How to Analyze a Divided Stock

Knowing how to analyze a stock will help you make smart investment choices.

The best investors in the world use a clear and logical framework.

In this article, I’ll show you how to analyze stocks like a professional.

10-Step Approach

We will always use the same 10-step approach to analyze a dividend stock.

By following each step, you'll determine if the company is a good investment.

Each step gets a score out of 10.

At the end, we’ll calculate a Total Dividend Score by adding all the scores and dividing by 10.

Let’s show you the 10 steps and use Stryker as an example.

1. Do I understand the business model?

How does the company make money?

Do I understand the products/services the company sells?

If the company doesn’t seem appealing or you don’t understand it, you can immediately stop your research.

The simpler and more attractive the business model, the better.

Stryker’s Business Model

Stryker makes money by selling medical devices like orthopedic implants, and surgical equipment. They also offer services, like product leasing and maintenance.

2. Is management capable?

You want to invest in companies that great managers lead.

Look at the track record of management and visit websites like Glassdoor to determine whether employees are happy to work for the company.

You also want to look at:

How much of the company does management own

Their dividend policy

How long they have been with the company

Stryker’s Management

Kevin Lobo has been the CEO of Stryker since 2012. He joined Stryker in 1998

He owns more than $29 million in shares

The company’s capital allocation policy prioritizes:

(1) Acquisitions

(2) Dividends

(3) Share repurchases

Stryker has generated attractive Returns On Invested Capital in the past:

3. Has the company grown the dividend attractively?

You want to invest in companies with a history of growing their dividends.

The higher the dividend growth, the better.

Look for 2 things in the company’s dividend history:

At least 10 years of dividend growth

A 5-year record of growing dividends by 5% or more

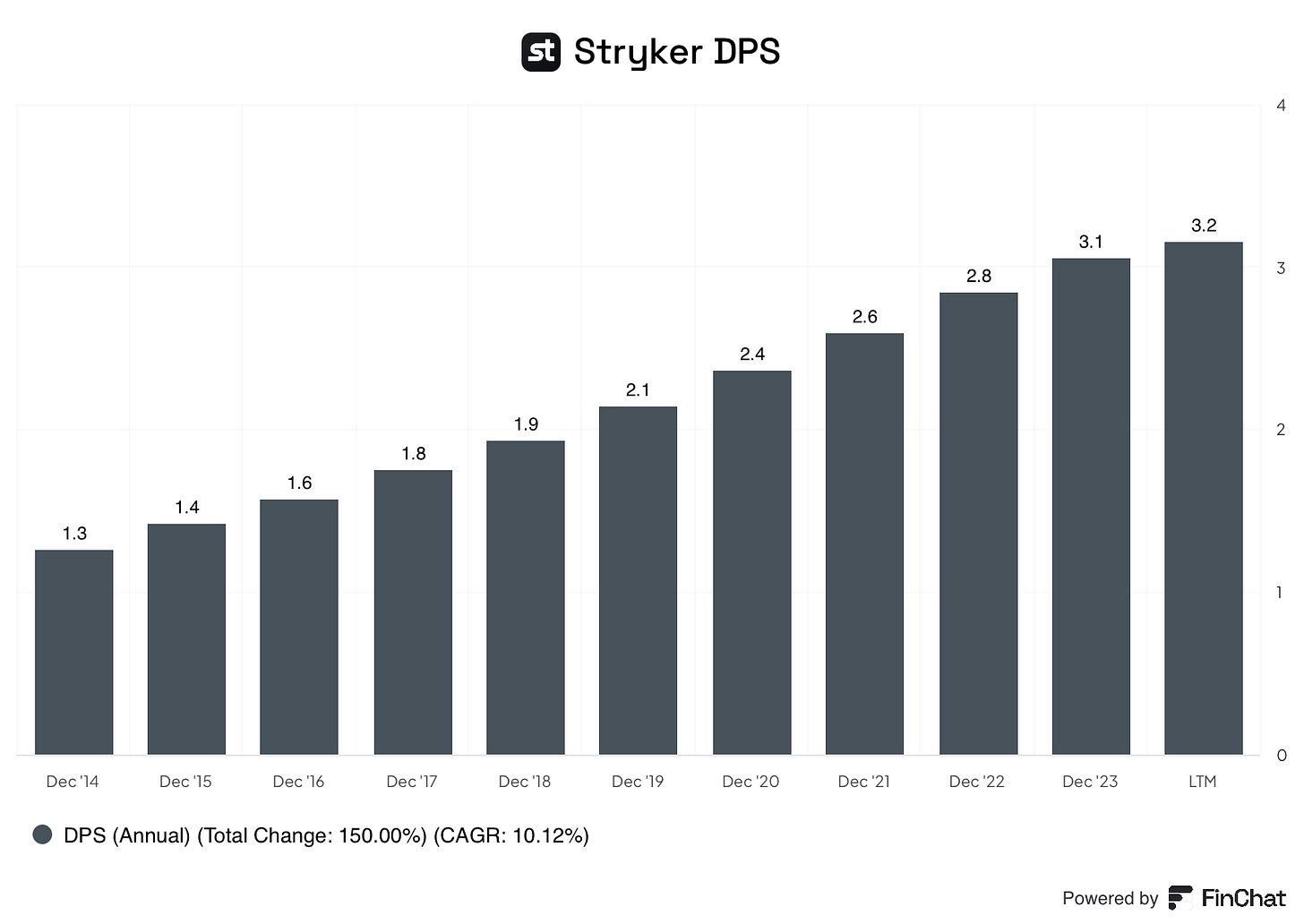

Stryker’s Dividend Growth

Stryker’s dividend payments have grown by around 10% per year over the past 10 years.

4. Is the company active in an attractive end market?

You want to invest in companies that are in stable or growing markets.

Here are a few characteristics we look for:

The company sells a necessary product

Recurring sales

A secular tailwind

Ideally, we want to invest in companies with only a few competitors and high barriers to entry.

The less competition, the better.

“Over the years, Buffett followed his philosophy of buying into industries with little competition. If he can’t buy a monopoly, he’ll buy a duopoly. And if he can’t buy a duopoly, he’ll settle for an oligopoly.” - The Myth of Capitalism (Book)

Stryker’s Market

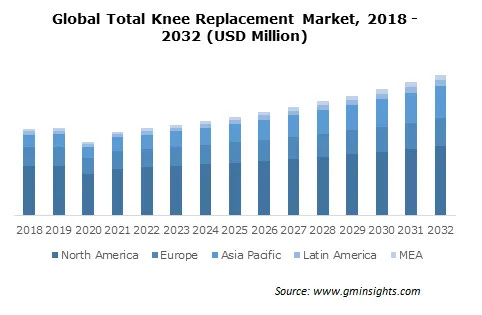

The aging population is a secular tailwind that should continue to drive sales of medical devices like hip and knee replacements.

5. What are the main risks for the company?

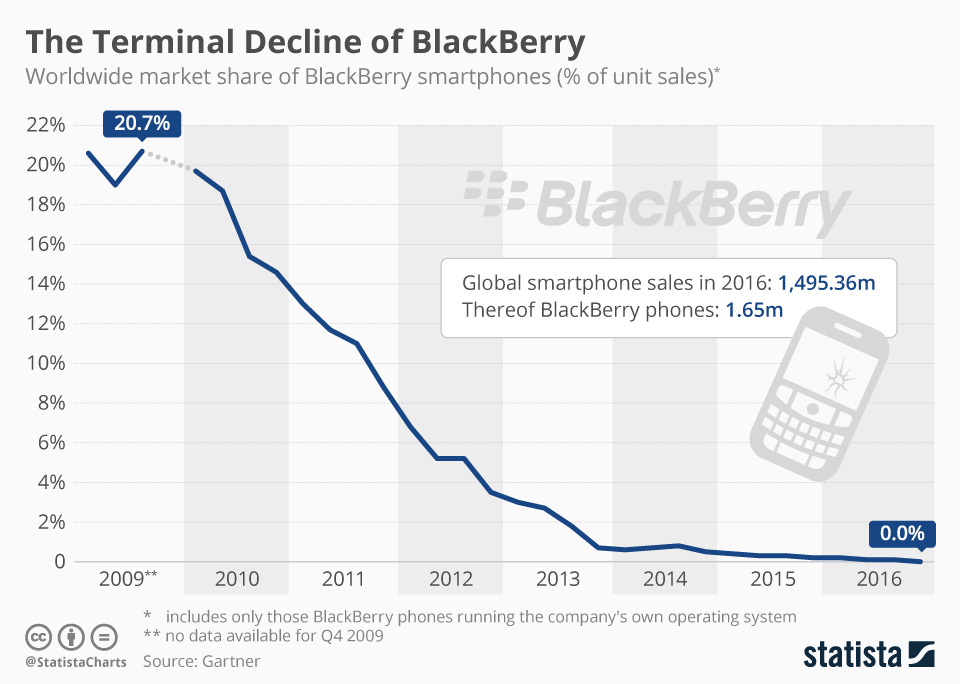

Disruption is the worst enemy of every long-term investor.

When you invest in a company that is losing its moat, you’ll end up with horrible investment results.

Take BlackBerry for example:

That’s why you should always identify the main risks a company faces before investing in it.

Stryker’s Main Risks

Stryker faces several key risks:

Regulatory Challenges

Competitive Pressure

Supply Chain Disruptions

Product Liability

Economic Conditions

Now let’s dive into the most important part: the Fundamentals.