💸 How to Generate REAL Passive Income

Forget side hustles and hype - here’s how dividends and compounding build lasting wealth.

👋 Howdy Partner,

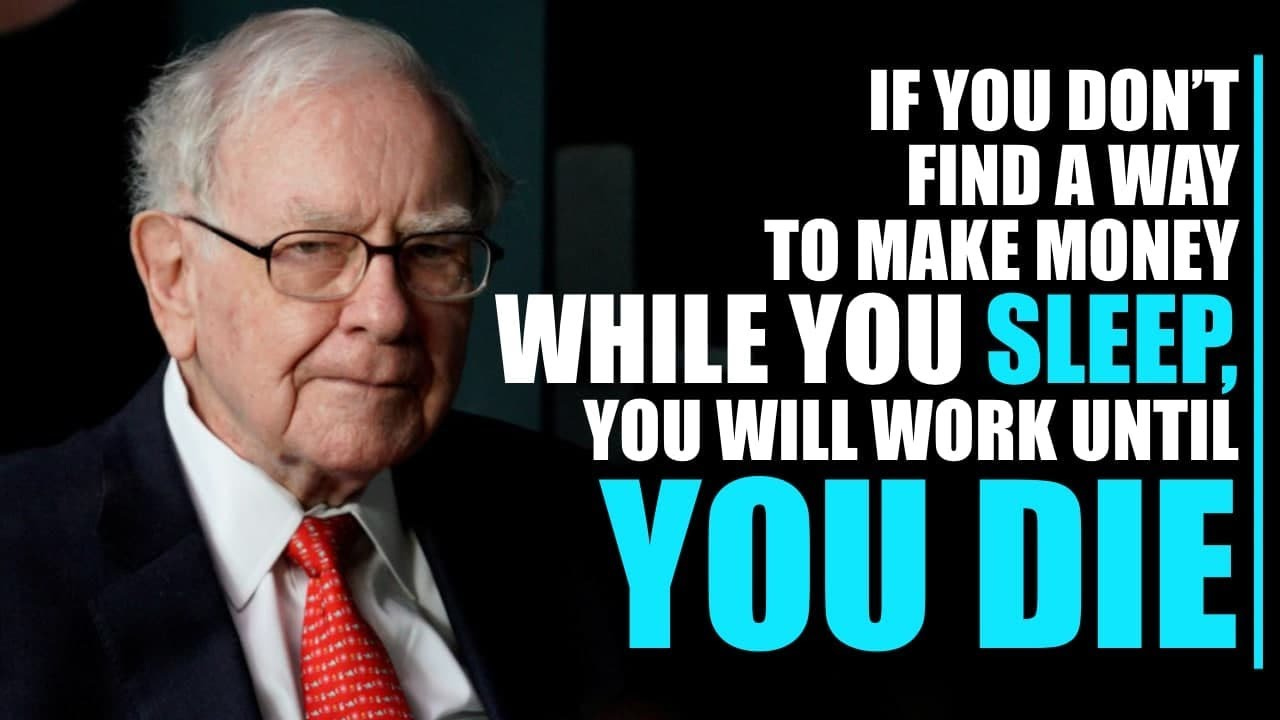

Most people earn money by trading time for dollars at a job.

That’s called active income.

The problem?

If you lose your job, can’t work, or retire, the money stops.

Passive income is different. It’s money that keeps coming in whether you’re working or not.

Warren Buffett knows passive income is important - just look at this quote:

You can think of it like planting a seed:

You do the work upfront

Over time, it grows and gives you fruit year after year

Dividend growth investing is one of the best ways to create this kind of income.

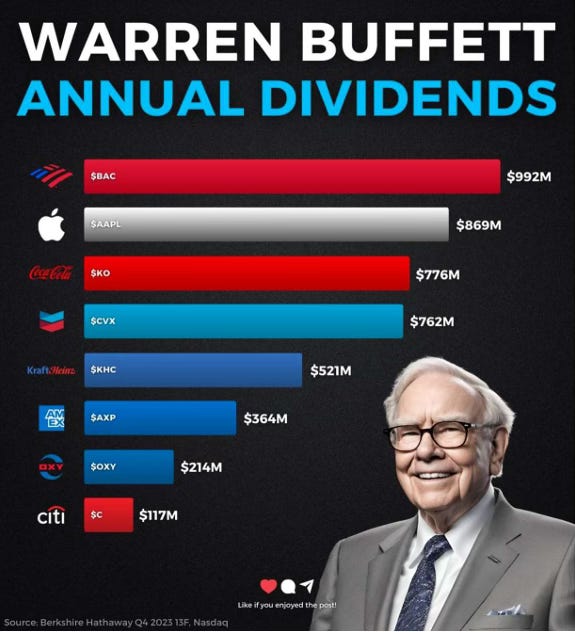

And Buffett has used it to create billions of dollars in passive income for Berkshire Hathaway every year.

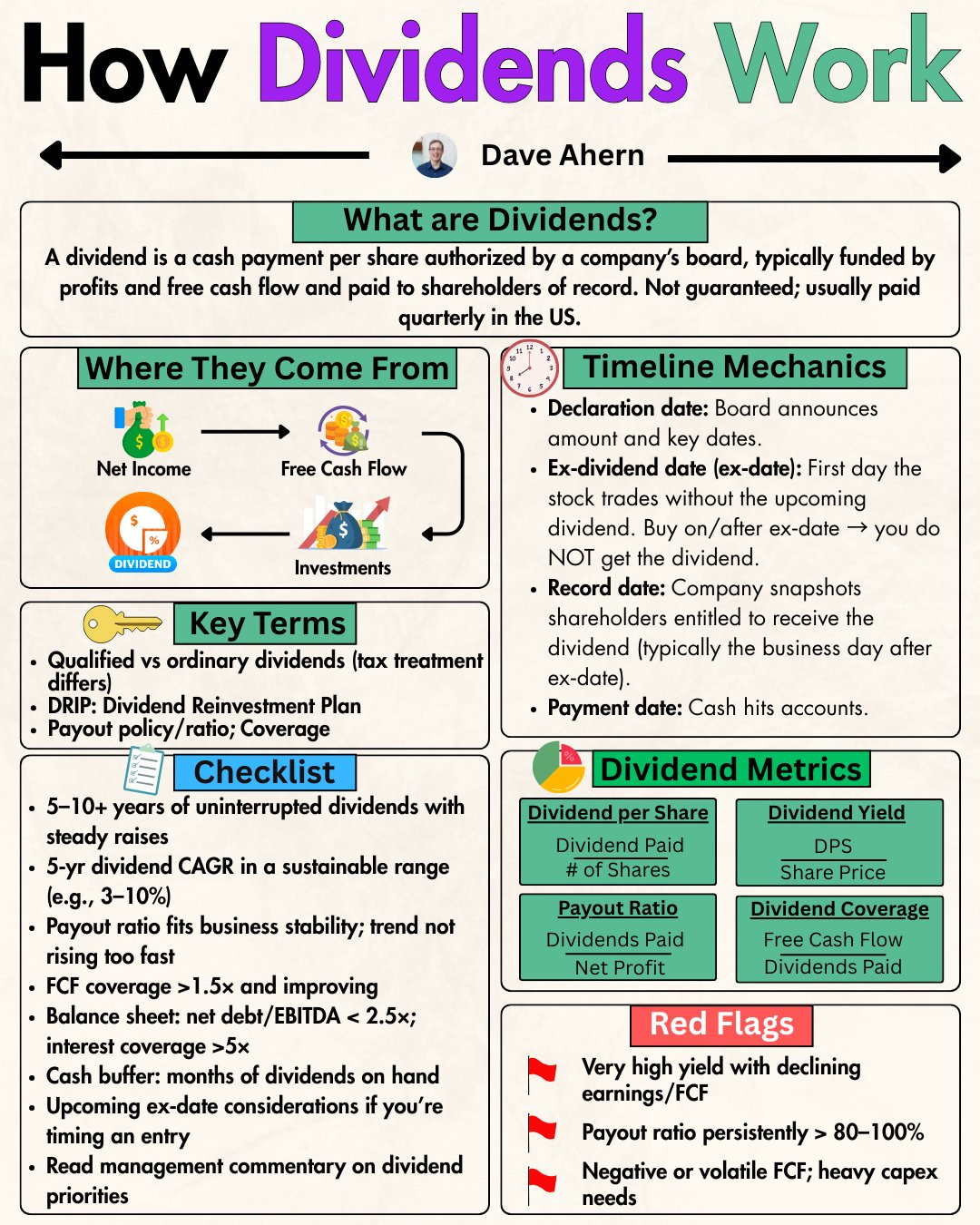

Why Dividends Matter

When you buy stock in a strong company, you become a part-owner. Many of these companies share profits with owners in the form of dividends.

Here’s why dividends are powerful:

They pay you cash every quarter (even if you never sell the stock)

The best companies grow their dividends year after year

Over time, those growing payments can become bigger than your original investment

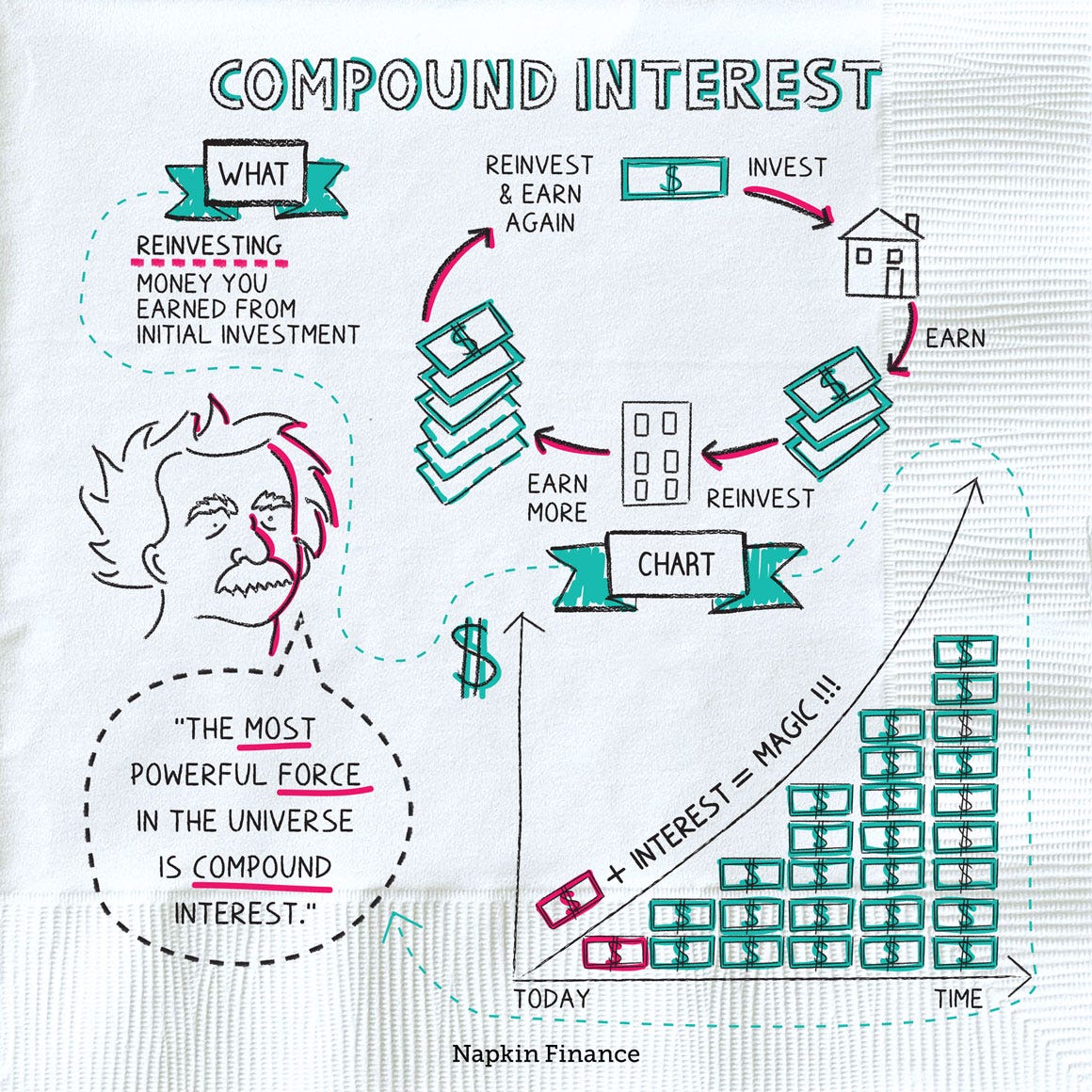

The Magic of Compounding

Albert Einstein once said, “Compound interest is the eighth wonder of the world.” Here’s what he meant:

Your investment grows

The money it earns also starts earning money

That cycle repeats over and over

We can go back to our seed analogy and think of it like an apple tree: one tree grows apples → those apples have seeds → new trees grow → they produce even more apples.

How This Works for Investors

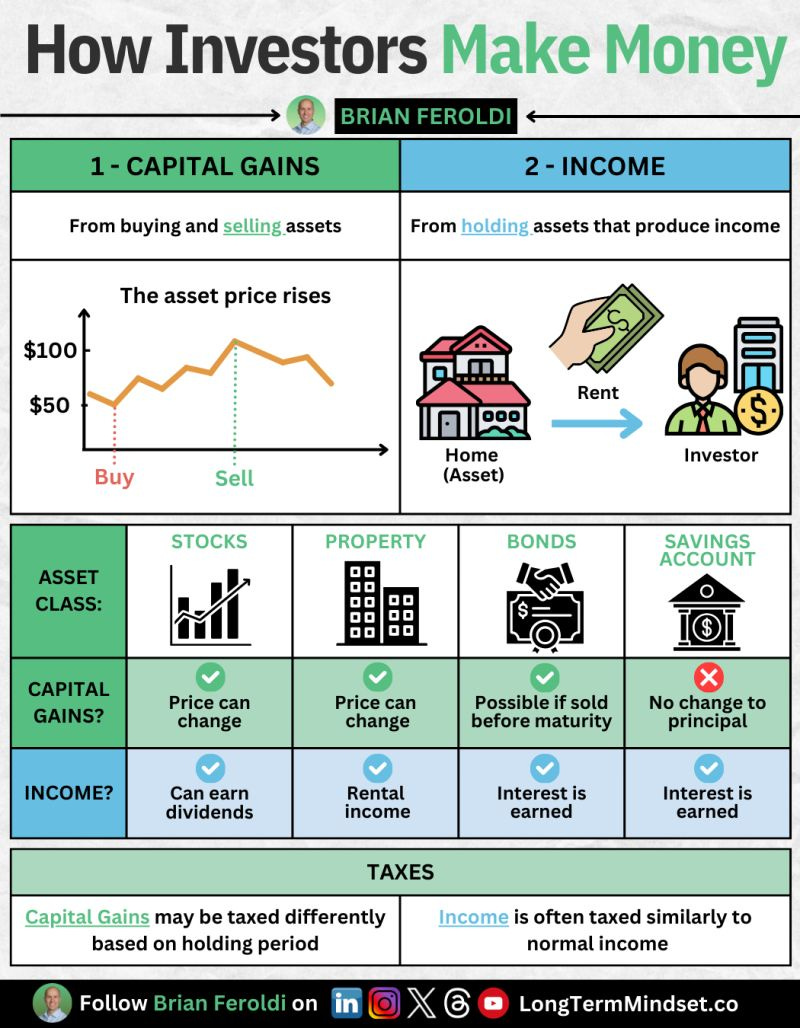

When a company earns profits, two big things can happen:

Capital Appreciation – As profits grow, the company becomes more valuable. That makes the stock price rise, so your shares are worth more.

Dividends – As profits rise, so will your dividend payments.

Here’s the real magic: if you reinvest those dividends to buy more shares, your ownership grows. More shares mean:

More dividends next time

A bigger slice of the company as it grows

Compounding that accelerates like a snowball rolling downhill

Over time, both the rising stock price and the rising dividends feed into each other - building wealth faster than most people imagine.

Real-Life Examples

Let’s look at some real-life examples of compounding in action.

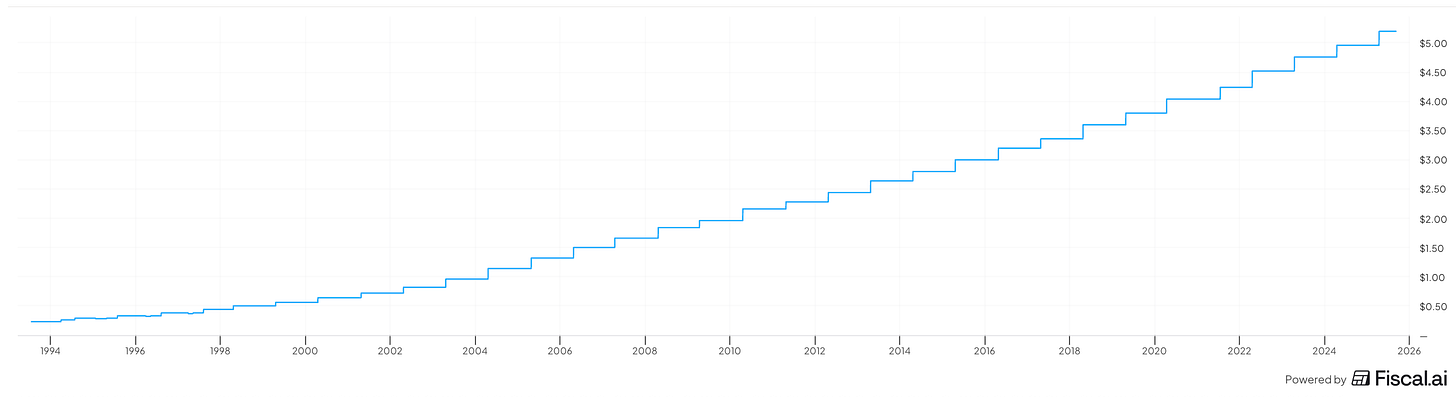

Coca-Cola

Warren Buffett bought Coca-Cola in 1988. The share price was still depressed after the “Black Monday” 1987 market crash. Here’s what Coke’s stock looked like back then.

Closing price 1988: $2.79

Dividends in 1989: $0.08 - 2.8% yield

Buffett has held Coca-Cola ever since then. Here’s what it looks like today:

Roughly $68 share price - 9% CAGR

$2.04 dividend - 16% CAGR (current yield: 3%)

Coca-Cola now pays Berkshire over $800 million per year in dividends alone.

Johnson & Johnson

This company has raised its dividend for over 60 years in a row.

If you bought $10,000 of JNJ 30 years ago and reinvested your dividends:

Your shares would be worth more than $208,000

You’d receive more than $6,000 per year in dividend payments.

Dividends Beat Other “Passive Income” Ideas

You’ve probably heard about things like:

Writing an ebook

Starting a YouTube channel

Building an online course

These can work, but they’re hard and usually take years of effort.

Dividend growth investing is different:

Anyone can do it

You make money from the best companies in the world

Your money works for you, even while you sleep

How to Get Started

You don’t need millions to begin. Here are some steps:

Save a portion of your income (10–20% is a common target)

Choose strong companies with a history of paying and growing dividends

Buy at fair prices. Don’t chase hype - look for value

Hold for the long term. Let compounding do the heavy lifting

That’s It For Today

Passive income is real. But it’s not about chasing get-rich-quick schemes.

It’s about owning quality companies, collecting dividends, and letting compounding turn small seeds into a forest of wealth

If you stick with it, dividend growth investing can create:

A steady stream of rising cash payments

Financial security (no more relying only on a paycheck)

The chance to build generational wealth for your family

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

If dividends are our income then dividend raises are our income raises.

Most people get a raise between 2% and 5%. Sometimes you'll hear of younger workers getting 7%, especially if they are hard working and talented. Their income is lower so a higher dollar amount equates to a higher percent.

Some dividend paying companies can give you a whopping huge dividend increase. For example, Strawberry Fields increased their dividend from $0.14/share to $0.16/share. That's only 2 pennies but it's actually ...

(2 ÷ 14) × 100 = 14.29% 😎

That's kind of unique though. It's hard to find a winner like that everywhere ... but they do exist!