🔥 Stock Idea: Wolters Kluwer

Wolters Kluwer is down 50% from its 52-week high in November 2024.

It’s got massive scale, serving customers in 180 countries, with necessary information and software.

The company is a serial-acquirer in a very fragmented industry with secular tailwinds behind it.

It’s also generating enormous cash flow, with a Free Cash Flow (FCF) to Net Income ratio of over 107%.

But it’s also got some problems:

Currency headwinds from a strong Euro

Declines in non-recurring transactional revenues and print media

Increasing exposure to financing costs and debt

All of that means the stock is down, and the dividend yield is well over 2.5%, with a 5-year Dividend Per Share (DPS) CAGR of over 10%.

Is this industry leader a buy? Let’s find out!

📖 Compmany name: Wolters Kluwer N.V.

✍️ ISIN: NL0000395903

🔎 Ticker: $WKL

📚 Type: Dividend Growth Stock

📈 Stock Price: €9002

💵 Market cap: €20.5 Billion

📊 Average daily volume: €74 Million

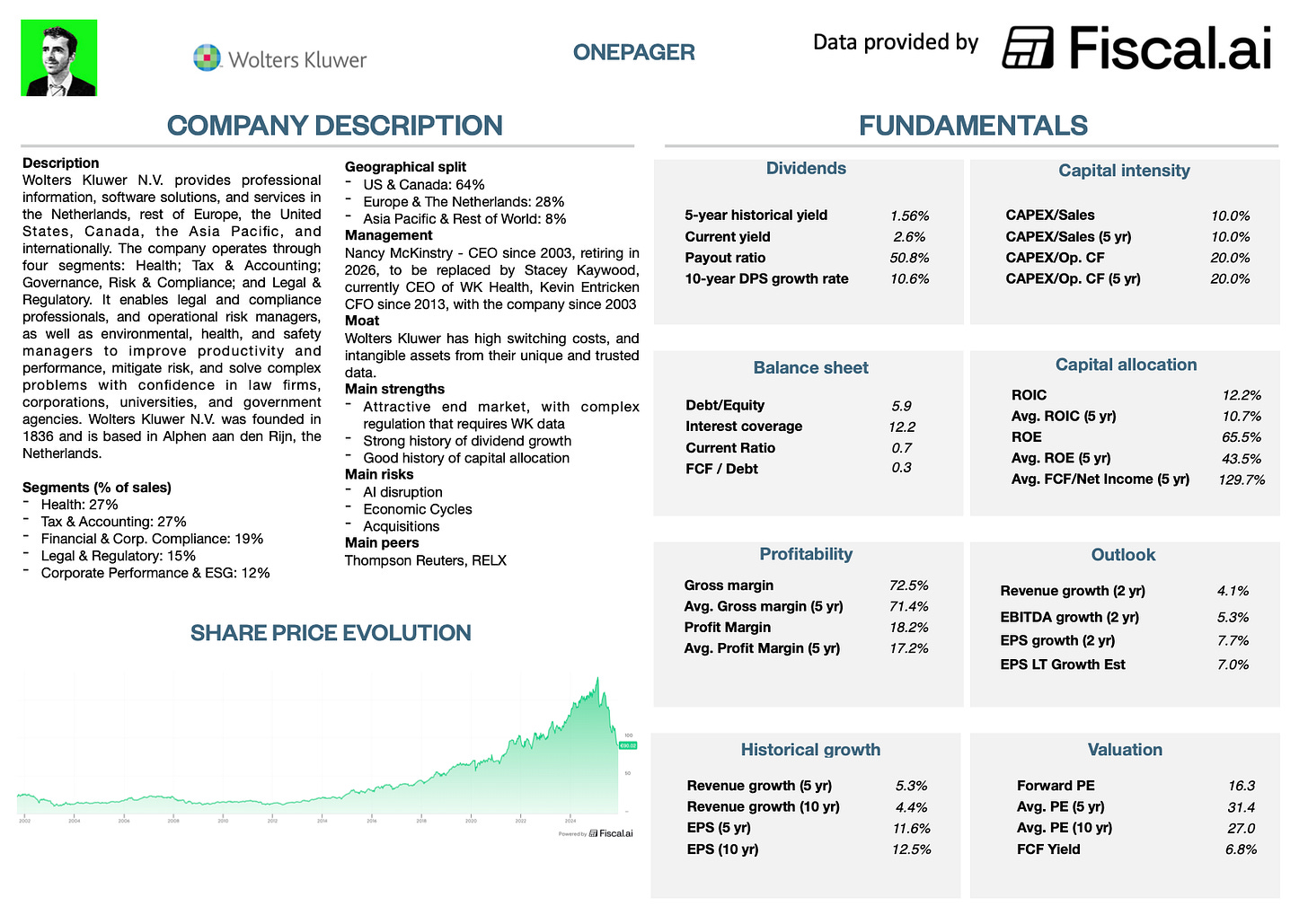

Onepager

Don’t know Wolters Kluwer?

Here are the basics (click on the picture to expand):

1. Do I understand the business model?

Wolters Kluwer sells software and information services to professionals like lawyers, accountants, and doctors.

Their tools combine expert knowledge with technology to help these professionals make important decisions daily.

They make most of their money from reliable, ongoing subscription payments.

Wolters Kluwer’s combination of expert knowledge, technology, and services is a powerful mix that:

gives customers actionable information

helps them automate their workflows

and ensure compliance with regulations

Revenue Split

Wolters Kluwer generates most of its revenue from the Health and Tax & Accounting divisions.

Here’s the revenue split for 2024:

Health: €1.6 billion (27% of revenue)

Tax & Accounting: €1.6 billion (27% of revenue)

Financial & Corporate Compliance: €1.1 billion (19% of revenue)

Legal & Regulatory: €0.9 billion (15% of revenue)

Corporate Performance & ESG: €0.7 billion (12% of revenue)

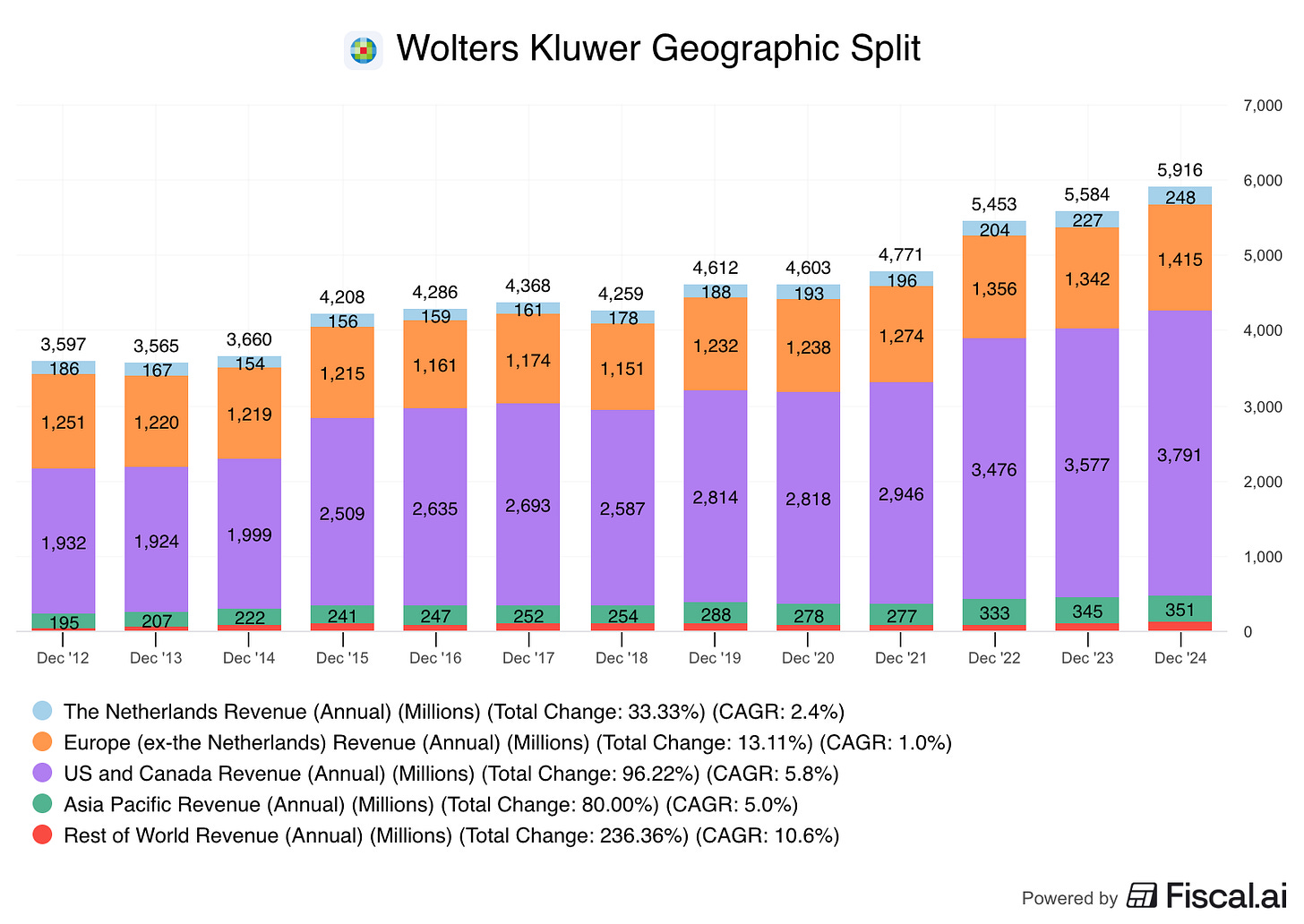

Geographic Split

The company has a broad global footprint but relies heavily on North America for the majority of its business.

U.S. & Canada: 64% of total revenues

Europe & The Netherlands: 28% of total revenues

Asia Pacific & Rest of World (ROW): 8% of total revenues

Who are the customers?

The customer base is very diversified and is made up solely of professionals and institutions:

Healthcare Professionals & Institutions: Clinicians, hospitals, and medical schools using tools like UpToDate.

Tax & Accounting Firms: Accounting firms of all sizes, often migrating to cloud software like CCH Axcess.

Corporate Legal & Compliance Departments: Banks, corporations, and law firms requiring regulatory guidance and entity management solutions.

Government Agencies & Universities: Users of specialized content and compliance tools.

What’s the moat?

Wolters Kluwer has trusted, specialized information, and high switching costs that work together to give them a competitive advantage.

Let’s look at both.

1. Trusted Content & Reputation (Intangible Assets)

The quality of Wolters Kluwer’s content and its trusted reputation are the first source of competitive advantage.

Trusted Information: The Wolters Kluwer brand means trust and reliability in complex fields like law and medicine, where getting the facts right is crucial. This trust allows them to charge premium prices.

A Foundation for AI: Their proprietary, expert-validated content is key as they add new AI features. The trustworthiness of their content makes their AI reliable, which is hard for other companies to compete with.

Business Scale: The digital subscription model means their business can grow without a lot of extra cost.

2. High Switching Costs

Wolters Kluwer’s software and services are essential, and deeply embedded in the daily, critical work of its customers.

Switching is costly, time-consuming, and risky for a professional to switch to a competitor.

For example, an accountant can’t easily change the core tax software they rely on every day.

Similarly, a doctor is unlikely to switch away from a trusted clinical tool like UpToDate when making decisions for patients.

Because the tools are so critical and hard to switch from, a very high percentage of customers renew their subscriptions year after year, which means stable revenue.

In 2024, more than 90% of the largest subscription accounts renewed their contracts.

2. Is management capable?

Nancy McKinstry - CEO

Ms. McKinstry has been the Chief Executive Officer and Chair of the Executive Board since September 2003,

She has led the company through its transformation from a traditional publisher to a global digital information and software provider.

Ms. McKinstry is planning to retire in February 2026.

Stacey Caywood, CEO of Wolters Kluwer Health since 2020 has been nominated as her successor.

Kevin Entricken - CFO

Mr. Entricken has been the Chief Financial Officer and Member of the Executive Board since May 2013.

He is responsible for all finance functions, including Treasury, Risk Management, and Investor Relations.

He’s been with Wolters Kluwer since 2003.

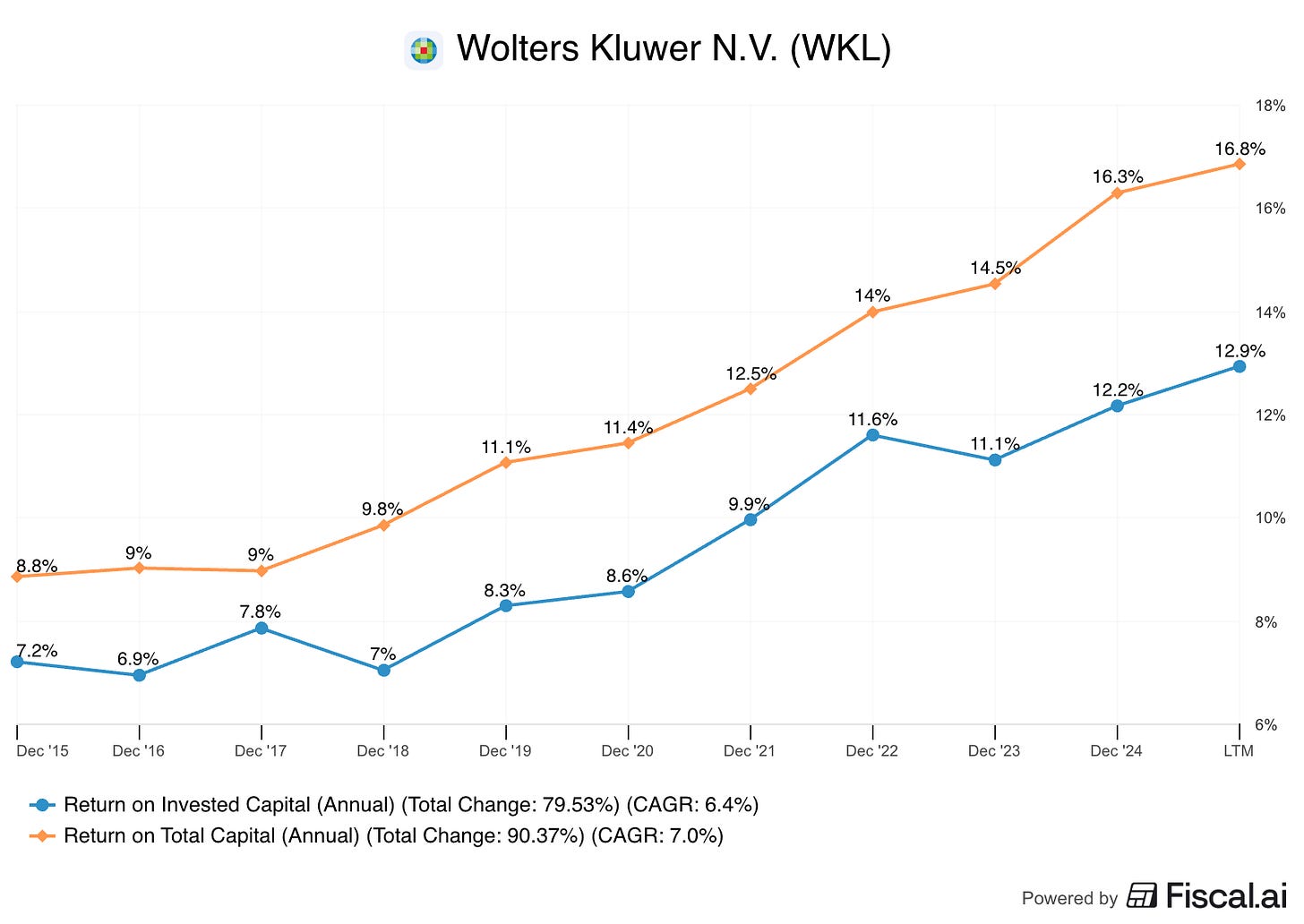

The management team has delivered high, and increasing returns on capital.

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

Wolters Kluwer has been increasing the dividend since 2016, giving them 9 years of growth at this point.

The company has grown its dividend by 14% per year (!) over the last 5 years.

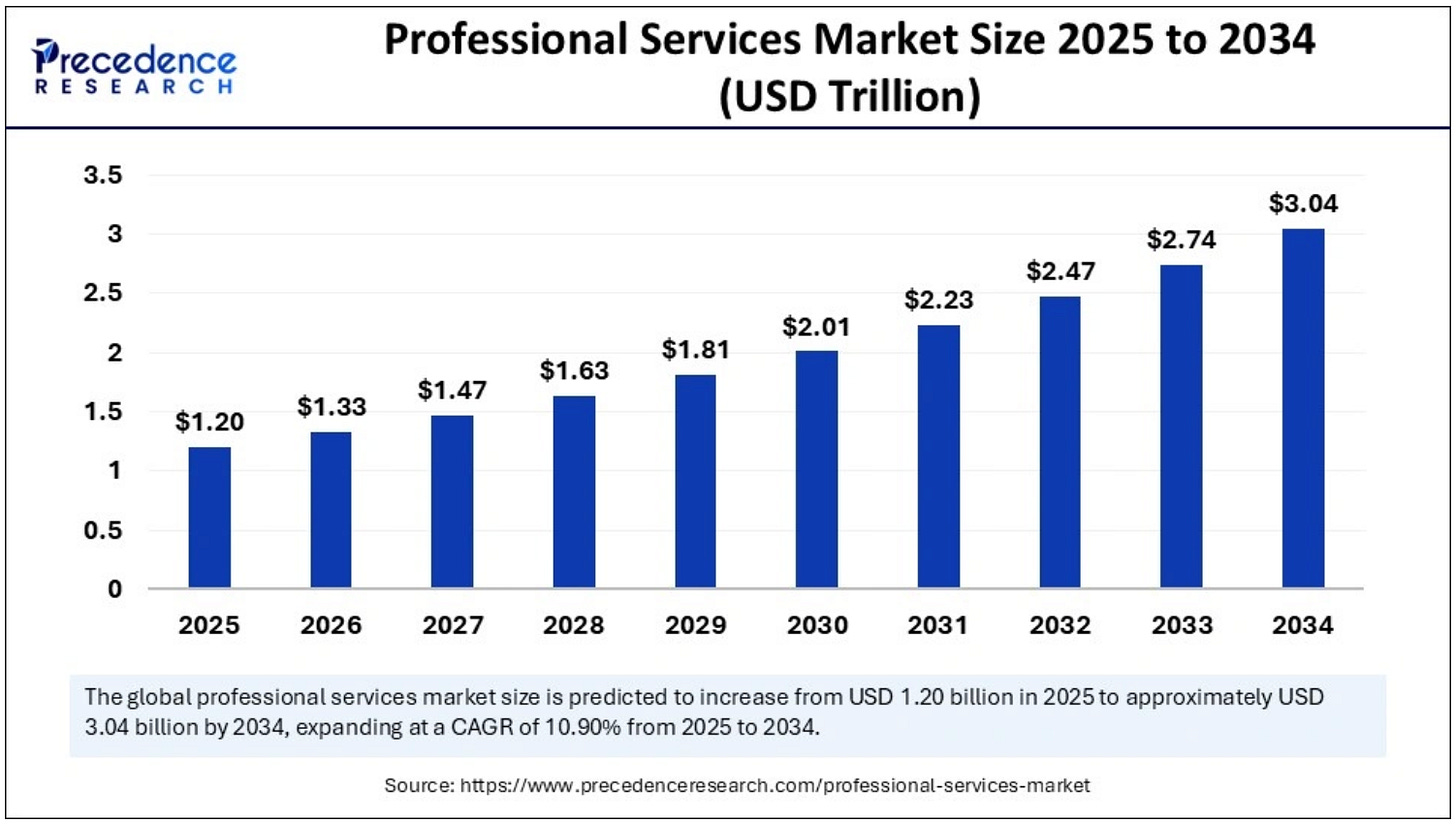

4. Is the company active in an attractive end market?

Wolters Kluwer is part of the professional services market which is expected to grow at 5% to 10% per year for the next decade.

This is a large and broad market.

Wolters Kluwer participates in very attractive submarkets with consistent secular tailwinds:

Regulatory Complexity: Laws, regulations, and compliance requirements are constantly changing, especially in finance, healthcare, and tax. This increases demand for WKL’s compliance software and updated expert content, that helps professionals navigate the complexity.

Digital Transformation: The ongoing digitization of professional workflows drives demand for WKL’s cloud-based software and digital information solutions. This trend fuels organic growth, particularly in recurring cloud software revenues, which grew 15% organically in H1 2025.

Professional Shortages: The shortage of professionals across sectors (e.g., accounting, healthcare) pushes firms and institutions to invest in productivity-enhancing tools like WKL’s AI-enabled software.

Data & AI Adoption: WKL is embedding AI features like summarization, Q&A, and virtual assistants into its platforms, supporting subscription renewals and attracting new customers.

5. What are the main risks for the company?

All companies face risk.

The main ones around Wolters Kluwer center on its ability to maintain the value of its proprietary content.

Disruption Risk (Generative AI)

The emergence of powerful Generative AI models could threaten the premium value of WKL’s digital information if that information can be easily synthesized and distributed by a competitor or a general-purpose model. This is the most significant long-term threat.

Economic and Cyclical Risk

While the large subscription base is resilient, non-recurring, transactional revenues are sensitive to economic downturns and interest rate fluctuations.

Integration Risk (Acquisitions)

Wolters Kluwer relies heavily on M&A (spending €833 million in the first half o 2025) to expand into high-growth adjacent markets. Poor integration of acquired technologies or teams could waste capital.

6. Does the company have a healthy balance sheet?

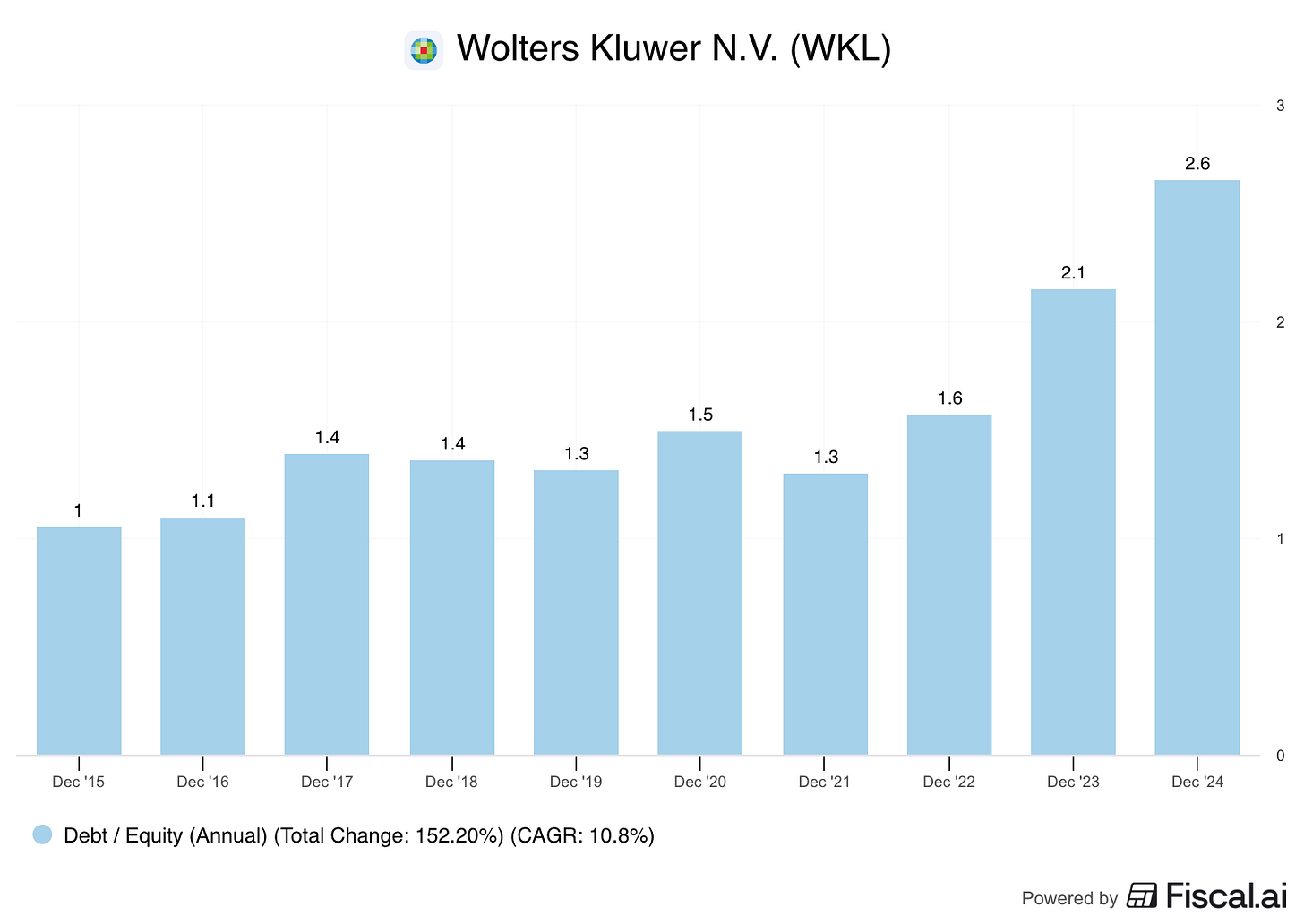

We like a Debt/Equity ratio < 50%.

Wolters Kluwer has a Debt/Equity ratio of 2.6 that’s been rising.

But this is where we hit the end of the free preview.

And the good stuff —

the deep-dive financials…

the valuation work…

and our final verdict on Wolters Kluwer…

…is waiting behind the paywall.

Because some insights are too valuable to give away.

If you want to be first in line the next time a limited number of Compounding Dividends subscriptions open at a discount…

Add your name to the waiting list here: 👉 Join the Waiting List

No pressure.

No payment.

Just a spot in line.

And you’ll be notified the moment doors open again.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data