💸 How $1,000 Becomes $6,730

What if your dividends didn’t just pay you—but paid more every year?

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Dividend Growth Matters

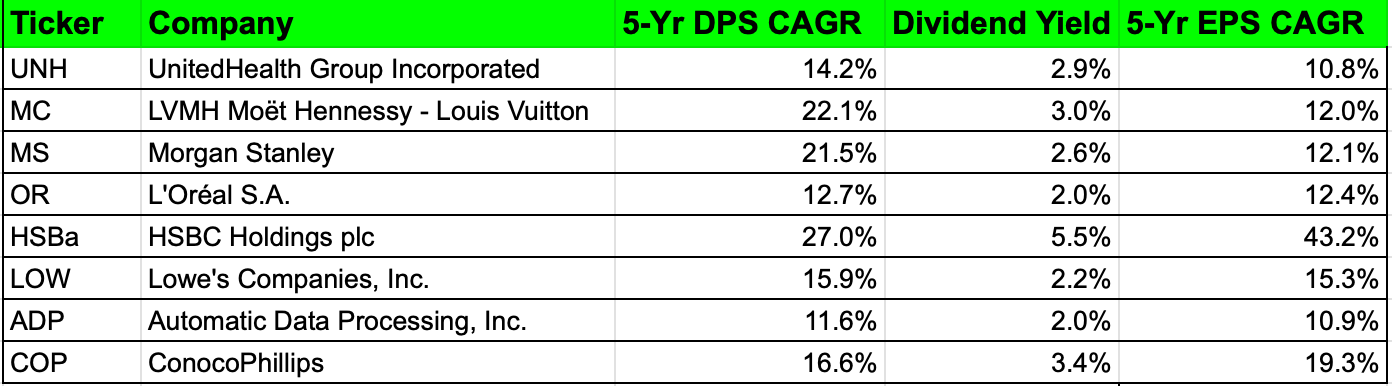

Here are 8 companies that didn’t just pay dividends – they grew them by 10% or more per year for 5 straight years.

Dividend growth is powerful.

Let’s say you earn $1,000 in dividends this year. If it grows by 10% annually, here’s what happens:

Year 1: $1,000

Year 5: $1,610

Year 10: $2,590

Year 20: $6,730

That’s the magic of compounding - not just from reinvested dividends, but from dividends that grow faster than inflation.

The lesson: Don’t just chase yield. Look for growth too. It adds up in a big way.

2️⃣ Compound Your Dividends

This chart shows why growing dividends matter.

Since 1992, the S&P 500 went up 781% on price alone.

But with dividends reinvested, it grew 1,481%.

That extra return came from dividends that got bigger every year.

It’s not just about getting paid - it’s about getting paid more over time.

3️⃣ An Investing Quote

Warren Buffett says that you don’t need to be brilliant.

You just need to start early, stay consistent - and let growth do the hard work.

Compounding can generate amazing results from average efforts.

"My life has been a product of compound interest. Nothing more. Nothing less. And nothing brilliant. " - Warren Buffett

4️⃣ Buffett Compounds His Dividends

Warren Buffett owns a lot of dividend-paying stocks - and it’s no accident.

He looks for businesses that generate steady, growing cash flow.

Dividends give Berkshire income without ever having to sell.

Top holdings like Apple, Coca-Cola, and Chevron all pay - and grow - their dividends.

That cash gives him flexibility: to reinvest, wait, or buy when the time is right.

It’s a strategy built for long-term compounding - just like dividend growth investing.

In my free e-book, I’ve pulled together my top takeaways from the 2025 Berkshire AGM—including what Buffett said about dividends, cash flow, and building wealth slowly.

Click the image to download it.

5️⃣ Example of a Dividend Stock

Morgan Stanley (MS) is a global financial services firm that provides services like investment banking, wealth management, and trading.

They focus on helping clients with their financial needs and finding new ideas to support growth while being responsible and sustainable.

Profit Margin: 22.3%

Forward PE: 16.1x

Dividend Yield: 3.0%

Payout Ratio: 42.9%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data