PepsiCo is an amazing business.

They reward their shareholders with high and stable dividends.

Let’s look at this dividend aristocrat today.

General Information

👔 Company name: PepsiCo, Inc.

✍️ Ticker: PEP 0.00%

🔎 ISIN: US7134481081

📚 Type: Dividend Aristocrat

📈 Stock Price: $173

💵 Market Cap: $239 billion

📊 Average Daily Volume: $6 billion

Business Model

PepsiCo is active in the food and drinks sector.

The company makes money by selling snacks and beverages. Every time you buy a drink from Pepsi or a bag of Lays chips, PepsiCo makes money.

PepsiCo can be seen as a conglomerate. They have over 23 brands, each bringing in over a billion dollars annually. That’s a lot of snacks and drinks!

Here is a breakdown of PepsiCo’s revenue:

Snacks (around 50% of total revenue): This includes popular brands like Lay's, Doritos, Cheetos, and Quaker Foods.

Beverages (around 45% of total revenue): Including their famous drinks such as Pepsi, Mountain Dew, Gatorade, and Tropicana juices.

Other Products (around 5% of total revenue): Think about water brands (Aquafina), and newer health-conscious products.

Geographical split

The geographical split of PepsiCo looks as follows:

Source: Finchat

Management

The CEO and Chairman of PepsiCo is Ramon Laguarta. He has been with PepsiCo for over 25 years. In 2018, he became the CEO.

The CFO of PepsiCo is Hugh F. Johnston. He has been with the company since 1987!

Insiders own 0.15% of the company. This is equal to $368 million.

Competitive advantage

PepsiCo has a competitive advantage for sure.

The moat of the company is based on its strong brand names. People know and love products of Pepsi. But please think for yourself. When did you last drink a Pepsi Coke or eat some Lay’s chips?

PepsiCo typically offers more choices in product categories than most competitors, so there’s something for everyone.

As a result, PepsiCo can sell more and charge higher prices than other companies, which helps it stay ahead.

Dividend

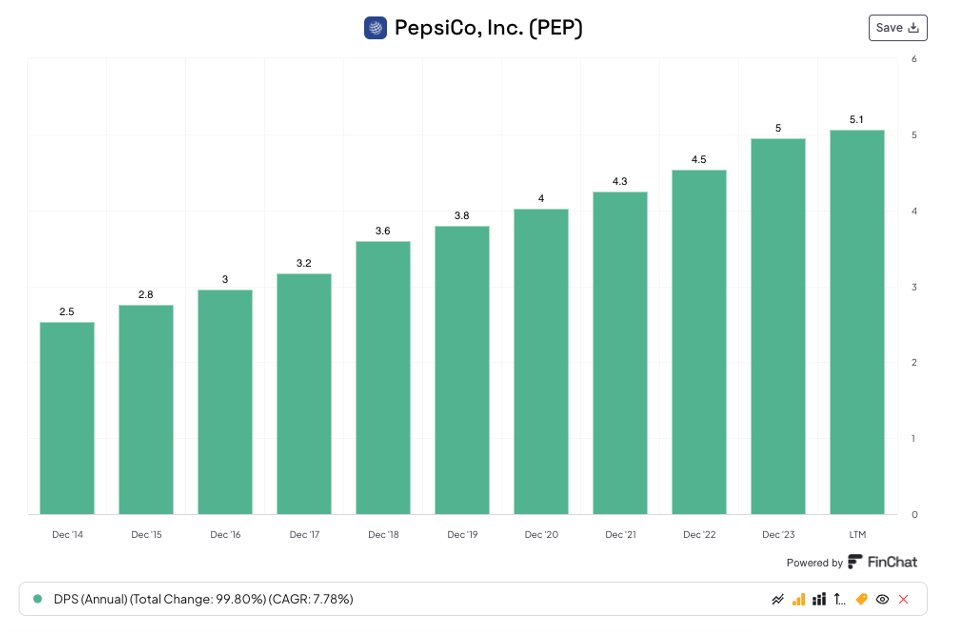

PepsiCo is a Dividend Aristocrat.

They have increased their dividend for 31 years in a row.

This is amazing. It means that when you invest in PepsiCo, you can be sure you will receive a dividend year after year.

PepsiCo:

Dividend Yield: 3.1%

Payout Ratio: 75.8%

Frequency dividend payments: quarterly

This means that when you invest $10,000 in PepsiCo, you’ll receive a dividend of $310 per year.

PepsiCo’s dividend will continue to increase in the years to come.

Source: Finchat

Valuation

The cheaper we can buy a great dividend company, the better.

PepsiCo currently trades at a forward PE of 21.4x.

Over the past 5 years, PepsiCo’s forward PE averaged 23.5x.

This indicates the company is slightly undervalued compared to its historical average.

Source: Finchat

Conclusion

That’s it for today.

PepsiCo is a beautiful dividend aristocrat. It’s an interesting company to own for dividend investors.

The company increased its dividend for 31 years (!) in a row and we expect this trend to continue.

Investors receive an attractive dividend yield of 3.1%. This means that you receive $310 in cash dividends per year for every $10,000 you invest.

Source: Finchat

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Disclaimer

This always brings up the unavoidable question - Pepsi or Coke? 😄

You are correct that the moat is in the brand. I think if you were to repackage both of Pepsi's and Coke's products into "generic" unlabeled containers and let only taste and price affect consumer's decisions then we would see a completely different shakedown of preferred products. Brand name recognition is definitely built on reputation but it also has a strong emotional component. A very prominent example of the emotional component can be see in the automotive sector. Who in the US hasn't heard of the Ford vs. Chevy vs Dodge banter? Oddly enough, nobody adds Toyota, Nissan, or Honda into that mix. Did the Japanese automakers dodge a bullet there?

I don't necessarily understand the emotional component of a brand but I recognize other people's emotions and try to play off of that. To that end, I would go to my local Walmart and Smith's (Kroger on the west coast) and watch what people put into their shopping carts. Pepsi or Coke? Starry or Sprite? Or maybe the generic store brand? Without any scientific rigor, I think the split was 40/40/10/10 between Coke drinks, Pepsi drinks, store brand generics, and everything else like Dr. Pepper and the like. I couldn't see deep enough inside the cart to check out the chips and snacks. 😏 I understand Coke and Pepsi both raised their prices but people still buy the products. I saw pricing power in action.

That said, I think both Coke and Pepsi are wonderful companies that are durable, well run, and offer great products for those into them. Some people may avoid the companies because they believe the products are unhealthy. It come as surprise to some but Coke and Pepsi have the muscle and resources to reformulate their drinks and snacks to reduce sugar and salt content while retaining most, if not all, the original taste. For example, when picking a cola, I will pick Zero-Sugar, Zero-Caffeine Coca Cola. It's readily available and tastes good for me.

For me to get into either Pepsi or Coke will require a COVID-crash price level. The dividend must be at least 4%. There are so many high quality companies that can exceed 4% and grow it. There are income oriented CEFs and ETFs like CHI and HIPS. Consider BDCs like Capital Southwest and Hercules Capital.