Novo Nordisk is a global pharmaceutical leader in diabetes and obesity care

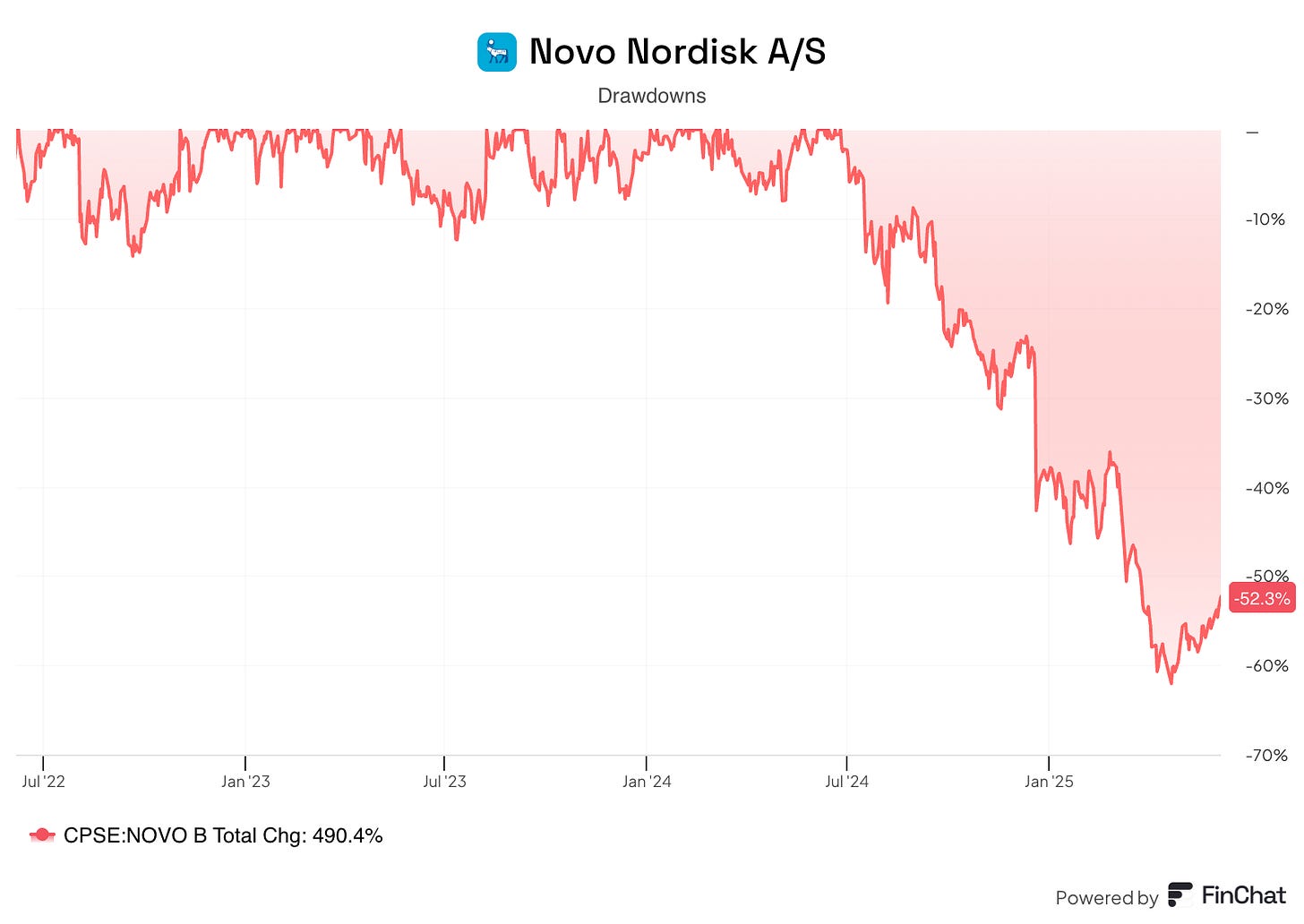

Novo Nordisk’s share price peaked in mid‑2024 at over DKK 1,000 then plunged sharply through early 2025. By late April 2025 it hit a 52‑week low of DKK 380, before modestly recovering to ~DKK 490.

That’s a drawdown of more than 60% at the low, and the stock is still more than 50% below the peak.

What happened?

There are five main reasons why the stock is down so much:

Disappointing trial results from CagriSema

Increased competition, mostly from Eli Lilly

Pricing pressures & regulatory challenges

Import tariffs from the United States

The CEO got fired

These are either temporary problems that present an interesting opportunity, or permanent ones that the market is correctly pricing into the stock.

Let’s dive into the company to find out which!

1. Do I understand the business model?

Novo Nordisk is a global pharmaceutical company. Their main revenue sources are from drugs that deal with diabetes and obesity.

Novo also has medications for rare diseases and cardiovascular problems.

The company focuses on discovering, developing, and manufacturing innovative drugs globally.

Novo Nordisk has a long history in a competitive industry. In 2023, the company celebrated its 100th(!) birthday.

Main Revenue Drivers

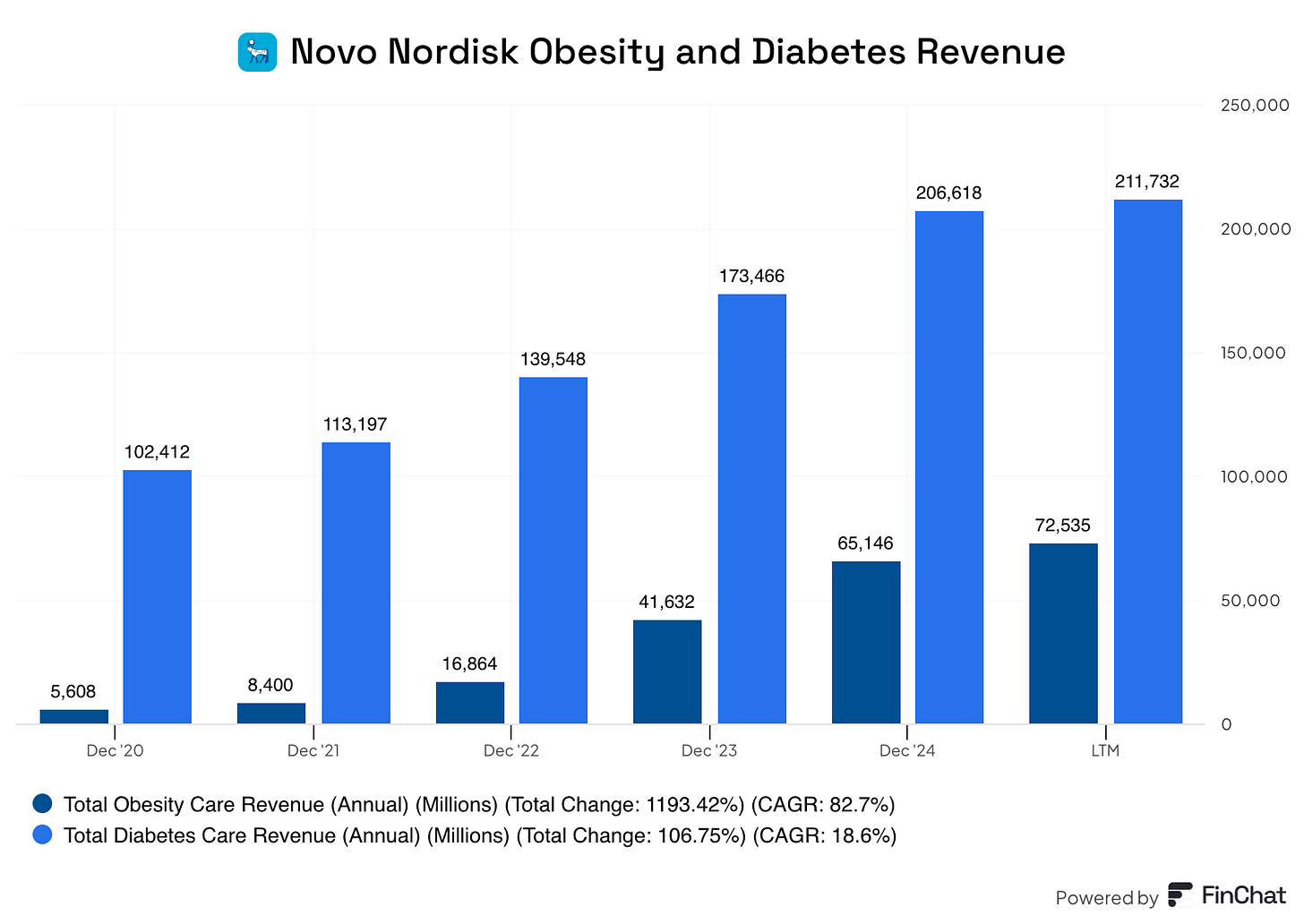

The obesity and diabetes markets are by far the most important for Novo - they made up more than 90% of revenue in 2024.

They offer two unique products:

Ozempic for diabetes care

Wegovy for obesity care

These drugs are both based on the same molecule called semaglutide.

Semaglutide is a medicine that helps people with type 2 diabetes and those trying to lose weight. It copies a natural hormone in your body to control blood sugar and reduce hunger.

Obesity Care is becoming more and more important in Novo’s revenue split. It’s one of the key growth drivers for the company, growing at more than 80% (!) per year since 2020.

The Diabetes Care market is growing at a still healthy 18% CAGR over the same time period.

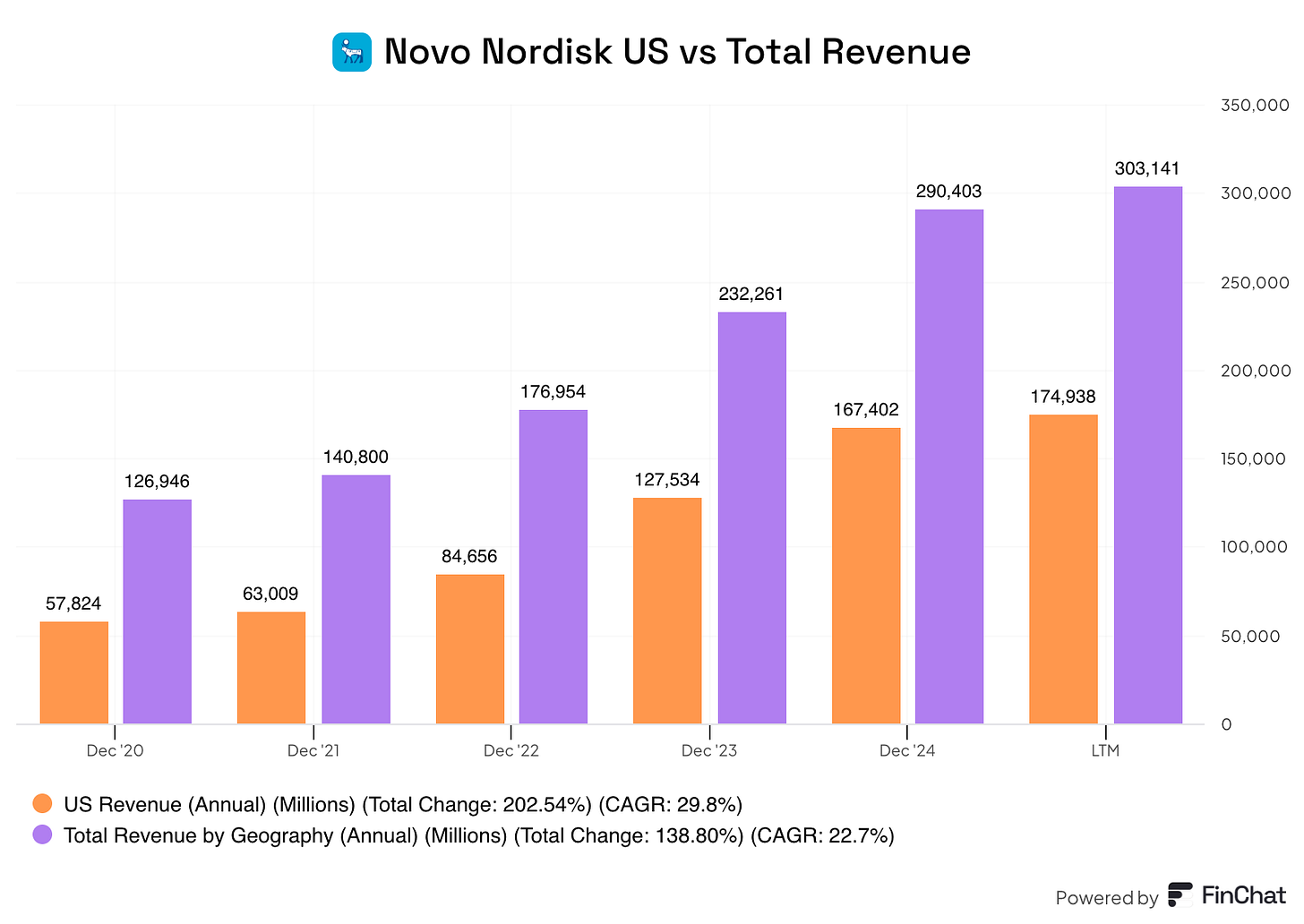

The U.S. Market is also important for Novo Nordisk, providing nearly 60% of the total revenue for the company.

2. Is management capable?

This is one of the problems leading to the large decline in Novo Nordisk’s share price.

In May, the Novo Nordisk Foundation, the company’s main shareholder, pressured CEO Lars Fruergaard Jørgensen to step down after eight years in the role.

Jørgensen has been with the company since 1991 and led them to dominate the weight-loss drug market with Wegovy and Ozempic.

Lars Sørensen, the Chair of the Novo Nordisk Foundation (and former CEO from 2000 to 2016), said the following about this topic:

“Considering recent market challenges and the decline in the company’s share price, we expressed an interest in being closer to the discussions in the company’s board. We also think that the timing is right for a new profile as CEO of the company. The aim is to make sure that the company is optimally positioned to secure future growth and realise its great potential.”

The Foundation seems concerned about losing ground in the obesity drug market, especially in the U.S.

Sørensen rejoined the board as an observer to lead the search for a new CEO and plans to become a full board member soon.

He’s pushing for an external candidate, a first for the company, as all prior CEOs were Danish and internal hires.

They’re likely looking for someone with strong U.S. market skills to deal with competition, pricing issues, and potential policy shifts.

Camilla Sylvest, head of commercial strategy, also left in April 2025, adding to the leadership changes. The board, led by Helge Lund, insists the company’s strategy remains unchanged.

There is good news within Novo Nordisk’s management, however:

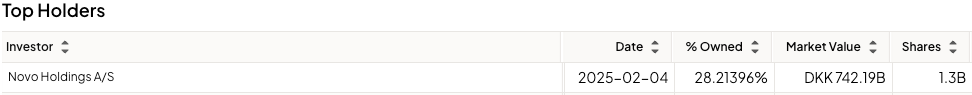

The Novo Nordisk Foundation owns nearly 30% (!) of the company with 1.3B shares.

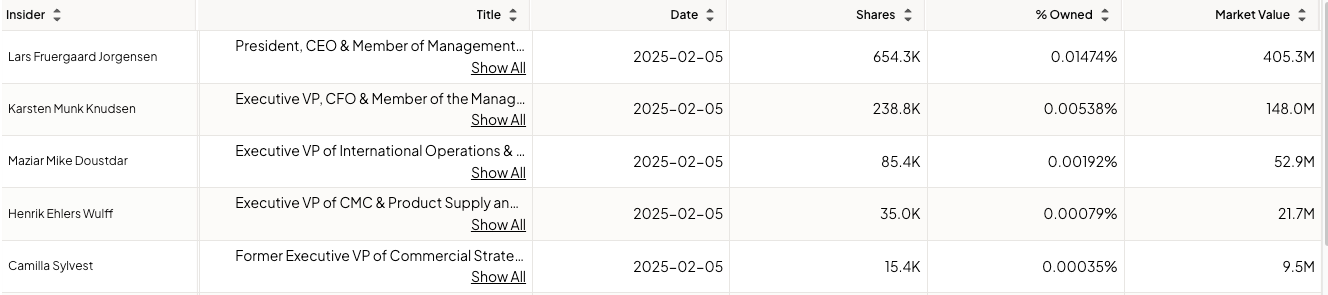

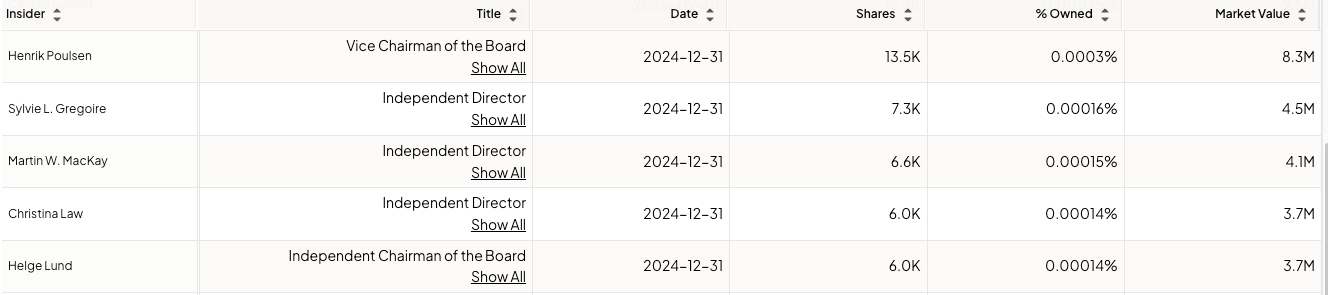

There is also heavy insider ownership, with former CEO Lars Jørgensen owning more $400M USD in shares, CFO Karsten Knudsen owning $148M USD, and various VP’s owning significant sums as well.

Various board members also own nearly $25M USD in shares, so there should be alignment with shareholders both at the leadership level and the board level.

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

Novo Nordisk has a beautiful chart here:

5-year dividend growth rate: 22.3% annually

10-year dividend growth rate: 16.4% annually

Source: Finchat

4. Is the company active in an attractive end market?

Novo Nordisk treats obesity - a condition that affects 1 out of every 8 people alive today. That’s a billion people - and the number is growing globally.

Novo also treats diabetes. That market is projected to continue growing as well.

Even though the diabetes market isn’t growing as fast as the obesity market, there’s still lots of opportunity there. Why?

1 in 2 adults with diabetes go undiagnoesd

Of the 537 million people with diabetes, only 43 million of them are treated with Novo Nordisk products.

Novo Nordisk, along with its only real rival - Eli Lilly - controls the entire market for modern diabetes and obesity drugs. They are a duopoly. That means they set the prices. They control the supply. And, more importantly, they control the future of this massive industry.

5. What are the main risks for the company?

All companies face risks. The market is pricing in lots of risks for Novo Nordisk at the moment.

Let’s go through the main ones.

1. Product and regulatory risks

The biggest near-term risk is pipeline disappointment. Novo’s high expectations for their new drug in diabetes and obesity, CagriSema is part of the reason for the collapse of the stock price.

In December 2024, Novo Nordisk published trial results for CagriSema.

People in the trial had an average weight loss of 22.7% over 68 weeks for participants.

This number is statistically significant, but it fell short of Novo's anticipated 25% target.

In March 2025, Novo Nordisk shared new trial results for CagriSema.

Patients lost 15.7% of their body weight in 68 weeks. That’s a lot. But investors wanted an even bigger number once again.

CagriSema was seen as a “next-gen” product, but it’s unclear if it’s better than what’s already on the market.

Mitigation:

CagriSema isn’t the only drug in Novo’s pipeline - they’re also working on Amycretin, which is a simpler, single molecule that targets the same GLP-1 and amylin receptors as CagriSema. In January 2025, early-stage trial results showed up to 22% body weight loss over 36 weeks, surpassing Lilly’s Zepbound (21%) at a similar time point. Phase II and III trials should begin next year and the drug could be on the market by 2029/2030.

Novo Nordisk also has the only approved GLP-1 oral medication with Rybelsus for diabetes - they’ve submitted a higher dose version for approval in the US for obesity, and will likely be the fist to market with an oral version of the weight loss medications - the current ones require an injection.

2. Competition

Eli Lilly entered the GLP-1 market later than Novo Nordisk, but with a more advanced molecule.

In 2022, Mounjaro (tirzepatide) was approved for type 2 diabetes. Unlike semaglutide, which targets only the GLP-1 receptor, tirzepatide is a dual agonist, activating both GLP-1 and GIP (glucose-dependent insulinotropic polypeptide) receptors. This dual mechanism enhances its efficacy for both blood sugar control and weight loss.

In 2023, Lilly gained approval for Zepbound (tirzepatide) for obesity, positioning it as a direct competitor to Wegovy. Clinical trials showed tirzepatide achieving 20.2% average weight loss after 72 weeks, compared to 13.7% for semaglutide, and superior A1C reductions (2–2.3% vs. 1.9% for semaglutide).

Lilly’s sales of diabetes and obesity drugs are growing rapidly, and in Q1, Lilly overtook Novo Nordisk for GLP-1 prescriptions for the first time with 53% of prescriptions written for Lilly’s drugs, vs 46% for Novo’s.

Mitigations:

The market and demand for these drugs is huge - Novo and Lilly both had to invest in manufacturing to keep up.

This will likely operate as a duopoly for a long time - neither company will be able to take 100% of the market share. It wouldn’t make sense to try to - the investment in manufacturing capacity would never be paid back before the drugs went off patent. Think of Boeing and Airbus - neither company can supply the global demand for commercial airliners. Novo and Lilly will likely be the same.

Novo has the first-mover advantage, and I’d argue more effective marketing - I bet you have the “oh, oh, oh, Ozempic” jingle in your head every time you read the word in this article.

They’ve also announced:

That CVS had made Wegovy the preferred GLP-1 on their formulary

Cash pay options starting at $499/month at CVS

A partnership with Telehealth company Hims to offer Wegovy at reduced prices

Novo Nordisk also remains the leader in global GLP-1 Market Share:

3. Pricing and political risks

Novo faces pricing pressure globally. U.S. policymakers are scrutinizing GLP‑1 drug prices (e.g. a Senate inquiry into Wegovy/Ozempic pricing), and Medicare negotiation of diabetes drugs (expected 2027) could force price cuts. President Trump has signed an Executive Order to try to lower drug prices, and the ever present threat of U.S. tariffs on EU goods could inflate costs on European-made drugs.

Mitigations:

Novo is partially hedged from the tariffs by its increasing U.S. manufacturing investments - Novo acquired Catalent in late 2024 to expand U.S. manufacturing.

The executive order doesn’t have an effective enforcement mechanism in place, and a similar one was tried during the first Trump administration and was struck down in court.

GLP-1 medications are already rebated for Medicare, so the price Medicare pays isn’t the list price - it’s unclear how much negotiation will reduce prices there.

4. Patent Expiration

With so much revenue coming from Ozempic and Wegovy, patent expiration is a big risk for Novo Nordisk. The patents expire in 2031/2032 and revenue from GLP-1 medications will likely drop significantly once generic competition comes on the market.

Mitigation:

This is a big risk for all drug manufacturers. Novo Nordisk will need to either keep innovating or acquire new medications by buying smaller firms. They do have drugs currently in the pipeline.

The main mitigation to this risk is the low price that the market is currently offering Novo Nordisk at.

6. Does the company have a healthy balance sheet?

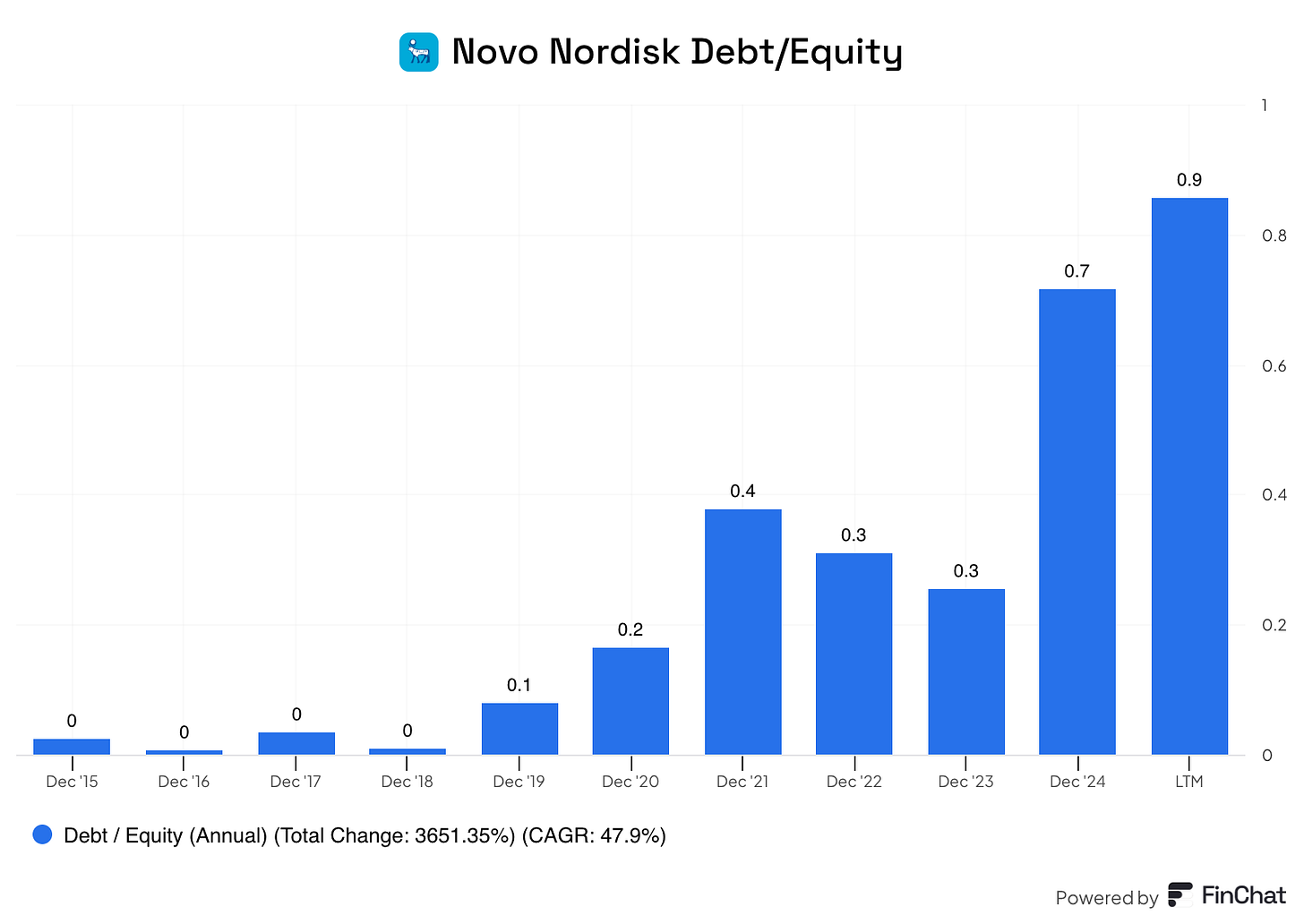

We like a Debt/Equity ratio < 50%.

Novo Nordisk currently has a Debt/Equity above that, but it’s typically much lower.

The company took on debt to finance the acquisition of Catalent.

They have huge free cash flow, and could pay off the entire amount of debt in less than one year.

The interest coverage ratio is currently over 40x.

Their balance sheet is rock solid.