This Oil Giant Can Survive (and Thrive) at $50 a Barrel

A low cost producer built to keep paying dividends when others can’t. Here's why we’re preparing to buy more if the stock drops:

👋 Howdy Partner,

Energy companies have always been important dividend payers.

Giants like Exxon and Chevron have decades of steady payments behind them.

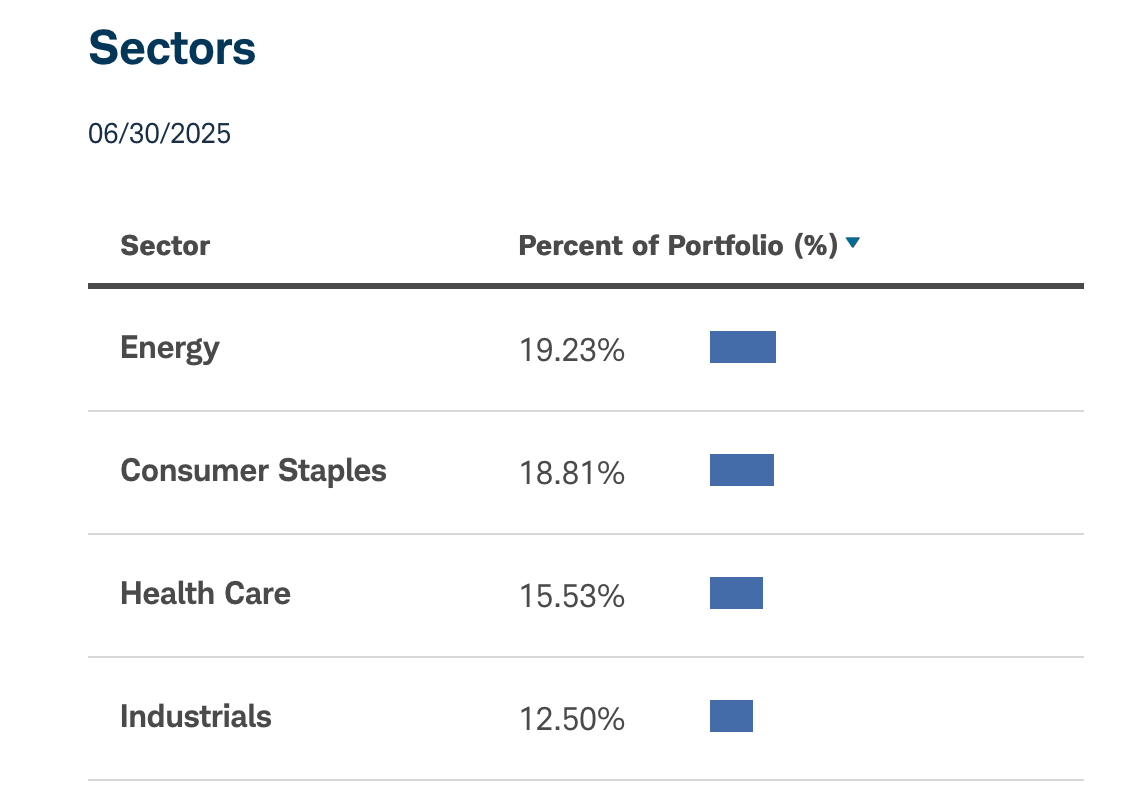

And if you look at the SCHD ETF - one of the most popular dividend ETFs out there - you’ll see the energy sector makes up nearly 20% of its holdings.

But you might have noticed that right now, things in the oil world are getting tough.

Layoffs and Lower Prices

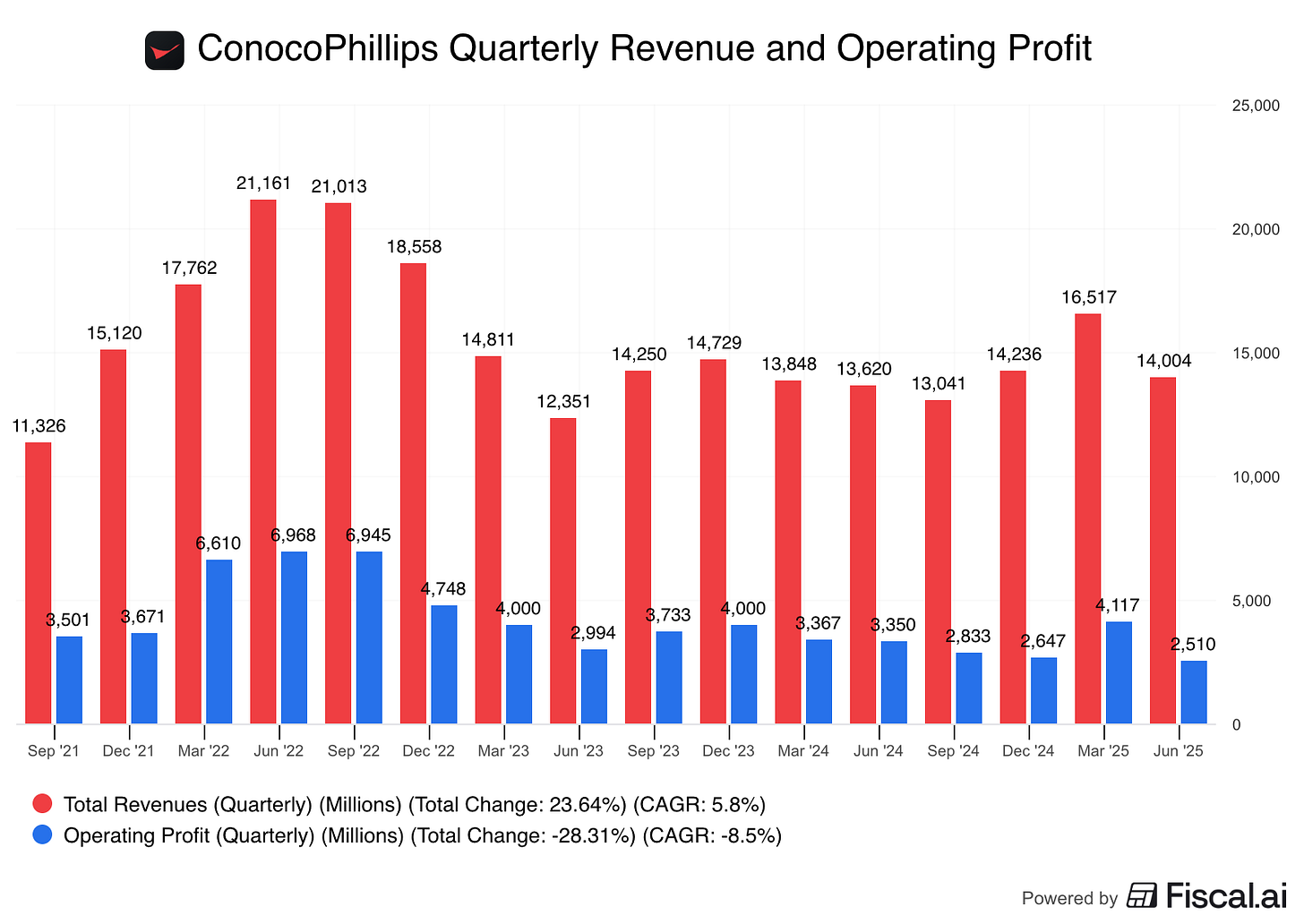

Earlier this month, ConocoPhillips, the third-largest oil producer in the U.S., announced major layoffs.

Between 2,600 and 3,250 people could lose their jobs. The reason? Earnings are falling, costs are rising, and oil prices look weak going into 2026.

And it’s not just ConocoPhillips.

BP, Chevron, Halliburton, and others are also cutting staff.

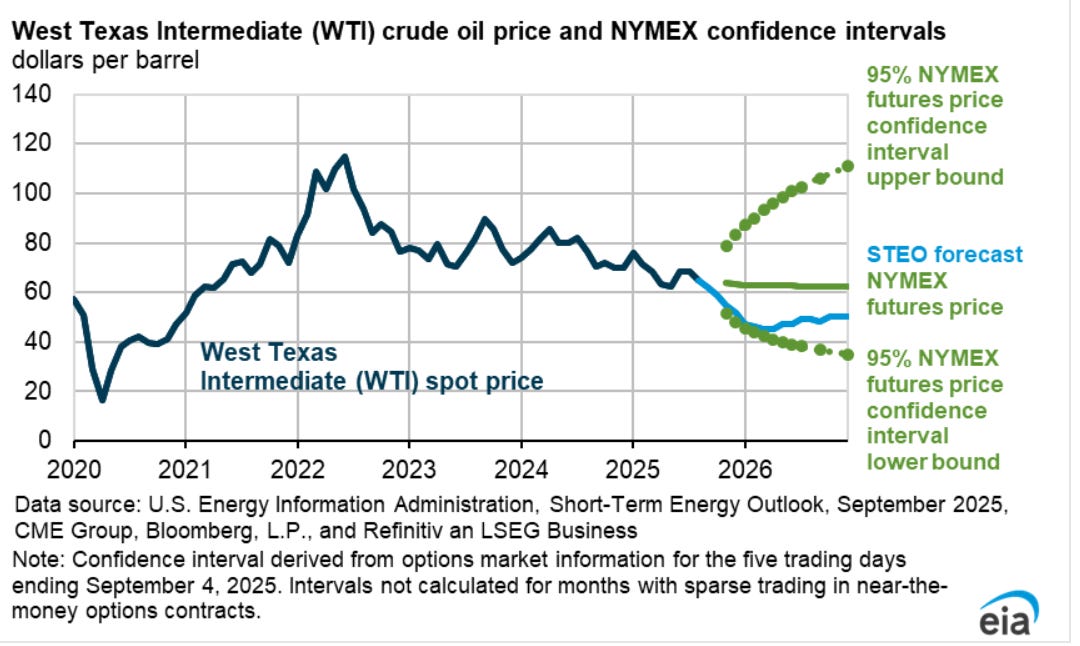

The U.S. Energy Information Administration (EIA) now expects oil prices to drop from the current price of around $63 a barrel to around $50 in early 2026.

That’s a huge shift.

Here’s what’s driving it:

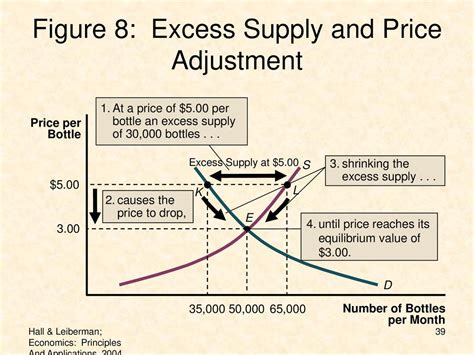

Too much supply: OPEC+ is pumping more oil, which is leading to…

Inventory builds: Global oil stocks are expected to grow by over 2 million barrels per day through early 2026

Lower demand growth: Oil demand isn’t keeping up with supply

Gas vs. oil shift: Natural gas prices are rising while oil is falling, making oil less valuable compared to gas

Tariffs and inflation: Trade wars and higher costs have added pressure on oil prices

The bottom line is that prices are falling because supply is rising faster than demand, and that imbalance is expected to last into 2026.

Why It Matters For Dividend Investors

Oil companies like ConocoPhillips, Exxon, and Chevron are important dividend payers.

If prices fall, high-cost producers struggle

Some may cut production or even shut down rigs

Earnings (and sometimes dividends) can take a hit

Oil is a cyclical business. And when cycles turn down, you find out which companies are built to survive, and which ones aren’t.

Now, here’s the good news.

We own a company that’s built to withstand even $50 oil.

This company doesn’t need to keep drilling new wells just to maintain production and stay alive.

Its oil comes from long-life assets that are already set up, and the ongoing costs are much lower than companies that produce oil from shale.

To give you an idea:

A shale producer might spend $6.5 billion a year just to keep production flat.

This company? They can keep the same production level for under $2 billion.

Their breakeven costs are much lower than shale produces - some assets below $30 a barrel.

That’s the kind of edge we want in a downturn. If weaker companies pull back, supply drops, and prices eventually bounce. When that happens, the survivors get stronger.

I’m writing this to prepare you: if oil prices fall and the stock drops, we’ll likely be buying more.