They Cooked the Books — Then Beat the Market

In the ‘90s, this trash titan faked $1.7B in profits. The stock crashed, but long-term investors still won big.

👋 Howdy Partner,

On Monday we talked about boring businesses.

Today we’re talking about one of the most boring businesses there is - trash.

Waste Management ($WM) is the largest garbage collection and recycling company in North America.

Boring businesses like WM often make investors rich, because they’re built on steady, simple, necessary demand.

But even though it operates in a steady, slow industry this “boring” company had a wild flash of drama. Before we get to that, let’s take a quick look at the business:

Company Overview

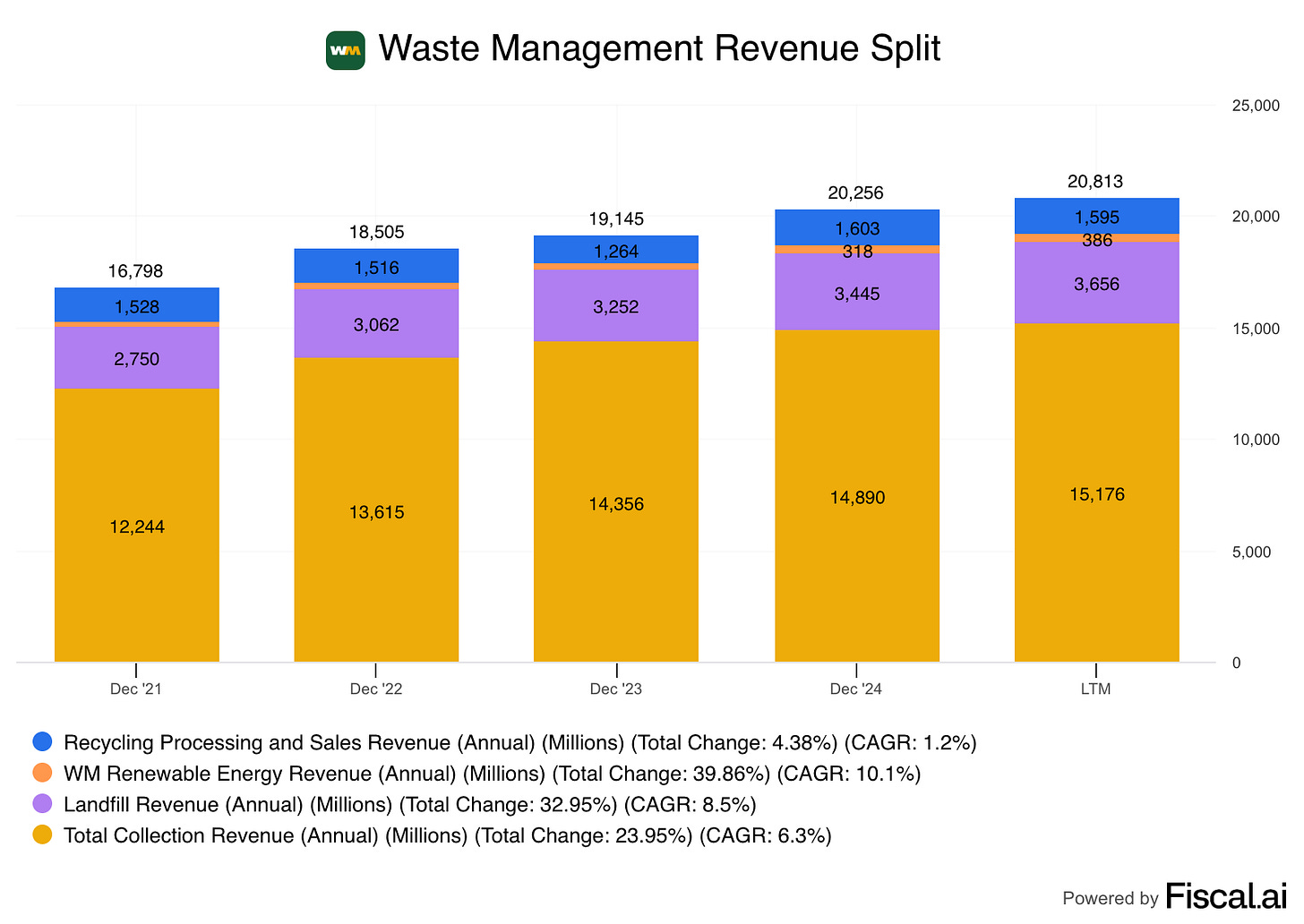

Waste Management is the backbone of America’s waste system. Their business is built on four core pieces:

Collection – residential, commercial, and industrial trash pickup

Landfills – the largest network of landfill sites in North America

Recycling – processing paper, plastics, and metals

Renewable Energy – turning landfill gas into electricity and fuel

It’s a simple, predictable model. As long as people produce trash (which they always will), WM has customers.

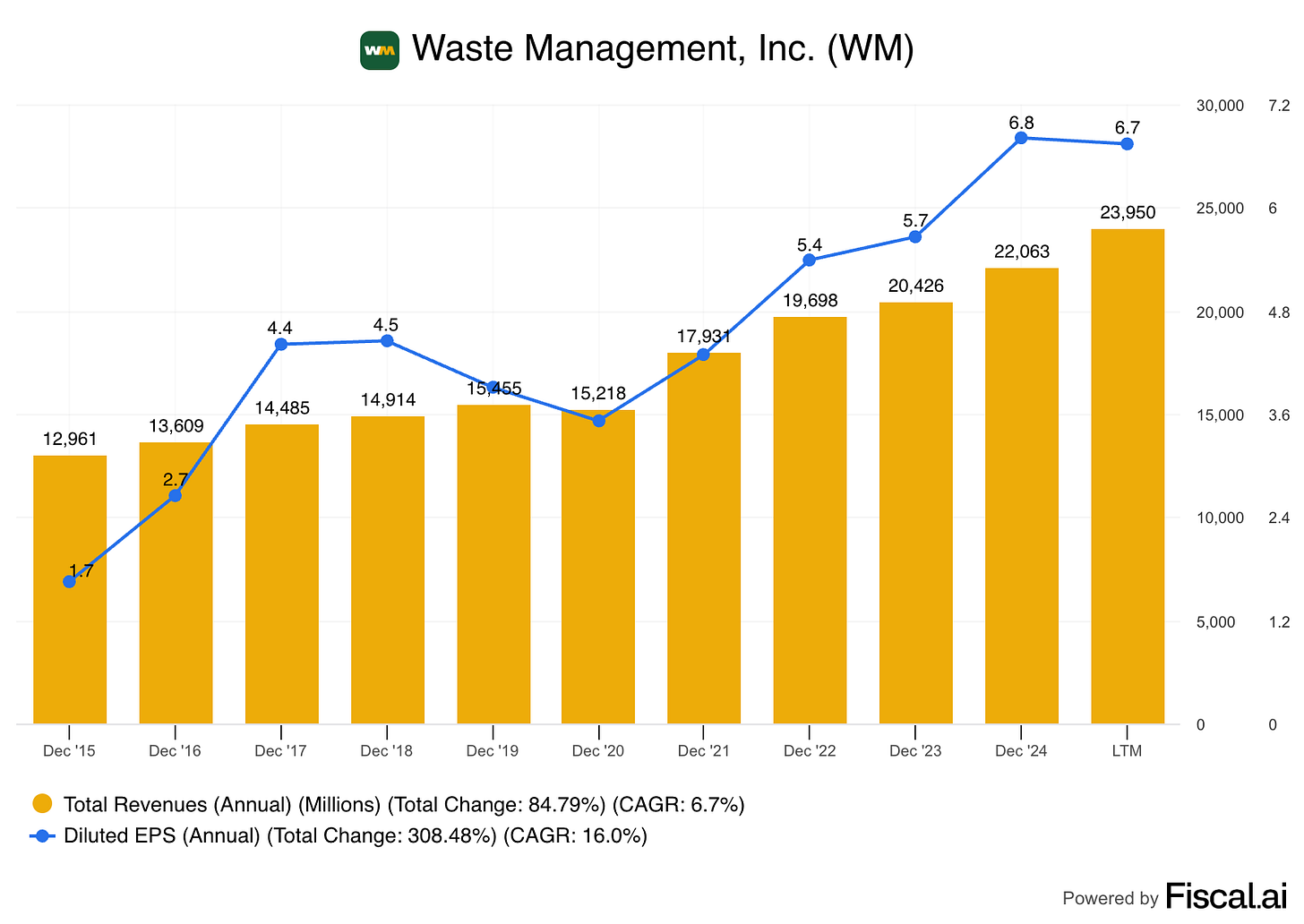

Financial Performance

Revenue & EPS Growth

WM has steadily grown revenue at about 7% per year.

EPS has grown a bit faster thanks to expanding net margins and buybacks.

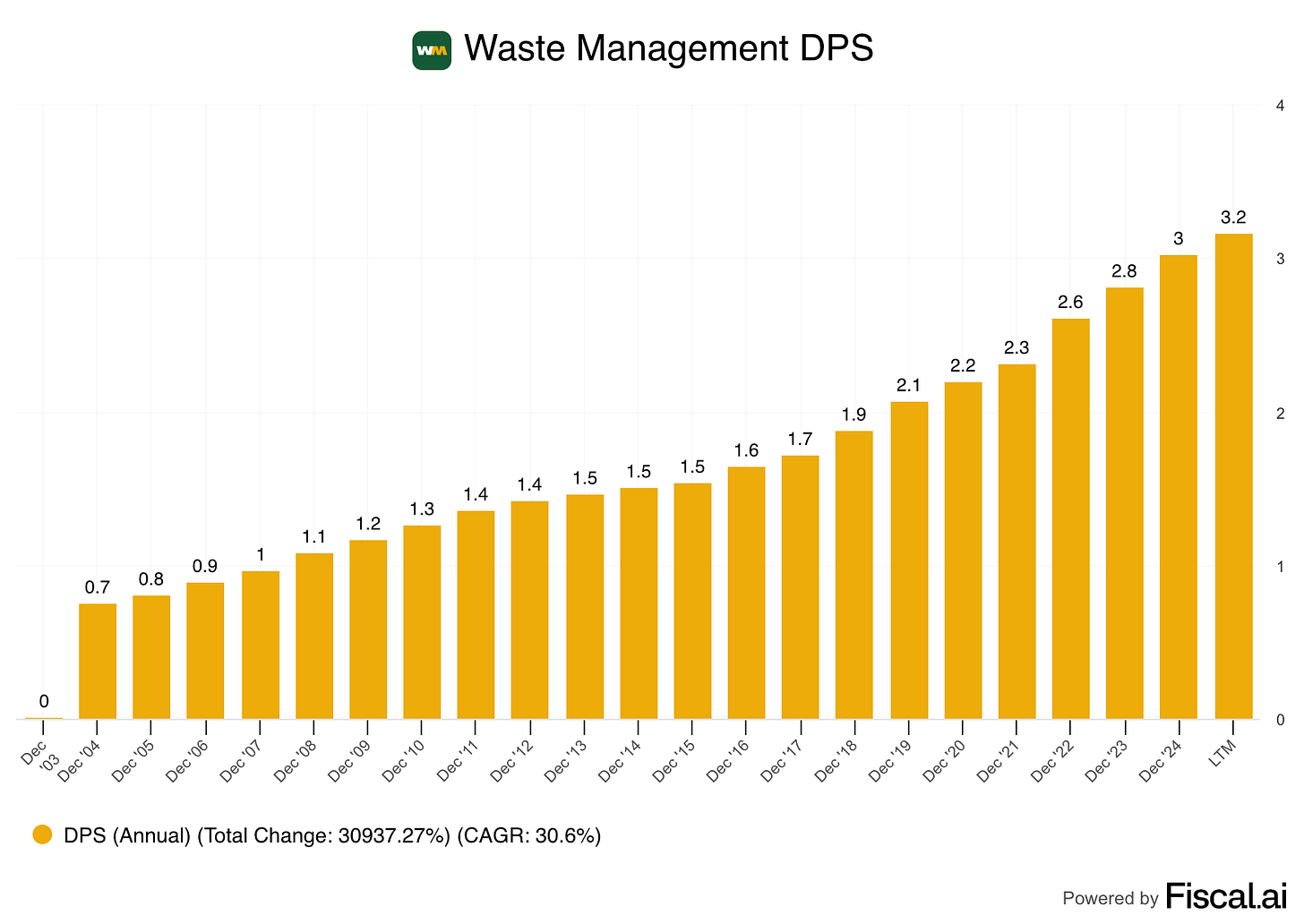

Dividends

WM is approaching Dividend Aristocrat status with 22 years of consecutive dividend hikes.

Dividend growth has been very steady, averaging around 7.5% to 8.5% per year over the past 5 and 10 years.

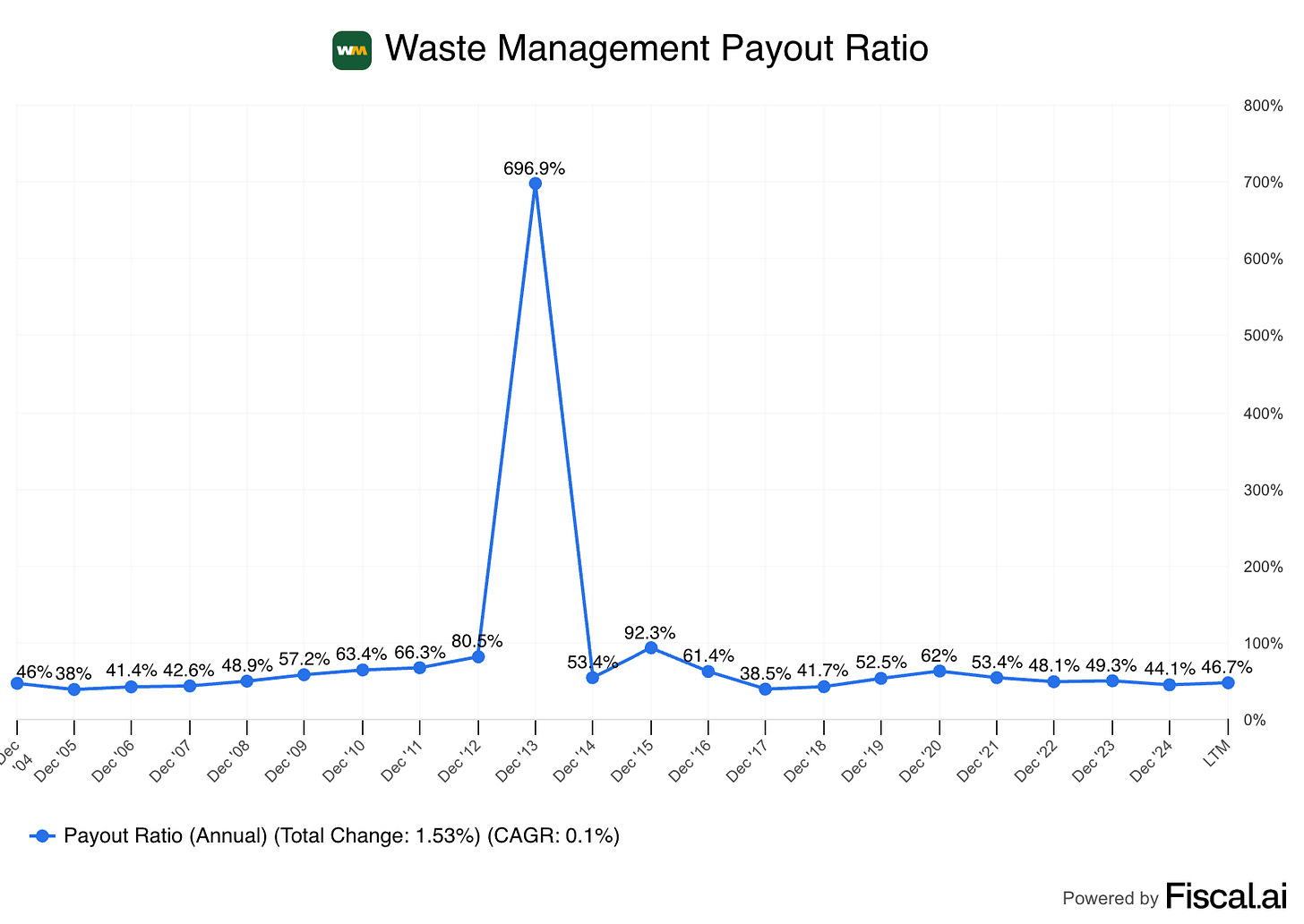

Payout Ratio

The dividend payments are typically well-covered by earnings, and WM’s steady cash flow makes them highly dependable.

Stock Performance

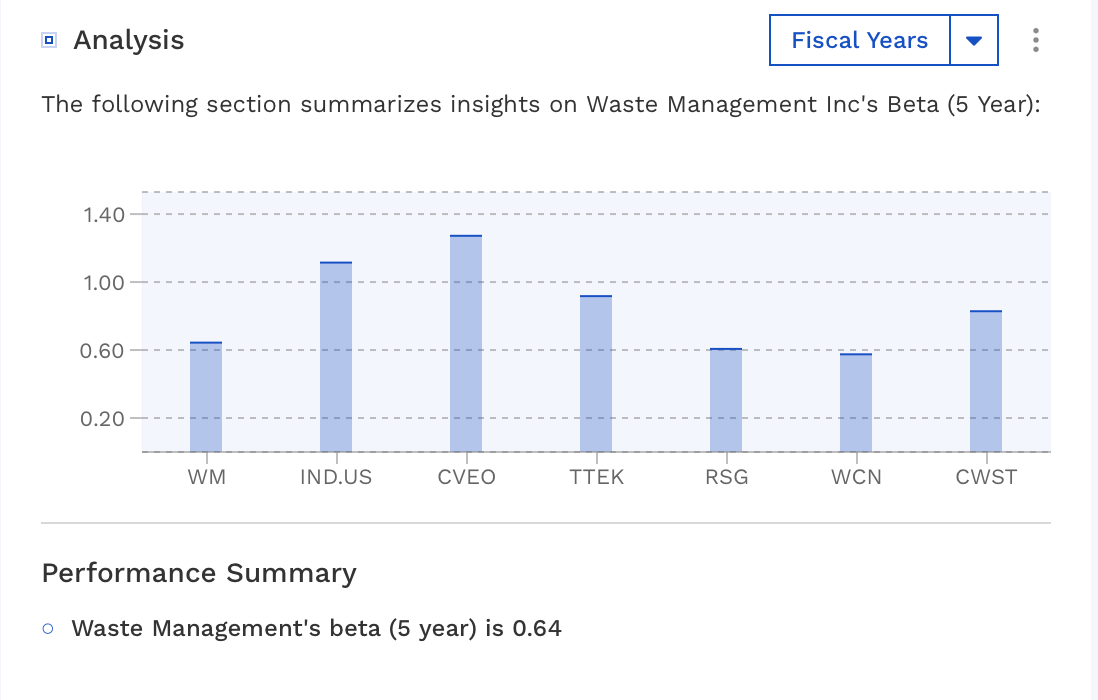

Today, WM trades like the defensive giant it is.

We can look at beta to see that WM’s volatility is lower than the S&P 500. Beta measures how much a stock’s price moves compared to the overall market.

A beta greater than 1 means the stock is more volatile than the market

A beta less than 1 means it is less volatile

The stock is a reliable compounder.

But it wasn’t always that way.

In the late 1990s, WM became one of the least boring stocks on Wall Street.

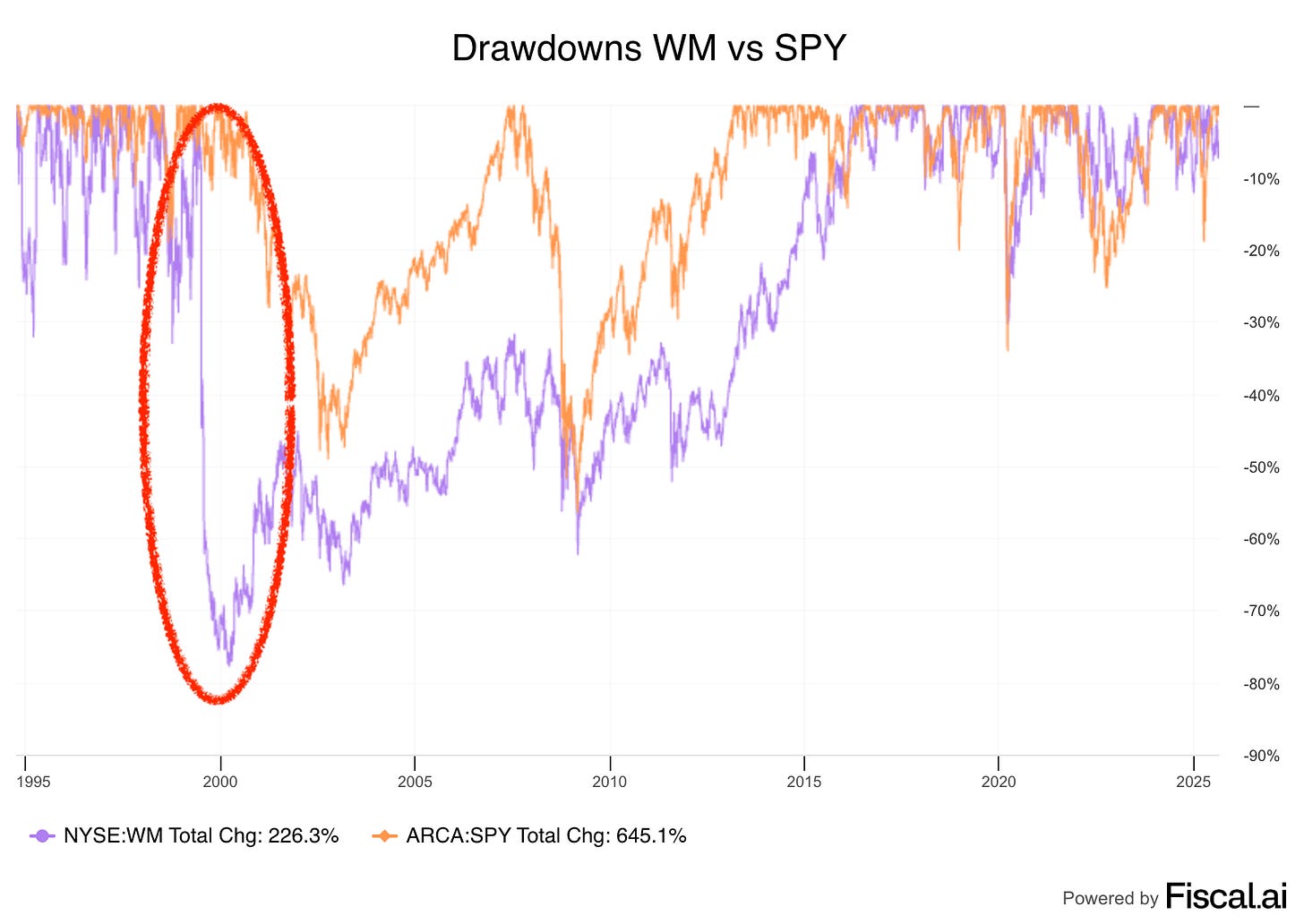

The company’s chart shows it: a massive drawdown rattled investors.

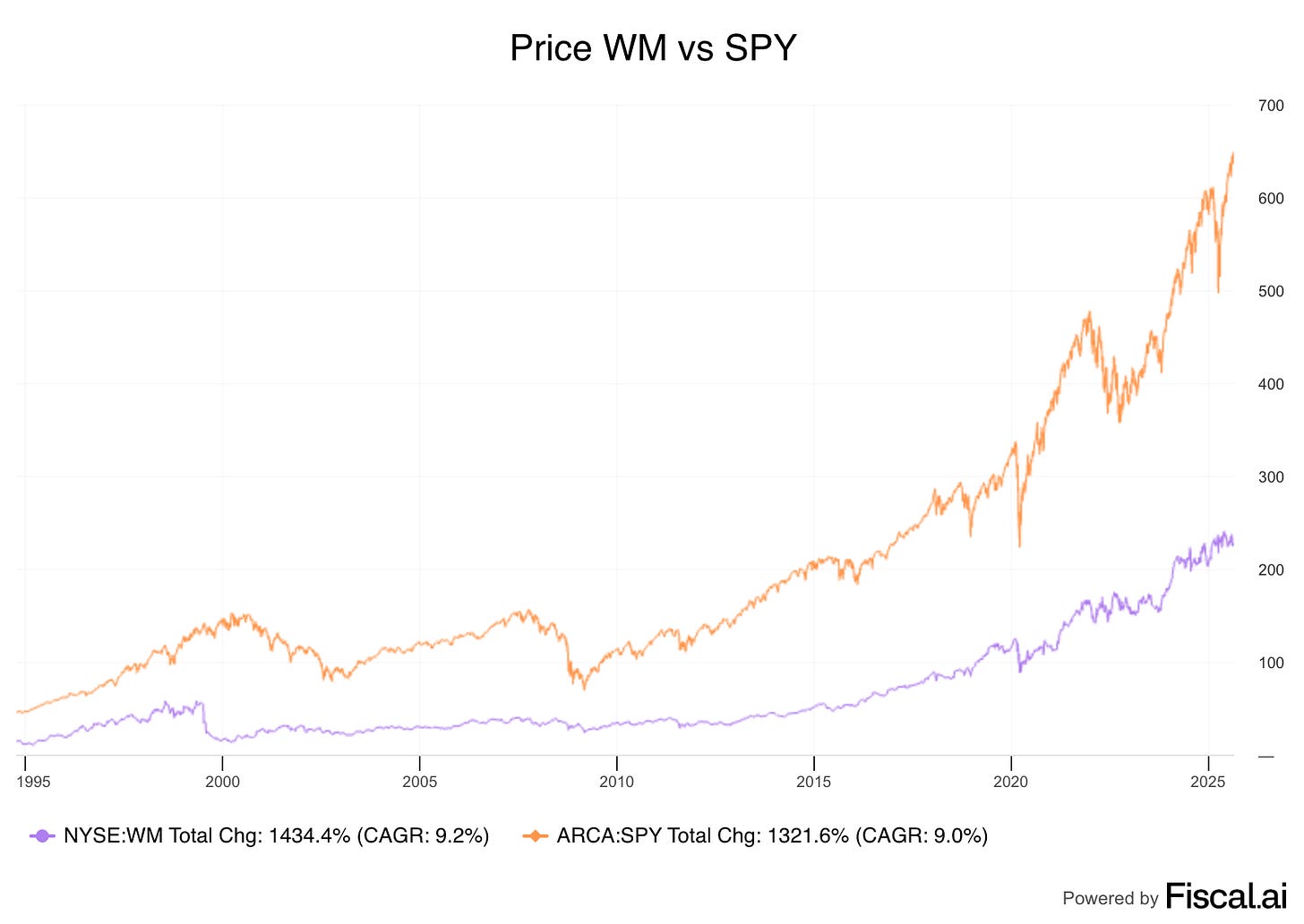

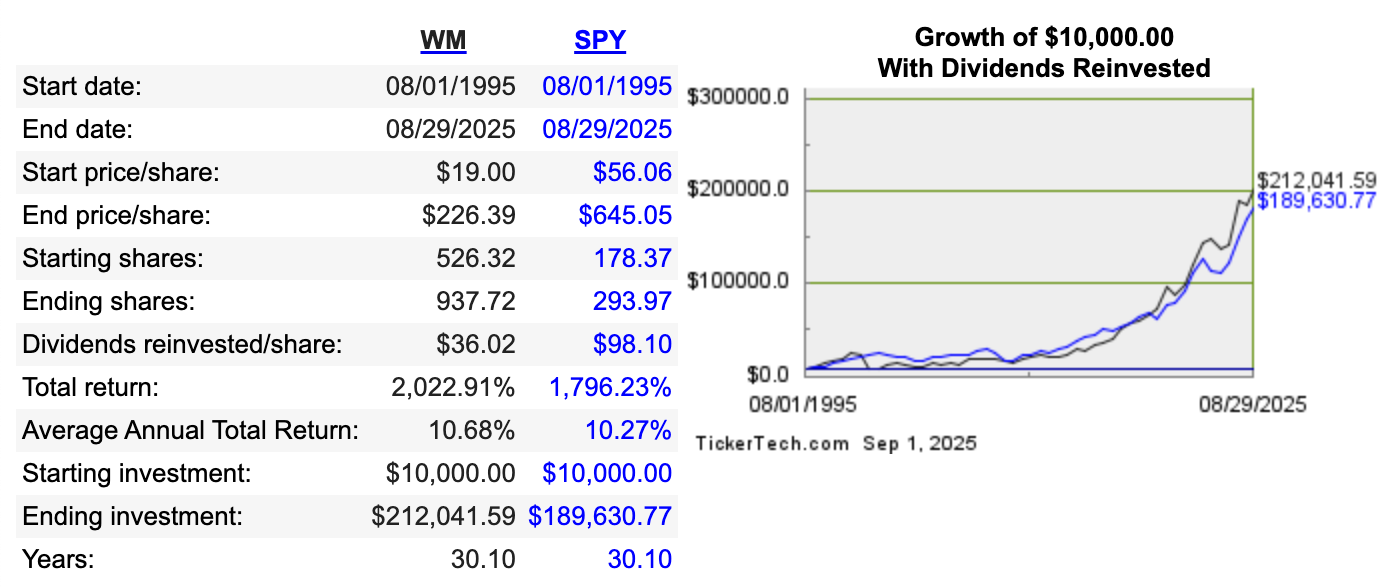

Since 1995, WM’s price return alone has actually lagged the S&P 500.

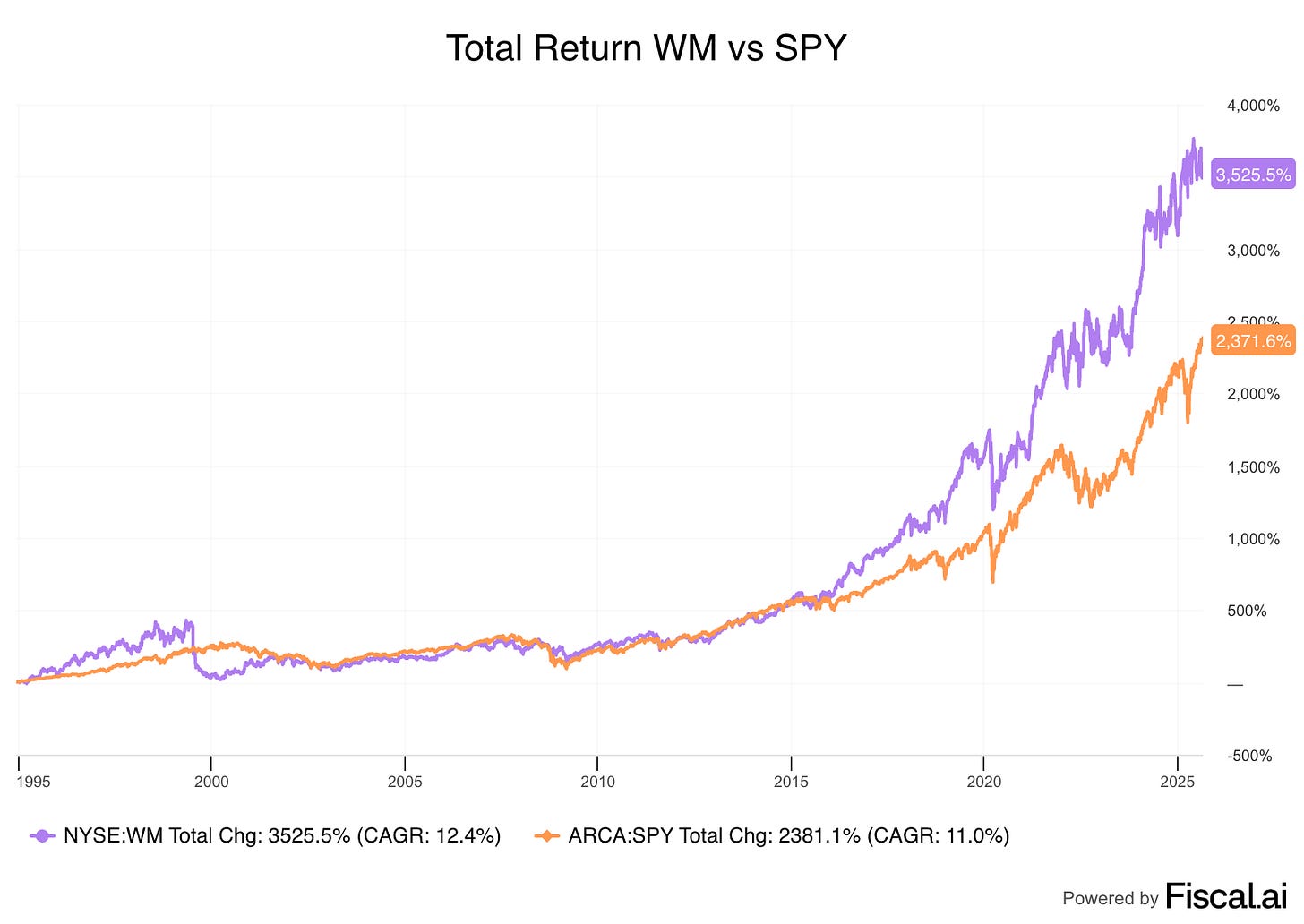

But once you include dividends and buybacks, WM’s total return has far outpaced the market.

That difference - price vs. total return - is exactly why we focus on dividends and returns to shareholders.

Despite what Wall Street wants you to believe, rising stock prices aren’t the only way to get rich.

The Flash of Excitement: 1998 Scandal

So what happened in 1998 to cause that big drawdown?

Even back in the 1990s, Waste Management was the king of garbage. They had trucks everywhere, landfills across the country, and billions rolling in.

But behind the mountains of trash, the bosses were cooking the books.

It started all the way back in 1971 when Waste Management went public.

They used a very aggressive acquisition strategy and grew too fast. In their first year as a public company alone they bought 133 companies.

Buying up companies left and right made their numbers messy.

But Wall Street loved the growth, and Waste Management played the ‘beat the estimates game’ - management gave revenue and earnings targets, then consistently beat them.

In 1993, revenue fell for the first time ever, and profits were down.

Instead of admitting profits were slipping, the top execs - led by founder Dean Buntrock - decided to cheat.

Executives manipulated depreciation schedules on garbage trucks and landfills, artificially increasing earnings by $1.7 billion.

For a while, the numbers looked great. Wall Street cheered. Then the truth came out - and the stock collapsed.

Billions in shareholder value were destroyed.

It was a rare, dramatic moment in the history of a company that otherwise runs on trash routes and landfill gas.

And it offers a lesson for investors:

Earnings are estimates. They can be manipulated.

Cash is a fact.

Let’s look at the 1997 10-K to see if we could have spotted anything fishy:

Note - these are reported as USA Waste Services which became the Waste Management we know today through a merger.

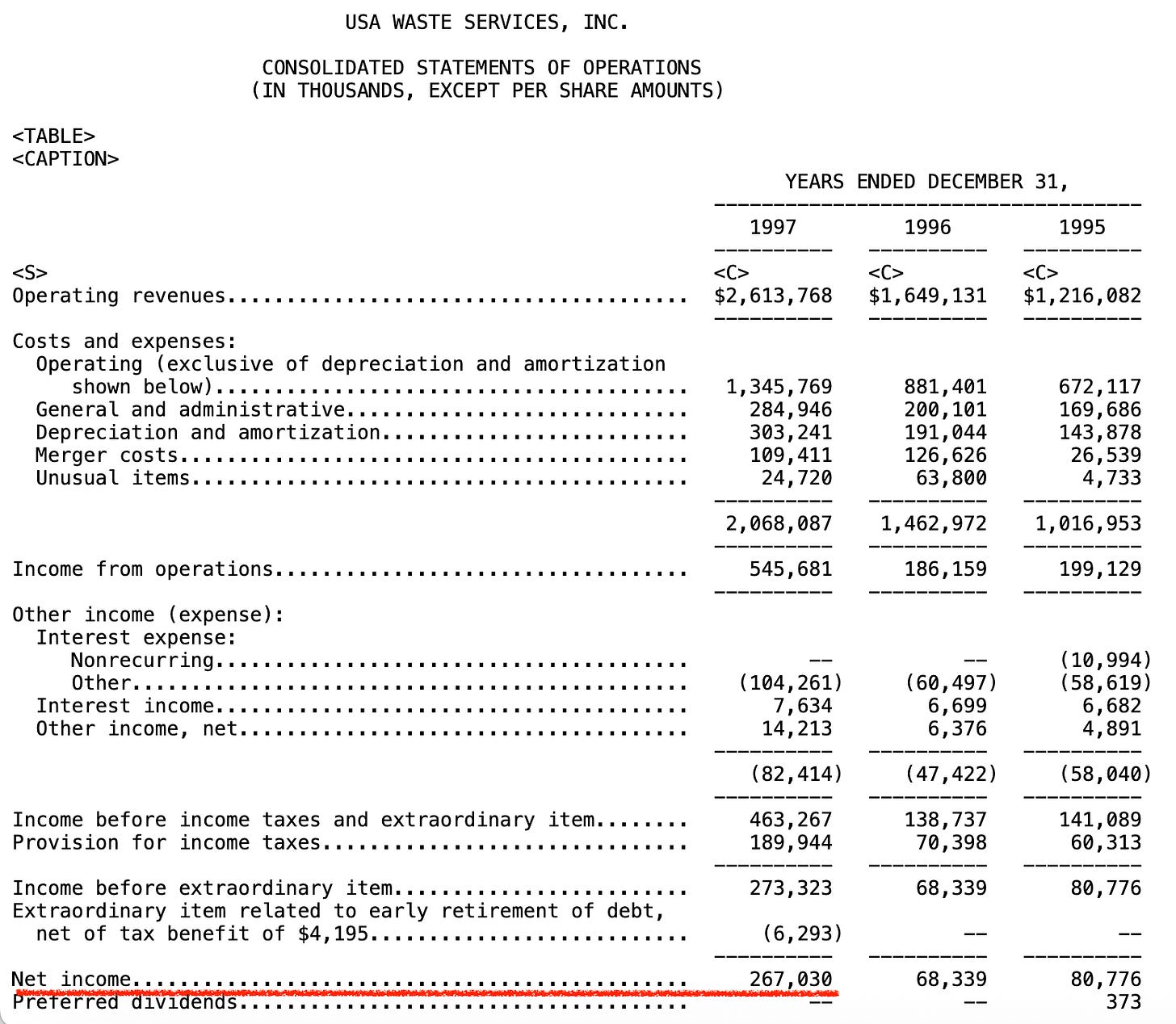

Income Statement

The reported net income was $267 million.

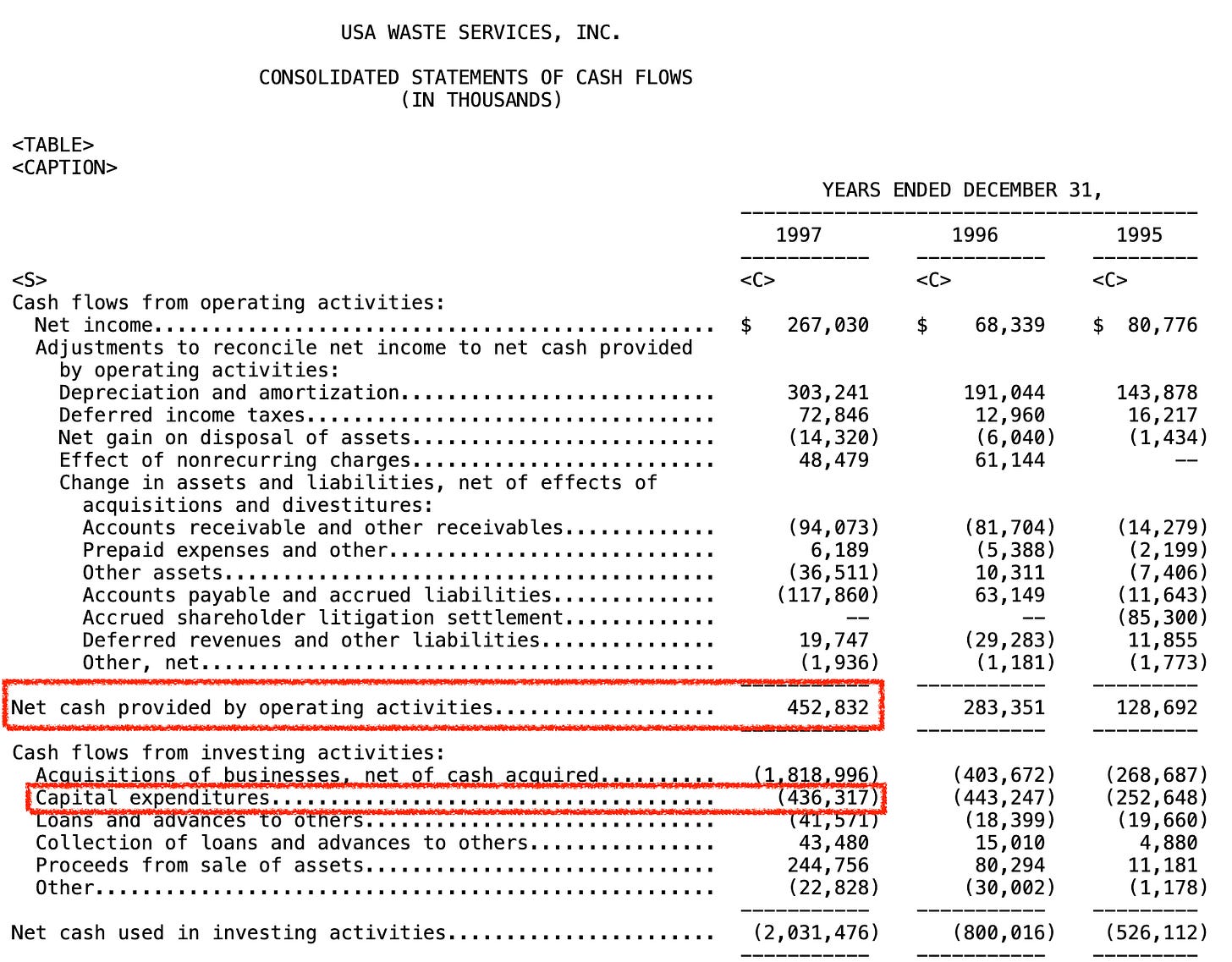

Cash Flow Statement

But let’s calculate the Free Cash Flow - we’ll subtract CapEx from Operating Cash flows:

I get $16.5 million of FCF, a big difference from $267 million of net income.

And check out the line above CapEx on the Cash Flow statement - $1.8 BILLION was spent on acquisitions.

This is why we focus on cash flows.

How WM Still Won

Even after the fraud, bad management decisions, and a huge stock drawdown, WM survived.

Because the business itself never changed. People still needed their garbage collected. Trash still went to landfills. Recycling and renewable energy became bigger over time.

The company cleaned up its books, replaced leadership, and kept doing what it does best: turning trash into steady, reliable cash.

That’s why, despite the scandal, if you’d have invested $10,000 in WM in 1995, today you’d have:

937 shares worth $212,000

Each paying $3.30 in dividends

Giving you $3,092 each year in dividends

And a 17.3% yield on cost

The big lesson here: boring businesses can make you rich if they’re steady and needed.

Don’t get fooled by “perfect” earnings, cash flow tells the real story.

And even when companies stumble, strong business models can survive and come back stronger.

One Dividend At a Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Waste Management nicely falls under Peter Lynch's idea of "a boring and dirty business". I honestly never considered the company. Now I will!

Thanks for highlighting it! 🙂