💸 The Biggest Risks to Markets in 2026

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

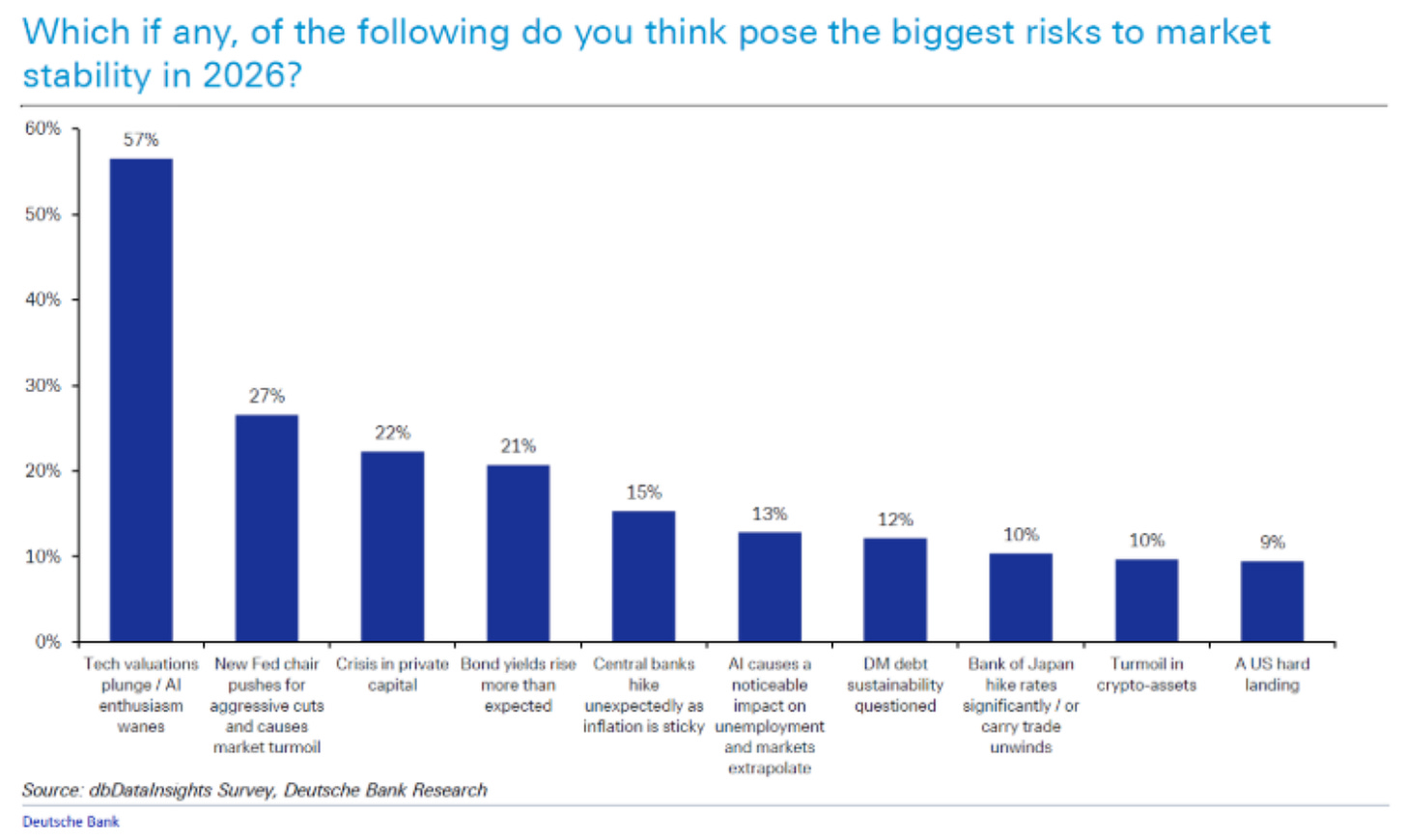

1️⃣ The Biggest Risks to Markets

A new survey from Deutsche Bank shows that investors are overwhelmingly worried about one thing: AI and Tech.

Over half of those surveyed (57%) believe a crash in tech valuations is the biggest risk to the market in 2026.

Other worries include:

The Fed: Unexpected interest rate moves.

Private Capital: Potential trouble in private lending.

Bond Yields: Interest rates rising higher than planned.

Will any of these cause a crash in 2026?

I have no idea, but markets rarely crash because of the things everyone is already watching. The biggest danger is usually the black swan event no one sees coming.

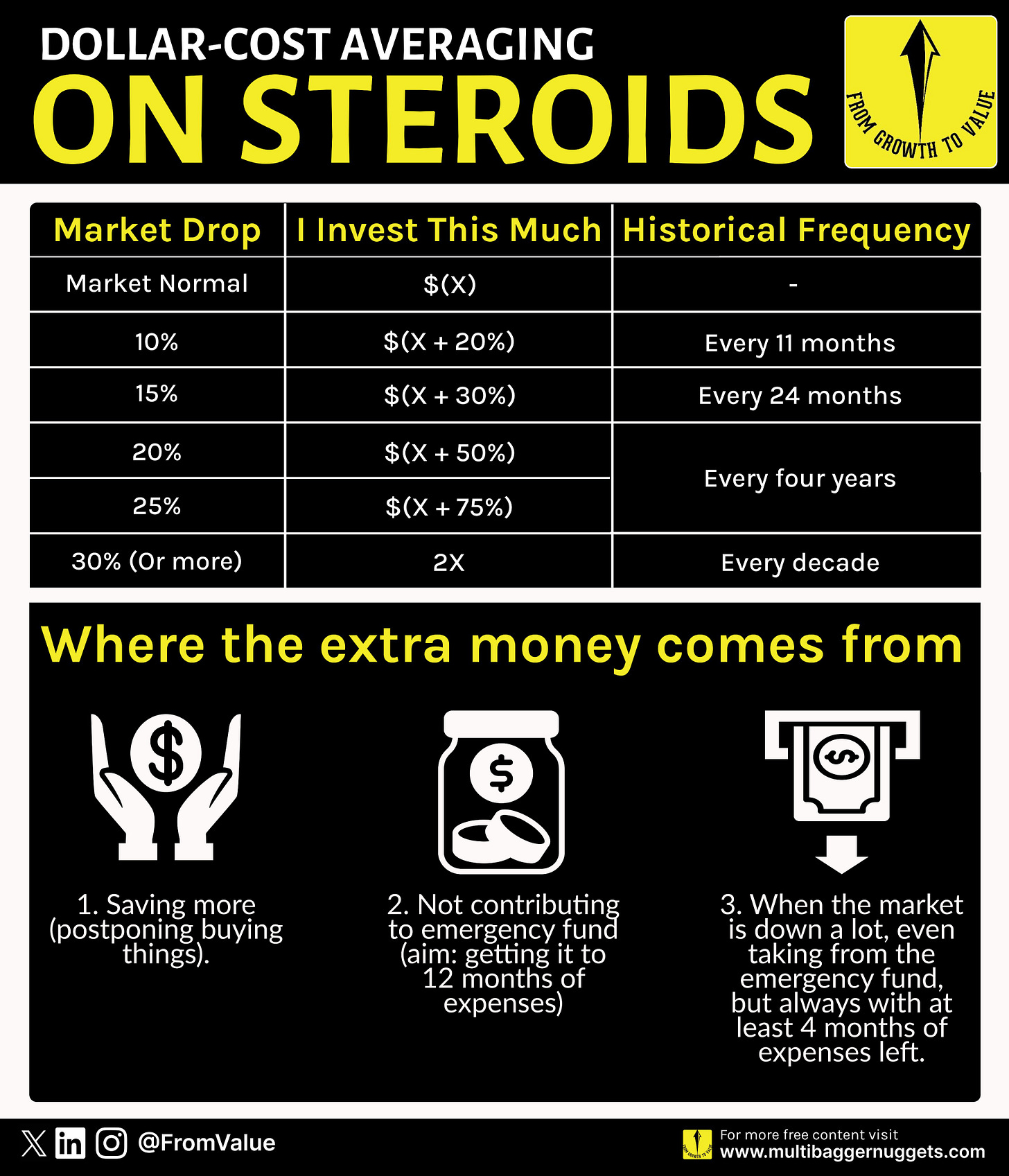

2️⃣ DCA on Steroids

Since we can’t predict the future, the best strategy is to have a plan.

If the markets do dip or crash, here is a great way to take advantage of it: Dollar-Cost Averaging (DCA) on Steroids.

Instead of investing the same amount every month, you buy the dip more aggressively as prices fall:

10% Drop: Increase your investment by 20%.

20% Drop: Increase your investment by 50%.

30% Drop: Double your usual investment.

This turns a scary market into a clearance sale for your portfolio.

3️⃣ An Investing Quote

Shelby Davis turned an investment of $50,000 in 1947 into $900 million by 1994.

That’s a return of almost 1,800,000%.

How’d he do it?

By buying boring stocks, like insurance companies, and investing more when the prices were low.

The math is simple: buying more shares at lower prices leads to higher returns later. But emotionally, buying during a crash is hard.

This quote from Mr. Davis might help:

“You make most of your money in a bear market, you just don’t realize it at the time.”

- Shelby Davis

4️⃣ Bear Market Guidebook

When markets get volatile, it is easy to let emotions take over.

UBS published a Bear Market Guidebook that shows you the truth about downturns:

They are a natural part of investing and, if you’re prepared, an opportunity to improve long-term returns.

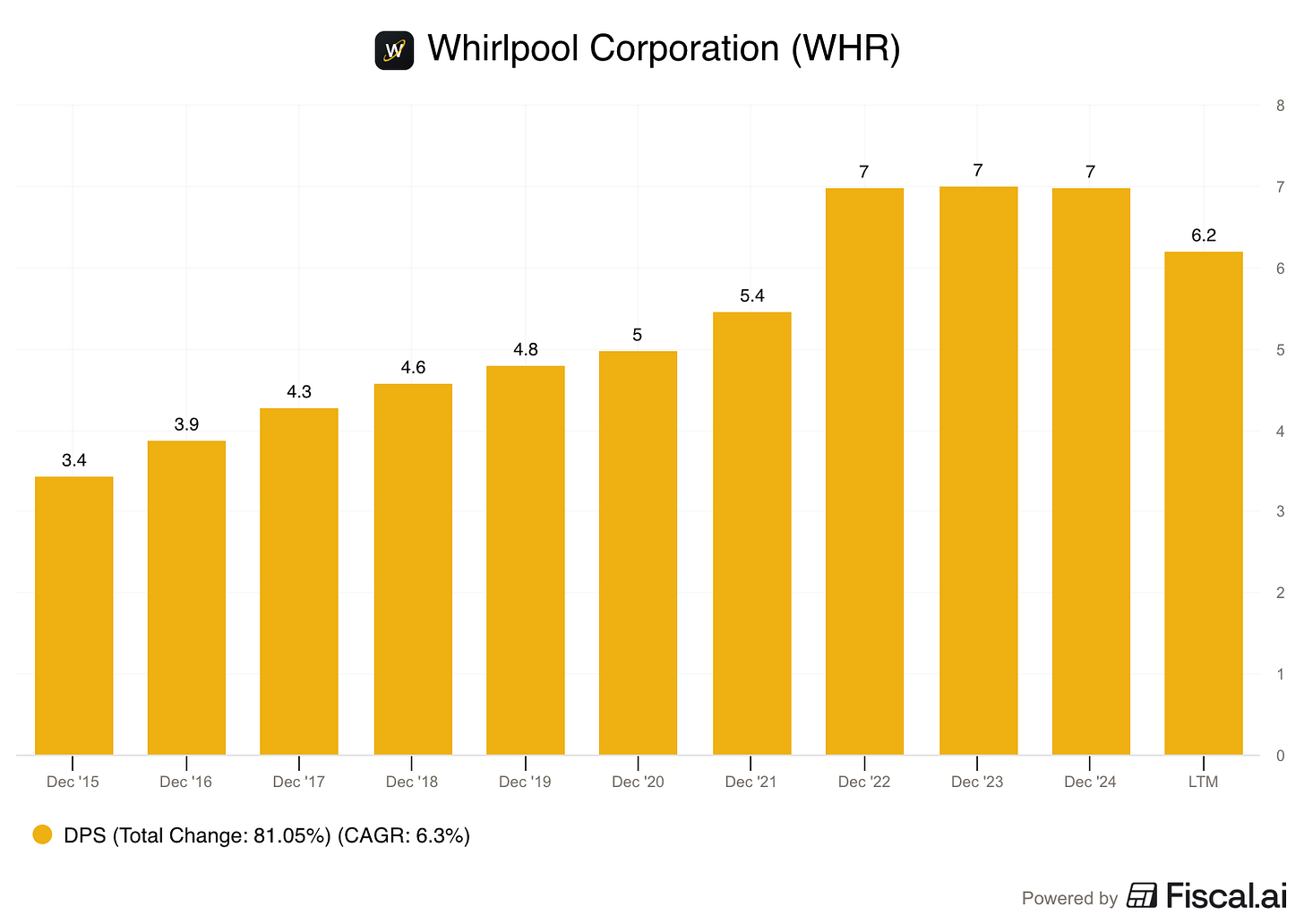

5️⃣ Example of a Dividend Stock

For our example of a dividend stock, we’ll use a company that’s seen plenty of bear markets, including the 1929 crash.

Whirlpool is more than a century old, dating back to 1911.

Today, the company is a leader in home appliances and owns a number of well-known brands including Maytag, KitchenAid, and Hotpoint.

It’s been struggling recently, but David Tepper has been buying a lot of the stock.

Profit Margin: -1.2%

Forward P/E: 12.2x

Dividend Yield: 4.2%

Payout Ratio: -188.5%

Source: Fiscal.ai

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

I'd take a look at Whirlpool's balance sheet before investing.