The 3 Safest Monthly Dividend Stocks Now

Monthly dividend stocks are highly appealing for income investors. That is because these particular dividend stocks pay their dividends every month, instead of once per quarter like most dividend-paying stocks.

However, investors must also evaluate stocks to make sure they have sustainable dividends. Income investors should avoid dividend cuts whenever possible. Therefore, focusing on strong fundamentals is key to investing in monthly dividend stocks.

The following 3 monthly dividend stocks have safe dividends, in addition to their high yields.

Note: Click here to instantly download your free spreadsheet of all 79 Monthly Dividend Stocks now.

This research report is by Bob Ciura, President of Content at Sure Dividend.

Realty Income (O)

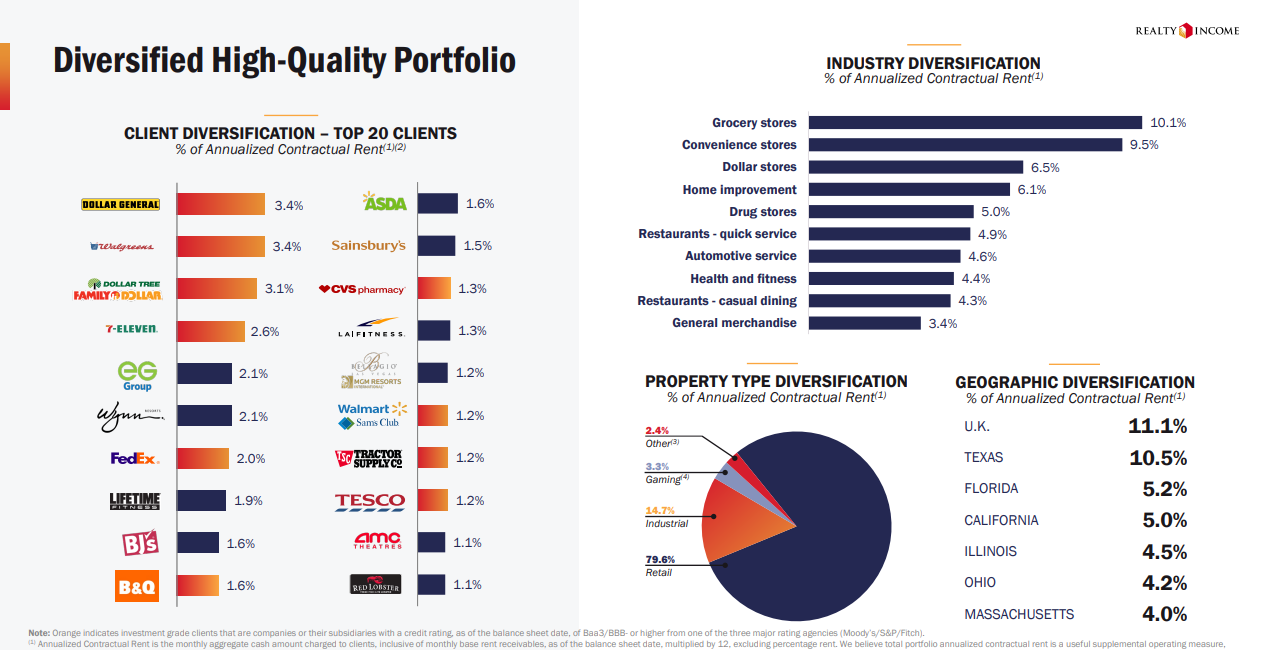

Realty Income is a real estate investment trust, or REIT, that operates more than 11,100 properties. The trust’s properties are standalone, which makes Realty Income’s locations appealing to a wide variety of tenants, including government services, healthcare services, and entertainment.

Realty Income had long been focused primarily on the U.S., but the trust has recently expanded its operations internationally, with a presence now in both the U.K. and Spain. The trust’s tenants are spread out over more than 70 different industries.

Source: Investor Presentation

Realty Income generates its growth through growing rents at existing locations, via contracted rent increases or by leasing properties to new tenants at higher rates, but also by acquiring new properties. Realty Income expects to increase its investments in international markets moving forward.

In the 2024 first quarter, Realty Income generated $1.26 billion in revenue following $598 million in investment volume. Its earnings slightly surpassed predictions, with normalized FFO per share reaching $1.05, a penny higher than the analyst estimate. This figure marked an increase from $1.00 in the previous quarter, and $1.04 in the first quarter of 2023.

Despite the positive financial performance, total expenses surged to $1.14 billion, up from $841.3 million in the prior quarter and $723.7 million a year ago, largely due to provisions for impairment and merger-related costs. However, Realty Income reaffirmed its 2024 guidance for normalized FFO and same-store rent growth, with expectations of acquisition volume around $2.0 billion.

Realty Income pays a monthly dividend, and has made more than 600 payments since going public in 1994. It has increased its dividend for 27 years, and is on the exclusive list of Dividend Aristocrats.

Its current dividend payout ratio near 80% is high, but within the normal range for a REIT. Due to its steady growth, even during the last financial crisis, the dividend looks sustainable with room for continued increases. Realty Income stock currently yields 5.4%.

STAG Industrial (STAG)

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has 563 buildings across 41 states in the United States. STAG Industrial went public in 2011 and has a market capitalization of $7.3 billion.

STAG is off to a good start to 2024. In the first quarter, core FFO per share grew 7% over the prior year’s quarter, from $0.55 to $0.59, and exceeded analyst estimates by $0.01. Growth was due primarily to new properties and rent increases.

Net operating income grew 10% over the prior year’s quarter even though the occupancy rate slipped sequentially from 98.2% to 97.7%. Moreover, the REIT reiterated its positive guidance for 2024, expecting core FFO per share of $2.36-$2.40.

STAG Industrial has grown its FFO per share at a 6.2% average annual rate over the last decade and at a 4.9% average annual rate over the last five years. The U.S. industrial real estate market is more than $1 trillion in size and STAG Industrial still has a market share that is less than 1% of its target market, which includes the top 60 markets of the country. Therefore, the REIT has ample room to continue to grow for years.

STAG Industrial also has a well-laddered lease maturity schedule, with a weighted average lease term of 4.9 years and about half of the leases maturing after the end of 2025. STAG Industrial has never cut its dividend throughout its history. STAG has increased its dividend for 13 years in a row.

Continued dividend increases down the road are likely, thanks to the company’s steady growth and modest dividend payout ratio of 62% for 2024. STAG currently yields 3.8%.

Agree Realty (ADC)

Agree Realty Corp. (ADC) is an integrated real estate investment trust (REIT) focused on ownership, acquisition, development, and retail property management. Agree has developed over 40 community shopping centers throughout the Midwestern and Southeastern United States. As of March 31, 2024, the portfolio consisted of 2,161 properties across 49 states, with 44.9 million square feet of gross leasable area, 99.6% of which was leased. The ground lease portfolio included 224 leases across 35 states, totaling 6.1 million square feet.

On April 23rd, 2024, Agree Realty reported first quarter results. The company invested $140 million in 50 retail net lease properties and initiated four development projects with a total committed capital of $18 million. Net income per share decreased by 2.4% to $0.43, while Core FFO per share increased by 3.5% to $1.01, and AFFO per share rose by 4.6% to $1.03.

The company ended the quarter with over $920 million in total liquidity and maintained a strong balance sheet. This will allow it to continue investing in new properties, which is critical for future growth. In the first quarter, the company acquired 31 properties for $123.5 million, located in 22 states and leased to tenants in 15 sectors. These acquisitions were made at a 7.7% capitalization rate with a remaining lease term of 8.2 years. Agree Realty anticipates a total acquisition volume of $600 million for 2024.

Agree Realty has grown AFFO by a compound rate of 6.8% over the past 10 years, and by 5.8% per year over the past five years. We expect that Agree Realty will continue to grow but at a slightly slower pace of 4.0% annually for the next five years. Current growth prospects stem from the recent acquisitions announced for the year.

Agree Realty currently pays a monthly dividend of $0.25 per common share. With a dividend payout ratio of 75% expected for 2024, the dividend appears safe. Agree stock currently yields 4.4%.

Disclosure: No positions in any stocks mentioned

That’s it for today

That’s it for today.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

These are great recommendations!

If you are looking for an income stream from your portfolio then Realty Income and Agree Reality are almost like "must own" businesses. Both are fantastic REITs with excellent balance sheets, great management, and a strong-strong moat.

How do you start to define a moat for a REIT?

Looking externally, consider the geography of their properties and the tenants leasing those properties. If you tried to drop red dots on a map to show Realty's and Agree's properties then you would see a smear of red across the entire map. That geographic diversity. Then look at the tenants and the business sectors they work in. It's like looking at a wall of candy where you see something of everything, from retailers to services ... from Target and Lowes to Bank of America to Burger King to AMC Theatres. That's diversity in income stream. Not everything will thrive in a heavy recession but not everything will collapse either.

Now look internally for the moat. Quality of leadership is high for both. Presentations are clear and easy to understand because management wants you to understand them. Capital allocation and management is prudent as seen by manageable debt levels and low cost of capital. Realty has an A- credit rating from S&P and Agree is BBB. This is great!

I don't know too much about STAG. For the industrial space, I look to Modiv Industrial, symbol MDV. The CEO of Modiv is Aaron Halfacre. He is a super clear communicator with a superb sense of snark and humor. What makes Modiv special? They are focused on industrial manufacturing vs simply "industrial" which may contain warehouses and logistics. Interesting fact about Modiv: they are headquartered in Reno, NV but do not own any properties in their home state!