💸 This Company Owns 80,000 Homes

And it pays a dividend...

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

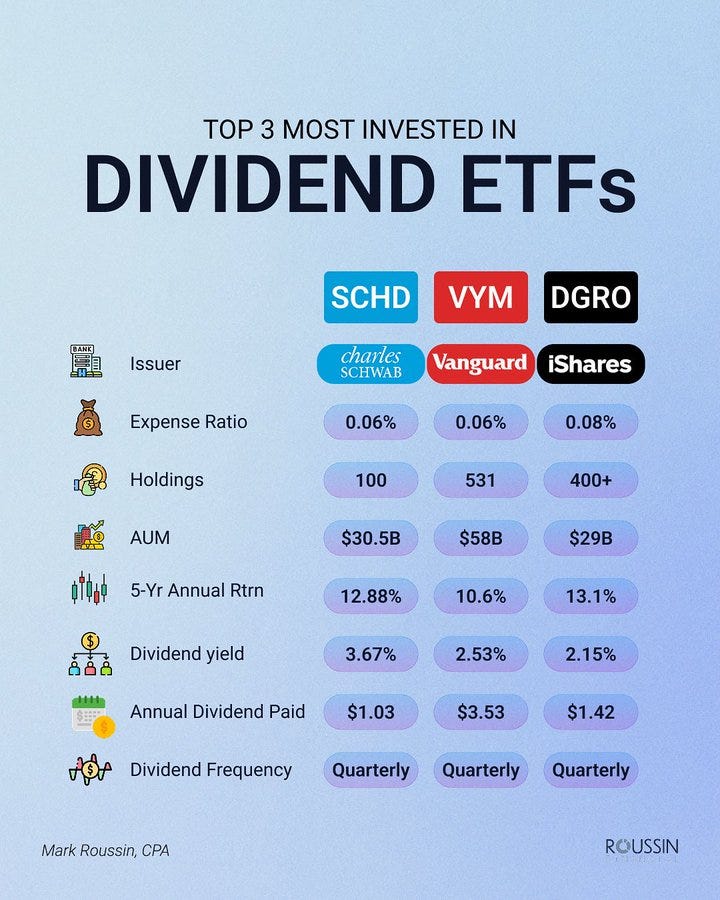

1️⃣ The 3 Biggest Dividend ETFs

ETFs are one of the easiest ways to invest in dividend paying companies.

Here are some of the essential stats of the 3 biggest ones in the U.S.

Together, they represent more than $125 Billion.

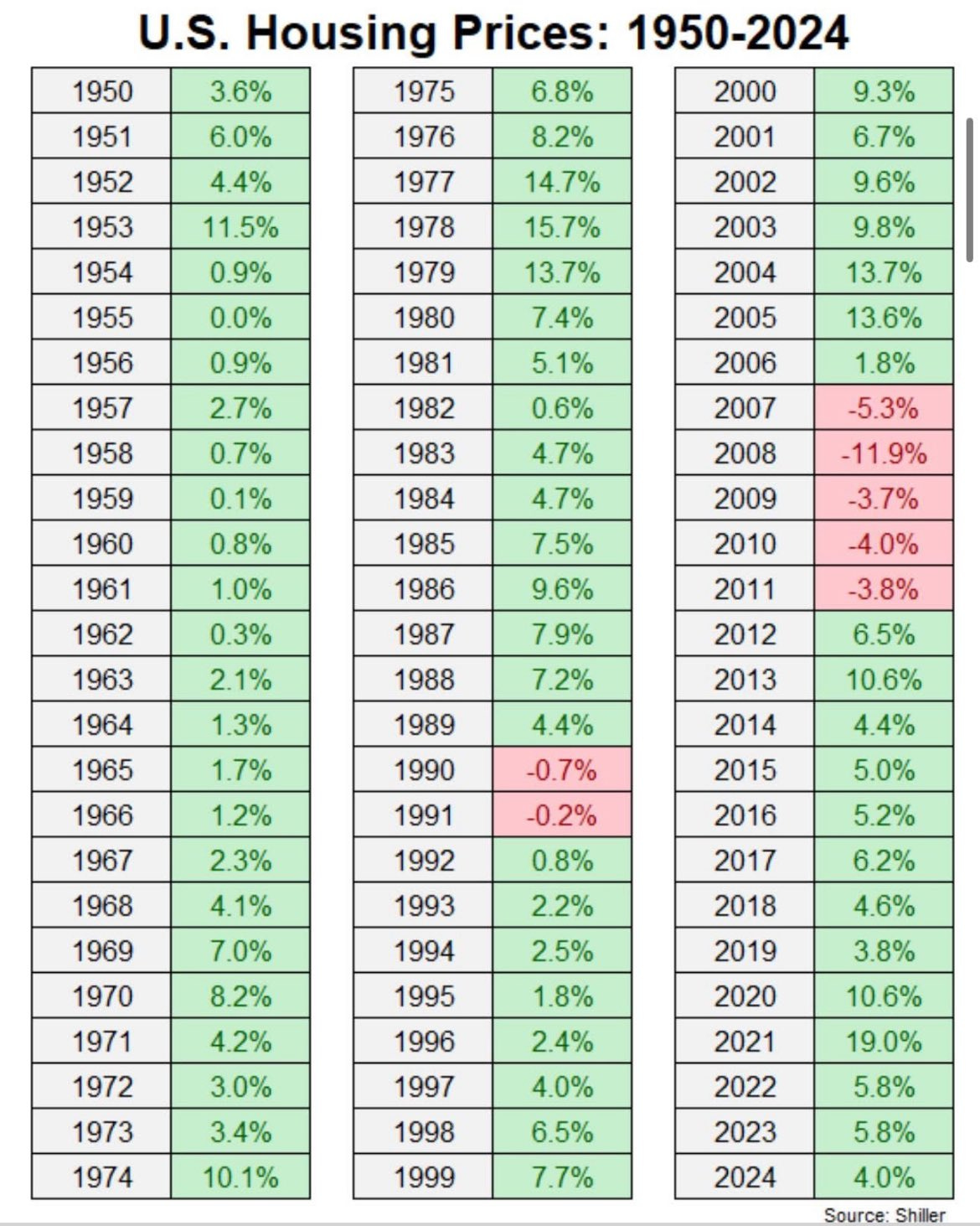

2️⃣ Housing Prices Outpace Inflation

Last week we showed you that real estate prices tend to increase with inflation.

Here’s U.S. how much U.S. housing prices went up each year from 1950 to 2024.

The main periods of inflation other than the post-pandemic period included in the chart are the 1970’s and 1980’s.

3️⃣ An Investing Quote

When you look for dividend payers, remember to look for a yield the business can deliver, not the one you want.

The goal isn’t the highest income possible today, it’s a sustainable and growing one long into the future.

Benjamin Graham put it this way:

“It is an axiom of investment that securities should be purchased because the buyer believes in their soundness, and not because he needs a certain income.”

-Benjamin Graham

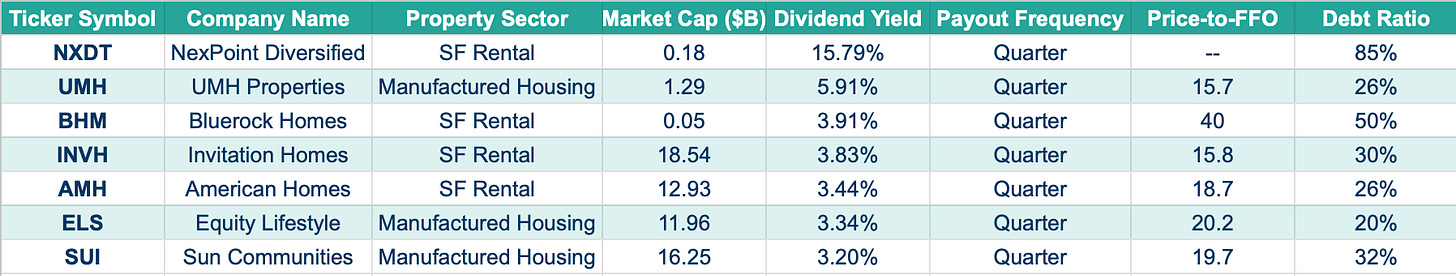

4️⃣ Housing REITs

Apartment REITs are popular, but they’re not the only way to invest in the U.S. housing market.

Here are REITs that own single family homes, or manufactured homes.

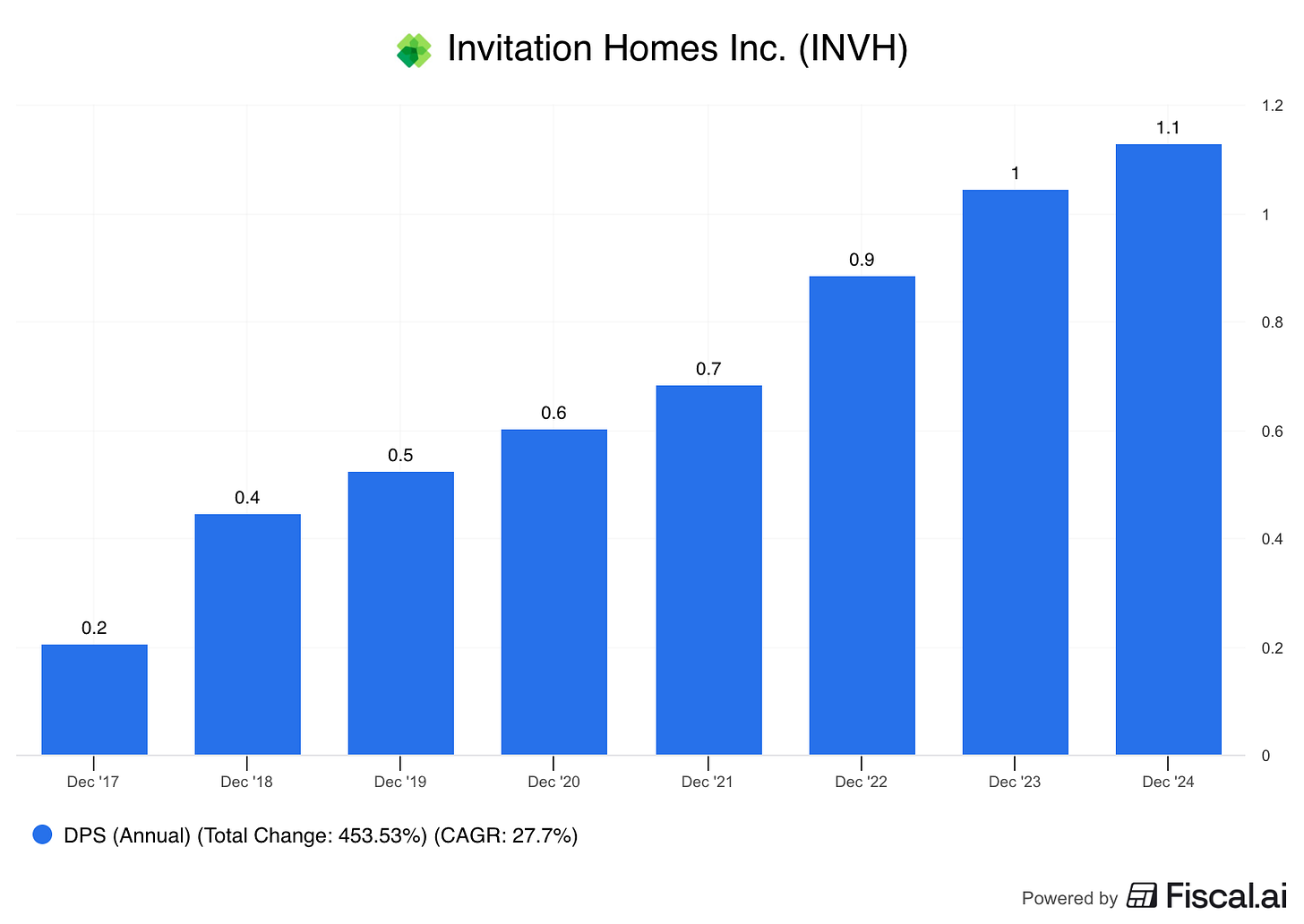

5️⃣ Example of a Dividend Stock

Invitation Homes is the largest single-family rental company in the U.S., owning over 80,000 houses across major metro areas.

They focus on providing affordable, well-located homes for families who prefer renting over owning.

Invitation makes money by collecting rent, charging service fees, and growing occupancy while benefiting from rising property values over time.

Profit Margin: 20.6%

Forward P/FFO: 15.4x

Dividend Yield: 3.8%

Payout Ratio: 61.7% (Core FFO basis)

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data