This One Mistake Costs Investors More Than Any Crash Ever Could

(And it’s probably not what you think…)

When most people think of “risk” in investing, they picture a market crash.

A red screen.

Falling prices.

That sick feeling in your stomach.

But here’s the truth:

The biggest risk isn’t the market.

It’s you.

Your behavior.

How you react when the market gets rough.

And that’s where dividend stocks can help.

Don’t believe me?

Here’s 5 reasons dividend stocks can help protect you from yourself.

Reason #1: They Pay You to Stay Put

When stocks go down, the instinct is to sell.

But what if you’re still collecting cash—every single quarter?

That steady drip of income makes it easier to stay calm and ride it out.

Reason #2: You Start Focusing on the Right Thing

Watching your stock prices fall is painful.

But watching your income hold steady, or grow?

That’s powerful.

It shifts your thinking from short-term fear to long-term confidence.

And that mindset change?

It can save your portfolio.

Reason #3: Dividend Payers Are Often Rock-Solid

Big dividends don’t come from shaky businesses.

They come from companies with:

Strong profits

Healthy balance sheets

Proven track records

These are the kinds of businesses that last.

And that kind of quality gives you something even more valuable than cash: peace of mind.

Reason #4: You Stop Thinking Like a Trader

Dividends don’t just pay you now.

They change how you think about time.

Suddenly, you’re not watching daily moves.

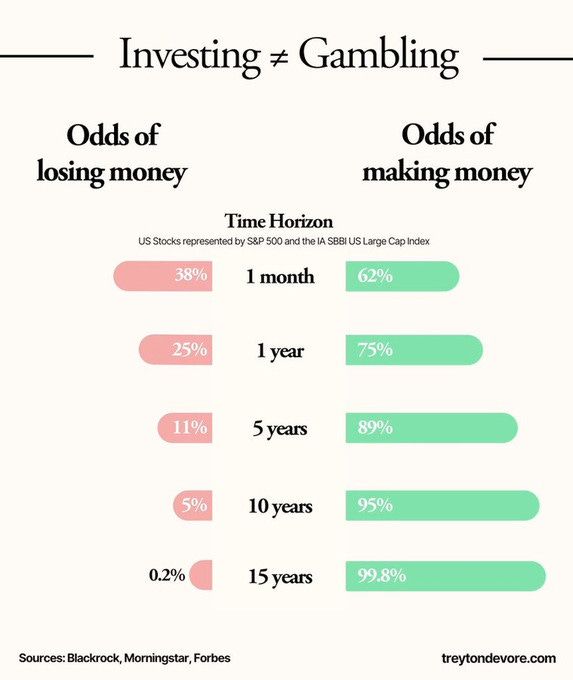

You’re thinking in years.

And that long-term view?

That’s where real wealth is built.

Reason #5: Reinvesting Dividends Creates a Beautiful Loop

When you reinvest, something magical happens.

Your income grows.

Not because the market went up.

But because you stayed invested.

It’s a positive feedback loop that rewards good behavior.

Patience pays - literally.

Conclusion

Dividends won’t make you a perfect investor.

But they can make you a better one.

And better behavior?

That’s the real secret to building wealth.

Even when the market gets scary.

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Call me a weirdo but I get kind of excited when I see stock prices go down, especially those in my "income portfolio". That means dividends and income streams are on sale! And, you don't need to clip coupons to get the discounted price. 😄