“Inversion” Helped Us (and Warren Buffett) Buy This Hated Stock

Charlie Munger had lots of great ideas - 'inversion' was one of his best.

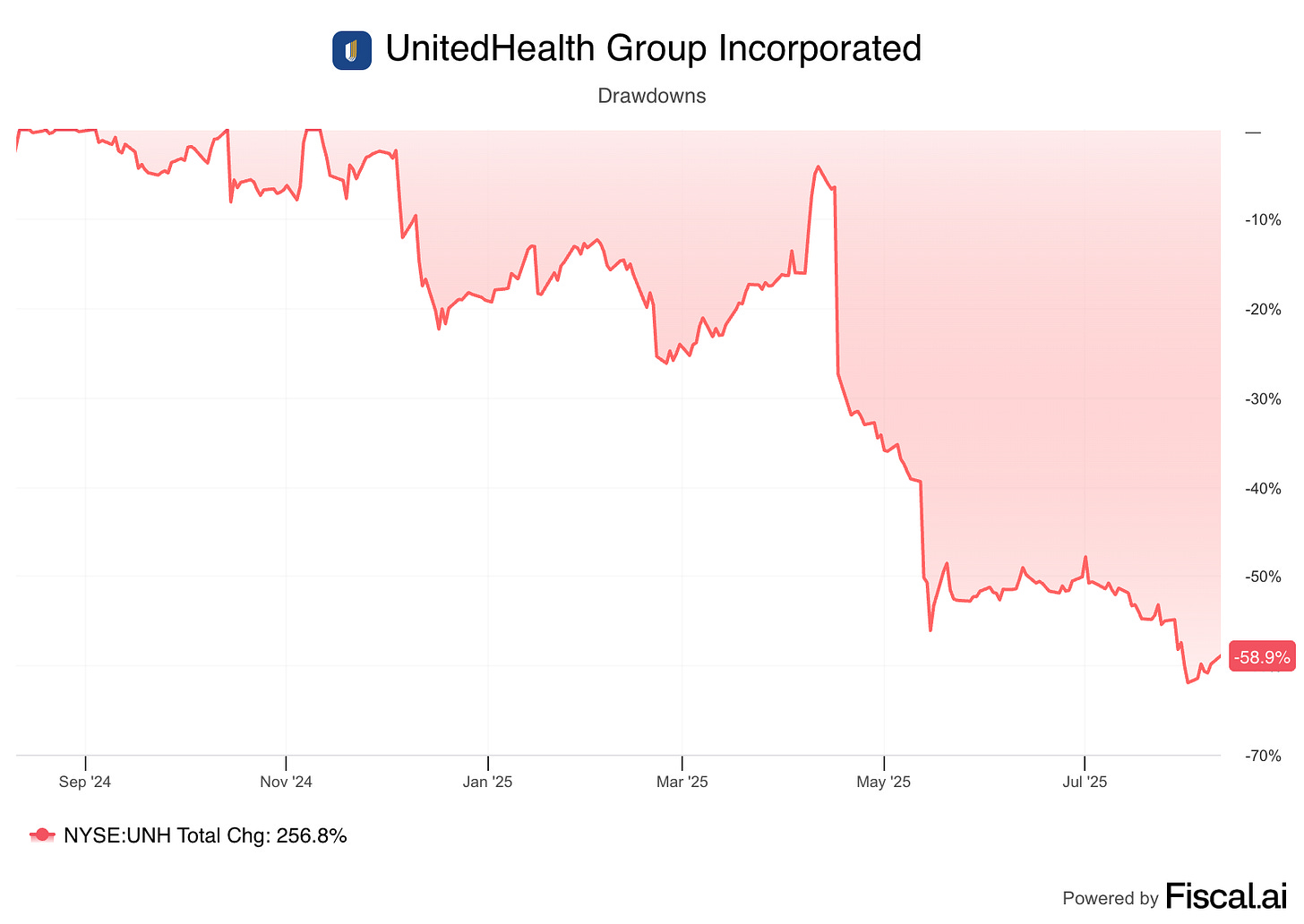

UnitedHealth Group’s stock has had quite a ride.

The company’s new guidance disappointed analysts.

The DOJ is investigating their billing.

They’re getting a new CFO.

The chart looked ugly.

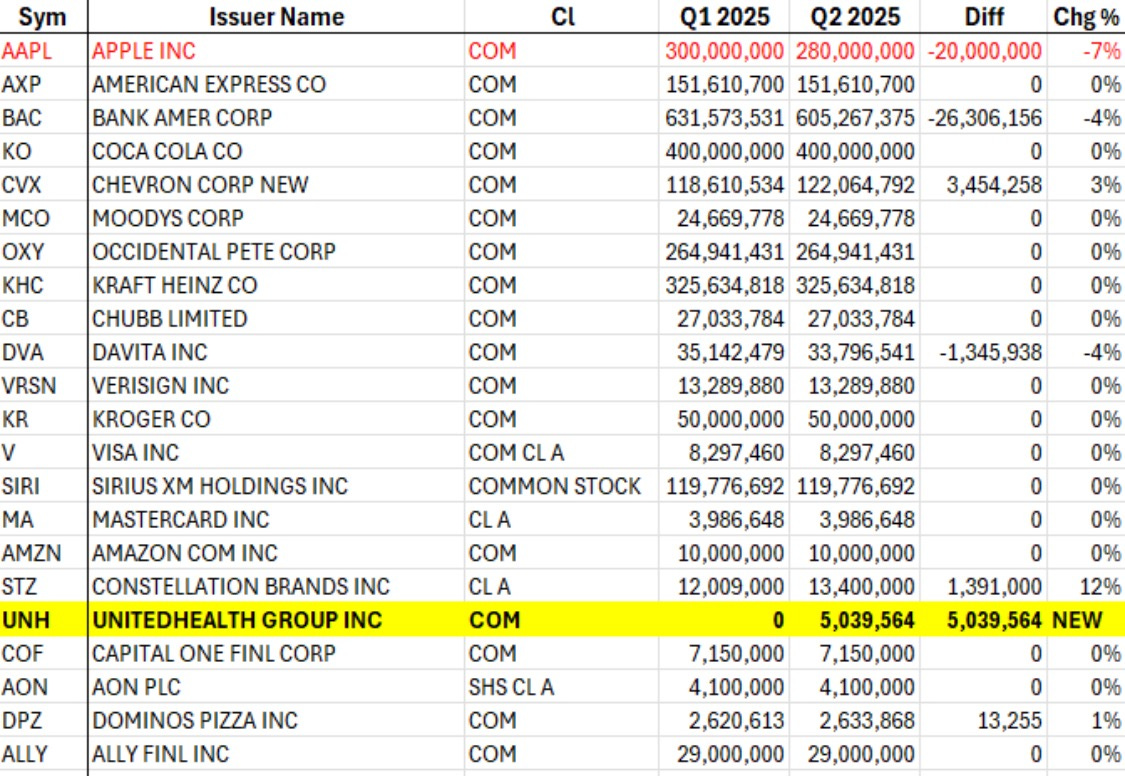

But Warren Buffett bought it.

And so did we - at a lower price than what Buffett reported.

Today I’m going to take some ideas from Charlie Munger’s book and show you why we both bought the stock, even though there was so much negativity around it.

Charlie loved the idea of inversion - that avoiding bad ideas and being stupid would take you a lot further than trying to be smart.

Today, I’m going to present the bear case for UnitedHealth and see if we can’t kill this idea.

The UnitedHealth Bear Case

The stock has dropped for a number of reasons, we’ll dive into each one, but here’s the list upfront:

Missed earnings, and reduced guidance

Regulatory investigations

Risks due to their integrated business model

Management instability

1. Missed Earnings, Reduced Guidance

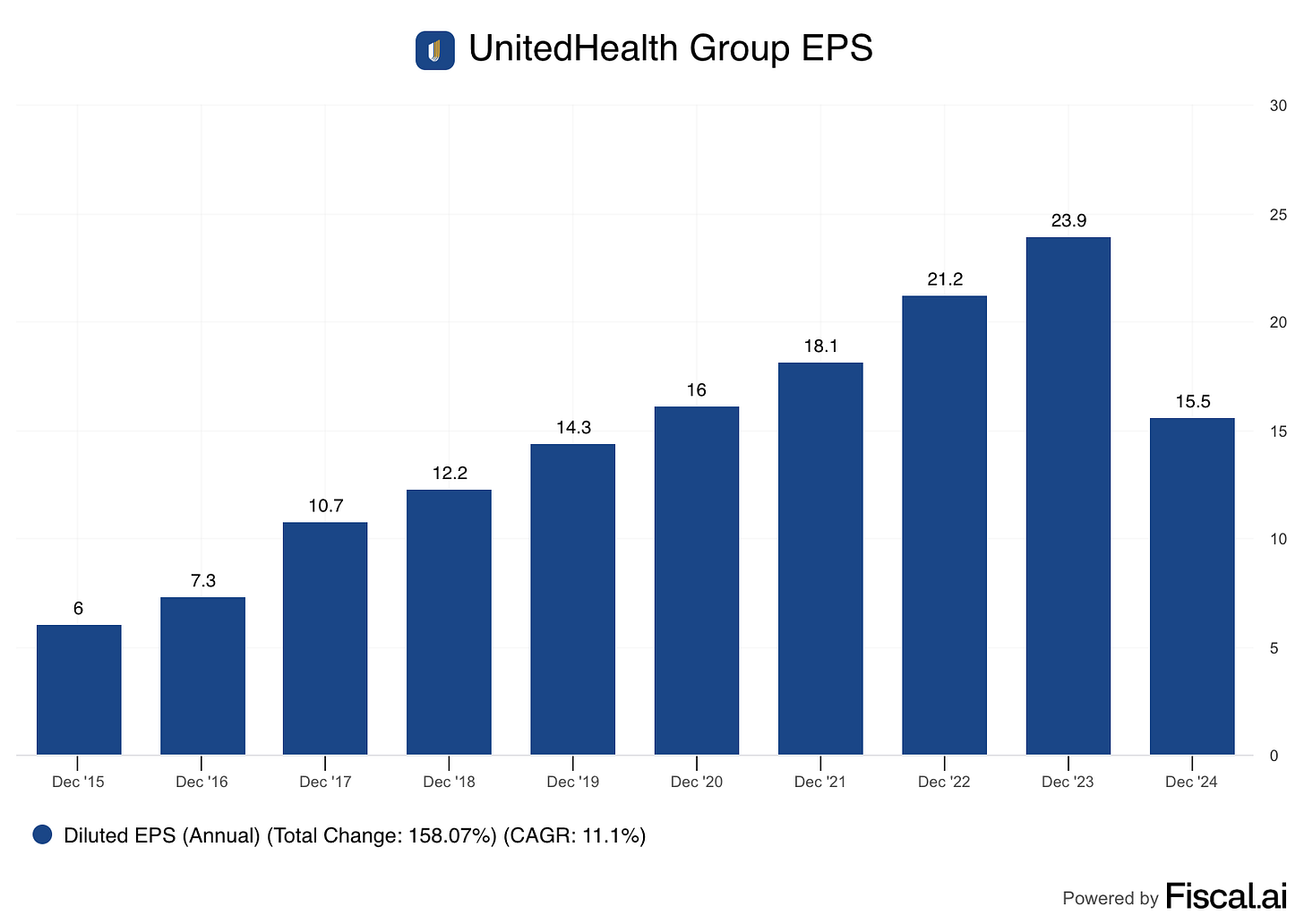

In May, UnitedHealth withdrew its April-issued 2025 EPS guidance of $26.00-$26.50 (down from $29.50-$30.00 previously)

On July 29, the company provided guidance of ‘at least $14.65 Per Share’

The consensus estimate was at $20.75, but there was a wide range of estimates from $18 to $26.

This is significantly lower than recent EPS numbers.

Earnings under $15 per share would take the company back to pre-COVID levels.

At the current share price, EPS of $14.65 puts the company at a forward P/E of 20.7x.

The consensus estimates don’t have the company’s earnings making a sharp recovery either:

From this view, the company may not be as cheap as the trailing P/E of 11.7 makes it appear.

2. Regulatory Investigations

UnitedHealth is facing increasing investigations and regulatory pressure.

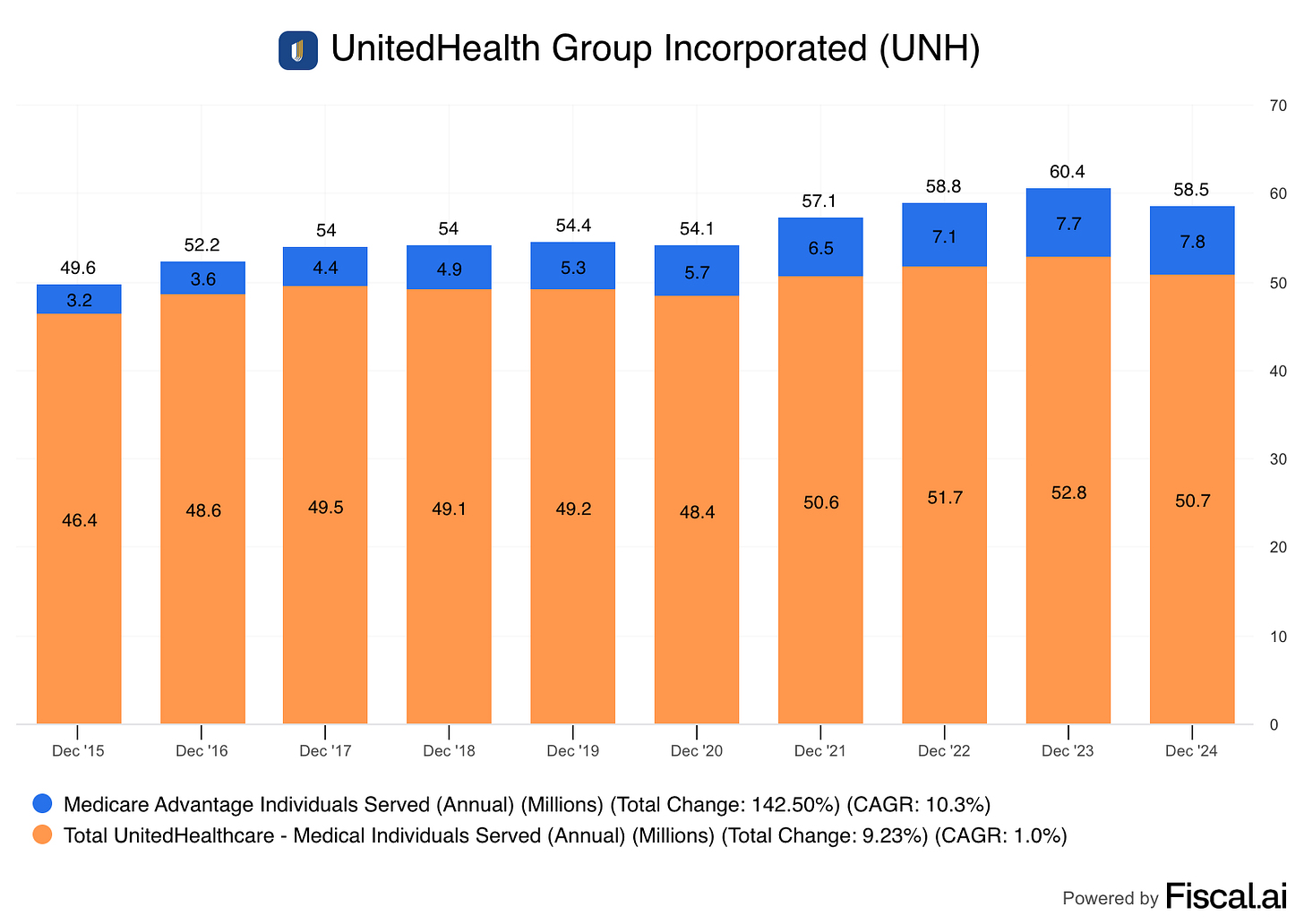

They are being investigated for billing practices in Medicare Advantage programs:

As well as for alleged payments to nursing homes to reduce hospital admissions:

This could be a big deal for United.

Medicare Advantage represents about 15% of their insurance business.

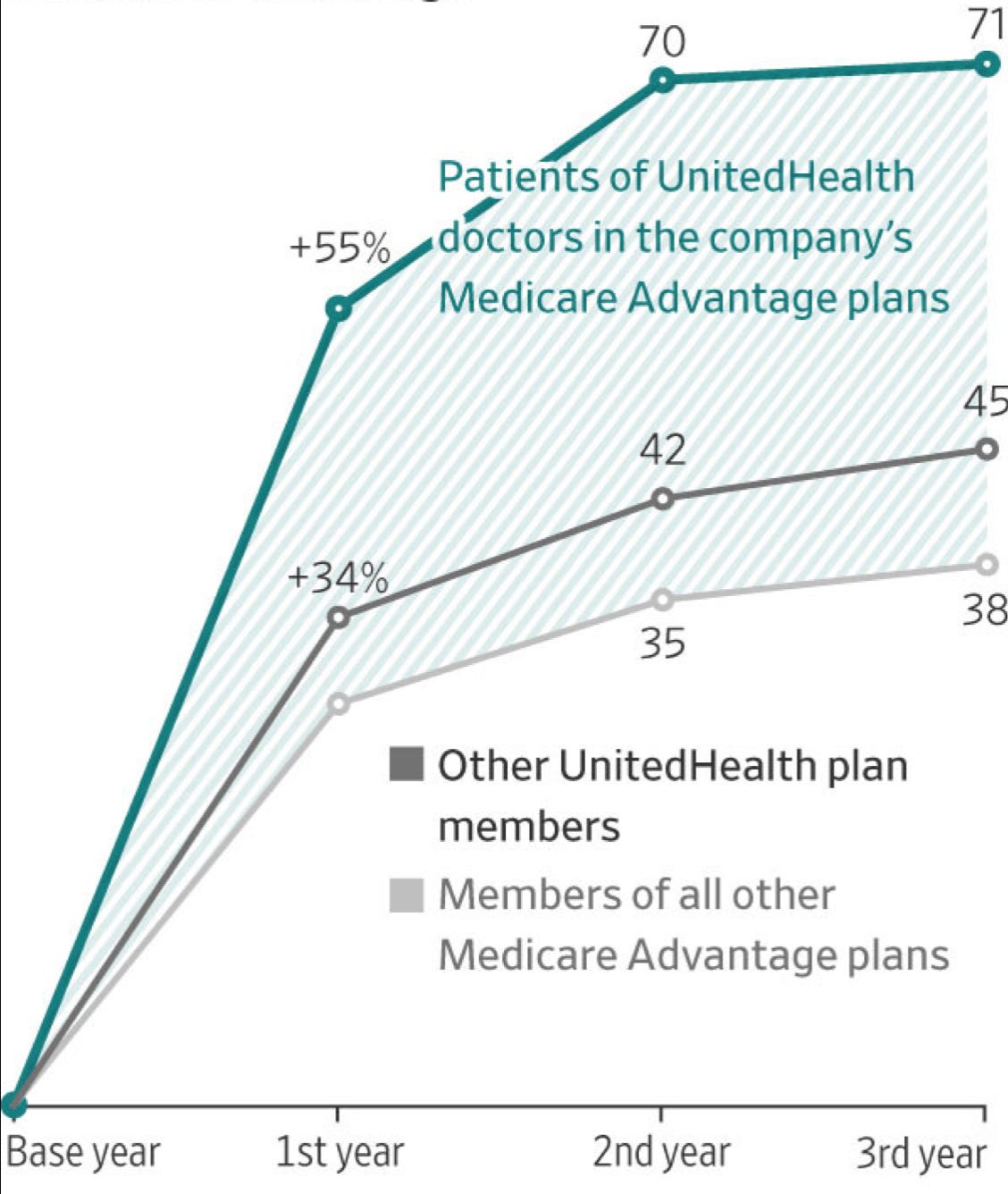

There is data to show that patients of UnitedHealth doctors enrolled in UnitedHealthcare Medicare Advantage plans receive more diagnoses, which result in higher payments for UnitedHealthcare.

The potential damage is high - according to the Wall Street Journal’s estimates, UnitedHeath was paid $8.7 billion in 2021 for extra diagnoses.

3. Risks Due to Their Integrated Business Model

The main reason the company pulled their guidance in May, then lowered it in July is increasing medical costs.

These rising costs hit UnitedHealth harder than many other companies because of their integrated model.

UnitedHelathcare is the insurance arm of the company. When costs to provide care rise, UnitedHealthcare’s profits shrink.

Optum Health is the provider arm of the company. It includes healthcare providers like doctors, nurses, and therapists in primary care offices, outpatient clinics, and home health settings. This is the business that actually delivers care to patients. When costs to provide care rise, UnitedHealth gets hit with lower profits here as well.

4. Management Instability

UnitedHealth has seen multiple changes in key leadership positions.

Stephen Hemsley was CEO of UnitedHealth Group from 2006 to 2017

David Wichmann led UnitedHealth Group from September 2017 to February 2021

Andrew Witty became CEO of UnitedHealth Group in February 2021 during an unexpected leadership change

Stephen Hemsley returned as CEO on May 13, 2025, after Andrew Witty resigned abruptly for personal reasons

John Rex has been CFO since 2016, and will be replaced by Wayne DeVeydt in September.

And of course, there was Brian Thompson’s murder in December of 2024.

That of course, piled on the narrative that ‘everyone hates insurance companies’.

Thompson was the CEO of UnitedHealthcare - the insurance arm of UnitedHealth.

UnitedHealth’s Bear Case in a Nutshell

UnitedHealth’s stock has been rattled by a perfect storm:

Earnings miss & slashed guidance – EPS could fall back to pre-COVID levels, making the stock less of a bargain than it looks.

Regulatory heat – DOJ probes into Medicare Advantage billing could threaten billions in revenue.

Business model risks – Rising medical costs hit both their insurance and care delivery arms at the same time.

Leadership shakeups – Multiple CEO changes, a new CFO incoming, and a tragic high-profile murder have fueled uncertainty.

Negative sentiment - Brian Thompson’s murder fueled the idea that ‘everyone hates insurance companies’.

It’s a mix of slowing growth, legal overhangs, negative sentiment, and management instability that has investors heading for the exits.

So the question is - does this kill the idea?

Let’s try to come up with evidence-supported rebuttals to the bear case and see if UnitedHealth can survive as an investment idea…