July Best Buys

June market insights + 5 high-yield dividend stocks to watch this July—spotlight on Brown-Forman, Nexstar, and more.

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

June 2025

In June the S&P 500 increased by 4.2%

Source: Fiscal.ai

The Fear & Greed Index indicates that we ended June in ‘Greed’ Mode.

This is unchanged from the end of May.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Brown-Forman.

Brown-Forman is one of the largest American spirits companies, known for making whiskey, tequila, and other premium alcohol brands.

Its best-known product is Jack Daniel’s, but it also owns Woodford Reserve, Old Forester, and Herradura tequila.

Recently, Brown-Forman has faced some headwinds:

Slowing demand in key international markets

Rising costs for glass, shipping, and agave

Increased competition from craft and global spirits

Weaker-than-expected sales of flavored whiskey products

Best Performers

Aneka Tambang was this month’s best performer, rising over 42%.

PT Aneka Tambang Tbk is a large Indonesian state‑linked metals and mining company founded in 1968. It operates in three key areas:

Nickel (ferronickel and nickel ore),

Precious metals & refinery (gold, silver, alumina), and

Bauxite & alumina

The stock price has been moving up strongly since the company reported strong Q1 earnings in March.

They’re part a major EV battery supply chain project with CATL and others planned to be operational by the end of 2026.

In mid-June, the company appointed new board members and management, aligning with national resource strategies, and coinciding with the stock price rise.

Spotlight: Brown-Forman Corporation ($BF.B)

How does the company make money?

Brown-Forman makes money by selling whiskey, tequila, vodka, and other alcoholic drinks.

Its portfolio includes some of the most iconic brands in the spirits industry:

Jack Daniel’s Tennessee Whiskey

Woodford Reserve bourbon

Herradura tequila

Finlandia vodka

Chambord liqueur

Alcohol is a global business with high margins. Brown-Forman sells to over 170 countries, and its brands are especially strong in the premium category.

This is a business built on heritage, pricing power, and global distribution.

Why do dividend investors like it?

Because Brown-Forman combines brand strength with long-term dividend growth.

It has raised its dividend for 41 straight years

It’s a Dividend Aristocrat

The payout is well-covered by earnings and free cash flow

The company has a strong balance sheet and is still family-controlled

The fundamentals look like this:

Dividend Yield: 3.5%

Payout Ratio: 48.3%

10-Year Dividend CAGR: 6.3%

Net Profit Margin: 21.9%

ROIC: 16.0%

Forward PE: 16.8x

Brown-Forman is currently trading at a much higher starting yield than we’ve seen in over a decade.

If you believe that the slowing demand is temporary and that the company can manage rising costs, it might be an interesting stock to look at.

July Best Buys

Walter Schloss liked dividends, and so do I.

Especially when I can get a high starting yield on a good company.

Brown-Forman isn’t the only stock trading at a high starting yield this month.

I looked through the Buy-Hold-Sell list for ‘Buy’ rated stocks with 4%+ starting yields to find some interesting companies to highlight.

I also used our Magic Formula screen of the European markets to find interesting candidates.

Let’s dive into 5 of the most interesting ones I found!

5. 📺 Nexstar Media Group (NXST)

While Wall Street obsesses over streaming wars, savvy investors are quietly collecting 4%+ yields from America's dominant local TV empire.

With nearly 200 local TV stations and a pile of digital media assets, Nexstar is the biggest broadcaster in the country.

That's a virtual monopoly on local news and advertising that Netflix can't touch.

Nexstar throws off tons of free cash flow, barely touches it (payout ratio under 30%), and still manages to yield 4%.

And when election season hits, this cash machine goes into overdrive, pumping out political ad revenue like a broken ATM.

Current yield: 4.2%

5-year average: 2.8%

Payout ratio: 34.7%

Forward P/E: 13.2

This is the kind of boring business that quietly makes people rich.

4. 🚛 Paccar Inc. (PCAR)

If you’ve ever seen a Peterbilt or Kenworth on the highway, you’ve seen Paccar.

These trucks move the economy.

But here’s what most people miss: Paccar runs a conservative, cash-gushing operation. It rarely makes headlines… but regularly sends big dividend checks—especially those juicy “specials.”

And it’s been doing it for decades.

Current yield: 4.8% (with specials)

5-year average: 3.7%

Payout ratio: 18.6%

Forward P/E: 17.5

Think of this one like an income factory with chrome trim.

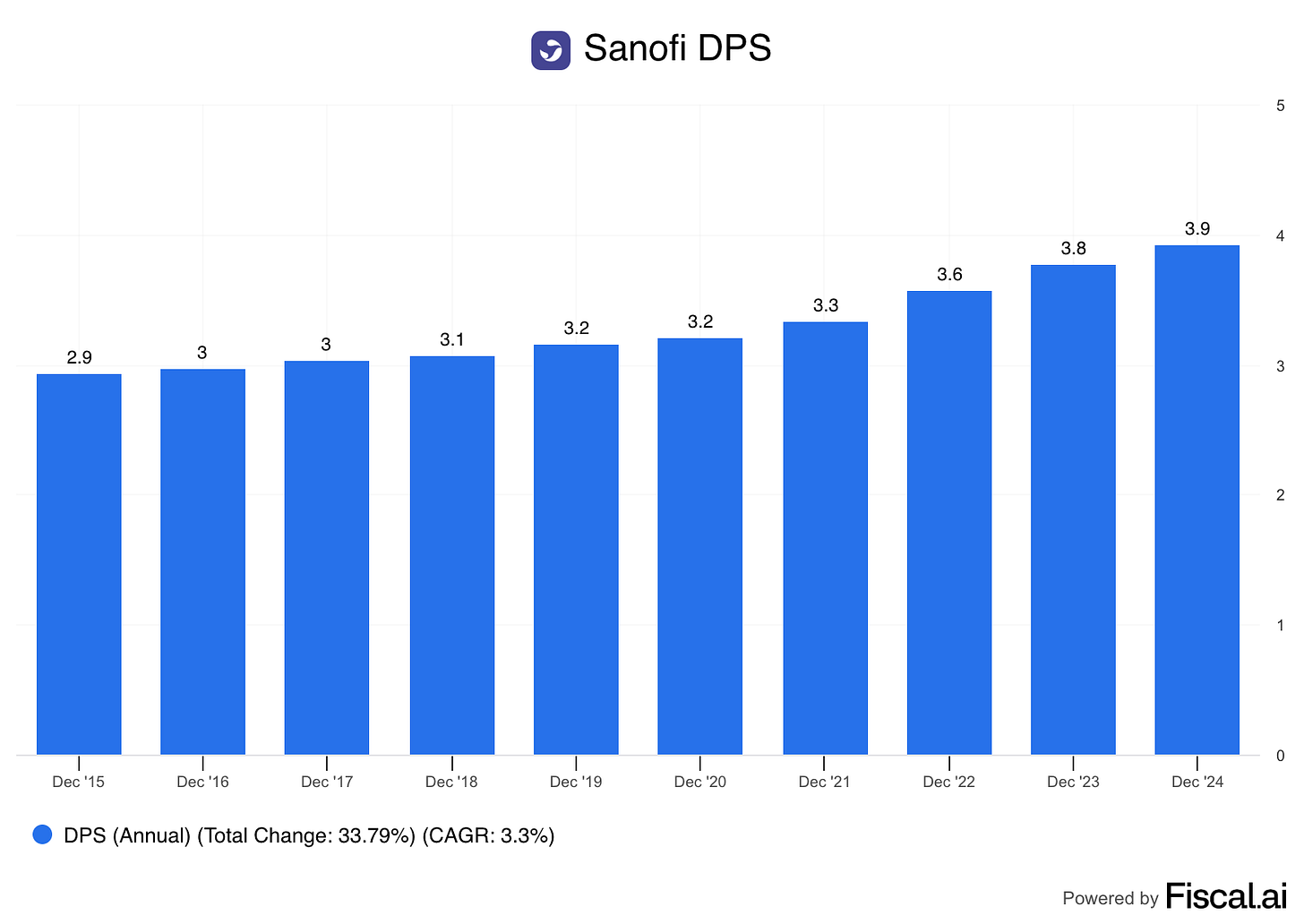

3. 💊 Sanofi (SNY)

While biotech gamblers chase the next miracle drug, Sanofi shareholders have been collecting fat dividend checks for 30 years straight.

This French pharmaceutical giant sits on a treasure trove of blockbuster drugs and vaccines that generate billions in recurring revenue.

Healthcare isn't going anywhere - and neither is Sanofi's dividend growth streak.

Current yield: 4.2%

5-year average: 3.8%

Payout ratio: 89.3%

Forward P/E: 10.1

In a world chasing miracle cures, Sanofi sells what already works.