This 5.6% Yield REIT Has Raised Dividends for 35 Years

The kind of compounder every income investor dreams of - high yield, solid tenants, and a dividend that’s never missed a raise in over three decades.

NNN is a U.S. real estate investment trust specializing in owning and developing retail properties leased to single tenants.

For 35 straight years, it has raised its dividend, while maintaining an occupancy rate that rarely dips below 98%.

The company’s focus on single tenants and long-term leases has made it a model of consistency in an otherwise cyclical real estate sector.

NNN hasn’t been spared from the dynamics described here.

Over the past 3 years, the company has grown revenue by 6% per year and FFO per share by around 3% each year.

Despite that, the share price is down more than 5%.

Let’s show you how a REIT fits into our 10-step process and see if NNN is an interesting opportunity.

NNN REIT

General information:

🏪 Company name: NNN REIT

✍️ ISIN: US6374171063

🔎 Ticker: NNN 0.00%↑

📚 Type: High Yield Stock

📈 Stock Price: $43

💵 Market cap: $8.12 billion

📊 Average daily volume: $53.7 million

1. Do I understand the business model?

NNN is a U.S. based Real Estate Investment Trust (REIT).

The company owns over 3,600 properties across the United States.

These are single tenant retail properties leased to companies like 7-Eleven, Mister Car Wash, United Rentals, and Lifetime Fitness.

NNN doesn’t run any of the stores. Instead, it collects rent from the businesses that use its buildings.

These leases are long-term (10–20 years) and net leases. That means the tenant pays for things like maintenance, insurance, and taxes - not NNN.

NNN grows through increases in rent and by buying more properties.

NNN’s Acquisition Strategy

NNN is very focused, only buying single-tenant net lease (STNL) deals. These are smaller deals and typically happen one building at a time, but they fit NNN’s deep expertise.

You won’t see NNN buy a big portfolio, a strip mall, or a grocery store with an attached pharmacy.

That focus makes their results steadier and often better than peers.

Here’s why their approach works:

Less competition - Few buyers spend time on these smaller deals, so NNN finds better opportunities

Stronger tenants - NNN has built trust with about 25 strong, growing brands. Many even see their credit rating go up after working with NNN.

Long-term thinking - They look at how a store could be reused in the future and how solid the tenant is today

Custom leases - Terms are matched to each tenant and location. Risky stores usually won’t agree to long leases, which protects NNN

The results speak for themselves.

Occupancy has averaged over 98% for 20 years

Earnings are steady, even when rates rise

NNN tends to get higher starting returns and more built-in rent growth than average

That means each acquisition grows NNN at above average rates - even when buying fewer properties.

In short: NNN’s harder, slower path gives them stronger, safer growth.

Sale-Leasebacks and Deep Relationships

NNN’s acquisitions usually come in the form of sale-leaseback transactions. This means that the company running the store sells the building and land to NNN, then immediately leases it back from them.

Why would a company do this?

Because the seller wants to raise cash but doesn't want to give up operational control of the property it's selling. A deal with NNN REIT can make that happen.

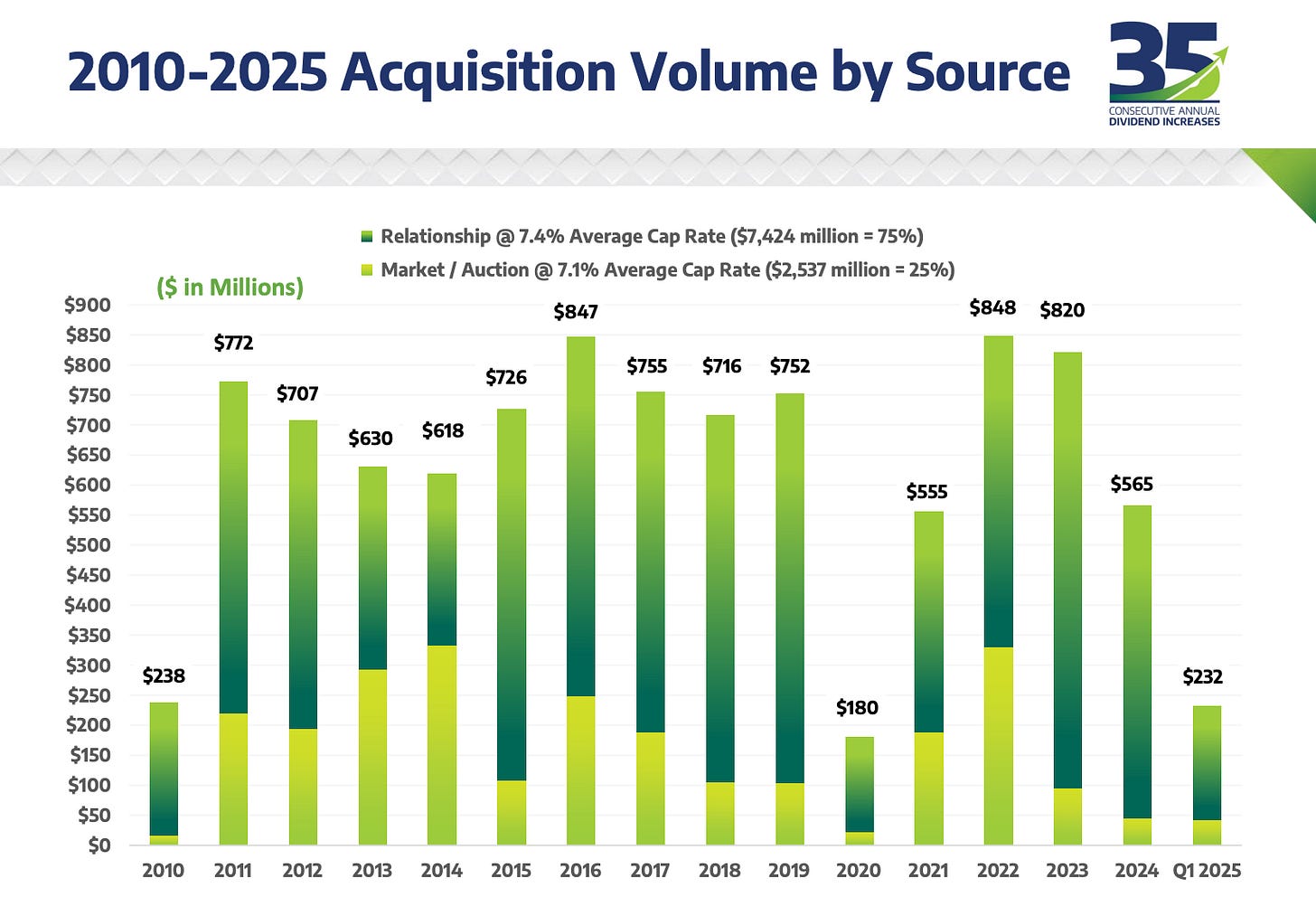

This brings up an important aspect to consider about NNN REIT: Roughly 75% of its transaction volume since 2010 has come from companies that it already has an existing relationship with.

Competitive Advantages

You might think that having competitive advantages would be difficult in retail real estate, but NNN has several:

High Occupancy

NNN has averaged about 98% occupancy for 20 years, far higher than most peers. They manage this by keeping rents around the market average, and by working with strong, growing companies.

Long, simple, steady net leases.

Most contracts run 10–20 years, giving reliable, predictable income. They also typically have rent increases built in.

Net leases mean tenants cover taxes, insurance, and maintenance, while NNN just collects rent.

Diversification

Over 3,600 properties across the U.S., with hundreds of tenants in different industries.

Relationship-based acquisitions.

NNN avoids auctions and instead buys smaller deals through long-term tenant relationships, often at better terms.

Financial strength.

With a BBB+ credit rating, conservative debt, and long maturities, NNN can handle rate changes and downturns.

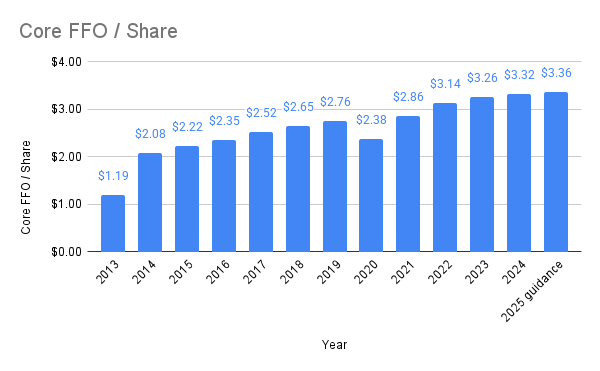

You can see the results of these advantages through NNN’s 35 year streak of raising dividends, and steady Funds From Operations (FFO) per share growth of 3–4% annually.

2. Is management capable?

Stephen Horn, Jr. - CEO

Mr. Horn has been the CEO since 2022.

He’s been with the company since 2003, working on acquisitions and as the Chief Operating Officer before being promoted to CEO.

Vincent Chao - CFO

Mr. Chao has been the CFO since January of 2025.

Prior to that he was the Director of Finance for another publicly traded REIT RPT Realty, and Head of U.S. REIT Research at Deutsche Bank Securities.

He replaces Kevin Habicht, who retired from NNN after 32 years.

The management team at NNN has consistently grown the company’s FFO/Share:

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

NNN has grown its dividend for 35 years in a row.

5-year dividend growth rate: 2.4% annually

10-year dividend growth rate: 3.1% annually

NNN hasn’t met our 5% growth target, but this is a high-yield company. It has at least grown the dividend to match the average rate of inflation.

4. Is the company active in an attractive end market?

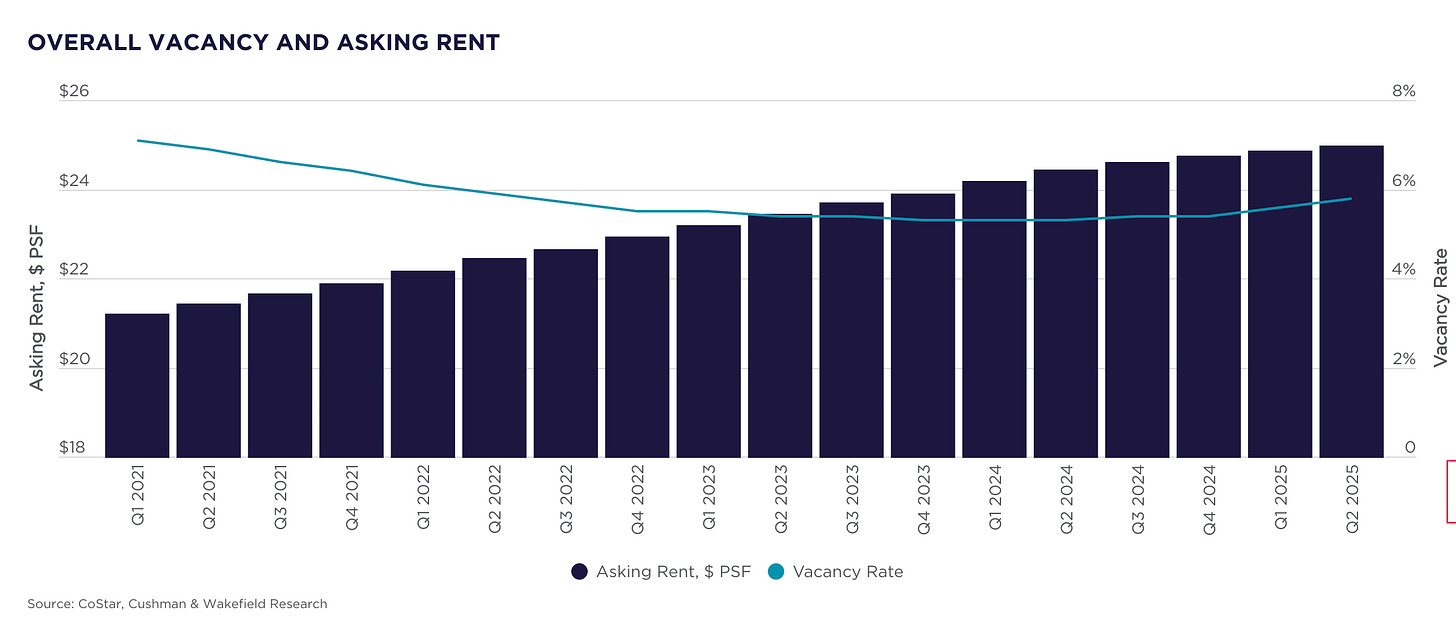

The retail real estate market is fairly mature.

However, vacancies have been trending down, and rent prices have been trending up.

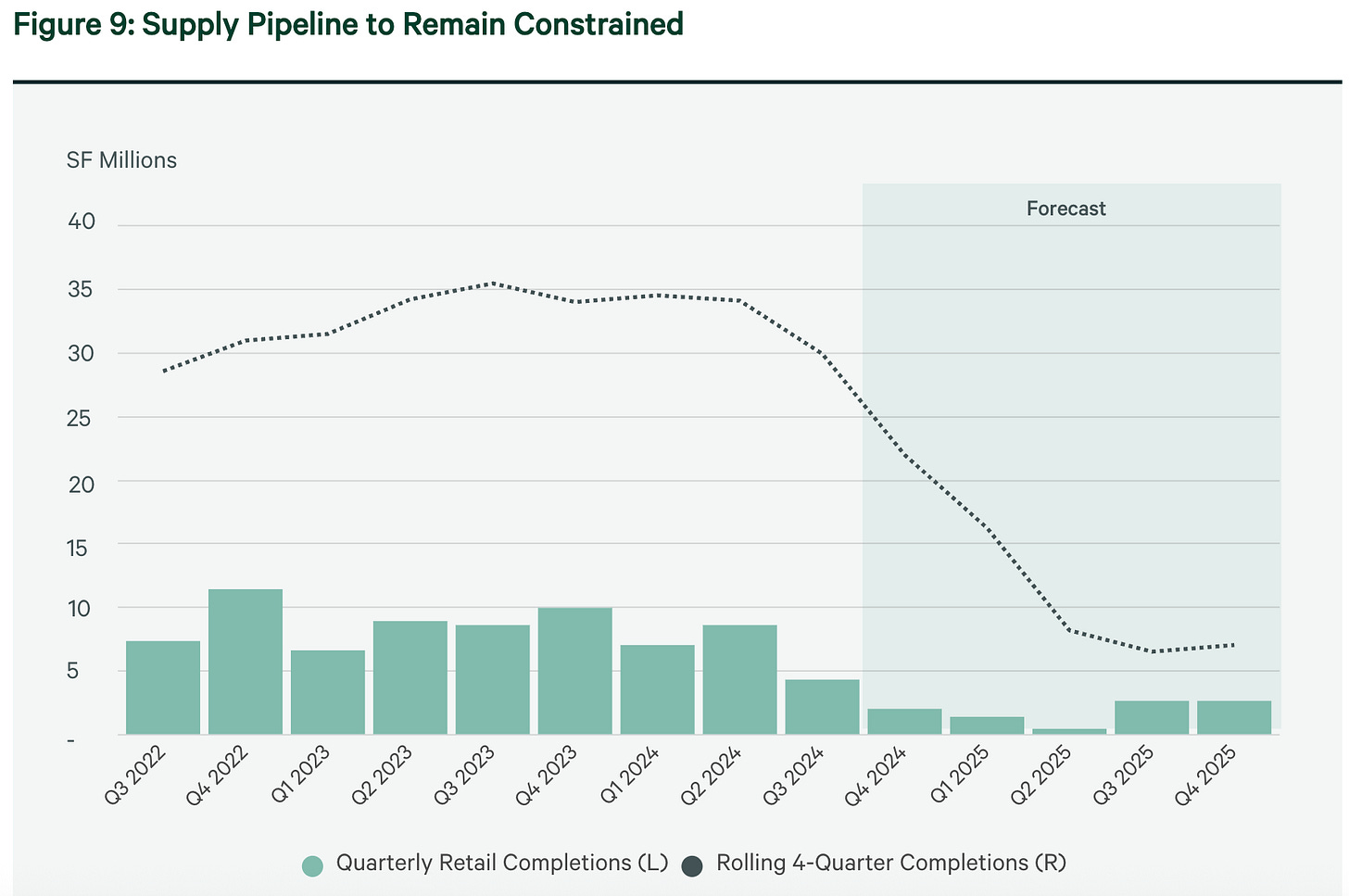

Construction is also sluggish, which means the demand for NNN’s properties should remain strong and support continual rent increases.

5. What are the main risks for the company?

Tenant Risk

NNN relies on tenants (like 7-Eleven, Sunoco, LA Fitness) to pay rent. If a tenant fails or leaves, rental income drops.

Mitigation: NNN has over 3,600 properties with more than 400 tenants. No tenant is more than 4.5% of rent, so the risk is spread out. Many tenants are service or necessity-based businesses.

Interest Rate Risk

NNN borrows money to buy properties. If interest rates rise, borrowing costs go up and profits may shrink.

Mitigation: NNN keeps debt at reasonable levels and mostly uses fixed-rate debt. They’ve managed through many interest rate cycles before.

Retail Industry Changes

Some retail chains are struggling with online competition. If stores close, NNN could lose tenants.

Mitigation: NNN focuses on service-oriented and essential businesses - like convenience stores, gyms, restaurants, and auto service that people still need to visit in person

Property Concentration Risk

If too many properties are in one location or industry, a downturn there could hurt results.

Mitigation: NNN’s portfolio is spread across 49 states and many industries. This geographic and sector mix helps smooth out problems in any one place.

6. Does the company have a healthy balance sheet?

The real estate industry runs on debt. That means that we need to look at the balance sheet of a REIT a little differently than we do for a typical company.