Inflation’s Up, REITs Are Down - Are They On Sale?

REITs are offering high yields and trading at deep discounts. Is this the inflation hedge the market’s ignoring?

I don’t spend much time trying to predict interest rates, the Fed’s next move, or the economy.

But sometimes, there are big trends that are worth paying attention to.

The biggest one over the past few years has been inflation.

Inflation

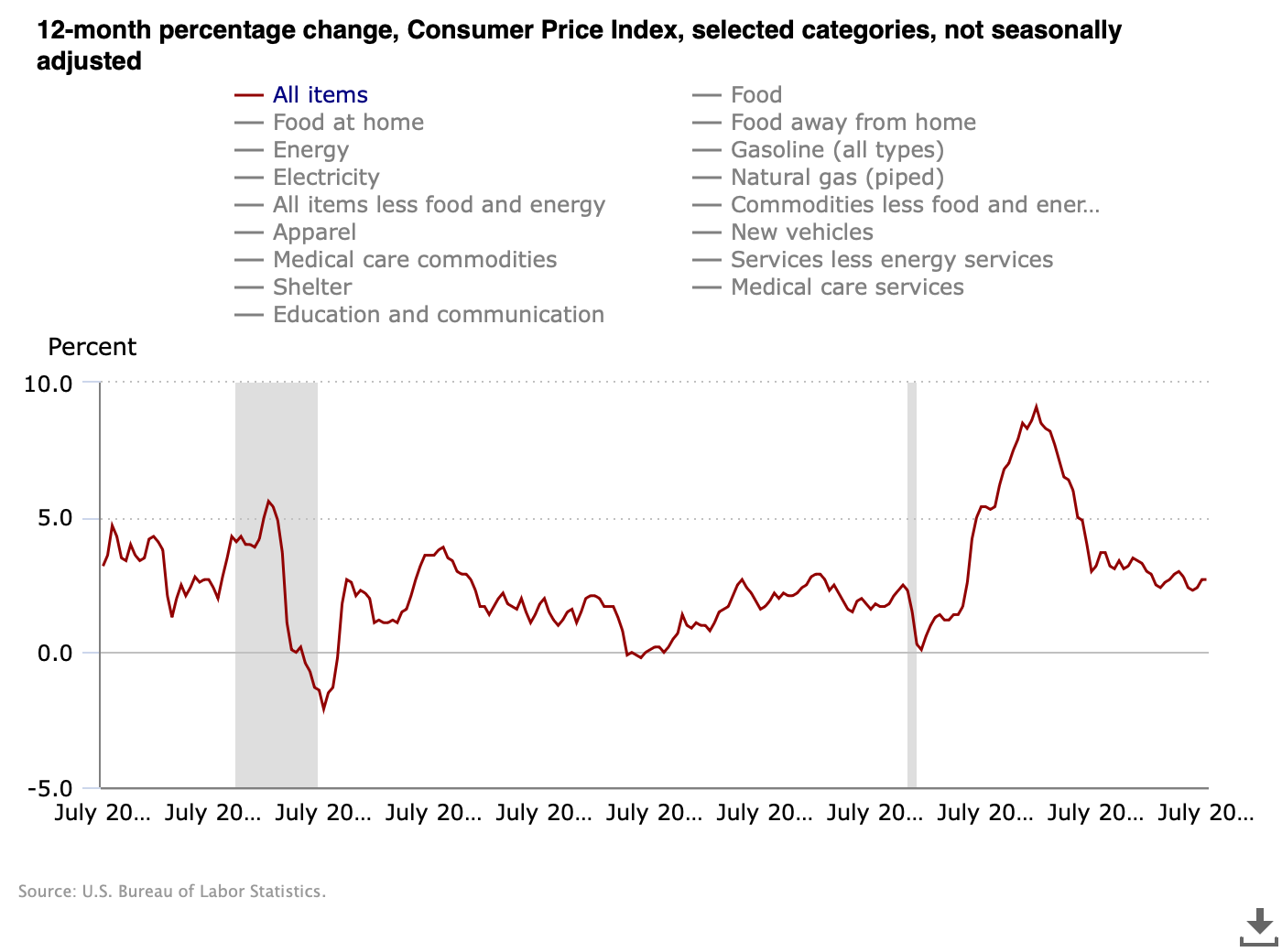

Here’s the yearly change in the U.S. Consumer Price Index over the past 20 years.

The COVID spike is obvious - and inflation still hasn’t returned to pre-2020 levels.

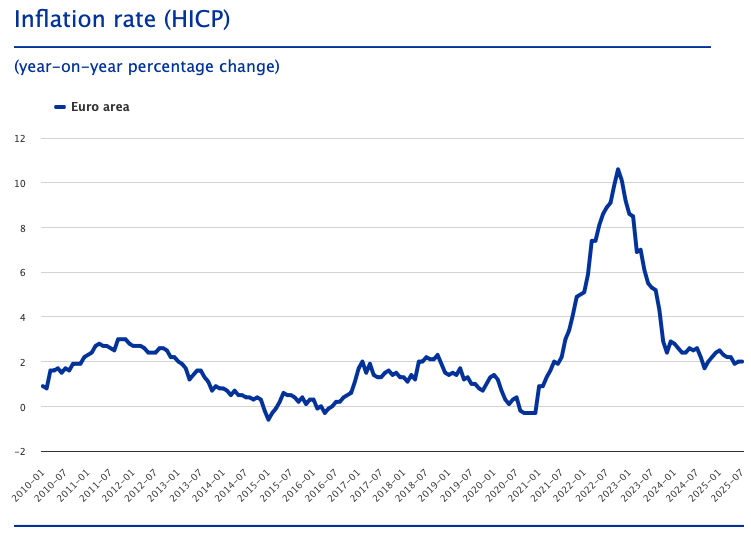

Europe’s chart looks almost identical.

You can think of these charts as showing how fast the prices you pay as a consumer are rising.

But there’s another angle we can look at.

Producer Price Index

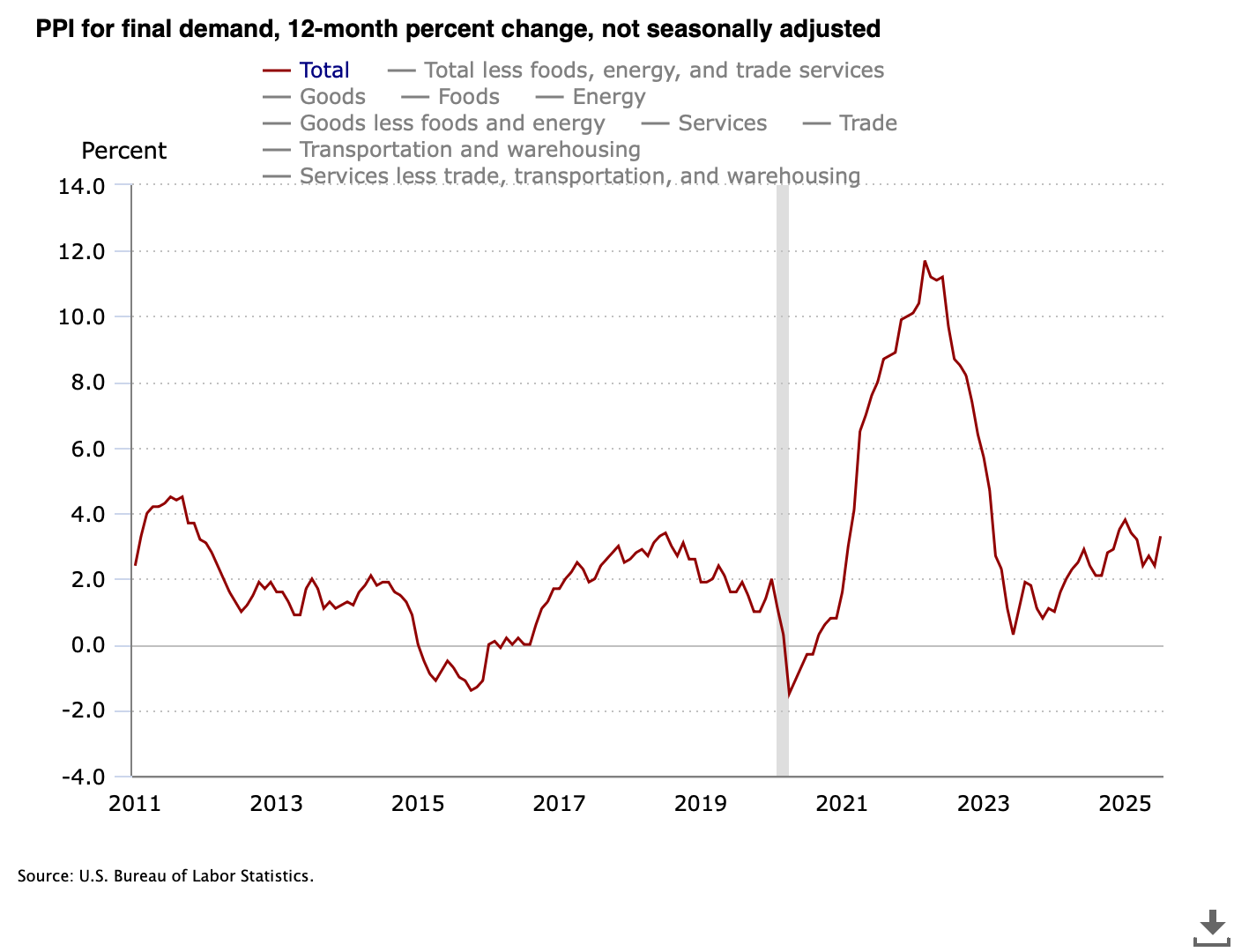

The Producer Price Index (PPI) tracks how much businesses pay for goods and services.

If CPI is what you pay at the checkout counter, PPI is what the store is paying the distributors.

Here’s the PPI year over year change for the past 20 years:

Notice the difference: consumer prices have flattened, but producer prices are still rising.

From July 2024 to July 2025, PPI rose 3.3% (vs. 2.5% expected).

From June 2025 to July 2025 alone, PPI rose 0.9%.

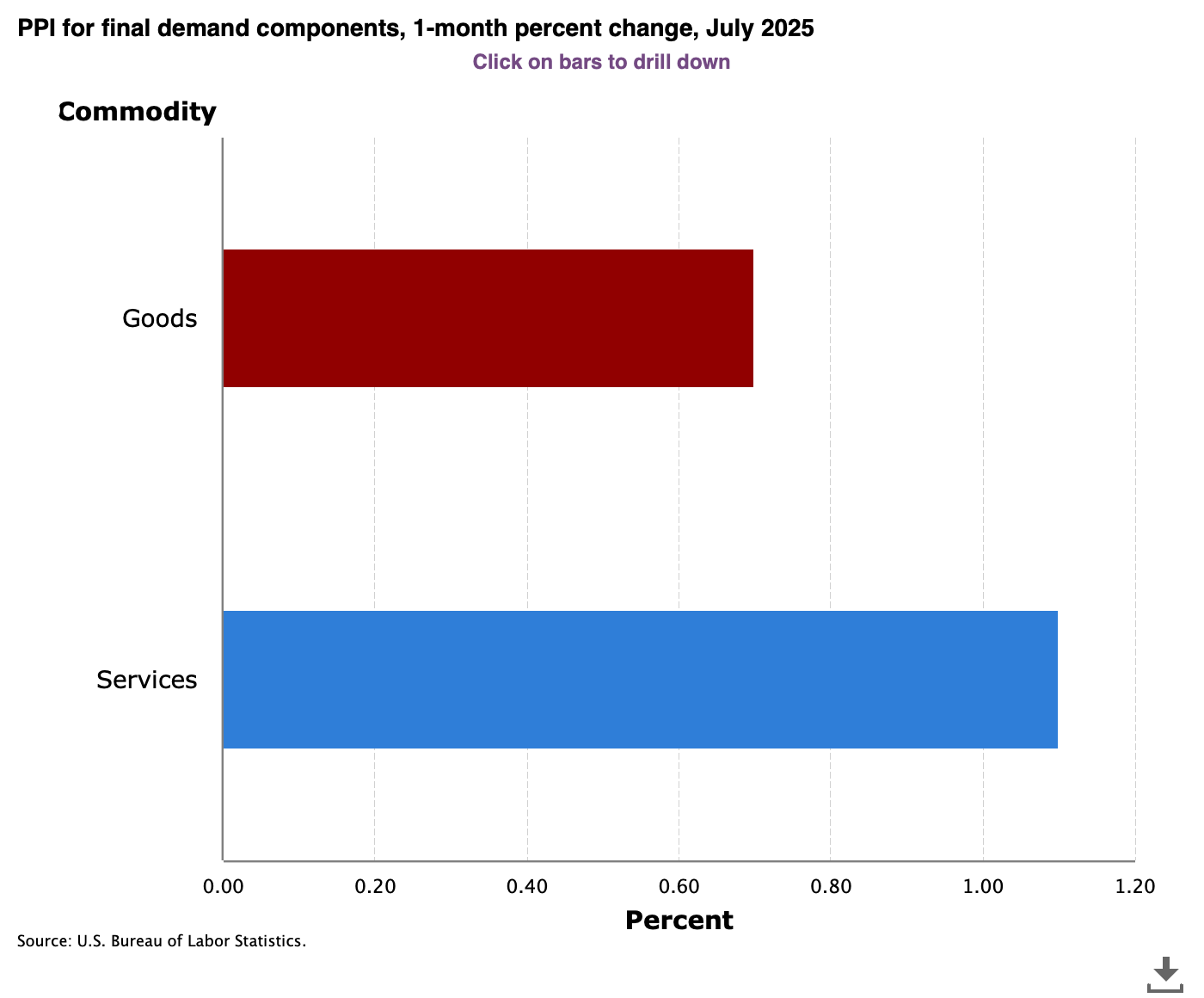

Breaking it down further: cost of services (which dominate the U.S. economy) are rising faster than goods.

The biggest driver of increasing services cost is increasing wages.

Wages

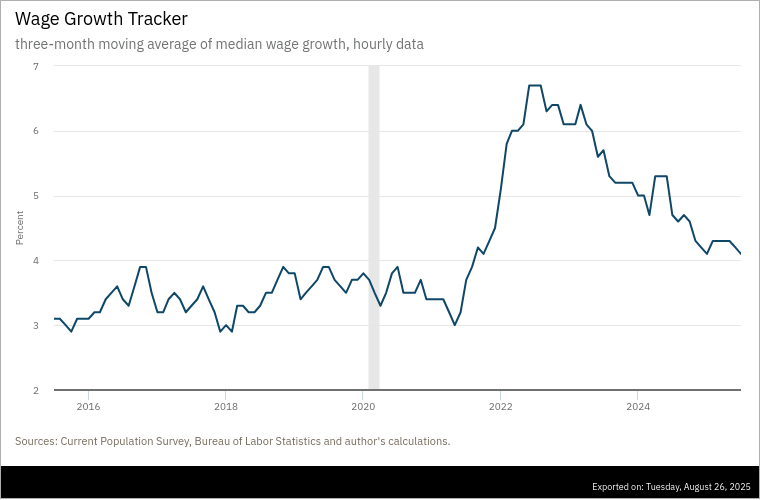

The Atlanta Fed’s wage tracker shows the same pattern: a big spike in 2022, then slowing, but still above the pre-COVID baseline.

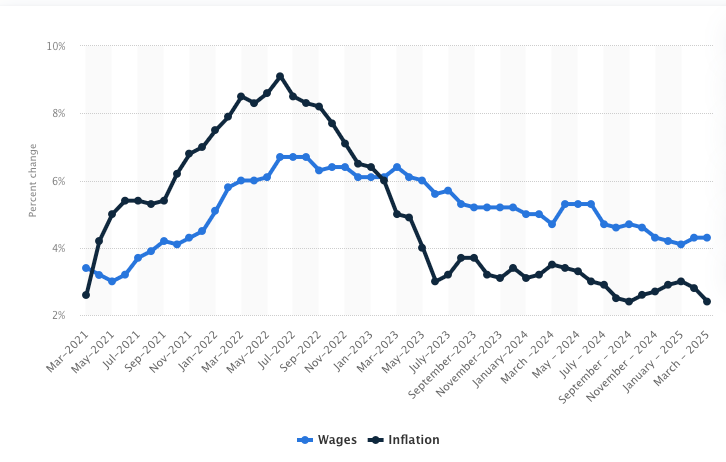

Wages have outpaced inflation since early 2023.

In theory, there a relationship between rising wages and rising prices:

When wages go up, businesses might raise prices to cover higher costs, which can cause inflation

People have more money to spend, which can push demand and prices up

But this isn’t guaranteed - if workers become more productive this doesn’t necessarily lead to inflation.

If the economy is slowing, central banks tighten policy (raise rates, decrease money supply), or if companies and consumer expect prices to be stable, higher wages don’t always lead to inflation either.

It depends on the overall economic situation.

Fed Shifts

At Jackson Hole, Fed Chair Jerome Powell hinted at a shift: the Fed may focus more on supporting employment and less on forcing inflation back to 2%.

Given the fact that consumer inflation is still running higher than it did before 2020, producer prices are continuing to rise, and so are wages, we could be entering a new era where inflation runs closer to 3% or higher.

What’s Done Well in Inflationary Environments?

If inflation might run higher than it has in the past, do we need to make changes to our portfolios?

The good news is that when you focus on buying strong, cash flowing companies at reasonable prices like we do, the answer is no.

But it’s probably worth asking what kinds of assets do well in inflationary environments.

Stocks generally keep pace with inflation over time.

Inflation-protected bonds: Such as TIPS (Treasury Inflation-Protected Securities) in the U.S., which adjust their principal with inflation.

Physical assets like gold, commodities, and real estate often shine when inflation is sticky.

REITs

Real estate is a great inflation hedge.

First, the supply of real estate is naturally limited, so the value of properties tend to go up with inflation.

And so do the cash flows generated by real estate - as prices rise, landlords can raise rents.

One of the easiest ways to own real estate is through REITs.

A REIT is a company that owns and manages a group of real estate properties that make money, like apartment buildings, offices, or shopping centers.

We wrote an entire guide to them here.

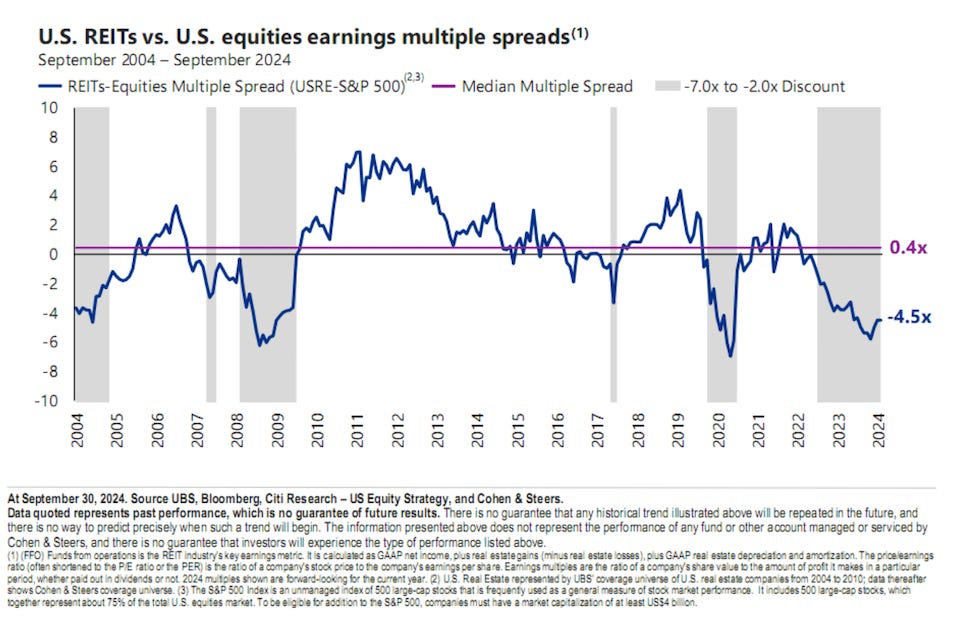

REITs are especially interesting right now - they’ve been beaten down by rising interest rates and are trading at steep discounts relative to the broader market.

With valuations depressed, REITs are offering unusually high yields today, giving investors the chance to lock in elevated income streams before the market wakes up.

Here are the yields of a few well-known ones:

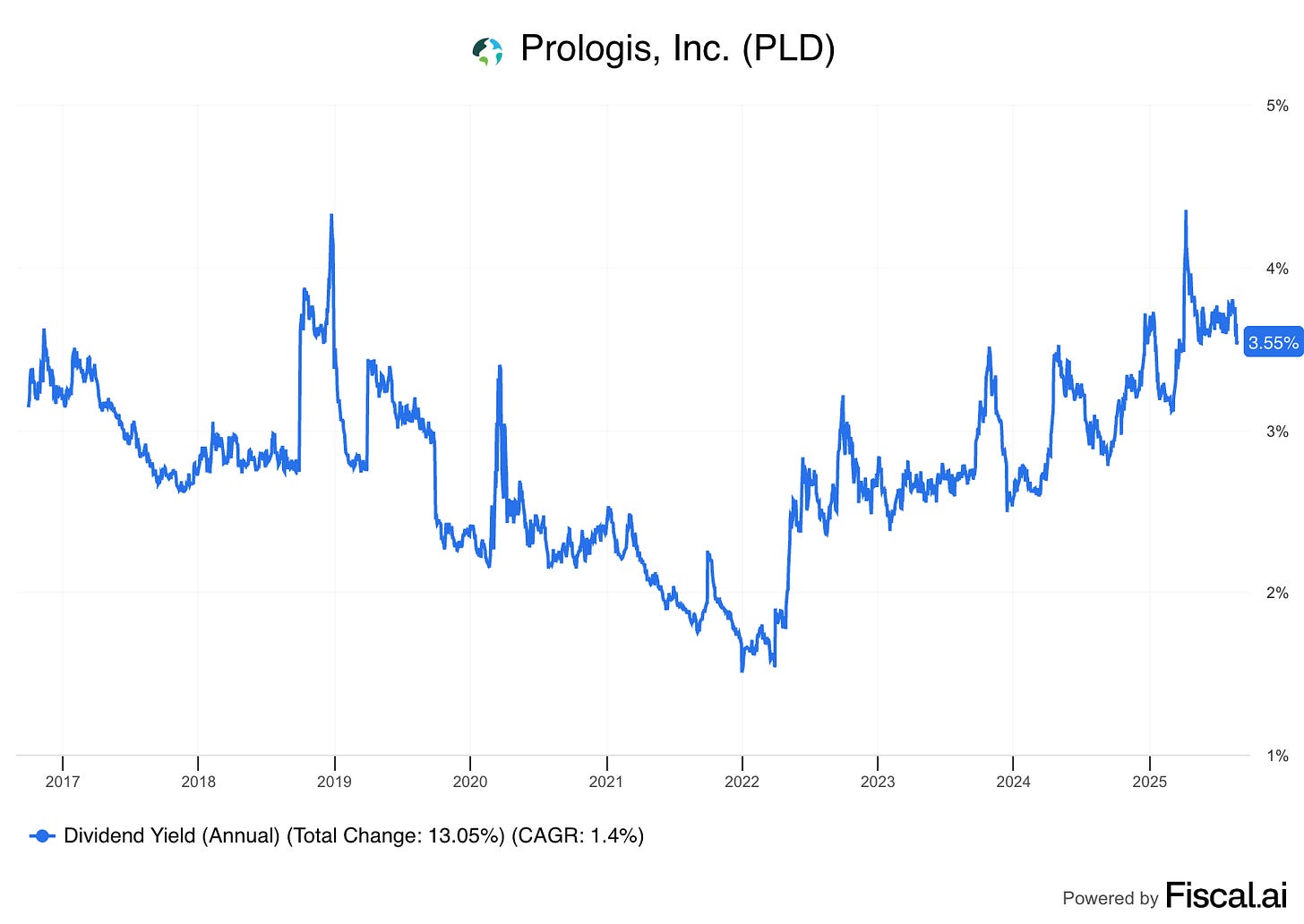

Prologis (PLD)

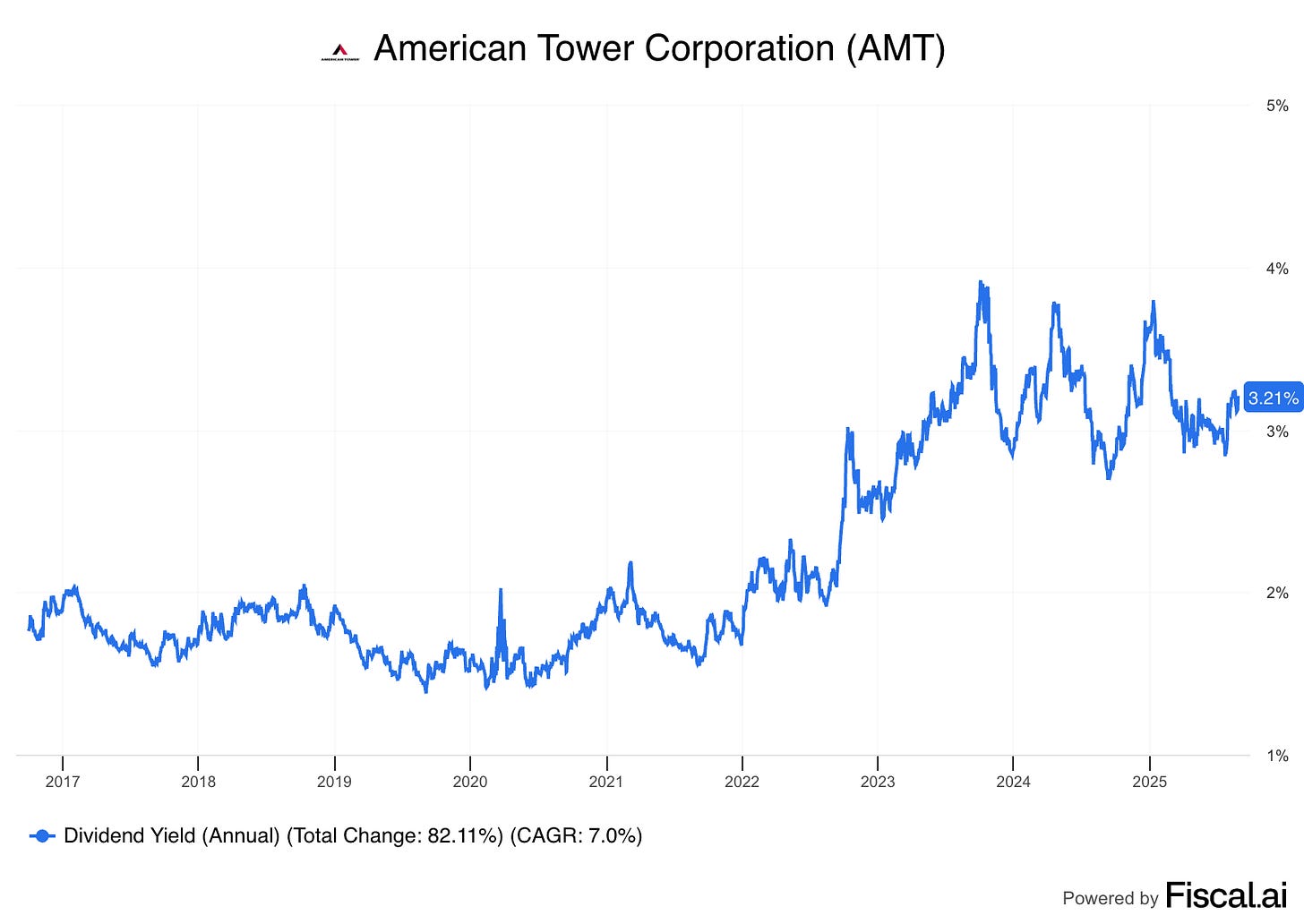

American Tower (AMT)

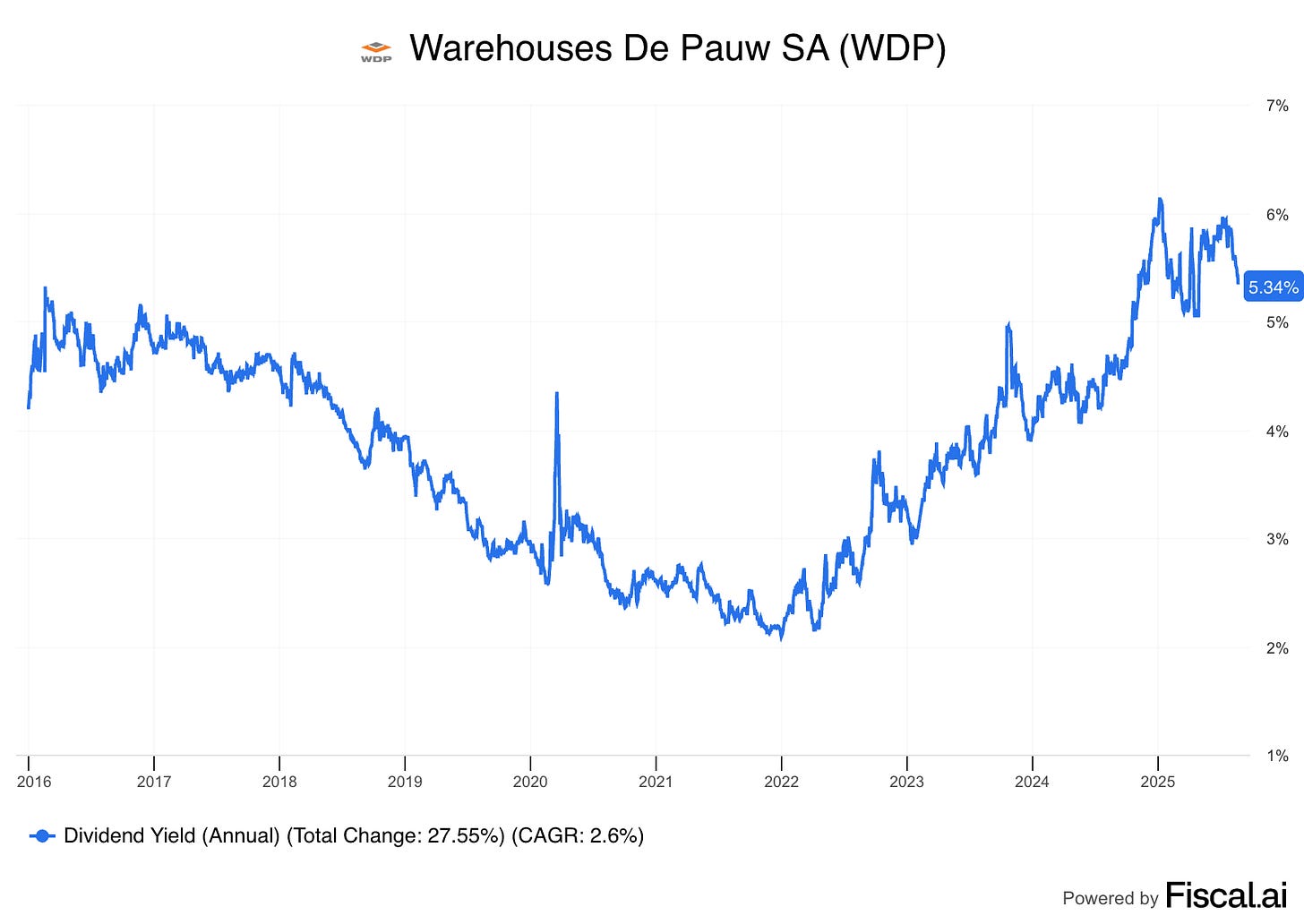

Warehouses De Pauw (WDP)

If Powell is signaling that inflation isn’t going back to the old 2% world, this may be a great opportunity to pick up some assets that not only survive inflation, but pay you more because of it.

On Saturday, we’ll take a look at some of the REITs I think are the most interesting right now!

One dividend at a time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data