The Dogs of the Dow 2026

Have you ever heard of the Dogs of the Dow?

It’s one of the simplest, contrarian strategies in the investing world.

You buy the 10 stocks in the Dow Jones Industrial Average (DJIA) with the highest dividend yield at the start of the year, hold them for 12 months, then repeat.

Why are they called “Dogs”?

The theory is that a high yield often indicates a stock that has fallen out of favor with the market. That it’s a company that’s “in the doghouse.”

But because these are Dow companies - blue-chip, financially sound giants, the issues that are pushing the price down are usually temporary.

And the market has usually overreacted.

By buying the “Dogs,” you’re betting on a recovery while getting paid a large dividend to wait.

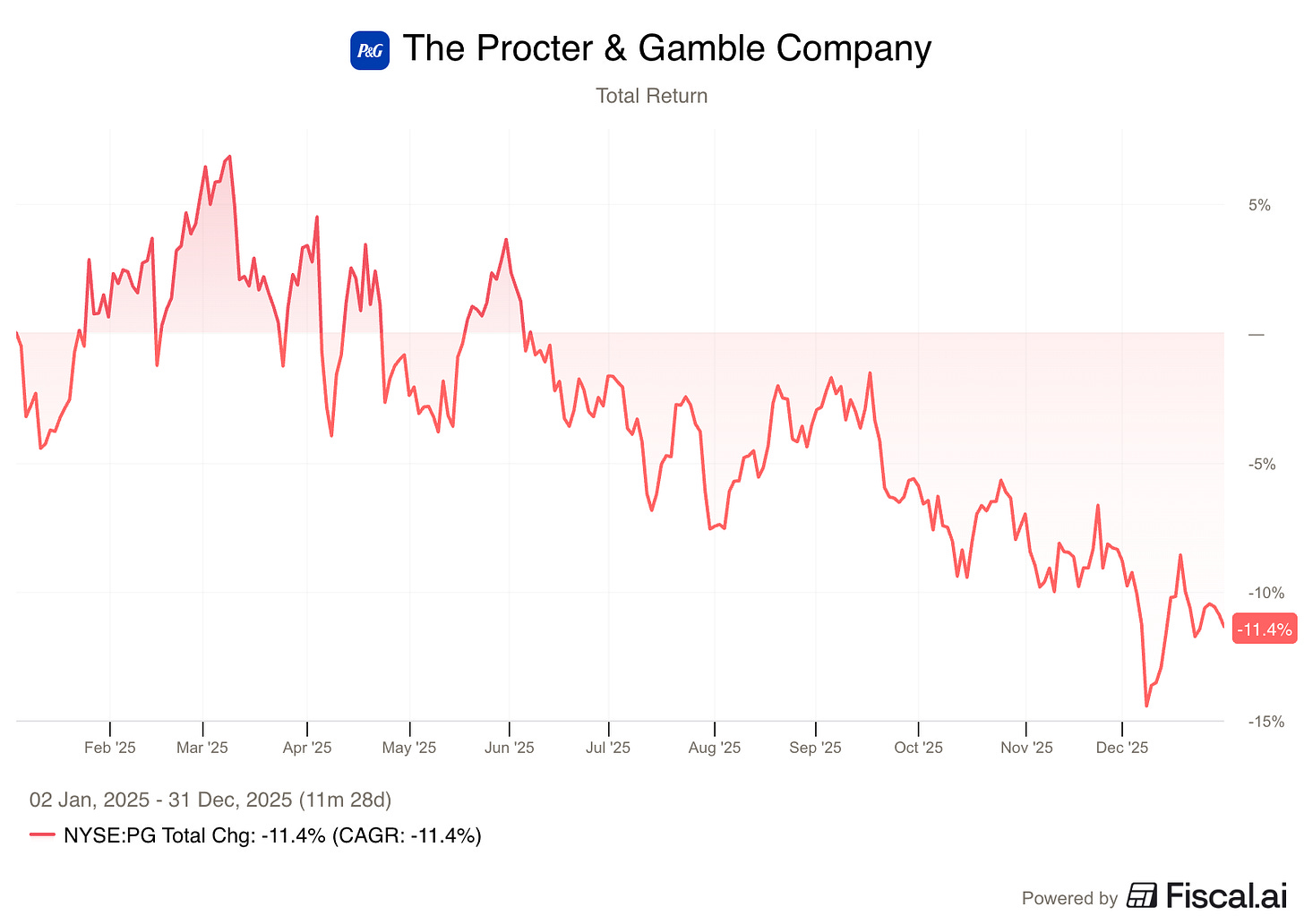

Out of the ten Dogs of the Dow 2025, only one generated a negative return - Proctor & Gamble, down -11.4% in 2025.

For the overall Dogs portfolio, the 2025 price return was 14.96% with a total return of 18.9%.

This total return beat both the Dow Jones Industrial Average, and the S&P 500, which returned 14.9% and 17.9%.

Let’s look at the 10 Dogs of the Dow for 2026 and see if we can find any interesting opportunities for this year.

The 10 Dogs of the Dow for 2026

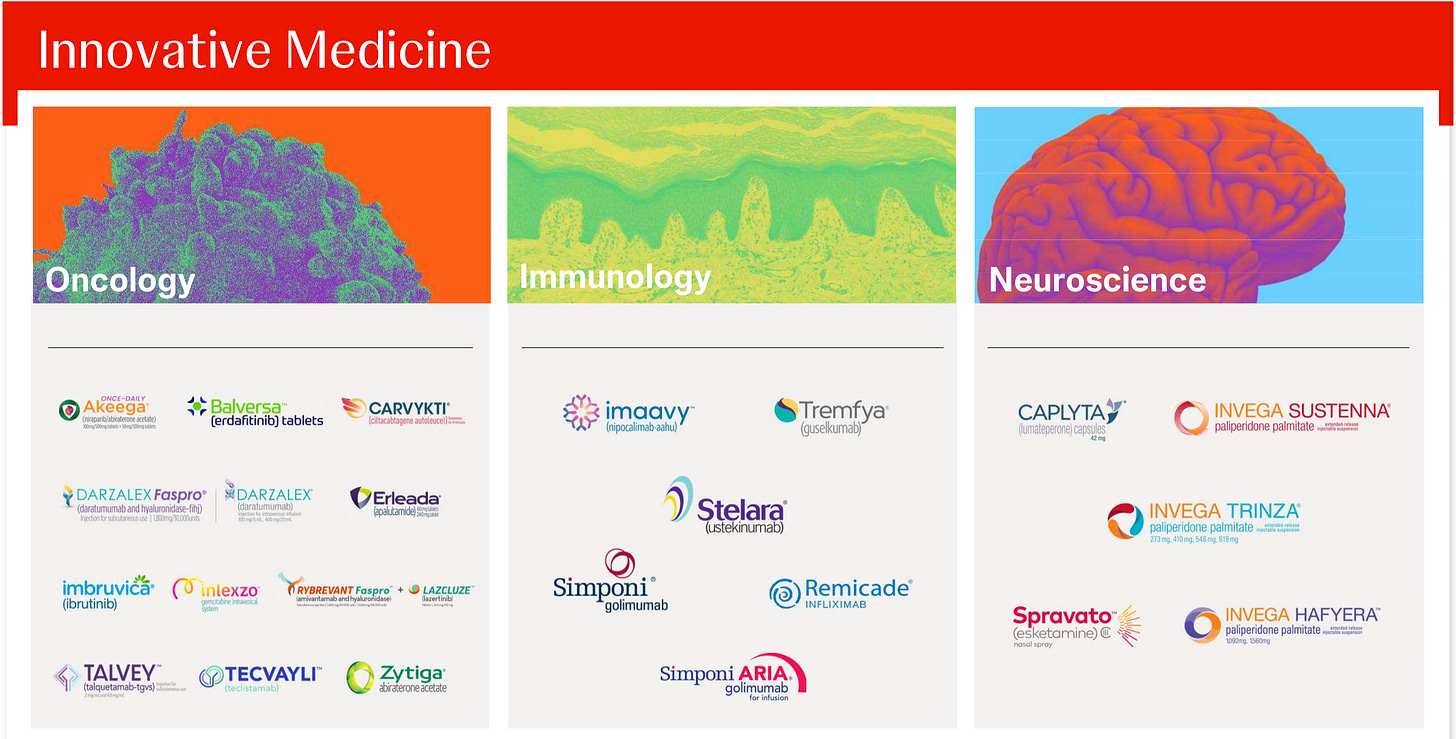

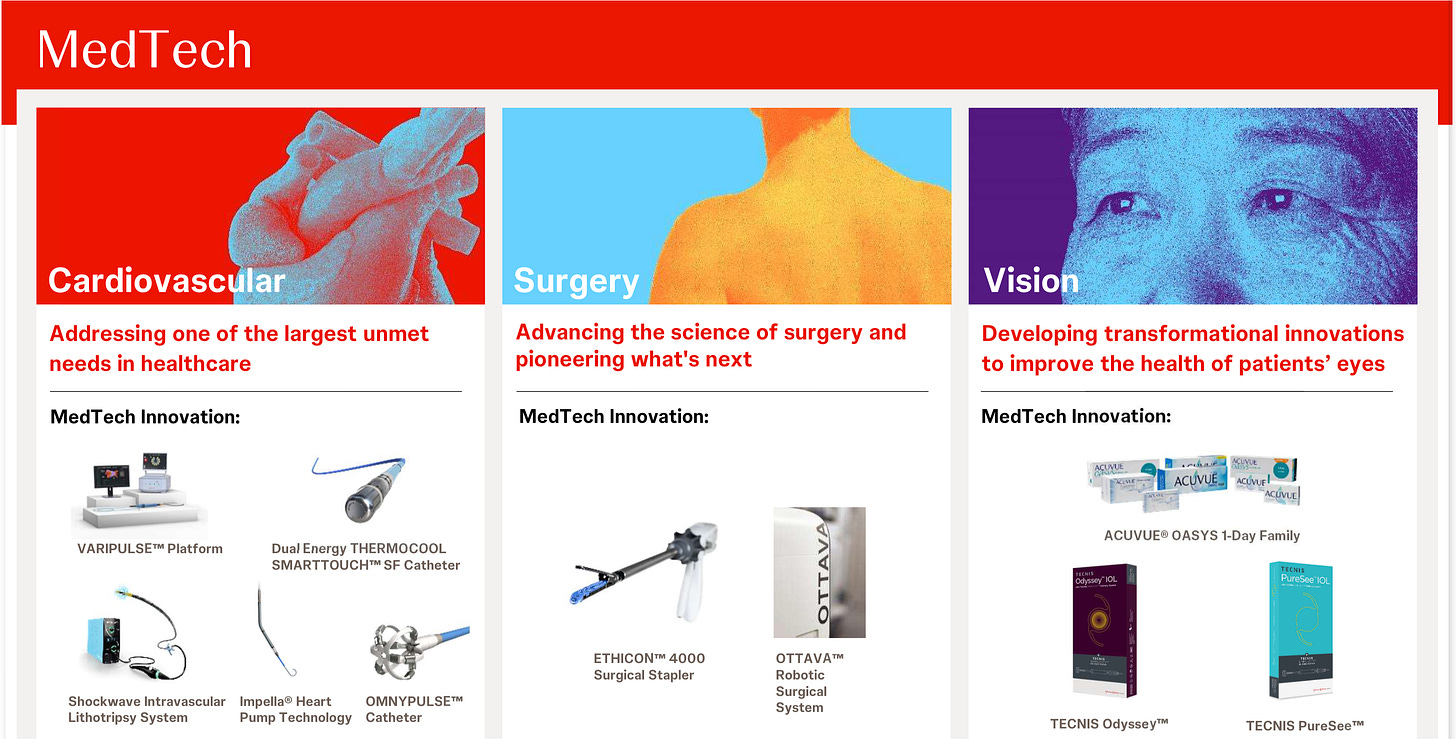

10. Johnson & Johnson ($JNJ)

How does the company make money?

J&J is now a pure-play healthcare company following the spin-off of its consumer division (Kenvue). It now focuses entirely on high-margin Innovative Medicine (pharmaceuticals) and MedTech (robotic surgery and cardiovascular devices).

Why It’s Interesting

J&J is very solid financially. It is one of only two U.S. companies with a AAA credit rating - higher than the U.S. government (Microsoft is the other one).

It’s got very diverse revenue sources, and generates a lot of cash. That lets it pay out reliable dividends, while still investing around $15 billion every year in R&D.

Current Yield: 2.4%

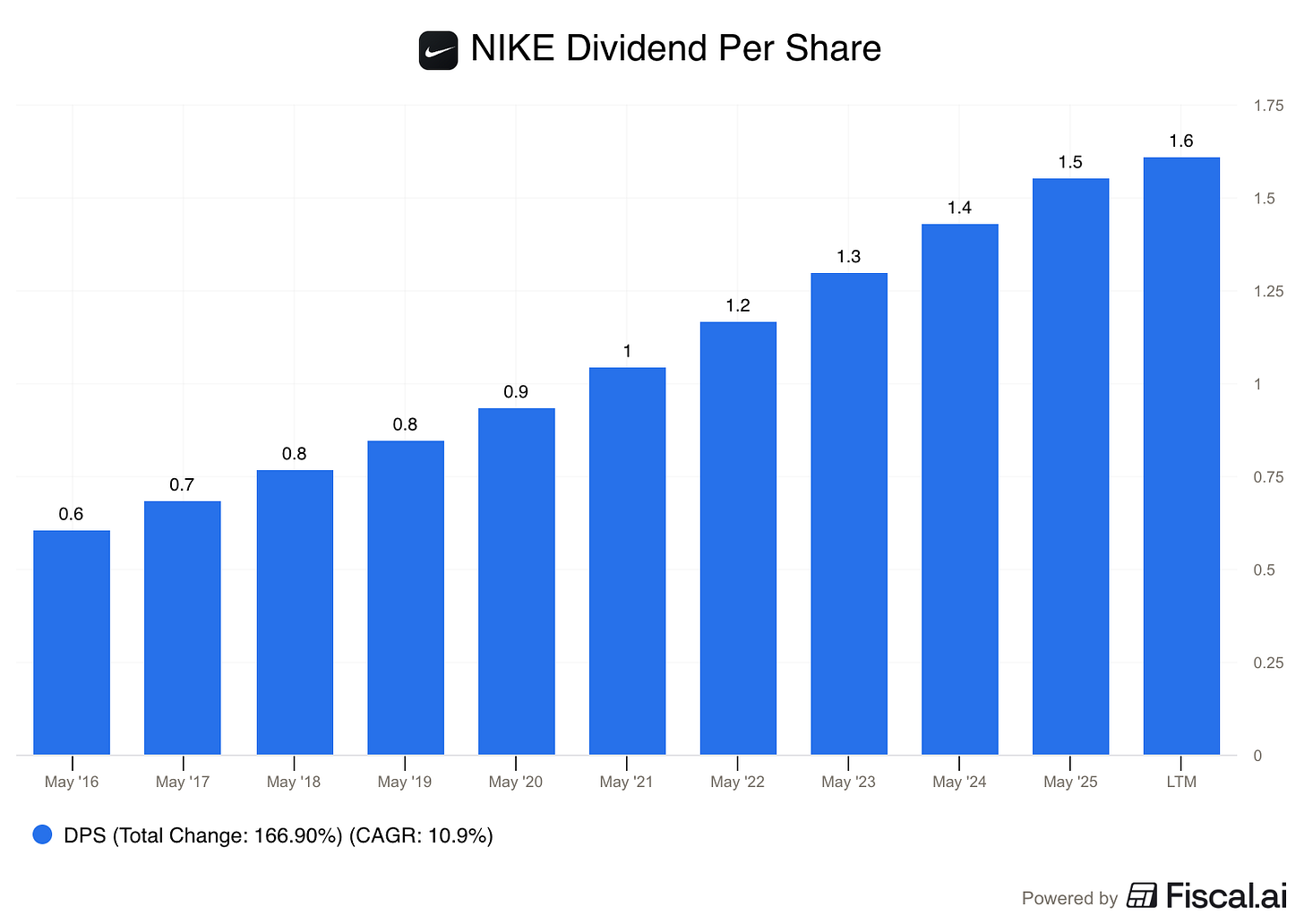

9. Nike ($NKE)

How does the company make money?

Nike is the world’s largest athletic brand, selling footwear, apparel, and equipment. It generates revenue through direct sales (Nike.com and stores) and wholesale partners like Foot Locker.

Why It’s Interesting

Nike is on track to achieve Dividend Aristocrat status in 2026, marking 25 consecutive years of increases. The stock is a “Dog” right now because of margin pressure from tariffs and a reset in its business strategy, but its 2.5% yield is near its highest levels in a decade.

Current Yield: 2.5%

8. Home Depot ($HD)

How does the company make money?

Home Depot is the world’s largest home improvement retailer. It serves two main customers: the “Do-It-Yourself” homeowner and the “Pro” contractor.

Why It’s Interesting

The stock has struggled recently due to a sluggish housing market and high interest rates. Home Depot’s moat is its massive scale and supply chain. Right now you can get a 2.4% yield and a payout ratio of 62% while you wait for a housing recovery.

Current Yield: 2.4%

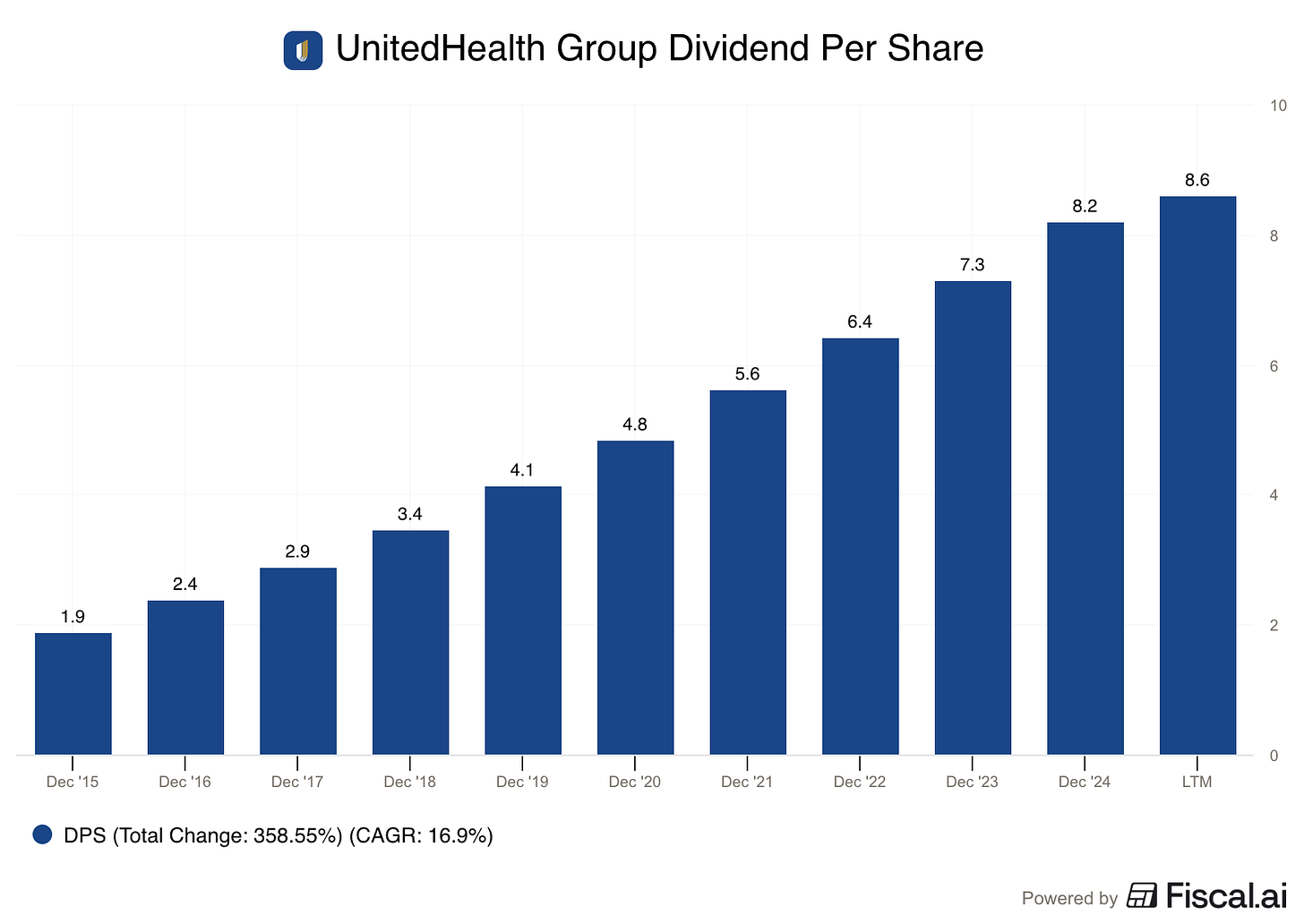

7. UnitedHealth Group ($UNH)

How does the company make money?

UNH is a diversified healthcare giant. It runs UnitedHealthcare (insurance) and Optum (pharmacy benefits, data analytics, and direct patient care).

Why it’s Interesting

It’s rare to see UNH on a “Dogs” list. The company had issues with higher than expected medical costs, a DOJ probe into its billing practices, and instability in management positions. While the stock has recovered some from the its very lowest point, it still offers a high dividend yield and a history of double-digit dividend growth rates that not many other Dow stocks can match.

Current Yield: 2.6.%

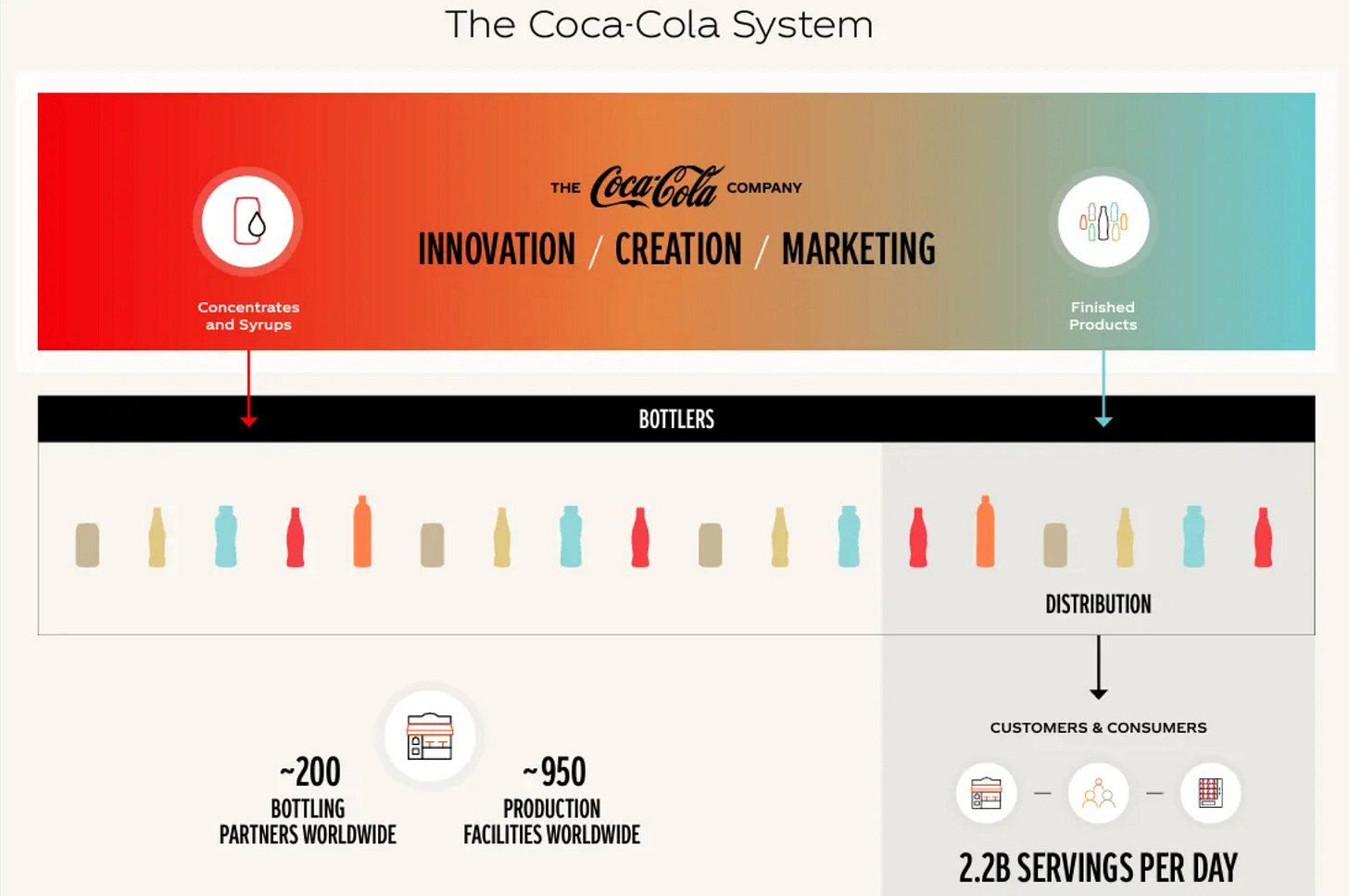

6. Coca-Cola ($KO)

How does the company make money?

Coke owns a massive portfolio of over 200 brands, from its namesake soda to Dasani water and Costa Coffee. It operates a high-margin asset-light model by selling concentrates to independent bottlers.

Why It’s Interesting

Coca-Cola has massive brand power that allows it to raise prices without losing customers. As a Dividend King with 63 years of consecutive increases, it offers a 2.9% yield from an incredibly stable business.

Current Yield: 2.9%

5. Procter & Gamble ($PG)

How does the company make money?

P&G sells daily essentials across 10 categories, including Tide, Gillette, and Pampers.

It focuses on “performance superiority” - making products so much better than generic brands that consumers are willing to pay a premium.

Why it’s Interesting

P&G is a great defensive company because they make daily products that you have to keep buying. It does face tariff-related cost pressures in 2026, but its “Supply Chain 3.0” initiative is expected to save $1.5 billion in costs. Yielding around 3%, it’s a stock you can buy and sleep well at night.

Current Yield: 2.9%

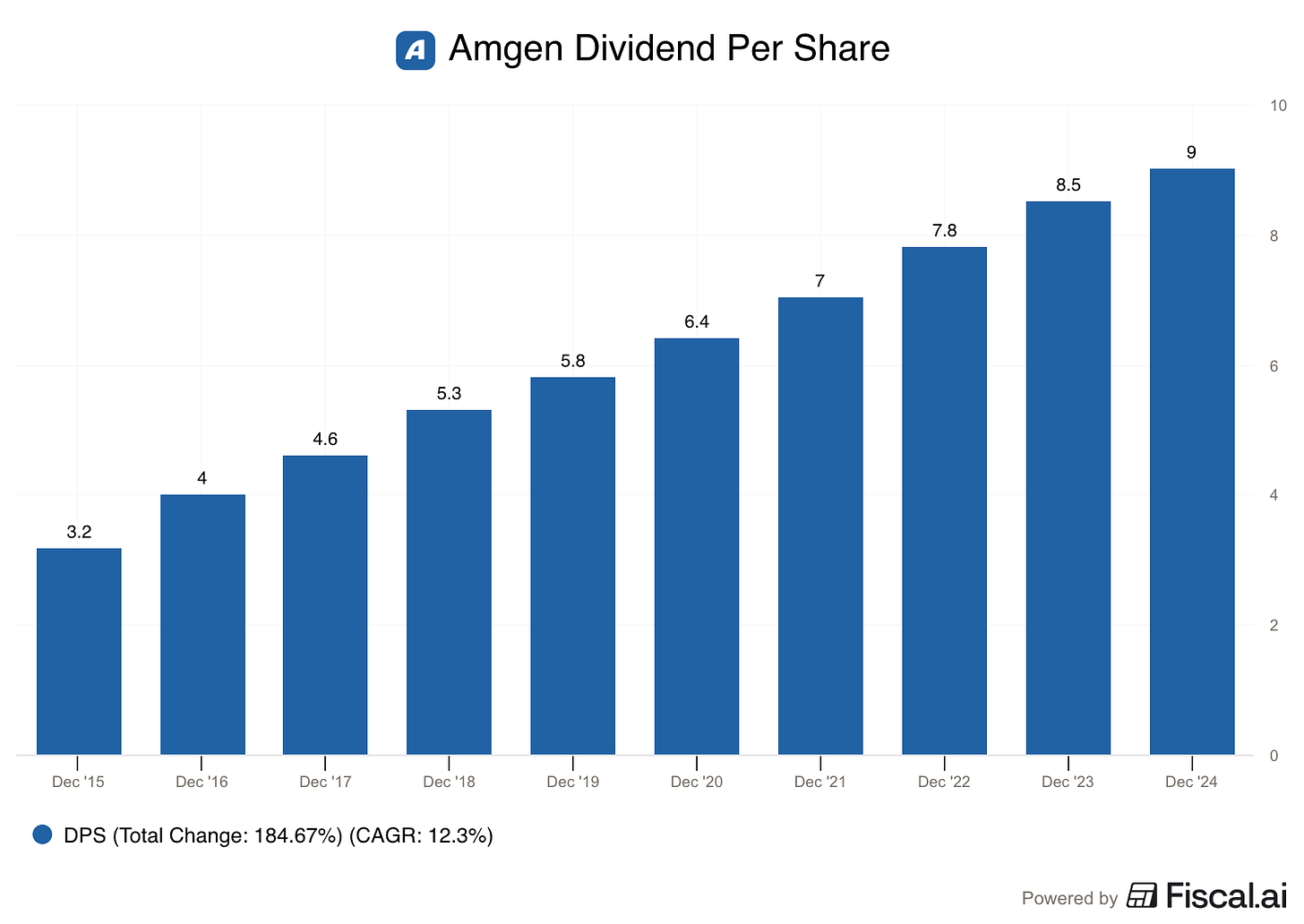

4. Amgen ($AMGN)

How does the company make money?

Amgen develops complex biological medicines for cancer, kidney disease, and inflammation.

Why it’s Interesting

Amgen consistently generates a lot of cash flow. They use some of it to acquire companies like Horizon Therapeutics and Decode, giving it room to continue to grow. They’ve also invested in improving their manufacturing efficiency, which should help their margins and give them cost advantages over competitors. It looks like the company should continue with their history of yearly high single digit dividend raises.

Current Yield: 3.1%

3. Merck ($MRK)

How does the company make money?

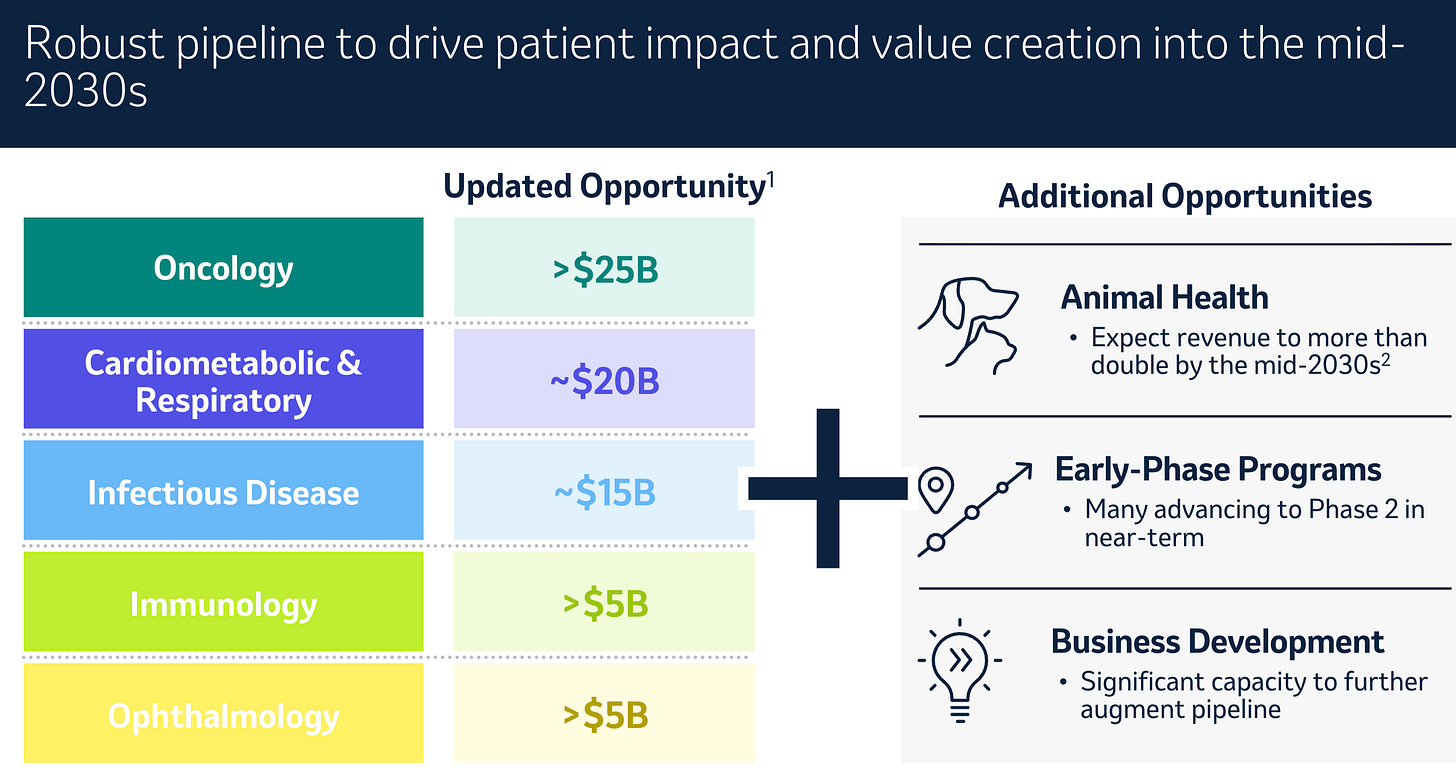

Merck is a leader in oncology (cancer treatment) and animal health. Its blockbuster drug, Keytruda, is one of the best-selling medicines in history.

Why It’s Interesting

Investors are worried about the 2028 “patent cliff” for Keytruda. However, CEO Rob Davis recently noted that the company has a $70 billion commercial opportunity in its pipeline. At a 3.2% yield, Merck is a value play on the next generation of cancer and cardiometabolic drugs.

Current Yield: 3.1%

2. Chevron ($CVX)

How does the company make money?

Chevron is an integrated energy company, meaning it does everything from drilling for oil to refining it into gasoline and chemicals.

Why It’s Interesting

Chevron is a dividend machine with a 4.5% yield. It’s got a very strong balance sheet and management is doing a good job with capital allocation, focusing on cash generation, while lowering their cost of production.

Current Yield: 4.1%

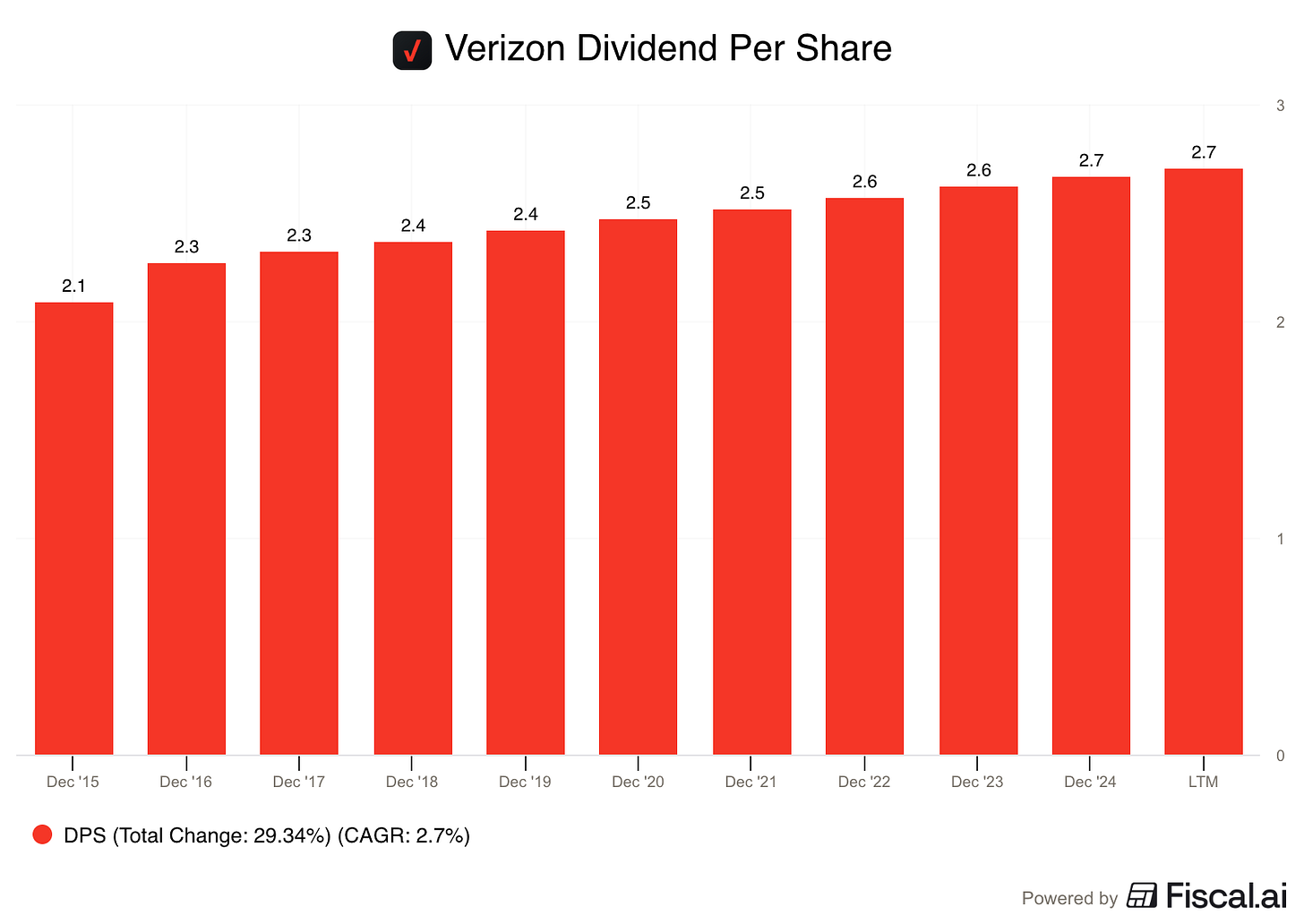

1. Verizon ($VZ)

How does the company make money?

Verizon provides wireless and wireline communications services. It makes the bulk of its money from monthly cell phone plans and high-speed fiber internet (Fios).

Why It’s Interesting

For the second year in a row, Verizon is the “Top Dog” yielding a massive 7%. After years of heavy spending on 5G, Verizon is finally ready for those investments to pay off, cutting costs and using its massive free cash flow to pay down debt and fund the big dividend.

Current Yield: 7%

Conclusion

The 2026 Dogs of the Dow offer an average yield of 3.3%, significantly higher than the broader index.

Whether it’s the high-yield stability of Verizon or the turnaround potential of Nike, these companies are stable and necessary pieces of the American economy.

One Dividend At A Time,

– TJ

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Just wondering if these are in the watchlist/candidates to be included in the portfolio?

Love how clean this is: 10 highest yield Dow names, hold 12 months, repeat.

I like adding ONE filter—dividend safety / payout ratio sanity—so you don’t chase yield traps. (HD payout ratio ~62% callout is exactly that.)

Similar frameworks on TraderNation (@tradernation) — link in profile.