💸 The DRIP Difference

#Dividend Day

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

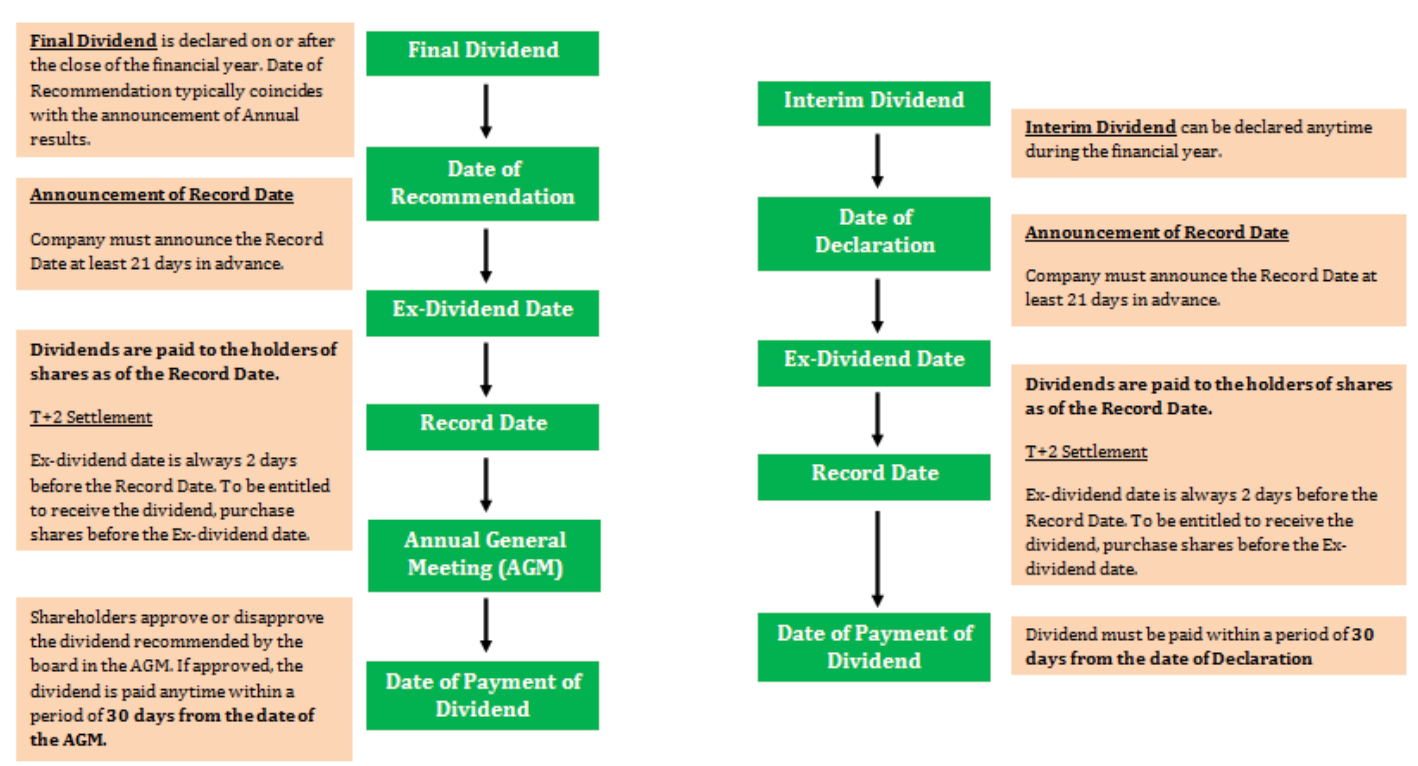

1️⃣ 4 Dates For Dividend Investors

When a company declares a dividend, it doesn’t hit your account instantly.

There is a specific calendar every investor must know.

Declaration Date: The board announces the dividend

Ex-Dividend Date: The most important date. You must own the stock before this day to get the payout

Record Date: When the company builds the list of who gets paid

Payment Date: The day the cash actually lands in your brokerage

The charts below will clarify the above concepts:

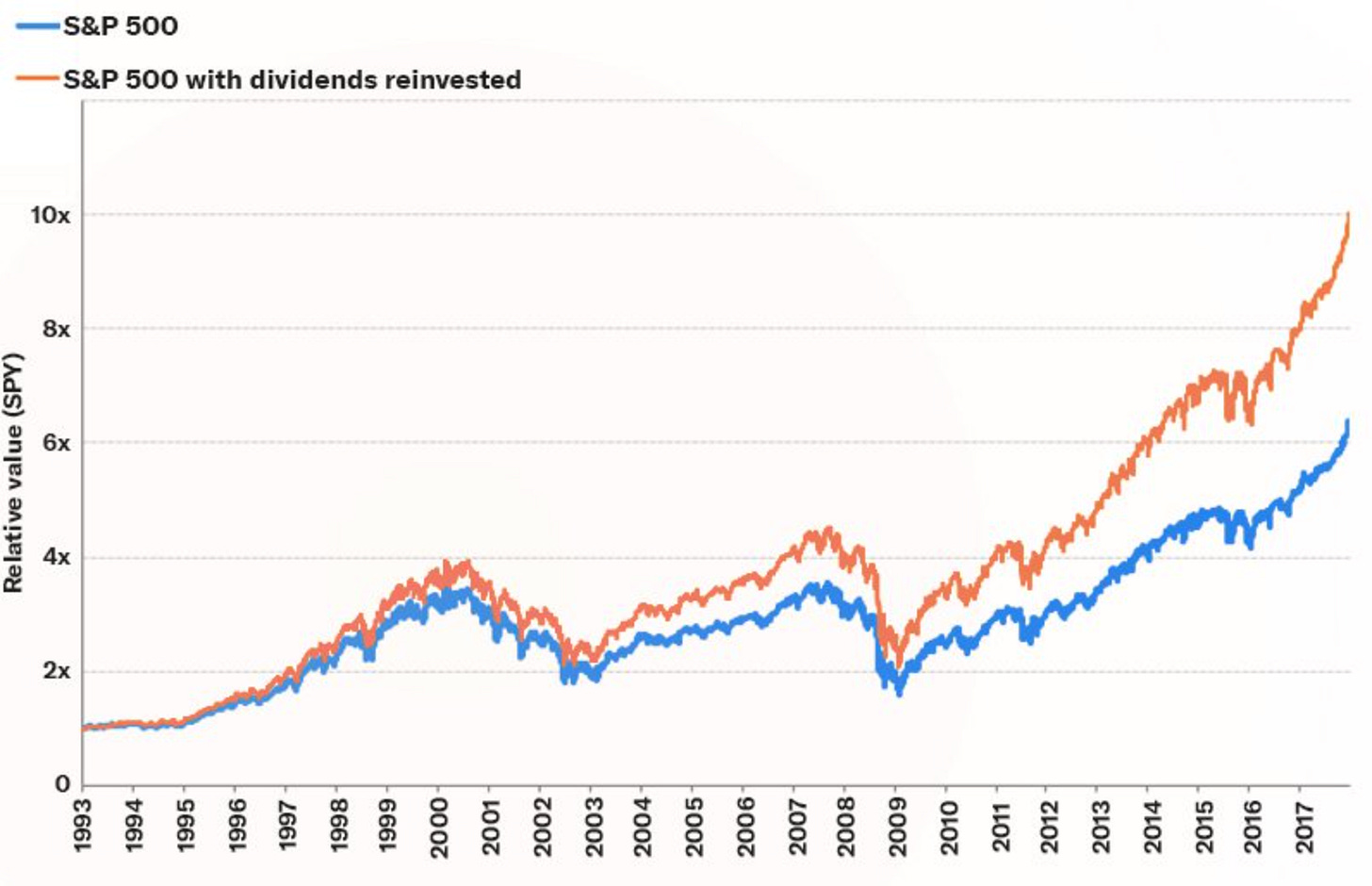

2️⃣ The DRIP Difference

You don’t have to spend your dividends.

A DRIP (Dividend Reinvestment Plan) automatically uses your payout to buy more shares of the company.

This creates a snowball effect:

Your dividends buy more shares

Those shares pay you more dividends

Which buy more shares, that pay you even more dividends…

Over 20 years, reinvested dividends account for nearly 40% of the S&P 500’s total return.

3️⃣ An Investing Quote

While the world looks for the next moonshot stock, the wealthiest investors focus on what they can keep.

Munger and Buffett famously held Coca-Cola for decades, letting the dividend grow while doing absolutely nothing.

In dividend investing, laziness is often a superpower.

“The big money is not in the buying and the selling, but in the waiting.”

— Charlie Munger

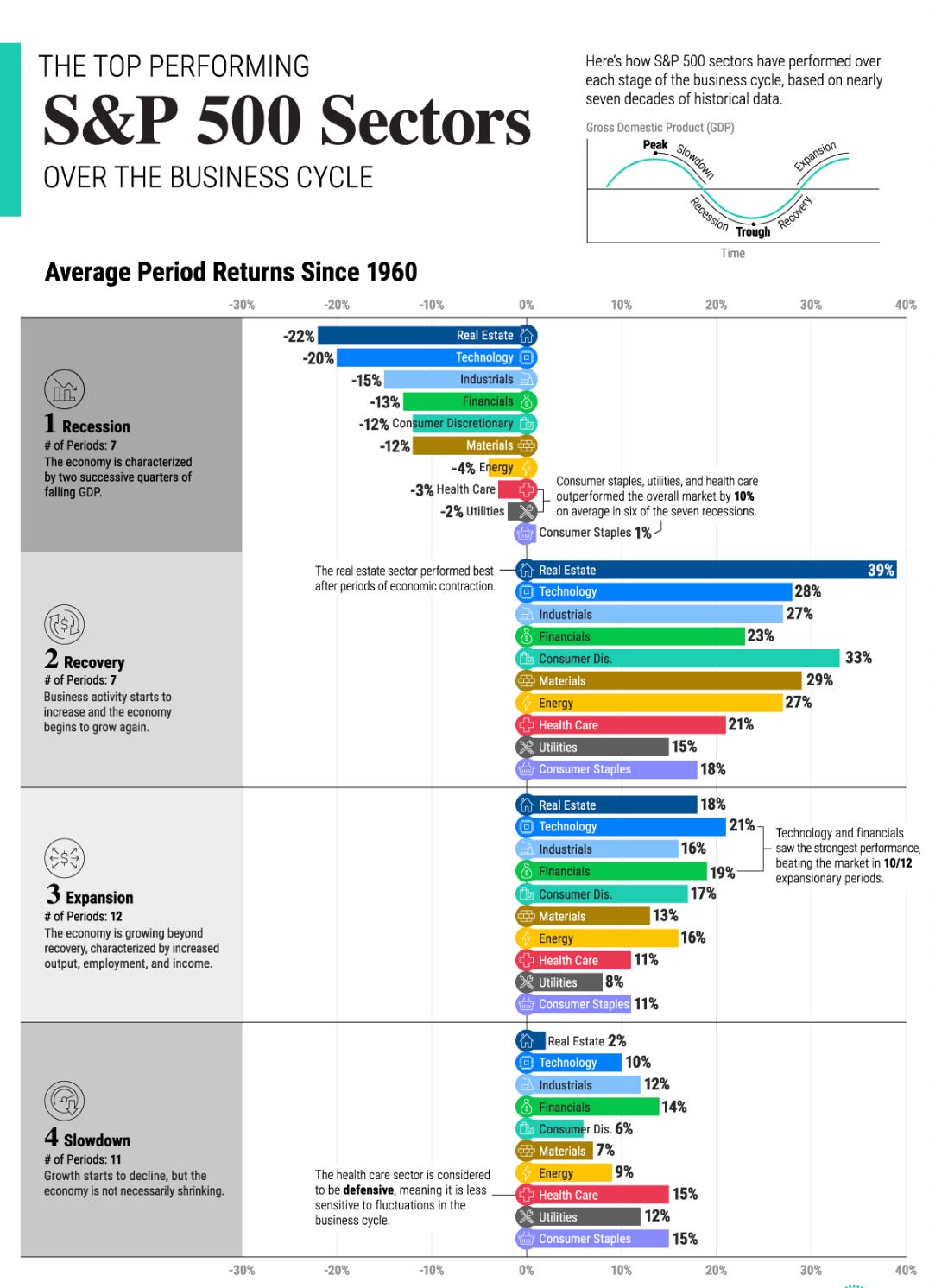

4️⃣ Consumer Staples is a safe harbor

After the massive tech run-ups of previous years, 2026 has seen a flight to quality.

Consumer Staples have become a safe harbor as investors are looking for earnings they can trust.

Here’s why:

Pricing Power: Even with inflation, these companies can raise prices on essential goods without losing customers.

Cash Reserves: These firms often hold massive cash piles, allowing them to raise dividends even during market volatility.

Low Volatility: These stocks typically fall less than the broader market during a correction.

State Street Investment Management created a report showing how different sectors perform at different points in the market cycle.

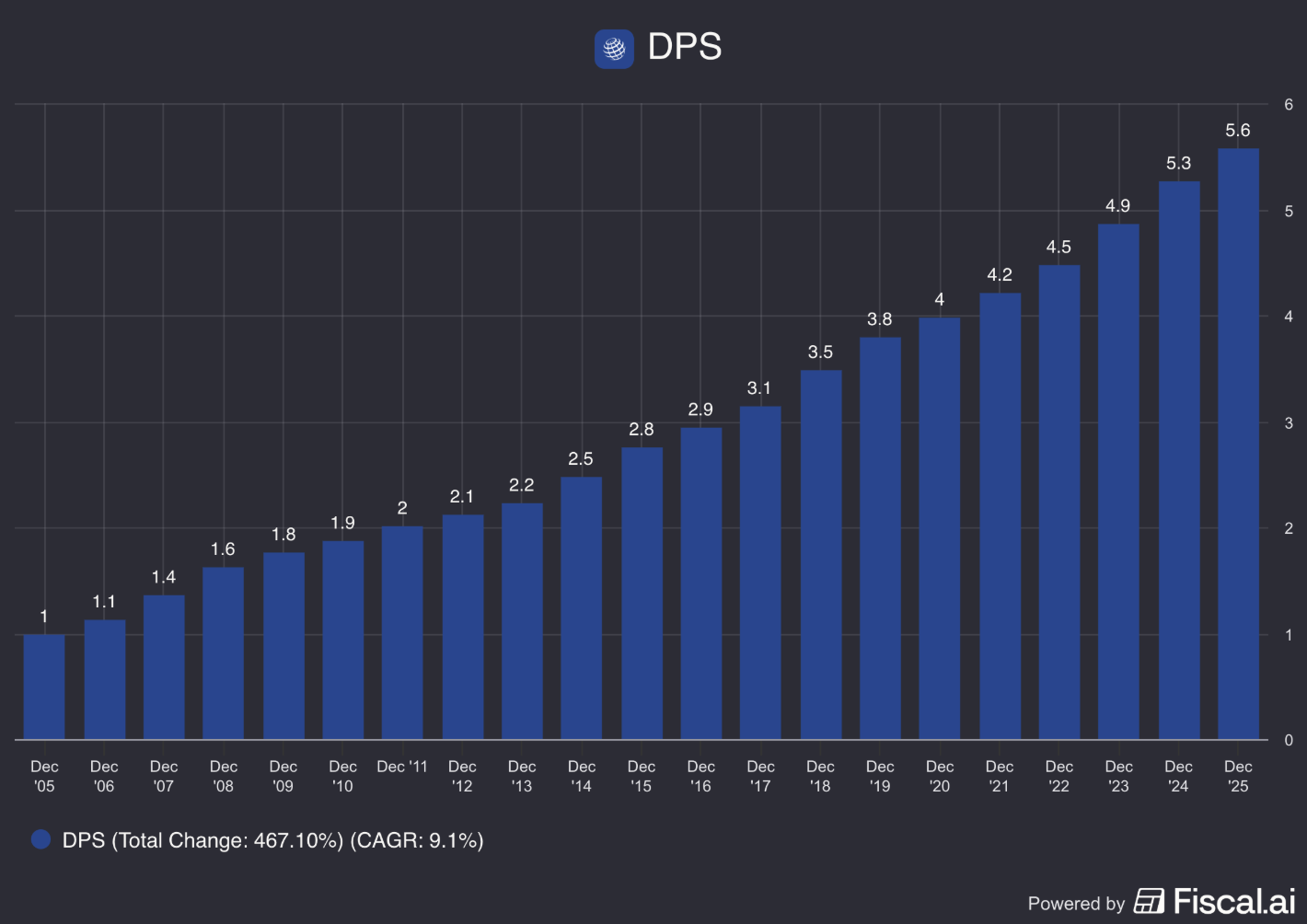

5️⃣ Example of a Dividend Stock

For a classic staple, let’s look at PepsiCo (PEP).

PepsiCo is a Dividend king with 54 years of dividend increases.

It has one of the largest food and beverage distribution networks in the world, reaching customers in over 200 countries.

They own Frito-Lay (snacks), Quaker (breakfast foods), and Pepsi (soft drinks )

Key numbers from Fiscal.ai:

Profit Margin: 8.8%

Forward P/E: 19.4x

Dividend Yield: 3.4%

Payout Ratio: 93.4%

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.