A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

December 2024

In December the S&P 500 decreased by 2.6%

The Fear & Greed Index indicates that we ended December in ‘Fear’ Mode.

As of the market close on Friday, we’re still in ‘Fear’.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

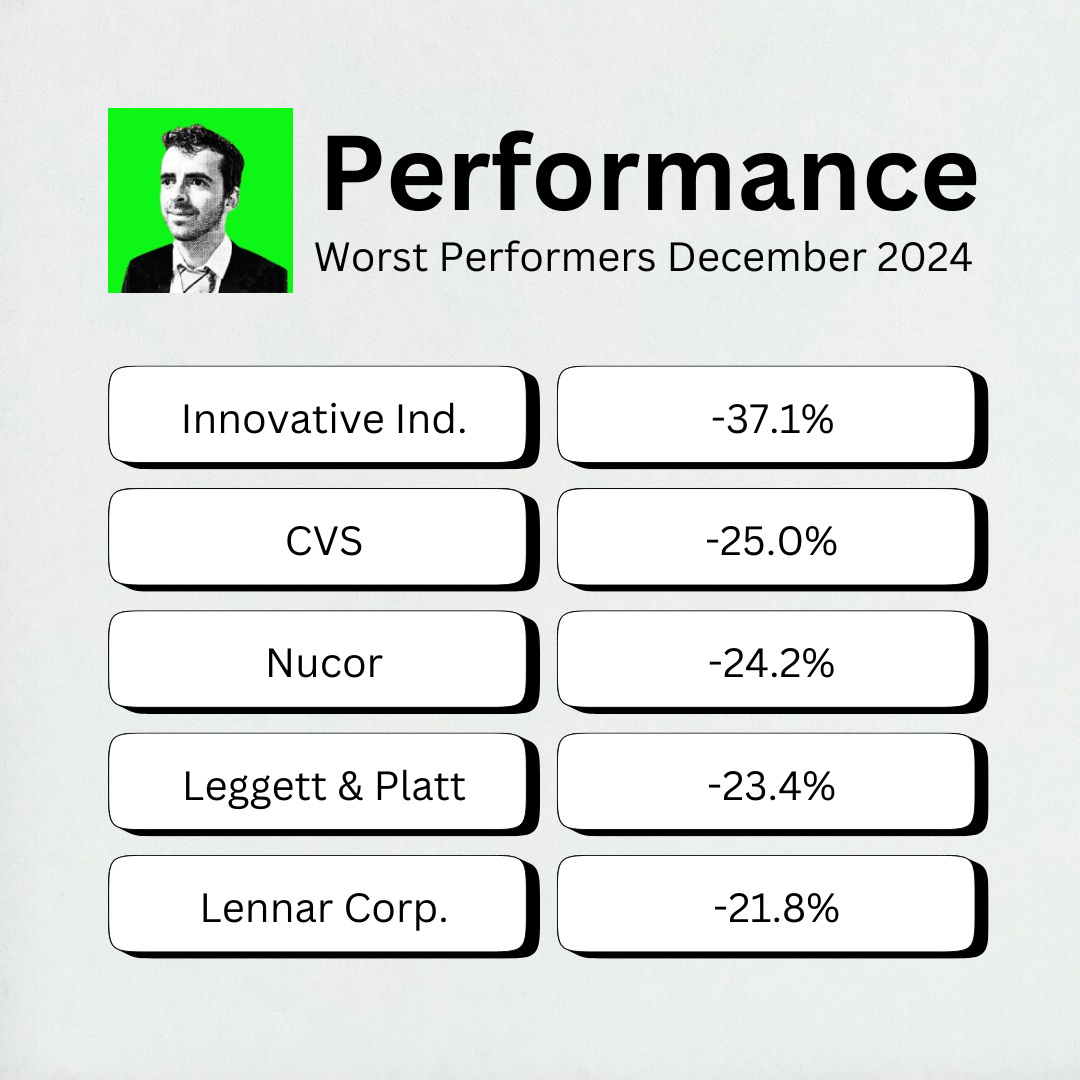

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Innovative Industrial Properties.

Innovative Industrial Properties is a REIT that leases to medical-use cannabis companies.

Best Performers

Spar Nord Bank A/S was this month’s best performer, rising 48%.

Spar Nord Bank A/S provides banking products and services to retail, business, and public sector customers in Denmark. They’re involved in loans, trading services, consumer financing, and gift vouchers.

The share price shot up when Nykredit announced a deal to buy Spar Nord Bank A/S in an all-cash deal.

Sector Review

Instead of looking at a specific company this month, I thought it would be interesting to review the performance of the market sectors for 2024.

With the S&P closing 2024 with a gain of 23%, it’s no surprise that many of the market sectors also performed well.

Communication Services: 40.2%

Tech: 36.6%

Financials: 30.6%

One interesting thing in this data?

That the healthcare sector lagged the market by so much this year, posting a gain of only 2.6%.

The healthcare sector can be a great place for dividend investors because it includes companies that provide essential services and products.

People need healthcare no matter the economy, which can lead to steady profits.

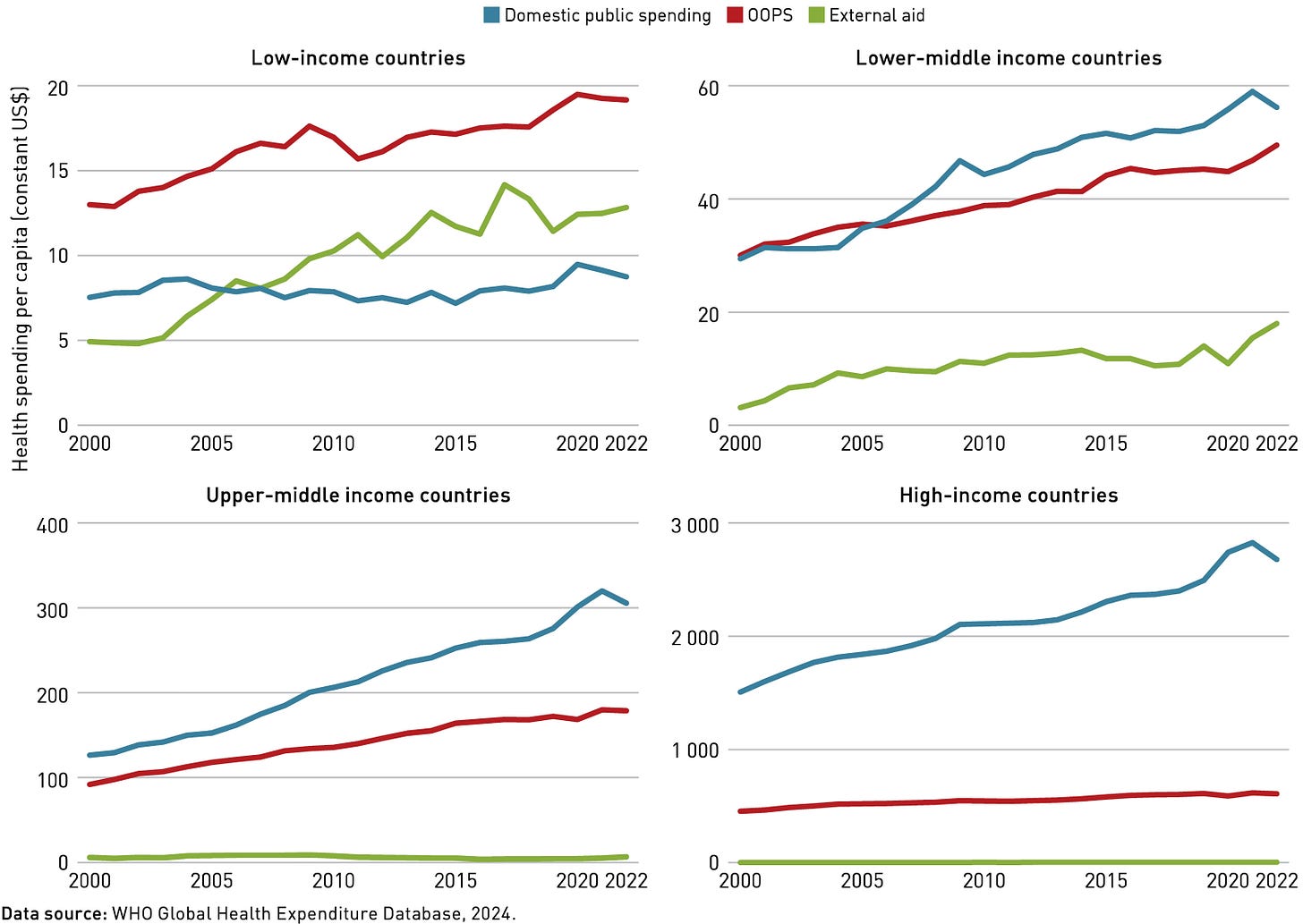

The image shows different types of healthcare spending in countries with different income levels.

The trend in healthcare spending is up, regardless of the income level of the country.

A lot of healthcare companies also have a history of paying dividends regularly.

This month, I’ve chosen the 5 ‘Best Buys’ from the healthcare industry.

Ready to see what they are?

Let’s dive in!

5. Novo Nordisk

How Novo Nordisk makes money

Novo Nordisk makes insulin and other diabetes and weight loss medications.

Their diabetes medication (Ozempic) and obesity medication (Wegovy) are both are the same molecule, semaglutide, which works by targeting a cellular receptor called GLP-1.

Why Novo Nordisk is interesting

Globally, Novo Nordisk holds 65% of the market for GLP-1 medicines by volume.

The market has sold off the stock due to less-than-expected results from its anti-obesity drug candidate CagriSema.

Novo may continue to have issues in the short to medium term, but sales of Wegovy and Ozempic won’t be affected.

Novo Nordisk currently offers a higher dividend yield and a higher expected earnings growth than the S&P 500.

Source: Finchat

4. Thermo-Fischer Scientific

How Thermo-Fischer Scientific makes money

Thermo-Fischer sells scientific instruments and lab equipment.

They also provide lab services and consumable products to researchers and labs.

Why Thermo-Fischer Scientific is interesting

TMO has a strong history of growth:

5-year revenue CAGR: 10.9%

5-year EPS CAGR: 12.4%

Despite this, the market has been selling off life-science stocks like TMO due to short-term worries about macroeconomics, and supply chain difficulties that may temporarily raise costs for the company.

None of these things changes the long-term outlook or fundamentals of the company.

The dividend yield isn’t high, but management has been buying back shares since 2018.

The pace of buybacks has also been accelerating the past few years.

Source: Finchat

Ready for the top 3?

Here’s what’s included:

2 Dividend Kings offering higher yields than normal

A Cannibal company that’s bought back almost 40% (!) of its shares over the past 10 years