Invest Rationally With This Nobel-Prize Winning Question

The one mental switch that prevents costly investing mistakes

👋 Howdy Partner,

It’s easy for dividend investors fall into emotional traps that destroy their returns.

We panic-sell during market downturns, chase high yields without doing proper research, and hold onto underperforming stocks because we're emotionally attached.

But Daniel Kahneman's work on decision-making psychology can help you avoid all of that.

Today, I'm sharing the one powerful question that transformed my investing.

Here's what we'll cover:

Why your brain is wired to make poor investment decisions

A Nobel Prize winner's secret to objective analysis

How to apply this technique to dividend stock selection

Let's dive in.

The Outside View: Your Secret Weapon for Better Investing

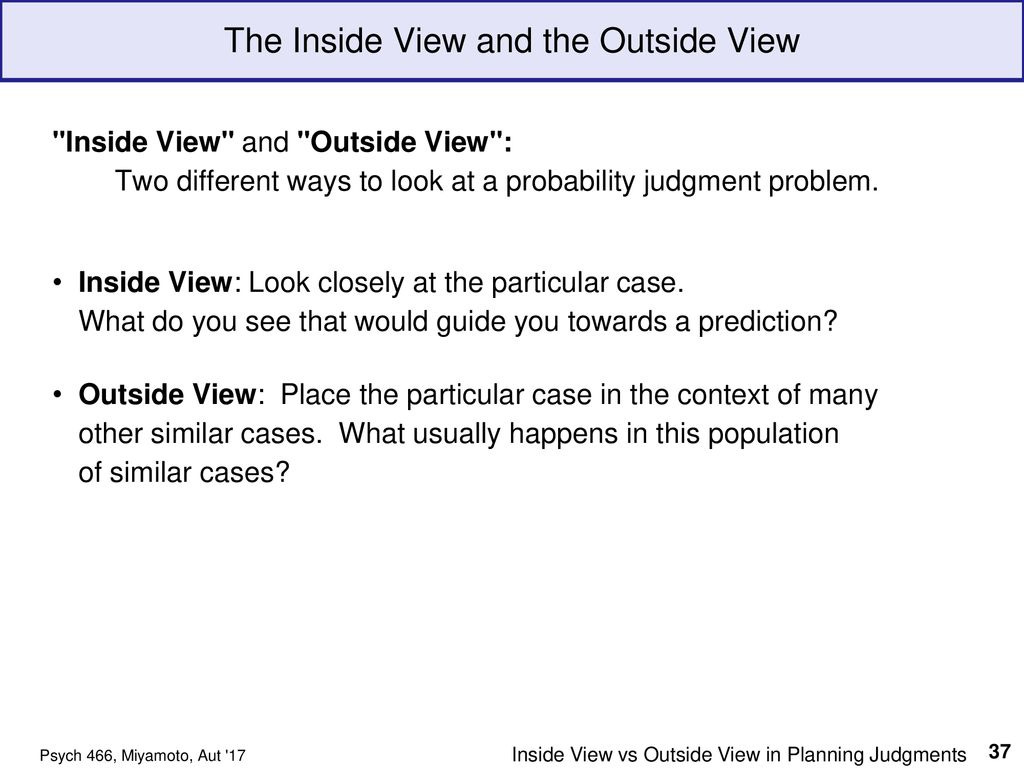

Our brains tend to see the "inside view" - meaning we're too close to our own decisions.

To make better investing decisions, you need to overcome your emotional biases.

Switching to the "outside view" will allow you to be more rational and more objective.

Here's how to do it, even if you're naturally emotional about money.

The Question That Changes Everything

The next time you're facing a crucial investing decision, ask yourself:

"What would I think if this were someone else's portfolio?"

This simple question, derived from Nobel laureate Daniel Kahneman's research, helps you shift from an emotional "inside view" to a rational "outside view."

Putting It Into Practice

Let's say you own shares of a Dividend Aristocrat that just announced a smaller-than-expected dividend increase.

Your first reaction might be to hold on because "it's always been reliable" or "it'll bounce back."

Now, imagine a friend showed you their portfolio with the same stock.

You'd probably analyze:

The company's payout ratio trends

Free cash flow coverage

The competitive position within the industry

Alternative dividend stocks in the same sector

Suddenly, you're thinking like an analyst rather than an anxious investor.

The Power of Perspective

This technique works especially well for:

Deciding when to sell underperforming positions

Evaluating new dividend stock purchases

Rebalancing your dividend portfolio

Analyzing the risk of a dividend cut

That’s It For Today

Here's what you learned:

Your brain naturally takes an "inside view" that's clouded by emotions

Asking "What would I think if this were someone else's decision?" triggers objective analysis

This perspective shift leads to better investing decisions

Before your next stock trade, write down your analysis as if you were advising a close friend.

You'll be amazed at how much clearer your thinking becomes.

One Dividend at a Time

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Inside / Outside.

I just went through this when I read your previous article, "Best Buys in March 2025".

You highlighted Newell brands. I looked it up, saw a juicy >4% dividend yield, and became emotional.

"Whoa! This could be something!"

That's me putting on the "inside view" hat.

Now I put the "outside view" hat on. I pretended someone else bought it and showed it to you or Pieter. As professionals, both of you would have been polite but the investment would have been stamped "clunker".

Then I spin the "outside hat" around and looked at it as an analyst. Does it pass my smell test to warrant further investigation? Would it smell good enough to recommend to someone else?

No.

Dividend cutter.

High debt to cash.

Low Return on "Anything".

That's enough for me to pass on it. There are better places for a 4% yield.