💸 The Ultimate Guide to Long-Term Investing

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Your Money Makes More Money

If you reinvest your dividends, your money grows much faster.

€5,000 can turn into a lot more over time.

So if you don’t need the cash right now, let your dividends go back into your investment.

You’ll own more of the company over time, and get paid more of the profits.

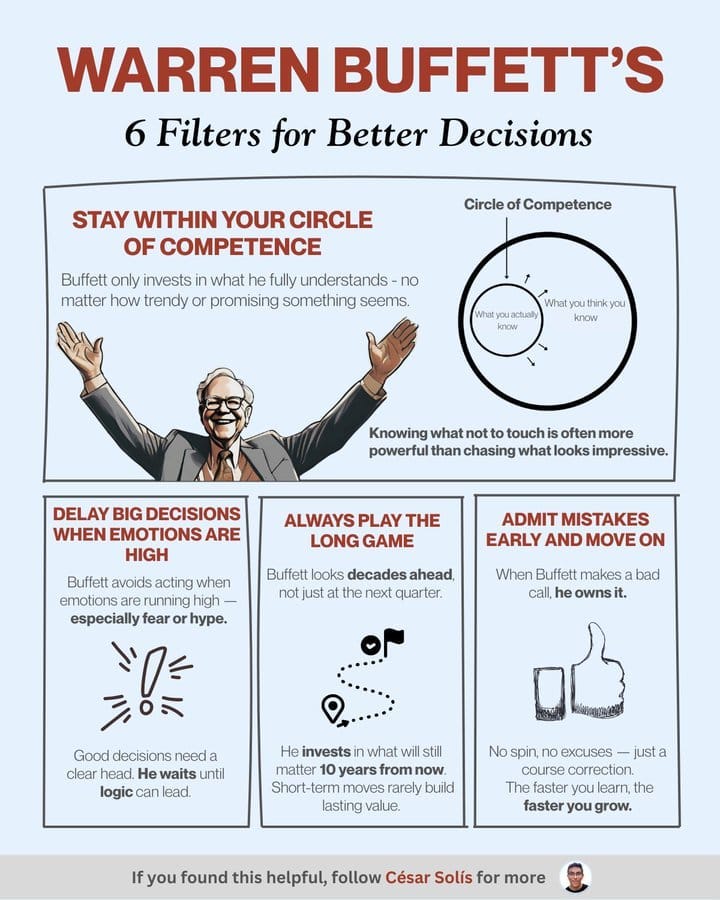

2️⃣ Make Better Decisions

This picture shows simple rules from Warren Buffett to make better decisions.

Think long-term, stay calm, and stick to what you understand.

And when you mess up? Own it and learn from it.

These rules work in investing, and in life.

3️⃣ An Investing Quote

C.S. Lewis was a famous writer who shared big ideas about life through stories like The Chronicles of Narnia.

He told us that money isn’t the only thing that can compound.

Just like your money grows when you reinvest your dividends, your decisions grow too.

Good decisions stack and make your life better over time.

Bad decisions stack too, and can make things harder.

“Good and evil increase at compound interest. That’s why the little decisions we make every day are of infinite importance.”

— C.S. Lewis

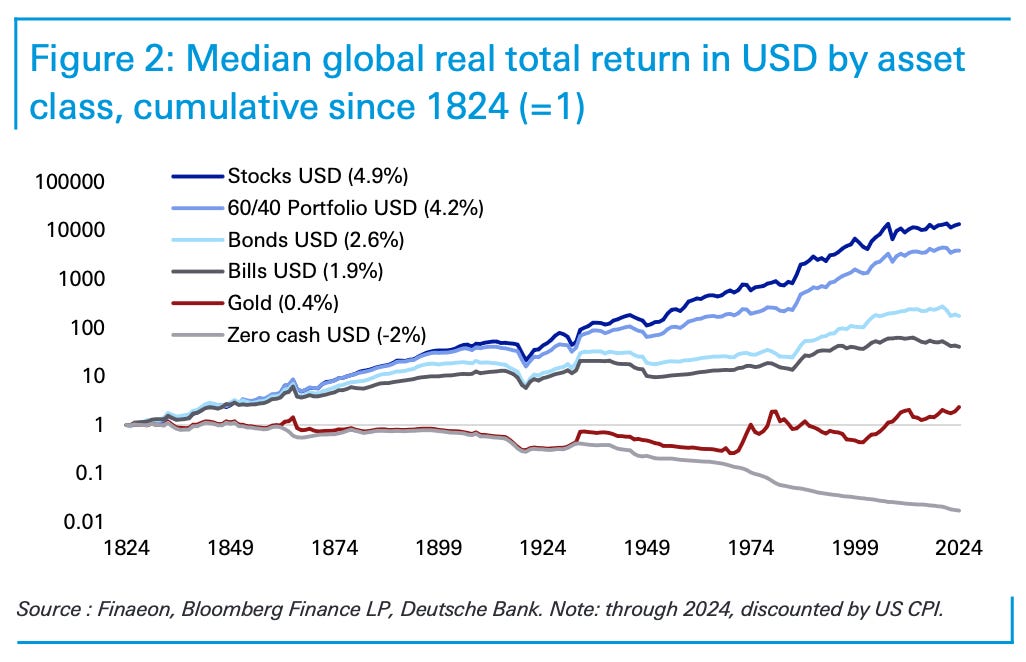

4️⃣ The Ultimate Guide to Long-Term Investing

Dividends and good decisions both benefit from the power of compounding.

But compounding doesn’t happen overnight.

To get it’s amazing benefits, you have to think and act focused on the long-term.

If you do, those choices and reinvested payouts can turn into real wealth.

Want to go deeper?

Here’s The Ultimate Guide to Long-Term Investing from Deutsche Bank.

Click the chart to read it.

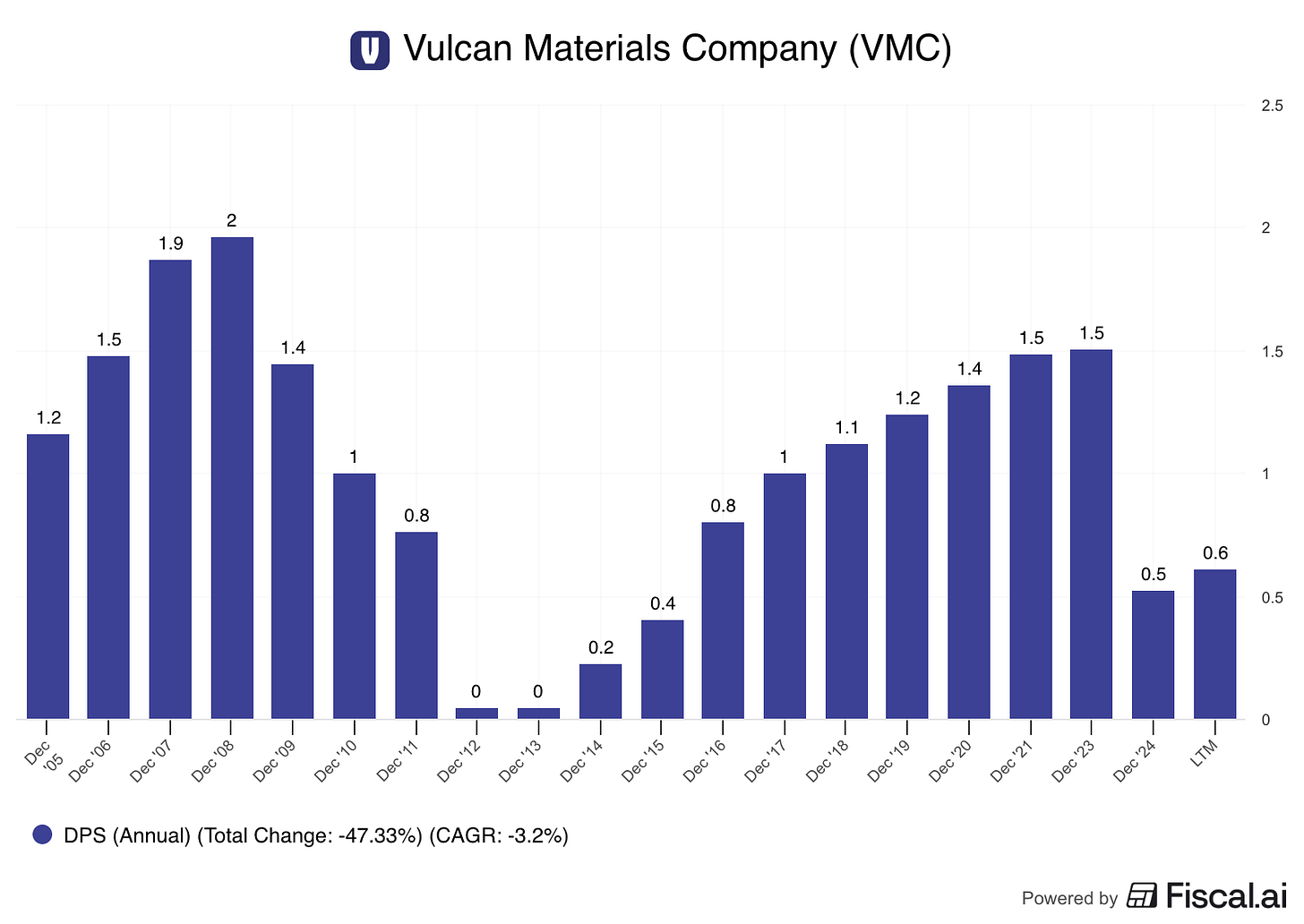

5️⃣ Example of a Dividend Stock

Let’s think very long-term for our example this week.

I’ve talked about Altria being the best performing stock of the past century.

But do you know what stock is #2?

It’s Vulcan Materials, the largest U.S. producer of construction aggregates, like crushed stone, sand and gravel.

These products are used in infrastructure, commercial and residential construction.

Why it’s lasted so long:

Its products are absolutely essential: roads, bridges, buildings all need aggregates, which gives a steady and long-term demand base.

It has durable competitive advantages: large accessible reserves, a broad footprint in high-growth markets, and strong operating discipline.

It uses a long-term focus: investing in infrastructure, logistics, margin improvement, and continuous reinvestment in operations.

The result of this long-term compounding?

A return of 14% per year over the last century.

Profit Margin: 12.5%

Forward P/E: 31.5x

Dividend Yield: 0.7%

Payout Ratio: 26.2%

Source: Fiscal.ai

That’s it for today!

Thanks for reading Compounding Dividends!

This post is public so feel free to share it.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.