Is It Time To Sell PayPal?

PayPal reported earnings yesterday, and the stock went down 20%.

They fired their CEO and replaced him with Enrique Lores, HP’s current CEO.

Is this a failing business that we need to sell?

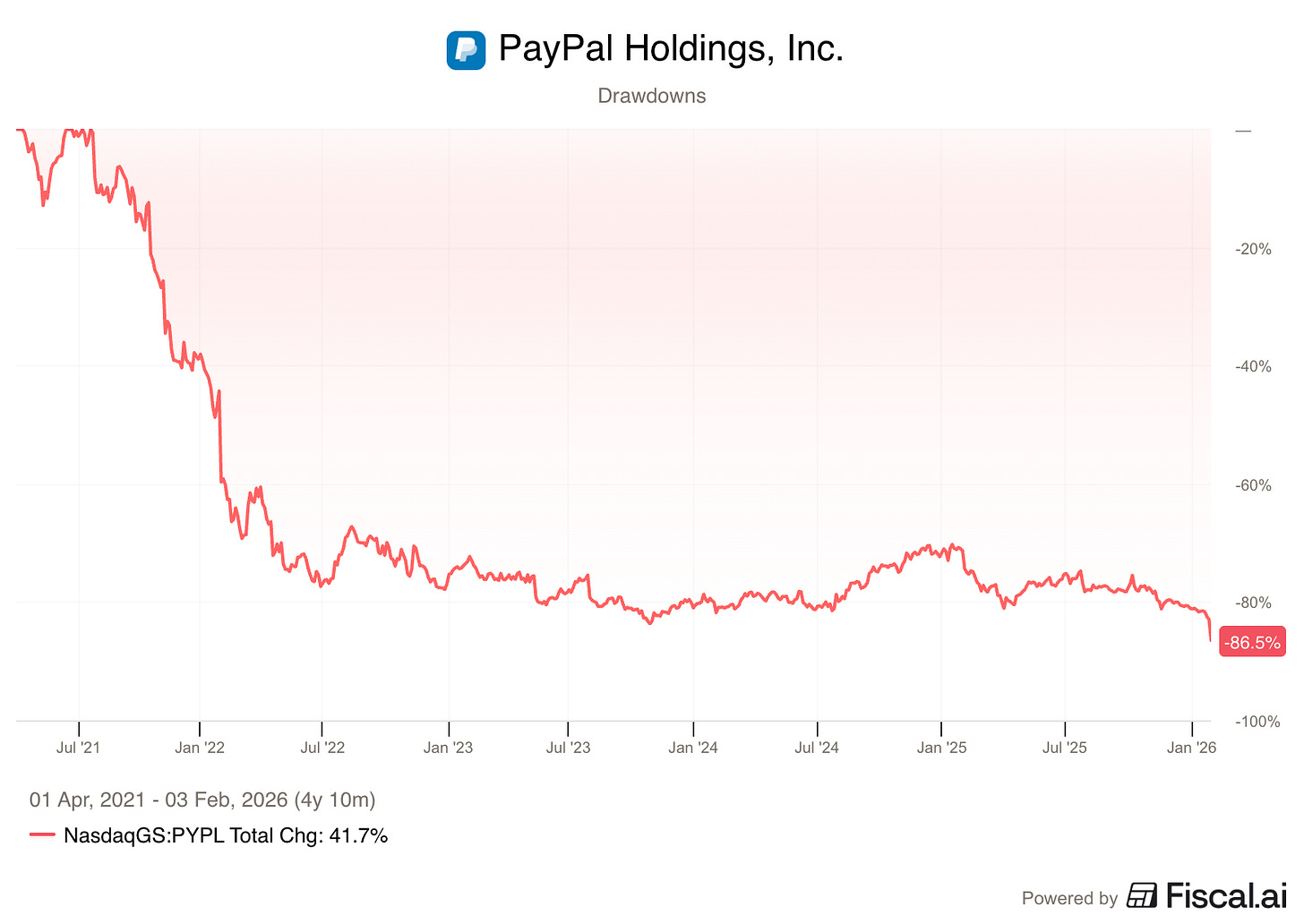

Investors on social media frequently call PayPal PainPal because the stock price has had such a wild ride.

From March of 2020 to July of 2021, PayPal shot up 250% as people bought everything online.

Investors were way too optimistic and were paying more than 100x earnings at the peak.

That optimism flipped and PayPal is now down more than 85% (!) from the pandemic highs, earning it the PainPal nickname.

A stock this beaten down is obviously a company going out of business, right?

Let’s look.

Is PayPal a broken business?

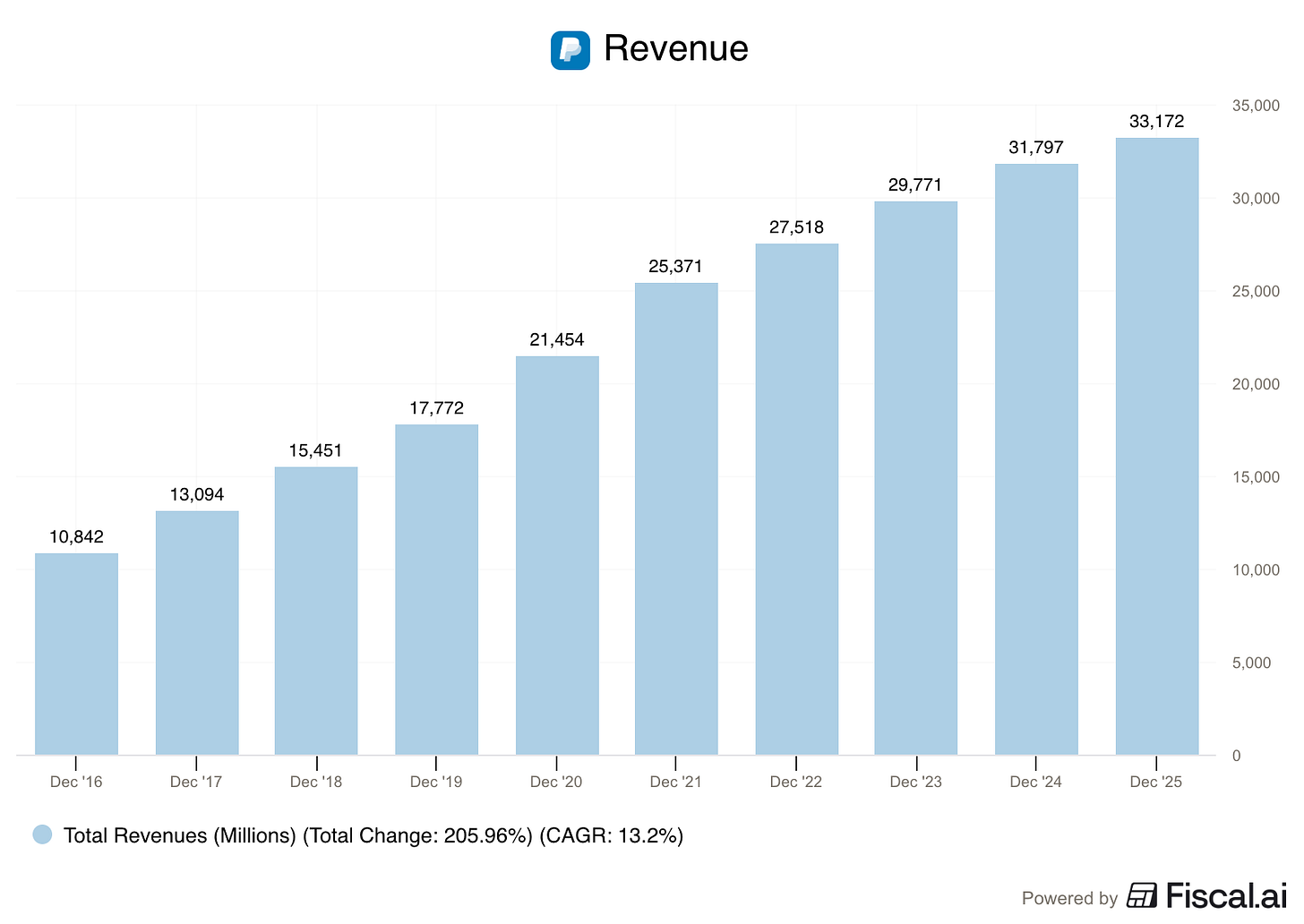

A broken business would surely have falling sales. Does PayPal?

Nope.

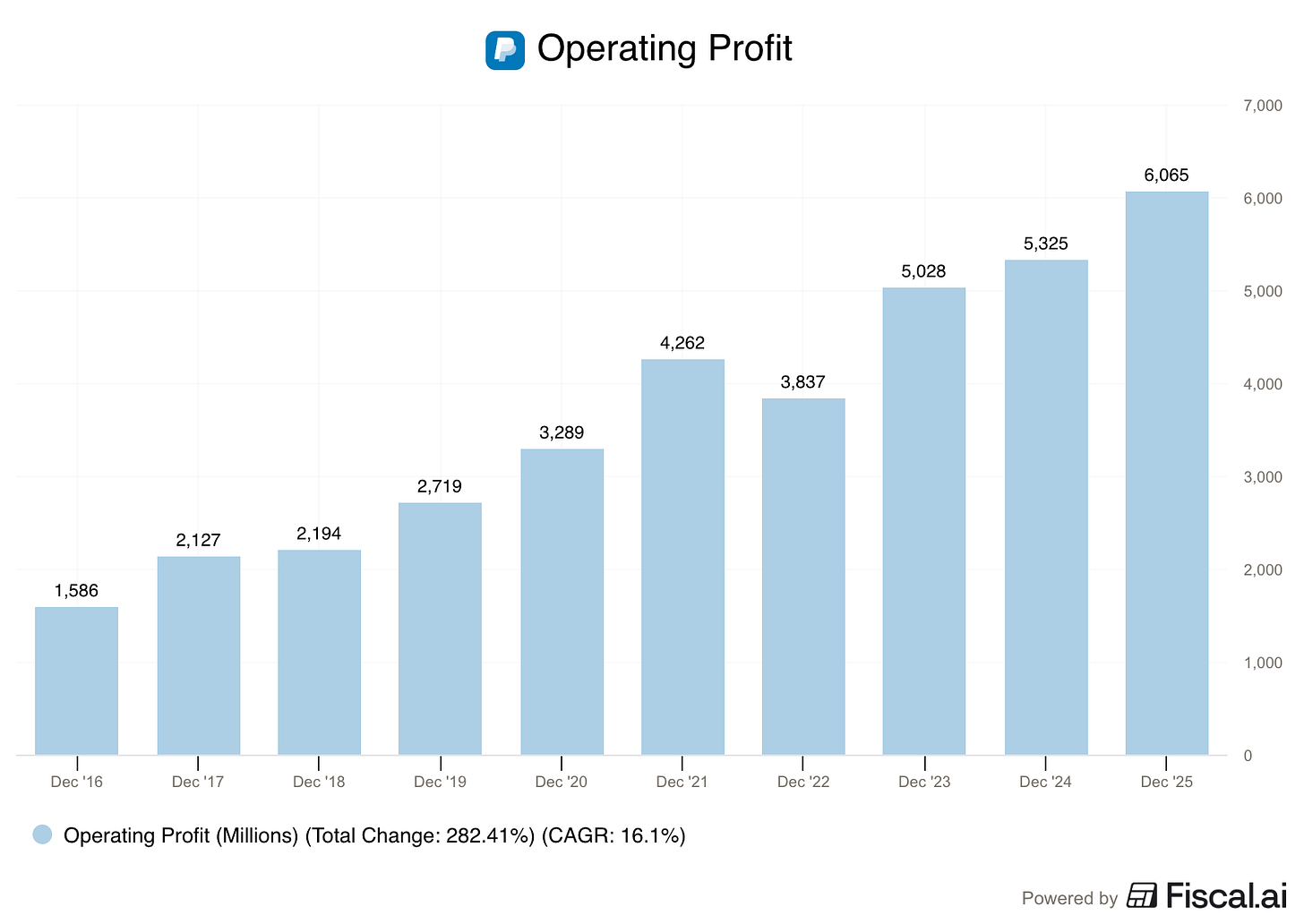

But revenue growth can be created by reducing profits… maybe PayPal has falling profits.

Nope.

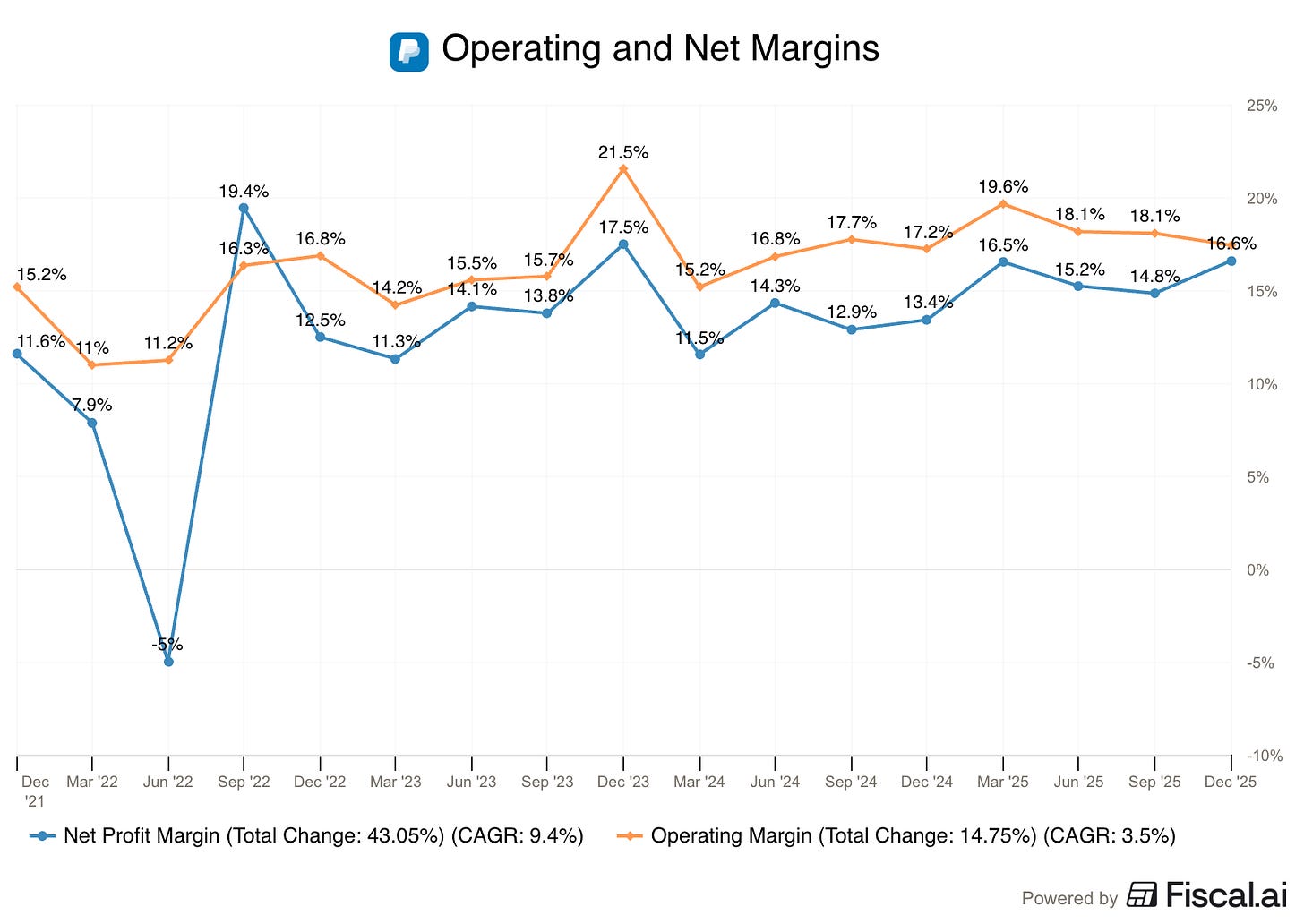

Here’s their Operating and Net Margins:

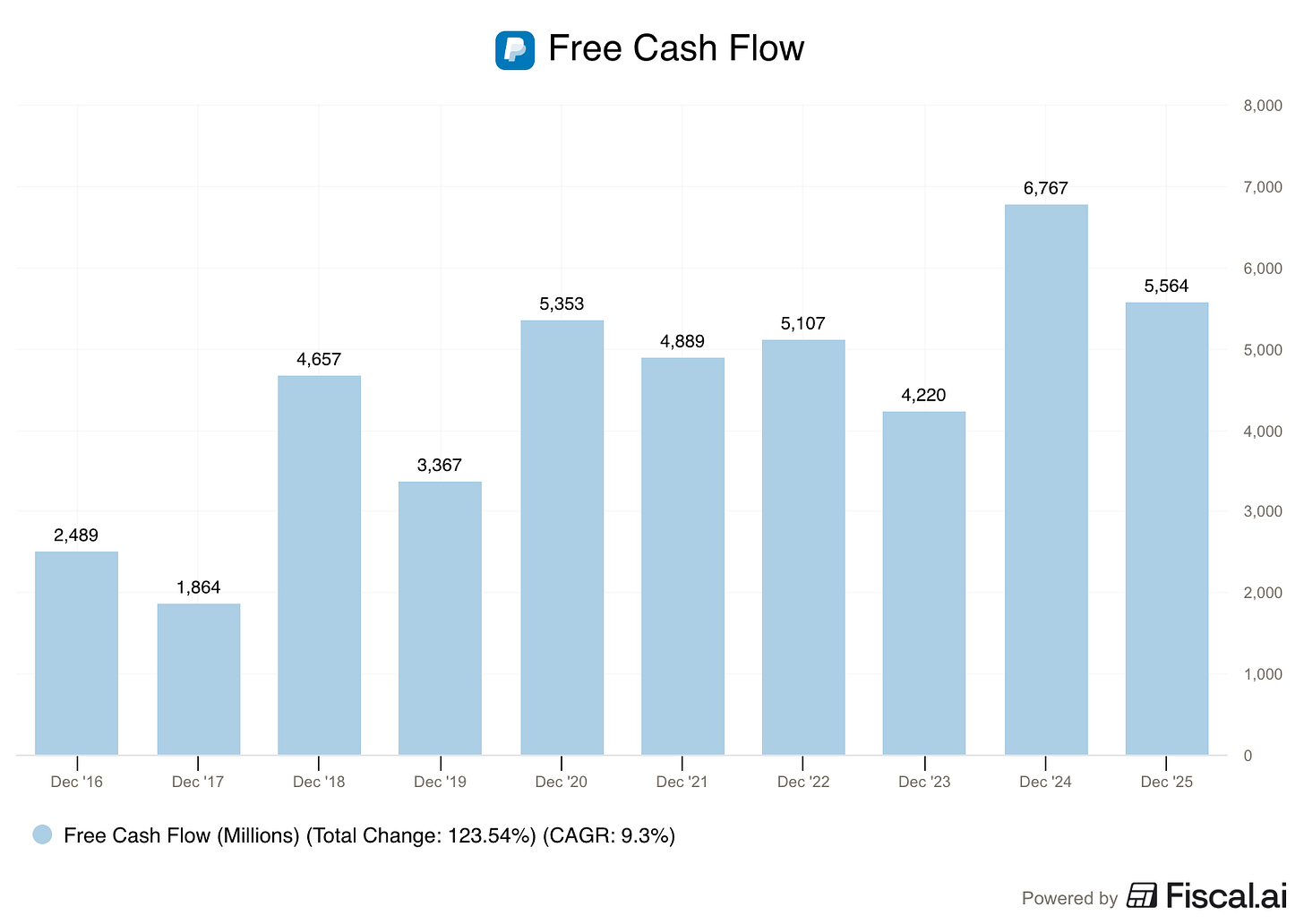

Maybe it doesn’t convert profits into cash - how’s the Free Cash Flow?

It’s not a straight line, but PayPal generates a lot of cash.

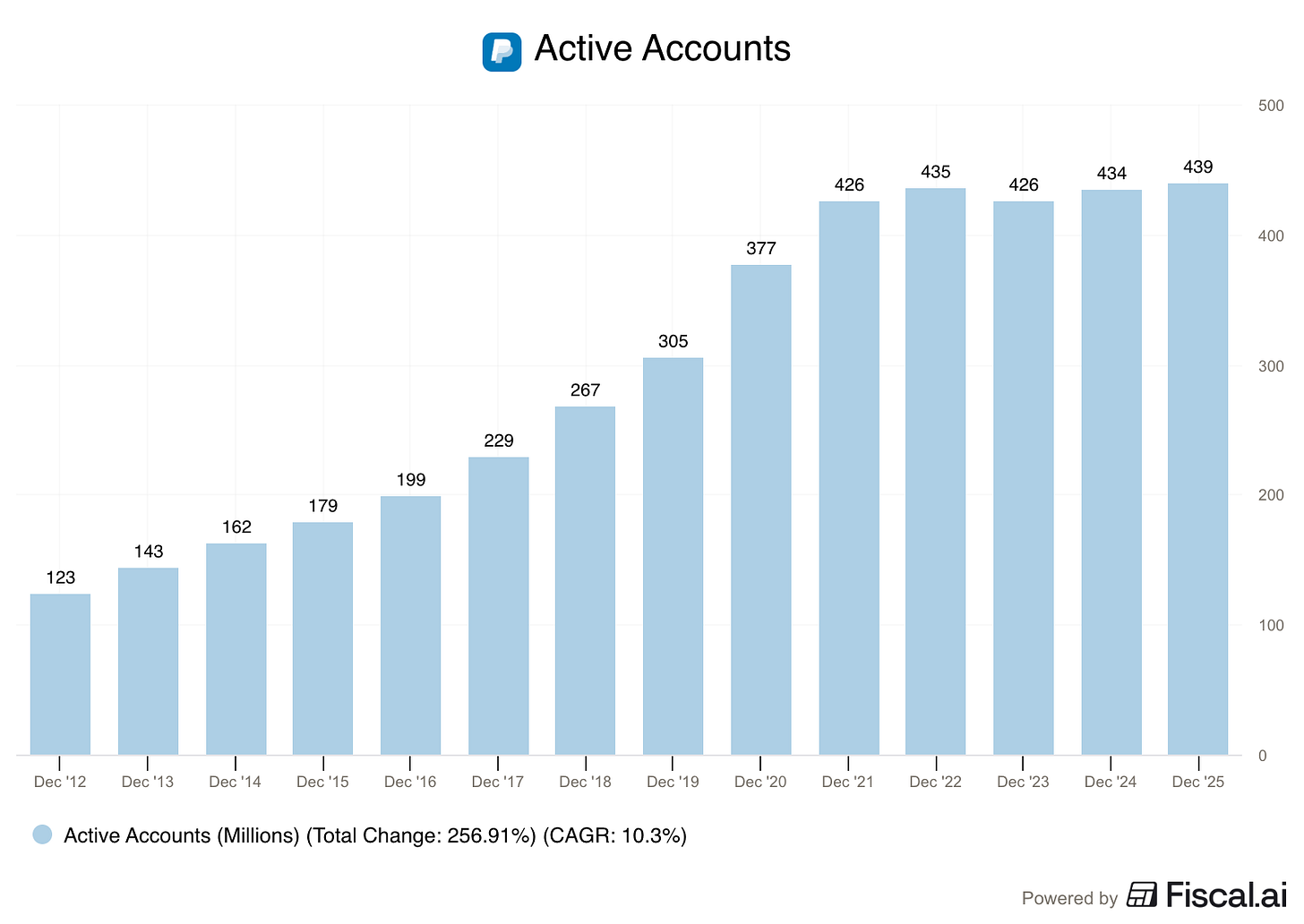

It must be that PayPal is ancient, and nobody uses it anymore.

Surely the amount of active accounts is headed off of a cliff…

Again, no.

What IS the problem?

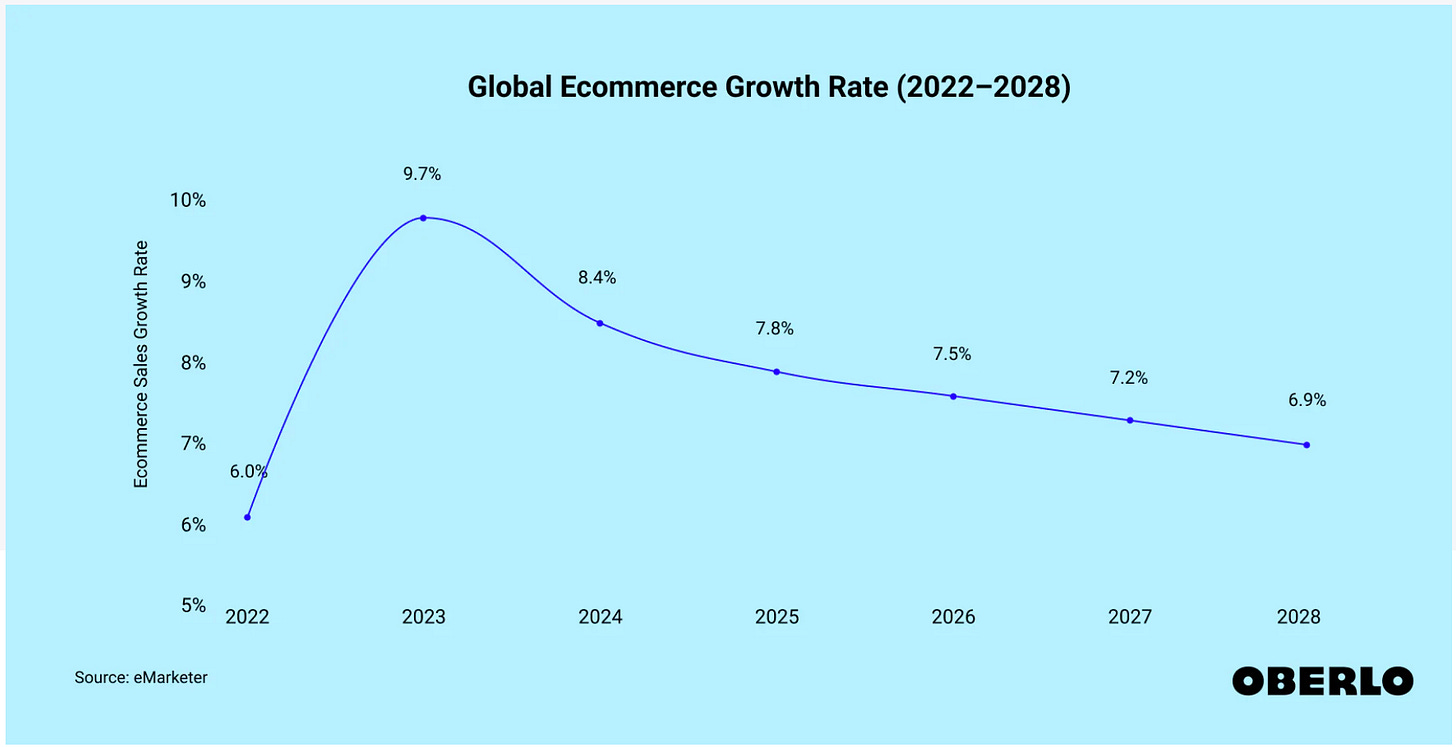

PayPal generates most of its revenue from e-commerce.

The e-commerce market broadly has been growing about 7% per year.

This quarter, PayPal’s branded checkout volume (the PayPal button you see when you checkout online) only grew by 1%.

Investors are worried that PayPal is quickly losing market share to competitors.

PayPal has a new checkout experience that performs very well when it’s fully optimized.

The trouble is that PayPal hasn’t been able to get enough merchants fully on the new experience fast enough.

Right now, only about 25% of merchants are on it and just half of those using the most optimized version.

That led to the firing of CEO Alex Chriss, and PayPal bringing in the board chair, Enrique Lores as CEO, effective March 1.

Who’s Enrique Lores?

Enrique Lores has been the CEO of HP Inc. since 2019.

He’s been with HP since he was hired as an intern in 1989.

He helped lead the separation of the company into HP Enterprises and HP Inc. in 2015, and is credited with cutting costs and streamlining the business to allow it to focus on growth.

Why the change?

The board said that the "pace of change and execution" under Chriss was not in line with expectations, particularly regarding the need for faster decision-making.

Lores has been on PayPal’s board for 5 years, so he knows the company well.

His history of leading large-scale change in a complex, global company like HP was seen as the "seasoned operational expertise" PayPal needs to speed up the roll out of branded checkout.

What Is PayPal Doing?

Jamie Miller (CFO) is acting as the interim CEO and she handled the call yesterday.

She made it clear that the company’s strategy isn’t changing.

They just want things to move faster, which makes sense.

New Checkout Performance

For merchants on the fully optimized, new branded checkout, they’re seeing anywhere from 1% to 5% increases in conversion (people who actually buy).

They saw doubled digit payment volume growth during the holiday season (compared to the 1% seen by the company.

Miller said that growth was faster than their local markets.

How Will PayPal Speed Things Up?

The company has figured out that merchants have too many custom integrations, and too many different needs to switch everybody over to the new platform at the same time.

Here’s what they’re doing instead:

They have created dedicated teams to work with a group of merchants that represent about 25% of their branded volume

These teams are creating custom deals to address these specific merchants’ needs like lowering costs, or helping with new customer acquisition

They were trying to deploy features one at a time, now they’re doing everything at once as a package

Once the merchant has the full new experience, PayPal runs campaigns for their customers to make sure they see the conversion lift

They’ve aligned incentives in these deals so that the merchants share in the financial upside of the new experience

That last one makes me very happy.

Why Will People Keep Using PayPal?

One of PayPal’s greatest strengths is data.

They’ve figured out that there are 3 important things they need to improve to make sure people choose the PayPal button when they checkout.

They call it Experience, Presentment, and Selection.

It’s really about making sure it’s obvious that you can use PayPal, then making sure that it’s fast and rewarding for you when you do.

1. Experience: How fast and easy is it?

This is all about removing anything that makes you stop or slow down while trying to pay. The goal is to make checkout so fast you barely have to think about it.

They’re using things like Fastlane, Biometrics (like FaceID or Fingerprints) and Passkeys to make sure you can buy in seconds.

2. Presentment: Where do you see it?

Presentment means making it obvious that you can use PayPal.

They’re making sure that you can see the PayPal button early, before you’ve already typed in your credit card info.

They’re also moving up the Buy Now, Pay Later options.

So when you’re looking at something on a product page, you might see a small note right under the “Add to Cart” button that says: “Or pay in 4 interest-free installments of $125 with PayPal.”

3. Selection: Why should you pick it?

Selection gives you a reason to choose PayPal over a regular credit card or Apple Pay.

PayPal is using Loyalty programs like PayPal Plus and Stash, where you can earn PayPal Rewards points tfor a discount on your next purchase.

Growth Has a Cost

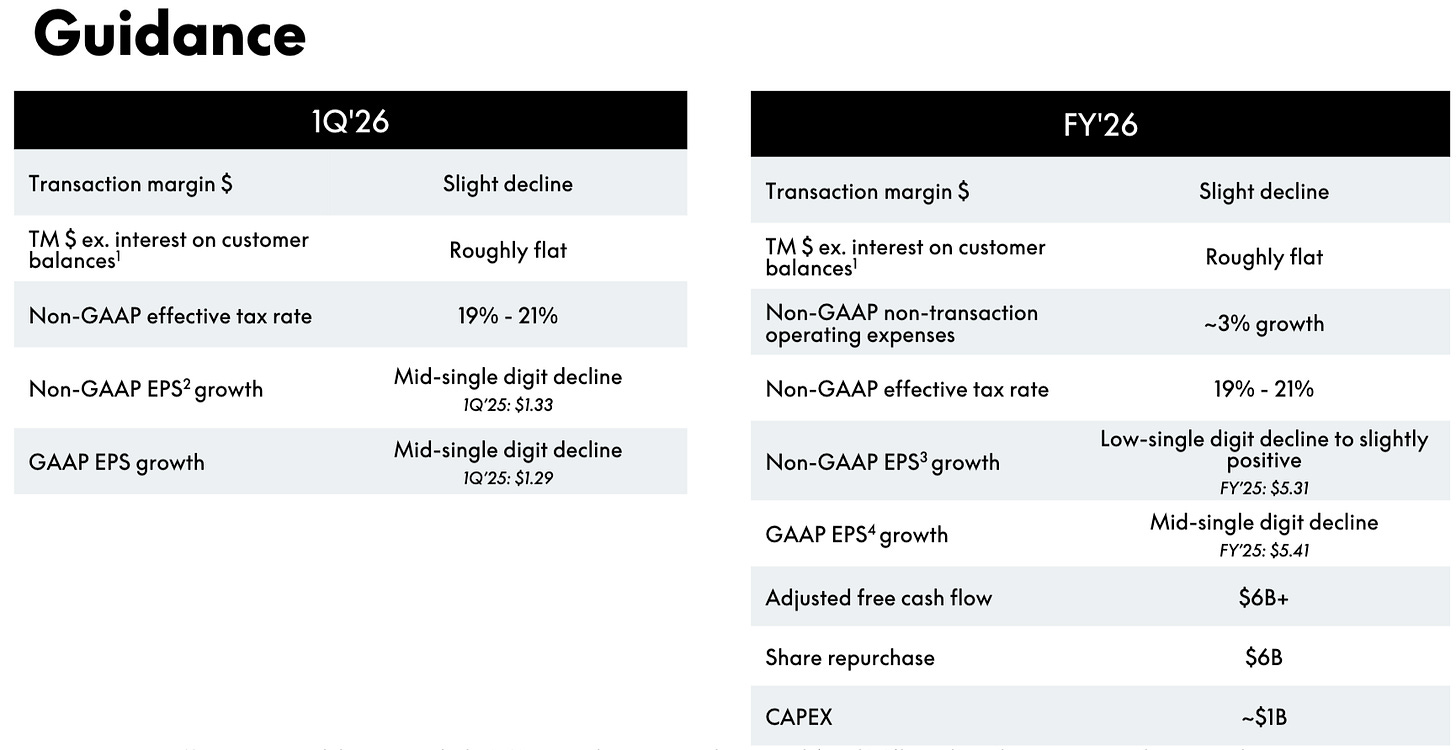

The other issue that I think drove PayPal’s stock down was their 2026 guidance.

They pulled the 2027 guidance from their investor day and are now giving guidance one year at a time.

Here’s 2026:

Here is why they guided the way they did.

1. Growth Investments

The biggest reason for the soft guidance is $1.5 billion to $2 billion in investment back into the business.

They to spend this money on things like PayPal Plus rewards and better merchant integrations to stop market share loss

This is the reason for the slight decline in Transaction Margins

2. Branded Checkout

Because they didn’t get enough merchants on the new checkout, they’re starting 2026 behind where they expected.

It will take time to get enough merchants on the new platform before it’s enough to move the whole company’s numbers

3. External Headwinds

They also cited a few factors that are simply outside of their control:

Lower Interest Rates: They expect a 1 to 1.5-point headwind because they will earn less interest on the money they hold for customers.

Tougher Economy: Low and middle-income customers are spending less on the discretionary types of items PayPal usually processes.

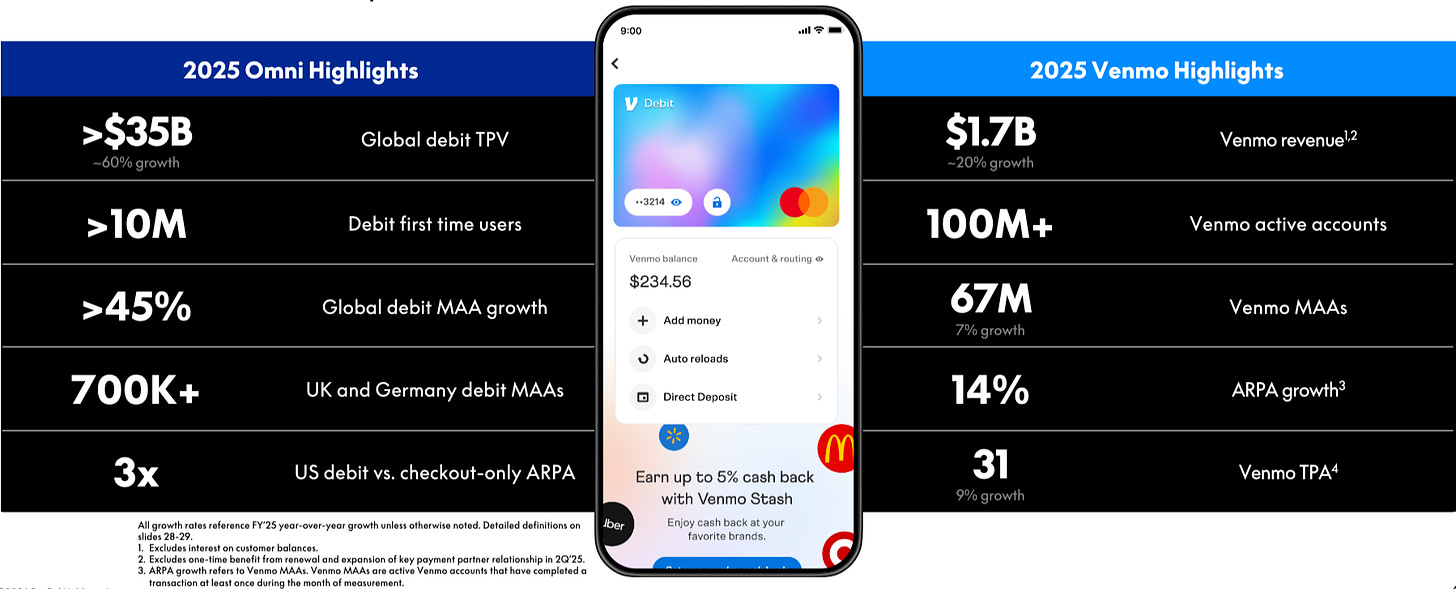

Other Areas of Growth

It wasn’t all bad news.

Venmo revenue grew 20%, with over 100 million active accounts.

PSP (the BrainTree unbranded business) now has 7 quarters of profitable growth (this was previously a drag on the business)

Buy Now, Pay Later payment volume grew 20% in 2025

Most importantly, they still expect to generate at least $6 billion in 2026 FCF, and buy back another $6 billion in shares.

Is It Time To Sell PayPal?

Was it a great earnings report?

No.

Did it justify a 20% selloff? Despite the profitable past, is PayPal a broken business? Or just a broken stock?

Paid Partners find out what I think, the current valuation, expected returns, and if we’re selling PayPal or holding on to PainPal a while longer.

🚨 Don’t Miss Out: The Doors Are Opening Soon

On February 24th, we are opening a limited number of discounted spots for new members.

These spots aren’t expected to last long!

You don’t want to miss your chance to get in at a discount (and get all the exclusive bonuses as well).

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Really insightful breakdown of the rollout bottleneck here. The fact that only 25% of merchants are on the new checkout and just half fully optimized makes the 20% selloff feel reactionary tbh. I've seen this happen with SaaS migrations at work where custom integrations always take longer than planned but once the flywheel gets going adoption accelerates fast. The shared upside model whre merchants benefit too is smart.