📈 Air Products and Chemicals, Inc.

Air Products is a world-leading industrial gas company.

Over the last 10 years, their dividend more than doubled.

Let’s show you why Air Products is an attractive dividend stock.

Air Products and Chemicals, Inc.

👔 Company name: Air Products and Chemicals, Inc.

✍️ Ticker: APD

🔎 ISIN: US0091581068

📚 Type: Dividend Aristocrat

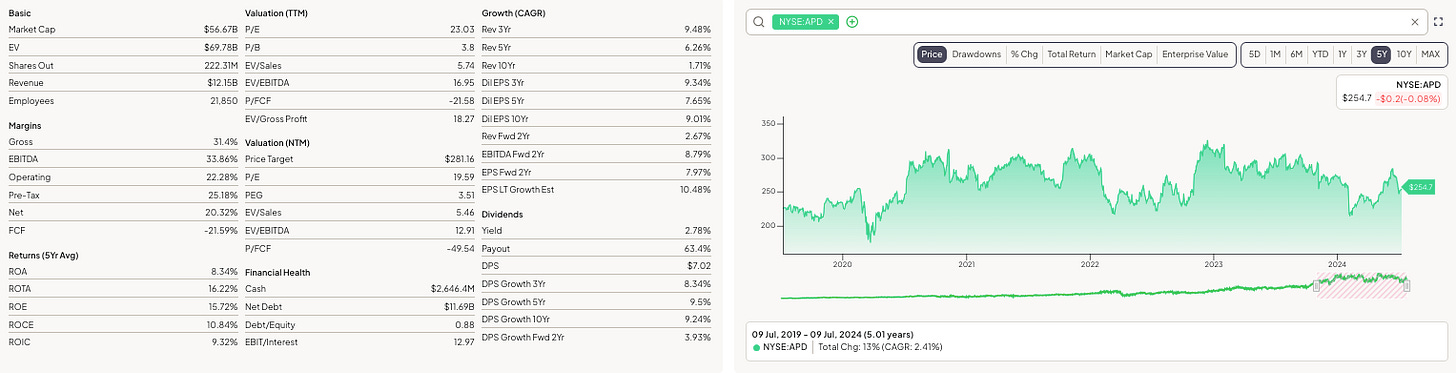

📈 Stock Price: $255

💵 Market Cap: $57 billion

📊 Average Daily Volume: $320 million

Business Model

Air Products is a global market leader in industrial gases. They are active in an oligopoly together with Air Liquide and Linde.

The company sells special types of gases, like oxygen, nitrogen, and helium, in tanks and pipes. These gases are used in many things, like making medicine, building rockets, and helping food stay fresh. Furthermore, they are also investing heavily in hydrogen.

Every time you drink sprinkling water or eat ice cream, chances are APD has a hand in producing the products you're using.

Air Products makes money by selling these gases to factories, hospitals, and many other businesses that need these special types of gases for their work.

Geographical split

The geographical split looks as follows:

Source: Finchat

Management

Seifi Ghasemi has been the chairman, president, and CEO for almost a decade. Mr. Ghasemi is a member of The Business Council, an association of the chief executive officers of the world’s most important business enterprises.

Melissa Schaeffer is the Chief Financial Officer and Senior Vice President. She holds a degree in Finance and Accounting from Indiana University and an MBA from Villanova University.

Insiders own 0.3% of the company. Ideally, we would prefer higher insider ownership.

Competitive advantage

Air Products is active in an oligopoly together with Air Liquide and Linde.

This gives them a lot of pricing power.

Furthermore, there are high switching costs for existing clients. Sales of gas contracts can have a term of up to 20 years. Air Products also offers onsite gas contracts. Air Products installs and operates gas production facilities directly at a customer's site. This makes customers even stickier and provides a predictable revenue stream for the company.

A company can easily afford to pay high dividends when revenues are predictable. This is a big plus for you as a dividend investor.

Dividend

Air Products is a Dividend Aristocrat.

They have increased their dividend for 26 years in a row.

This is wonderful. Investing in the company results in receiving an attractive dividend every single year.

Air Products:

Dividend Yield: 2.7%

Payout Ratio: 63.4%

Frequency dividend payments: quarterly

This means that when you invest $10,000 in Air Products, you’ll receive a dividend of $270 per year.

As you can see, APD’s dividend more than doubled over the last 10 years:

Source: Finchat

Valuation

The cheaper we can buy a great dividend company, the better.

Air Products currently trades at a forward PE of 20.4x.

Over the past 5 years, Air Products forward PE averaged 24.4.

This indicates the company is undervalued compared to its historical average.

Source: Finchat

Conclusion

That’s it for today.

Air Products is an undervalued dividend aristocrat, making it an attractive choice for you as a dividend investor.

The company increased its dividend payment for 26 consecutive years. We expect this trend to continue

If you invest in APD you receive an attractive dividend yield of 2.7%. This means you receive $270 in cash dividends per year for every $10,000 you invest.

Source: Finchat

That’s it for today

That’s it for today.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Air Products is selling the LNG tech and hardware business to Honeywell for $1.8 billion. LNG demand is going to increase more and more ... and, Air Products sold it?

Maybe Honeywell paid more than what it's worth and Air Products is laughing all the way to the bank?

I understand Honeywell are chasing after green hydrogen and maybe this purchase aligns with that somewhere on a PowerPoint slide?

Do you consider Air a better buy than Air Liquide?