I Ran the Magic Formula on Europe. Here's What I Found

I screened 4,000 stocks—only 77 made the cut

🚨 Big News!

I just launched the Compounding Dividends YouTube channel - today's post actually comes from there.

Quick favor:

👉 Click here to subscribe to the channel - it really helps a new channel like ours get off the ground.

And if you want to go the extra mile, watch a video or two to the end.

YouTube’s algorithm eats that up.

Here’s today’s article in video form:

Thanks for the support. Now, back to today’s issue:

👋 Howdy Partner,

What if you could steal a page from the playbook of one of the greatest investors alive - and use it to find high-quality, dividend-paying European stocks?

That’s exactly what we’re doing today.

We’re running Joel Greenblatt’s Magic Formula through a powerful screening tool - Fiscal.ai - across the Euronext and London Stock Exchange.

Who’s Joel Greenblatt?

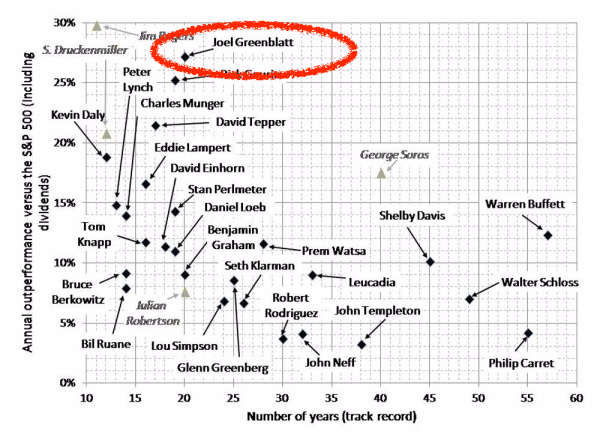

Joel Greenblatt is an investor, author, and professor at Columbia Business School, where he teaches value investing and entrepreneurship.

He also ran a hedge fund that delivered 40%+ annual returns for over 20 years.

His “Little Book That Beats the Market” contained a strategy that beat the market using just two metrics: Return on Capital and Earnings Yield.

He called it the ‘Magic Formula’.

Today we’re using Greenblatt’s Magic Formula, but I’m adding a twist: we’re filtering for dividend stocks only - because compounding income matters.

The Magic Formula

The screen looks for undervalued stocks with high returns on capital. Here's a simple breakdown of how it works:

Rank by Earnings Yield: Calculate the earnings yield of a company (this is basically the inverse of the P/E ratio). Rank stocks based on this yield; higher yields are better.

Rank by Return on Capital: Calculate the return on capital. Rank stocks again; higher returns are preferred.

Combine Rankings: Combine the two rankings for each stock. The goal is to find stocks that score well in both categories.

That’s the breakdown of the screening method. In the book, Greenblatt suggested you use this as a quantitative strategy. If you took this approach, you’d:

Select Top Stocks: Choose the top-ranked stocks from this combined list to invest in.

Hold for a Year: Maintain these investments for about a year, then repeat the process.

Our Screener Criteria

Here’s how I set up the Fiscal.ai screener:

Exchanges: The Euronext in Paris, Brussels, Amsterdam, and Lisbon, as well as the London Stock Exchange

5-yr Average ROCE: >8% I used a 5-year average to find companies with consistently high returns. I chose ROCE because it captures both debt and equity - we want companies that invest all of their capital wisely

Earnings Yield: >6%

Market Cap: > $1 billion

Dividend Yield: >2%

That does give us a list of companies, but it’s NOT the Magic Formula.

To get that, we need to move the results of the screener to a spreadsheet.

There are a few steps we still need to do:

Sort them by Earnings Yield, highest to lowest, and give them a number - highest Earnings Yield get #1.

Sort them by ROCE, again highest to lowest, with the highest getting #1

Add the ranks

Sort them by combined rank, lowest to highest

NOW we have the Magic Formula - if you want the results, you can download my spreadsheet here:

The Top 10

Here are the top 10 results from our Magic Formula Europe screen:

Instead of buying the top 10 or 20 and holding them for a year, we’re using this as a screen to find potentially interesting companies to add to our portfolio.

Narrowing the List Further

We’re not going to spend a lot of time looking at every company on the list.

Instead, our first goal is to find reasons to say ‘no’ as fast as possible.

For each company, we’ll ask:

Do I understand how the company makes money?

Does this company interest me?

Can I make an educated guess about where this company will be in 10 years?

If you say 'no' to any of those questions, move on to another company.

Here are some that I quickly ruled out

Rio Tinto Group - I tend to avoid mining companies, and the dividend history is unstable

B&M European Value Retail S.A. - too much debt

Métropole Télévision S.A. - no growth and a high Payout Ratio

ITV plc - again, no growth

This will leave us with a shortened list that we can look deeper into.

Here are a few that look interesting

Centrica

How the company makes money

Centrica generates revenue primarily through energy supply, services, and solutions, including retail energy sales and energy management services for businesses and households.

Why it might be interesting

Recent growth has been good, the Payout Ratio is low, and the balance sheet looks very solid.

Trigano

How the company makes money

Trigano manufactures and sells recreational vehicles, camping equipment, and trailers, targeting consumers and businesses in the leisure and outdoor market.

Why it might be interesting

Steady growth, a low Payout Ratio with a good balance sheet in an industry I’m sure I can understand.

Greggs PLC

How the company makes money

Greggs PLC operates a chain of bakery shops, selling baked goods, sandwiches, and drinks to consumers through retail and delivery channels.

Why it might be interesting

Steady growth, impressive returns on capital, and active in a simple industry.

Ipsos SA

How the company makes money

Ipsos SA provides market research and consulting services, generating revenue through surveys, data analytics, and insights for businesses across various industries.

Why it might be interesting

A high Dividend Yield, reasonable Payout Ratio, and a nice history of Dividend Growth.

Conclusion

Peter Lynch famously said:

“The person that turns over the most rocks wins the game”

This means: the more companies you look at, the better your chances of finding a good one.

Using a stock screener like the one at fiscal.ai helps a lot.

Combining it with good criteria, like Joel Greenblatt’s Magic Formula, will help you find better companies faster.

There are almost 4,000 companies on the Euronext and London stock markets.

In just a few minutes, we cut that number down to 77!

I’ll look through these and tell you if I find something really interesting.

You should do the same.

Rember:

The more companies you look at, the more likely you are to find a great investment.

That’s it for today!

Today we:

Used Joel Greenblatt’s Magic Formula to screen for high-quality, dividend-paying stocks on the Euronext and London Stock Exchange

Further filtered the list by quickly eliminating companies with too much debt, unstable dividends, in unattractive industries, outside our circle of competence, or with poor growth

Chose a few companies to investigate more deeply based on business model, financial strength, and long-term potential

Some interesting companies we found were:

Centrica – Strong recent growth, low payout ratio, solid balance sheet

Trigano – Steady business in recreational vehicles, understandable model, good balance sheet

Greggs PLC – Bakery chain with strong returns on capital and simple business

Ipsos SA – Market research firm with a high dividend yield and dividend growth history

Things to keep in mind when using screeners:

Don’t blindly buy the top-ranked names

Use the list to find interesting ideas, then do your own research

Focus first on eliminating businesses you don’t understand or don’t like

When something catches your eye, dig deeper into the fundamentals

The more companies you study, the better your odds of finding a great dividend investment

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data