Portfolio Update October 2025

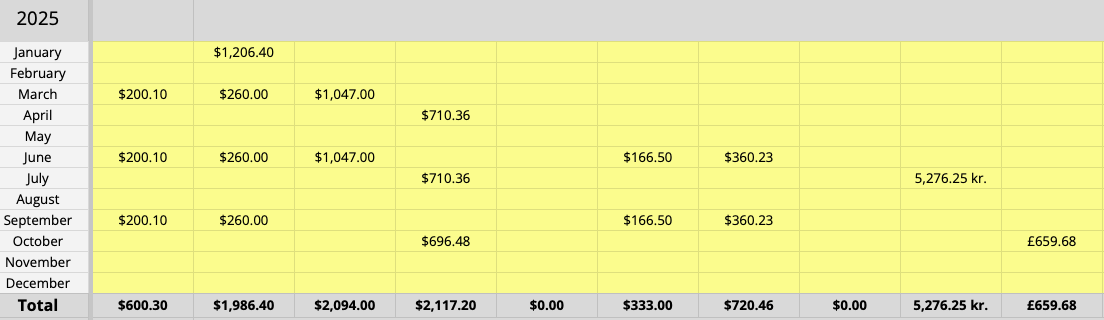

$2,450.79 in dividends.

👋 Howdy Partner,

I’m feeling great… Want to know why?

Because I know we’re investing in great businesses that pay us to own them.

In September and so far in October, we have received $2,450.79 in dividends.

We’ve received over $9,000 in dividends so far this year.

Remember, my goal is build $5,000 in reliable, recurring, passive income. Every month. Rain or shine.

Right now, I’m projected to receive about $1,850 per month.

But remember, the portfolio is still being built - 37% of it is still in cash.

If the Portfolio were fully invested at the same average yield, I’d already be at 60% of my goal!

And once we’re fully invested?

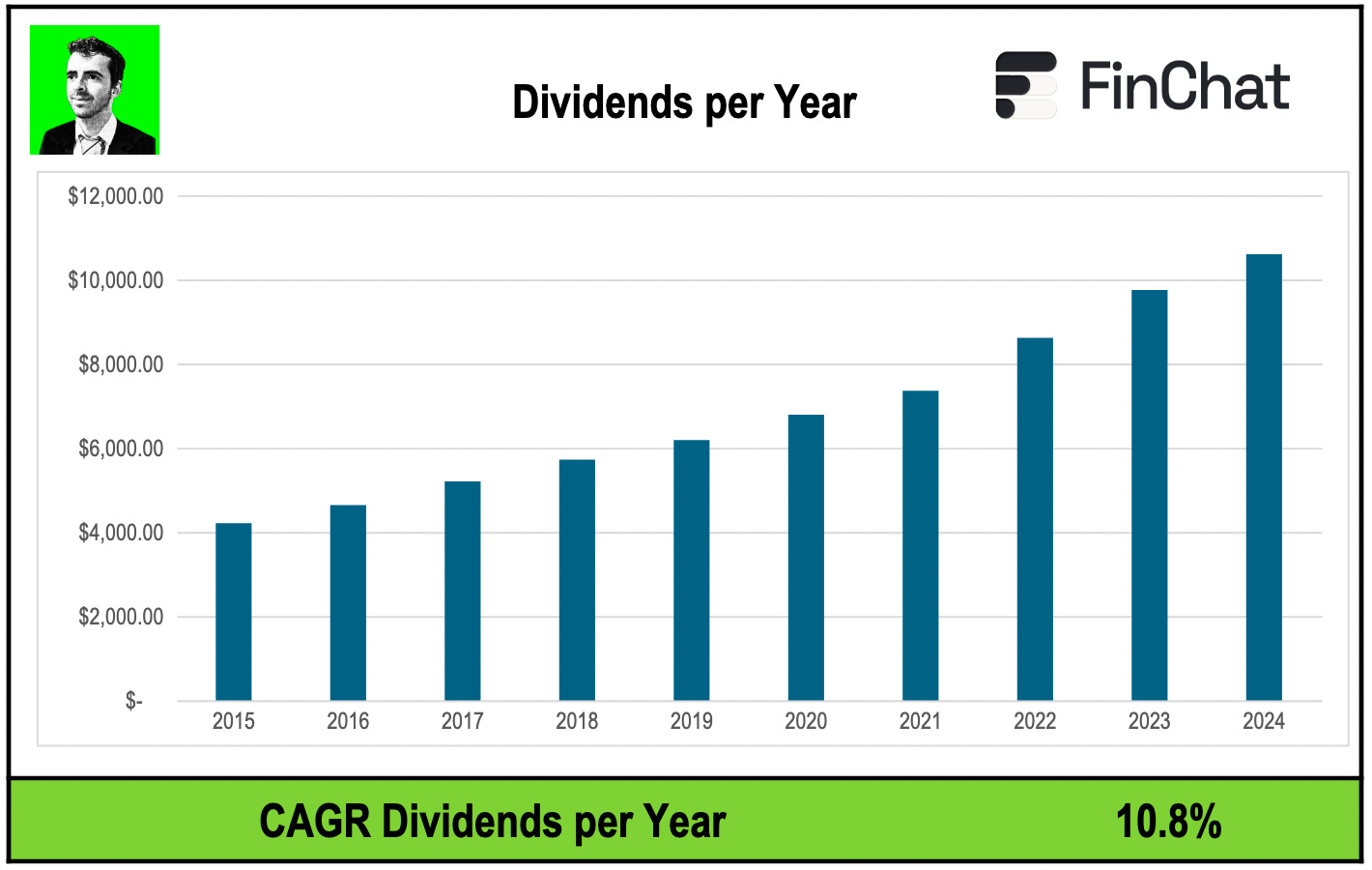

Our Dividend payments will just keep growing. Look at this chart:

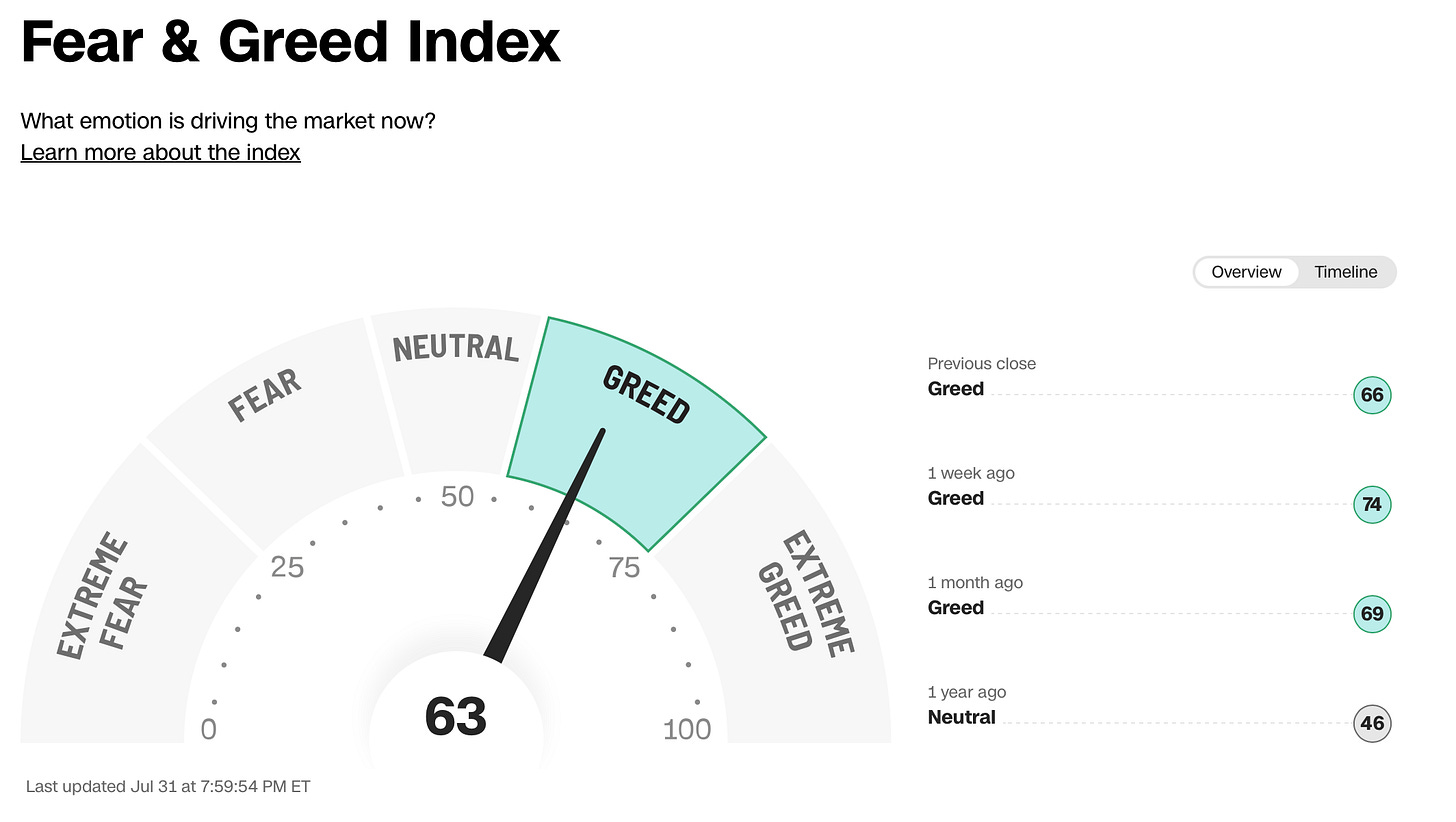

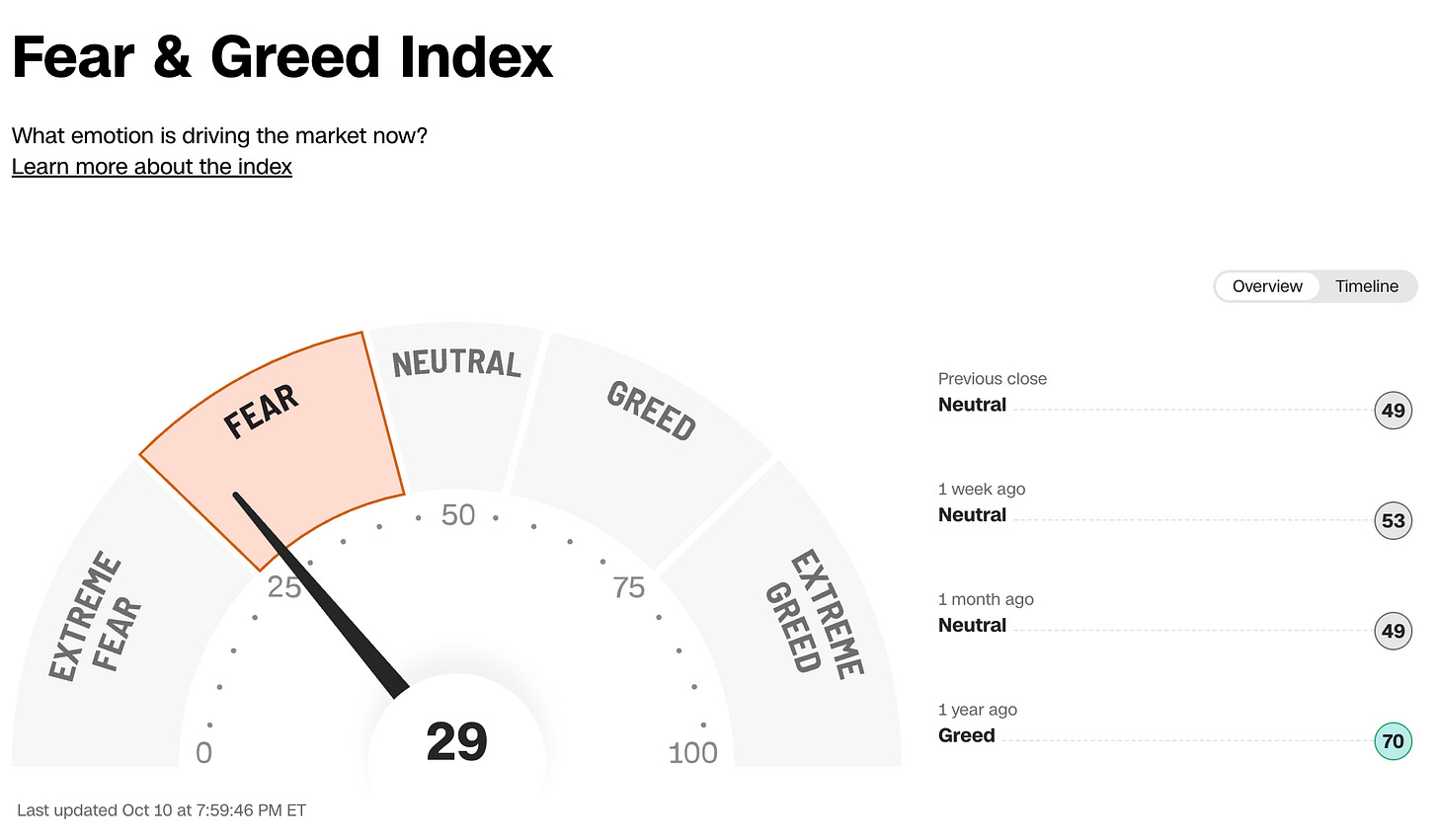

Current environment

Markets can change fast.

In August we were squarely in ‘Greed’ mode:

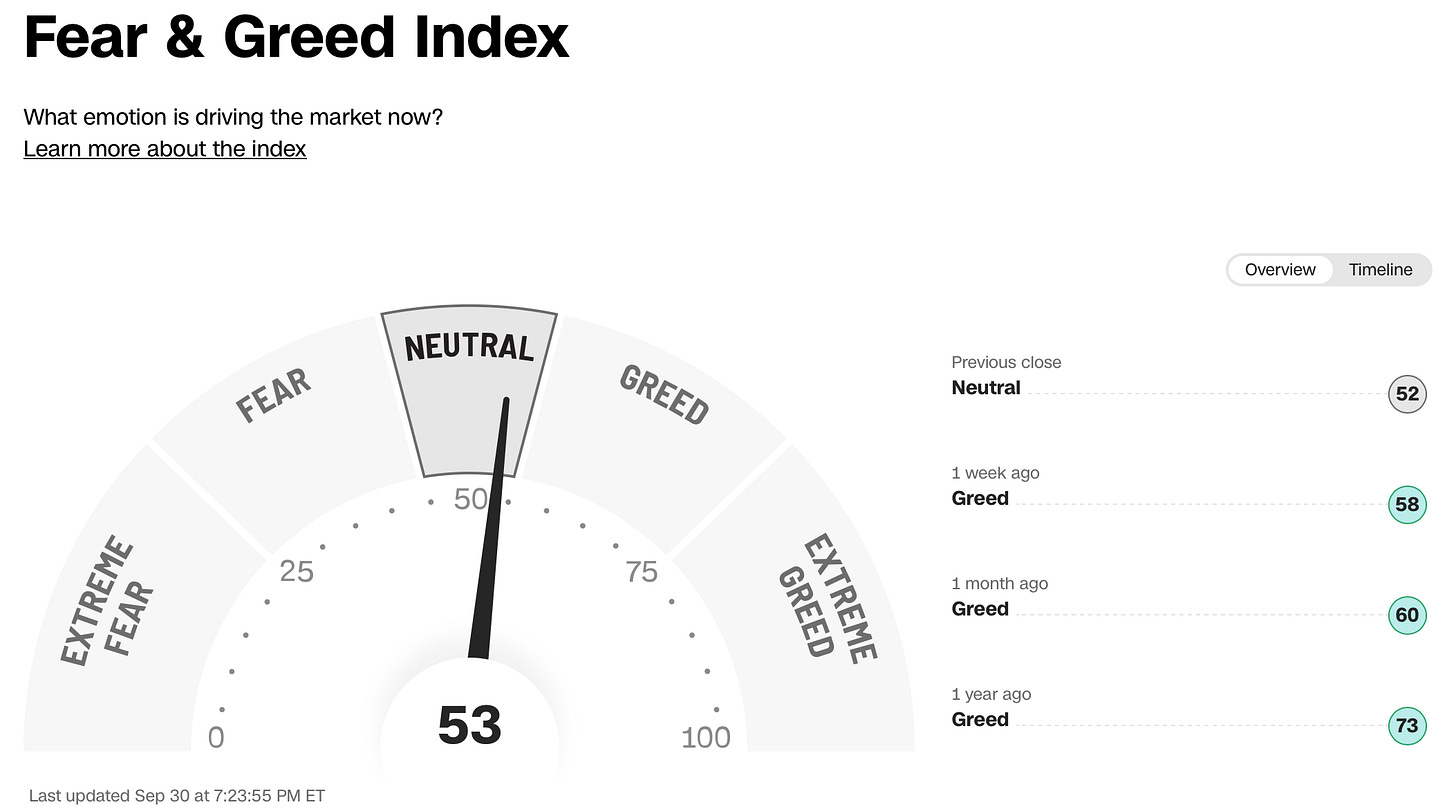

We ended September in ‘Neutral’ mode .

On Friday, Trump’s threat for more tariffs on China moved us back to ‘Fear’ mode.

If the market stays in ‘Fear’ mode, we’ll be looking for attractive places to put cash to work.

“to be fearful when others are greedy and to be greedy only when others are fearful.”

-Warren Buffett

Our Buy-Hold-Sell update had 188 ‘Buy’ rated companies on it.

But that’s not what today’s email is about.

Today, we’re talking about the companies that we already own.

Let’s look at the fundamentals of the Portfolio.

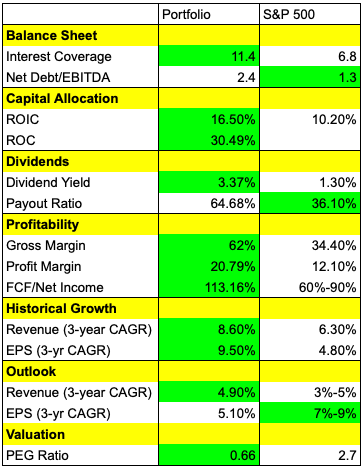

Portfolio Fundamentals

Our goal is simple.

We want to buy great companies and receive our share of the profits.

So far, I think we’re doing a great job.

Why? Because our companies have very healthy fundamentals:

Our portfolio companies have:

Better balance sheets

Better capital allocation

Higher profits

More cash generation

Better past growth

Lower valuations

That looks like a pretty good group of companies to own to me!

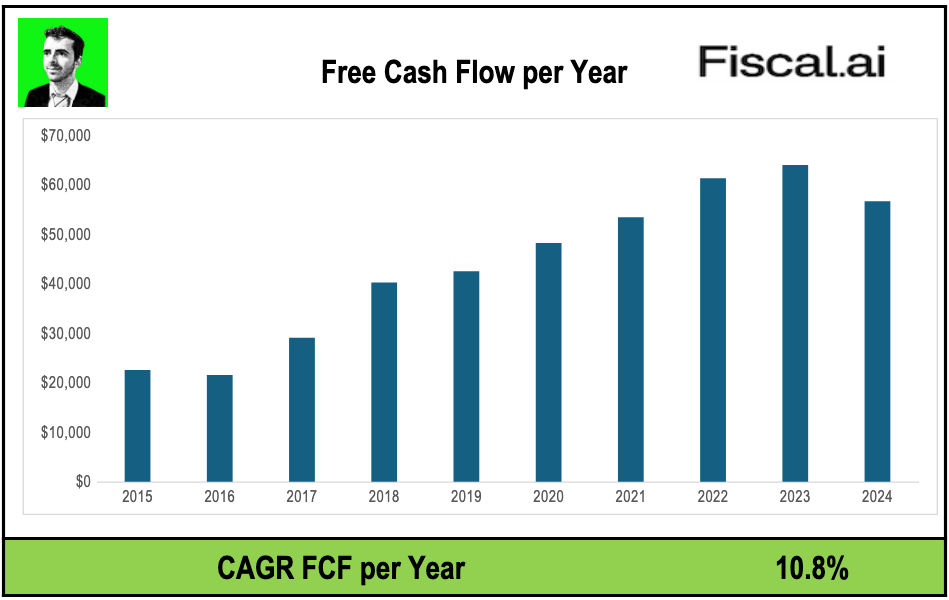

Free Cash Flow

Earnings are an opinion, (Free) Cash Flow is a fact.

As shareholders, we are the owners of the companies we invest in.

As a result, we should look at the cash a company generates for us.

Here’s an overview of how much Free Cash Flow our companies have generated:

Our Portfolio evolved from generating $22 billion in Free Cash Flow per year to more than $55 billion.

And I can guarantee you one thing: this number will keep increasing in the years ahead.

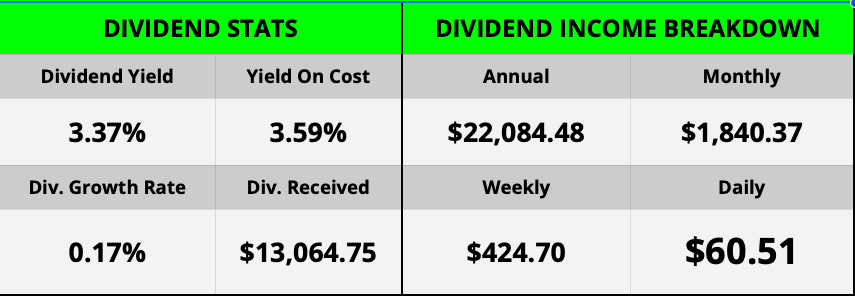

Dividend Stats

Our Portfolio is currently projected to generate more than $22,000 in income per year.

That works out to:

$1,840 per month

$424 every week

$60.51 per day

Fully invested, we would currently receive nearly $3,000 per month!

Dividend Growth

But the really exciting part?

The dividend growth over time.

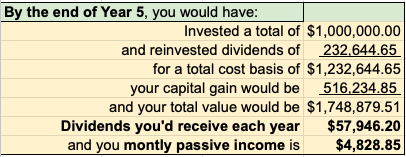

Let’s project some numbers.

The yield on cost of our Portfolio is currently 3.59%

Our companies have grown their Dividends by 16.75% per year over the past 5 years

Let’s be conservative and cut it in half - we’ll project 8.5% Dividend growth

We’ll also project that the share prices increase by 7% per year moving forward

In only 5 years, I’d be nearly at my goal of $5000/mo!

Now, here’s the thing, partner…

All of this - the cash flow, the compounding, the steady growth, it doesn’t happen by accident.

It happens because we own great businesses that pay us to wait.

And we stay patient.

Disciplined.

Focused on the long game.

If you’ve been following along and thinking, “I’d like to see exactly what they’re buying… when they’re buying… and how they’re thinking about it” well, you can.

When you become a paid partner, you’ll get 24/7 access to the full Compounding Dividends Portfolio…every position, every update, every move.

You’ll see how we’re turning dividends into real, growing income.

Become a paid partner here and start building your compounding machine today.

Because the best time to plant a dividend tree?

Was ten years ago.

But the second best time, is right now.

One Dividend At A Time,

TJ

YouTube

Don’t forget to subscribe to the Compounding Dividends YouTube channel here

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data