How To Survive A Market Crash

The stock market has done incredibly well over the past few years.

Nowadays, we are getting more and more warnings of a potential market crash.

How can you survive one? Let’s dive in right away.

Why the Fear?

The S&P 500 is down less than 2% over the past month.

It’s up more than 12% so far this year.

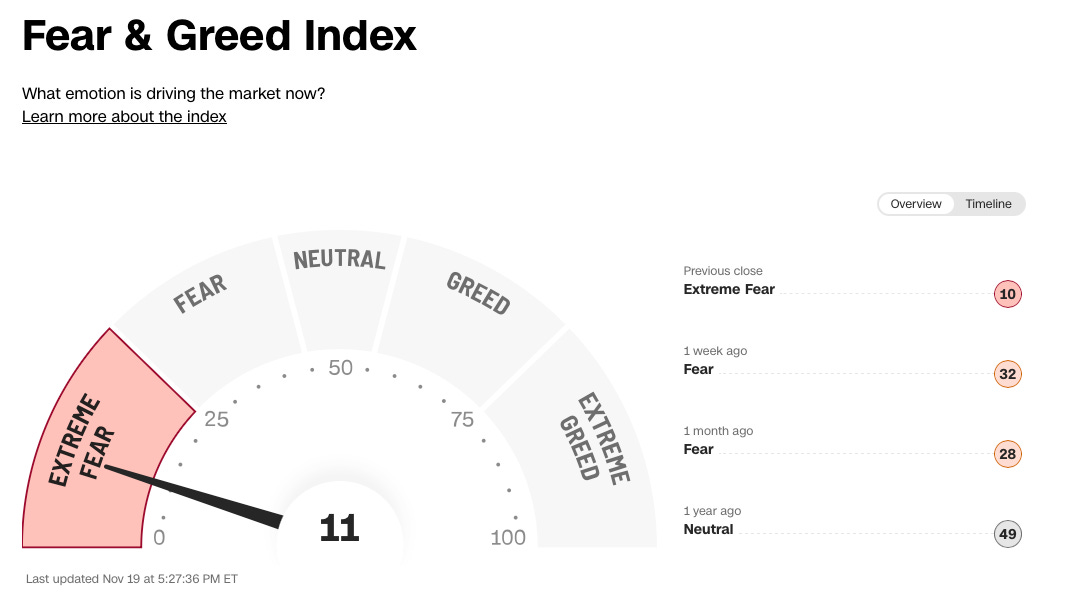

But the Fear & Greed Index is showing ‘Extreme Fear’.

What’s going on?

Valuations Are High

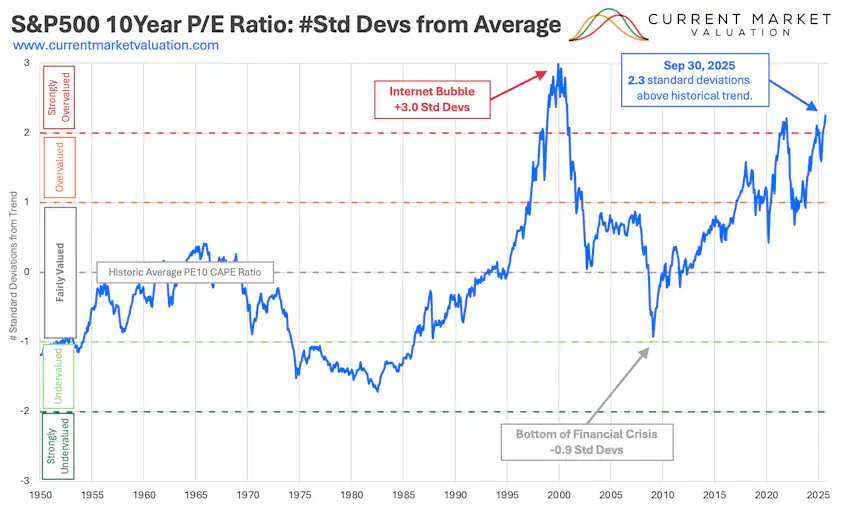

Stocks do look expensive (especially in the United States).

If we look at the 10-year P/E ratio, we get the following:

This tweet from Tobias Carlisle also sums it up quite well:

It states the S&P 500 is so richly valued we can expect negative returns in the years ahead.

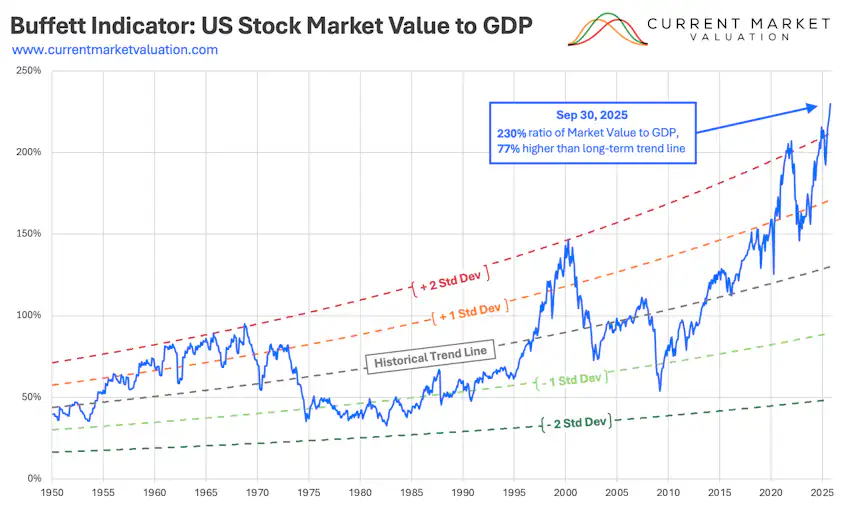

Another great metric? The “Buffett Indicator”.

💡

The Buffett Indicator compares the total value of all U.S. stocks to the size of the U.S. economy to show if the market is cheap or expensive.

As you can see, the market also looks expensive based on this metric:

But up until now, investors have been willing to pay up for US stocks.

Extreme Concentration

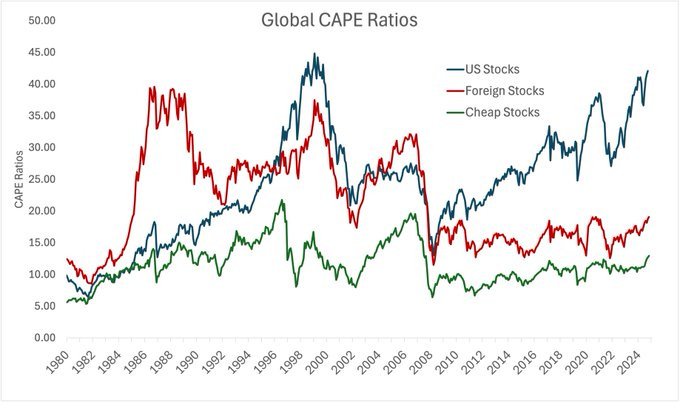

The S&P 500 has beaten nearly every other strategy over the past few years.

Here’s the comparison against non-US stocks, and value stocks.

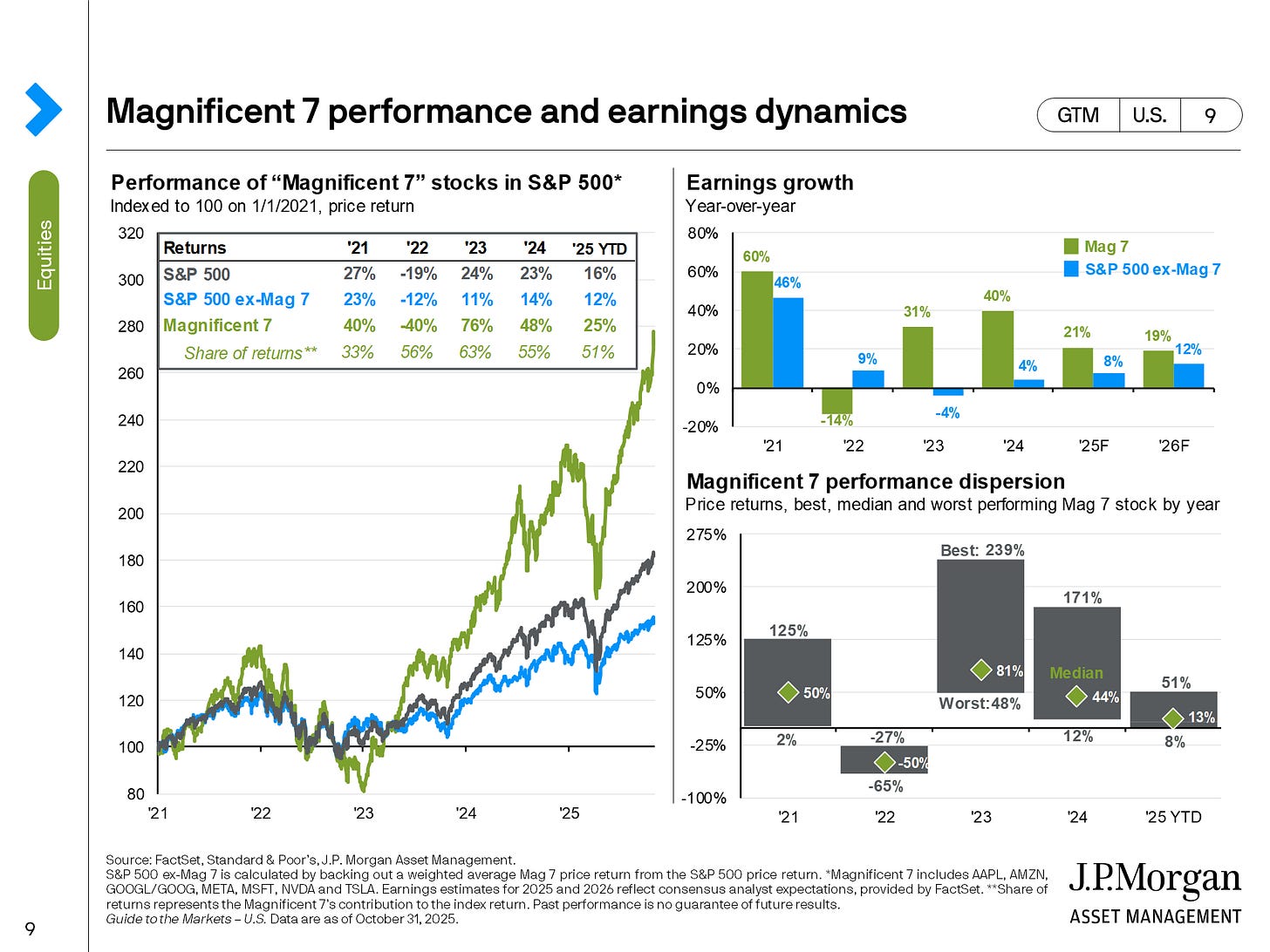

A lot of the performance of the S&P 500 has been driven by the amazing performance of Big Tech companies, known as ‘The Magnificent 7’:

In the chart below you can see the performance of:

The Magnificent 7

The S&P 500

The S&P 500 without the Magnificent 7

The outperformance of the S&P 500 has created a lot of FOMO.

And investors have rushed into the S&P 500.

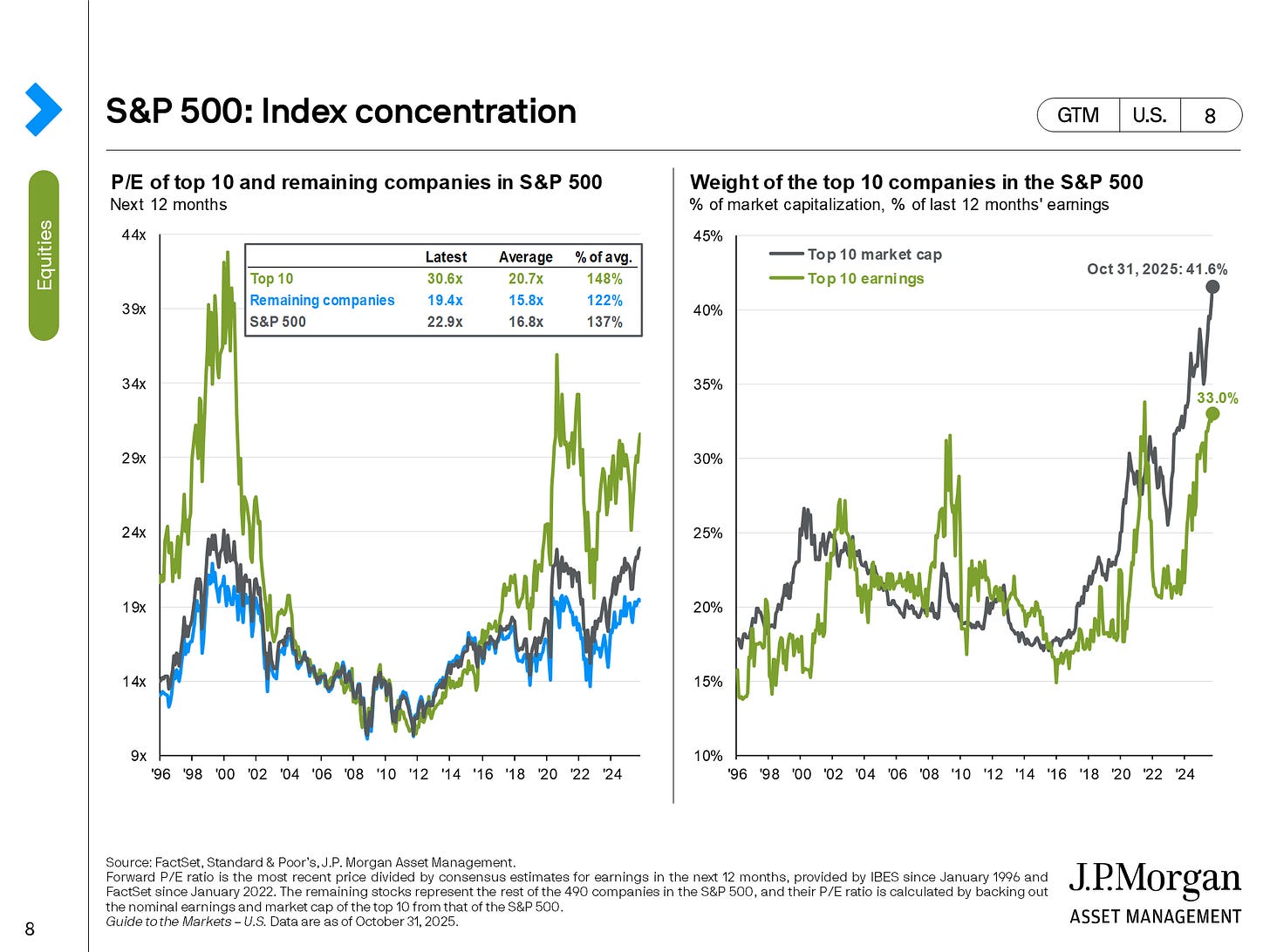

It’s a market cap weighted index, which means more money goes into the largest stocks.

It resulted in a lot of concentration, with the top 10 stocks now making up more than 40% of the index.

Today the entire market relies on just 10 Big Tech stocks.

It’s a dangerous thing if you ask me.

Is The AI Bubble Popping?

The reason these Big Tech stocks have done so well?

Everyone is building data centers and getting hyped about AI.

But now some investors wonder if AI is turning into a bubble.

Even the CEOs of the Mag 7 have suggested there are “elements of irrationality.”

“There was clearly a lot of excess investment, but none of us would question whether the internet was profound or did it drive a lot of impact. It’s fundamentally changed how we work digitally as a society. I expect AI to be the same. I think it’s both rational, and there are elements of irrationality through a moment like this.”

-Sundar Pichai, Google CEO“I do think that there’s definitely a possibility (of a bubble), at least empirically, based on past large infrastructure buildouts and how they led to bubbles, that something like that would happen here”

-Mark Zuckerberg, Meta CEO

If Big Tech crashes, the whole S&P 500 will drop too.

Those companies now take up a huge part of the index.

Are We In A Bubble?

Have we already seen the peak of this bull market? Is a crash coming soon?

I have no idea.

And neither does anyone else.

What we do know is that market crashes are inevitable.

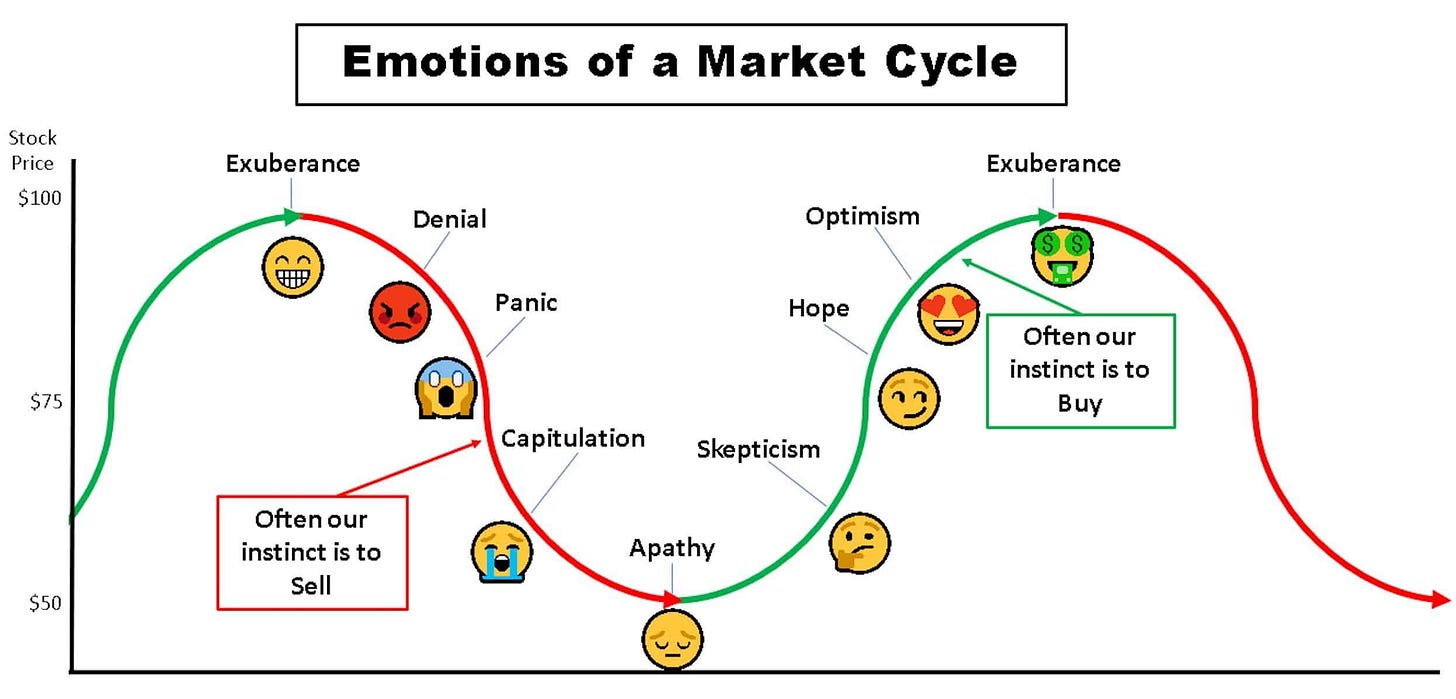

The investment world runs on emotional cycles.

Howard Marks agrees. Here’s what he said in his memo “It Is What It Is” (March of 2006):

“In the world of investing, nothing is as dependable as cycles. We cannot know how far a trend will go, when it will turn, what will make it turn or how far things will then go in the opposite direction. But I’m confident that every trend will stop sooner or later. Nothing goes on forever.”

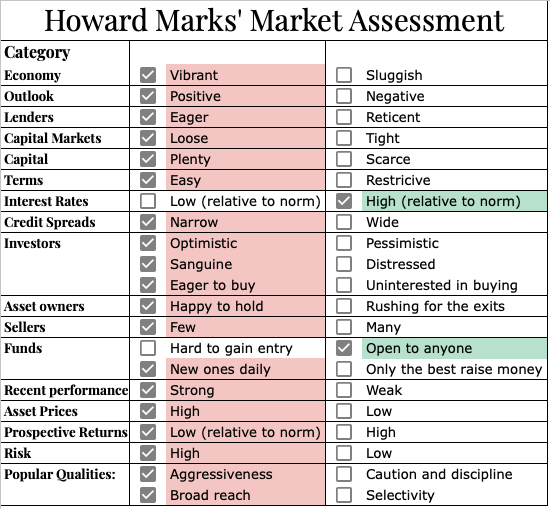

Howard Marks advice?

We can’t know where things are going, but we better know where we are.

He uses a checklist to determine this:

More checks on the left = closer to a top.

More on the right = closer to a bottom.

Here’s how I see it today:

The conclusion? We’re probably closer to the top of the cycle than the bottom.

But we still can’t know the timing or the trigger that will turn things.

So what can we do with that information?

Be prepared.

How To Prepare For A Market Crash

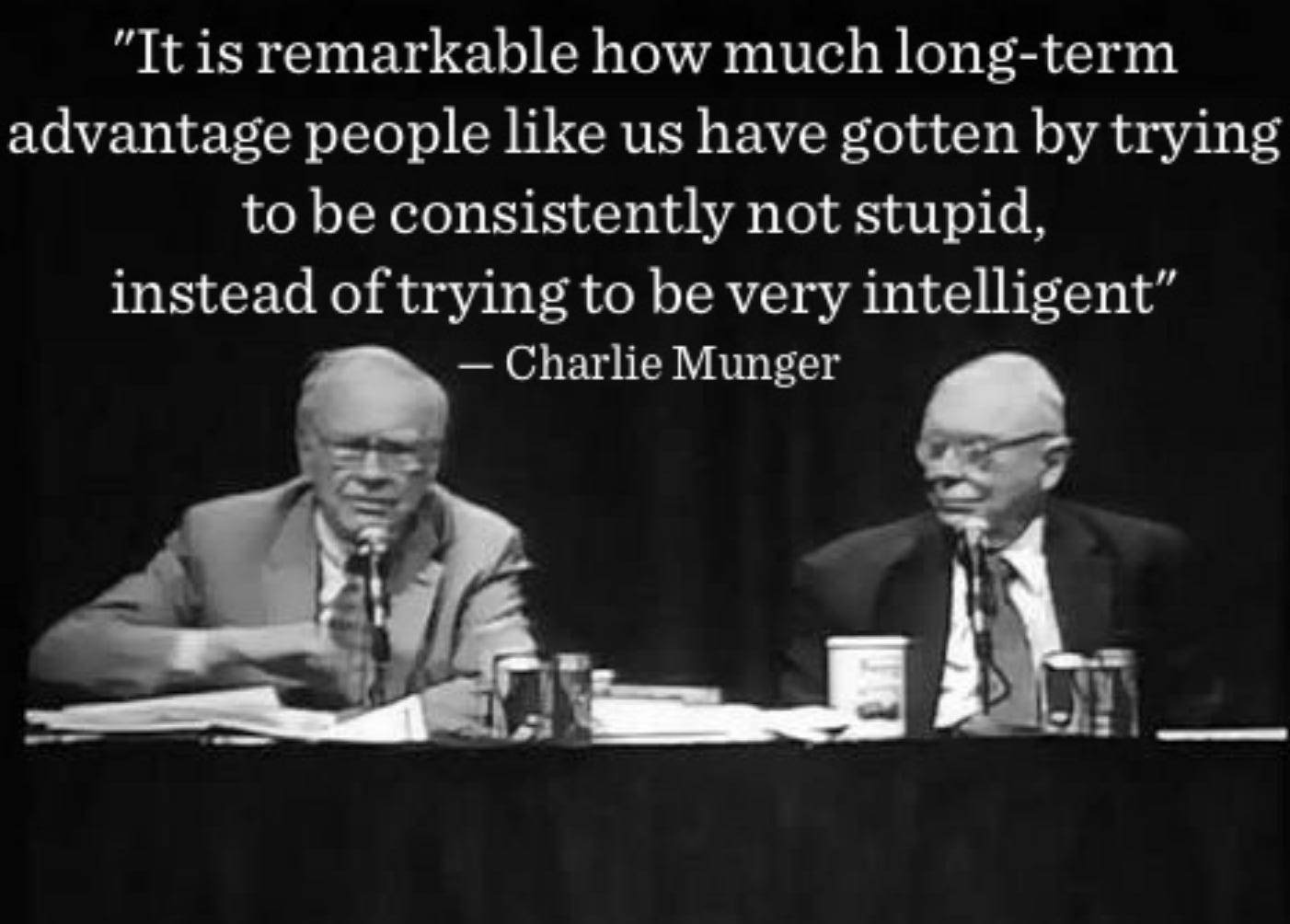

Surviving a market crash is all about avoiding mistakes.

Here are some of the biggest mistakes you should avoid:

1. Don’t Be a Forced Seller

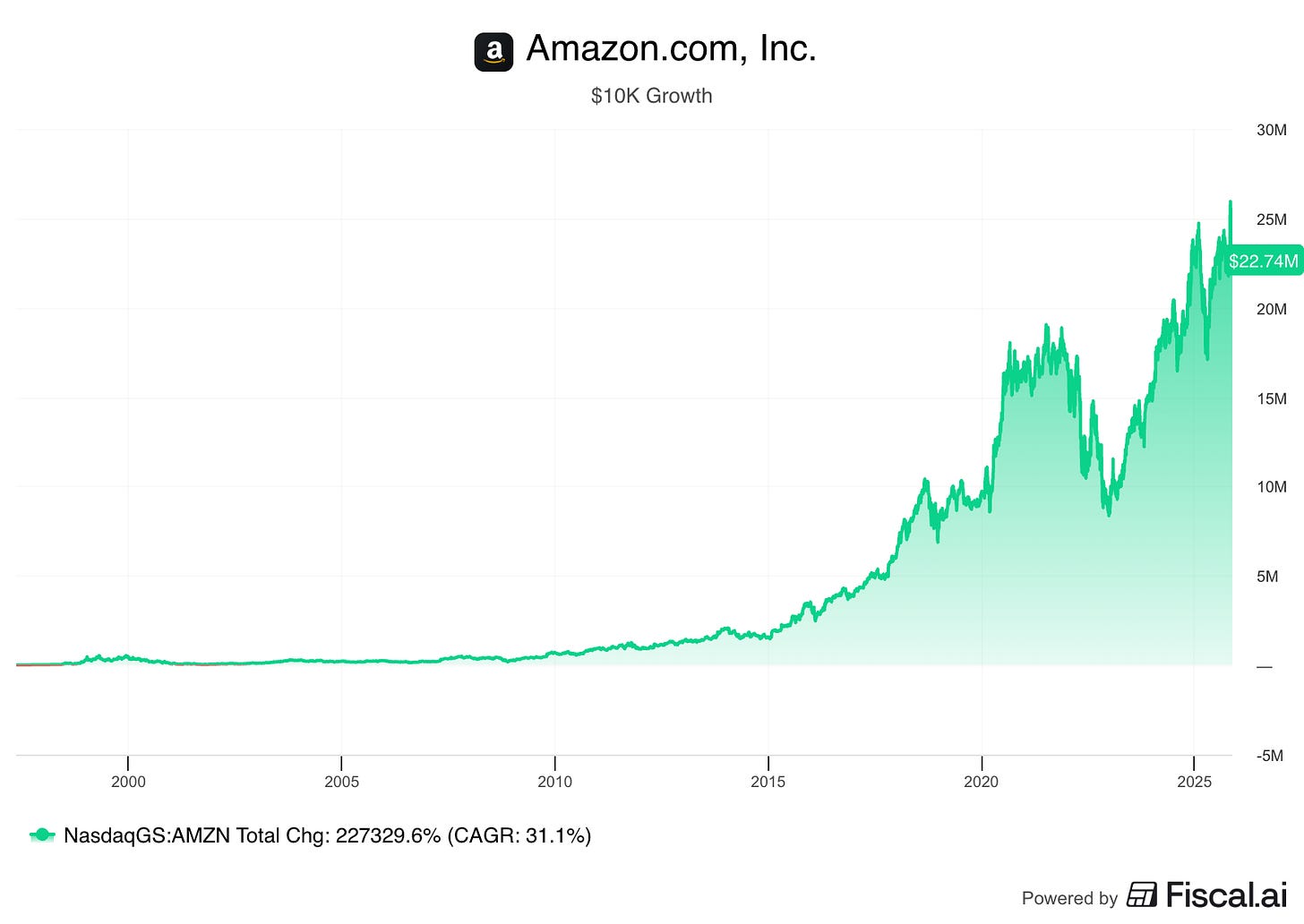

Investors who bought Amazon at the IPO and held until today are rich.

$10,000 invested in Amazon in 1997 is worth $22 Million (!) today.

Investors who were forced to sell their Amazon stock in the dot.com crash lost 95% of their money.

As Charlie Munger once said:

“There are only three ways a smart person can go broke: liquor, ladies and leverage”

Only invest with money you lose and have a long term mindset.

2. Know Your Companies

When stocks are crashing, the only thing that keeps you from selling is your conviction in the businesses you own.

That’s why you need to truly understand each company.

In our portfolio, we have that conviction because we choose companies with:

Great fundamentals

A rising intrinsic value

Reasonable valuation levels

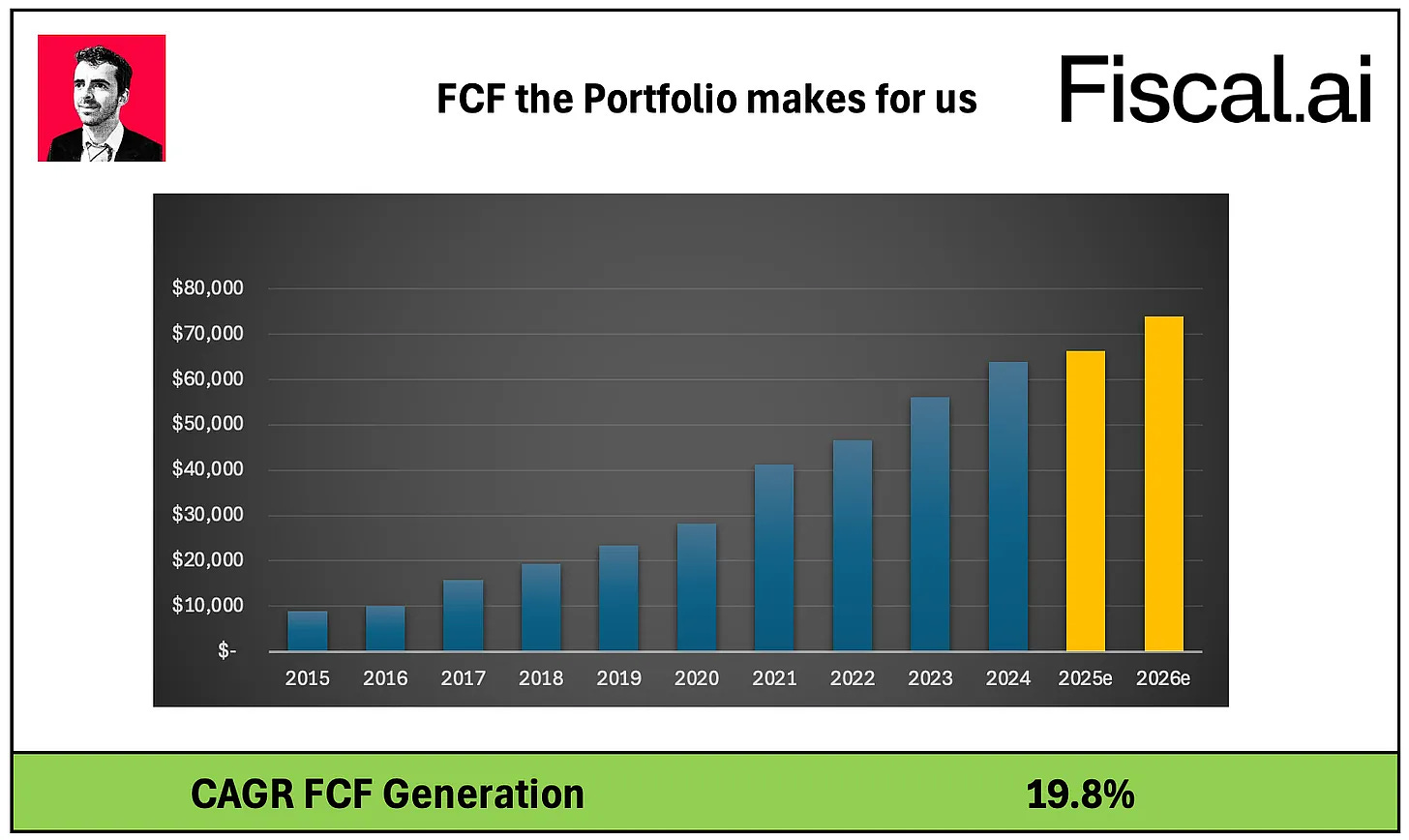

Here’s the Free Cash Flow the Compounding Quality Portfolio generates:

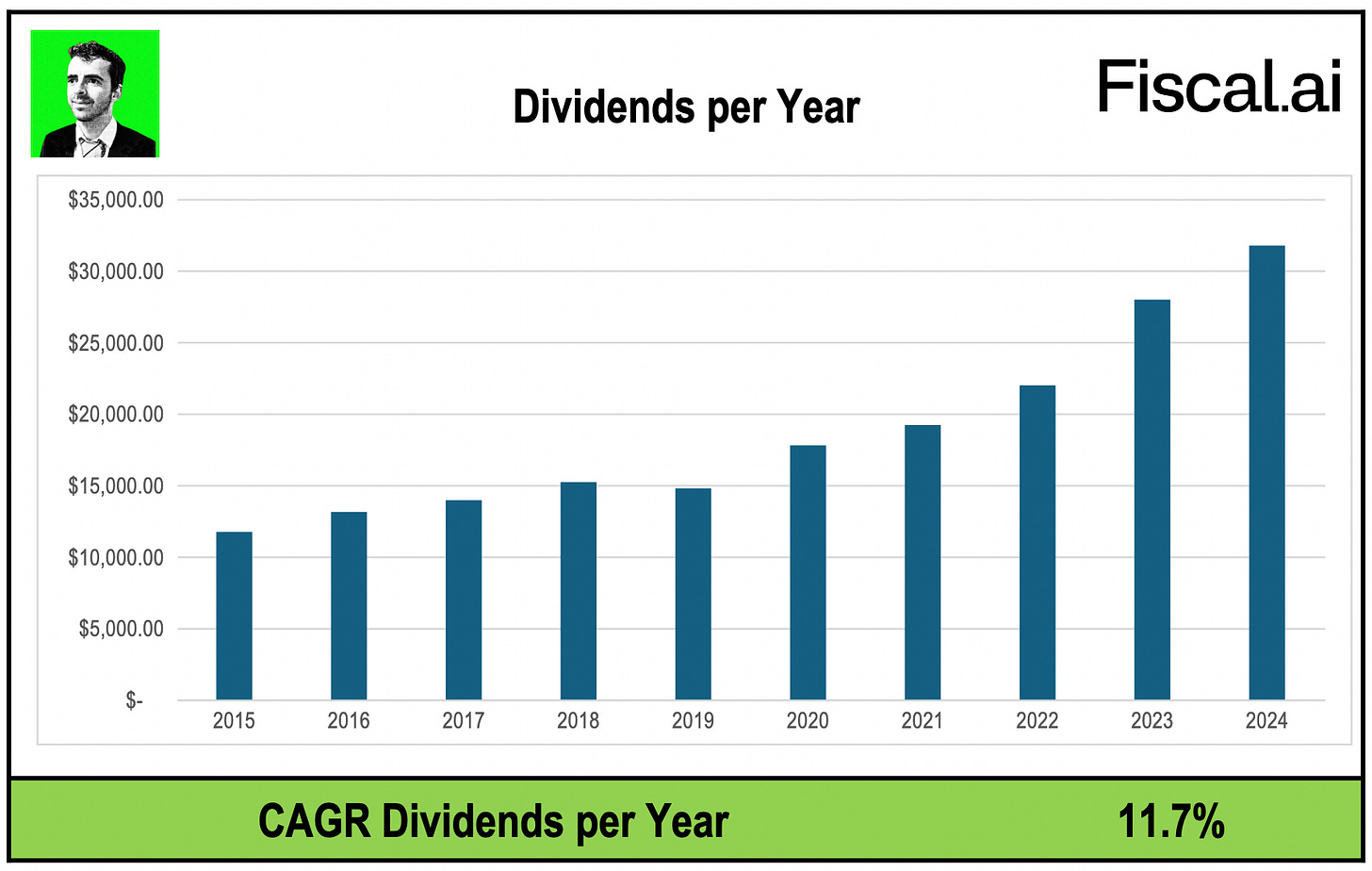

An overview of the evolution of the Dividends for Compounding Dividends:

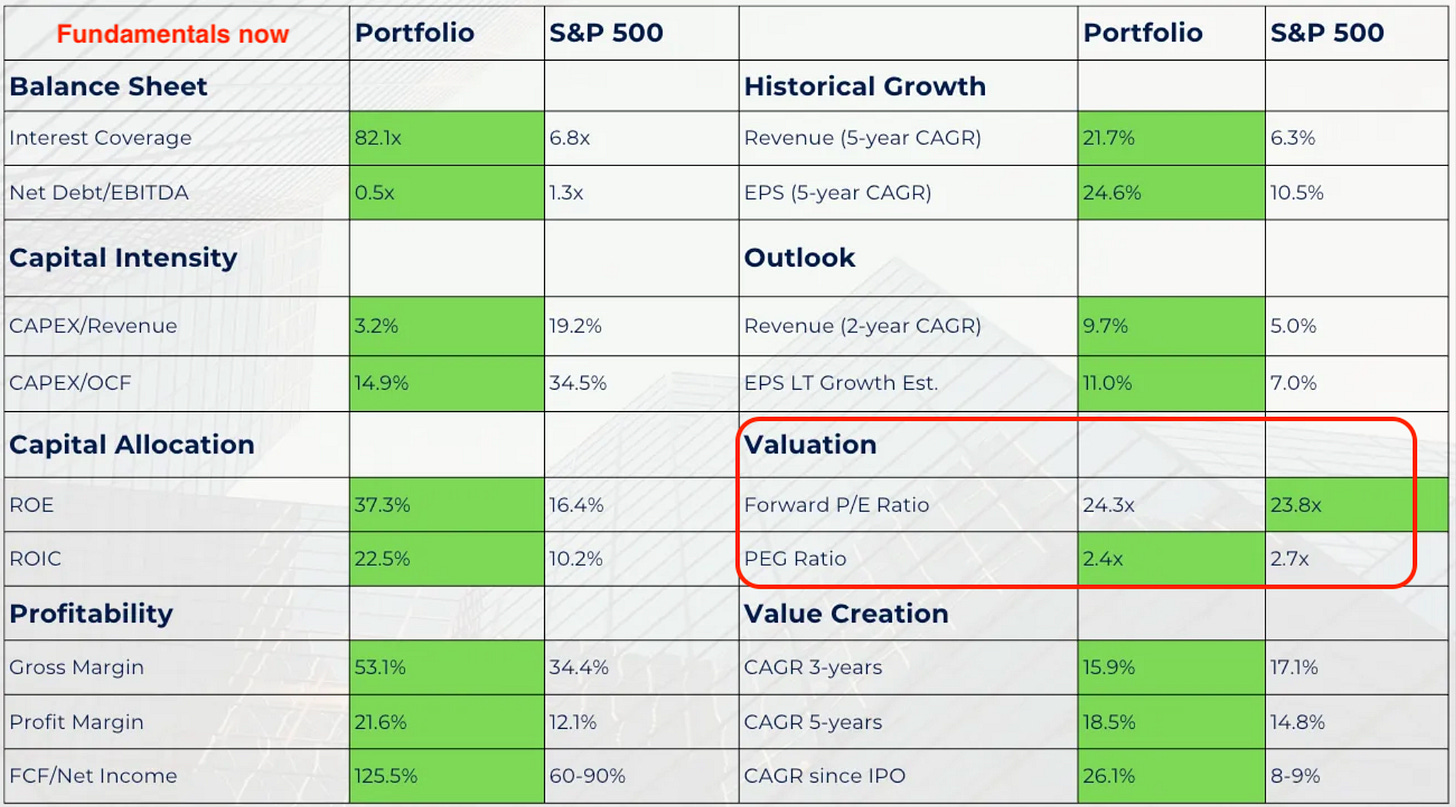

The Fundamentals for Compounding Quality look as follows:

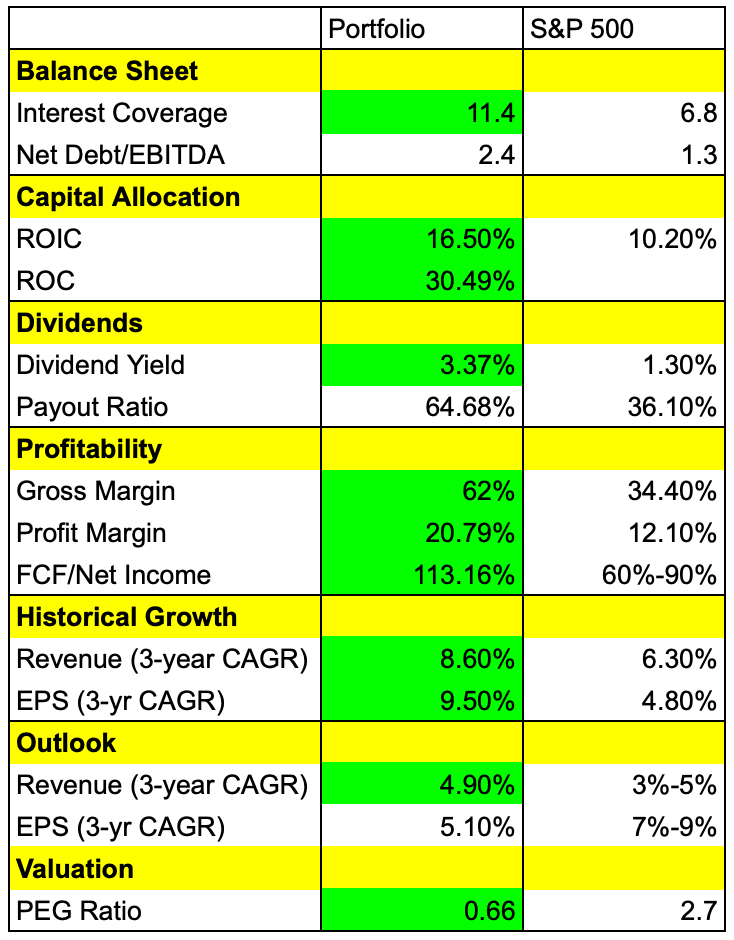

Compounding Dividends’ Fundamentals:

3. Water your flowers

Peter Lynch reminds us to water our flowers and cut our weeds.

Don’t wait until the market crashes to cut your weeds.

Only own stocks you’re willing to own for the next 10 years

Don’t try to wait for a better exit

Only the best companies are good enough for you

4. Change Your Mindset

If you own great companies and have some cash, a market crash is great news for you.

As Napoleon said:

“A genius is the man who can do the average thing when everyone else around him is losing his mind.”Here are 6 insights you can use to keep your head calm:

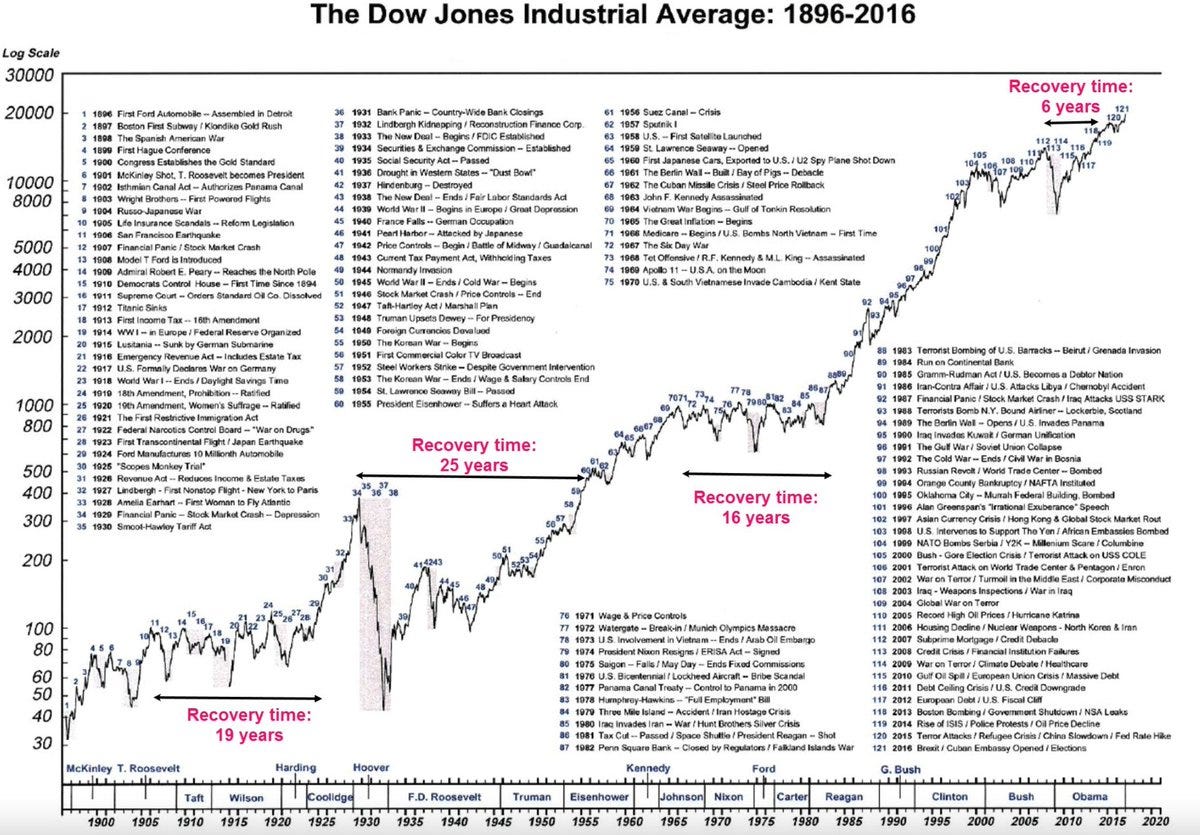

1. After every bear market, there’s a great bull market

2. Bear markets are opportunities

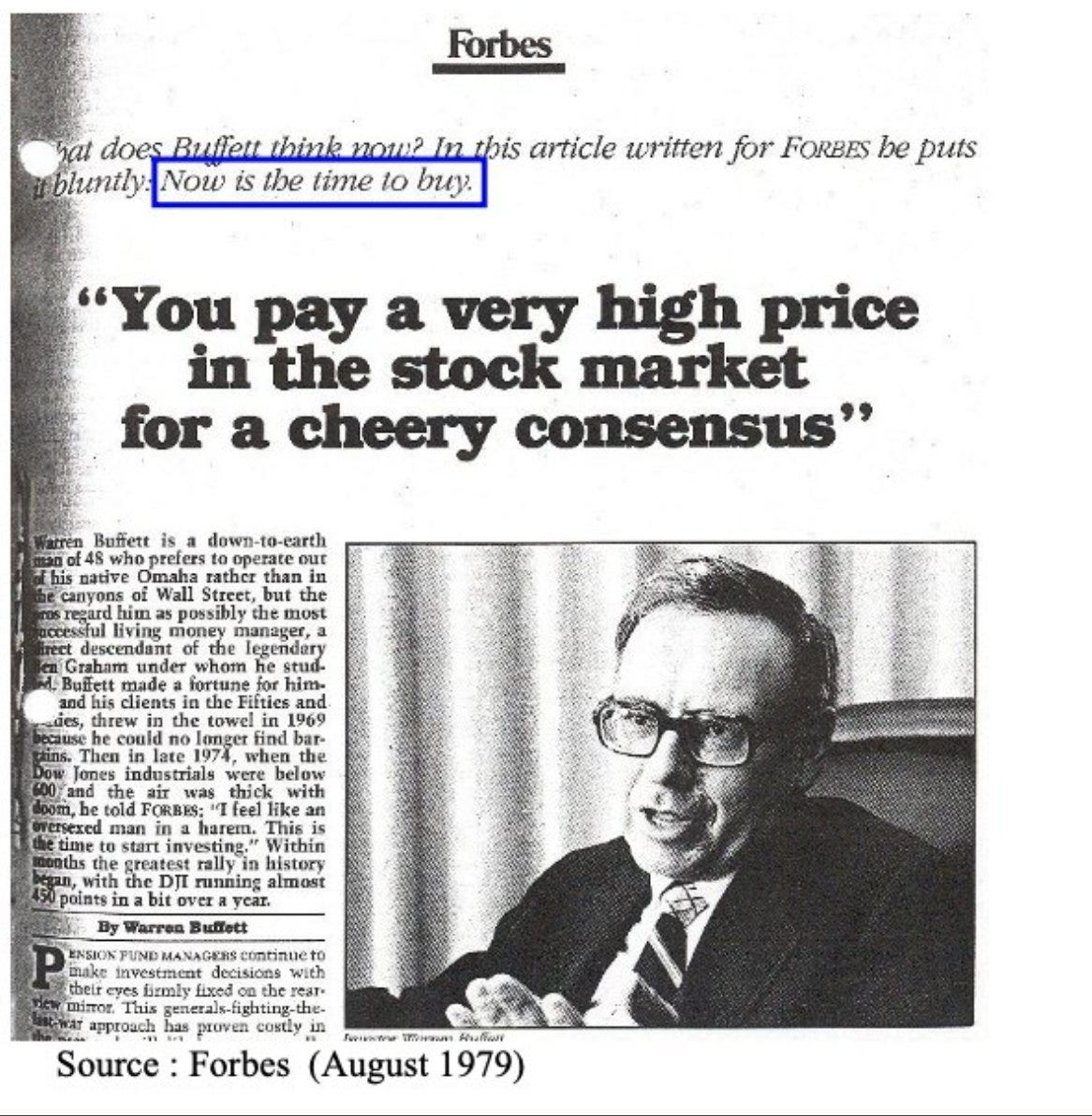

Warren Buffett in the middle of the 2008 crisis: “I feel like an oversexed man in a harem.”

3. Buy when there’s blood in the streets

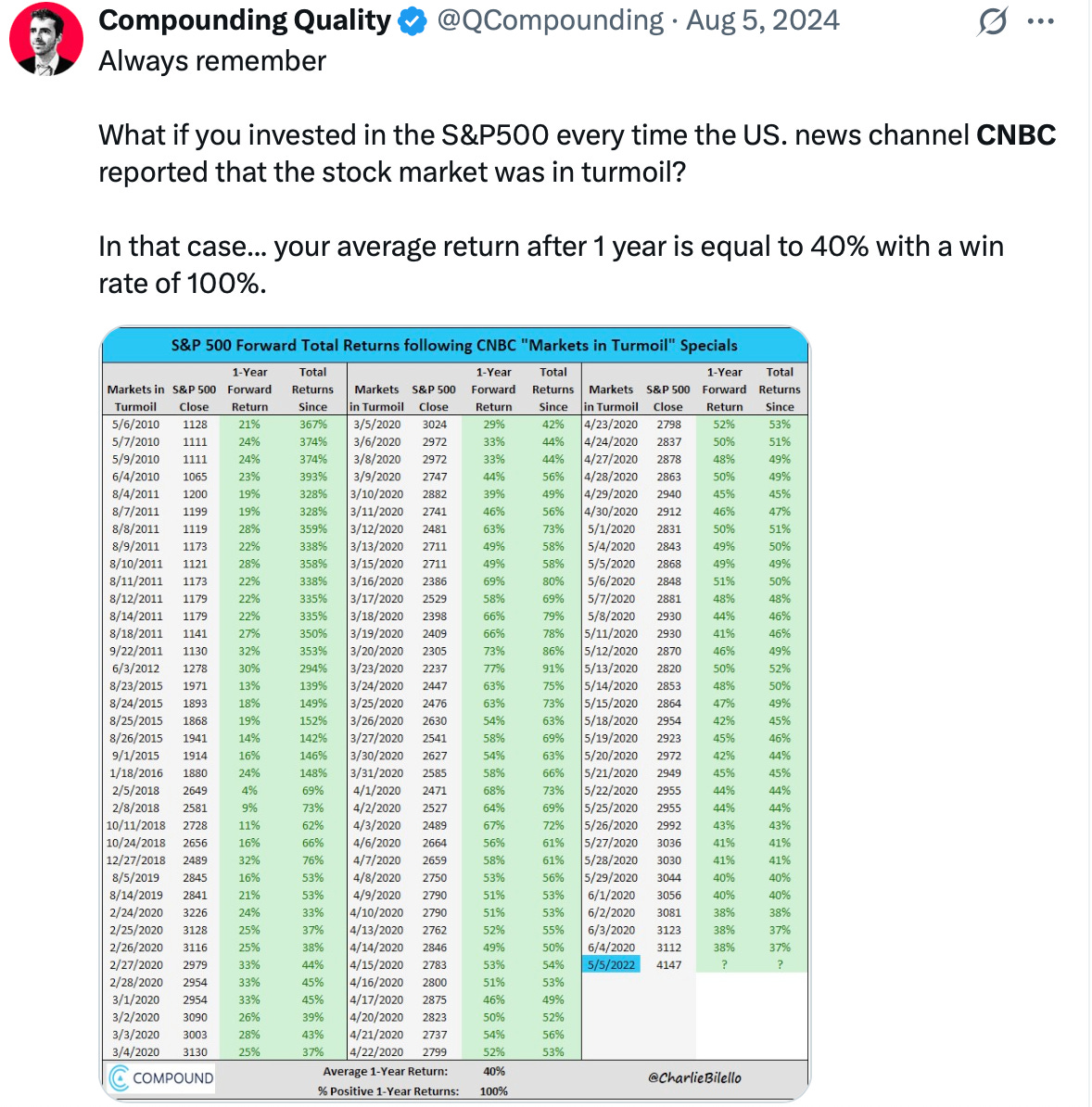

The best time to buy stocks?

When the media are talking about stock market crashes.

4. Confidence as a contra-indicator

Buy when Consumer Confidence and CEO Business Confidence is low:

5. Be prepared for stock market crashes

Berkshire Hathaway’s stock halved 4 times since Warren Buffett took charge in 1965.

Here’s what Warren Buffett has to say about stock market crashes:

6. Learn from successful investors

As an investor, you’ll go through bear markets multiple times during your life.

These quotes from famous investors help you to stick to your plan when the market gets rough:

Conclusion

The main lesson here is simple:

Market crash are inevitable. Use them to your advantage.

Never be a forced seller and always have a cash buffer

Know what you own and why you own it

Focus on the fundamentals of the companies over the stock price

Only the best companies in the world are good enough for you

Every market crash offers amazing opportunities

And always remember…

… In the long term stocks always go up.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.