Portfolio Update: June 2025

$820.33 in dividends...

👋 Howdy Partner,

I’m feeling great… Want to know why?

Because I know we’re investing in great businesses that pay us to own them.

In June, we received $820.33 in dividends.

We’ve received over $5,000 in dividends so far this year.

Remember, my goal is build $5,000 in reliable, recurring, passive income. Every month. Rain or shine.

Right now, I’m projected to receive about $1,250 per month.

But remember, the portfolio is still being built - 50% of it is still in cash.

If the Portfolio were fully invested at the same average yield, I’d already be at 50% of my goal!

And once we’re fully invested?

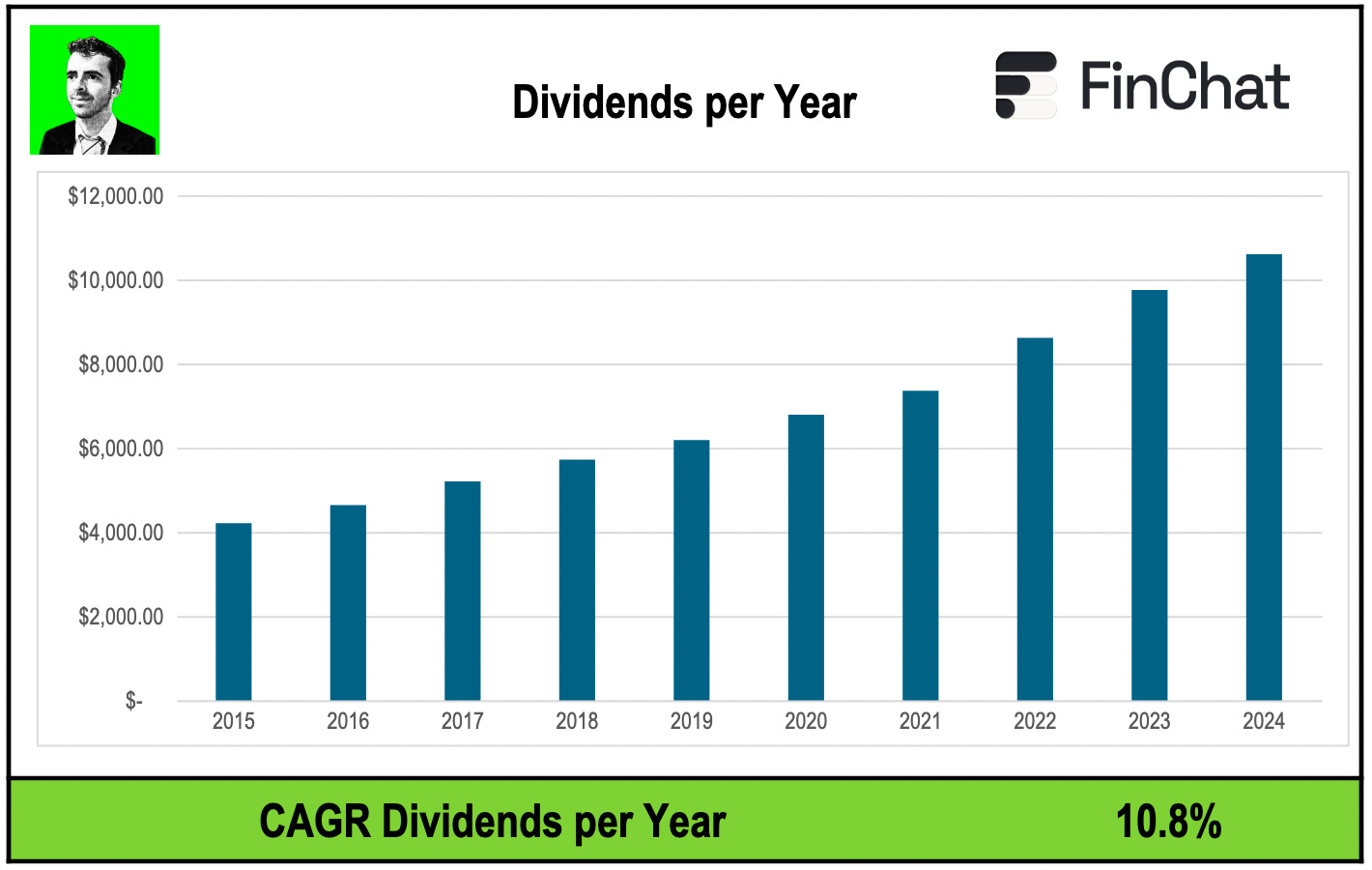

Our Dividend payments will just keep growing. Look at this chart:

Current environment

Markets can change fast.

Remember when there was a lot of uncertainty in the market because of the import tariffs from Donald Trump.

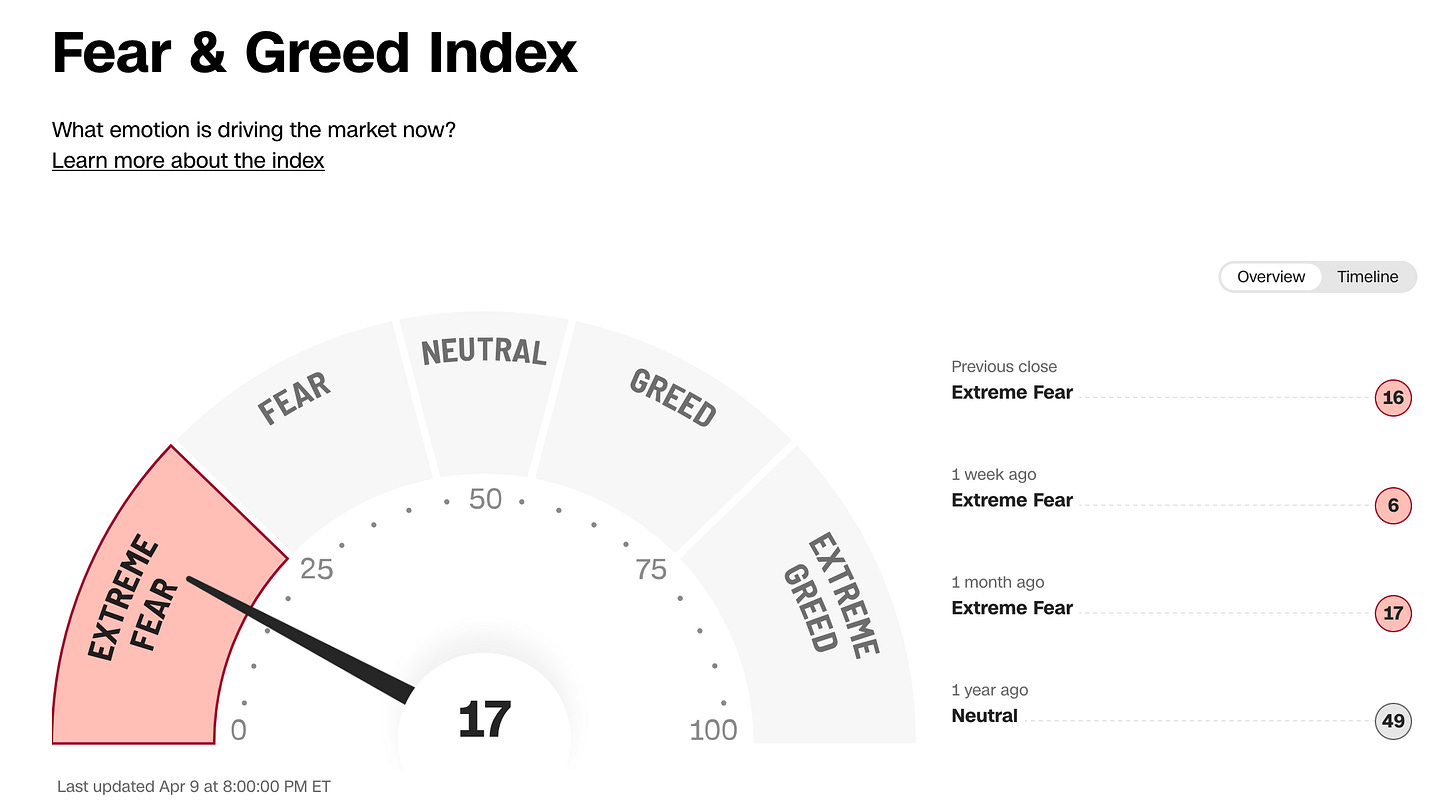

Here’s what the Fear & Greed Index looked like at the beginning of April:

But since then, we’ve moved back into ‘Greed’ mode - and even advanced to ‘Extreme Greed’.

Warren Buffett reminds us that this is a time to be cautious.

“to be fearful when others are greedy and to be greedy only when others are fearful.”

-Warren Buffett

Does that mean we can’t find attractive investment opportunities in today’s market?

Of course not!

Our Buy-Hold-Sell update had 148 ‘Buy’ rated companies on it.

But that’s not what today’s email is about.

Today, we’re talking about the companies that we already own.

Let’s look at the fundamentals of the Portfolio.

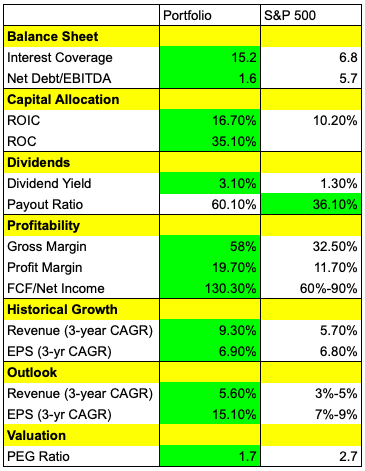

Portfolio Fundamentals

Our goal is simple.

We want to buy great companies and receive our share of the profits.

So far, I think we’re doing a great job.

Why? Because our companies have very healthy fundamentals:

Our portfolio companies have:

Better balance sheets

Better capital allocation

Higher profits

More cash generation

Better past growth

Higher future growth

Lower valuations

That looks like a pretty good group of companies to own to me!

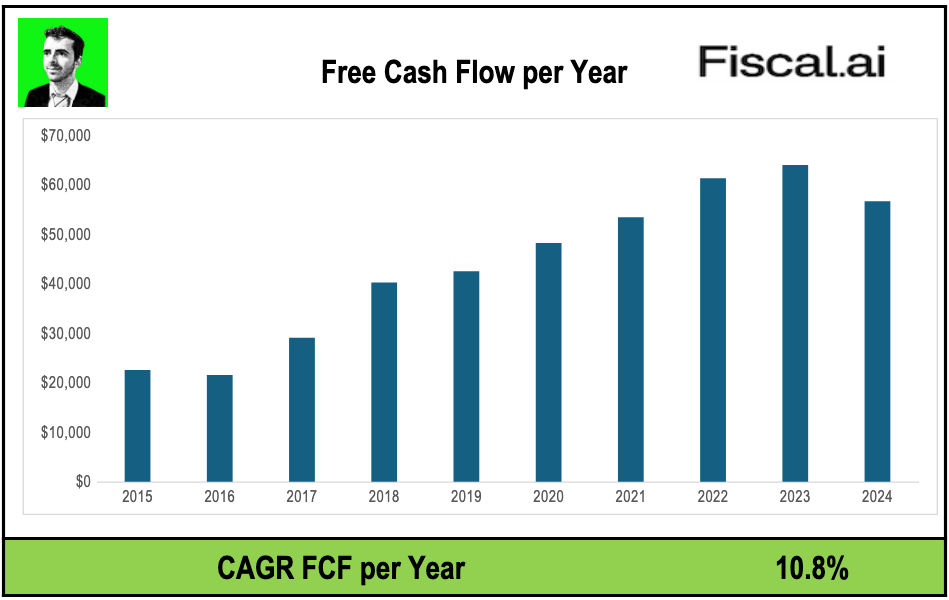

Free Cash Flow

Earnings are an opinion, (Free) Cash Flow is a fact.

As shareholders, we are the owners of the companies we invest in.

As a result, we should look at the cash a company generates for us.

Here’s an overview of how much Free Cash Flow our companies have generated:

Our Portfolio evolved from generating $22 billion in Free Cash Flow per year to more than $55 billion.

And I can guarantee you one thing: this number will keep increasing in the years ahead.

The ultimate goal? A Portfolio that shares more Free Cash Flow per year than you need to live a comfortable life.

The Shareholder Yield for Our Portfolio looks like this:

It’s great seeing the Portfolio still trades at very reasonable valuation levels.

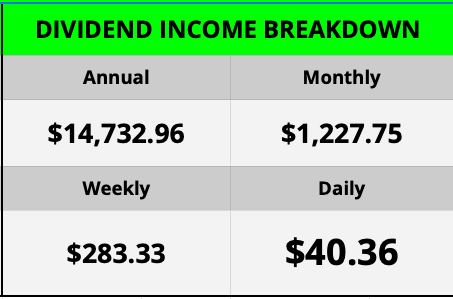

Dividend Stats

Our Portfolio is currently projected to generate nearly $15,000 in income per year.

That works out to:

$1,227 per month

$283.33 every week

$40.36 per day

Fully invested, we would currently receive roughly double these amounts!

Dividend Growth

But the really exciting part?

The dividend growth over time.

Let’s project some numbers.

The yield on cost of our Portfolio is currently 3.29%

Our companies have grown their Dividends by 14.98% per year over the past 5 years

Let’s be conservative and cut it in half - we’ll project 7.5% Dividend growth

We’ll also project that the share prices increase by 7.5% per year moving forward

In only 5 years, our monthly income would triple!

Our Portfolio

Here’s an overview of all positions: