💸 Stop worrying about Venezuela and start owning businesses

How to know which headlines matter

On Saturday, the United States went into Venezuela, captured President Nicolás Maduro, and flew him out of the country.

Now, it seems that the U.S. intends to ‘run Venezuela’ for a while.

How will markets react, and what does this mean for your investments?

How Will Markets React?

It’s Monday morning and a lot of investors are checking the global markets that are already open.

They’re looking at the S&P and NASDAQ futures, trying to predict how markets will react to the news.

My 2¢?

I have no idea how markets will react, and I don’t care.

A Huge Advantage

This is one of the biggest reasons I invest the way that I do.

And I think it’s a massive advantage to be able to ignore the market, and stock prices.

I’m not invested in ‘the market’, so I don’t have to worry about what it’s doing.

I own businesses, most of which will feel very little to no effect from what’s going on in Venezuela.

Let’s talk about the difference.

Investing In The Market

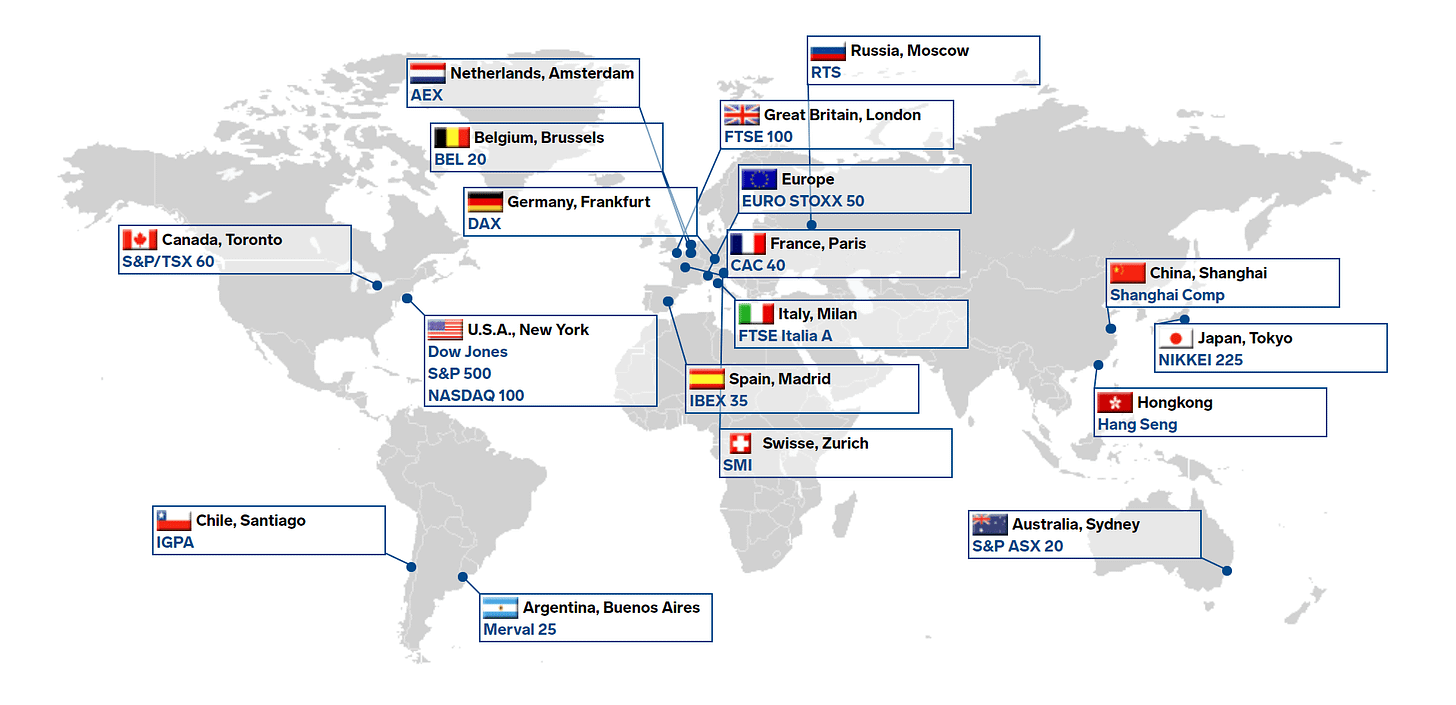

Investors who buy the NASDAQ index own 100 companies.

Those who own the S&P 500 own 503 (despite the name).

The STOXX 600 has - you guessed it - 600 companies.

When you own that many companies, it’s impossible to understand all of them.

This forces you to stop thinking about businesses and start thinking about the market.

When you detach from real businesses, it becomes a lot harder to be rational.

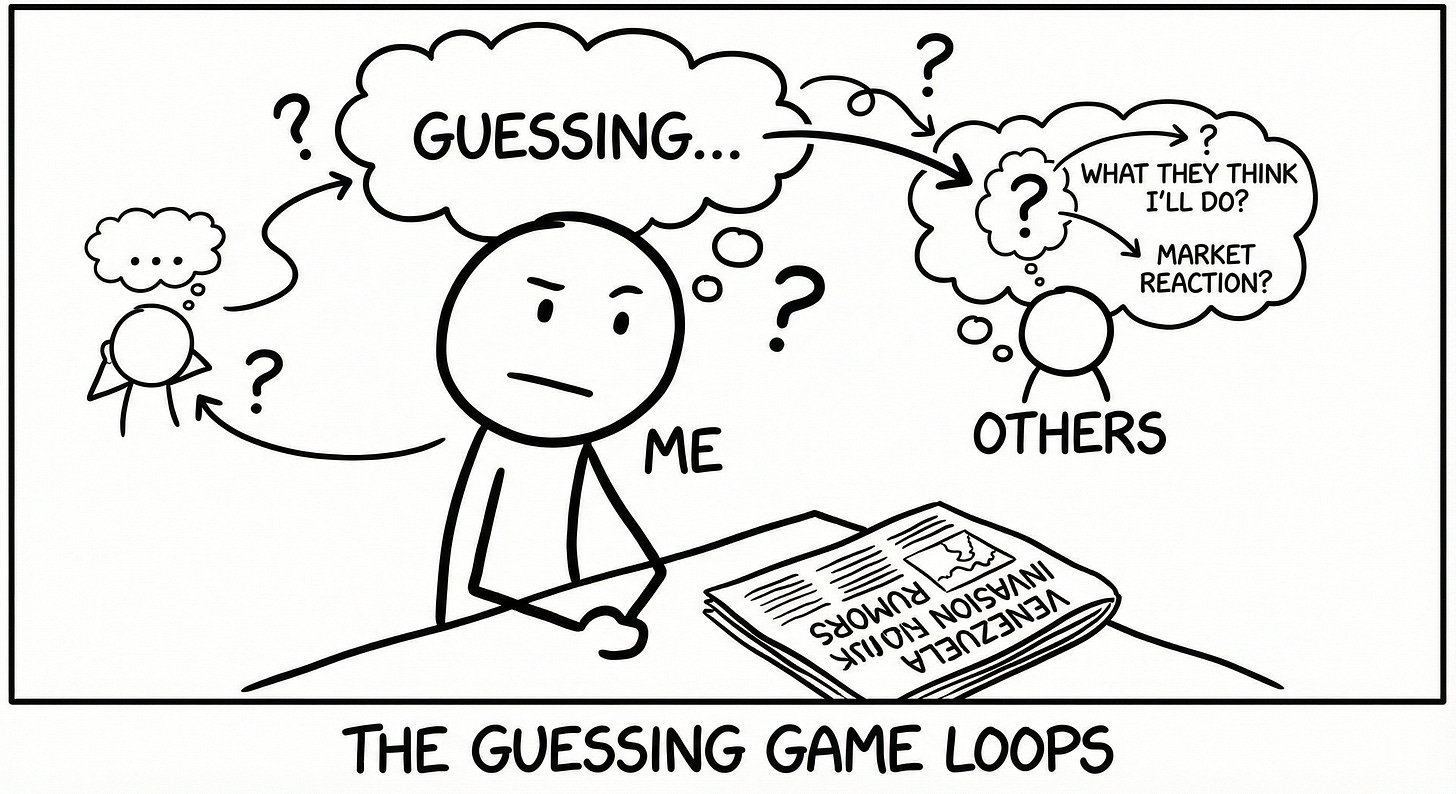

You can’t analyze facts, so you wind up guessing and speculating about what other people will think, and what that will do to the market.

From there it’s really easy to start going more than one level deep.

To guess what other people think that you think that they’ll think about what the Venezuela invasion will do to the market.

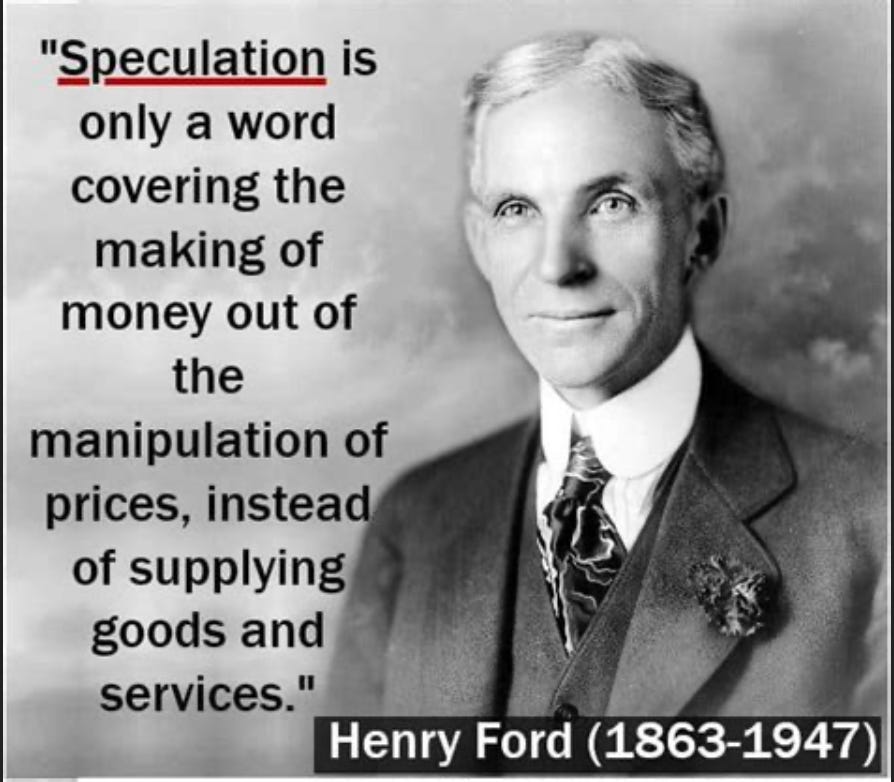

You end up speculating on the price of a ticker symbol instead of thinking about the value of an asset.

When the market drops, you have no logic to lean on, making it almost impossible to stay rational.

And it can spiral out of control very quickly.

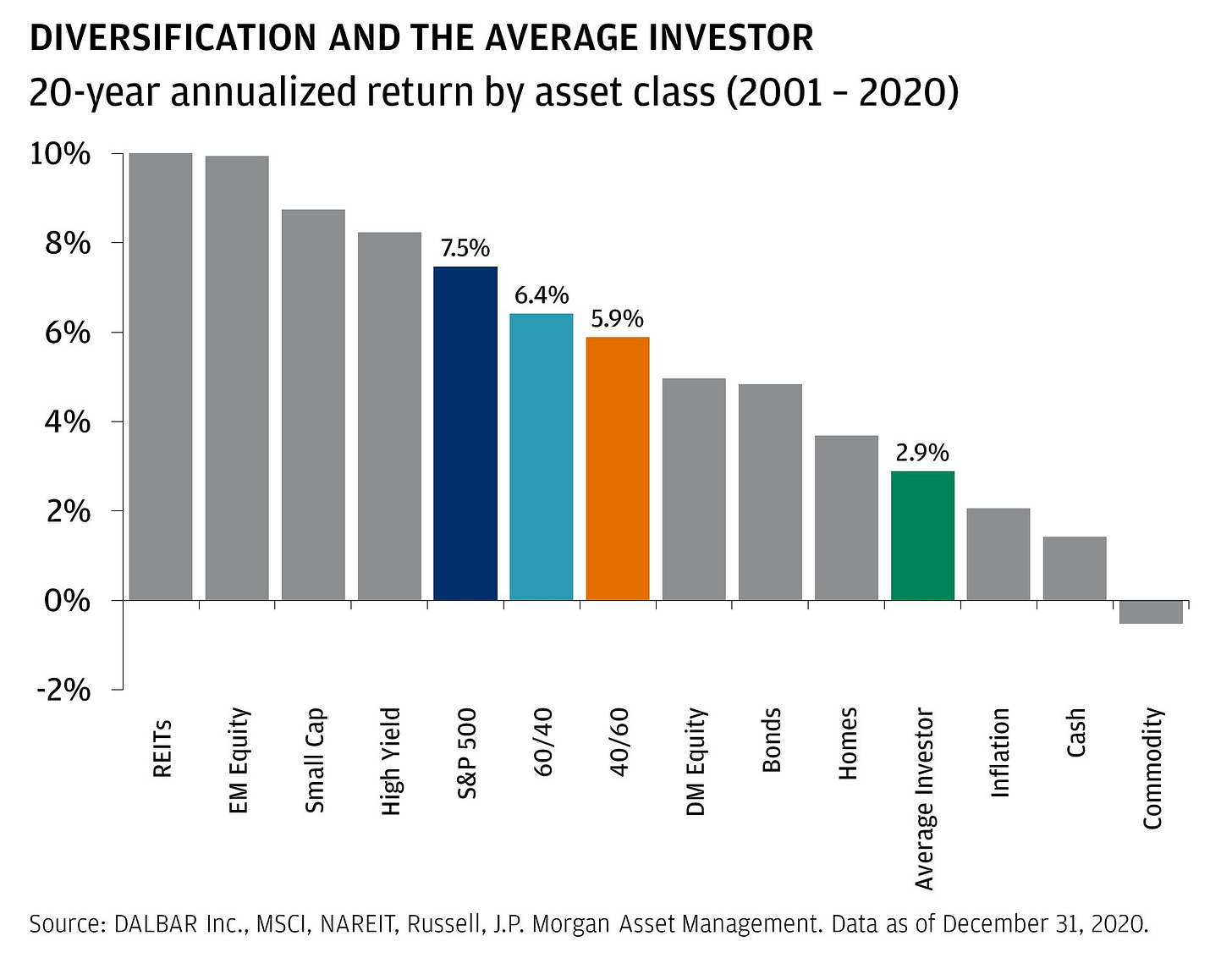

Of course, if you can just ignore it all and stay invested over the long term, things usually work out fine.

But the performance data of the average investor vs the indexes tells us that most people have a very hard time doing this.

Owning Businesses

As investors, we don’t own the market, we own pieces of specific businesses.

We understand what these companies actually do.

And we don’t care about the price of the businesses today, or next week.

We care about how much money the business is going to make this year, next year, and 5 years from now.

Prices jump around based on headlines and market sentiment, but actual business results usually change very slowly.

Focusing on the business results makes it much easier to be rational.

Let’s look at an example.

Coca-Cola

In honor of his recent retirement, we’ll start with a Warren Buffett favorite.

Coca-Cola does business all over the world.

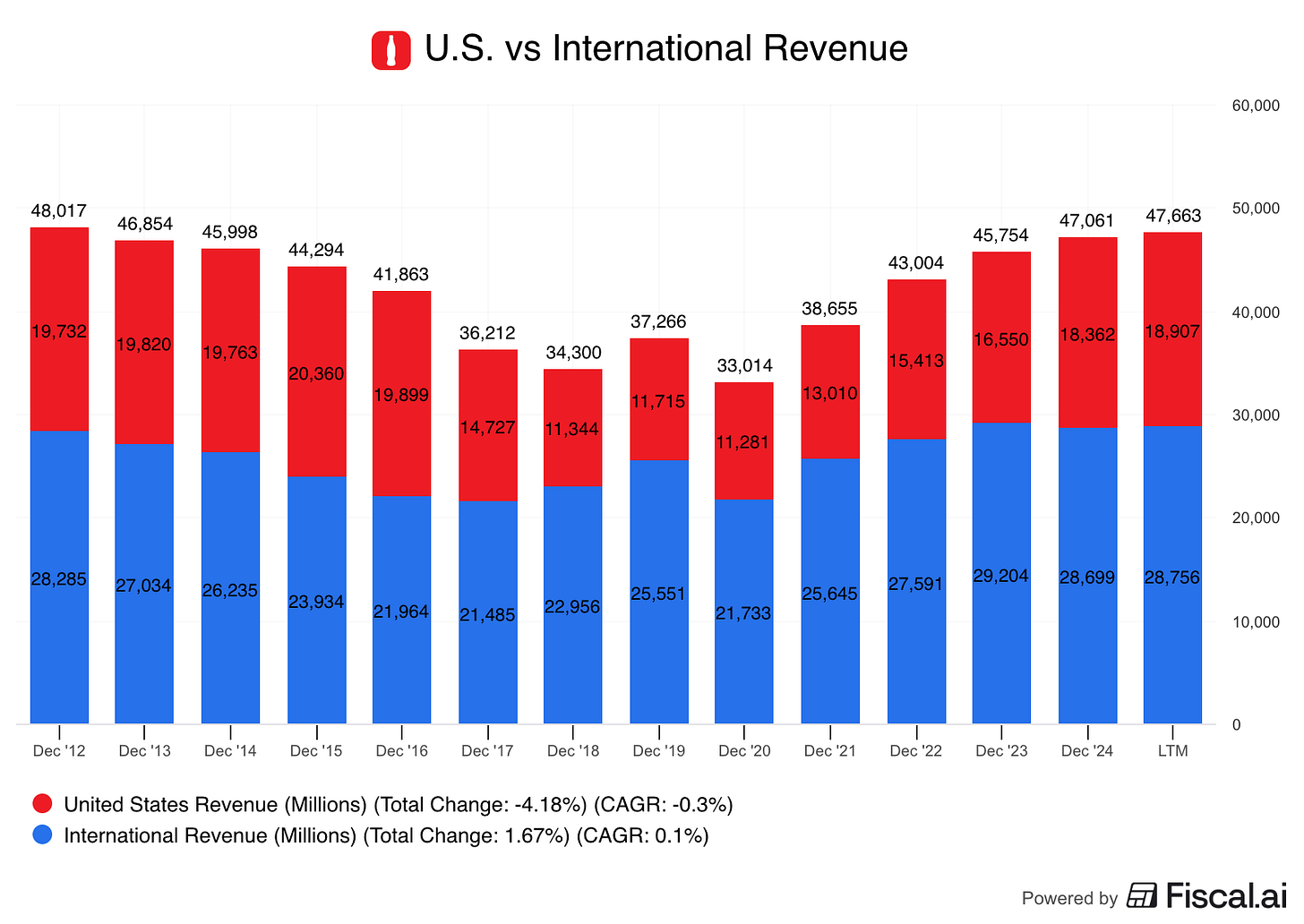

In fact, most of its revenue comes from outside the U.S.

But only about 13% of the total comes from Latin America.

How much comes from Venezuela?

Unfortunately Coke doesn’t break it down that far, but we can guess.

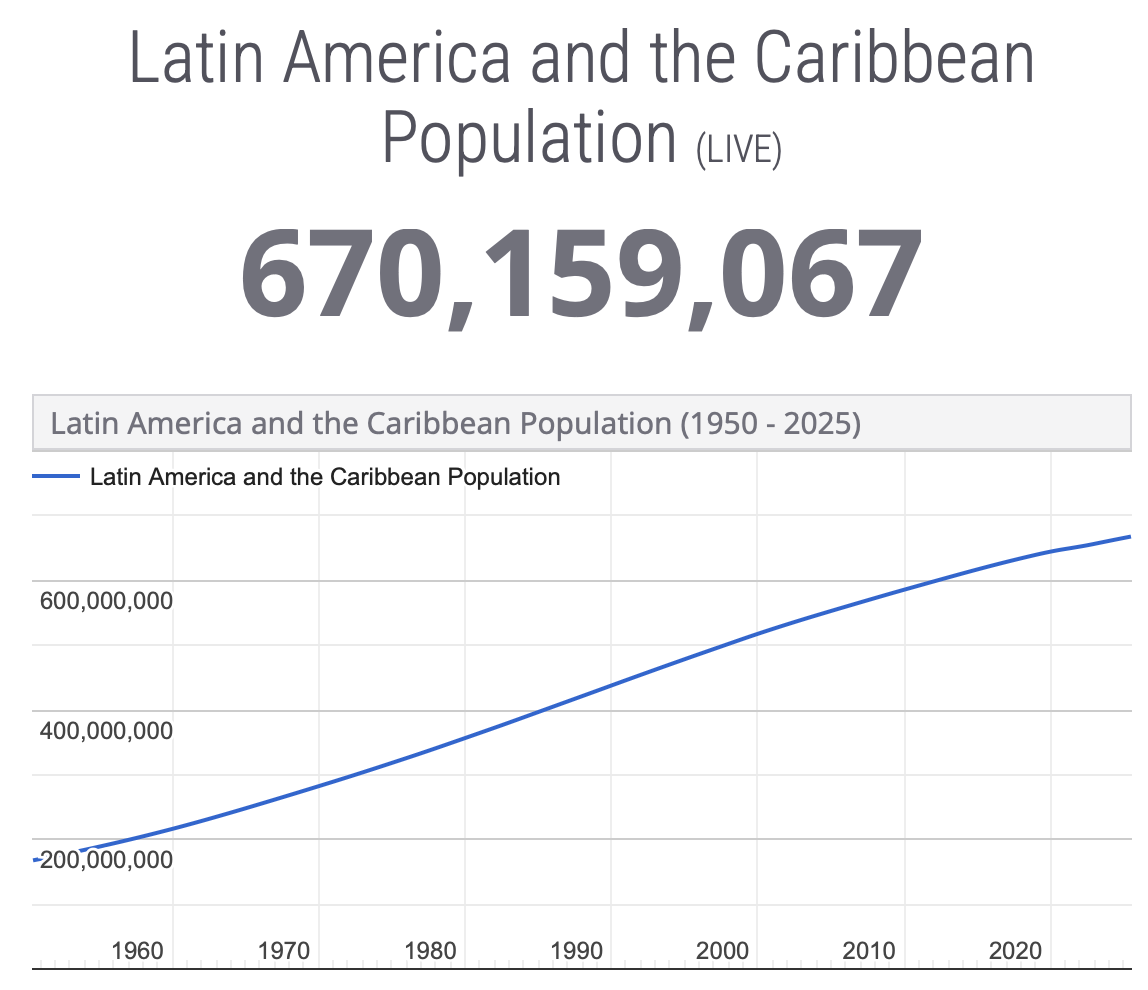

Latin America has about 670 million people.

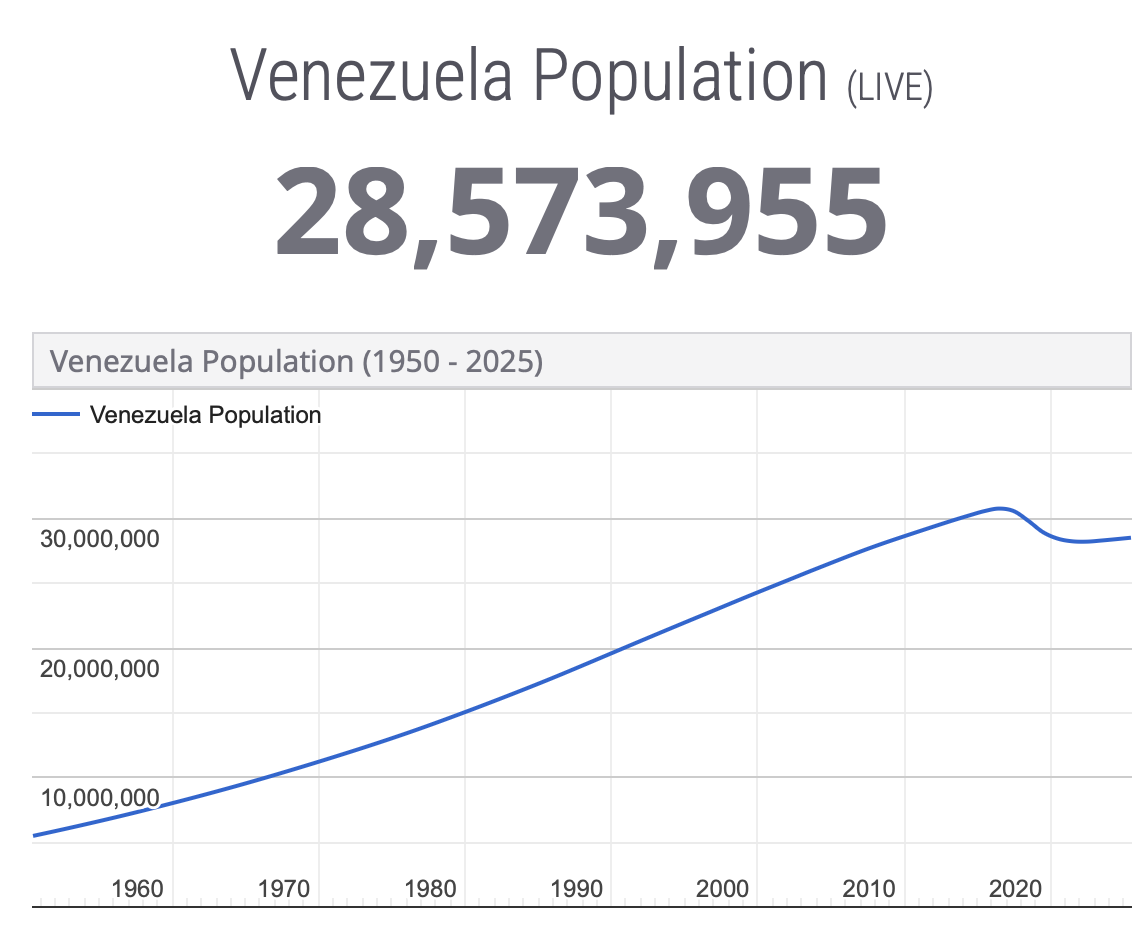

Venezuela has about 28.5 million.

Assuming Coke sales are evenly distributed across Latin America (they’re not), that means about 5% of Coke’s Latin American revenue comes from Venezuela.

In truth, it’s probably smaller.

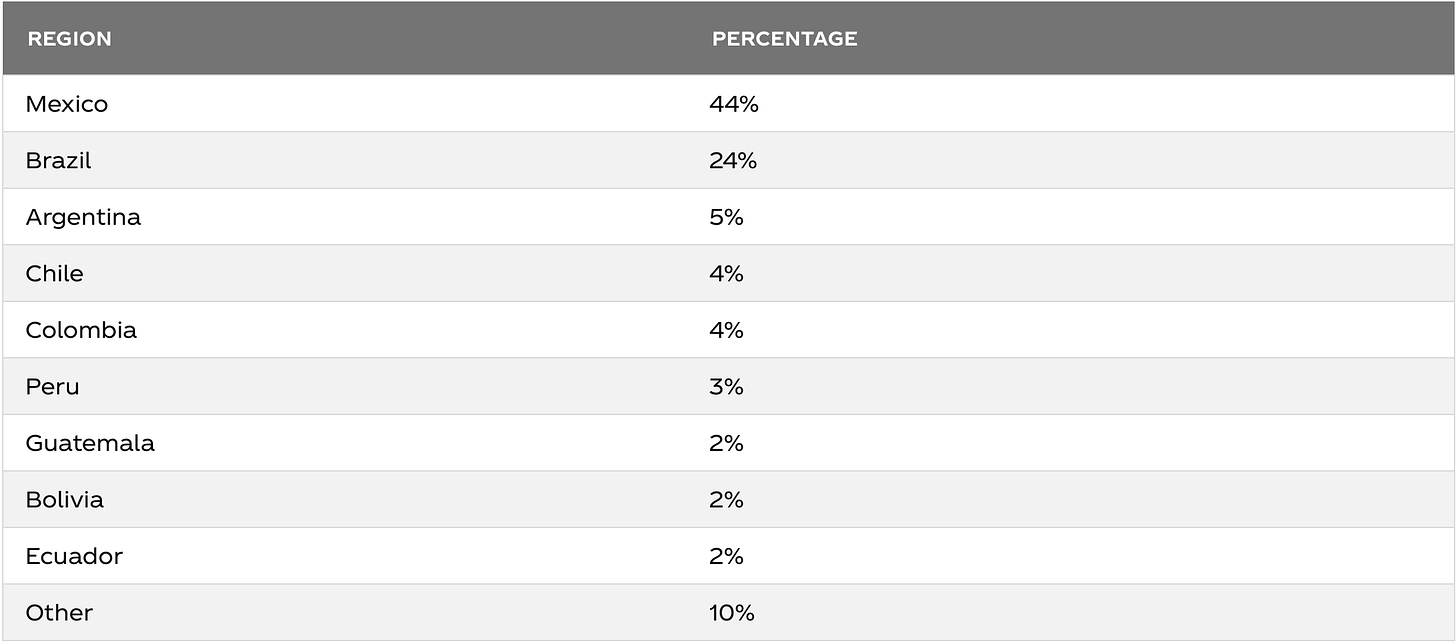

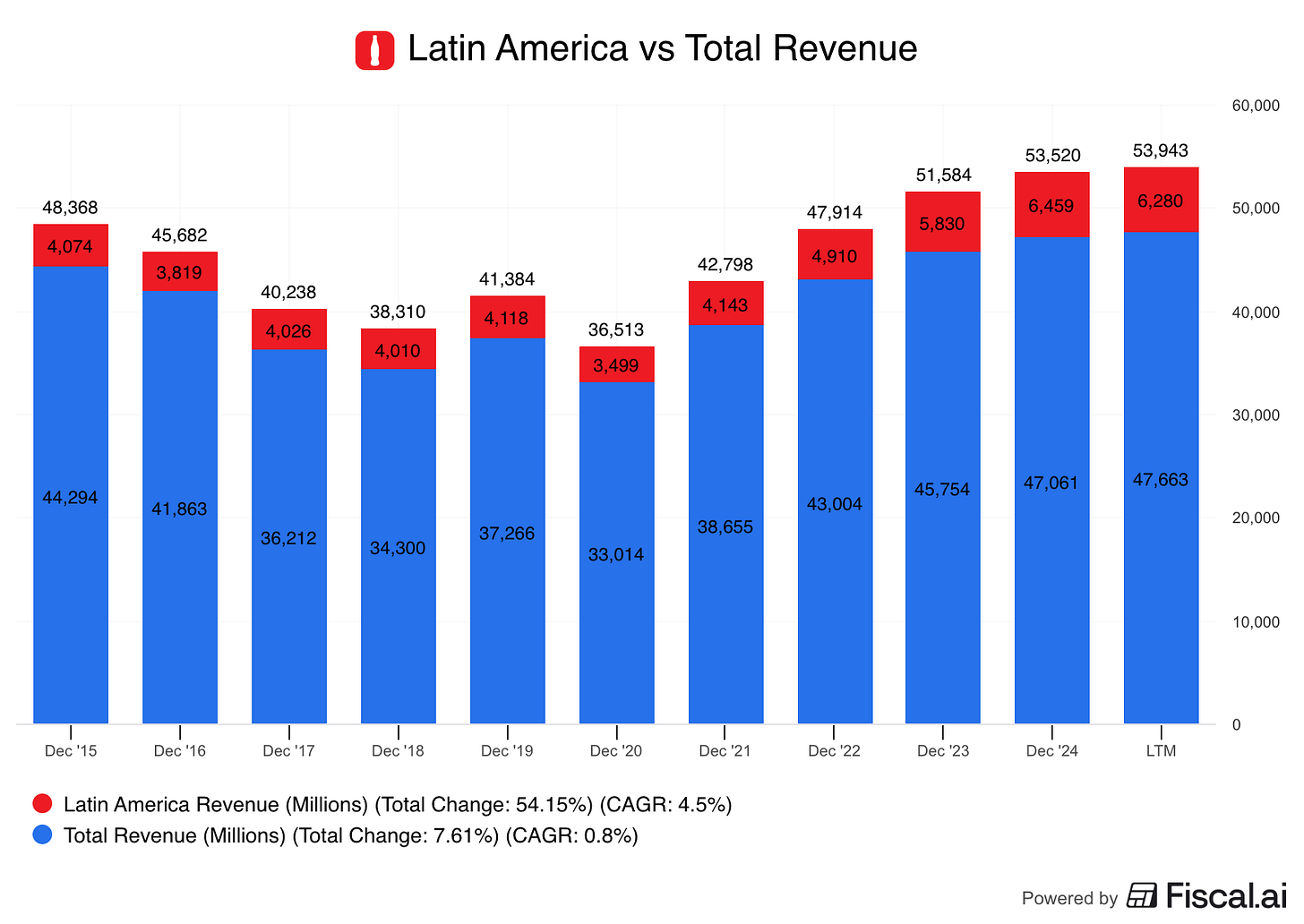

Here’s how Coca-Cola breaks down their Latin American revenue.

Venezuela would fall into the ‘Other’ category, and our 5% estimate would take up half.

So it’s very likely that we’re high.

But let’s be conservative and say that Venezuelans completely stop drinking Coke this year, and that they do make up 5% of Latin American revenue.

How much will that cost Coke?

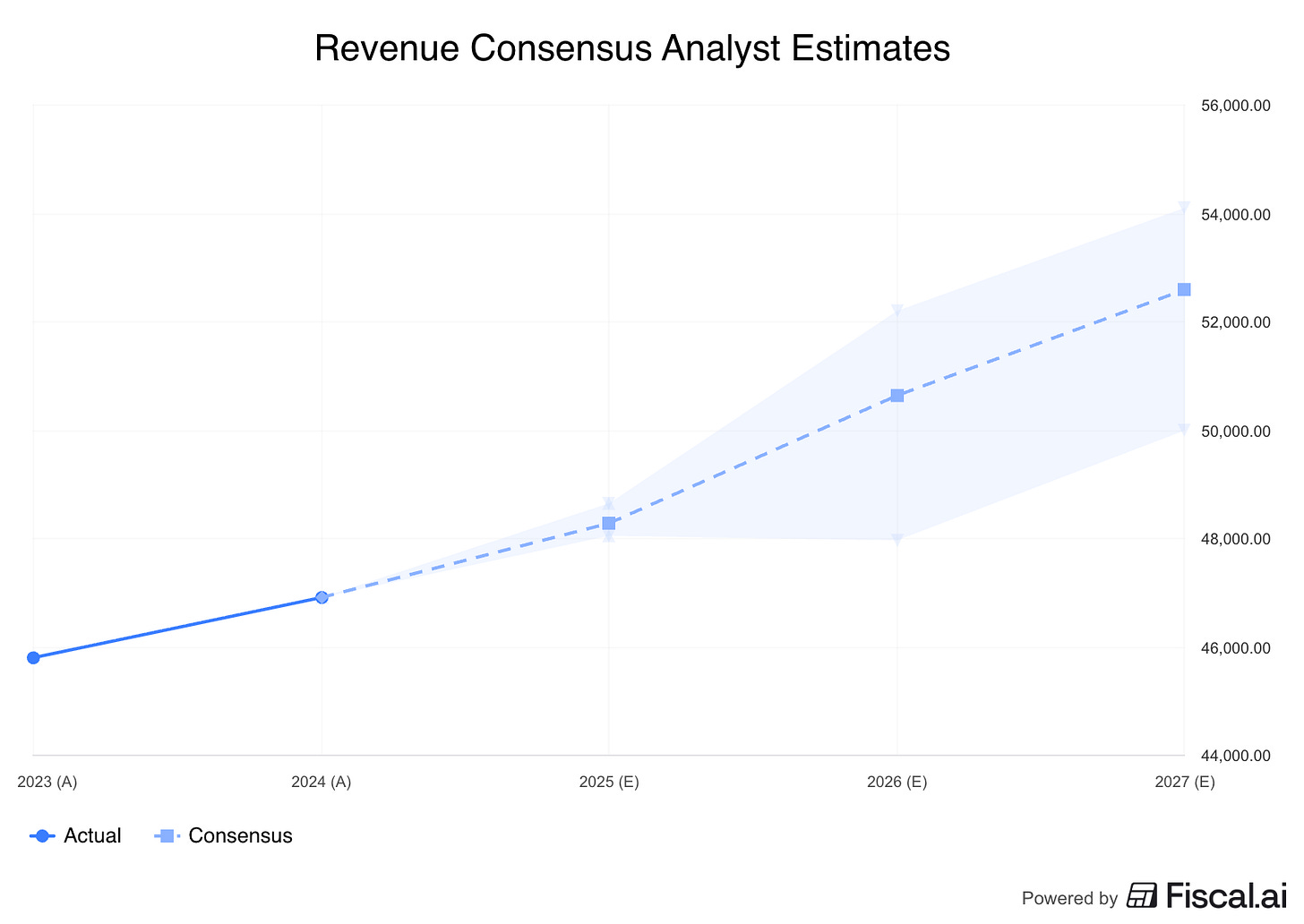

The consensus estimate for Coke’s 2026 revenue is $50.6 billion.

Latin America will be about 13% of that, or $6.5 billion.

Venezuela will be 5% of that, or $325 million.

Which comes out to 0.6% of Coke’s total 2026 revenue.

If you’re invested in Coca-Cola, are you worried about the Venezuela situation anymore?

I wouldn’t be.

We can do the same exercise with lots of different businesses.

How much less pizza will Domino’s sell because Venezuela was invaded?

How will cigarette sales for tobacco companies be effected?

Will it affect Texas Instruments chip sales?

Will Unilever sell less lotion or soap?

See the difference?

One makes you a speculator, guessing how humans will react to news.

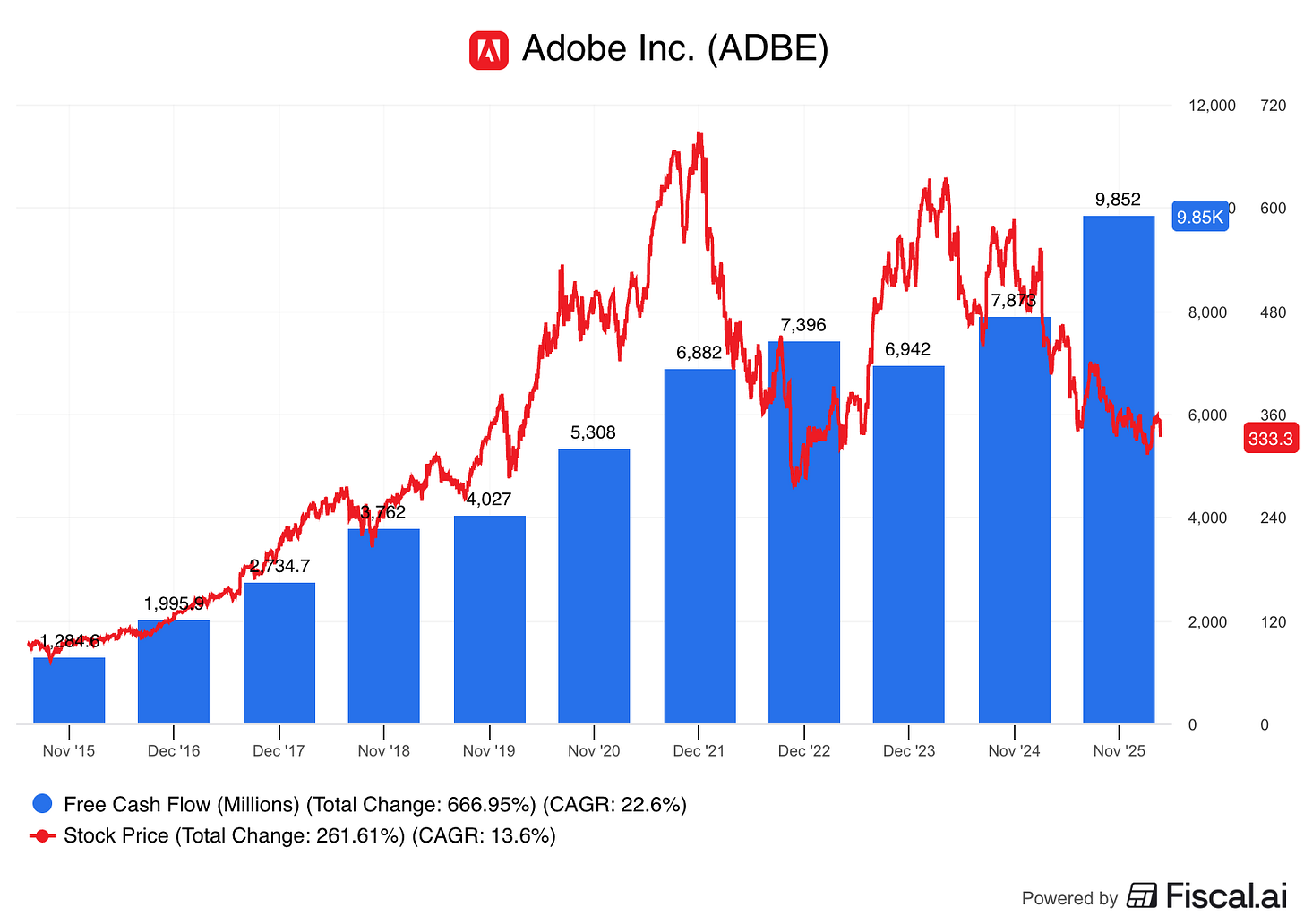

The other makes you a business owner, focused on cash flow.

We choose the latter.

And when you buy great, stable businesses like we do, their cash flows don't change all that much.

It may seem boring, but we sleep better because we know exactly what we own.

One Dividend At A Time,

-TJ

P.S…

We will have a limited number of discounted memberships that will reopen later in 2026.

If you want your name on the list, so you get notified before anyone else,

you can do that here:

You’ll also get a copy of my 10 favorite cannibal stocks when you do.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data