Ultimate Guide to BDCs

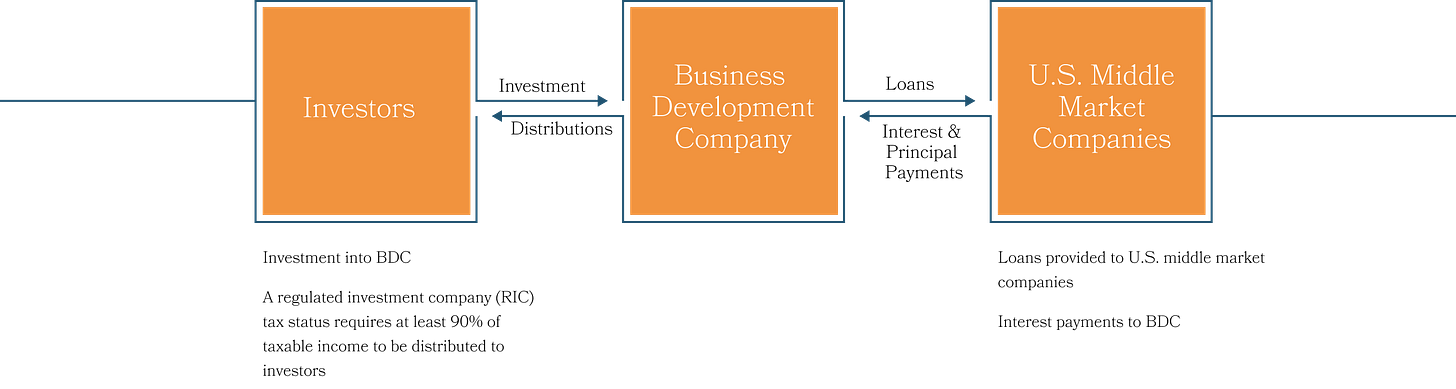

Business Development Companies (BDCs) are interesting because of their high yields and because they’re an easy way to invest in private credit.

But what exactly is a BDC, and how do you invest in the right ones?

Let's teach you everything you need to know.

What is a Business Development Company?

You can think of a BDC as a bank for private companies.

For a small business to grow, they need cash.

But they often can't get loans from big banks because they’re too small or too risky.

BDCs lend money to these firms so they can expand.

How do BDCs Make Money?

A BDC makes money in a few simple ways.

1. Interest Spreads

BDCs borrow money at a low cost and lend it out at a higher rate. The difference between what they pay and what they earn is called the spread.

2. Interest Income

Most BDCs focus on loans. When a private company borrows from a BDC, they pay interest every month. A lot of these loans have rates that go up when the Fed raises rates. This means the BDC earns more when interest rates are high.

3. Equity

Sometimes, a BDC will also take a small piece of ownership (stock) in the company. If that company grows and gets sold, the BDC makes profit on its ownership.

4. Fees

BDCs charge the companies they help for things like setting up the loan or giving business advice.

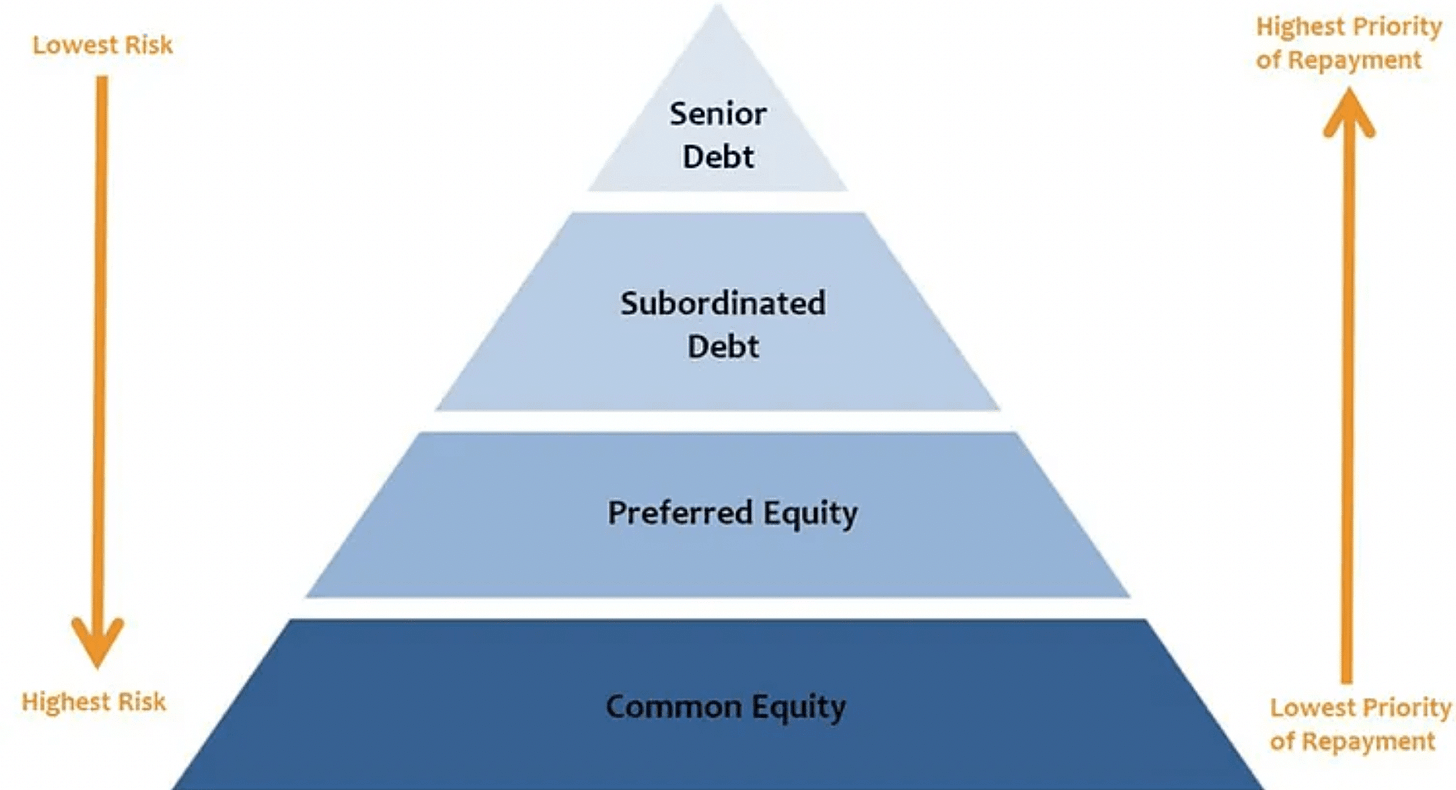

Types of Loans

Because a BDC is mainly a lender, it’s important to understand the different types of loans they can make.

First lien secured loans (Senior Debt) – loans backed by the borrower’s assets. These are the first loans that must be repaid if the business fails.

Second lien or mezzanine loans (Junior Debt) – higher risk debt, paid out after the first lien loans that come with higher interest rates.

Unitranche loans – a blend of senior and junior debt in a single package.

The main thing to understand is that the senior debt gets the highest priority of repayment, making it lower risk and usually lower interest rates.

The further down you go in the capital stack, the lower your priority of repayment, but the higher the potential rewards become.

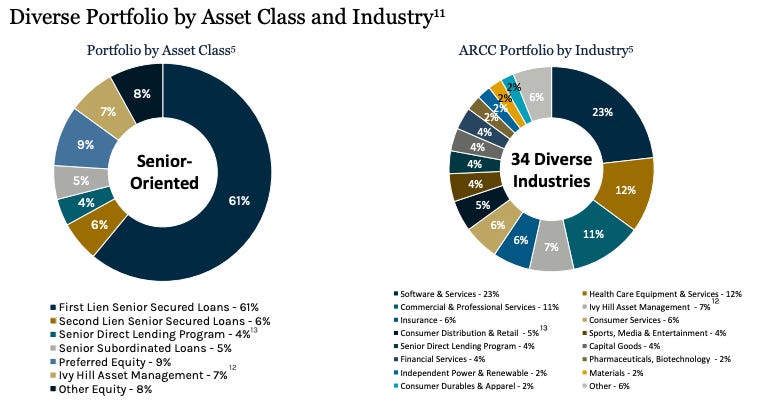

Business Development Companies often create a portfolio of different types of credit and equity to create diversification.

Let’s look at an example of a BDC’s portfolio.

I’ve used Ares Capital Corporation because they’re a very large and diverse BDC.

They own:

A lot of secured loans

Some second lien and subordinated loans

A bit of preferred and common equity

You can also see that they invest in businesses across a lot of industries including:

Software

Insurance

Power

Healthcare

Asset management

Consumer goods, services, and materials

Analyzing A Business Development Company

BDC Metrics

Business Development Companies have to be evaluated using different metrics than a standard stock.

That’s because they’re really investment funds that make money by lending instead of businesses that sell products.

Let’s talk about the most important ones.

Net Investment Income (NII): This is the BDC equivalent of EPS for a corporation or FFO for a REIT. It measures the earnings power of the loan portfolio before any capital gains or losses.

Distributable NII (DNII): This non-GAAP metric is a cash flow proxy. It adds back non-cash expenses like share-based compensation to show exactly how much cash is available for dividends.

Core NII: This excludes volatile one-time fees, like prepayment fees, to show the BDC’s recurring earnings power.

Net Investment Income (NII)

Net Investment Income is calculated as:

NII = Total Investment Income - Operating Expenses

Total Investment Income includes interest income from loans, dividend income from equity positions, and fee income (origination, prepayment, structuring fees)

Operating Expenses include base management fees, incentive fees, interest expense on debt, and general & administrative (G&A) cost

Distributable Net Investment Income (DNII)

This is a non-GAAP metric that adds back non-cash expenses.

DNII = NII + Non-cash Expenses (e.g., Share-based comp)

Core Net Investment Income (Core NII)

This is another non-GAAP metric that excludes volatile income from one-time fees (prepayment fees for example) to sho the recurring earnings power of the portfolio.

Core NII = NII - One-time fees

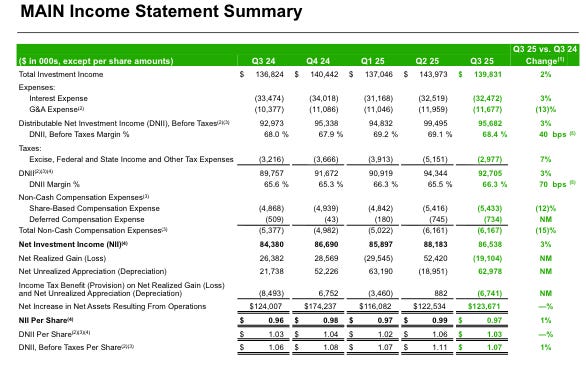

Let’s use Main Street Capital as an example of how to look at these metrics.

Here’s their Q3 Income Statement.

Main Street Capital reports NII and DNII for us.

NII: $84.4 million

DNII: $89.8 million

What about Core NII?

We’ll have to do that ourselves. Fees aren’t broken out in the income statement, but we can look at management’s discussion to find them.

They tell us they had:

a $2.2 million increase in fee income, primarily due to a $1.4 million increase in fees related to increased investment activity and a $0.9 million increase from the refinancing and prepayment of debt investments

Subtracting the $2.2 million in Fee Income from $84.4 million of NII gets us to $82.2 million in Core NII.

Evaluating Dividend Sustainability

Now we know how to figure out how much a BDC made.

Another important thing to know is how well those earnings cover the dividend.

One major red flag is Payment-in-Kind (PIK) interest.

This is interest paid with more debt instead of cash.

Because BDCs must pay out 90% of their taxable income, high PIK levels can force them to borrow money just to pay your dividend.

Fortunately for us, MAIN does not have any PIK interest, so we don’t have to worry about it in this case.

So what are we looking for?

DNII covers the base dividend by more than 110%

PIK income less than 15% of total revenue

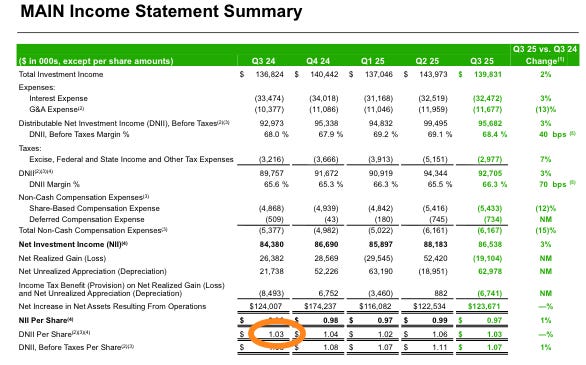

Going back to the Income Statement, we can see that DNII per share is $1.03.

The base dividend for the 4th quarter will be $0.765, meaning DNII is 135% of the base dividend - nice and safe.

Core NII per share is $0.91, also easily covering the base dividend.

Looking at the Balance Sheet

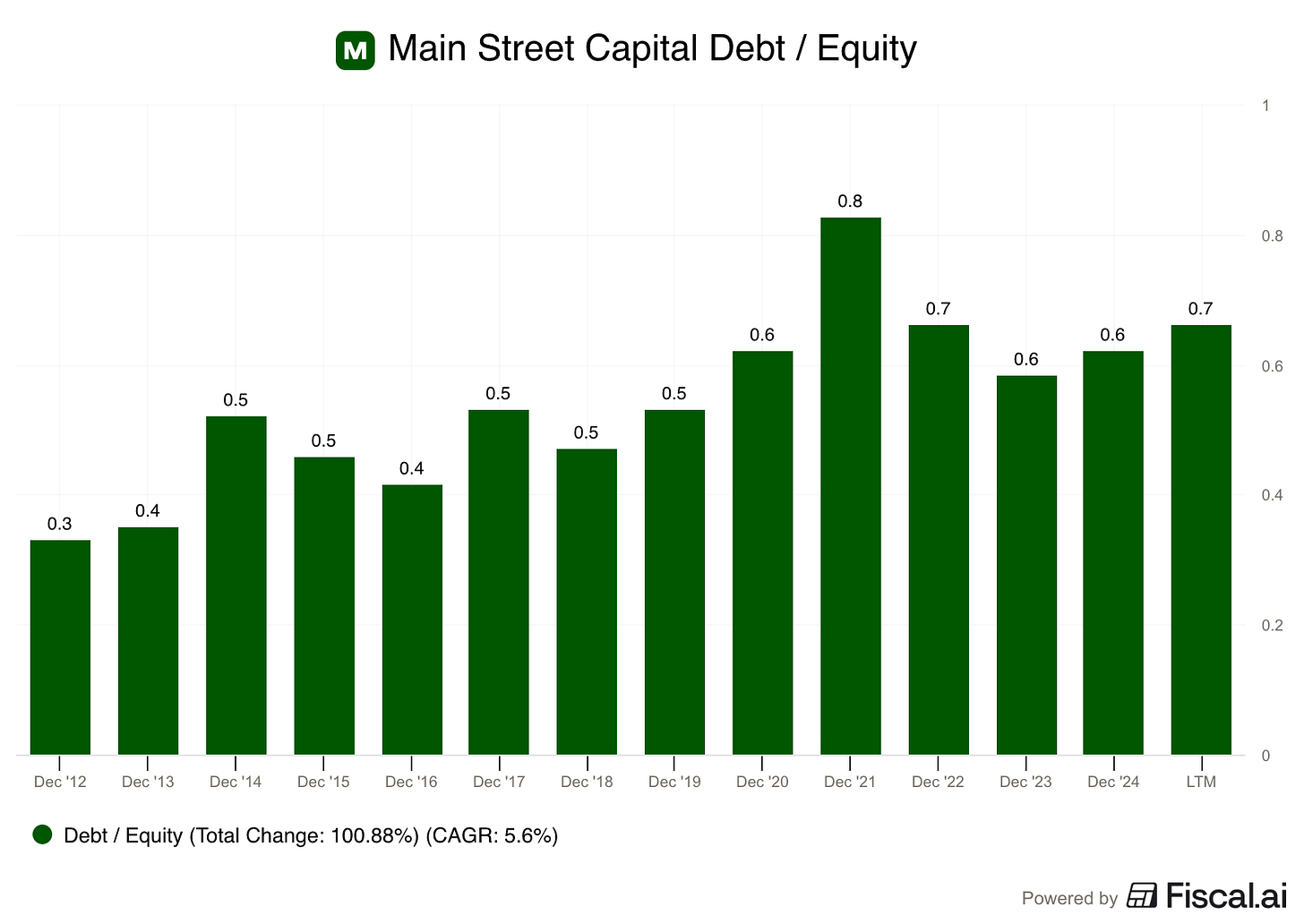

BDCs use debt to fund their loans to private companies.

We need to make sure that the BDC isn’t over leveraged.

Here’s what we’re looking for.

Leverage Ratio (Debt/Equity): While the legal limit is 2:1, most BDCs target a ratio of 1.0x to 1.25x.

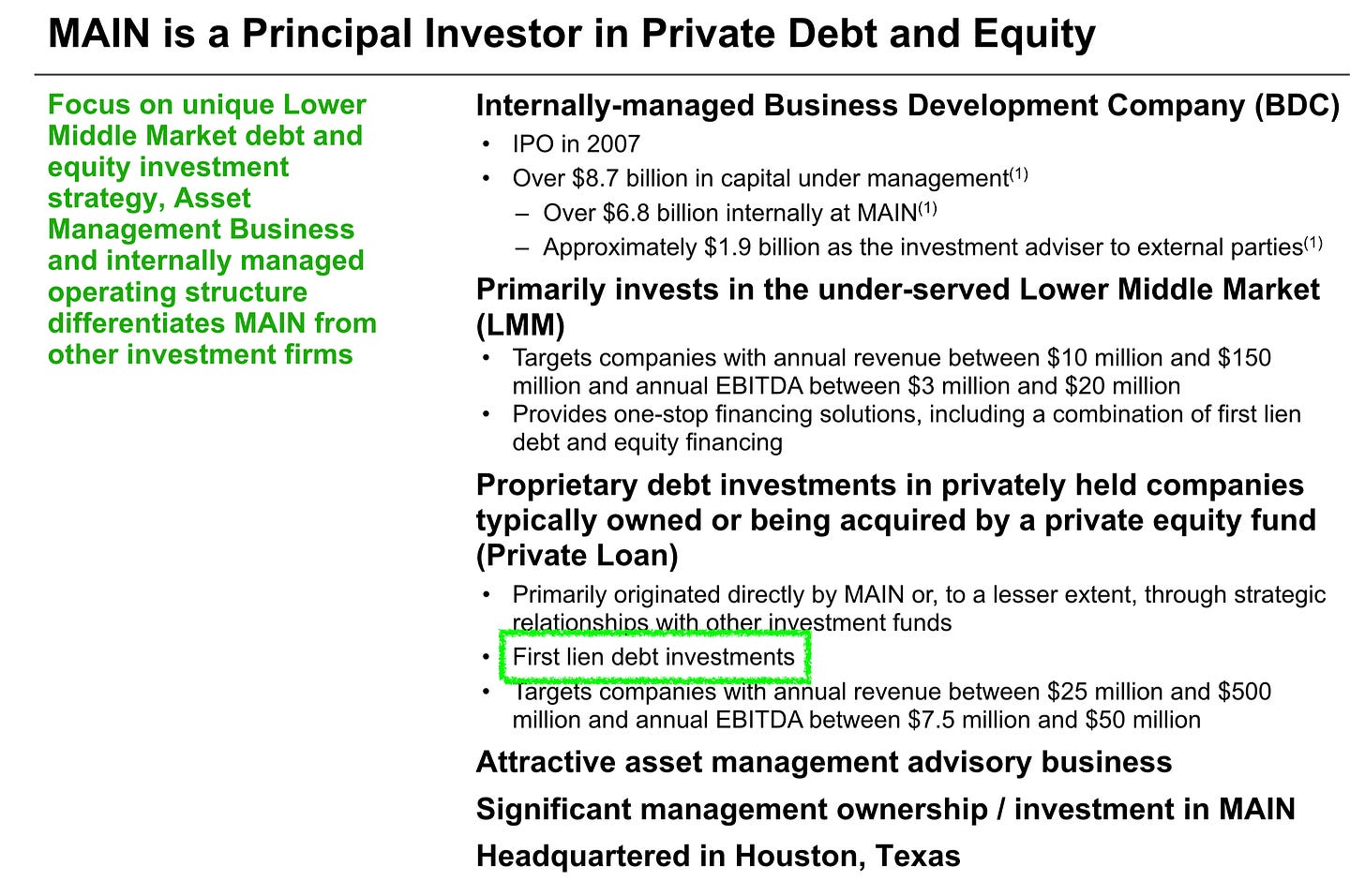

Asset Seniority: We also want to see how much of the portfolio is in First-Lien Senior Secured loans. These are the safest loans that get paid back first if a creditor defaults.

Main Street Capital maintains a Debt/Equity ratio below 1.

They also invest in first lien debt for middle market companies.

Credit Ratings

While we’re considering the balance sheet, we should also look at the BDC’s credit rating.

An investment-grade credit rating (BBB- or higher) is a major advantage.

It lets a BDC issue unsecured bonds, which are cheaper and don’t require pledging specific assets as collateral.

High-quality BDCs usually have more than 50% of their debt in these unsecured bonds.

MAIN has a BBB- credit rating:

Capital Allocation

A BDC is like a REIT in that it has to pay out most of the profits to shareholders.

So to grow, they have to either take on debt, or issue new shares.

When a BDC chooses to issue new shares, we need to look at the stock price and the Net Asset Value (NAV).

You can think of the NAV as the ‘net worth’ of the BDC. It’s a simple calculation:

NAV = Total Assets−Total Liabilities

Premium to NAV: If a BDC trades at a premium (like 1.1x its Net Asset Value), it can sell new shares for more than they are worth and invest that cash into new loans. This is accretive to existing shareholders.

Discount to NAV: If the price is too low (below 1.0x NAV), the BDC should not issue shares to grow. Raising money would dilute existing owners, making growth very difficult.

In the most recent quarter, MAIN had a NAV of $32.78 per share.

As long as the stock price remains above this, it can issue new shares to keep growing.

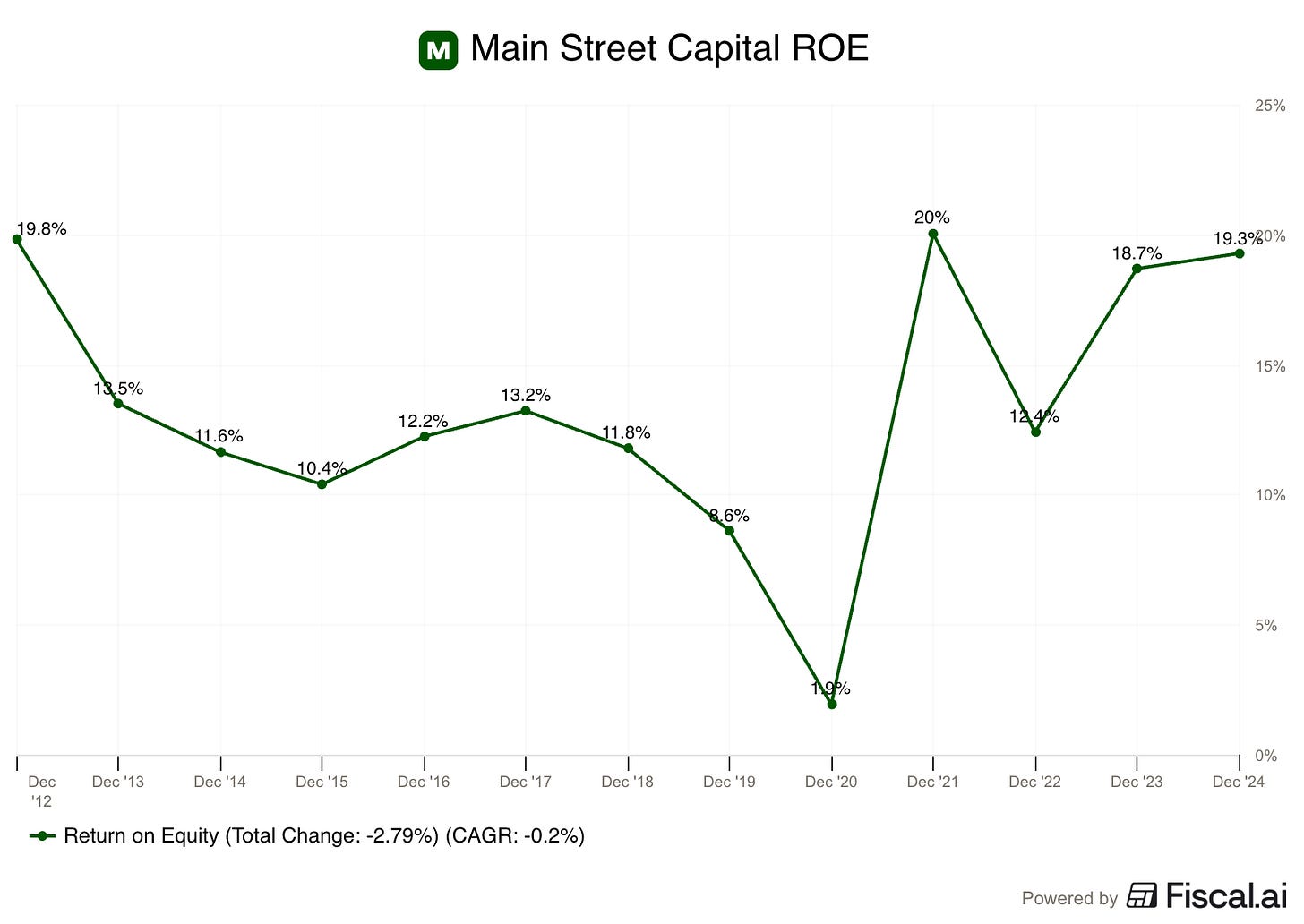

Return On Equity

Return on Equity tells us the return that the management team of the BDC is generating with the shareholder’s capital.

A healthy BDC should be able to earn a ROE of 10% or more.

Main Street Capital typically earns at least 10% on its equity.

Valuing a BDC

How Do You Value a BDC?

This is where most investors get stuck.

Valuation matters.

But the full step-by-step process, including a full valuation of Main Street Capital,

is part of the paid version of this guide.

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

Conclusion

Investing in BDCs can seem tough if you’re not used to looking at investments in credit.

But once you get used to the industry-specific metrics, looking at a BDC is very similar to looking at a high yield dividend stock.

BDCs can be interesting investments because they provide a simpler, more liquid way to invest in private credit.

Some other reasons they can be attractive:

High Dividend Yields: Because they are required to distribute at least 90% of their taxable income, BDCs often offer some of the highest yields in the equity market.

Inflation Protection: Many BDCs focus on floating-rate loans, meaning their income (and your potential dividends) can actually increase when interest rates rise.

Diversification: Adding BDCs to a portfolio provides exposure to smaller companies, and credit investments, both of which often behave differently than the large-cap stocks in the S&P 500.

Professional Underwriting: You gain access to a diversified portfolio of private business loans managed by experienced credit teams.

Liquidity: Unlike direct investment in private equity or private debt funds (which often lock up your money for years) BDC shares can be bought and sold instantly on major stock exchanges.

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Thanks for the guide