Lowe’s is one of the largest home improvement retailers in the world

The stock returned 35,000% (!) to shareholders since 1990.

Let’s teach you everything you need to know about this dividend aristocrat.

Lowe’s Companies, Inc.

👔 Company name: Lowe’s Companies, Inc.

✍️ Ticker: LOW 0.0%

🔎 ISIN: US5486611073

📚 Type: Dividend Aristocrat

📈 Stock Price: $215

💵 Market Cap: $123 billion

📊 Average Daily Volume: $661 million

Business Model

Lowe’s is the second biggest home improvement retailer in the world.

The company makes money in 2 ways:

Products (around 95% of total sales): Lowe's makes money by selling home improvement products like hammers and lightbulbs.

Services (around 5% of total sales): Services like home installation and repairs.

Lowe's customers are professionals like builders, repair experts, homeowners, and renters. They serve people doing their home projects and those who hire others to do the work.

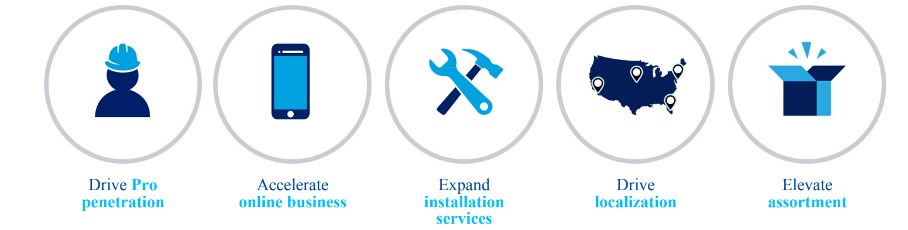

Lowe’s has a simple and effective strategy. It’s called their ‘Total Home Strategy’, which offers everything needed for any home project. It’s based on five pillars:

Geographical split

Currently, Lowe’s is only active in the United States.

Management

Marvin R. Ellison is the chairman, president, and CEO of Lowe’s Companies since 2018. Marvin has more than 35 years of retail leadership and operational experience.

Brandon Sink is the Chief Financial Officer and Executive Vice President of Lowe’s. He joined Lowe’s in 2010 and has more than 20 years of experience in accounting and finance roles.

Insiders own 0.1% of the company. In an ideal world, we would like the insider ownership to be higher.

Competitive advantage

Lowe’s has a moat based on economies of scale and has huge stores with lots of different items in stock.

When something breaks at home or a builder needs something right away, people can go to their local Lowe's and find it quickly.

Since Lowe's is so big, they can keep more items in inventory compared to smaller stores, which means they are more likely to have what you need right when you need it.

Dividend

Lowe’s is a Dividend Aristocrat.

They have increased their dividend for 29 years in a row.

This is wonderful. Investing in Lowe’s results in receiving an attractive dividend every single year.

Lowe’s Companies:

Dividend Yield: 2.0%

Payout Ratio: 35.2%

Frequency dividend payments: quarterly

This means that when you invest $10,000 in Lowe’s, you’ll receive a dividend of $200 per year.

Lowe’s has a low payout ratio (35.2%). This means their dividend is sustainable and that there is plenty of room to keep increasing their dividends in the future.

Source: Finchat

Valuation

The cheaper we can buy a great dividend company, the better.

Lowe’s currently trades at a forward PE of 17.2x.

Over the past 5 years, Lowe’s forward PE averaged 17.0x.

This indicates the company is valued correctly compared to its historical average.

Source: Finchat

Conclusion

That’s it for today.

Lowe’s is a beautiful dividend aristocrat. It might be an interesting company to own if you are a dividend growth investor.

Lowe’s increased their dividend payment for 29 consecutive years and still has a low payout ratio.

We expect the dividends to keep growing in the future.

If you invest in Lowe’s you receive an attractive dividend yield of 2.0%. This means you receive $200 in cash dividends per year for every $10,000 you invest.

Source: Finchat

That’s it for today

That’s it for today.

In case you missed it:

Subscribed

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

We would be remiss if we didn't mention Lowe's competitor, Home Depot. 😉

Both retailers have a large footprint, enormous scale, and a great runway for growth. A lot of people are not selling their homes to move upward and onward to a bigger, better, more plush home. Mortgage rates are higher now and house prices haven't necessarily come down much, if at all. To that end, more people are remodeling and fixing up their current home than ever before. It was especially evident during the COVID crisis when everyone was stuck at home with a lot of free time on their hands. This was their chance to paint their interiors a new color, install new floors, buy new appliances, and clean up their yards.

I don't think that trend is going to end soon. My local Home Depot, about 3 miles from my home, is always packed on the weekends and there's a decent evening crowd for those picking something up after work.

Both Home Depot and Lowes are cannibal stocks.

Home Depot has a slightly higher dividend yield, although Lowes may have a longer record.

Both companies have very similar operating ratios in many cases because they kind of do the same thing, kind of the same way. Depending on what you are looking for, each may have something for cheaper than the other. Both of their professional services are small compared to their retail segments. Home Depot is trying to grow their professional services through the acquisition of SRS and make those products and services available to individual, residential customers too.

Their stock prices follow each other trend-wise, but in the long term, Lowe's wins in the total return performance.

Wow, an increase in dividends 29 years in a row! Thanks for the write up.