Like Buffett, I Got My Start With a Newspaper Bag

Turns out, a childhood job taught me everything I needed to know about value.

Fun fact:

At age 10, I was a paperboy - just like Warren Buffett.

Buffett has been obsessed with newspapers his whole life.

He’s owned them. He reads five a day. He has a newspaper tossing contest in Omaha.

And he often talks about the lessons that he learned delivering them.

So today, I want to share the lessons I learned from delivering them too.

📬 Lesson 1: Responsibility and the Basics of Business

Delivering newspapers was my first real job.

And I learned all the lessons that a first job is supposed to teach you:

Show up every day, rain or shine.

Keep your customers happy.

Do the work - even when you’re not getting paid right away.

And if you go above and beyond, you can move up.

At first, I split one of four routes in town with my best friend.

By the time we were done, we ran three of them - just the two of us.

His older brother took over the fourth, since it required a car.

We had newspaper empire in a few years!

🚗 Lesson 2: Disruption Happens - Even to Kids

When we quit, all the routes were combined into one ‘motor route.’

Newspaper ‘tubes’ - the mailboxes without a door - were installed at every house.

One person drove the route, delivering all the papers without ever getting out of their car.

It was faster. But I’m not sure it was better.

When we delivered on foot, we knew our customers.

Some wanted the paper between the storm door and the front door.

Others had spot on the porch.

My favorite had an old tin milk cooler where the paper went - and sometimes there was a tip or candy inside.

The new route erased all that.

Now, the only thing that mattered was efficiency:

Tubes had to be placed at an exact height and distance from the road so the driver never had to get out.

That was my first lesson in disruption.

The new way was cheaper. Faster. More scalable.

But it lost the personal touch.

📈 Lesson 3: My First Exposure to Stocks

One hot day, I sat down under a tall hedge with a paper from my bag.

I flipped to the stock section for some reason.

There were charts of the indexes, and some information on individual stocks in tiny type:

I didn’t understand much of it. But one thing caught my eye:

The 52-week high and low.

I realized if you bought at the low and sold at the high, you’d make a lot of money.

That moment embedded one of the simplest, most powerful ideas in investing:

Buy low. Sell high.

It would take me years to learn how hard that is in practice.

But the concept clicked right then and there.

💸 Lesson 4: Raised by a Natural Value Investor

Even before newspapers, my roots in value investing were growing.

I grew up comfortably middle class.

But my mom didn’t. She grew up poor - she just didn’t know it at the time.

That affects you, even when you’re an adult, and even when you’re not poor anymore.

And it shaped how she raised me:

We didn’t buy anything unless it was on sale

If a cashier made a mistake, she got her money back - even a quarter

She had a giant accordion of coupons she brought everywhere

She could quote prices from memory: “It’s $X here, but $Y down the street”

As a teenager, I was mortified.

But now?

I look back and realize: she was training me to be a value investor.

She taught me to care about the pennies. To track prices. To be skeptical.

And most of all - to never pay full price.

With that kind of upbringing, how could I not wind up a value investor? How could I not value income over speculation?

The seeds were planted long before I knew what a P/E ratio was.

🧠 Lesson 5: The Right Personality for Long-Term Investing

I’ve always had a streak of contrarianism.

I don’t like being told what to do. Or what to think.

I’ll often argue a point for sport, or just to see if someone can defend it.

(Helpful in investing. Slightly less helpful at dinner parties.)

That tendency has a downside. But there’s an upside too:

I question my assumptions

I read bear cases on my own holdings

I don’t mind when the market disagrees with me - as long as my thesis is solid

I’m more interested in being right eventually than being popular.

This makes most people uncomfortable. But it’s one of the most valuable traits an investor can have.

And it seems to come more naturally to me than to most.

Full Circle

Looking back, ending up where I did makes perfect sense.

The paper route taught me how business works

The stock pages sparked my curiosity

My mom raised me to hunt for value

And my personality made me question the crowd

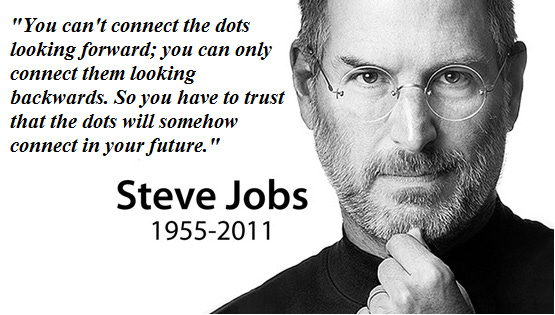

I didn’t take a straight path into investing, but like Steve Jobs said:

One Dividend At A Time

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data