PayPal is eating itself alive… and that’s a good thing.

Over the last decade, the company has slashed its share count by nearly 20%.

And in 2024 alone, it spent more than $6 billion buying back its own stock.

Source: Finchat

Yet the market isn’t convinced.

Investors worry about competition from Apple Pay, Adyen, and Stripe. They wonder if PayPal’s best days are behind it.

So let’s take a closer look.

1. Do I understand the business model?

PayPal is one of the oldest digital payment companies. It lets people and businesses send, receive, and store money online.

It runs a two-sided network, meaning it connects both buyers and sellers. The more buyers PayPal has, the more sellers want to use it - and vice versa.

That’s a powerful advantage. It’s what makes PayPal sticky.

PayPal isn’t just the yellow checkout button though.

They also own Venmo.

And they provide unbranded checkout for online merchants, as well as a host of additional services, including:

Buy now, pay later

Payouts to vendors, contractors, etc

Risk and fraud management

Cross-border transactions

PayPal’s Advantages

PayPal’s main advantage? Data.

They know what their members have bought in the past, what they’re shopping for now, their preferences, their shipping address, etc.

That’s valuable to merchants because it helps them find the right customers and sell more.

It’s also valuable to the members because it lets PayPal help them find what they’re looking for, and buy it more easily.

2. Is management capable?

You want to invest in companies led by great managers.

Alex Chriss took over as CEO in 2023. Before that, he ran the Small Business and Self-Employed Group at Intuit - where he was responsible for more than half the company’s revenue.

He owns over $7 million in PayPal stock. That’s a good sign.

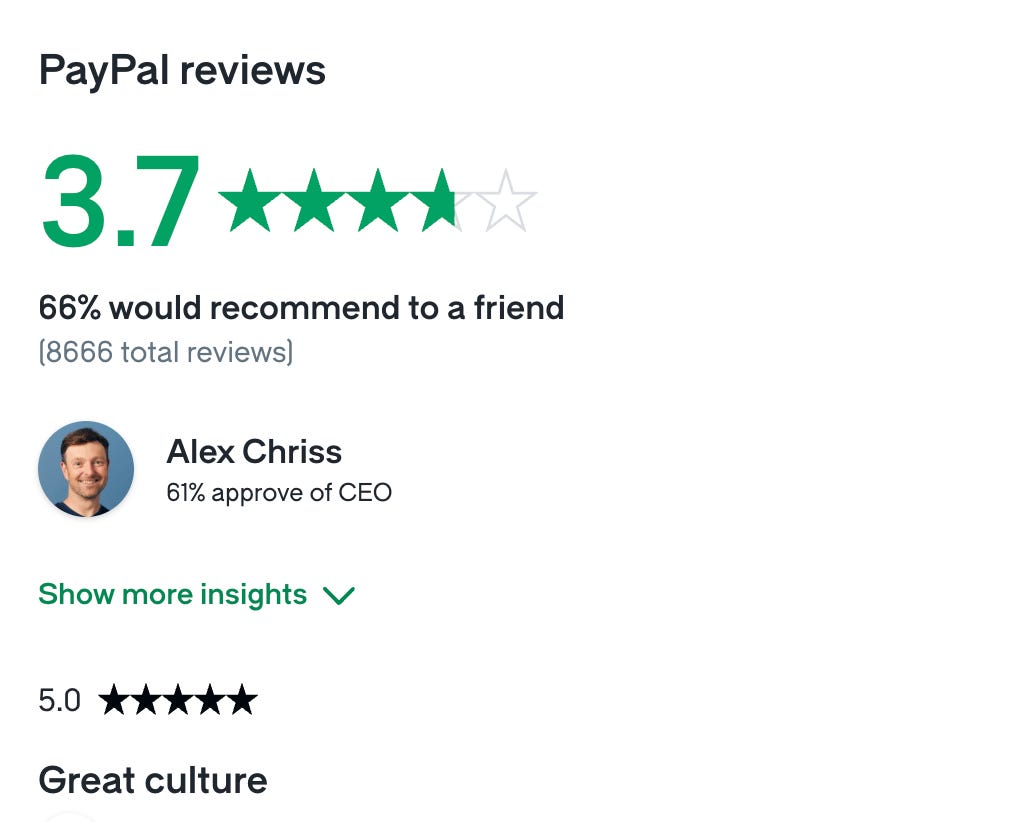

More than 60% of employees approve of his leadership, giving him a 3.7-star rating.

3. Has the company grown its Free Cash Flow attractively?

In this step we’d normally be looking at dividend growth.

But PayPal is a Cannibal Stock. It doesn’t pay dividends - it buys back shares.

So Free Cash Flow (FCF) is critical. That’s the money fueling buybacks.

Over the past decade, PayPal’s FCF has grown at more than 15% per year.

Source: Finchat.

4. Is the company active in an attractive end market?

You want to invest in companies that are in a stable or growing market.

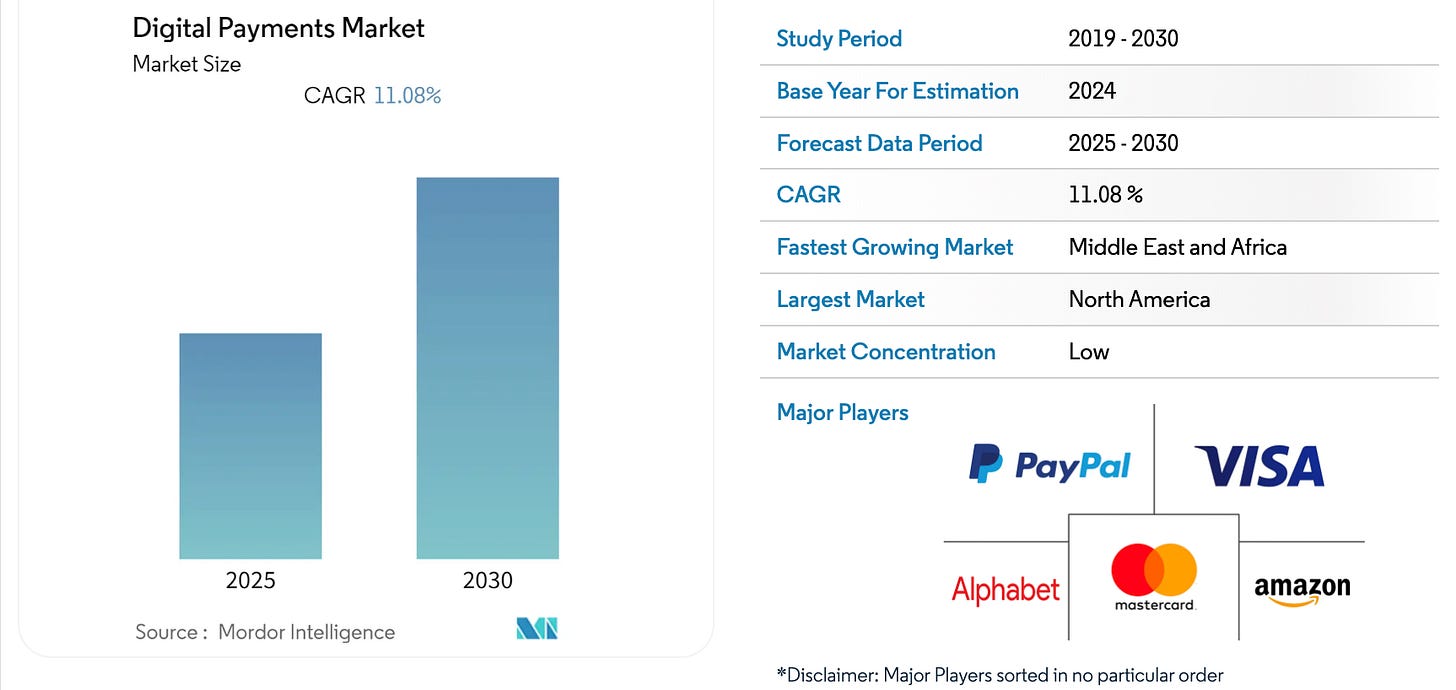

Digital payments fit the bill.

The sector is expected to grow 11% annually for at least the next five years.

5. What are the main risks for the company?

Disruption is the worst enemy for every long-term investor.

When you invest in a company that is losing its moat, you’ll end up with horrible investment results.

Let’s talk about PayPal’s largest risks

Competition

Rivals like Apple Pay, Google Pay, and Stripe are competing for market share, especially as more payments move to mobile wallets

Regulation

Governments worldwide are tightening rules on digital payments, fraud prevention, and money laundering, which could increase costs or limit PayPal’s operations

Transaction Margins

As e-commerce platforms push their own payment solutions (e.g., Amazon Pay, Shopify Payments), PayPal might have to lower fees to stay competitive, squeezing profitability

Fraud & Security Risks

As a major payments platform, PayPal is a constant target for fraud, hacking, and chargebacks, which could increase costs and damage its reputation

User Growth & Engagement

If PayPal struggles to attract new users or keep existing ones engaged, its growth could slow, especially with the rise of alternative payment options

Economic Slowdowns

In recessions or economic downturns, consumer spending drops, leading to fewer transactions on PayPal’s platform and lower revenue

Now let’s dive into more into the balance sheet and other Fundamentals.