PepsiCo (PEP) has been getting a lot of attention from dividend investors recently.

It’s not just a soda company.

It’s a global snack and beverage giant with operations in more than 200 countries and some of the world’s most recognizable brands: Lay’s, Doritos, Mountain Dew, Gatorade, Tropicana, and Quaker Oats.

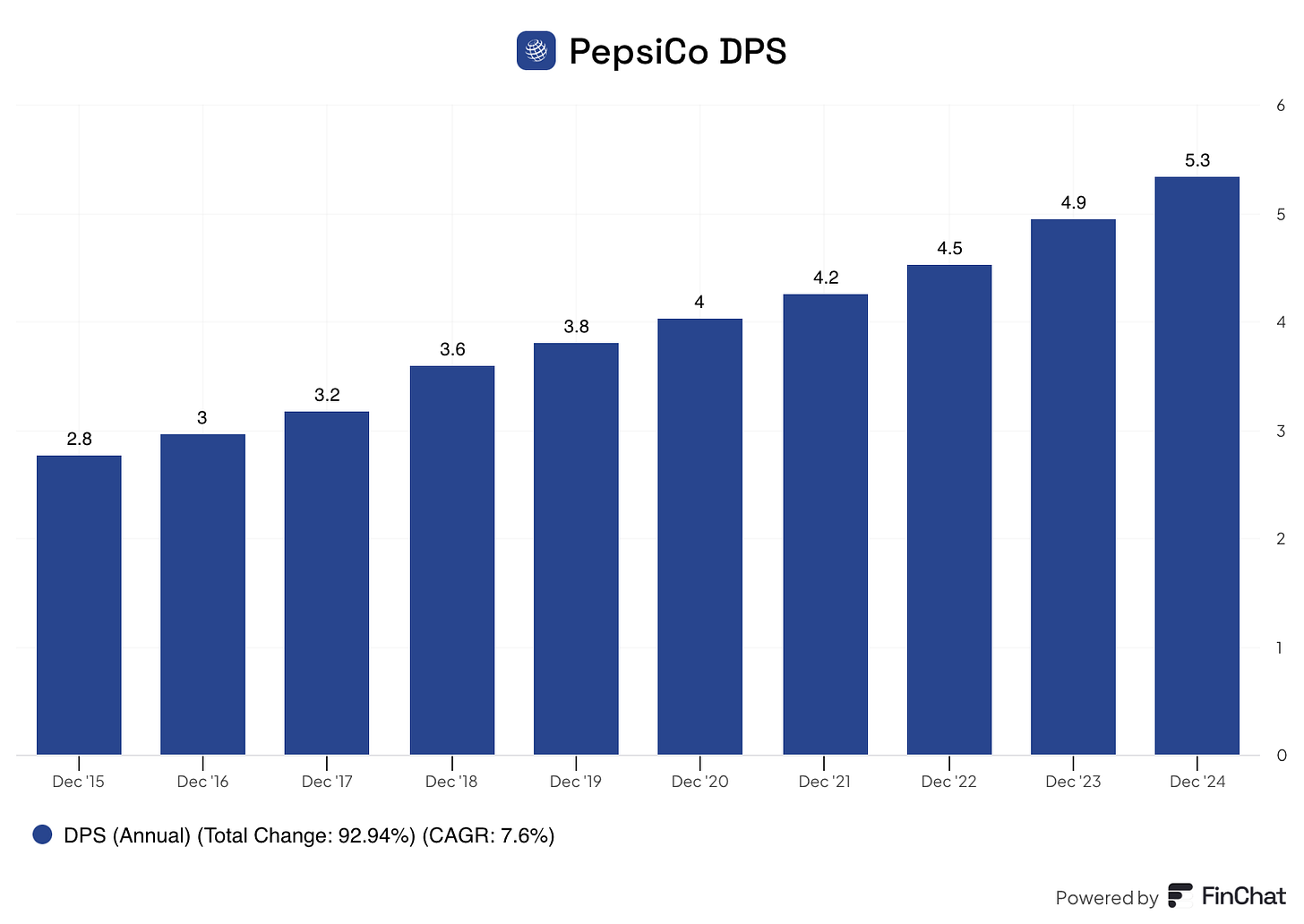

On the surface, there’s a lot to like for dividend investors.

Pepsi has paid—and grown—its dividend for 50 consecutive years. That makes it a Dividend King.

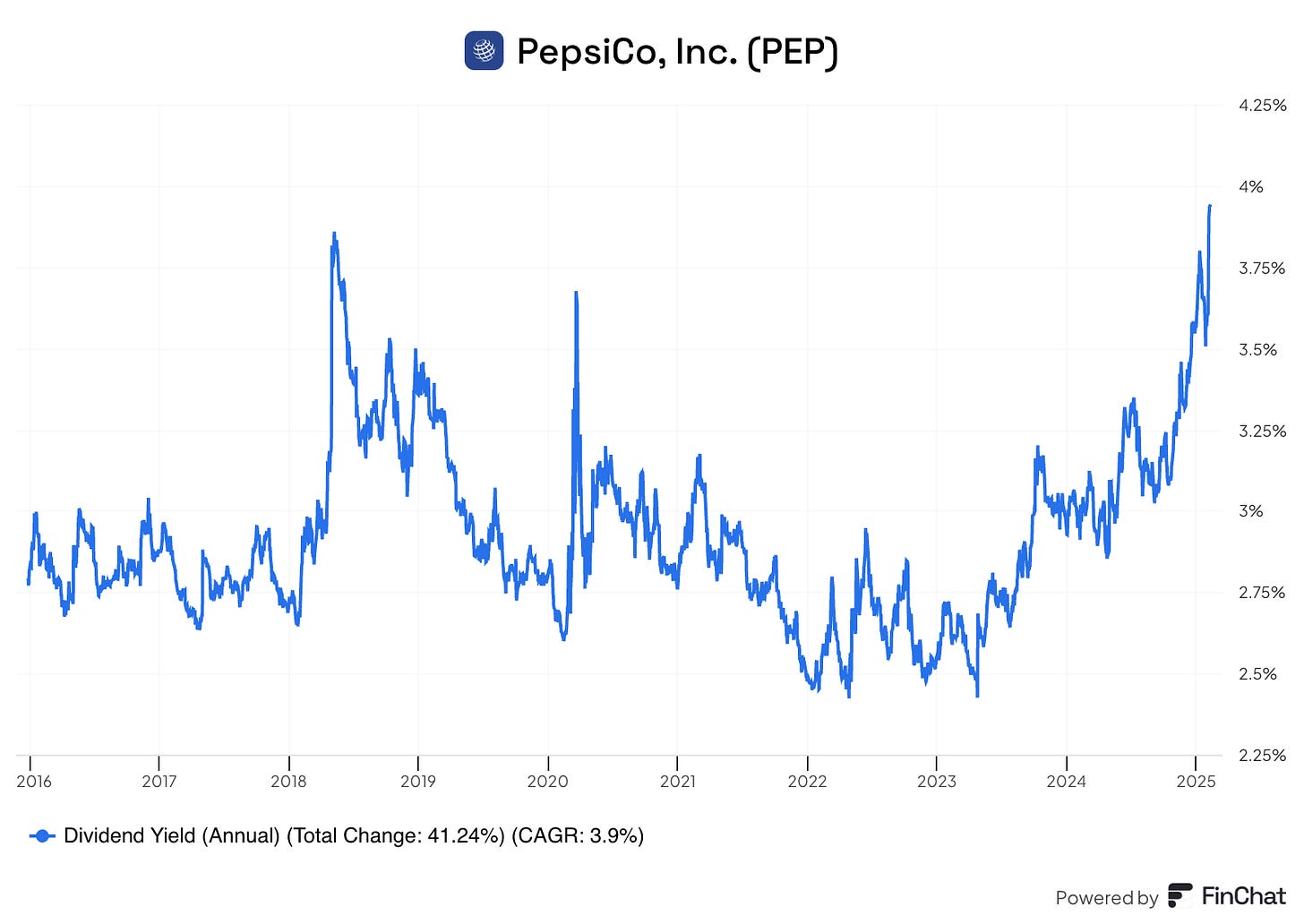

In addition, PepsiCo is trading at a high dividend yield, relative to its history.

So far, so good.

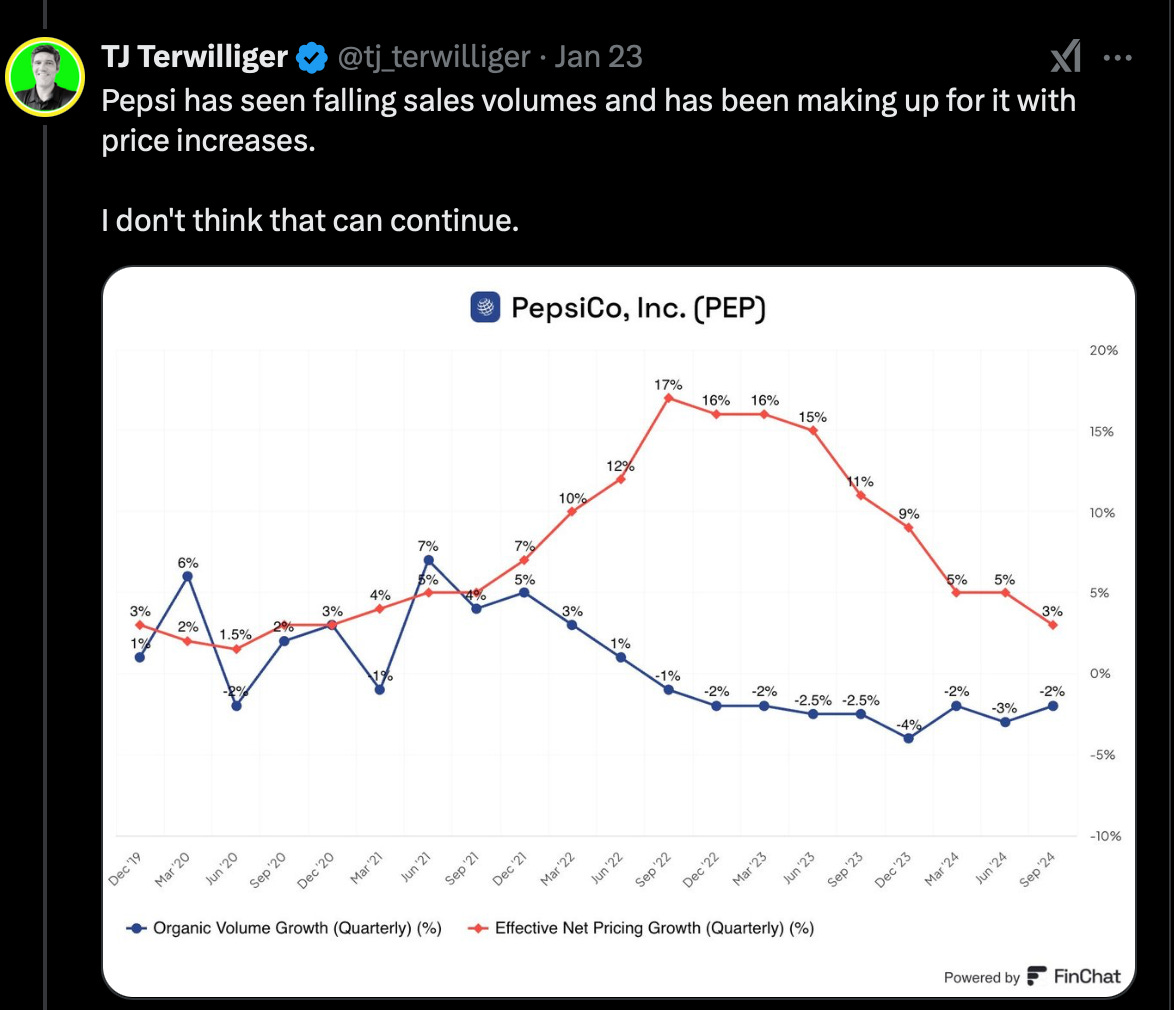

But I looked at PepsiCo a few weeks ago and decided to pass - here’s what I wrote on X at the time:

After those posts, Terry Smith announced that Fundsmith had sold out of its position in PepsiCo.

I’m sure it had nothing to do with my posts, but it’s a great confirmation of my decision!

Today we’ll dive more into PepsiCo to show you exactly why I passed on the stock.

Why I Passed on Pepsi

In a consumer company like PepsiCo, everything starts with sales.

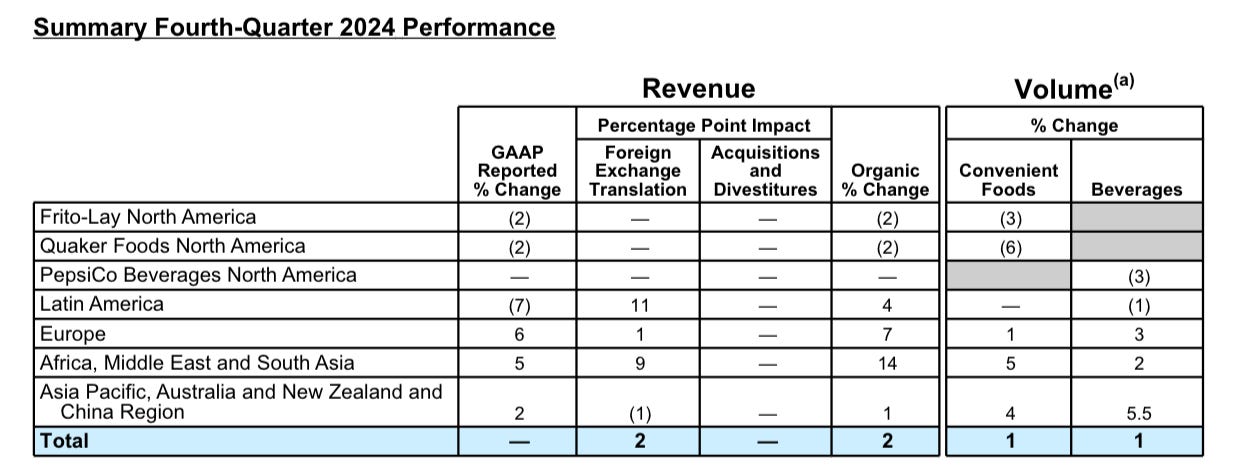

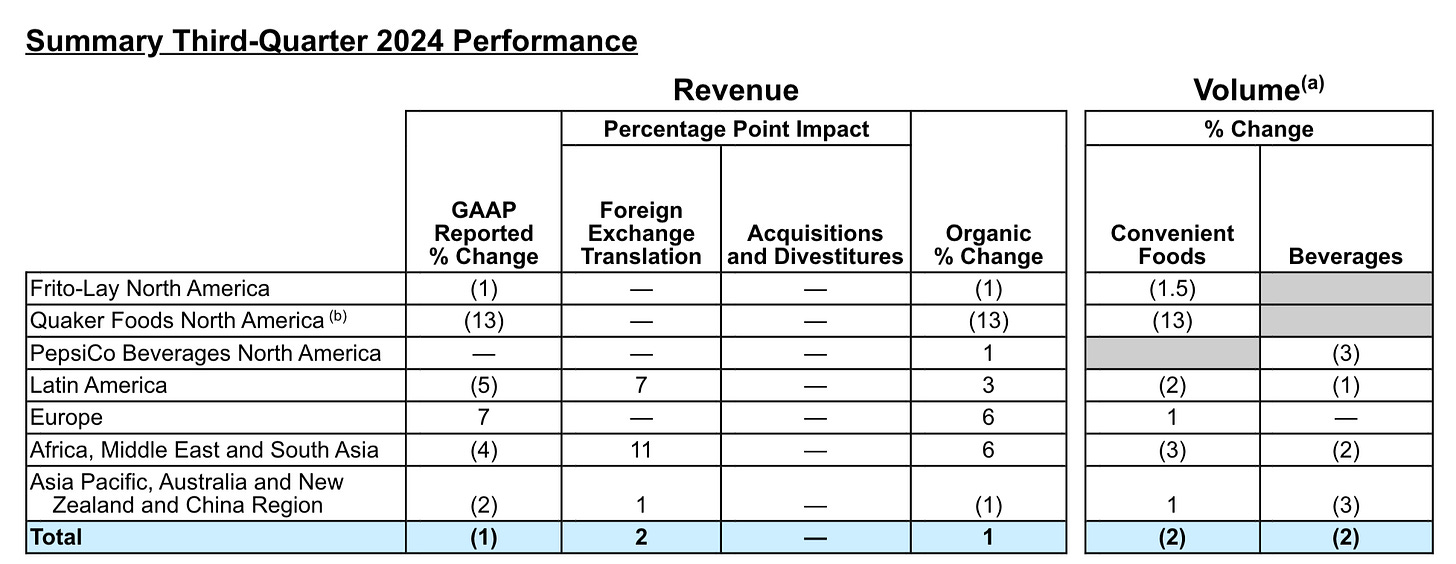

Pepsi is facing a big problem: declining sales volumes.

People are drinking less soda. Snack sales are slowing too.

You can see this in the most recent 10-Q filings:

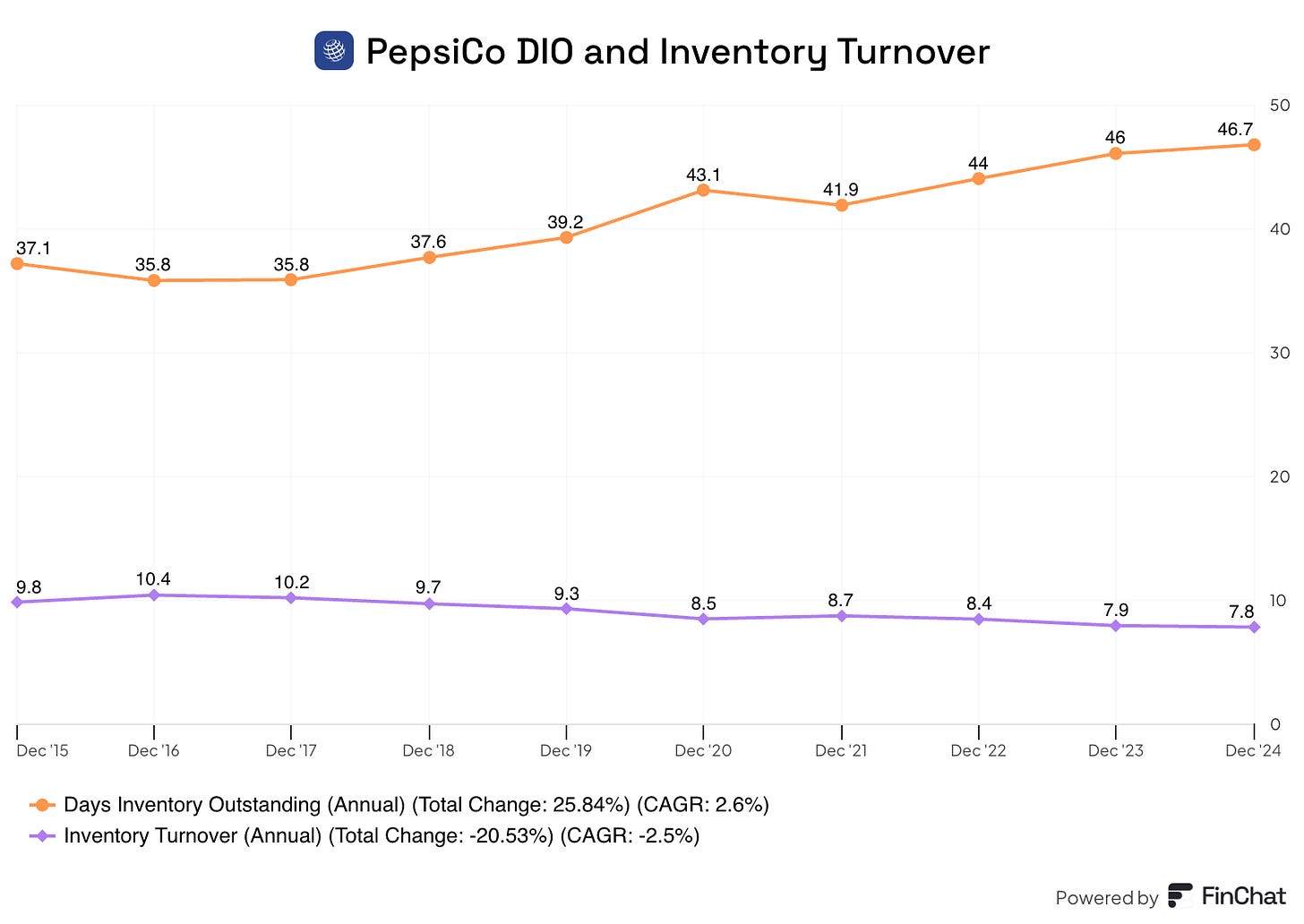

We can confirm the slowing sales trend by looking a few ratios:

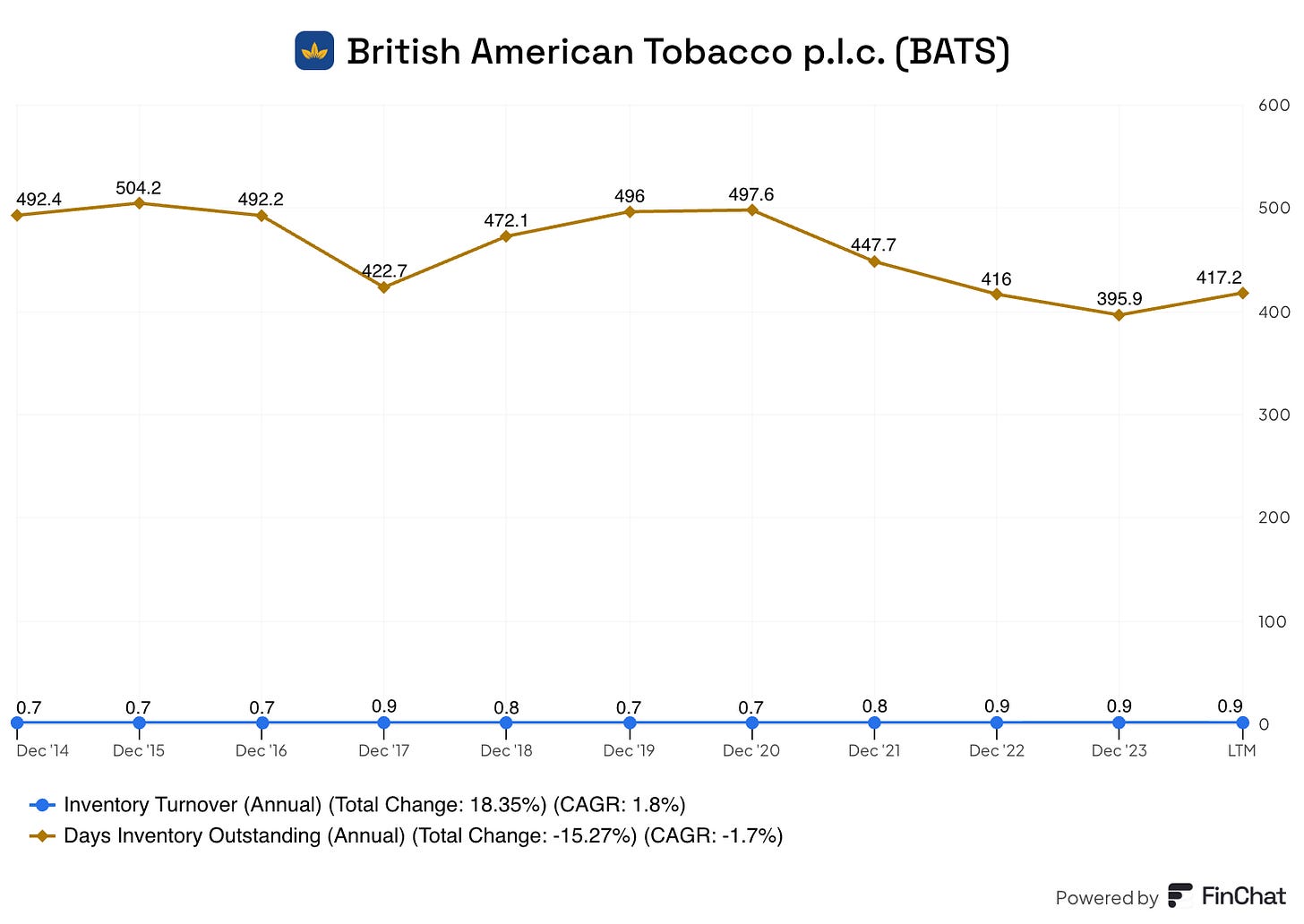

Days Inventory Outstanding (DIO)

Definition: DIO measures how long it takes, on average, to sell the inventory a company has on hand.

Calculation: It’s calculated by dividing the average inventory by the cost of goods sold (COGS) per day.

Purpose: A lower DIO means the company sells its inventory quickly, which is generally good for cash flow.

Inventory Turnover

Definition: Inventory turnover shows how many times a company sells and replaces its inventory over a period (usually a year).

Calculation: It’s calculated by dividing the cost of goods sold (COGS) by the average inventory.

Purpose: A higher inventory turnover indicates efficient inventory management and strong sales.

What do they tell us?

DIO tells you how many days inventory sits before it’s sold.

Inventory Turnover tells you how often inventory is sold and replaced.

Pepsi shows an increasing DIO and a slowing Inventory Turnover, confirming that Pepsi’s sales are slowing.

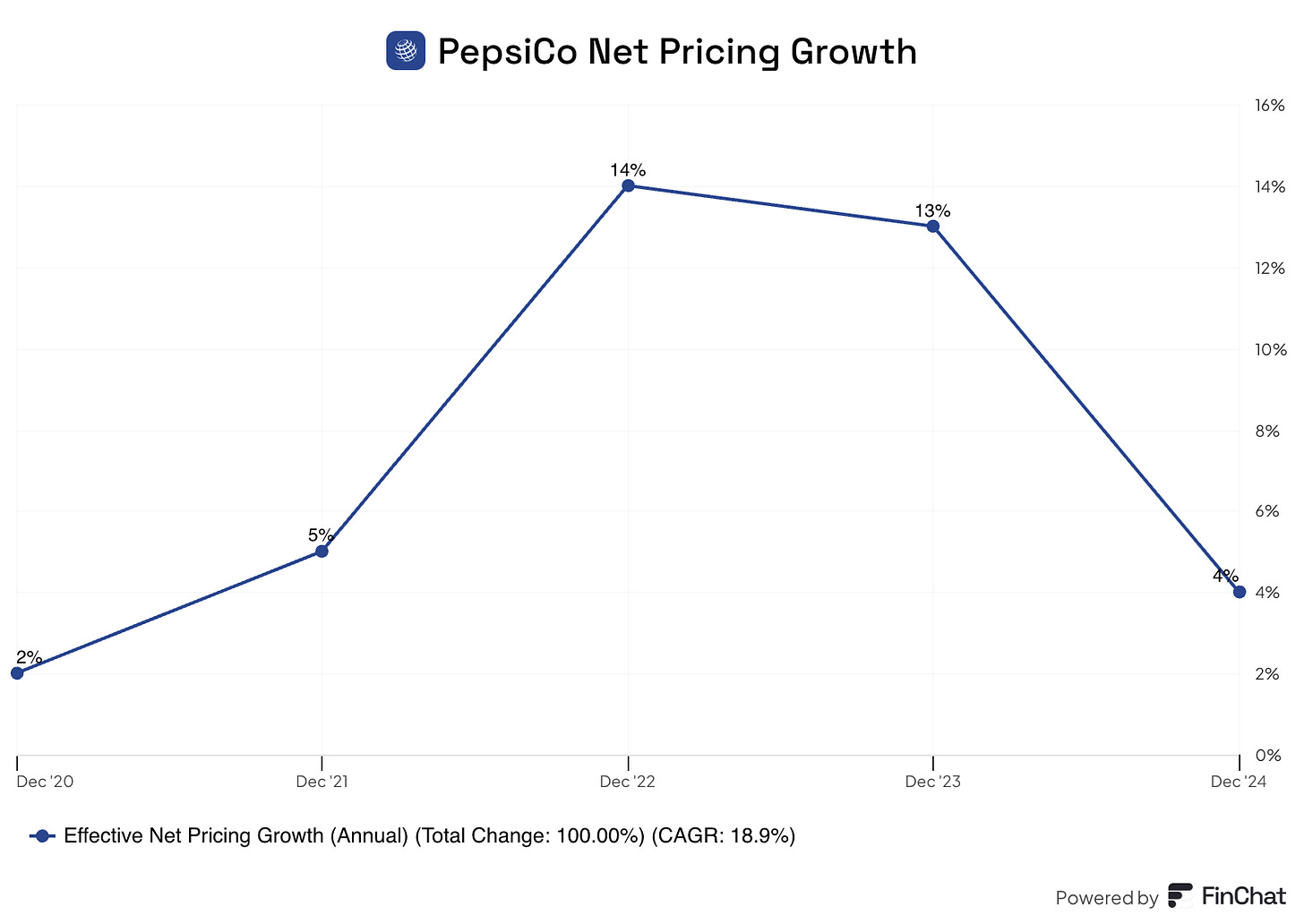

So how is Pepsi keeping earnings up?

By raising prices.

That can work—for a while. But here’s the catch: you can only charge so much for a 12-pack of soda or a bag of chips before people stop buying or switch to cheaper brands.

Pepsi Isn't Like Tobacco

Some might compare Pepsi to the tobacco companies, which have survived years of falling sales volumes by charging higher prices and rewarding shareholders with fat dividends.

But Pepsi is no Marlboro.

First, tobacco is addictive. Nicotine keeps smokers hooked.

Snacks and sugary drinks? Not so much. Sure, they’re habit-forming to a degree, but quitting potato chips isn’t exactly as hard as quitting cigarettes.

Second, tobacco companies benefit from incredible brand loyalty. Smokers rarely switch brands, and you won’t find "generic" cigarettes on the shelf next to Marlboro or Camel.

That’s not true for Pepsi.

Walk down the soda aisle, and you’ll see plenty of store brands offering cheaper alternatives. The same goes for snacks.

Those low-cost competitors can easily steal customers if Pepsi keeps raising prices.

Compare Pepsi’s DIO and Inventory Turnover with British American Tobacco:

British American Tobacco is seeing falling DIO and rising Inventory Turnover

They’re selling what they’re making.

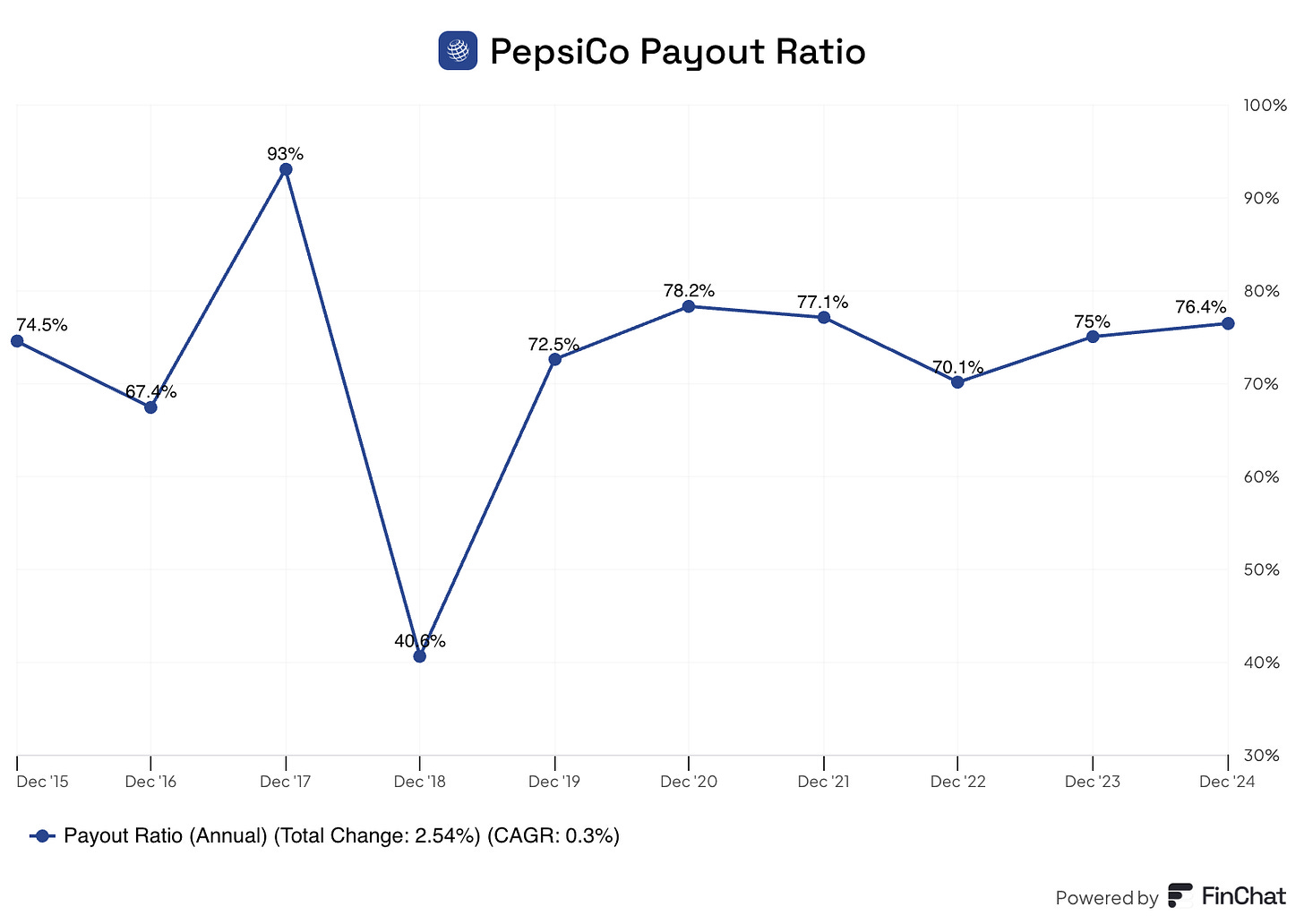

Growth Problems Ahead

Pepsi already pays out more than 70% of its earnings as dividends. That doesn’t leave much room for growth of the dividend or reinvestment.

If sales volumes keep dropping and Pepsi hits its pricing ceiling, where will future growth come from? That’s the big question—and one that’s too hard for me to answer.

So I’m not buying PepsiCo.

Curious to find out which companies I DO think are attractive?

Start your trial period on Compounding Dividends here.

One Dividend At A Time

TJ & Pieter