🔥 Stock Idea: Abbott Laboratories

Abbott Laboratories touches almost every part of healthcare.

From infant formula to the sensors that help diabetics manage their glucose, and even the tests doctors use to diagnose heart attacks.

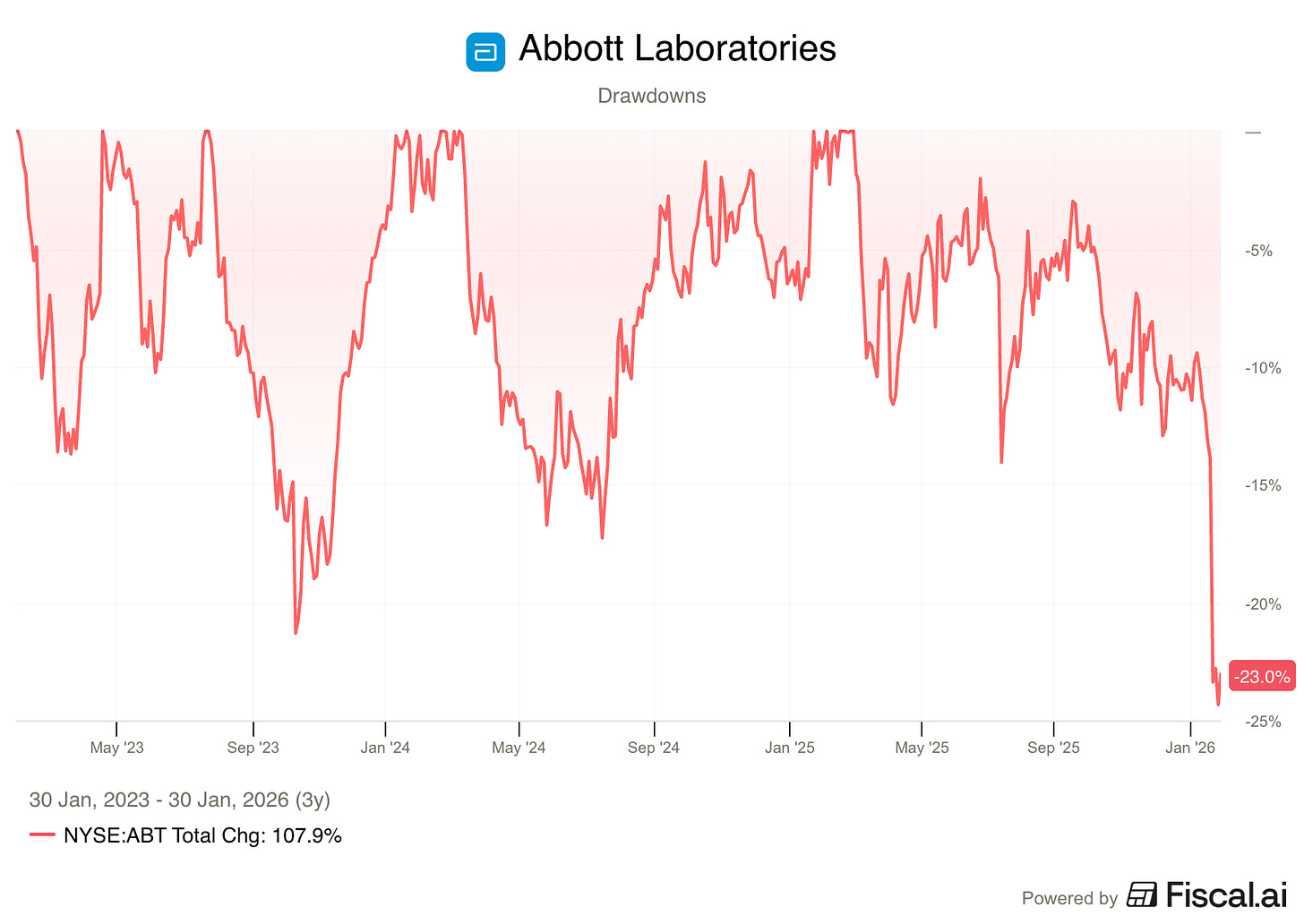

But after earnings, the stock dropped 10% and is now down about 15% on the year - is Abbott an interesting Dividend King to buy?

Let’s find out!

Right now, the company is facing some challenges:

Legal battles over specialty infant formula

Inflation forced them to raise prices, but customers started pushing back and demand weakened.

The massive COVID-testing market has declined

All of that means the stock has hit a 52-week low, and for the first time in a while, the dividend yield is pushing toward 2.4%.

Abbott Laboratories

Abbott is a global healthcare company that makes a wide variety of medical products.

They have four main businesses:

Medical devices: heart and diabetes devices

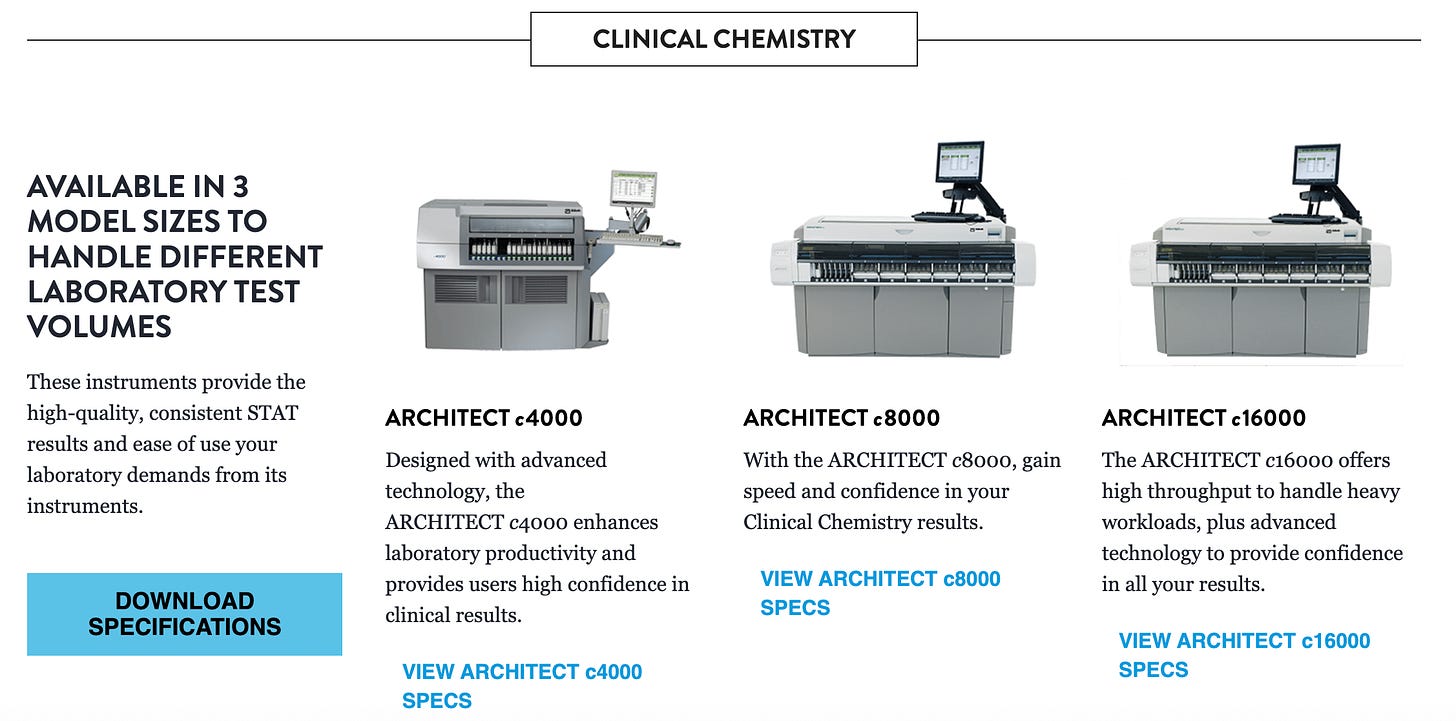

Diagnostics: lab testing equipment

Nutrition: shakes and baby formula

Established Pharmaceuticals: generic medicines sold in emerging markets

Their business model tends to be stable because it’s built on products people need regardless of how the economy is doing.

Company name: Abbott Laboratories

✍️ ISIN: US0028241000

🔎 Ticker: $ABT

📚 Type: Dividend Growth Stock

📈 Stock Price: $109

💵 Market cap: $184.4 Billion

📊 Average daily volume: $851.4 Million

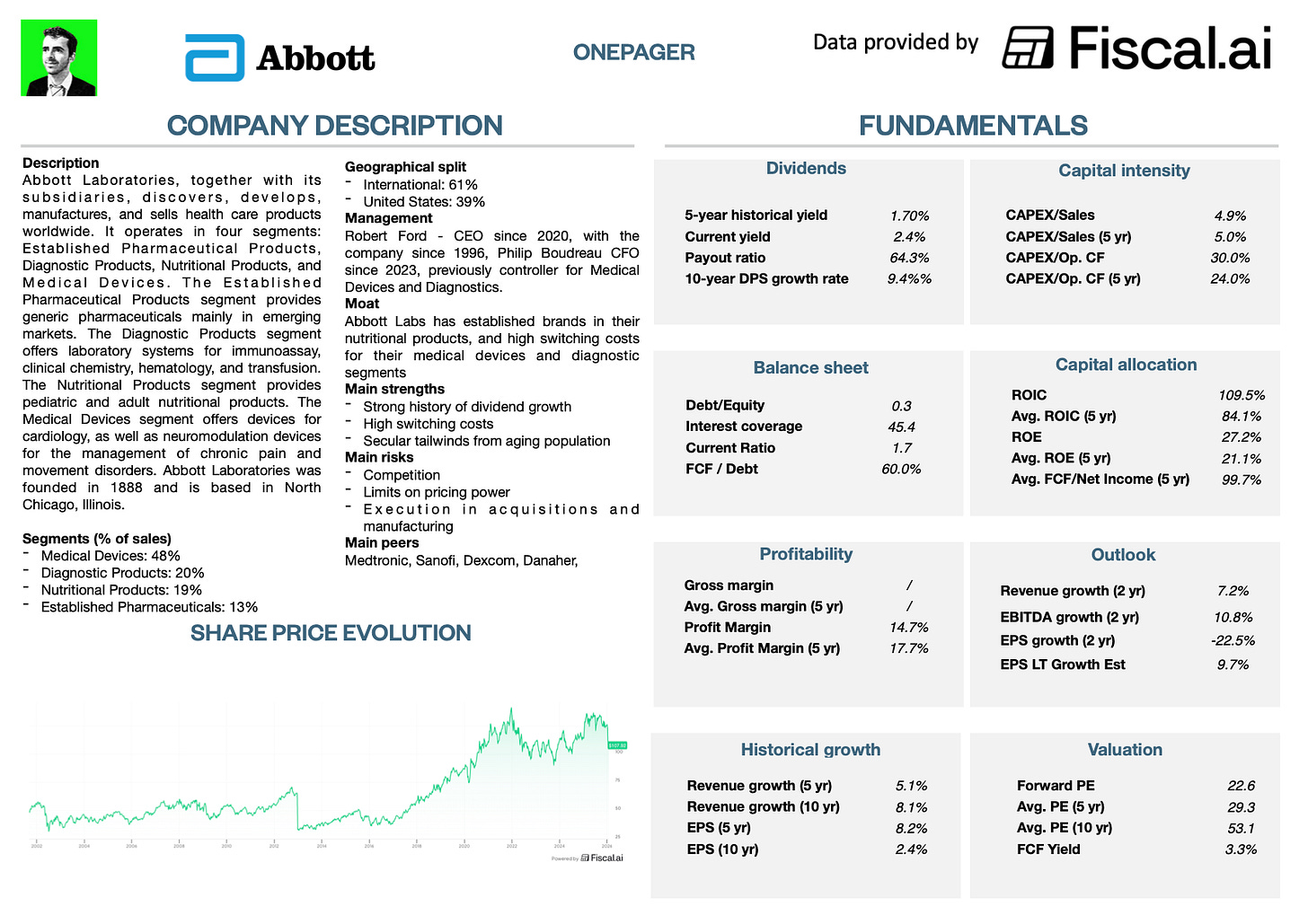

Onepager

Don’t know Abbott Laboratories?

Here are the basics (click on the picture to expand):

Now let’s dive into the full investment case!

1. Do I understand the business model?

Abbott operates as a diversified healthcare conglomerate.

Instead of being a pure-play drug company or a pure-play device maker, they spread their risk across four segments.

They focus heavily on high-growth areas like

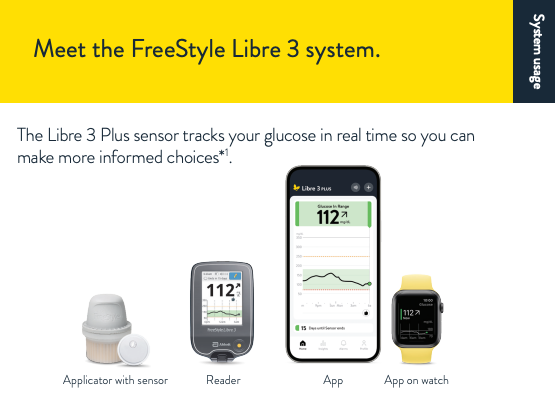

Diabetes care, where their FreeStyle Libre system is the world leader

Branded generics in emerging markets like India and Brazil, where they sell trusted versions of medicines that no longer have patents.

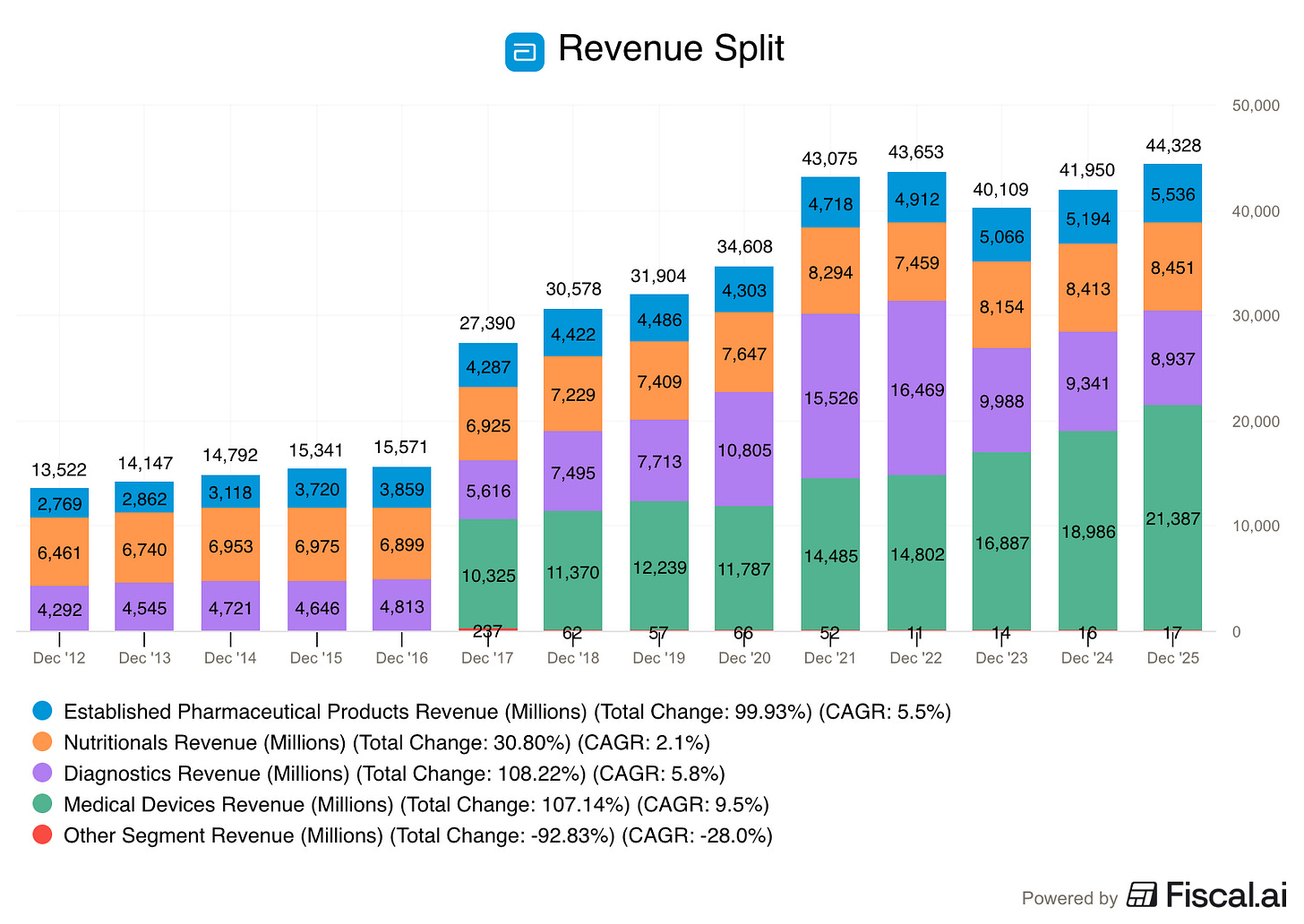

Revenue Split

Most of the revenue comes from Medical Devices and Diagnostics.

Here is the revenue split for fiscal year 2025:

Medical Devices: $21.39B (48.3% of revenue)

Diagnostic Products: $8.94B (20.2% of revenue)

Nutritional Products: $8.45B (19.1% of revenue)

Established Pharmaceuticals: $5.54B (12.5% of revenue)

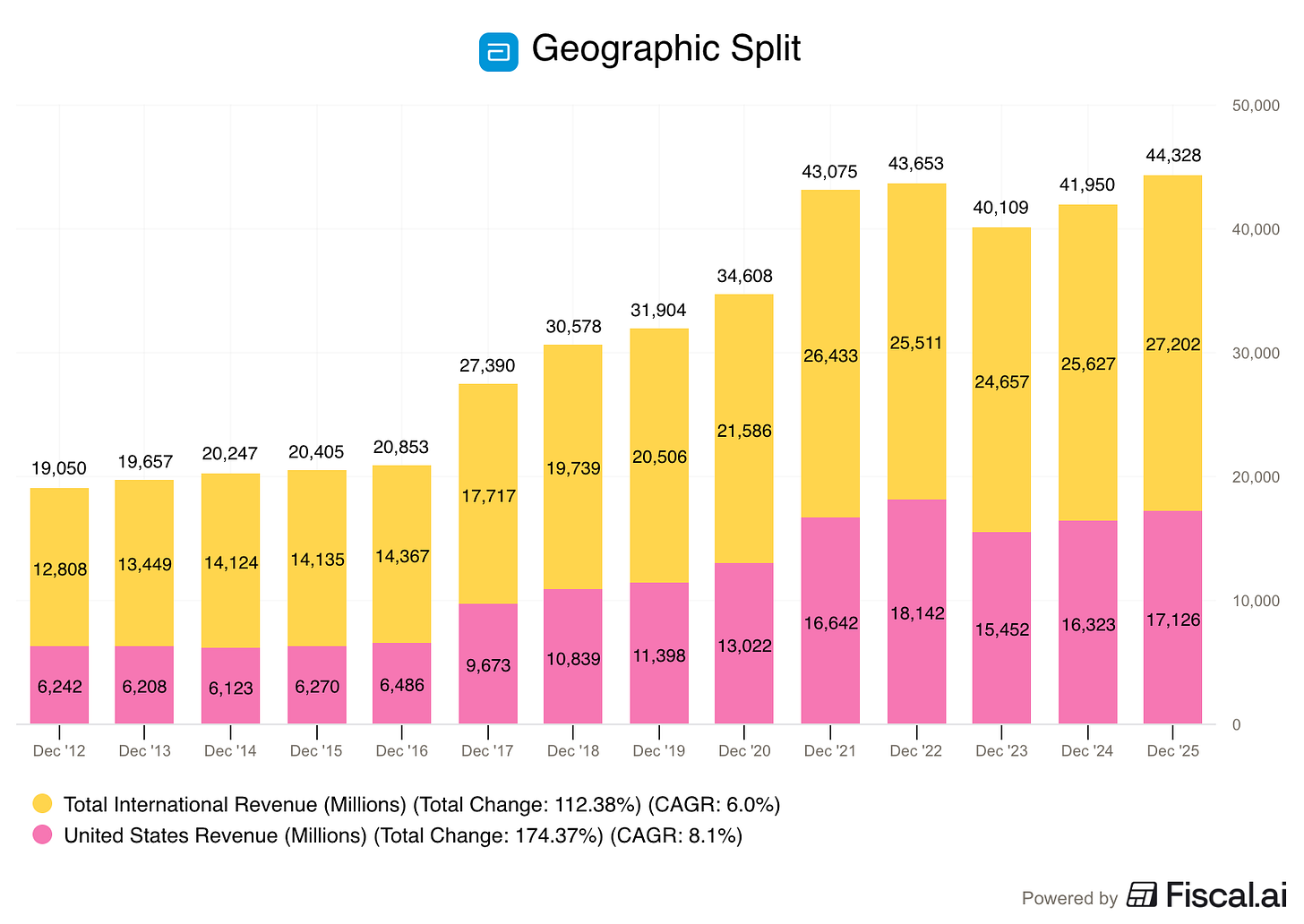

Geographic Split

Abbott is a truly global business, with a majority of its sales coming from outside the United States.

International Markets: 61.4% of revenue

United States: 38.6% of revenue

A significant portion of their international sales comes from Emerging Markets, which are the main focus for their pharmaceutical and nutrition growth.

Who are the customers?

Because Abbott is so diverse, their customers are everywhere.

In Diagnostics and Medical Devices, their customers are hospitals, surgeons, and commercial laboratories.

In Nutrition and Diabetes Care, their customers are everyday people buying products at pharmacies or grocery stores.

They also deal with governments, particularly for infant formula contracts (like the WIC program in the U.S.) and national healthcare systems in Europe and Asia.

What’s the moat?

Abbott’s moat is built on two things: High Switching Costs and Intangible Assets.

In their Diagnostics business, once a hospital installs an Abbott architect machine, they are effectively locked in.

Those machines only run on Abbott’s proprietary chemicals and tests.

Switching to a competitor like Roche would mean ripping out the whole system and retraining the entire staff.

In Medical Devices, the moat comes from patents. Abbott owns the rights to breakthrough tech like the TriClip for heart repair and the FreeStyle Libre for diabetes.

Competitors have to spend years and billions of dollars in R&D and clinical trials to even try to compete.

Finally, in Nutrition, they have brand power.

Parents often stick with the formula brand they trust (like Similac), and elderly patients stick with the supplement their doctor recommends (like Ensure).

2. Is management capable?

Robert B. Ford - CEO

Mr. Ford has been with Abbott since 1996 and took over as CEO in March 2020.

He successfully pivoted the company to become the world leader in COVID-19 rapid testing, which generated billions in extra cash.

He is currently leading the company’s major $21B transition into cancer diagnostics through the Exact Sciences acquisition.

Philip Boudreau - CFO

Mr. Boudreau has been with Abbott since 1997 and was appointed CFO in 2023.

He previously served as the controller for the Medical Devices and Diagnostics segments, meaning he has deep knowledge of the company’s most profitable divisions.

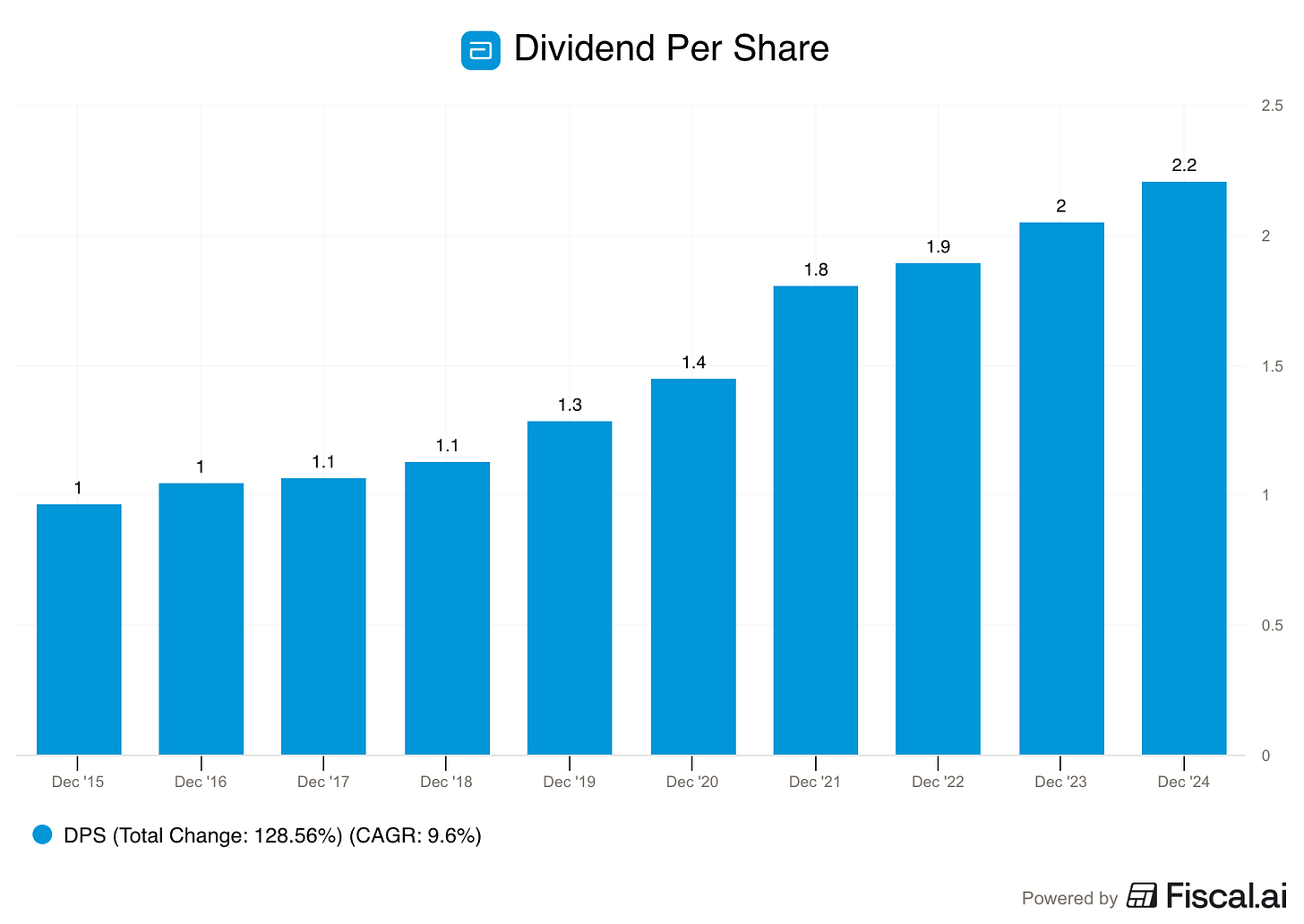

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

Abbott has both: It has 54 consecutive years of growth, and its 5-year dividend CAGR is 9.4%.

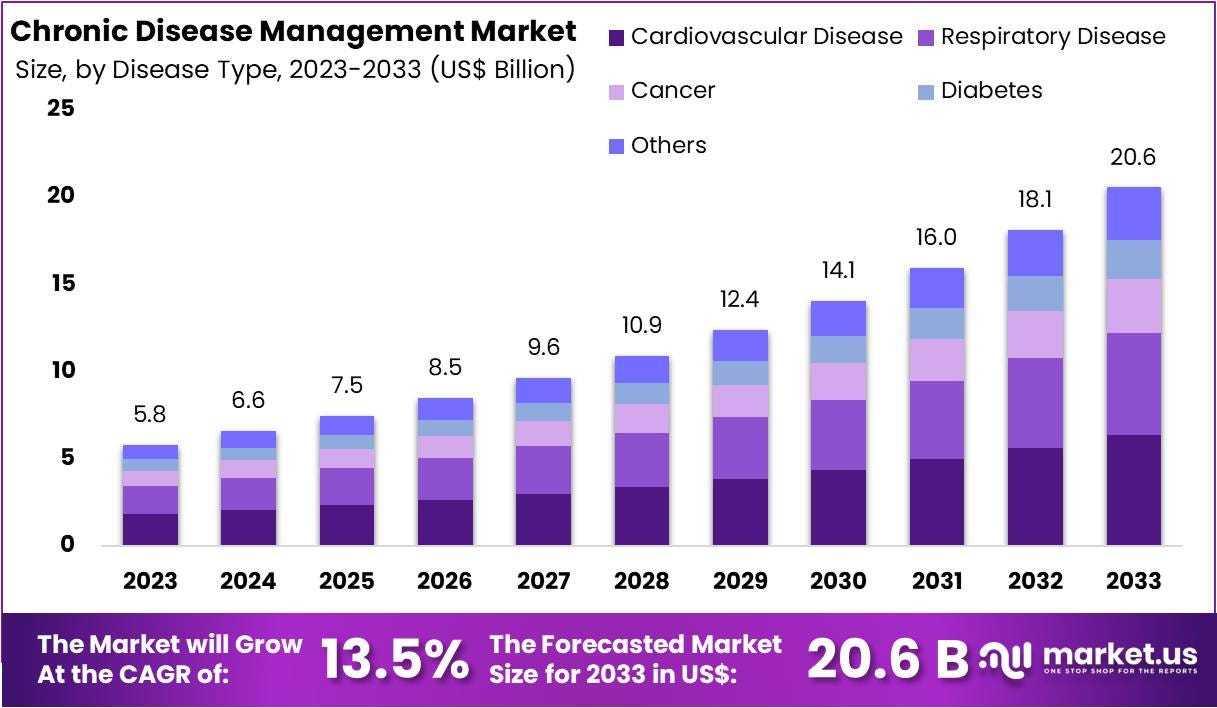

4. Is the company active in an attractive end market?

The global healthcare market is one of the most attractive places to invest because it has multiple secular tailwinds driving it.

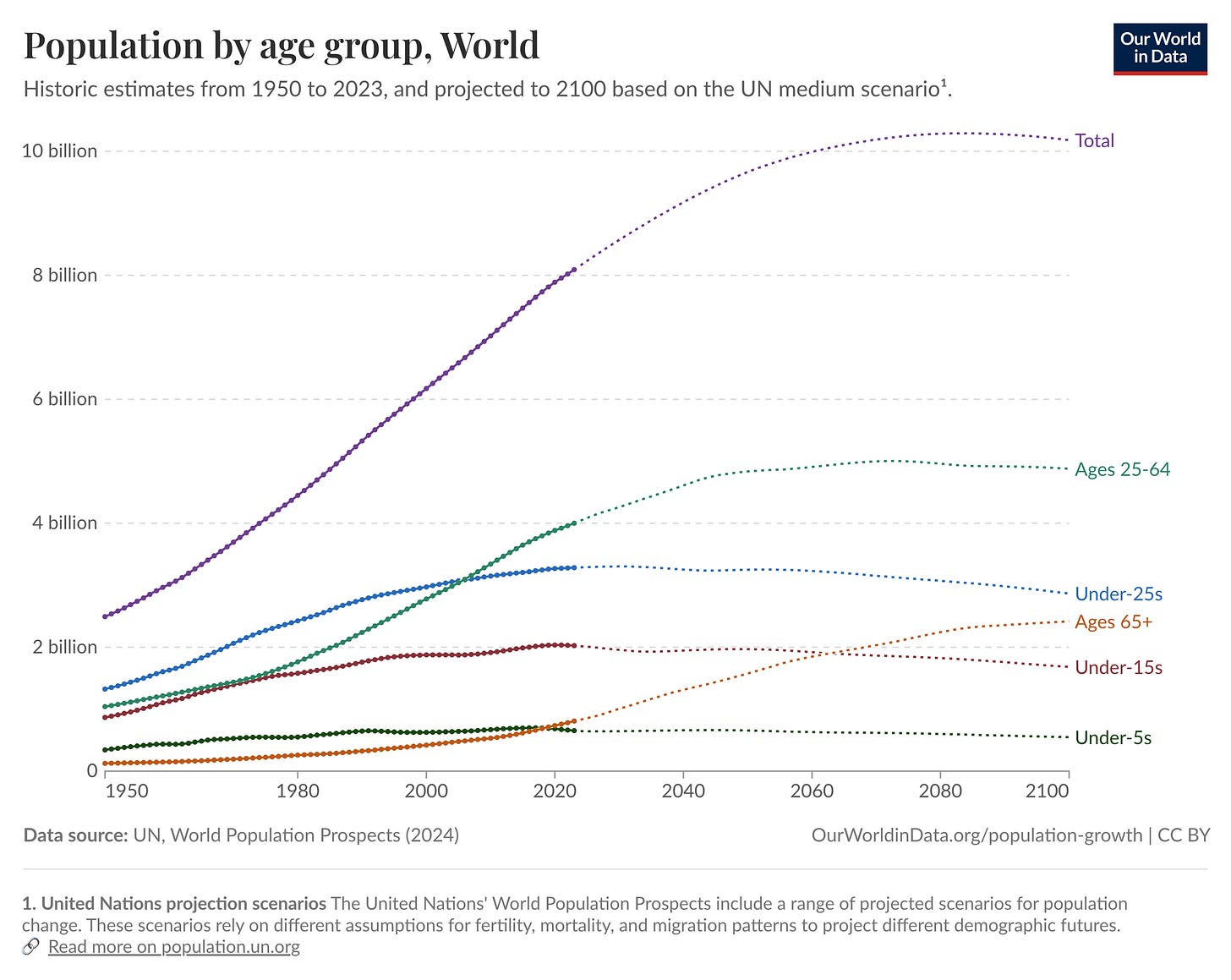

Aging Population:

As more people live into older age, they need more heart valves, pacemakers, and nutritional support.

Look at the projected growth of the 65+ age group in this chart.

Chronic Disease:

Diabetes and heart disease are global epidemics, and Abbott sells tools like glucose meters and pacemakers to manage them.

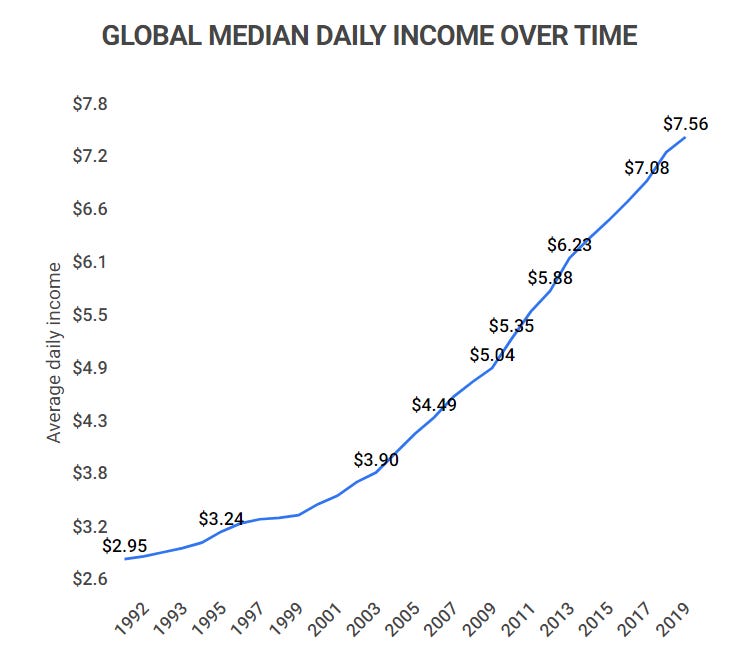

Emerging Middle Classes:

As countries like India grow, more people can afford branded medicines and infant formula, growing the pool of potential markets for Abbott.

5. What are the main risks for the company?

Legal Liabilities (NEC Lawsuits)

Abbott is facing hundreds of lawsuits claiming its specialty formula for premature babies caused a dangerous intestinal condition. One jury already awarded $495 million in damages.

Mitigation: Abbott is aggressively appealing these verdicts and notes that medical associations still support the use of these life-saving formulas. They have $8B in cash to handle potential settlements.

Pricing Power Limits

In 2025, Abbott raised prices on formula and shakes to fight inflation, but sales volumes dropped because customers found the products too expensive.

Mitigation: Management has shifted strategy to “volume-led growth,” meaning they are using promotions and slightly lower prices to win back customers and market share.

Volume-Based Procurement in China

In China, the government uses “Volume-Based Procurement” to force companies to significantly lower their prices in exchange for large contracts. This pricing pressure created a $400 million headwind for Abbott’s diagnostics business in 2025.

Mitigation: Abbott is offsetting these lower prices by selling much higher quantities of products to a larger number of hospitals. They are also moving more of their manufacturing into China to reduce their own production costs.

Acquisition Risk for Exact Sciences

Abbott has agreed to buy Exact Sciences (the maker of Cologuard) for $21 billion to enter the cancer testing market. If they struggle to combine the two companies or if the technology doesn’t grow as predicted, it could result in a significant financial loss.

Mitigation: Abbott has a strong track record of successfully integrating large acquisitions, such as the $25 billion St. Jude Medical deal. To ensure a smooth transition, they are keeping the Exact Sciences headquarters and leadership team in place.

GLP-1 Weight-Loss Drugs

There is concern that new weight-loss drugs like Ozempic could eventually reduce the number of people who need heart treatments or diabetes devices.

Mitigation: Abbott has found that many people starting these drugs actually want to use an Abbott glucose sensor to track how the medication is affecting their body. The company is positioning its technology as a companion to weight-loss drugs rather than a competitor.

Manufacturing and Recall Risks

A single mistake at a factory can lead to a global product recall, which can damage the company’s reputation and stock price overnight. Past issues with baby formula and sensor recalls have shown this to be a real risk.

Mitigation: Abbott does have 4 diverse business segments. If one area (like Nutrition) faces a recall, the other segments (like Medical Devices or Pharmaceuticals) are usually strong enough to keep the overall company profitable.

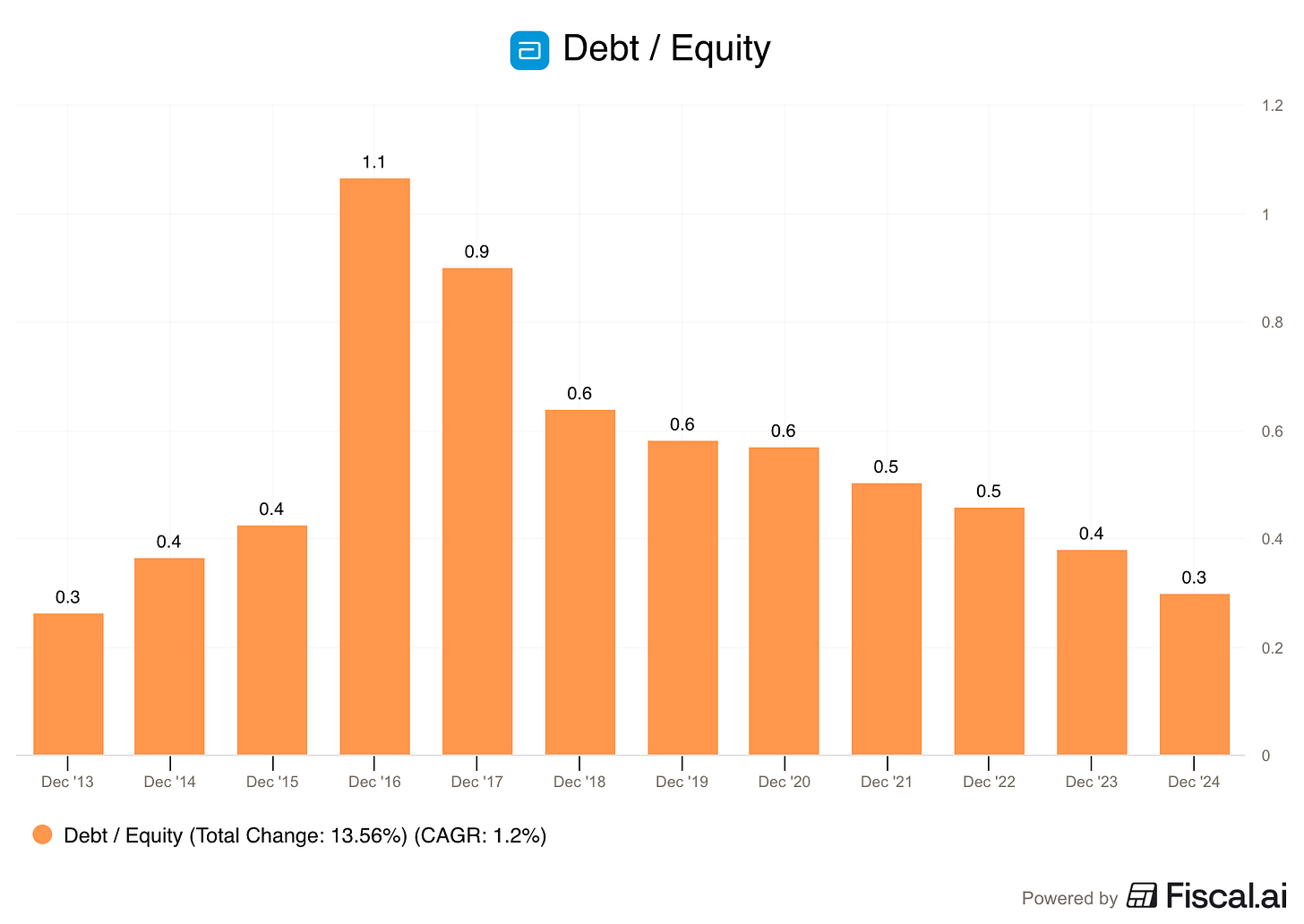

6. Does the company have a healthy balance sheet?

We like a Debt/Equity ratio < 50%.

Abbott has significantly reduced their Debt/Equity ratio, and is currently at 30%.

Let’s look at a few other important metrics:

Interest coverage ratio: this tells us if the business can afford the interest payments

Current ratio: this tells us if the business might have trouble meeting upcoming debt obligations

FCF / Debt: This tells us how easy it would be to pay off the debt with existing cash flow

Here’s how they look for Abbott Laboratories:

Interest coverage ratio: 75

Current ratio: 1.7

FCF / Debt: 0.6

Abbott has a very strong balance sheet.

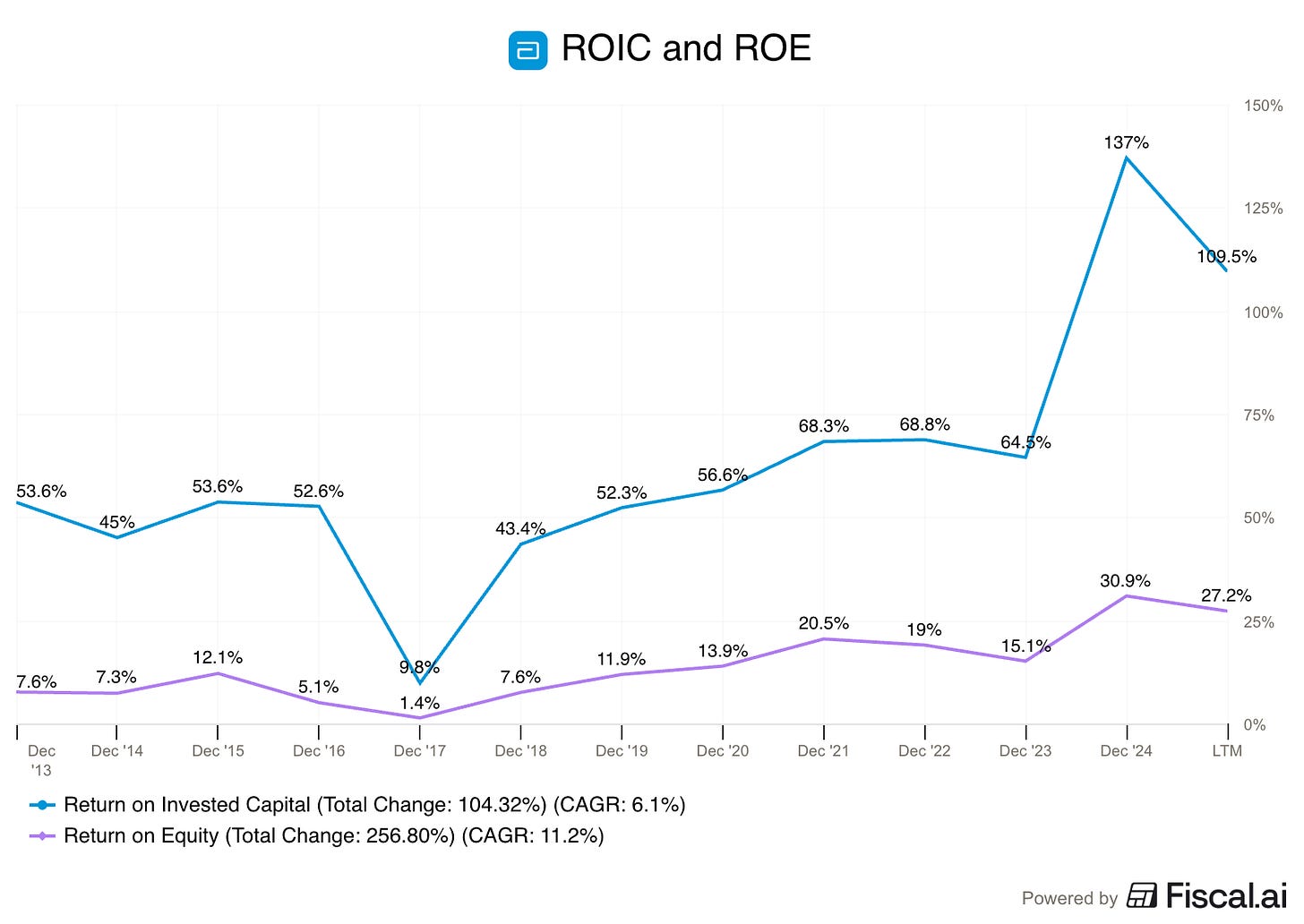

7. Is the company a great capital allocator?

Key signs:

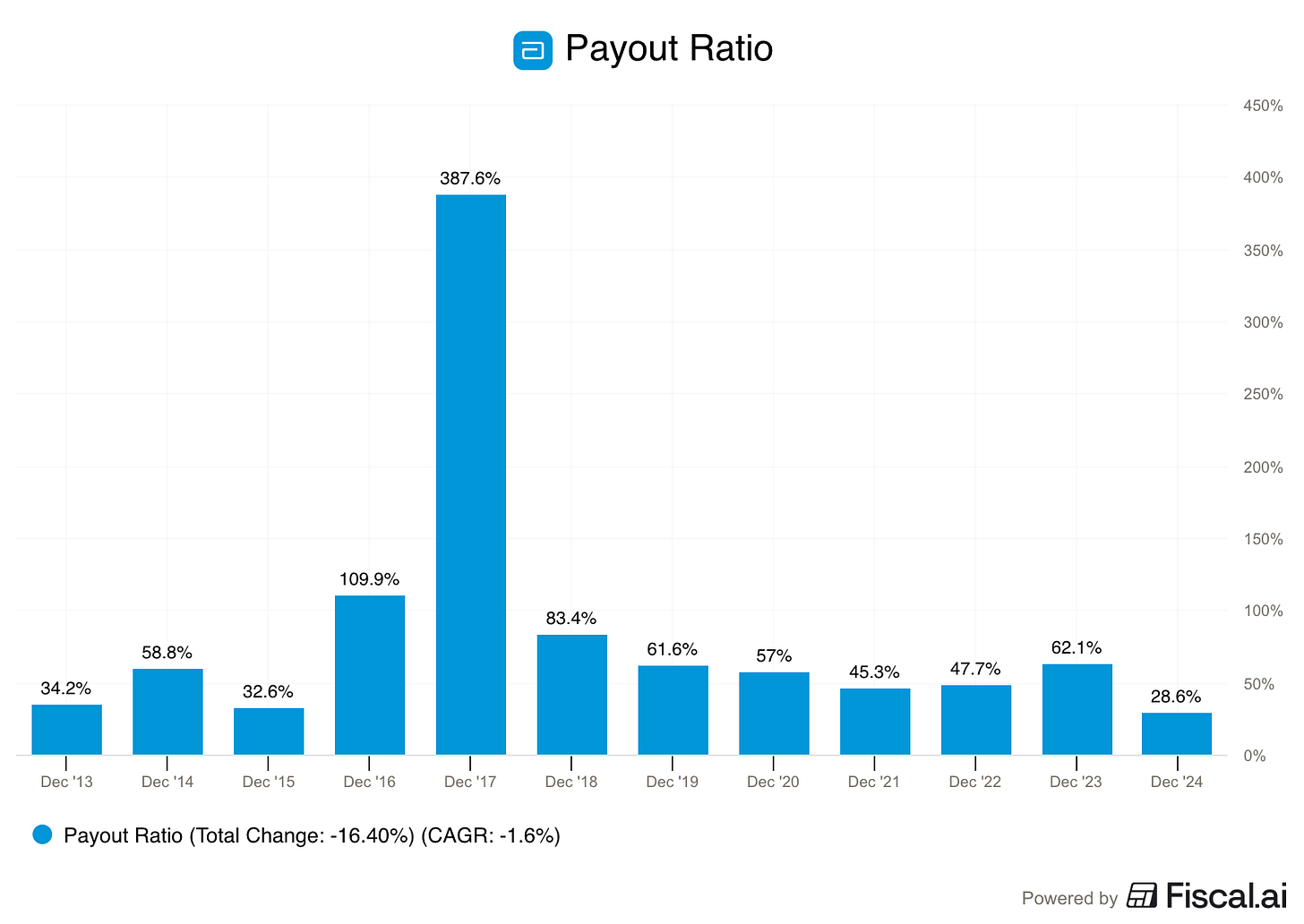

Payout Ratio <60%

Effective investments or buybacks

Abbott’s payout ratio tends to be around 60% or lower, leaving plenty of room for both dividend raises and the $21B Exact Sciences acquisition.

The company does not heavily buy back shares, but management has generated very high Returns on Invested Capital and Equity in the past.

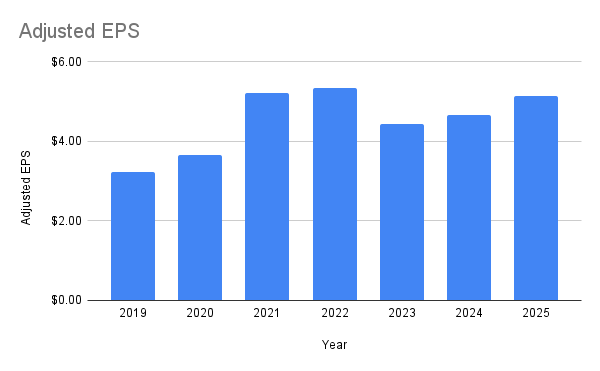

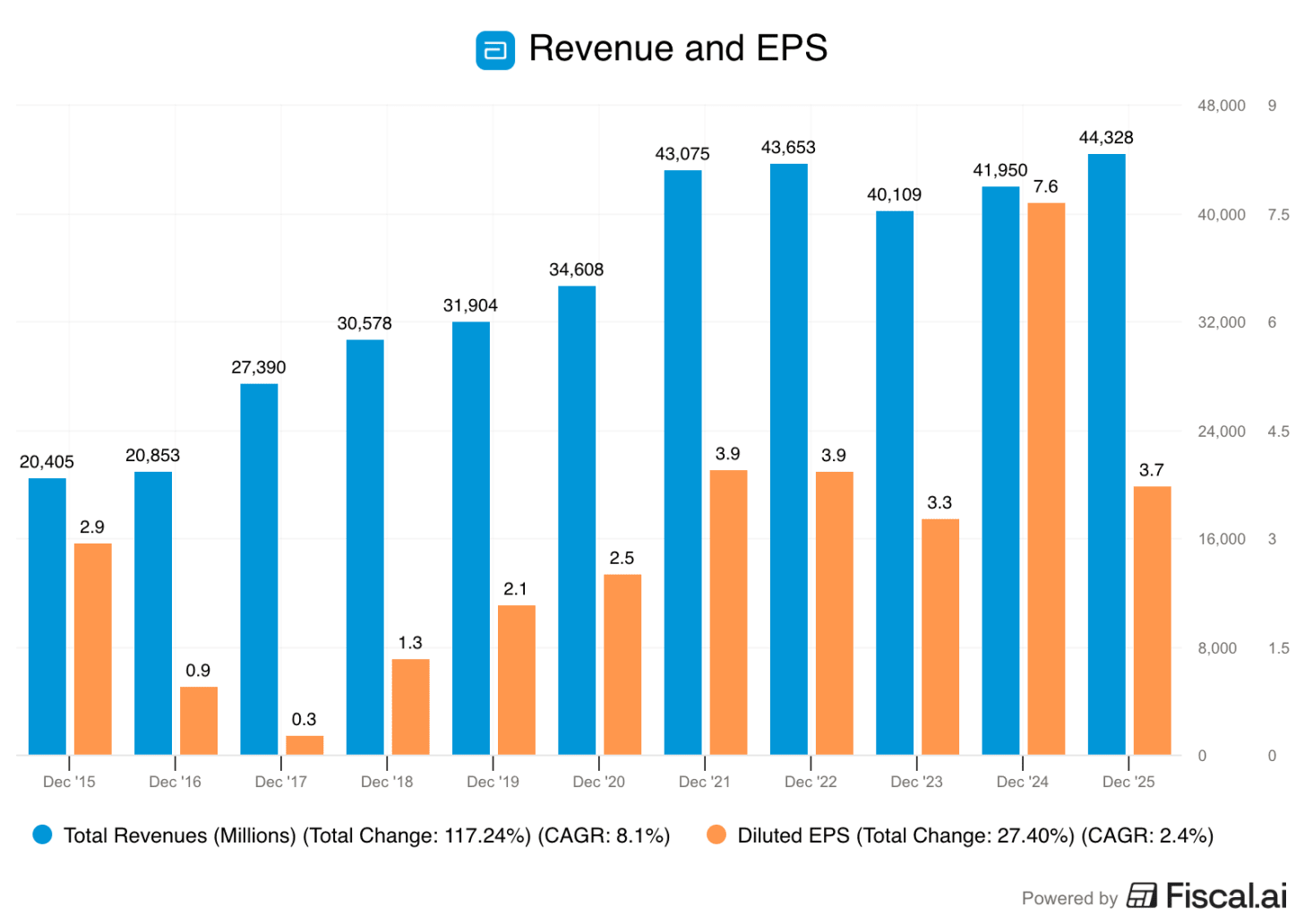

8. How does the past and future growth of the company look?

5-year revenue growth: 5.1%

5-year EPS growth: 8.2%

The EPS in 2024 is an outlier due to a significant one-time tax benefit.

Abbott’s management prefers to use Adjusted EPS to look at the business.

Here’s a chart of the past few years Adjusted EPS:

To get the adjusted numbers, they remove “Specified Items” - expenses that management believes don’t reflect the company’s daily performance.

Here is a breakdown of what they typically remove:

Amortization: Accounting rules say that Abbott has to write down the value of their acquisitions over time. It is consistently the largest adjustment, totaling $1.68 billion in 2025.

Business Changes: Abbott regularly removes costs for Restructuring (streamlining operations or closing old product lines) and Acquisition expenses (the legal and integration fees for buying new companies).

Other Costs: While the categories stay the same, the specific items inside Other change to reflect the times:

Regulatory Hurdles: Since 2021, Abbott has adjusted for the high cost of complying with new European medical device rules (MDR and IVDR).

Legal Risks: They remove one-time legal charges, such as a $165 million reserve for a settlement in 2025.

Asset Write-offs: If a project or piece of technology loses its value (impairment), they remove that loss from their adjusted results.

Abbott’s adjustments tend to be consistent.

They systematically ignore non-cash accounting costs and one-time fees.

The only real variable is the “Other” category, which has shifted from debt-related costs in 2019 to heavy regulatory and legal costs today.

Future Growth

Abbott’s massive diversification and 54-year dividend streak make it a titan of the healthcare world.

The real question for investors isn’t just where Abbott has been, but where the dividend is going next.

We’ve just scratched the surface of the Abbott investment case.

Our deep-dive analysis, including our projection of Abbott’s future growth, dividend growth, valuation, and whether we’re adding Abbott to Our Portfolio is reserved exclusively for paid partners of Compounding Dividends.

🚨 Don’t Miss Out: The Doors Are Opening Soon

On February 24th, we are opening a limited number of discounted spots for new members.

These spots aren’t expected to last long!

You don’t want to miss your chance to get in at a discount (and get all the exclusive bonuses as well).

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.