High-Yield Secrets Most Investors Miss

23 great high-yield companies, and 5 you'd be crazy to ignore

Let me ask you a simple question.

What would you rather do: spend $50,000 or $10,000 to make $500 in annual dividends?

You’d pick the second option, of course. And that’s the power of high-yield stocks.

Today, we’re diving into these income machines: companies that pay much bigger dividends than the average stock.

Some investors think that high-yield stocks are risky, or low-quality companies.

But here’s a little secret most investors overlook…

High-yield doesn’t always mean high risk.

Companies in the top 40% of dividend yields outperform the S&P 500 most often.

The best of these companies don’t just hand out profits recklessly—they also keep plenty of cash on hand for growth.

The second quintile of high-yielders outperforms the S&P 500 just as often as the first, but their payout ratio is conservative - below 50% on average.

These can be very interesting companies

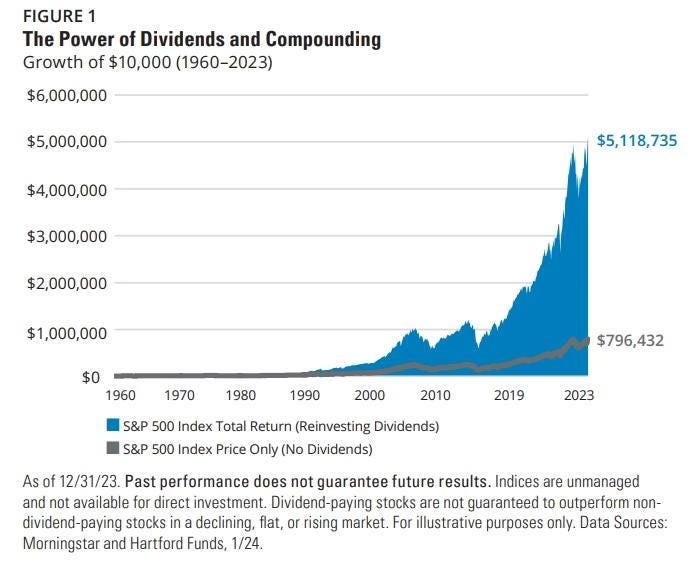

They fuel one of the most powerful forces in finance: compounding.

Reinvest those fat dividend checks, and you’ve got a snowball rolling downhill, gaining speed, and building a fortune over time.

Want proof?

Look at Altria—formerly Philip Morris.

It’s the best performing stock of the past century.

Since 1925, the company has delivered annual returns of over 16%. One single dollar invested back then is worth over $2.6 million today.

Source: Which U.S. Stocks Generated the Highest Long-Term Returns?

Crazy, right? But here’s the kicker...

Even if you’d bought just 20 years ago, that same company would have beaten the S&P 500—and your $10,000 would now be giving you almost $9,500 in yearly dividends.

All this happened with a stock price that declined.

That’s the magic of reinvesting high dividends.

In this article, I’ll show you five high-yield companies that stand out from the pack. These aren’t just stocks—they’re cash-flow machines ready to fuel your financial freedom.

Let’s dive in.

Start with a screen.

Our Investable Universe has a High-Yield bucket, but today I’m going to start with a screen using Finchat instead.

This will let me:

Narrow things down even further, to select companies with lower Payout Ratios, and good capital allocation metrics

Look for any new companies that may fit my criteria

The Criteria

5-year average ROIC: > 8%

5-year EPS CAGR: > 5%

5-year Revenue CAGR: > 4%

Dividend Yield: > 4%

Payout Ratio: < 60%

5-year DPS CAGR: > 4%

The Result?

23 companies fit all these criteria.

Some interesting facts:

Highest Yield: 14%

Highest ROIC: 42.6%

Highest DPS Growth: 82.3%

Average Dividend Yield: 5.9%

Average Payout Ratio: 41.3%

Let’s Dive In!

I started by eliminating as many companies as I could.

That’s exactly how you should approach investing. Stick to what you understand. Ignore the noise.

Most investors chase what’s hot. They buy stocks they don’t really get. They don’t think about cycles, risks, or long-term durability.

That’s how they end up losing money.

By cutting out the junk, you’re doing what the best investors do—focusing only on the highest-quality businesses. Ones you actually understand. Ones that can survive—and thrive—no matter what happens in the economy.

That’s how real wealth is built.

For me this includes:

The mining companies on the list - too cyclical

The pharmaceutical companies - outside my circle of competence

Companies with dividend histories that are too unattractive - like this:

Source: Finchat

Then, I picked 5 from what I think are interesting.

Here they are:

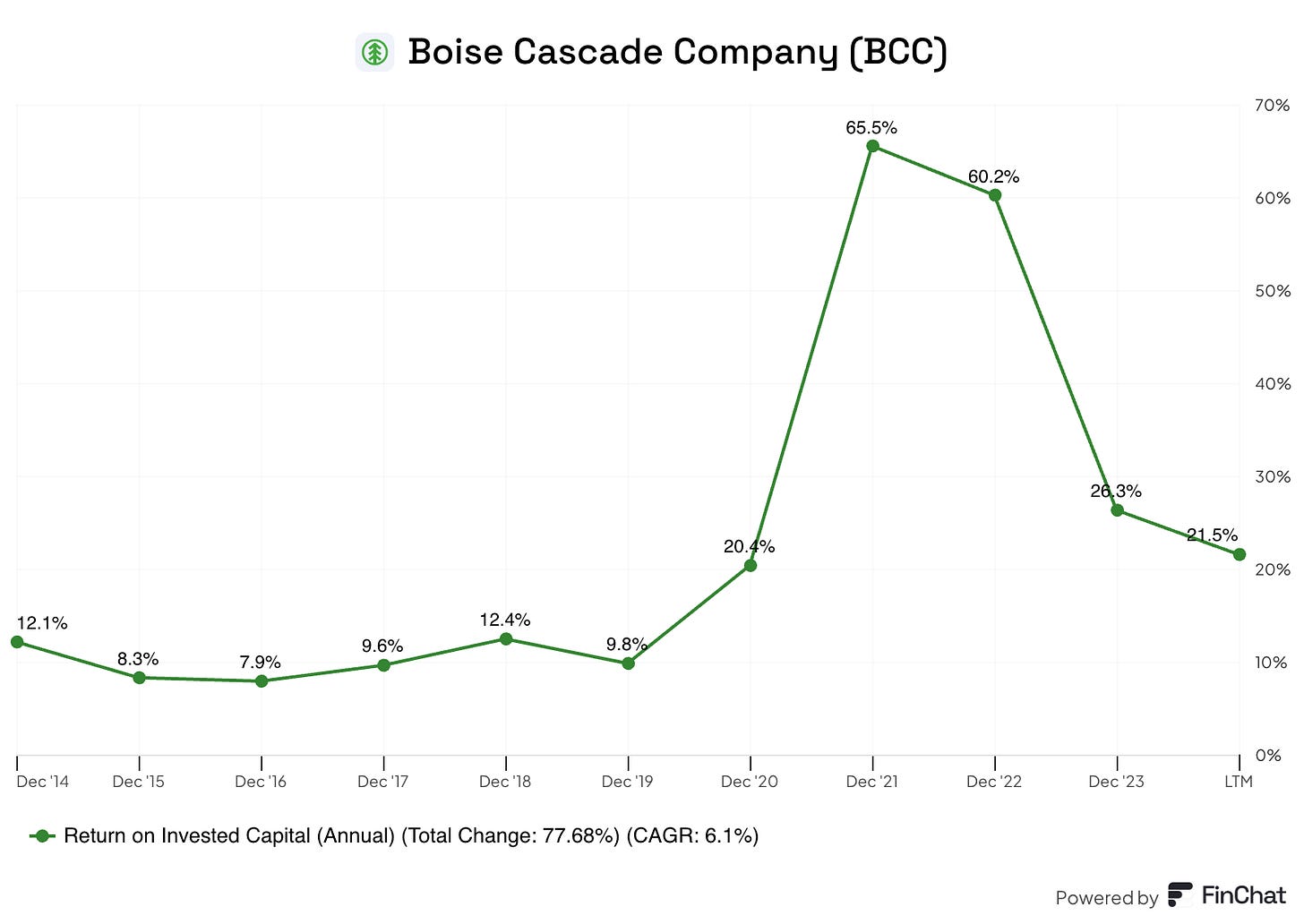

5. Boise Cascade Company ($BCC)

This lumber and building materials company might not sound glamorous, but it’s a cash machine, especially during construction upswings.

With a vertically integrated model and disciplined cost management, Boise Cascade maintains strong margins and pays attractive dividends.

Its ability to generate excess cash during housing booms often results in shareholder rewards beyond the regular payout - like the $5.20 per share it paid in November of 2023, or the $5.21 per share in September of 2024.

What else makes BCC interesting?

The US housing shortage should drive sales for years to come

A solid balance sheet with a Debt/Equity Ratio of 0.2

A history of consistently attractive ROIC

Source: Finchat

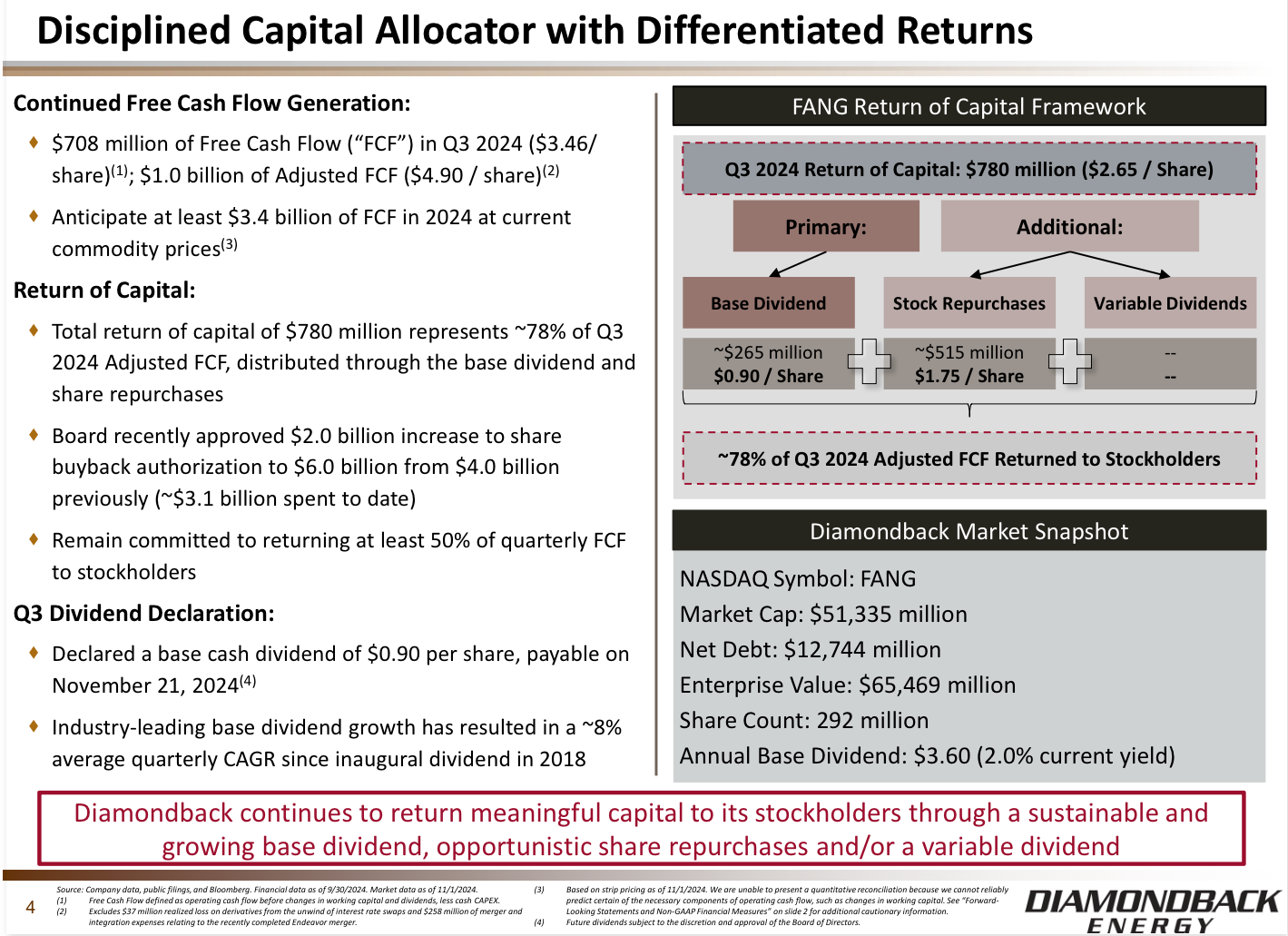

4. Diamondback Energy ($FANG)

Diamondback is a favorite among energy dividend investors.

Focused on low-cost oil and gas production in the Permian Basin, the company thrives even when oil prices aren’t sky-high.

Thanks to its capital efficiency and commitment to returning profits, Diamondback not only pays a solid base dividend but supplements it with variable payouts linked to oil prices.

What else makes FANG interesting?

Consistent, high growth rates in revenue and earnings

A solid balance sheet (Debt/Equity of 0.3)

A history of buybacks

Source: Finchat

Ready to see the top 3 and get a spreadsheet of all the screener results?

Let’s go!