🔥 Stock Idea - ADP

ADP is the market leader in the critical world of corporate payroll.

They earn stable, recurring revenue by handling essential tax and human capital management tasks like payroll and compliance.

ADP is an important partner for many businesses around the world - let’s dive into this Dividend King today!

Automatic Data Processing, Inc.

Businesses around the world rely on ADP’s services.

It could be one of the most stable companies in the modern economy.

It’s got massive scale, serving over 1.1 million clients and paying over 42 million workers globally.

The company benefits from a powerful structural moat based on high switching costs and decades of built-up regulatory data and expertise.

It’s a strong generator of cash flow, with a history of growing capital returns for over 15 years.

But it’s also got some problems:

The business is sensitive to economic downturns, especially rising unemployment or slowing wage growth.

It faces an increasing risk of technological disruption from newer, leaner cloud platforms and advancing AI capabilities that could replace some of its offerings.

Its core business, which is highly reliant on scale, is in a fiercely competitive market.

Is this industry leader a buy? Let’s find out!

💰 Company name: Automatic Data Processing, Inc.

✍️ ISIN: US0530151036

🔎 Ticker: $ADP

📚 Type: Dividend Growth Stock

📈 Stock Price: $256.37

💵 Market cap: $101.1 billion

📊 Average daily volume: $503.5 million

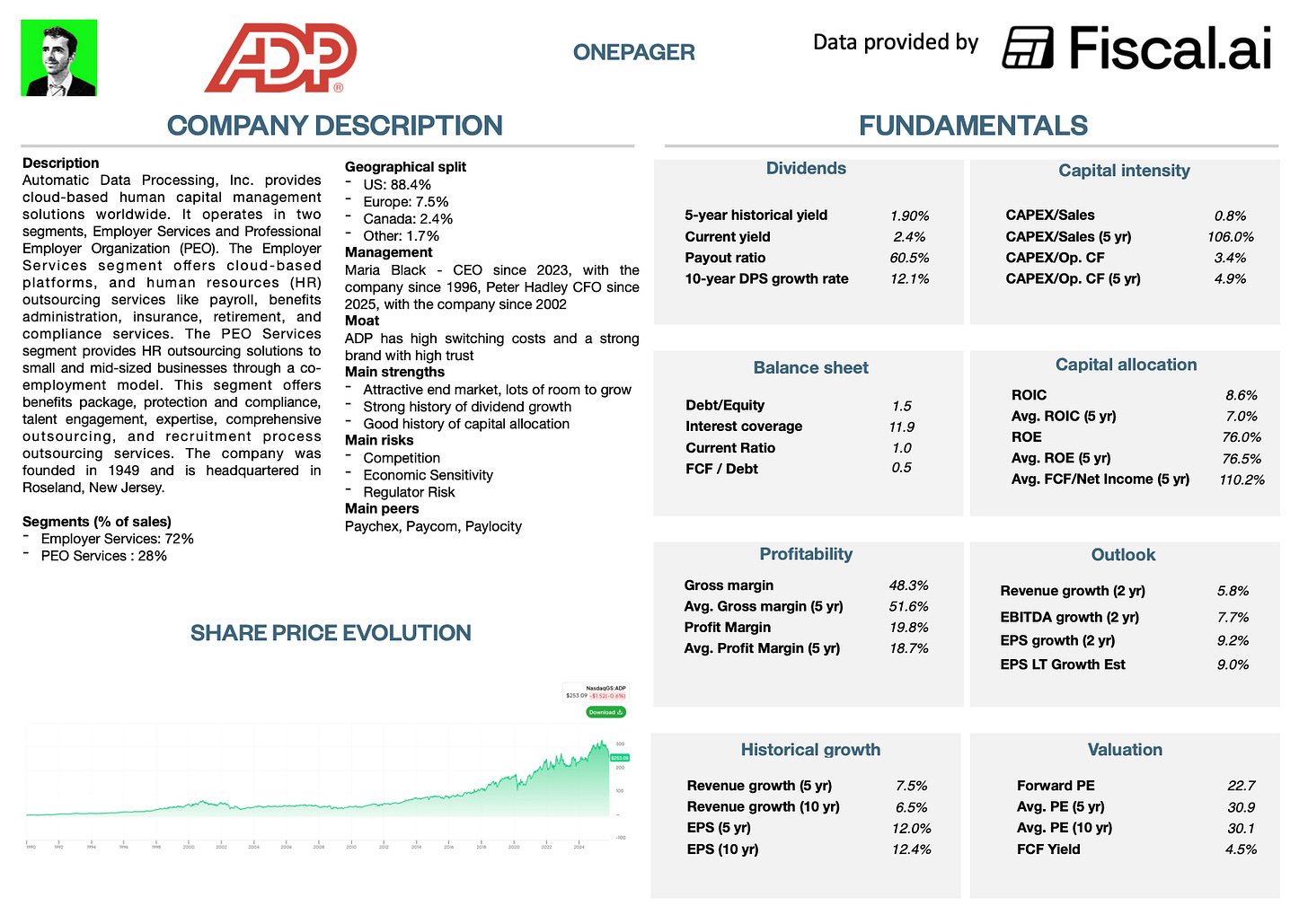

Onepager

Don’t know Automatic Data Processing, Inc.?

Here are the basics:

1. Do I understand the business model?

Automatic Data Processing, Inc. (ADP) is a global technology company that provides cloud-based Human Capital Management (HCM) solutions to businesses of all sizes.

They help businesses manage their workforce through an entire employment cycle - from hiring to retiring.

The core service is payroll processing, but it also bundles other critical tasks like:

Talent acquisition and management.

Time and attendance tracking.

Benefits and compliance administration.

Tax filing, which involves handling $3.3 trillion in client funds in the U.S. annually.

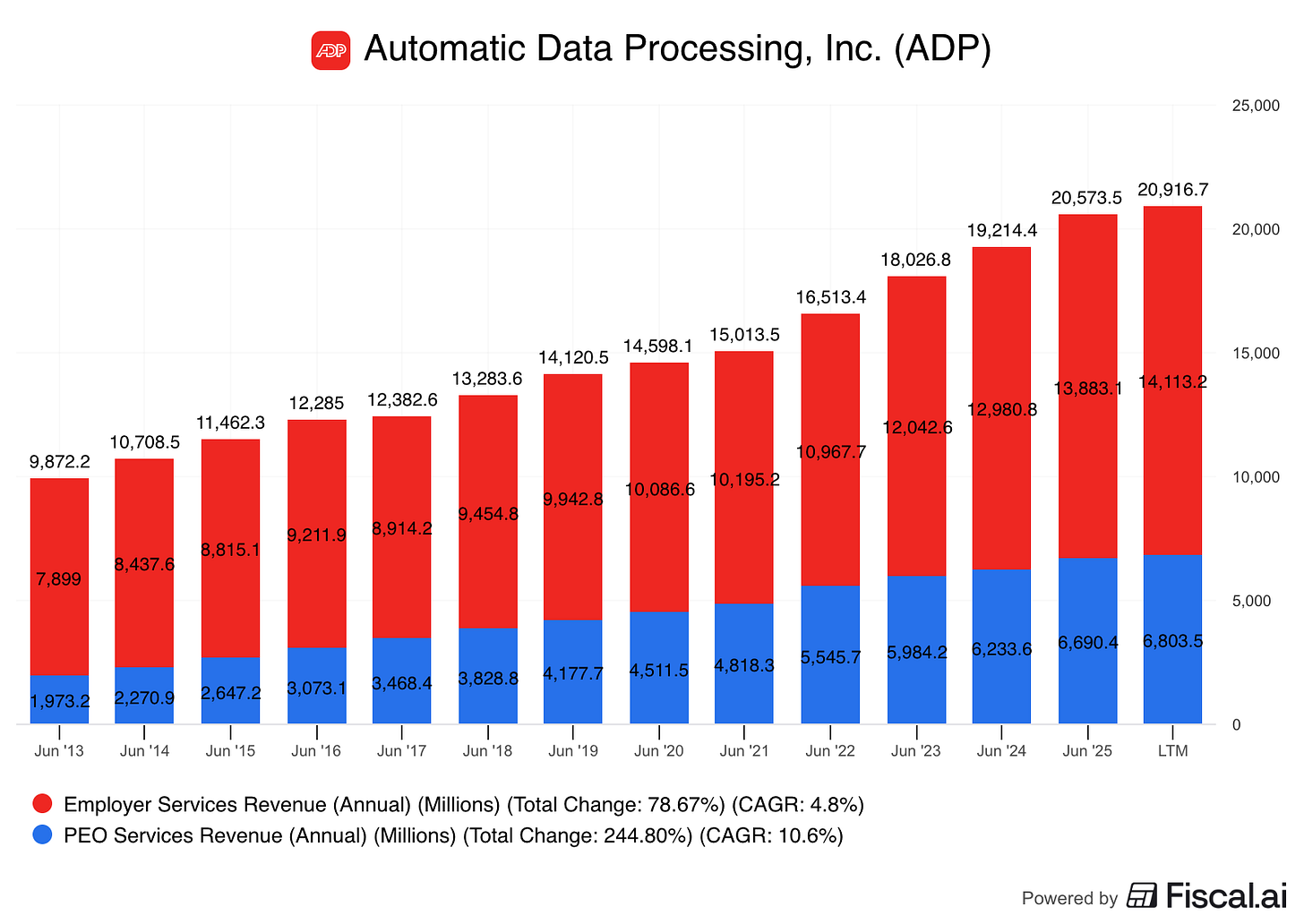

ADP operates through two main segments:

Employer Services (ES): Offers a comprehensive range of global HCM technology and outsourcing services (other than PEO).

Professional Employer Organization (PEO) Services: A full-service Human Resources Outsourcing (HRO) solution, primarily run through ADP TotalSource, where ADP acts as a co-employer with its client’s worksite employees. This allows small and mid-sized businesses to offer services and benefits on par with larger enterprises.

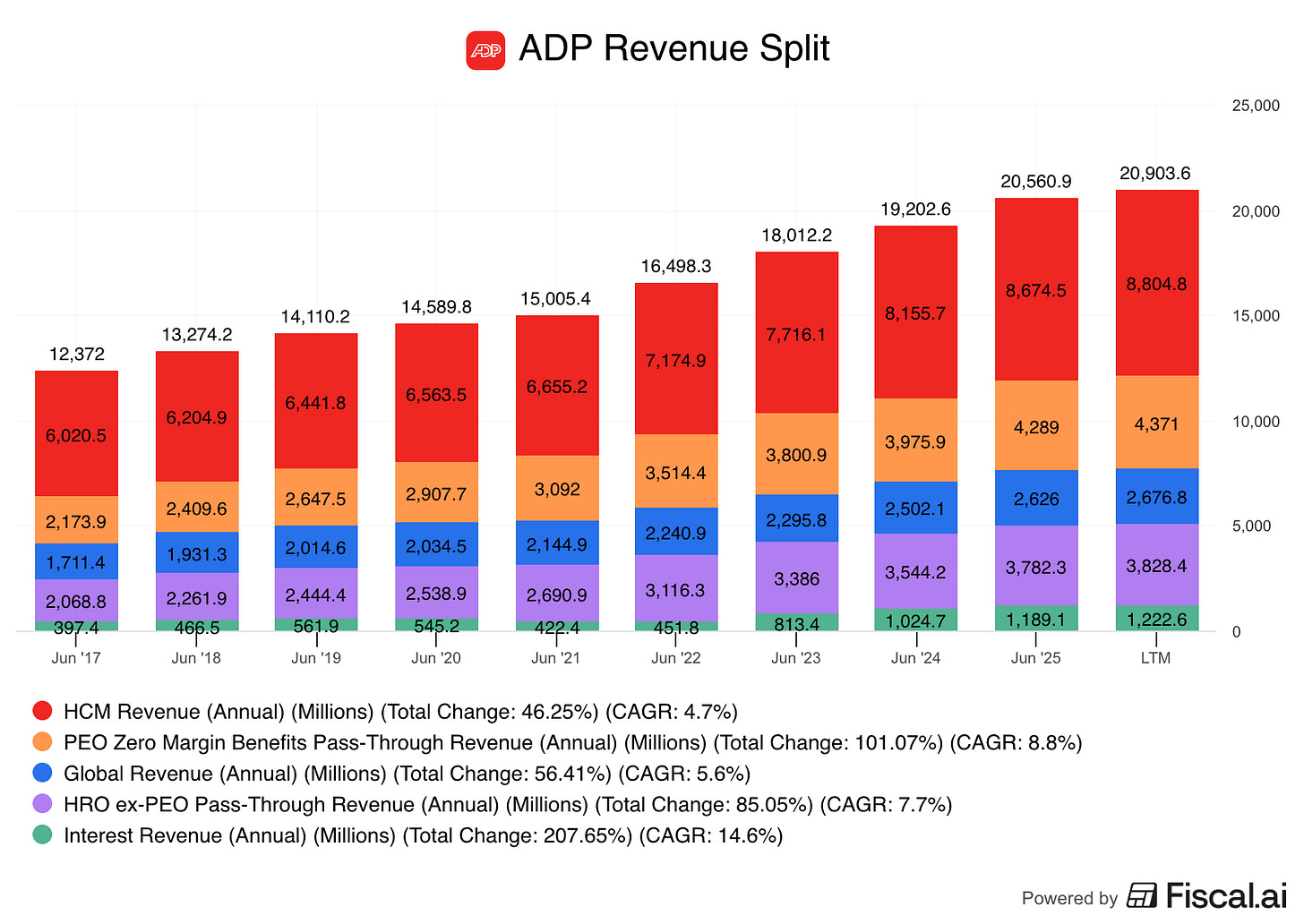

Revenue Split

ADP’s revenue is largely derived from its software and service fees, complemented by interest earned on client funds (”float”).

Here is the revenue breakdown for 2025:

Human Capital Management (HCM) Technology (Includes most payroll/HR software fees): 42.2%

PEO Zero-Margin Benefits Pass-Throughs (Cost of benefits passed to clients): 20.9%

HR Outsourcing (HRO), excluding PEO pass-throughs: 18.4%

Global Solutions (International revenue): 12.8%

Interest on funds held for clients (Float Income): 5.8%

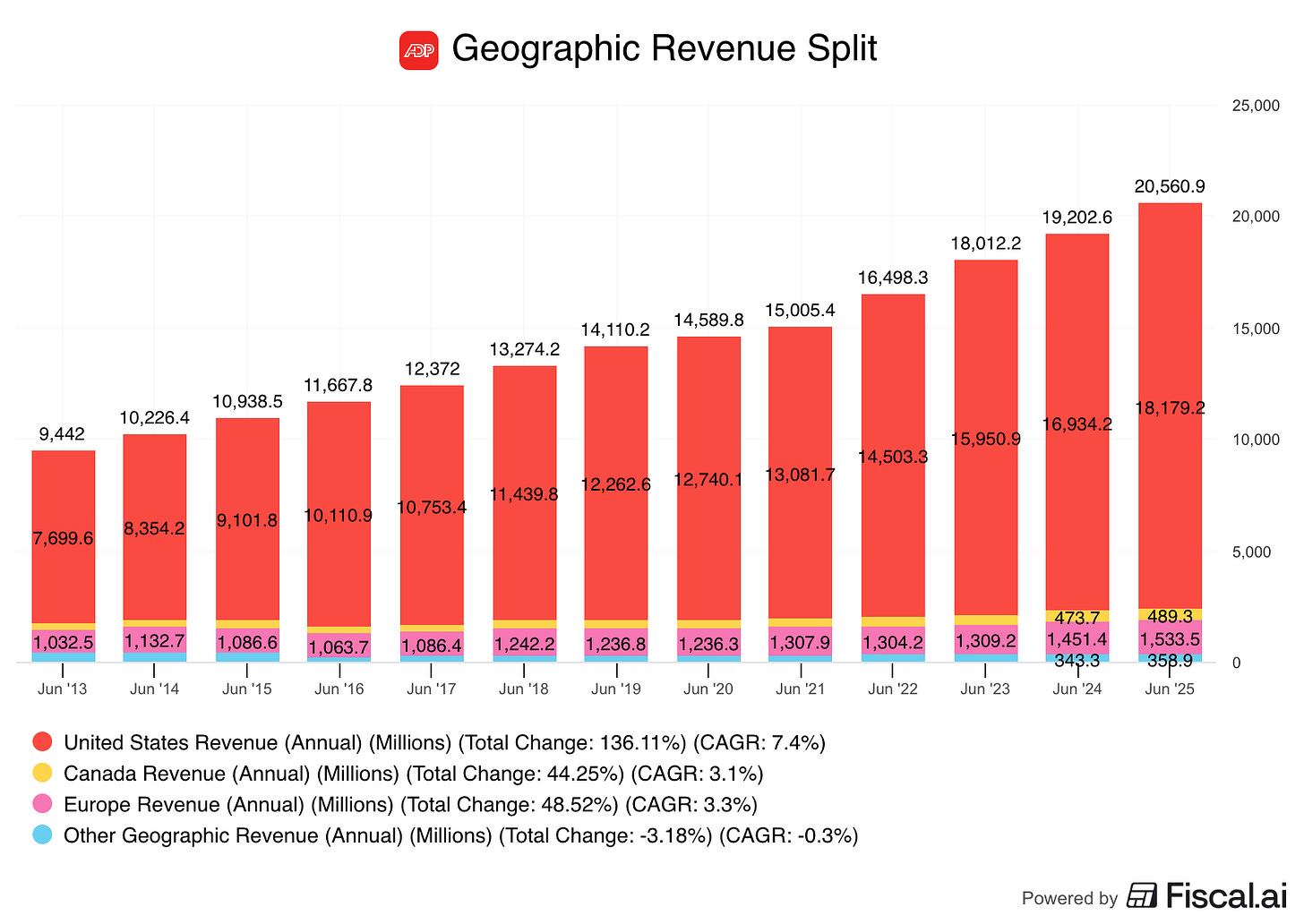

Geographic Split

The vast majority of ADP’s revenue and assets are concentrated in the United States.

United States: 88.4% of revenue

Europe: 7.5% of revenue

Canada: 2.4% of revenue

Other (140+ countries/territories): 1.7% of revenue

Who are the customers?

ADP has a customer base of over 1.1 million clients globally.

These customers span all sizes and industries, and ADP has different products for different needs.

Small Businesses (1-49 Employees): Served primarily by RUN Powered by ADP.

Mid-Market (50-999 Employees): Served primarily by ADP Workforce Now.

Enterprise (1,000+ Employees): Served by ADP Lyric HCM and bespoke global solutions.

ADP’s revenue is very diversified.

No single client accounts for more than 2% of consolidated revenues.

What’s the moat?

ADP’s competitive advantage comes from high switching costs combined with its strong brand and industry trust.

Switching Costs

Getting payroll and taxes right are incredibly important to any business.

ADP has integrated itself so deeply into these critical functions that switching away from them to a competitor is very risky and difficult.

The fact that the average client relationship is around 13 years in the core Employer Services segment and the 92.1% retention rate are proof of just how hard it is to switch.

Brand and Trust

ADP has a strong brand, built on decades of providing reliable service for its customers.

They have 80% of the Fortune 500 as customers and handle more than $3 Trillion in client assets every year.

That gives ADP credibility and trust.

They also have decades of experience managing tax, compliance, and regulatory changes across 140+ countries.

The fact that ADP pays 42 million workers gives it the “industry’s largest and deepest HCM dataset,” which they use to continuously improve their products and the client experience.

When you combine all of these things together, ADP has a very strong moat.

2. Is management capable?

Maria Black - CEO

Ms. Black became President and CEO in January of 2023.

She’s been with ADP since 1996.

She’s worked as President of ADP and President ofWorldwide Sales and Marketing.

That gives her experience across sales and operations and a good understanding of the company.

She also owns about $12 million worth of ADP shares.

Peter Hadley - CFO

Mr. Hadley has been Chief Financial Officer since July 2025, and has been with ADP since 2002.

His was previously Corporate Treasurer, and President, Asia Pacific.

He owns around $2 million in ADP shares.

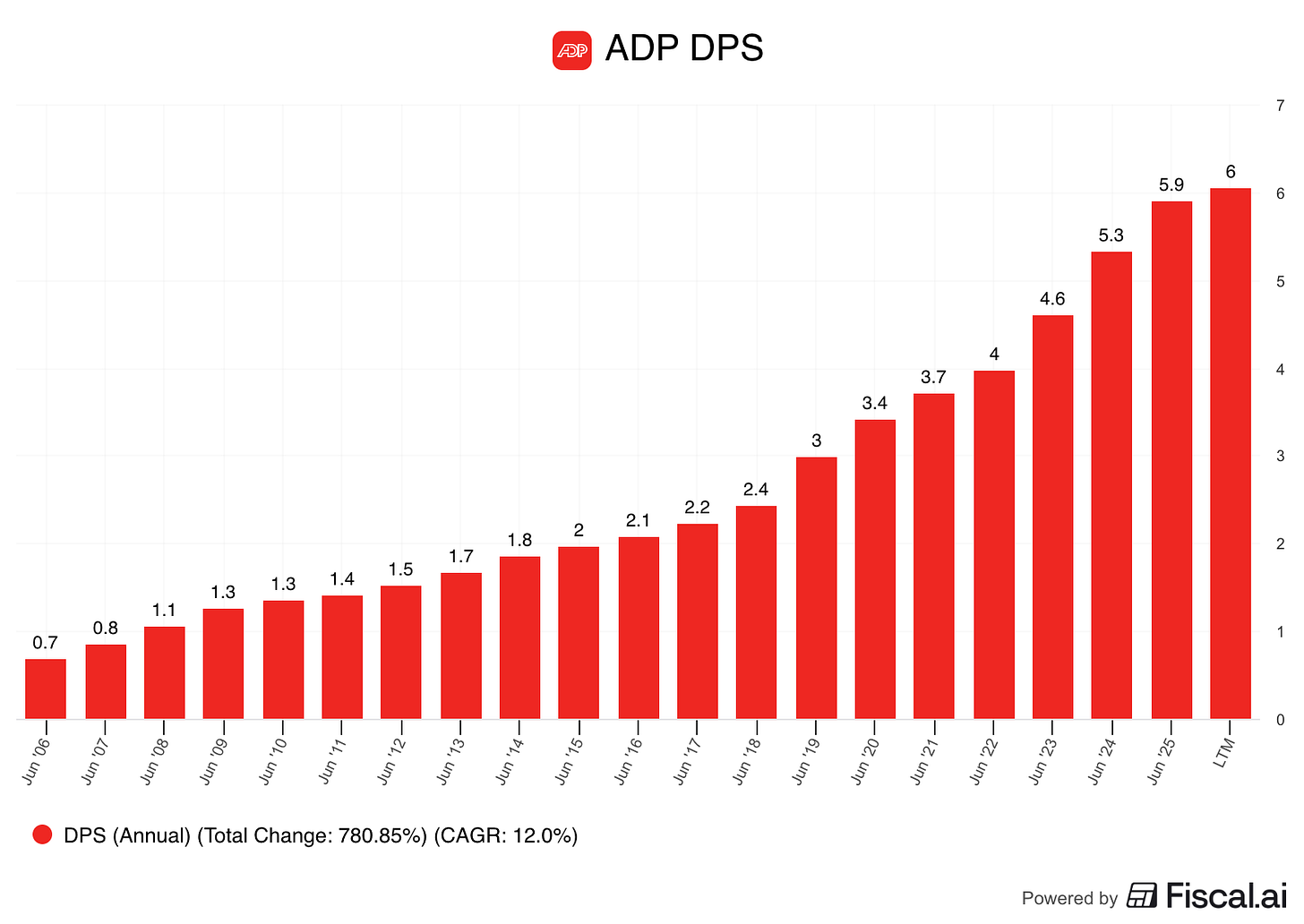

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

ADP became a Dividend King this year, with its 50th consecutive year of dividend raises.

Over the last 5 years, ADP has increased its dividend by 11.1% each year on average.

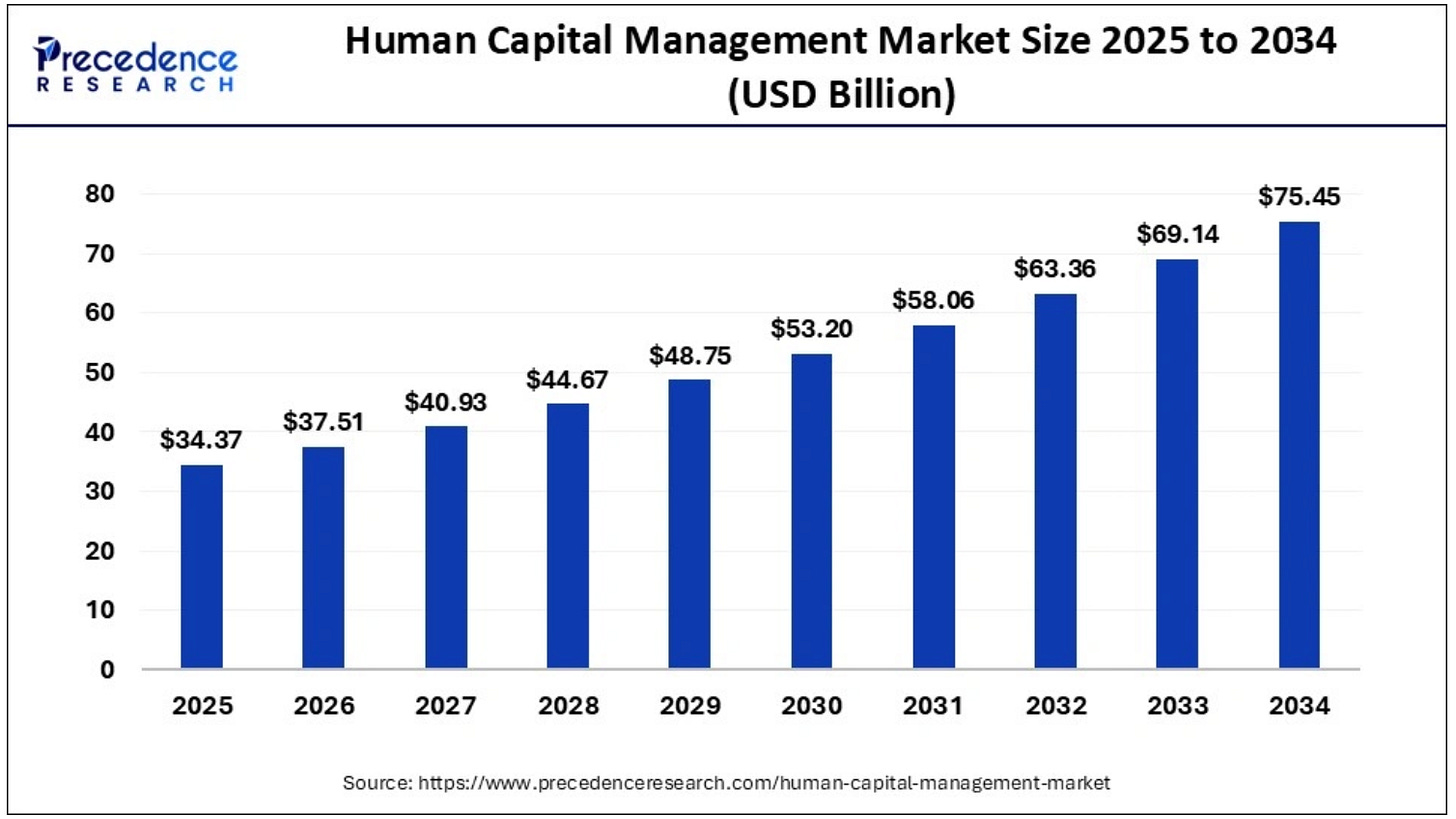

4. Is the company active in an attractive end market?

ADP operates in the Human Capital Management (HCM) and payroll services market, which provides services that every business in the world needs.

I would call this a very attractive market.

First, the services are recurring.

Second, there are secular tailwinds such as:

Regulatory Complexity: Labor, tax, and compliance laws globally continue to get more complex, meaning that businesses will always need specialized, up-to-date solutions like ADP’s

Rising Cost of Benefits: As healthcare costs rise, the PEO model (like ADP TotalSource) lets smaller employers save costs and offer competitive benefits plans

Shift to Cloud/AI: Businesses continue to move off legacy systems and on to modern, cloud-based HCM platforms with advanced tools like AI

Global Expansion: Growth in the global workforce and the need for multinational companies to manage payroll across many jurisdictions provides a natural tailwind for ADP’s Global Solutions segment

These tailwinds are expected to grow the market by 9% per year until 2034.

5. What are the main risks for the company?

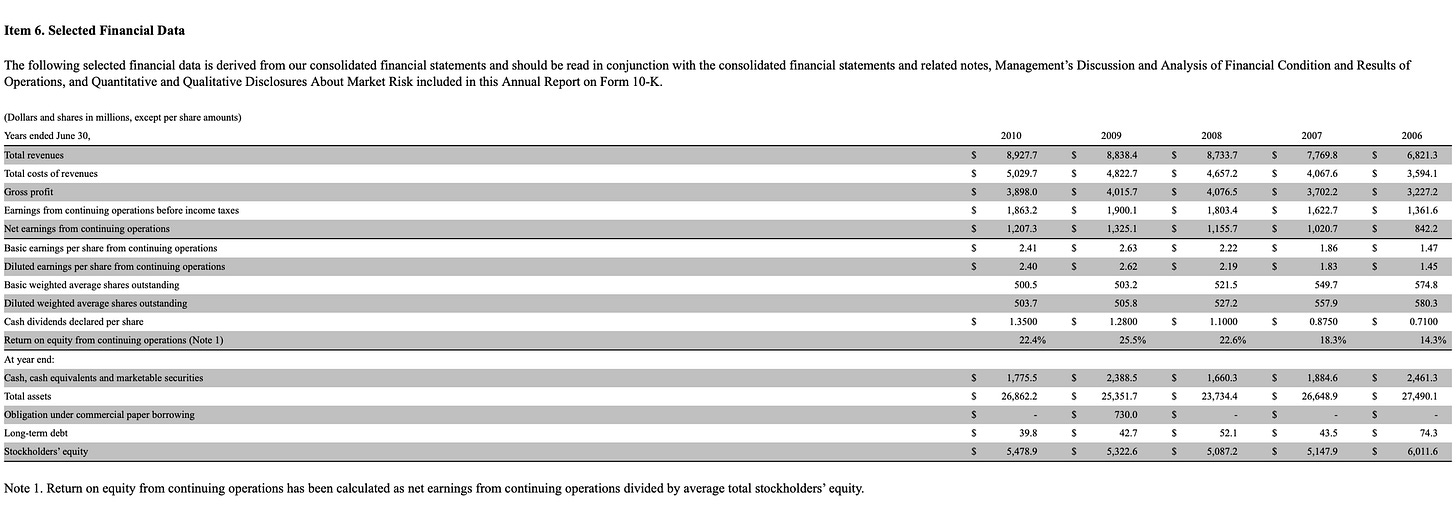

Economic & Labor Slowdowns

ADP’s revenue is highly dependent on the level of employment, wage growth, and labor force participation within its client base. A macroeconomic slowdown leading to job cuts or hiring freezes directly impacts the fees ADP earns (through its “pays per control” metric).

Mitigation: ADP has done well in past recessions (2008, 2020) by maintaining growth in its top line. The company also benefits from float income, which is currently high due to elevated interest rates, providing a buffer against slower hiring. Here are the financials through the 2008 recession:

Technological Disruption & Competition

ADP faces stiff competition from new, innovative cloud platforms (e.g., Paylocity, Paycom) and traditional players (Paychex). The emergence of generative AI could also enable companies to build better in-house payroll processing capabilities, potentially reducing demand for ADP’s core services.

Mitigation: ADP is actively mitigating this by continuously investing in and rolling out next-generation cloud platforms (ADP Lyric HCM, Workforce Now NextGen) and heavily embedding AI technology (ADP Assist) across its entire product portfolio and internal service teams.

Regulatory & Security Risk

As a financial transaction processor and custodian of massive amounts of sensitive employee and tax data, ADP is highly exposed to evolving global data privacy regulations (GDPR, CPRA) and the risk of a security or cyber breach. Non-compliance or a breach could result in significant penalties and irreparable damage to its critical brand reputation.

Mitigation: ADP maintains robust security and compliance programs, including implementing Binding Corporate Rules (BCRs) to govern cross-border data transfer, giving it a compliance advantage. It invests heavily in its systems to safeguard client data and funds. These regulations and risks are also a major reason why it’s beneficial for businesses to outsource HR and compliance to an expert like ADP.

So here we have it.

A Dividend King with rock-solid fundamentals…

A wide moat built over decades…

And a customer base that spans the globe.

But.

Will ADP keep winning in the age of AI?

Can this old titan still outpace the new kids on the block?

Or is the payroll crown starting to wobble?

Let’s peel back the numbers… and see what the market’s not pricing in yet.

👉 Become a Paid subscriber to dive into the fundamentals

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.