💸 Stop Comparing SCHD to the S&P 500

If you’ve been looking at SCHD lately and feeling disappointed that it hasn’t kept up with the S&P 500, you’re not alone.

Social media is full of posts like this - charts comparing price performance, hot takes about “underperformance,” and calls to dump SCHD for an S&P index fund.

But here’s the truth:

If you’re comparing SCHD’s price chart to the S&P 500’s, you’re asking the wrong question.

Different Goals, Different Metrics

The S&P 500 (and the funds that track it — SPY, VOO, etc.) exist for one main purpose:

Capital appreciation.

Their goal is to match the total return of the U.S. stock market.

So naturally, when you analyze them, you look at metrics like:

Earnings growth - what’s driving long-term returns

Valuation (P/E ratio) - how much investors are willing to pay for those earnings

Total return - price appreciation + dividends

But SCHD’s mission is entirely different.

Its goal isn’t price growth. It’s reliable, growing income.

So when you measure SCHD’s success, you need to use a different scorecard:

Dividend yield - how much income your money earns now

Dividend growth rate - how fast that income grows over time

Payout consistency - whether it keeps rising through good and bad markets

A Tale of Two Markets

Let’s look at how different these funds really are.

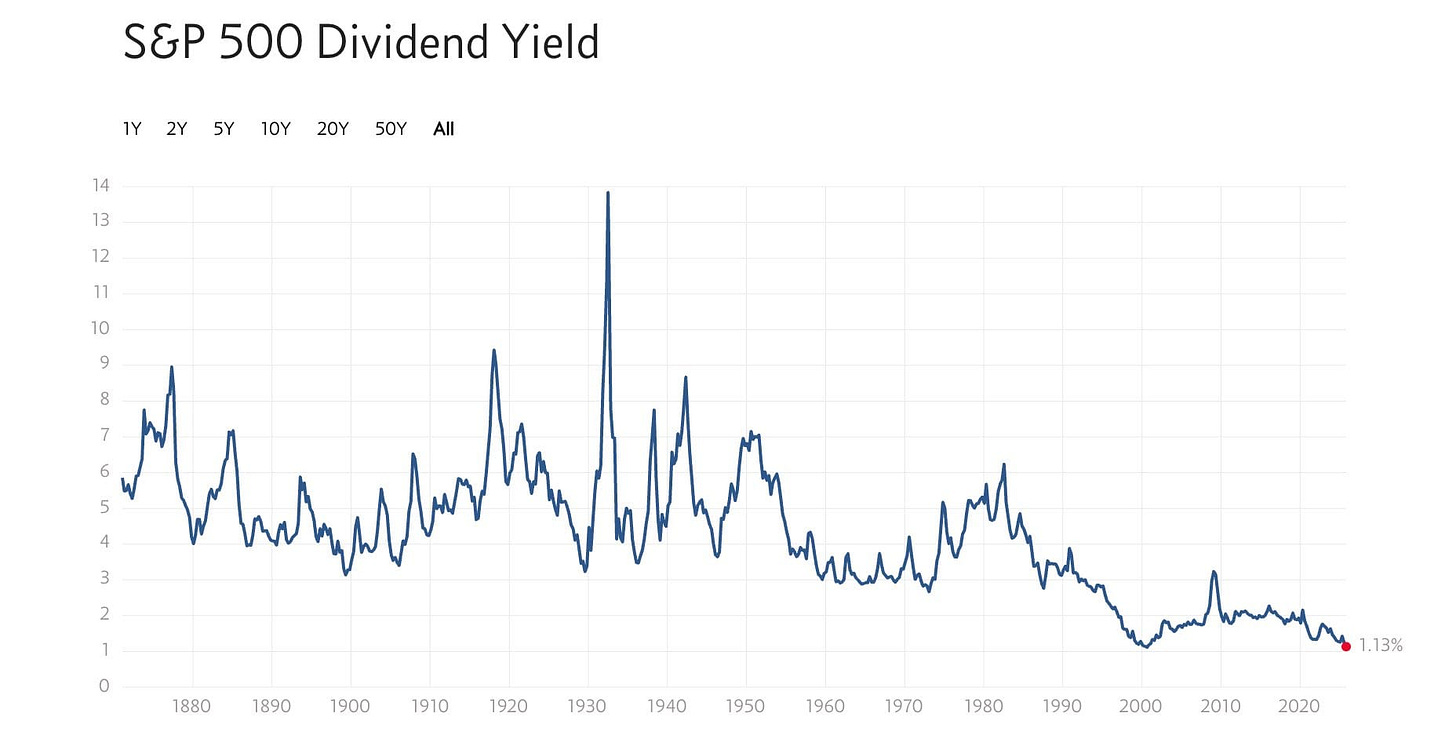

The S&P 500’s dividend yield has been shrinking for decades - down to around 1.1%, one of its lowest levels ever.

SCHD, on the other hand, typically yields between 3% and 4% - roughly 3x more income per dollar invested.

So if you’re an income-focused investor, SCHD plays the same game you do.

It’s also worth noting how differently the two are priced.

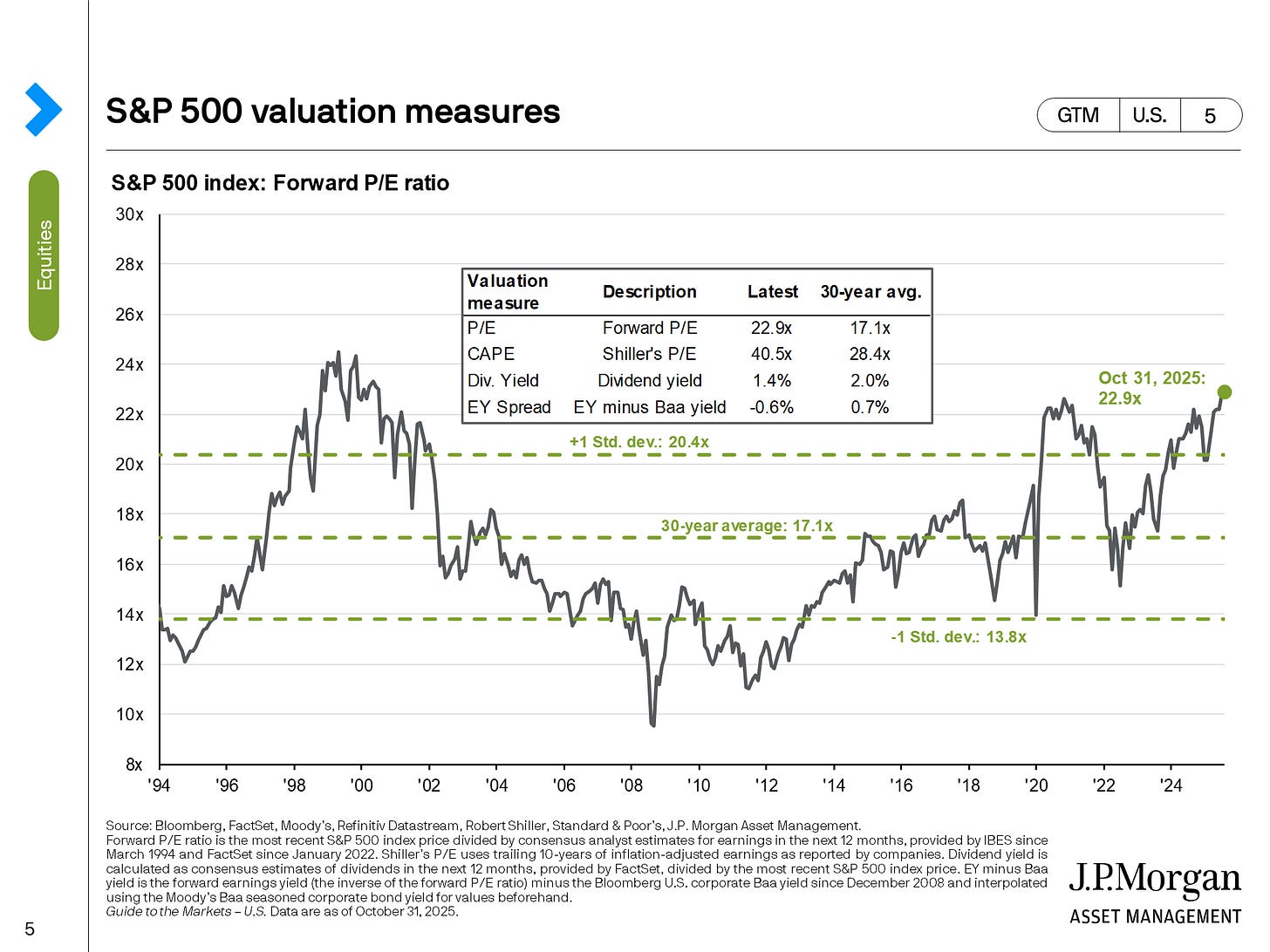

The S&P 500’s forward P/E ratio is sitting above its long-term average, meaning investors are paying a premium for every dollar of earnings.

SCHD’s holdings, by contrast, are much cheaper.

That doesn’t mean SCHD will outperform in price, but it does mean you’re buying more future income at a lower price.

The Mag 7:

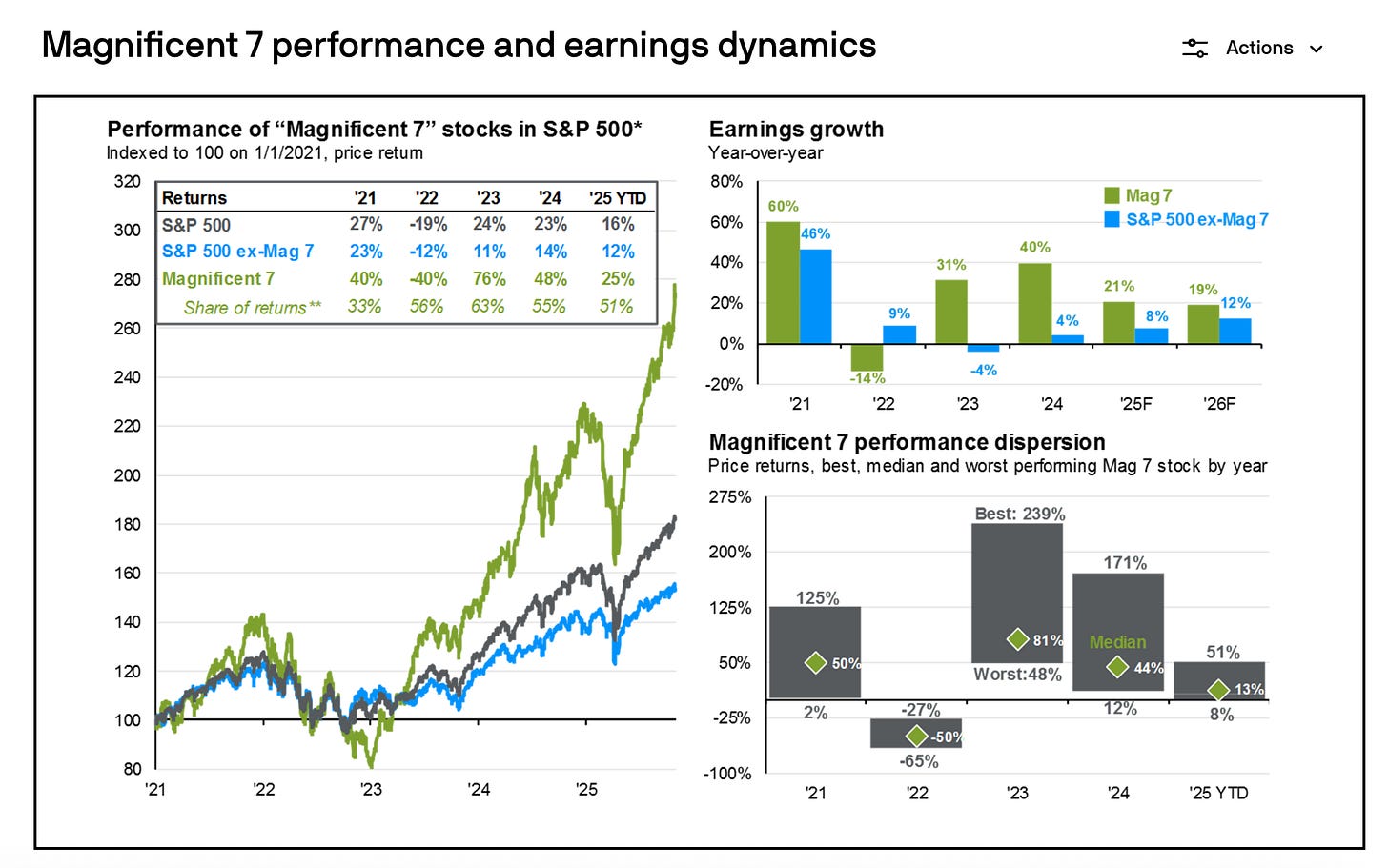

One reason the S&P 500 has pulled ahead in recent years comes down to seven stocks:

Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla.

Those “Magnificent 7” companies have driven almost all of the S&P’s earnings growth. Without them, the index’s performance looks a lot weaker.

SCHD owns none of them.

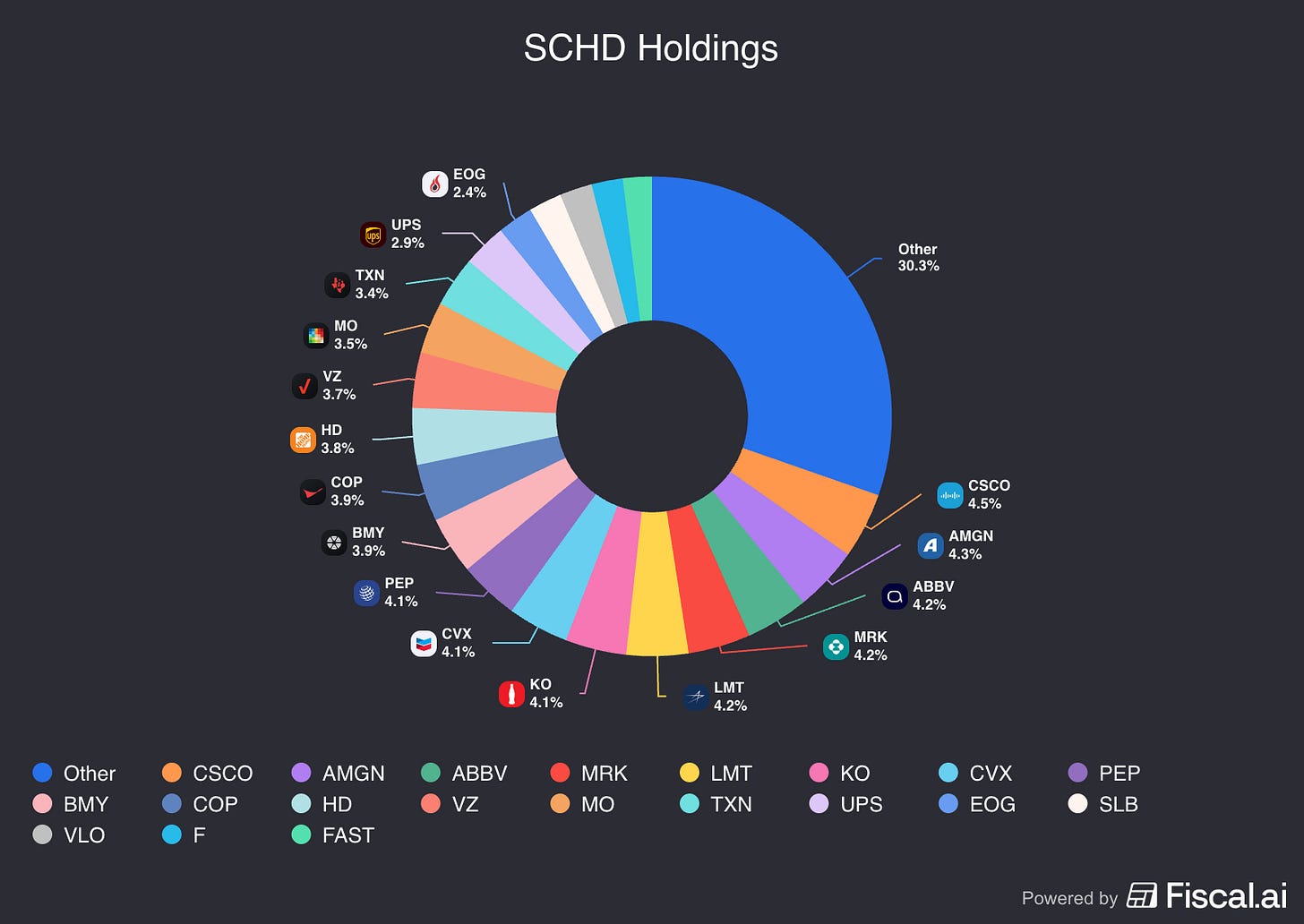

Instead, it owns companies like

Cisco, Amgen, Merck, Pepsi, and Coca-Cola, steady businesses with consistent cash flows and reliable dividends.

So expecting SCHD to “keep up” with the S&P 500, when they own entirely different kinds of companies, totally misses the point.

It’s like comparing a pickup truck to a sports car because they both have four wheels.

Buybacks vs. Dividends

Another difference: how companies return cash to shareholders.

S&P 500 companies are spending record amounts on share buybacks, often when valuations are sky-high.

SCHD’s holdings, on the other hand, prioritize dividends - direct, tangible cash flow to investors.

The Right Scorecard for SCHD

Once you understand what SCHD is for, the long-term success story becomes clear.

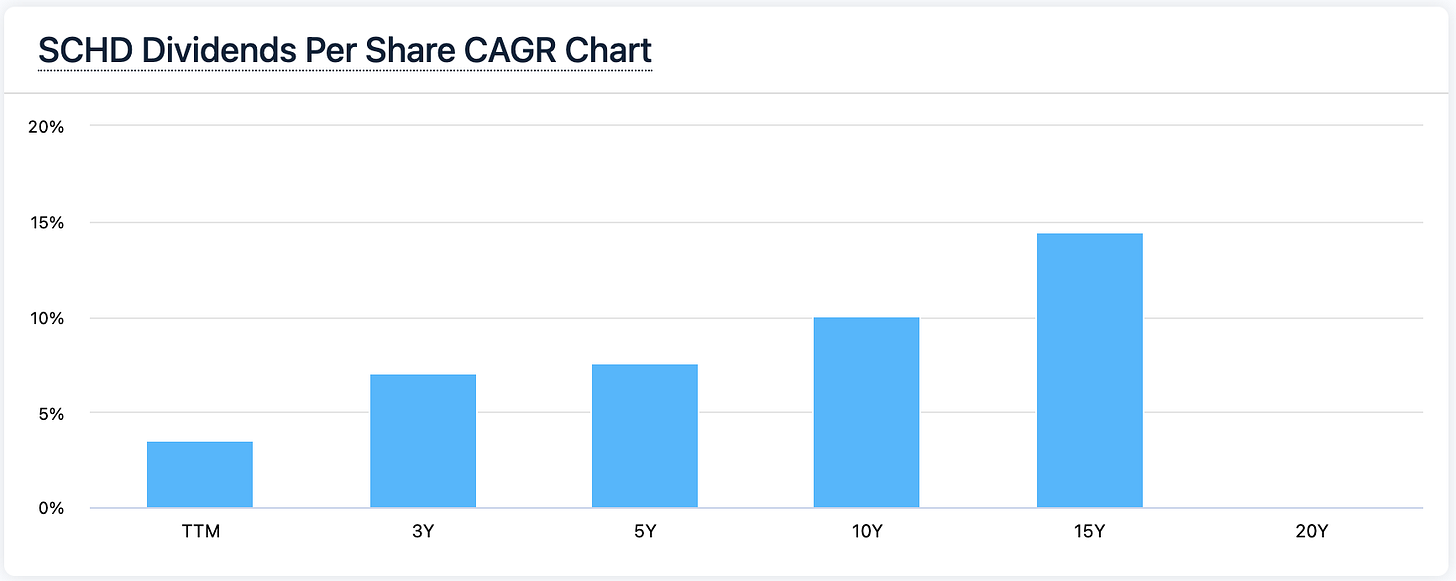

The dividend per share has grown every single year since launch:

3-year growth rate: 5%+

10-year growth rate: ~10%

15-year growth rate: nearly 15%

That means SCHD’s income is doubling roughly every 5 years, using the Rule of 72.

Price charts won’t show that. But your bank account will.

The Bottom Line

Comparing SCHD’s price to the S&P 500’s is like comparing a rental property to a growth stock.

Both can make you money, but in totally different ways.

The S&P 500 is a market growth vehicle. It lives and dies by earnings multiples and investor sentiment.

SCHD is an income compounding machine. It lives and dies by the cash flow of real, dividend-paying businesses.

If your goal is growing capital, own the S&P 500.

If your goal is growing income, own SCHD.

And if you want balance, you can own both.

Just don’t confuse which scorecard you should use for each one.

Final Thought

During bull markets, it’s easy to be tempted by rising price charts.

But if you’re investing for dividends, remember: your paycheck matters more than what the market will pay for the stock.

SCHD isn’t supposed to win the race on price.

It’s supposed to win the race on income stability, consistency, and compounding.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.