Howard Marks’ warning - and our dividend advantage

Prices are high, risks are rising. But dividend growth strategies stay grounded in real value.

Howard Marks on Price, Value, and Playing Defense

In his latest memo, Howard Marks revisits one of the most important questions in investing: what’s the difference between value and price?

Value comes from a company’s ability to earn money over time. It’s built on fundamentals like earnings, cash flow, balance sheet strength, management quality, and competitive position.

Price is just what investors are currently paying. It moves up and down with moods, news, and speculation.

Fundamentals change slowly.

But prices can swing wildly because of investor psychology - optimism, fear, or FOMO.

This dynamic means that in the short run, the market can create significant mispricings, which creates two opportunities for investors:

Buy a bargain

Pay way too much

Most investors only see the first and don’t think too much about the second.

Think about investors using strategies like passive investing, momentum or trend following.

Where Are We Today?

This is the important question for investors who believe that prices eventually reflect a company’s value.

Here’s Marks’ answer from the memo:

U.S. stocks are expensive by historical standards (high p/e ratios, record valuations vs. GDP, tight credit spreads).

Risks are growing: tariffs, debt, inflation concerns, and geopolitical strain.

Yet prices are still rising, largely thanks to optimism about AI and a small group of mega-cap tech stocks.

Marks concludes that the market has shifted from “elevated in price” to “worrisome”.

I agree with him. You can pick your favorite valuation measure when it comes to U.S. stocks, they all look expensive.

Here’s the “Buffett Indicator” - the market cap of all U.S. stocks divided by GDP.

It’s the highest it’s ever been.

Marks also gives us some advice: don’t go to extremes like selling everything, but dial back risk - what he calls moving to INVESTCON 5.

The Dividend Growth Advantage

So what does this mean for dividend growth investors?

It actually reinforces the strength of our strategy.

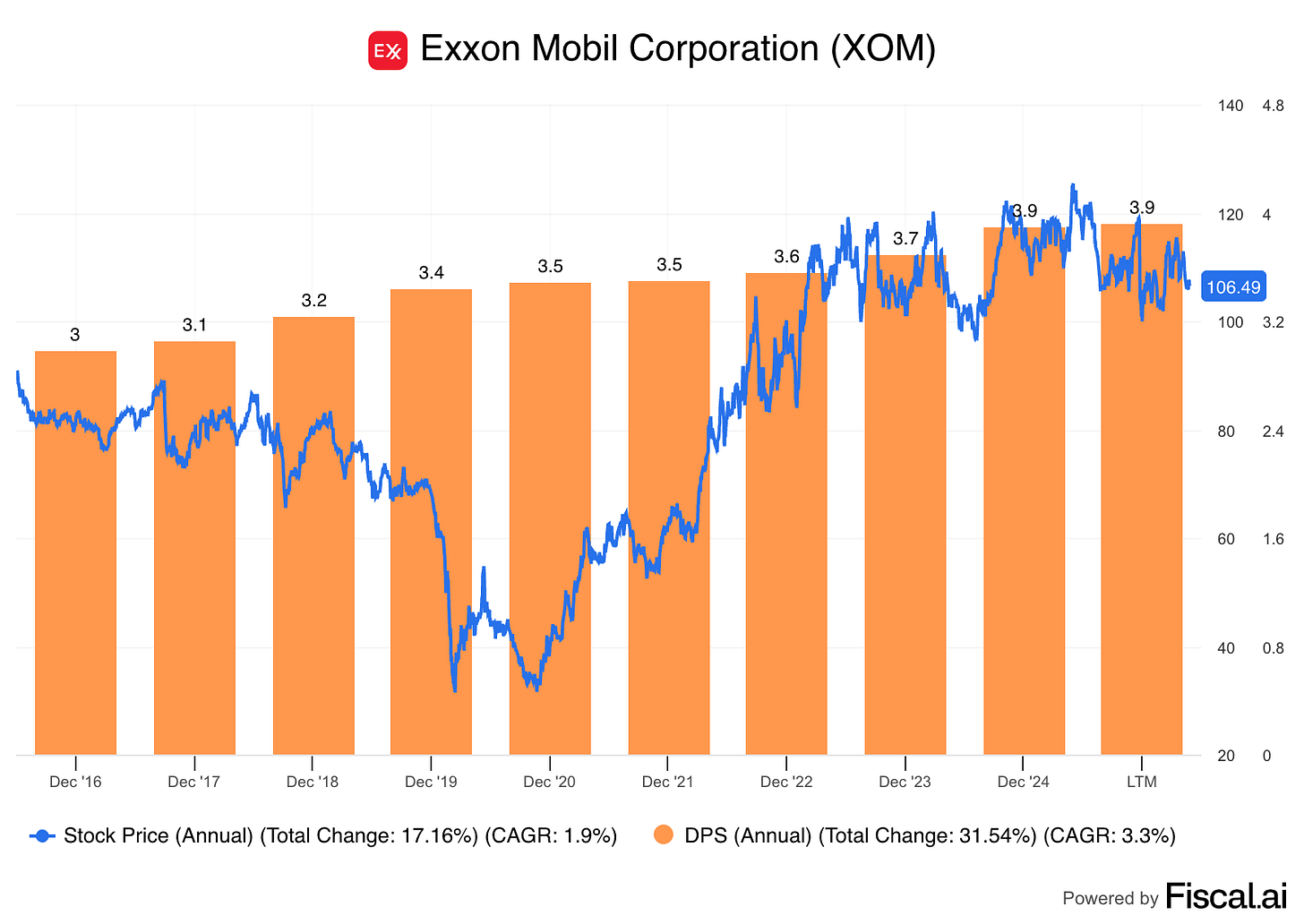

Cash Flows Over Prices:

Marks reminds us that market prices are driven by shifting moods, dividends come directly from profits. They are tied to value, not speculation.

Consistency

Quality dividend growth companies generate steady cash flows and return them to shareholders, quarter after quarter. Even if stock prices fluctuate, dividends continue to be paid.

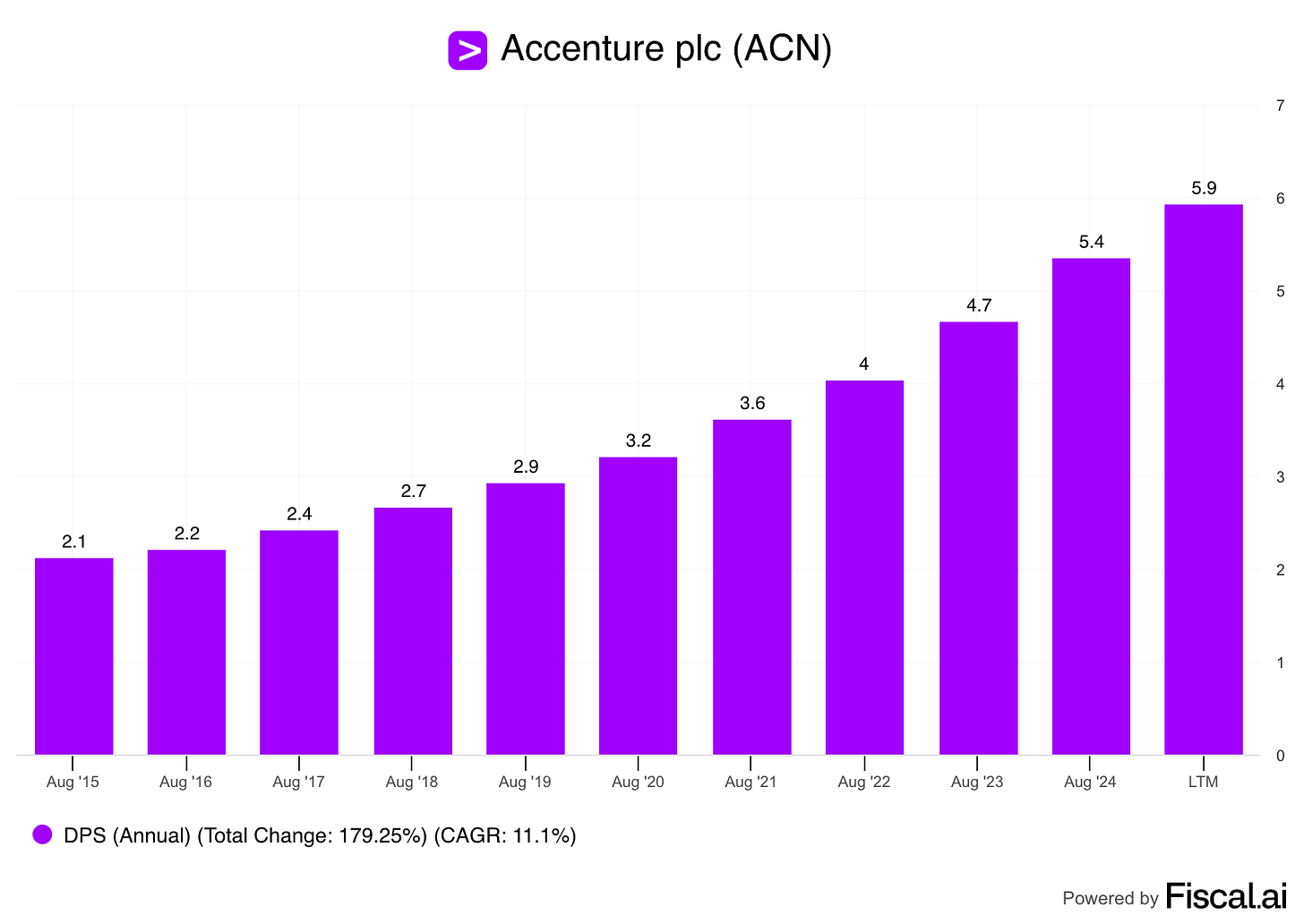

Growth Over Time

Dividend growers don’t just pay; they increase payouts. This compounds investor wealth, regardless of short-term price swings.

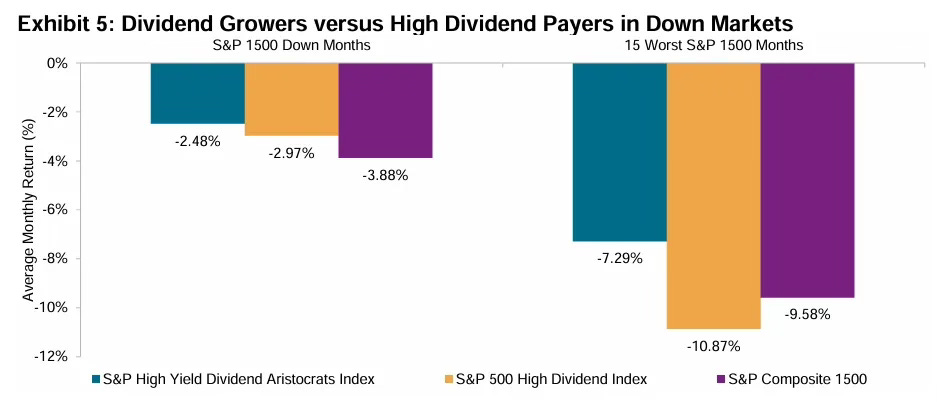

Defense in Volatile Markets

When the market feels “worrisome,” dividends serve as built-in defense. Instead of relying on price appreciation, investors collect a steady return. This helps reduce stress (and price volatility) and keeps compounding working in the background.

Valuation Anchor

Dividends also act as a check on overvaluation. If a company can’t support its dividend through earnings, the payout (and investor trust) will eventually break. That forces investors to focus on fundamentals, not just market hype.

Bottom Line

Markets often swing on psychology, not reality

Prices may run far ahead of value, and no one knows when they’ll snap back

Dividend growth investing helps protect against this uncertainty

By focusing on businesses with reliable cash flows and a culture of rewarding shareholders, we stay anchored in value.

Prices may be “worrisome.” Dividends are not.

They keep coming in - through booms, busts, bubbles, and everything in between.

One Dividend At A Time

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

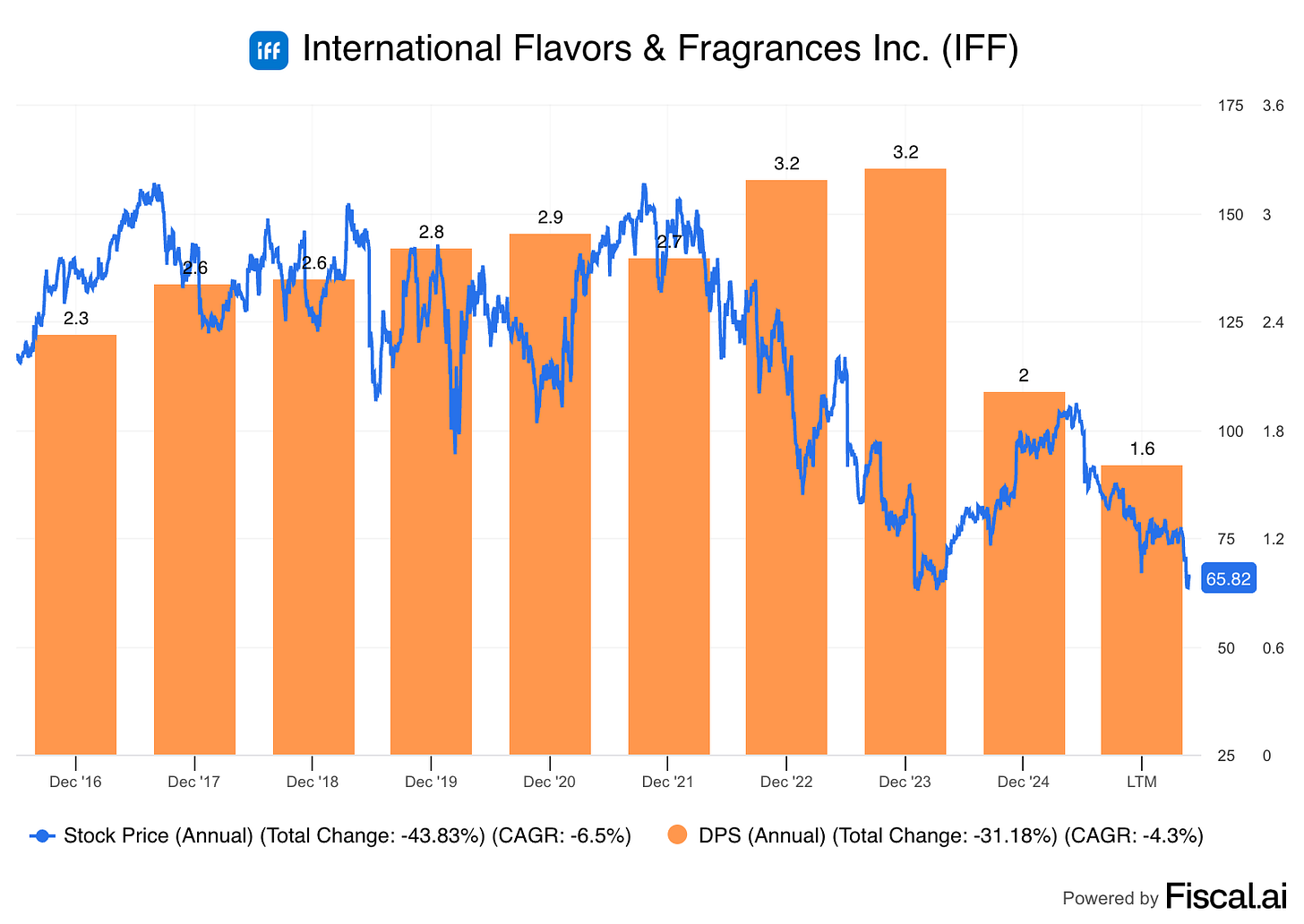

Fiscal.ai: Financial data