Real Estate Without the Hassle: My Top REIT Picks Now

Own real estate without managing tenants, toilets, and turnover and collect yields of up to 7%. Here are 12 REITs worth looking at while they’re still cheap.

👋 Howdy Partner,

On Wednesday, we looked at inflation, producer prices, and wages.

Here’s the quick version:

Price growth for consumers has slowed, but costs for businesses are still climbing

Wages are rising causing inflation in services

The Fed may allow inflation to run closer to 3% instead of pushing back to 2%

That means we may be in a world where inflation keeps moving higher for years.

Real estate tends to do well in that environment.

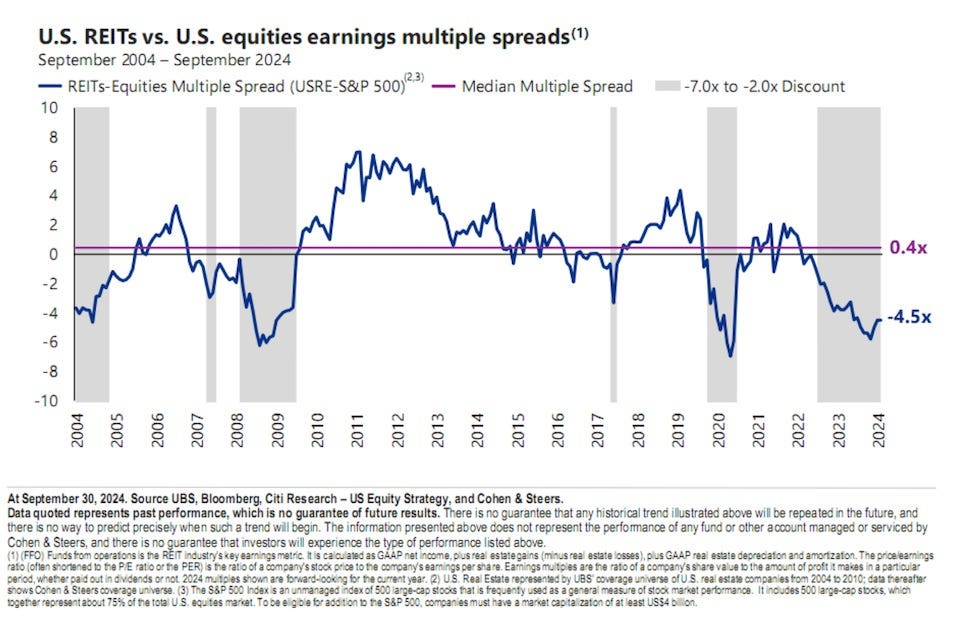

And today, REITs are cheap relative to equities.

What Are REITs?

A REIT (Real Estate Investment Trust) is a company that owns real estate and makes money from rent.

They could own: apartments, offices, warehouses, land, shopping centers

You buy shares in the REIT just like a stock

The REIT collects rent, pays expenses, and sends the rest to investors as dividends

By law, REITs must pay out most of their profits as dividends.

That makes them a natural fit for dividend growth investors.

Why Own REITs Instead of Buying Real Estate?

Income: REITs often pay higher dividends than most stocks

Inflation protection: When prices rise, rents usually rise too

Diversification: You get exposure to real estate without needing to buy and manage property yourself

Liquidity: Unlike physical property, you can sell REIT shares anytime in the stock market

What to Watch With REITs

Instead of earnings per share (EPS), REITs are usually judged by Funds From Operations (FFO).

FFO (Funds From Operations) is a better measure of cash flow for REITs because it focuses on the cash that comes from owning and managing real estate.

Why not Net Income or FCF (Free Cash Flow)?

Net Income includes things like depreciation, which is a big non-cash expense for real estate.

Buildings lose value on paper every year, but that doesn’t mean the REIT actually lost cash

This usually makes net income can look lower than the actual cash the REIT is generating

Free Cash Flow (FCF) can be affected by big one-time purchases or sales of properties, which can make cash flow look very jumpy and less consistent.

What makes FFO better?

FFO adds back depreciation and amortization to net income because those are non-cash costs

It excludes gains or losses from selling properties, focusing on the cash flow from regular operations

So, FFO shows a clearer picture of the cash a REIT generates from its real estate business, which is what we care about most.

Other key metrics:

P/FFO ratio: Similar to P/E, but for REITs

Dividend yield: Calculated the same as for a stock: DPS/Share price

Payout ratio: Use FFO in place of EPS: Dividend Per Share/ FFO Per Share

Balance sheet strength: Debt levels matter a lot, especially when rates rise

Property quality and growth: Location and type of real estate drive long-term returns

Interesting REITs Right Now

Now that you know what REITs are and why they might be interesting right now, here are some that I’m looking deeper into.

Each one is a little bit different. Let’s give you a look at my REIT shortlist right now.

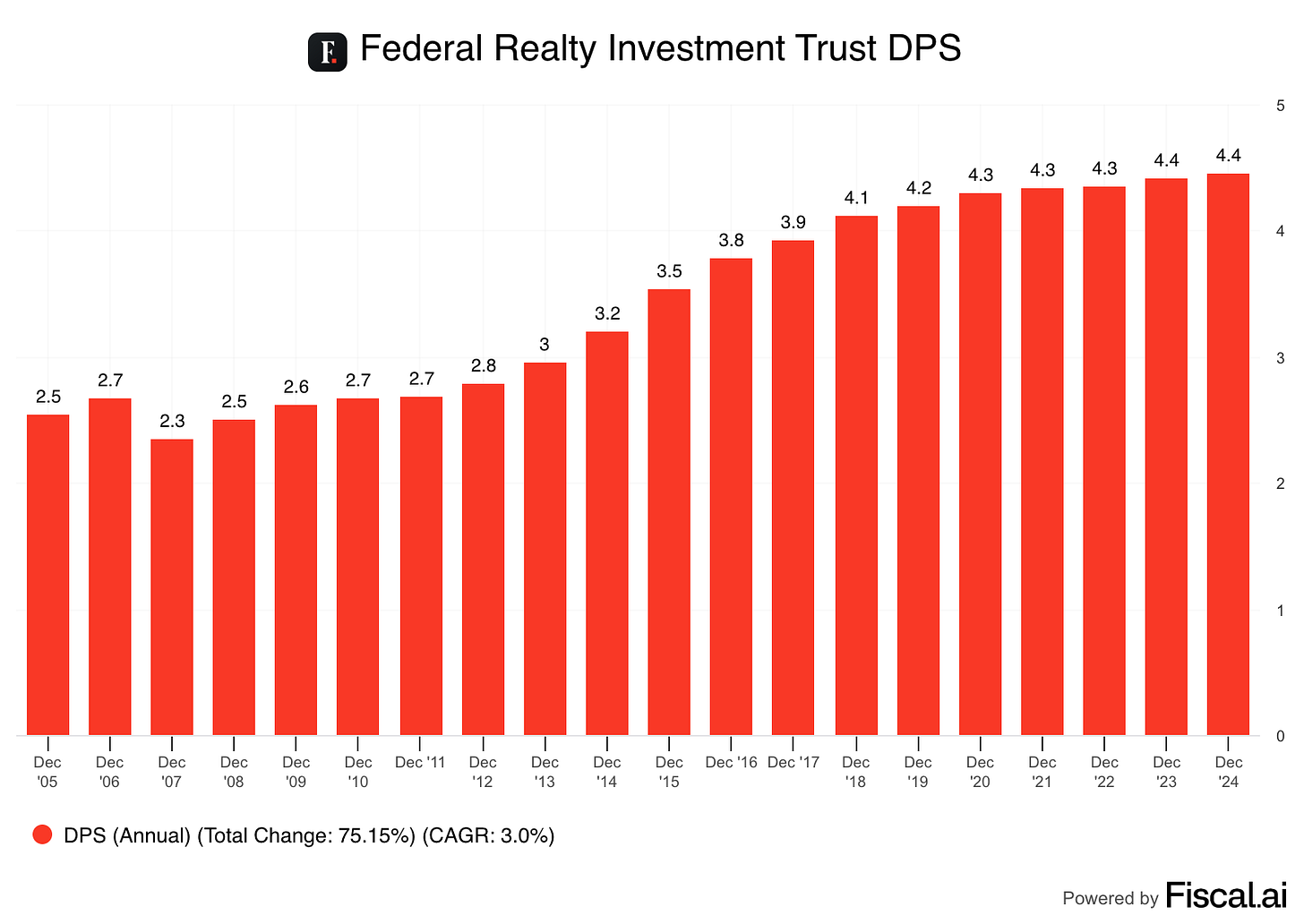

Federal Realty Investment Trust (FRT)

Focuses on high-quality retail in top U.S. cities

Long track record of steady growth in revenue and earnings

A “blue-chip” style REIT

Important metrics

Forward Dividend Yield: 4.53%

FFO Payout Ratio: 64.99%

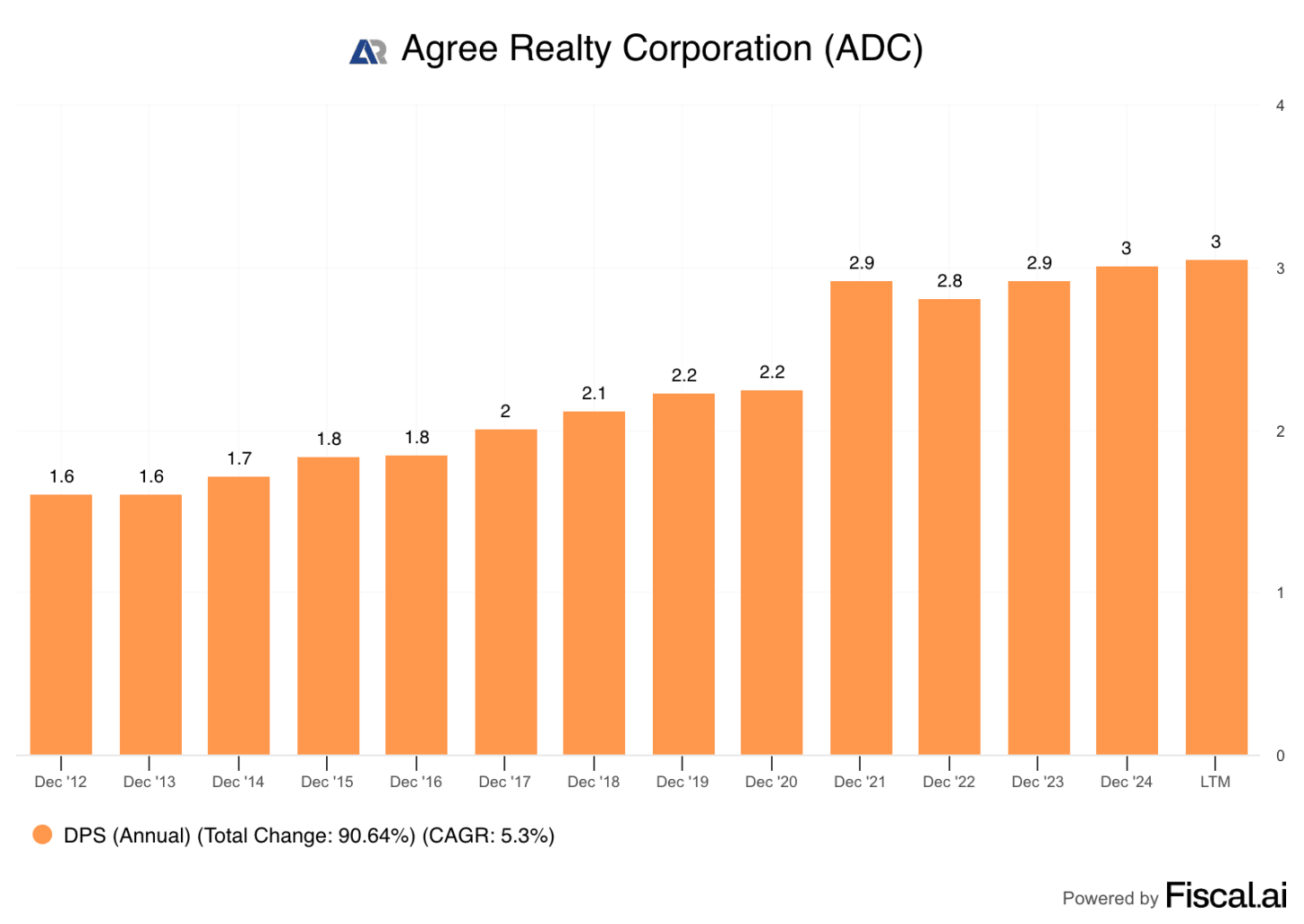

Agree Realty (ADC)

Owns net leased retail properties in strong locations

Consistent growth and solid balance sheet

Management continues to invest heavily for future growth

Important metrics

Forward Dividend Yield: 4.23%

FFO Payout Ratio: 81.87%

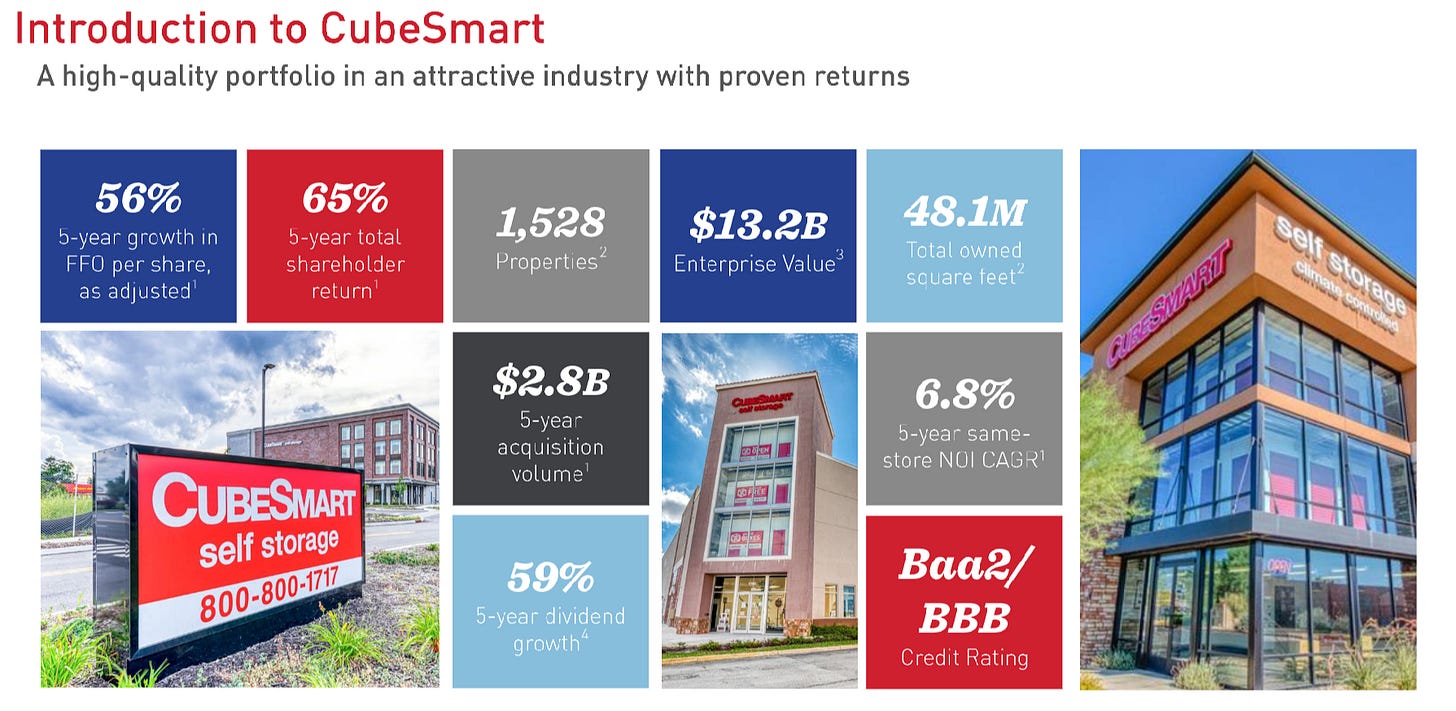

Cubesmart (CUBE)

Self-storage REIT

Healthy balance sheet and steady growth

Growing demand as people move and downsize

Important metrics

Forward Dividend Yield: 5.10%

FFO Payout Ratio: 79.09%

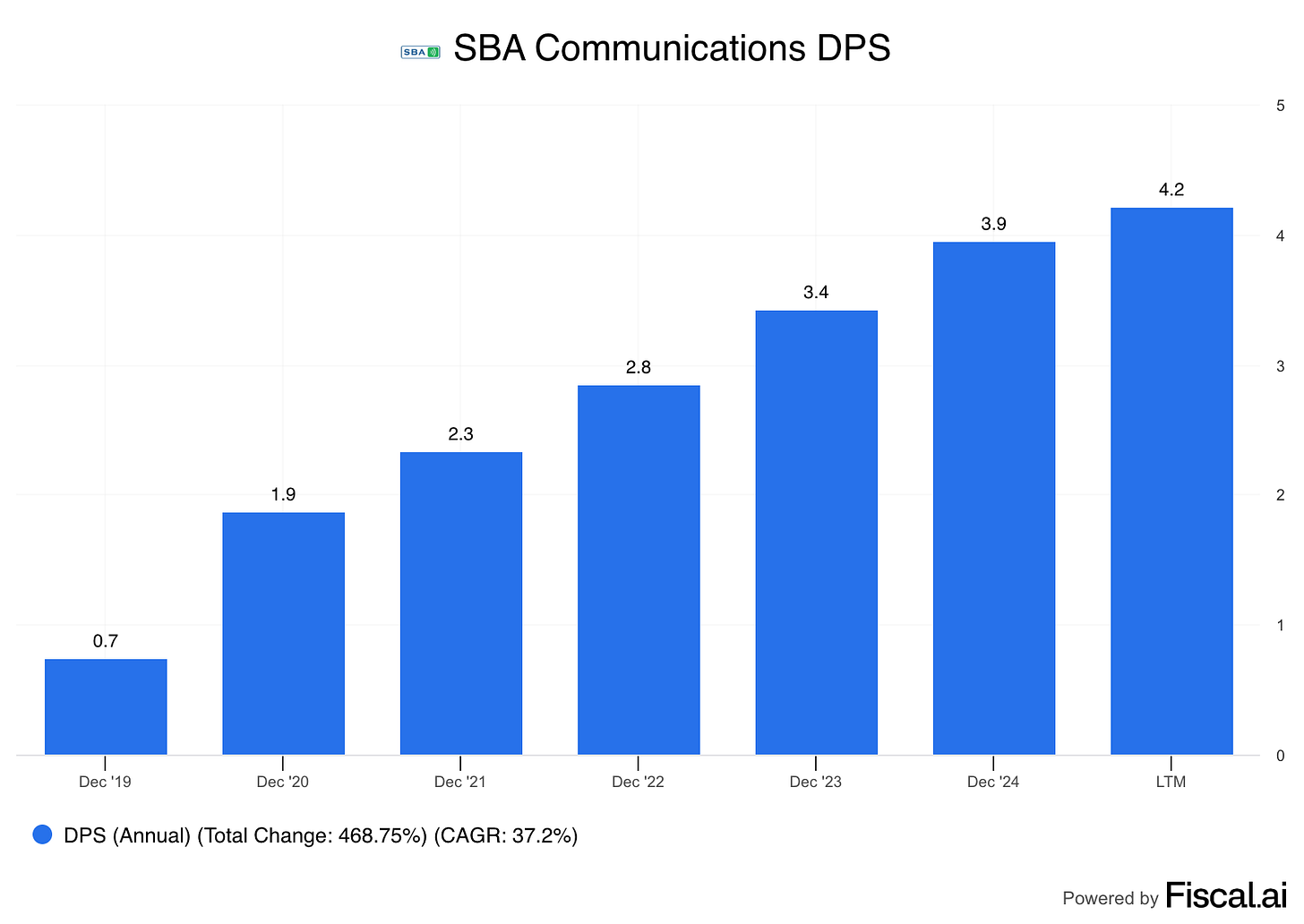

SBA Communications (SBAC)

Owns wireless towers and antenna sites

Strong dividend growth record (18.8% 5-YR CAGR)

Healthy balance sheet, benefits from rising data usage

Important metrics

Forward Dividend Yield: 2.15%

FFO Payout Ratio: 42.86%

The next 8 REITs have unique holdings or are in unique positions that make them more interesting than the average REIT.

Ready to dive in?

I’ve highlighted what makes them more interesting than average in bold.