Texas Instruments has grown its dividend by more than 15% per year for the past decade, and is currently trading at a starting yield over 2.5%.

Should you invest in this dividend grower right now?

Let’s find out!

1. Do I understand the business model?

Texas Instruments is the world's largest analog chipmaker.

Their chips are used in lots of things, like cars, industrial machines, and personal electronics.

Business Structure

Texas Instruments’ business is dividend into 2 segments:

Analog chips handle real-world signals, like sound or light. They help devices measure things like temperature or pressure by turning the real-world signal into a digital one that can be processed by a computer.

Embedded chips are small processors that control specific tasks within devices. Here’s some of what they can do:

Control Functions: They manage operations like turning lights on and off, or adjusting temperature

Automation: Embedded chips help automate processes in devices, making them more efficient. For example, in washing machines, they control wash cycles

Communication: They enable devices to communicate with each other, such as smart home devices that work together

Real-Time Processing: These chips can quickly process data from sensors, allowing devices to respond instantly, like in cars for braking systems

Energy Efficiency: Many embedded chips are designed to use less power, helping devices run longer on batteries

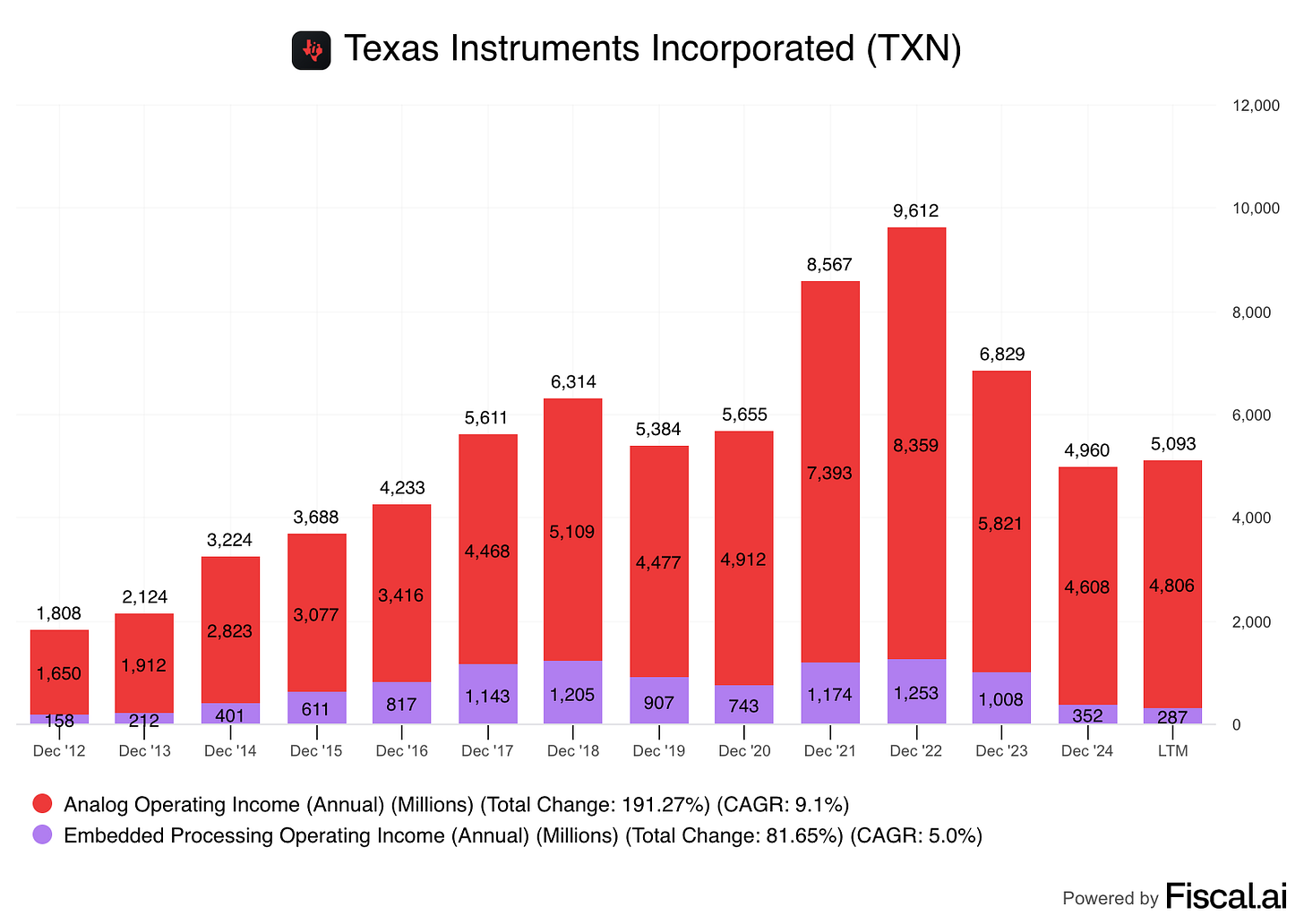

The analog chip segment generates the majority of the revenue.

It also generates most of the operating income:

Competitive Advantages:

Scale: Texas Instruments is the world’s largest analog chipmaker, giving them cost advantages

Intangible assets: The company has years of built up knowledge and expertise around chip design and manufacturing

Switching costs: Once an analog chip or control chip is designed into a product, the manufacturer doesn’t want to change it - remember the car shortage during the COVID pandemic - automakers halted production before they switched chips!

2. Is management capable?

Haviv Ilan, President, Chief Executive Officer, and Director:

Ilan became CEO in April 2023, succeeding Rich Templeton.

He joined the company in 1999 when they acquired Butterfly, a wireless start-up in Israel. He’s been the Executive Vice President and Chief Operating Officer (2020–2023), and Senior Vice President of Analog Signal Chain.

Ilan only holds around $9 million of TXN 0.00%↑ stock.

Rich Templeton, Chairman of the Board:

Templeton (former CEO from May 2004 to March 2023) has been chairman since April 2008.

He joined TI in 1980, and also held roles such as Chief Operating Officer (2000–2004) and Executive Vice President of the Semiconductor business (1996–2004). He reshaped TI’s focus on analog and embedded processing, overseeing major acquisitions like National Semiconductor. He also holds $92 million in TXN 0.00%↑ stock.

Rafael Lizardi, Senior Vice President and Chief Financial Officer:

Lizardi oversees finance and operations. He previously served as Corporate Controller and has been with TI for over two decades. He owns around $23 million in TXN 0.00%↑ stock.

The management team at Texas Instruments has generated attractive Returns on Invested Capital for a long time:

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

Texas Instruments has a great history of dividend growth

5-year dividend growth rate: 9.8% annually

10-year dividend growth rate: 15.3% annually

Source: Fiscal.ai

4. Is the company active in an attractive end market?

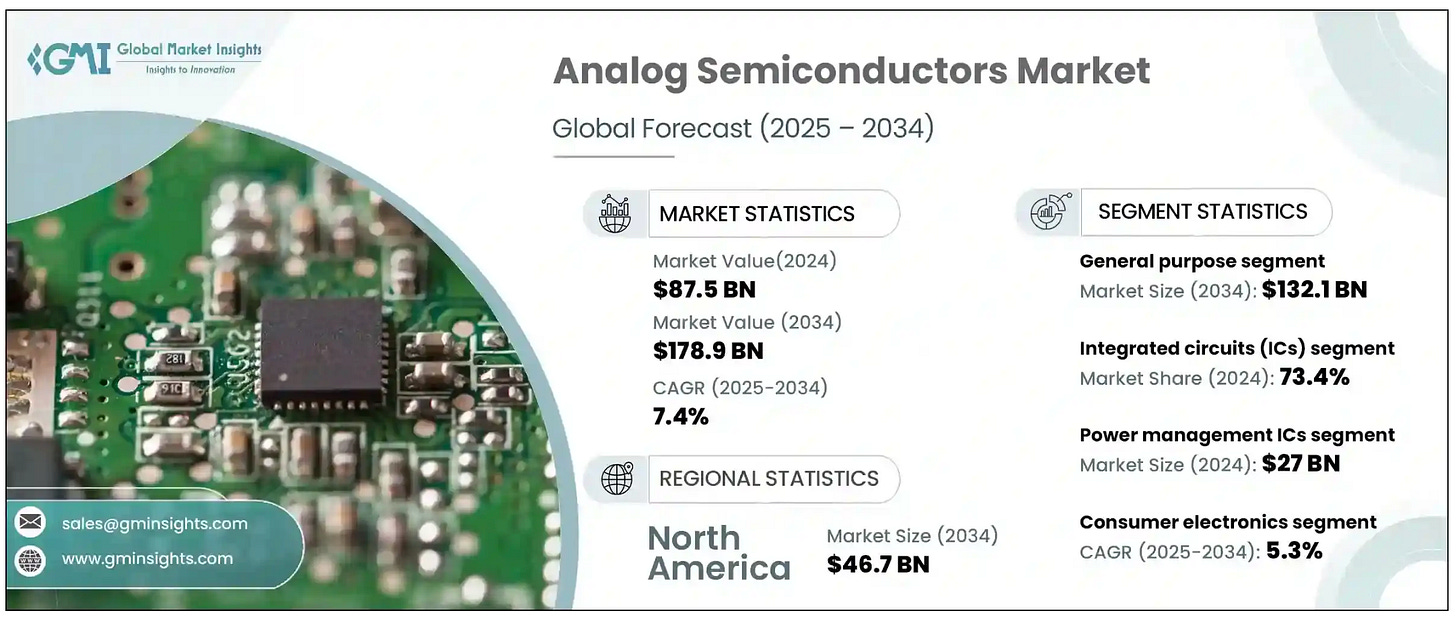

The analog semiconductor market is projected to grow at 7.4% over the next 10 years.

Texas Instruments is increasingly concentrating on the automotive and industrial markets.

Automotive Applications:

The automotive sector is a significant growth driver. The rise in electric vehicles, advanced driver-assistance systems, and infotainment systems is increasing semiconductor content per vehicle.

Industrial Applications:

The industrial sector is another key driver of growth. Demand for analog and embedded chips in automation, robotics, and smart infrastructure is growing due to trends like Industry 4.0 and IoT (Internet of Things).

5. What are the main risks for the company?

Cyclical Nature of the Semiconductor Industry

The semiconductor industry tends to be cyclical, with periods of strong demand followed by downturns. From 2022 to 2023, TI saw revenues drop 12%. Between 2023 and 2024, they fell another 10%.

Mitigation: Texas Instruments products have a long shelf life, so any build up of inventory will likely be sold eventually. The cyclicality of the industry isn’t new, so management does plan for it. The company’s strong balance sheet also mitigates the risk here.

Geopolitical Tensions and Global Trade Disruptions

TI is a global company - geopolitical tensions and trade issues can affect the company’s ability to deliver products, support customers, or access manufacturing.

Mitigation: TI is investing heavily in U.S. manufacturing. They also have manufacturing outside of the U.S. there are two factories in Japan, one in China, and one in Germany.

Rapid Technological Change and Innovation Needs

Rapid technological change could lead to shortened product life cycles and increased R&D spending. TI's long-term success depends on its ability to meet the industry needs and develop new products in a timely and cost-effective manner.

Mitigation: The analog and embedded chip technologies are not on the leading edge of innovation. In general, they don’t change as often or as rapidly as the most advanced semi-conductors.

Supply Chain and Manufacturing Risks

TI relies on third-party suppliers, which poses risks of disruptions, quality issues, and limited access to key materials, services, and utilities. These supply chain challenges could impact TI's manufacturing operations in the long run.

Mitigation: Texas Instruments is currently in a large CapEx cycle, where some of the these issues are being addressed. The manufacturing in Japan, China, and Germany also help to mitigate these risks.

Talent Retention and Recruitment

TI's continued success depends on its ability to retain, train, and recruit skilled personnel in a competitive environment. Failure to do so could disrupt the business in the long term.

Mitigation: There are less people with expertise in analog chips than the more ‘exciting’ leading-edge tech. Texas Instruments’ size and leadership position in the industry likely give it an edge in hiring over other competitors.

Regulatory and Legal Compliance Risks

Like any large, global comapny, TI is subject to complex laws, rules, and regulations. Changes or non-compliance with these could have long-term adverse effects on TI's results and reputation.

Mitigation: TI is well aware of the risks here. They have lots of experience and expertise dealing with regulation and compliance.

6. Does the company have a healthy balance sheet?

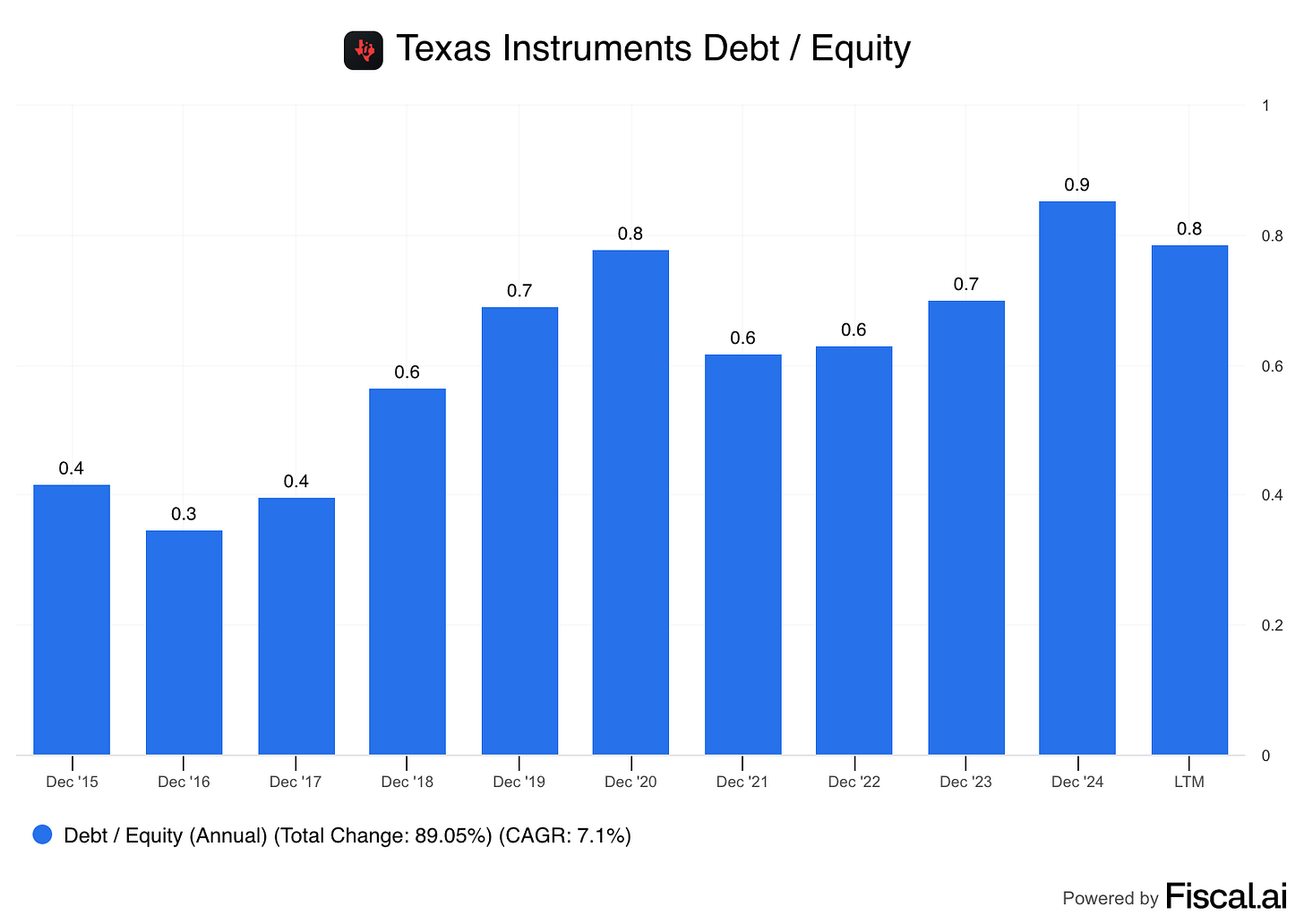

We like a Debt/Equity ratio < 50%.

Texas Instruments has a Debt/Equity ratio of 80%.

You can see that the general trend is up, but it’s also a bit cyclical.

Texas Instruments is spending a lot of money on CapEx right now - management says they’re midway through a 6 or 7 year CapEx cycle. They’ve taken on some debt to build new manufacturing and build up their inventory. The new plants aren’t producing yet, and the inventory hasn’t sold.

Essentially the comapny is investing and hasn’t seen the returns yet. When they do, debt should come down and equity should go up, improving this ration.

But let’s see how the balance sheet looks right now.

Interest coverage ratio: 10.6x

Current ratio: 5.3x

FCF to Debt ratio: 0.5x

Conclusion: These numbers are VERY healthy. Texas Instruments has an excellent balance sheet.

7. Is the company a great capital allocator?

Key signs:

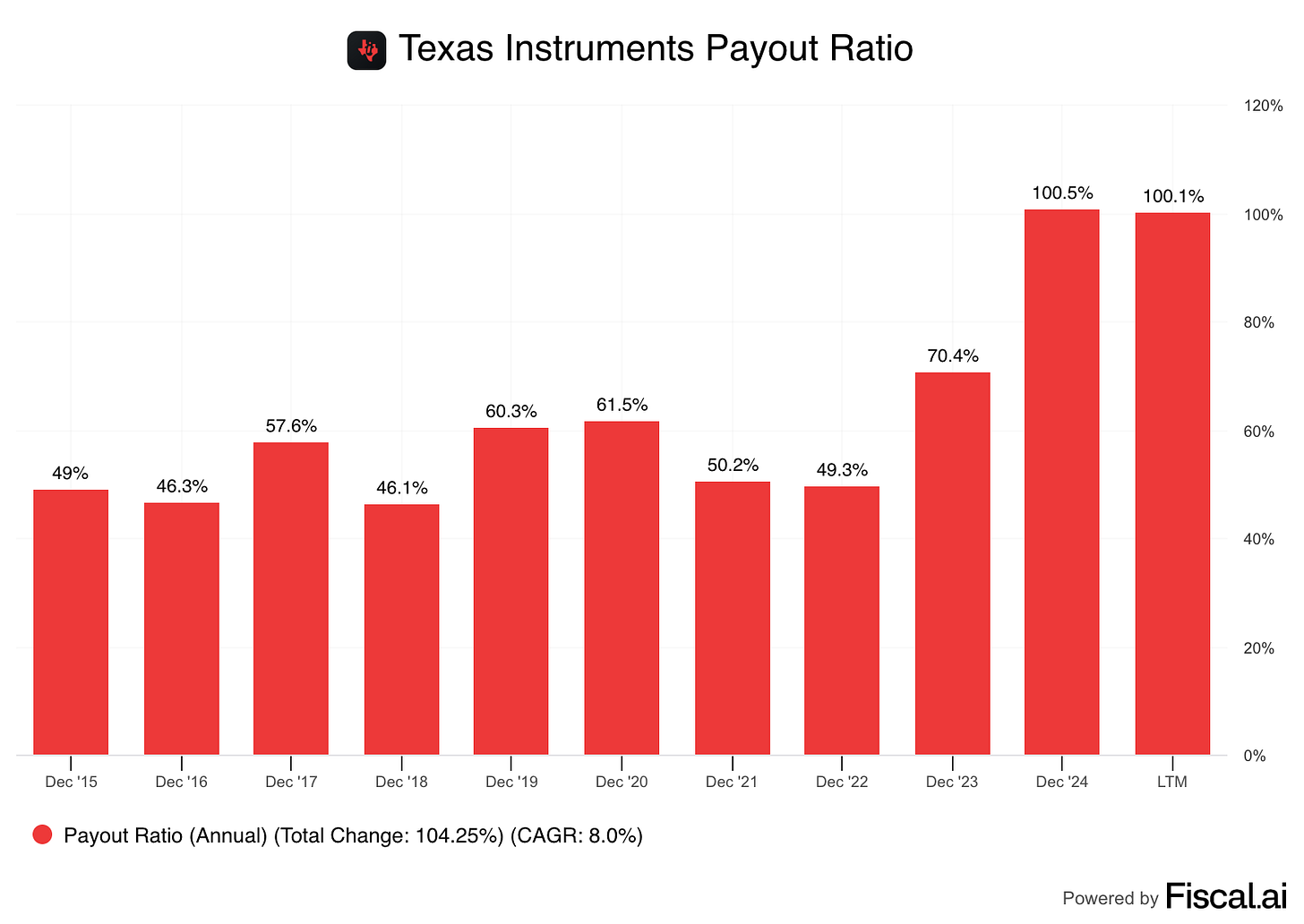

Payout Ratio <60%

Effective investments or buybacks

Texas Instruments has a Payout Ratio of more than 100%!

Do we need to worry about this?

The short answer is ‘no’.

Remember the CapEx cycle I talked about where Texas Instruments is spending a lot on growth? That’s happening at the same time the industry has slowed down post-COVID, making the earnings look much lower than they actually are.

Management has chosen to use the strong balance sheet to continue to pay out dividends during the investment cycle, indicating confidence that the company will earn much more after the investments are completed.

The company has a history of attractive returns on investments made in the business:

The declines in 2023, and 2024 are likely mainly due to the recent increase in growth CapEx that haven’t paid back a return (yet).

8. How does the past and future growth of the company look?

Texas Instruments has struggled with growth:

5-year revenue growth: 2.6% per year

5-year EPS growth: 0.2% per year

Long-term EPS growth rate: 13%

The management team focuses on FCF / Share - a great metric in my opinion. Let’s look at that.

We’ve talked about the CapEx cycle the company is in, so using the FCF as reported won’t be accurate because of all the spending on future growth.

Adjusted FCF / Share

To account for this, I took the average FCF margin from 2015 to 2022 (about 34%) and applied it to the revenue.

Here’s how that looks:

From 2015 to 2022 the CAGR is about 8% per year

From 2015 to the last 12 months, it’s about 3.5%

Management’s Projections

The management has been very open about the investments for growth.

They’ve also been very open about the fact that they don’t know what revenue will look like over the next few years.

I have to say, I like this kind of communication.

Remember that the semiconductor industry tends to be cyclical - the timing of these cycles will affect TI’s revenue in the next few years.

The number of semiconductors sold over the past few years is way below the growing trend line.

Here’s the management team’s projections for FCF / Share under 4 different revenue scenarios:

I have to say that I find it somewhat troubling that even though the semiconductor market that Texas Instruments is involved in has shown steady growth, the company doesn’t seem to be growing at the same rate.

The trend line in the number of units shipped chart grows at about 6% per year

The high end of management’s FCF / Share projection is 7% per year

Neither one of those numbers gets us to the 13% projection that fiscal.ai is showing.

And Texas Instruments hasn’t historically bought shares back quick enough to get us there:

9. Can the company grow dividends into the future?

Let's check:

Current yield: 2.6%

Payout ratio: 100.1%

Adjusted Payout Ratio

We’re going to again adjust for the growth CapEx spending. We’ll use my adjusted FCF / Share number for the last 12 months to calculate a new Payout Ratio:

Current DPS: $5.44

Adjusted FCF / Share: $5.94

Payout Ratio: 91.5% - still quite high

Forward Payout Ratio

We know the balance sheet is very strong, and that the elevated CapEx is expected to last until 2026. Let’s use management’s projections to calculate a forward Payout Ratio.

If we grow the dividend by 4% the next 2 years, the 2026 DPS is about $5.90

Management’s low end FCF / Share is $8

Forward Payout Ratio: 73% - better, especially if FCF / Share is expected to grow faster than the DPS.

10. Does the company trade at a fair valuation level?

We value every company 3 different ways:

1. Dividend Yield vs History

Historical average dividend yield: ~2.76%

Current yield: 2.6%

Suggests Texas Instruments might be around fair value.

2. Earnings Growth Model

This shows us the yearly return we can expect from a company.

It takes into account Earnings Per Share growth, the dividend yield, and multiple contraction or expansion.

The formula looks like this:

Expected return = EPS Growth + Dividend Yield + Multiple Expansion (or contraction).

Here are the numbers for TXN:

EPS Growth: 6% - I’m using the industry growth rate

Dividend Yield: 2.6%

Change in Price to Adjusted FCF: Flat

I’m using my adjusted FCF number here to get a current P/FCF of about 36

TXN has historically traded between 20x and 30x FCF

Remember that we’re around a trough in the cycle, so sales are low, making the P/E or P/FCF number look higher than the normalized one

To be conservative, I’m not going to assume multiple compression, but I’m not assuming expansion either

Expected return = 6% + 2.6% + 0% = 8.6% return per year

3. Reverse Dividend Discount Model

As Charlie Munger says, “Invert, always invert!”

Solving complex problems is often easier backward. That’s exactly what we do with the Reverse DDM.

Solving the DDM for growth tells us how much dividend growth is priced in by the market.

Here’s the formula:

Expected growth = Required return – (DPS next year / Current share price)

Let’s put some numbers in for UnitedHealth Group:

Required return: 10%

DPS next year: $5.66 (4% growth from current)

Current share price: $206

Expected growth = 10% - (5.66 / 206) = 7.3%

This tells us that the market is pricing in a 7.3% growth in Texas Instruments’ dividend

5-year DPS CAGR: 9.8%

Dividend Score

Texas Instruments receives a Dividend Score of 7.1/10.

The main categories that hurt the score?

Growth - the financial results of the company haven’t kept up with broader industry

Dividend Future - the payout ratio is very high right now, which the balance sheet can support, but the dividend relies on continued strong growth into the future

Valuation - Texas Instruments looks fairly valued to me at the moment

Conclusion

Texas Instruments checks many of the right boxes for dividend growth investors - it looks like the kind of company we should want to own.

Strong position in analog and embedded semiconductors, two essential and growing markets

Management is transparent and focused on long-term value creation through FCF/share

15+ years of impressive dividend growth and a healthy balance sheet

Currently in a heavy investment cycle, which is masking near-term profitability

Historical growth in revenue, EPS, and FCF/share has lagged the broader industry

Market seems to be pricing in either faster than historical growth, or further multiple expansion

That’s higher than recent performance and not clearly supported by fundamentals

But here's what most dividend investors get wrong about Texas Instruments: Good companies don't always make good investments, and TI's stock price is pricing in growth rates the company hasn't achieved in years.

That doesn’t mean Texas Instruments is a bad business. Far from it. It just means it’s not cheap enough today to offer the kind of low-risk, high-reward setup we want in our portfolio.

We’ll keep an eye on it. But for now, it stays on the “watch list.”

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data