The best dividend stocks aren’t bought for the dividend

Here's what to look for instead...

Most dividend investors get it backwards.

They scan lists of high-yield stocks. They chase the biggest payouts. They get excited about 8% yields without asking why they're so high.

Then they wonder why their "income" stocks keep cutting dividends.

Here's the problem: A dividend is your share of the profits.

No profits? No dividend.

That means if you want consistent, growing income, you need to own a business that consistently grows its profits.

The math is straightforward.

A company earning $5 per share can afford a $2 dividend.

A company earning $1 per share cannot.

So don’t focus on the dividend.

Focus on the business behind it.

Start with the business, not the payout

When you invest in dividend stocks, you’re not just buying an income stream - you’re becoming a part-owner of a real company.

“A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that doesn’t not depend on its share price.”

—Benjamin Graham

And not just any company will do.

The best businesses - the ones we’re looking to buy for long-term dividend growth - usually share a few traits:

✅ They’re understandable - If you can’t explain how the company makes money, you shouldn’t invest in it.

✅ They have durable advantages - Profit attracts competition. You want companies with a wide moat: strong brands, network effects, cost advantages - something that keeps the cash flowing even when things get tough.

✅ They earn high returns on reinvested capital - Some profits are paid to you. The rest are reinvested. You want those retained earnings compounding at a high rate.

✅ They have a long runway for growth - The longer a business can grow, the longer your dividend can grow.

Real-world example: W.W. Grainger (GWW)

Let me show you what this looks like in practice.

Grainger isn’t exciting.

But it’s one of the best-performing dividend stocks of the past 20 years.

Let’s quickly walk through our points above to show you how to find a great company:

Is Grainger understandable?

W.W. Grainger runs a fairly simple business.

It sells industrial supplies - things like replacement parts, safety gear, plumbing parts, and janitorial products to other businesses.

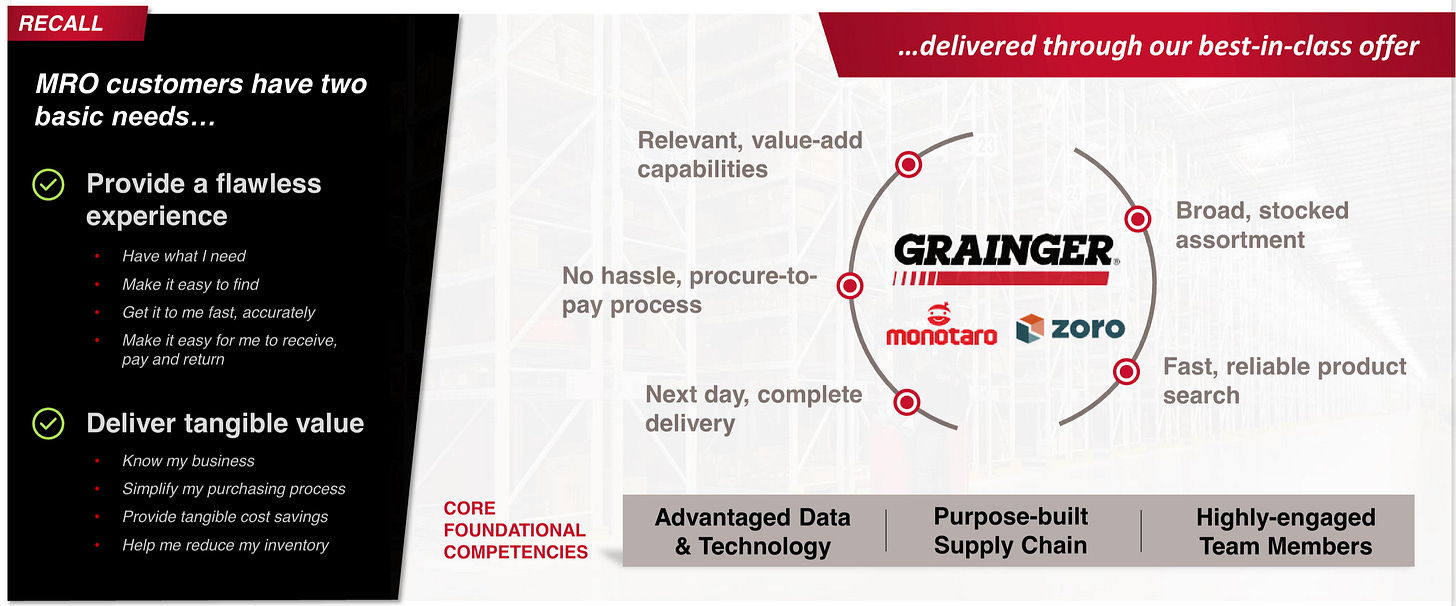

Does it have durable advantages?

Yes.

Grainger has built a massive distribution network and digital ordering system that makes it the go-to supplier for maintenance, repair, and operations (MRO) across North America.

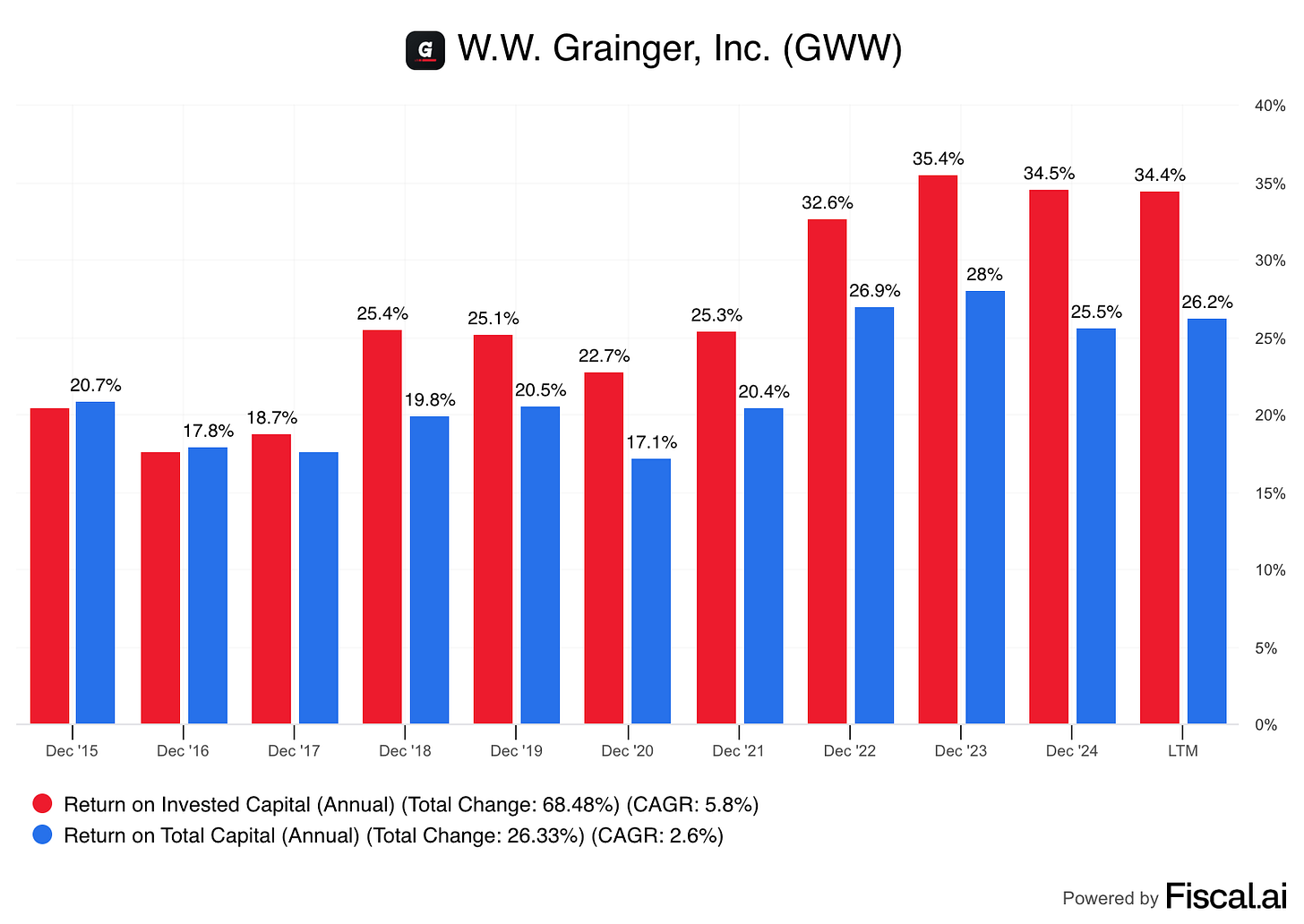

Does it earn high returns on reinvested capital?

Yes. Grainger consistently earns very high returns on both Invested Capital and Total Capital:

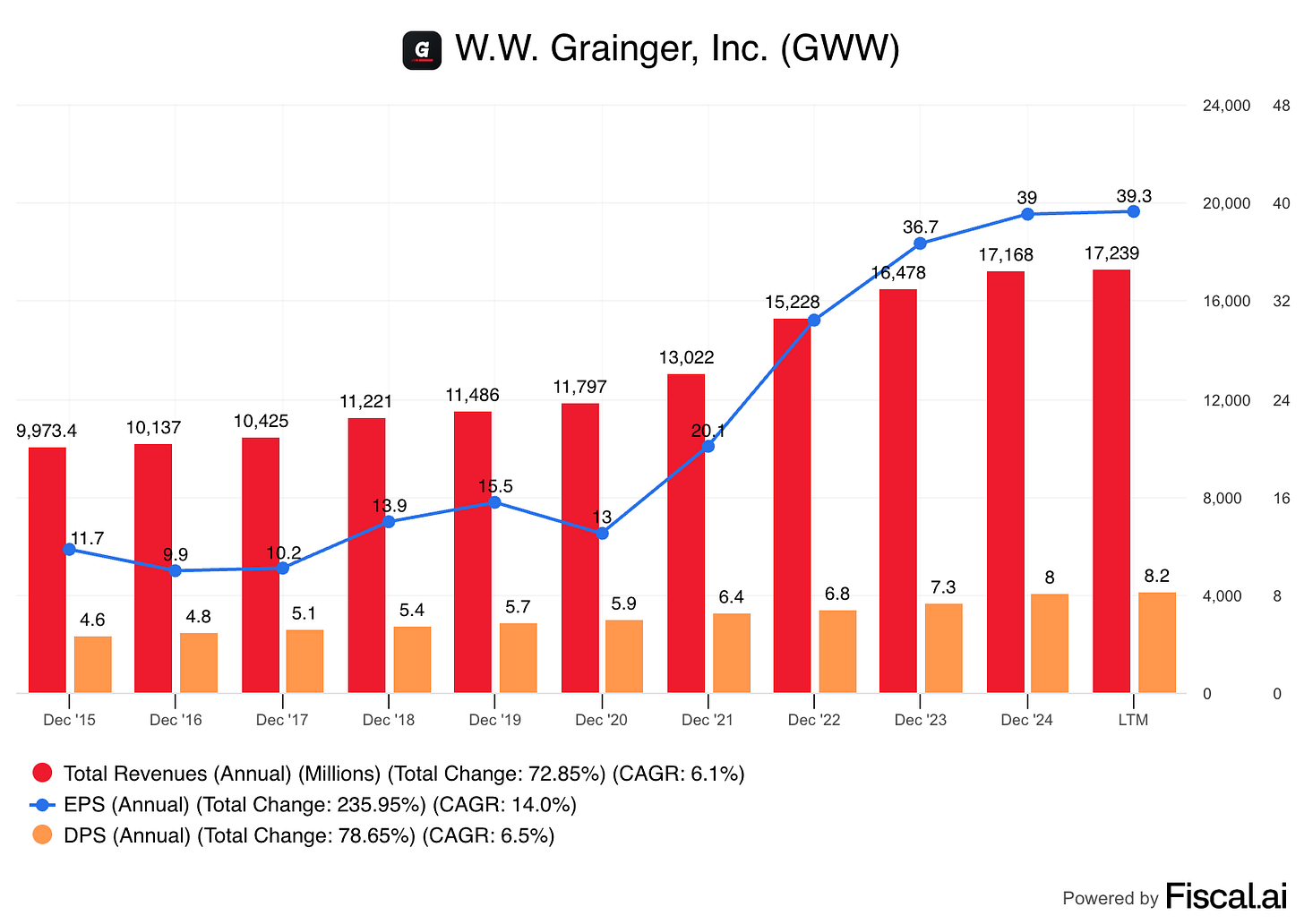

Since 2015, Grainger has grown:

Revenue from $9.9B → $17B+

Earnings per share from $11.7 → over $35

Its dividend every single year (52 straight hikes)

Does it have a long runway for growth?

W.W. Grainger operates in the highly fragmented maintenance, repair, and operations, or MRO, product distribution market.

It is the industry leader in sales of high-touch solutions in North America, but Grainger is estimated to have a high-single-digit percentage market share.

Its smaller endless assortment segment holds less than a 1% market share in the US.

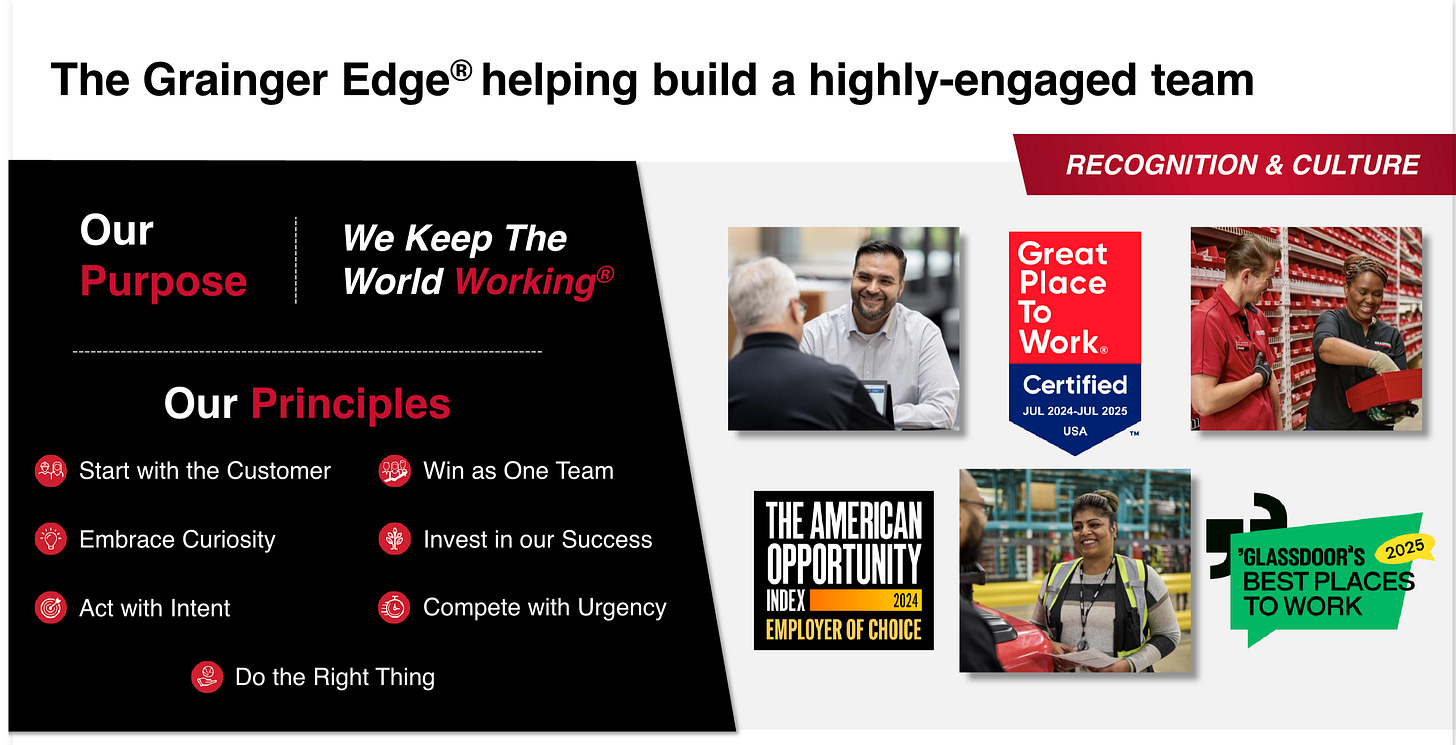

Don’t forget about the people in charge

You’re trusting management to do two big things:

Reinvest profits wisely

Share the rest with you

That takes discipline. Long-term thinking. Integrity.

I look for:

A history of treating shareholders like partners

Clear, shareholder-friendly capital allocation

A culture of accountability, not empire building

Management won’t always get it right. But great leaders know that dividends come from discipline - not just earnings.

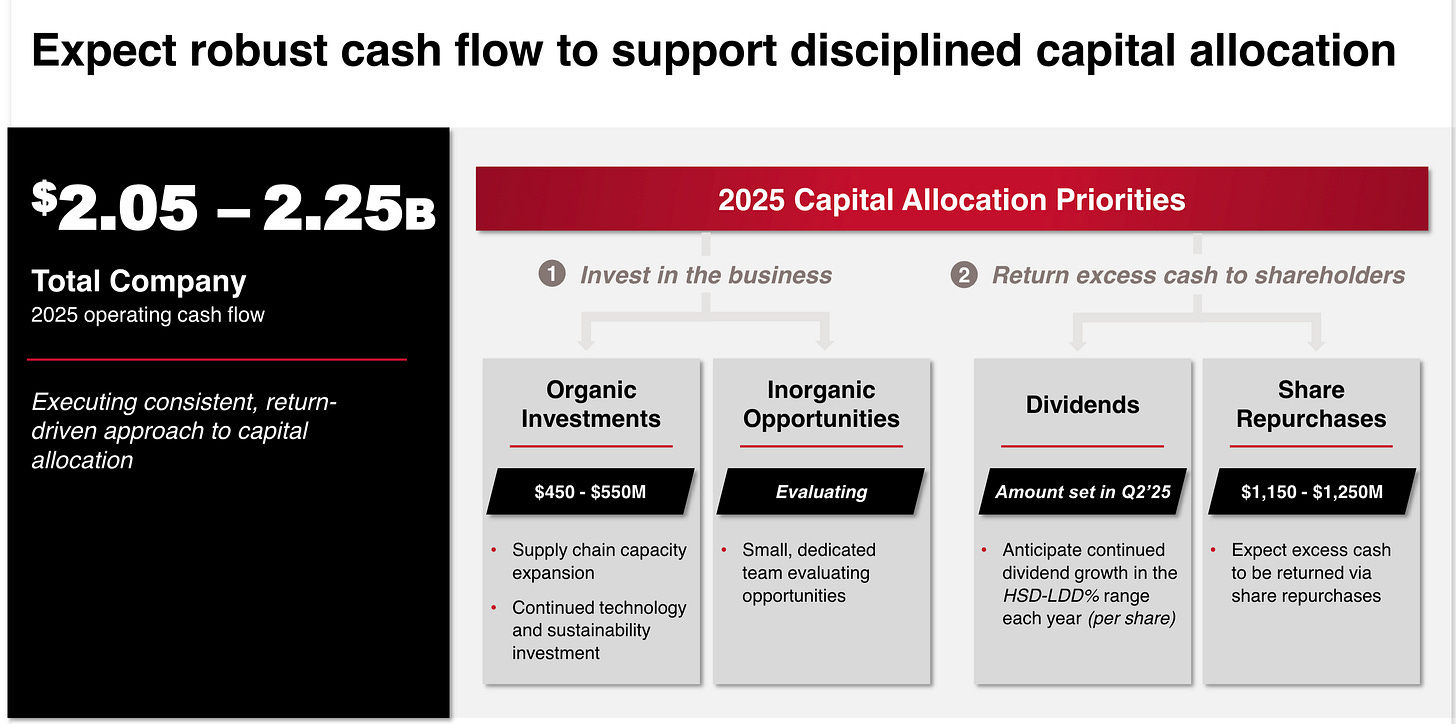

Grainger’s Management

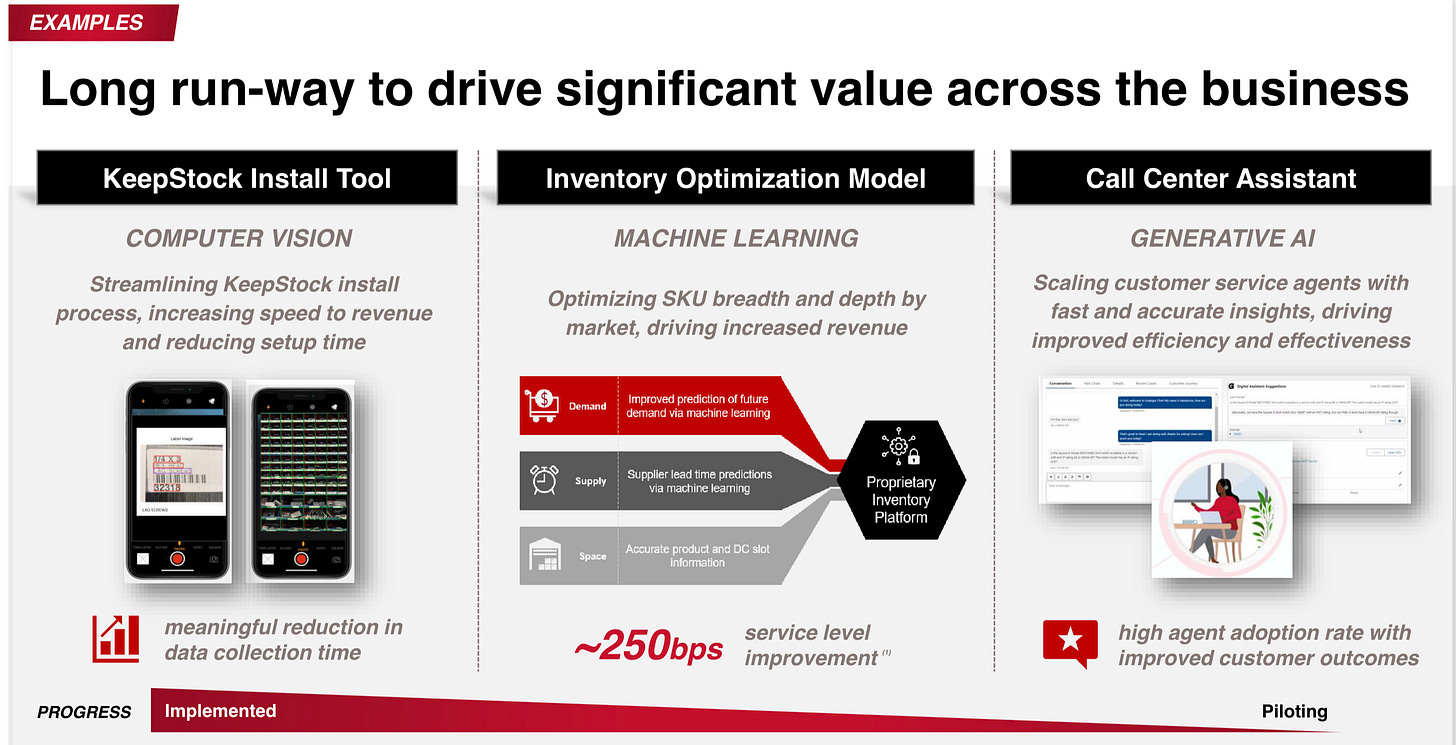

The management team knows that a great business starts with taking care of your customers and employees.

They’re reinvesting in the business:

And they have a clear, shareholder-friendly capital allocation policy:

The dividend takes care of itself

A high yield might look appealing. But if it’s not backed by profits, it’s a mirage.

That’s how investors fall into traps: chasing payouts from weak businesses that eventually cut them.

When you own great businesses, they do the heavy lifting. They earn more each year. They reinvest wisely. They send you a growing stream of cash.

And while they're doing all that work, you can focus on the things that matter most to you.

Look at companies like Johnson & Johnson, W.W. Grainger, or Microsoft.

The dividends didn’t come first - the business performance did.

Here’s the takeaway:

If you want reliable, growing income - buy reliable, growing businesses.

When you own a great business, the dividend tends to take care of itself.

One Dividend At A Time,

—TJ

P.S…

On Wednesday I’ll walk you through an example of a business that wasn’t a great one that recently cut the dividend. I’ll show you the signs that were there before it happened, and why I never considered it for Our Portfolio.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data