💸 How to Get Rich (without getting lucky)

Plus my Episode with Dave from The Investing for Beginners Podcast

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ 🎧 Finding Safe Compounding Dividends

I recorded a podcast with Dave from The Investing for Beginners Podcast.

The topic of our conversation? Dividends!

Here’s what you’ll learn:

You can listen here:

Apple | Spotify | Google | Amazon | Tunein

2️⃣ How to Get Rich (without getting lucky)

You want to become wealthy?

This framework from Naval Ravikant can help you:

3️⃣ An investing quote

Markets have been turbulent recently.

This is one of my favorite quotes from Ben Graham - it reminds us that we own businesses.

What matters is how the business performs over time, not what price the market quotes for it today.

"The true investor... will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies...” - Benjamin Graham

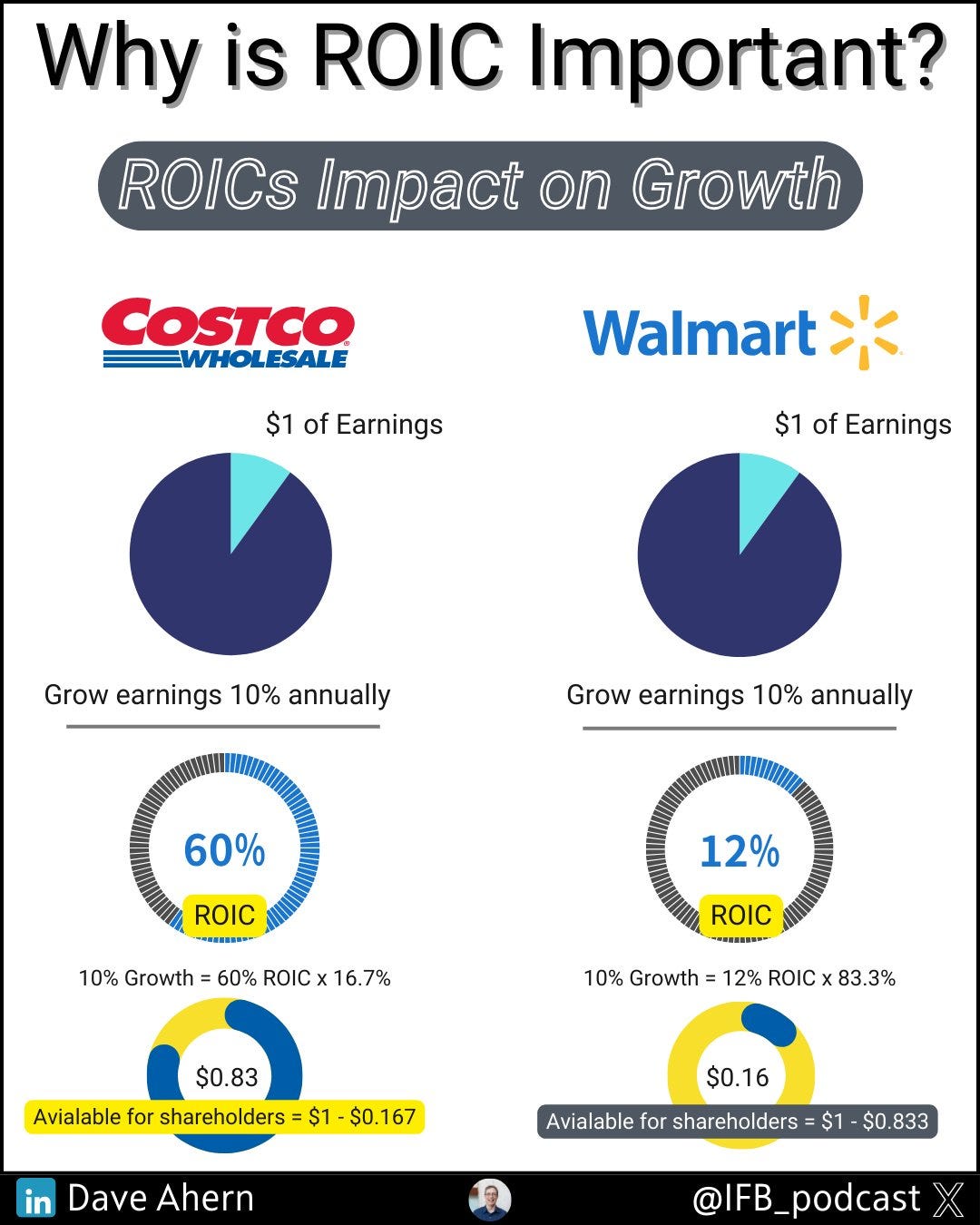

4️⃣ Why ROIC Matters

Dave from the IFB podcast did a great job showing why ROIC matters.

Using Walmart and Costco as examples, we’ll assume both earn $1 per share. Both want 10% growth.

Costco only needs to reinvest 16.7% of its profits because it earns a 60% return on every dollar it reinvests.

Walmart must reinvest 83.3% of its earnings to achieve the same 10% growth because of the lower 12% ROIC.

Costco has 83.3% of profits - 83 cents per share - available to use for dividends, buybacks, or paying off debt.

Walmart has just 16.7 cents per share for shareholders.

It’s not just about earnings. It’s about how efficiently a company turns those earnings into long-term value.

Click on the picture to read the whole thread on X.

5️⃣ Example of a dividend stock

Berkshire Hathaway just bought Constellation Brands.

They’re an alcohol company that produces and markets a diverse portfolio of beer, wine, and spirits, including popular brands like Corona and Modelo.

Profit Margin: 17.3%

Forward PE: 12.3x

Dividend Yield: 2.3%

Payout Ratio: 104.1%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data