, stronger balance sheets, and more robust dividend growth. That's a winning combination.

It’s not a reach for yield at any cost. It’s precision investing.

And it’s moving into some of the best international businesses most U.S. investors have never heard of.

Sector Shifts

The reconstitution altered the index’s sector allocation:

Sectors Gaining Weight:

Materials: +0.9%

Utilities: +0.8%

Consumer Discretionary: +0.5%

Real Estate: +0.3%

Consumer Staples: +0.3%

Sectors Losing Weight:

Communication Services: -1.5%

Energy: -0.5%

Health Care: -0.5%

This suggests a shift toward companies with hard assets and stable consumer demand - potentially a more defensive positioning.

Geographic Shifts

Perhaps most interesting were the changes in country exposure:

Countries Gaining Weight:

France: +11.9%

Italy: +2.4%

Countries Losing Weight:

Taiwan: -4.5%

Germany: -3.6%

Japan: -3.0%

Why International Diversification Matters

These reconstitution changes underscore several key benefits of international investing:

1. Higher Yield Potential

Our ETF now offers a dividend yield of 5.13%, significantly higher than most U.S. dividend ETFs. International markets can provide more generous dividend policies compared to U.S. companies, which tend to favor share buybacks.

2. Economic Cycle Diversification

Different economies operate on distinct cycles. When the U.S. economy slows, other regions might be accelerating. By investing internationally, you're not tying your entire portfolio to one economic cycle.

3. Currency Diversification

The U.S. dollar fluctuates in value against other currencies. International investments can provide a hedge against dollar weakness, potentially boosting returns when converted back to dollars.

4. Exposure to Different Market Structures

Many international markets have different sector compositions than the U.S. While technology dominates U.S. indices, international markets often have stronger representation in financials, industrials, and materials - providing natural portfolio diversification.

5. Access to Emerging Market Growth

Developing economies often grow faster than mature ones. Investing internationally provides exposure to emerging markets like Brazil, Indonesia, and Thailand, which may experience higher long-term growth rates than developed markets.

Interesting Companies to Explore

Let's review how the index is constructed, and a few of the interesting companies added to the ETF: