European Magic Formula Update: 6.1% Yield, 97 Stocks

👋 Howdy Partner,

Back in June, I ran Joel Greenblatt’s Magic Formula on 4,000 European stocks.

Only 77 made the cut.

I just ran the same screen again, and this time, 97 companies passed.

So what changed?

The short answer: dividends went higher, ROCE went a bit lower.

The average dividend yield is now 6.1% (up from 5.3%)

Earnings yield fell slightly from 9.6% to 9.25%

Return on capital (ROCE) dropped from 6.1% to 5.3%

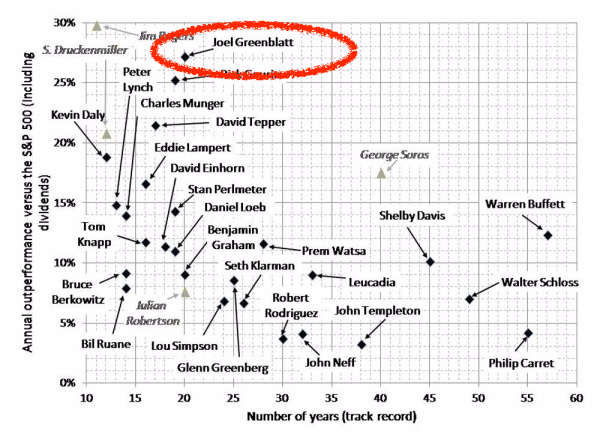

A Refresher on Greenblatt and the Magic Formula

Joel Greenblatt ran a hedge fund that delivered 40%+ annual returns for over a decade.

His “Little Book That Beats the Market” contained a strategy that beat the market using just two metrics: Return on Capital and Earnings Yield.

He called it the ‘Magic Formula’.

The Magic Formula

The screen looks for undervalued stocks with high returns on capital. Here’s a simple breakdown of how it works:

Rank by Earnings Yield: Calculate the earnings yield of a company (this is the inverse of the P/E ratio). Rank stocks based on this yield; higher yields are better.

Rank by Return on Capital: Calculate the return on capital. Rank stocks again; higher returns are preferred.

Combine Rankings: Add the two rankings for each stock. The goal is to find stocks that score well in both categories.

My Screener Criteria

Here’s how I set up the Fiscal.ai screener:

Exchanges: The Euronext in Paris, Brussels, Amsterdam, and Lisbon, as well as the London Stock Exchange

5-yr Average ROCE: >8% I used a 5-year average to find companies with consistently high returns. I chose ROCE because it captures both debt and equity - we want companies that invest all of their capital wisely

Earnings Yield: >6%

Market Cap: > $1 billion

Dividend Yield: >2%

That gives us a list of companies, but it’s NOT the Magic Formula.

To get that, we need to move the results of the screener to a spreadsheet.

There are a few steps we still need to do:

Sort them by Earnings Yield, highest to lowest, and give them a number - highest Earnings Yield get #1.

Sort them by ROCE, again highest to lowest, with the highest getting #1

Add the ranks

Sort them by combined rank, lowest to highest

NOW we have the Magic Formula.

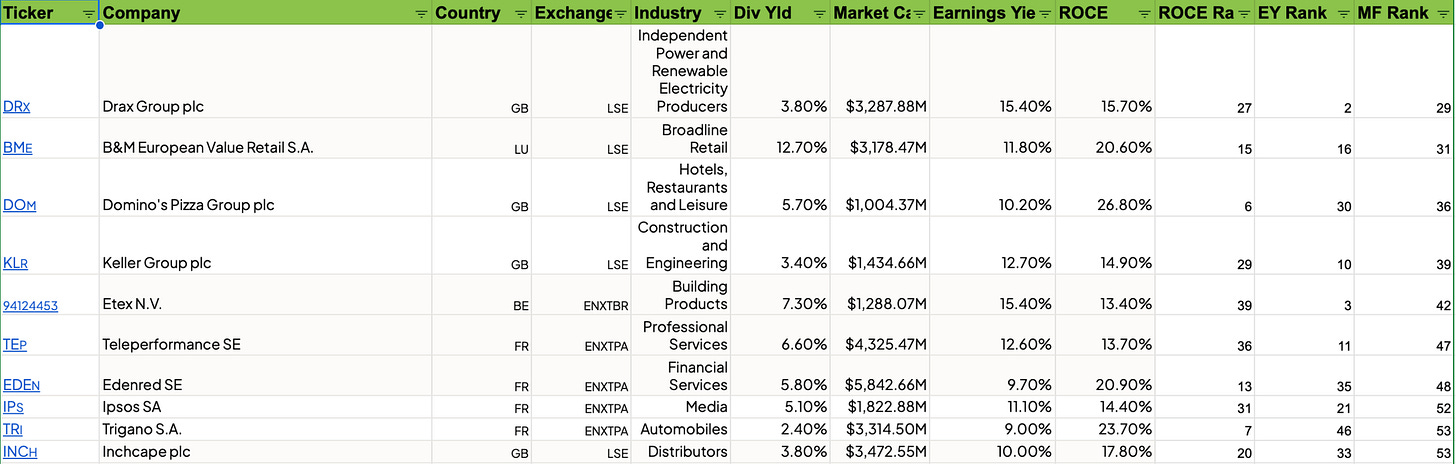

The Top 10

Here are the top 10 results from the latest Magic Formula Europe screen:

What Changed

Some highlights of what changed since June:

Centrica - June’s #1 pick, is now off the list.

Drax Group jumped from #10 all the way to #1.

Rio Tinto slipped from #2 to #11.

Domino’s Pizza Group (DOM not DPZ) climbed from #14 to #3.

Simple, rules-based screens can shift fast, especially when earnings and valuations move.

If you want the whole list, you can get it here:

Some Interesting Companies

Instead of buying the top 10 or 20 and holding them for a year as Greenblatt suggests, we’re using this as a screen to find potentially interesting companies to add to our portfolio.

Here are a few:

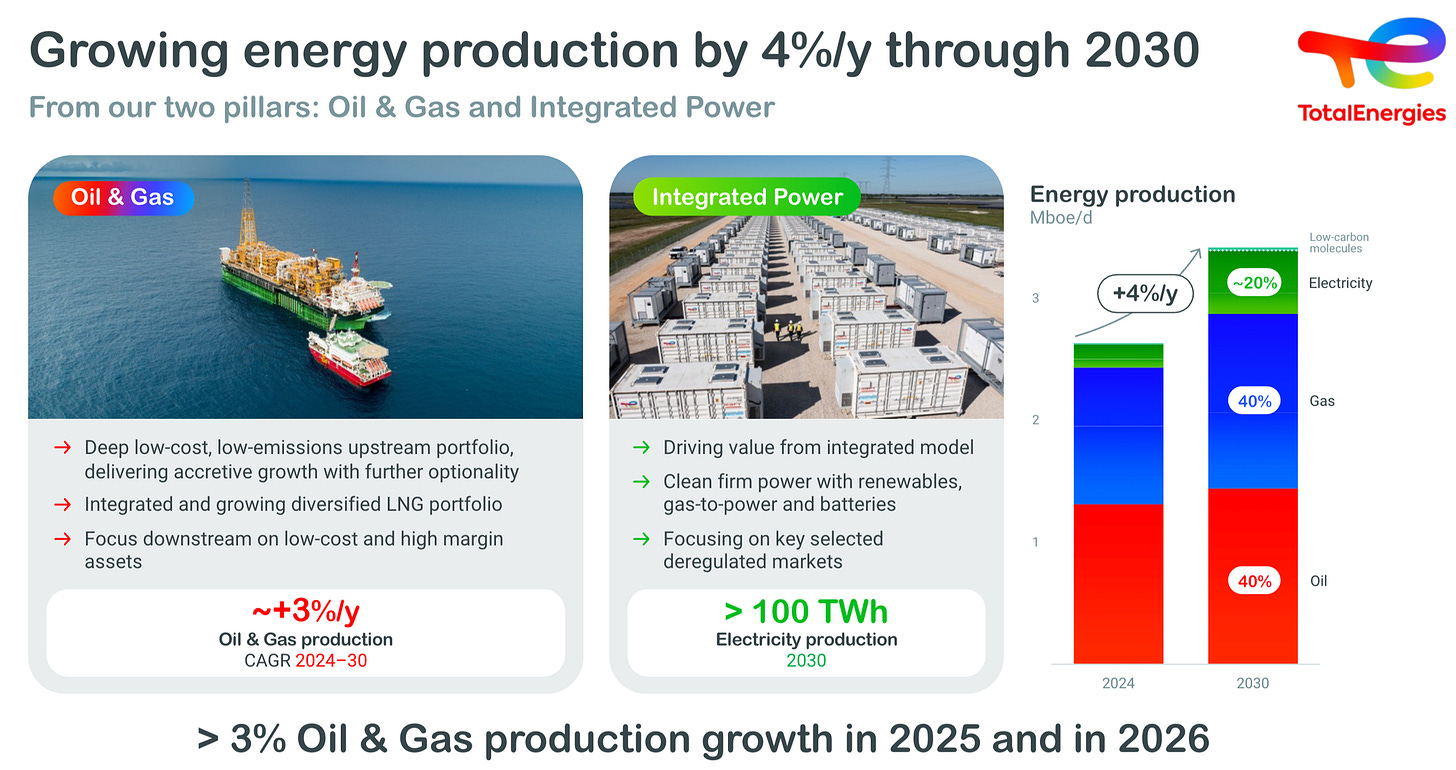

TotalEnergies

How the company makes money

TotalEnergies is a global energy company involved in oil and gas production, refining, and selling fuel, as well as from its growing businesses in renewable energy and electricity.

Why it might be interesting

It has strong cash flow, a solid dividend, and is investing heavily in clean energy. The payout ratio is reasonable, and the company has stayed profitable even during energy price swings.

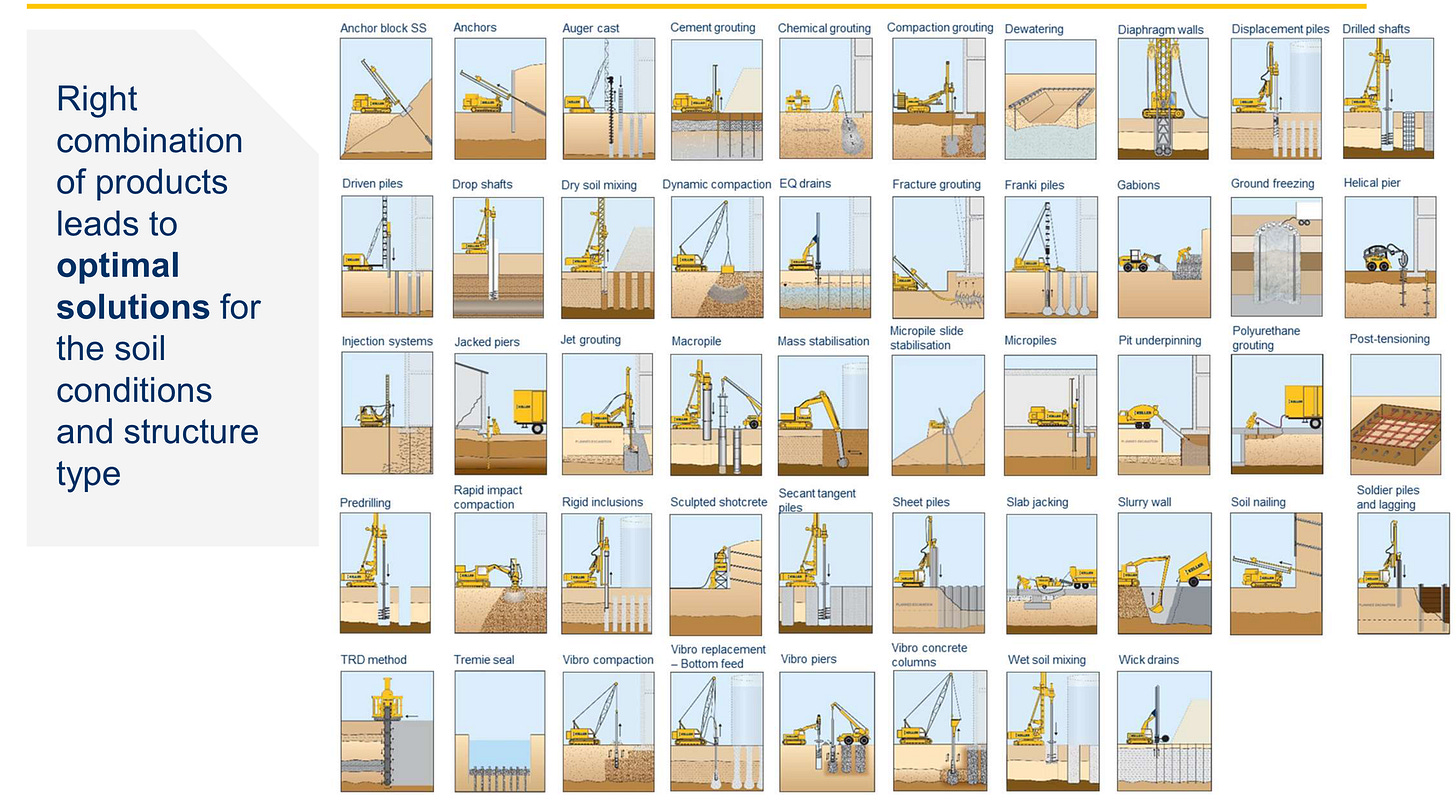

Keller Group

How the company makes money

Keller provides engineering and construction services, focusing on ground improvement and foundation work for large infrastructure and building projects.

Why it might be interesting

It’s a leader in a niche field with high barriers to entry. Earnings have been rising, debt is under control, and the company pays a steady dividend backed by consistent demand for infrastructure work.

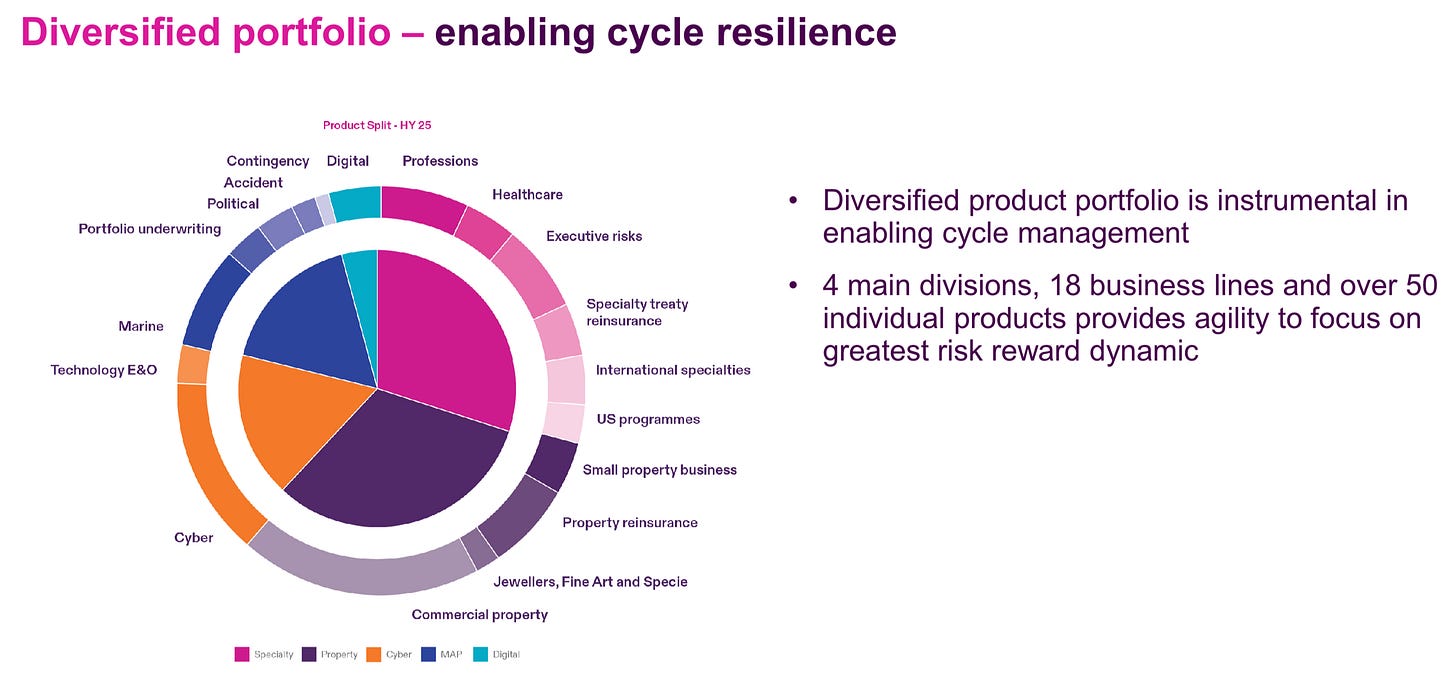

Beazley plc

How the company makes money

Beazley is a specialist insurance company. It makes money by underwriting insurance and reinsurance in areas like cyber, property, and marine risk.

Why it might be interesting

Insurance pricing has improved, and Beazley is known for strong underwriting discipline. It’s very profitable and recently boosted its dividend and share buybacks.

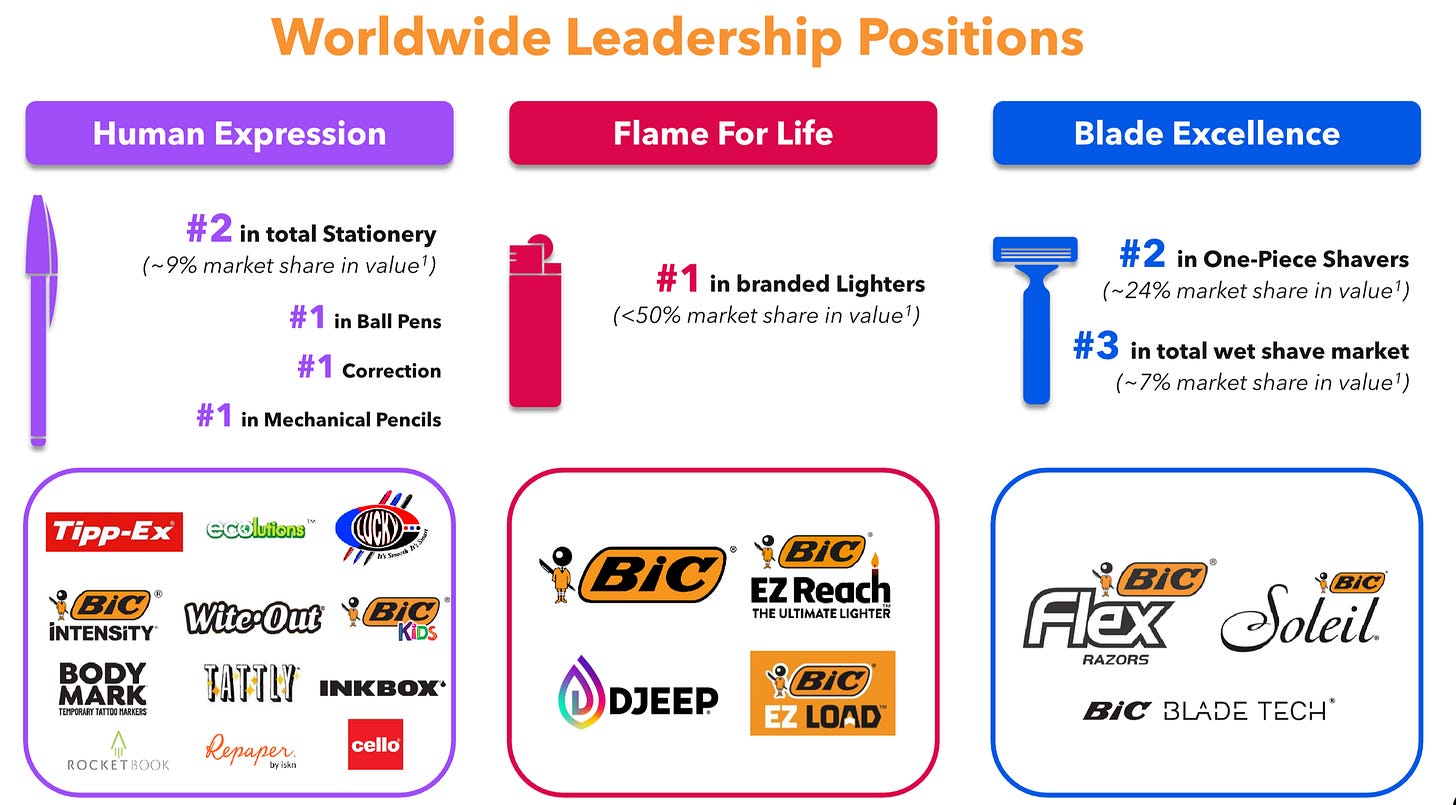

Société BIC

How the company makes money

BIC makes everyday consumer products like their pens, lighters, and razors. It earns money from selling these items globally through retailers and distributors.

Why it might be interesting

It’s a simple, well-known business with steady cash flow and low debt. The dividend yield is strong, and the company has been improving margins through cost control and automation.

Gaztransport & Technigaz (GTT)

How the company makes money

GTT designs and licenses membrane containment systems used to transport and store liquefied natural gas (LNG). It earns money mainly from licensing fees and engineering services.

Why it might be interesting

It’s a high-margin, capital-light business with strong demand for LNG infrastructure. The company pays a generous dividend and benefits from global energy transition trends.

Sodexo

How the company makes money

Sodexo provides food services and facilities management to businesses, schools, hospitals, and government clients around the world.

Why it might be interesting

It has stable, recurring revenue, margins are improving, debt is reasonable, and the company has a long history of paying reliable dividends.

Conclusion

I’ll close this with the same Peter Lynch quote I closed the last one with:

“The person that turns over the most rocks wins the game”

The more companies you look at, the better your chances of finding a good one.

Using a stock screener like the one at fiscal.ai helps a lot.

We cut 4,000 companies down to 97 in just a few minutes.

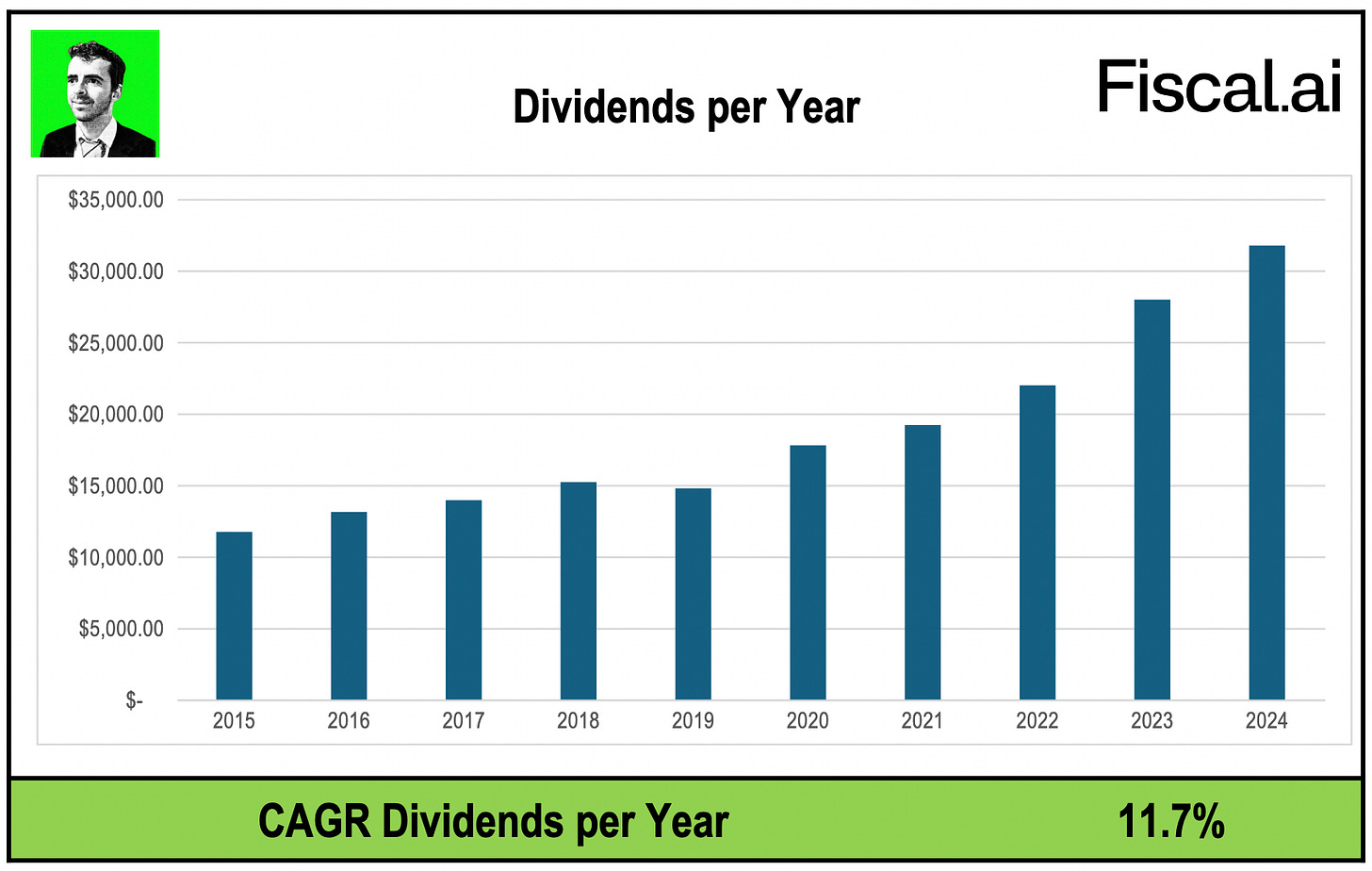

Compounding Dividends 2.0

As you might already know, something big is coming up.

I’m so excited, I can barely keep it in.

On November 4th, Compounding Dividends 2.0 will launch

This means I’ll be diving deeper, moving faster, and looking into more great dividend payers like these ones.

But that’s not all… Compounding Dividends 2.0 is coming with:

🌱 A brand-new platform full of new tools

💸 Exclusive insight into My Dividend Portfolio

📈 Every Wednesday a new stock idea during the entire month of November

🏗 Our updated watchlist full of new investment ideas

🚀 A vibrant community full of dividend ideas

📝 The dividend investor toolkit which teaches you how to select dividend stocks yourself

📄 PDF with one-pagers for all stocks

📘 Special report: 3 Dividend Stocks to Buy

🎁 And much more!

We don’t buy dividend stocks just for the yield.

The dividend also keeps growing every single year.

More income, without more effort.

Join the VIP list to make sure you don’t miss it.

This could be the start of something special.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.