👋 Howdy Partner,

UnitedHealth is a stock that I initially refused to look at.

Why?

Because I’ve spent years as a healthcare provider, and none of us like insurance companies.

The U.S. healthcare system is a mess - it’s complex, the incentives are wrong, and nobody would ever build such a system from scratch.

It’s so bad that Berkshire Hathaway, Amazon, and JP Morgan gave up.

But this started as discussion in the community, where I got asked about company.

By the way, if you’re not active in the community, you should be - the more partners that engage, the more valuable it becomes.

And the more I thought about it, the more I realized that all my frustrations about the healthcare system are the moat of UnitedHealth.

Why UNH Isn’t Going Anywhere

1. It’s not just an insurance company.

Most people think of UnitedHealth as just another insurer. The company that denies your claim. That raises your deductible. That buries you in paperwork.

But UnitedHealth has built something much more powerful:

It controls the infrastructure of the healthcare system.

Through its Optum division, UnitedHealth owns:

The data (through its analytics business)

The doctors (via massive clinic networks like OptumCare)

The pharmacy benefits (OptumRx)

And even parts of the hospital billing and IT systems

In short: they don’t just write the check. They own the cash register.

It’s like if Visa owned Amazon, CVS, and your doctor’s office.

2. It has float.

This is the secret that Warren Buffett built his fortune on.

When you pay an insurer (like UnitedHealth), you’re paying for a promise to maybe get money in the future.

In the meantime, UnitedHealth sits on trillions in premiums—money they haven’t paid out yet.

That capital - called float - is free money to invest.

So UnitedHealth isn’t just a health insurer. It’s a huge asset manager, with $55 billion in investments on the balance sheet.

3. Every new regulation strengthens their moat.

Most people believe regulation is a threat to big companies.

In healthcare, it’s the opposite.

Because of its scale and compliance muscle, UnitedHealth thrives in red tape.

Every new rule, every new billing code, every layer of bureaucracy… it all makes it harder for a small player to compete.

UnitedHealth has 400,000 employees and AI systems scanning millions of claims per day.

The startup with a few doctors and a dream?

Good luck.

4. They've already “disrupted” their disruptors.

Think of all the companies that were supposed to revolutionize healthcare:

Oscar Health

One Medical

Amazon Care

Clover Health

Babylon

Livongo

Most of them either got bought… or got buried.

Meanwhile, UnitedHealth absorbs the parts that work:

Telemedicine? They’ve got it.

Value-based care? Already rolled out.

Onsite clinics? Check.

AI and predictive analytics? Core to Optum’s entire model.

5. The people who hate the system... still depend on it.

This is the part no politician wants to admit.

Americans despise their insurance companies.

But they fear losing access even more.

And UnitedHealth is now deeply embedded in every corner of the healthcare system—from Medicare Advantage plans to the backend systems hospitals rely on to get paid.

You don’t like the toll booth.

But you can’t skip the highway.

UnitedHealth builds monopolies. It owns the rails.

It’s been growing earnings every single year for more than a decade.

And it does it all while everyone is complaining about their co-pay.

What’s Going On, and Is It An Opportunity?

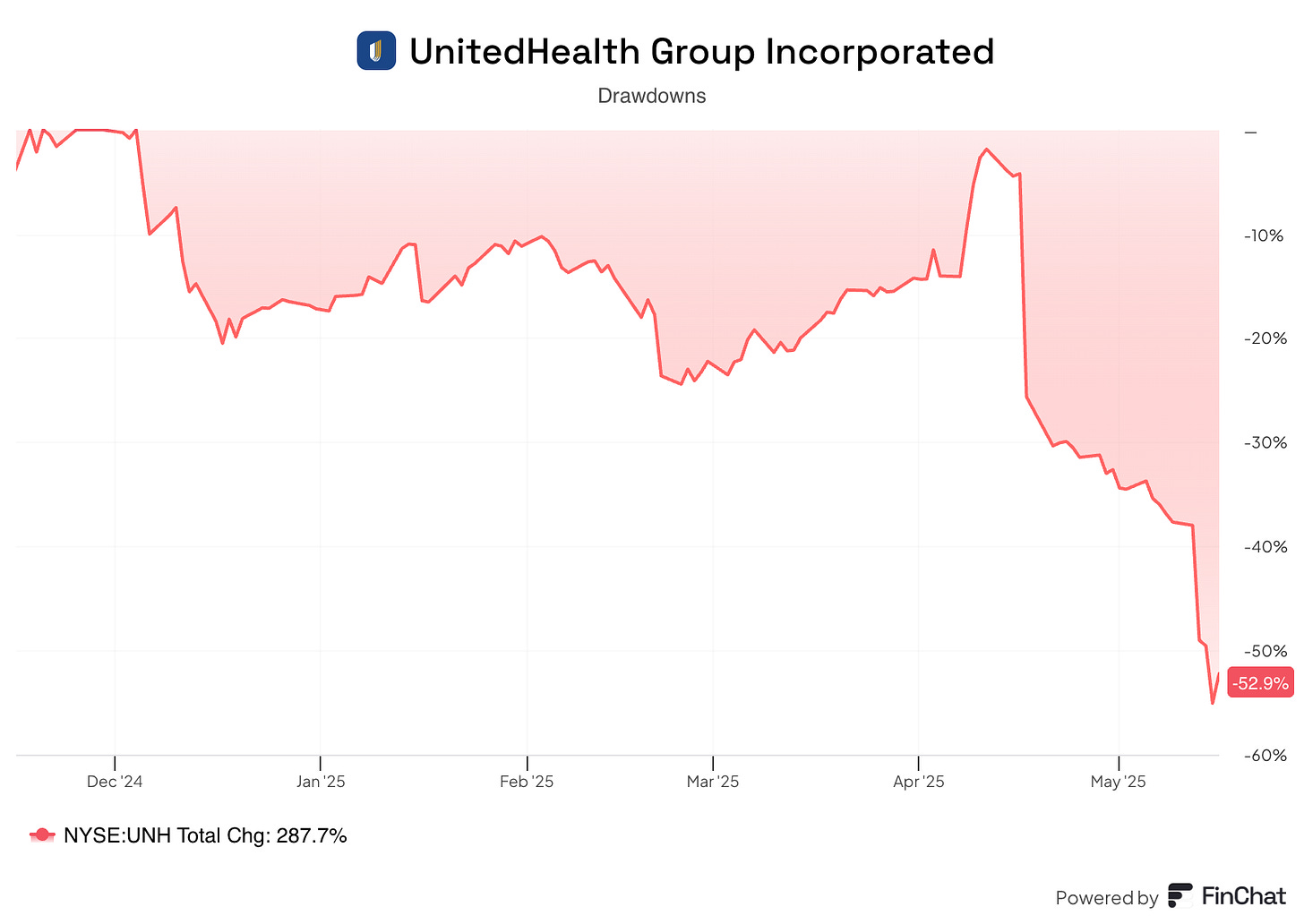

UnitedHealth’s stock is falling like a brick.

The largest U.S. health insurer has lost over $288 billion in market value in just one month.

Let’s dive in and see if this is warranted or if it presents an opportunity.

What is UnitedHealth Group?

UnitedHealth Group (UNH) is one of the largest healthcare companies in the world. It’s based in the U.S. and owns and operates businesses that provide health insurance and healthcare services to help people access medical care and stay healthy.

Who Are They?

UHG has two main divisions:

UnitedHealthcare: This is their health insurance arm, offering plans for individuals, families, employers, seniors (through Medicare Advantage), and low-income people (through Medicaid). It covers more than 50 million people.

Optum: This division provides healthcare services - including doctor visits, mental health care, pharmacy benefits, data analytics, and technology solutions. Optum serves patients, doctors, and other insurers.

UHG works with a huge network of 1.3 million providers and 6,700 hospitals to deliver care.

They aim to make healthcare more affordable and effective through coordinated care and technology.

How Do They Make Money?

Insurance Premiums: UnitedHealthcare collects monthly premiums from customers (individuals, employers) or government programs (Medicare, Medicaid) for insurance coverage. This is a major revenue source.

Government Payments: For Medicare Advantage and Medicaid plans, UHG receives fixed monthly payments from the government per enrollee, adjusted for health conditions (sicker patients mean higher payments).

Cost Control: UHG profits by spending less on care than they collect in premiums or government payments. They do this by:

Negotiating lower rates with doctors and hospitals.

Using prior authorizations to avoid unnecessary treatments.

Promoting value-based care (through Optum) to keep patients healthier, reducing expensive hospital stays.

Optum Services: Optum generates revenue by:

Running clinics and providing direct care.

Managing pharmacy benefits (e.g., home delivery of meds).

Offering technology and data services to hospitals, doctors, and other insurers.

What Happened?

Basically a lot of bad news at once.

Here’s a quick overview:

April 17 – Disappointing quarterly earnings

Q1 2025 earnings had revenue and earnings slightly higher than last year, but they fell short of analysts’ expectations.

The company lowered its full-year 2025 earnings forecast from $29.50–$30.00 per share to $26.00–$26.50 per share.

The main reason was that medical costs, especially within the Medicare Advantage program, were much higher than expected.

May 13 – CEO steps down and 2025 outlook suspended

On May 13, CEO Andrew Witty suddenly stepped down for “personal reasons.”

On the very same day, the company suspended its full-year 2025 financial outlook because medical costs remained higher than expected.

Former CEO Stephen Hemsley then stepped back in to lead the company.

Here’s part of the statement:

May 14 – Criminal investigation announced

To add fuel to the fire, The Wall Street Journal reported that the US Department of Justice has opened a criminal investigation into possible fraud within UnitedHealth’s Medicare Advantage division.

The article did not give exact details of the allegations.

UNH says they don't know anything about it and that WSJ is wrong.

Investors are concerned about reputational damage, impaired financial performance, legal risks, and growing political pressure, and rightfully so.

The Financials

Let’s quickly look at UnitedHealth’s financials to get a sense of the business.

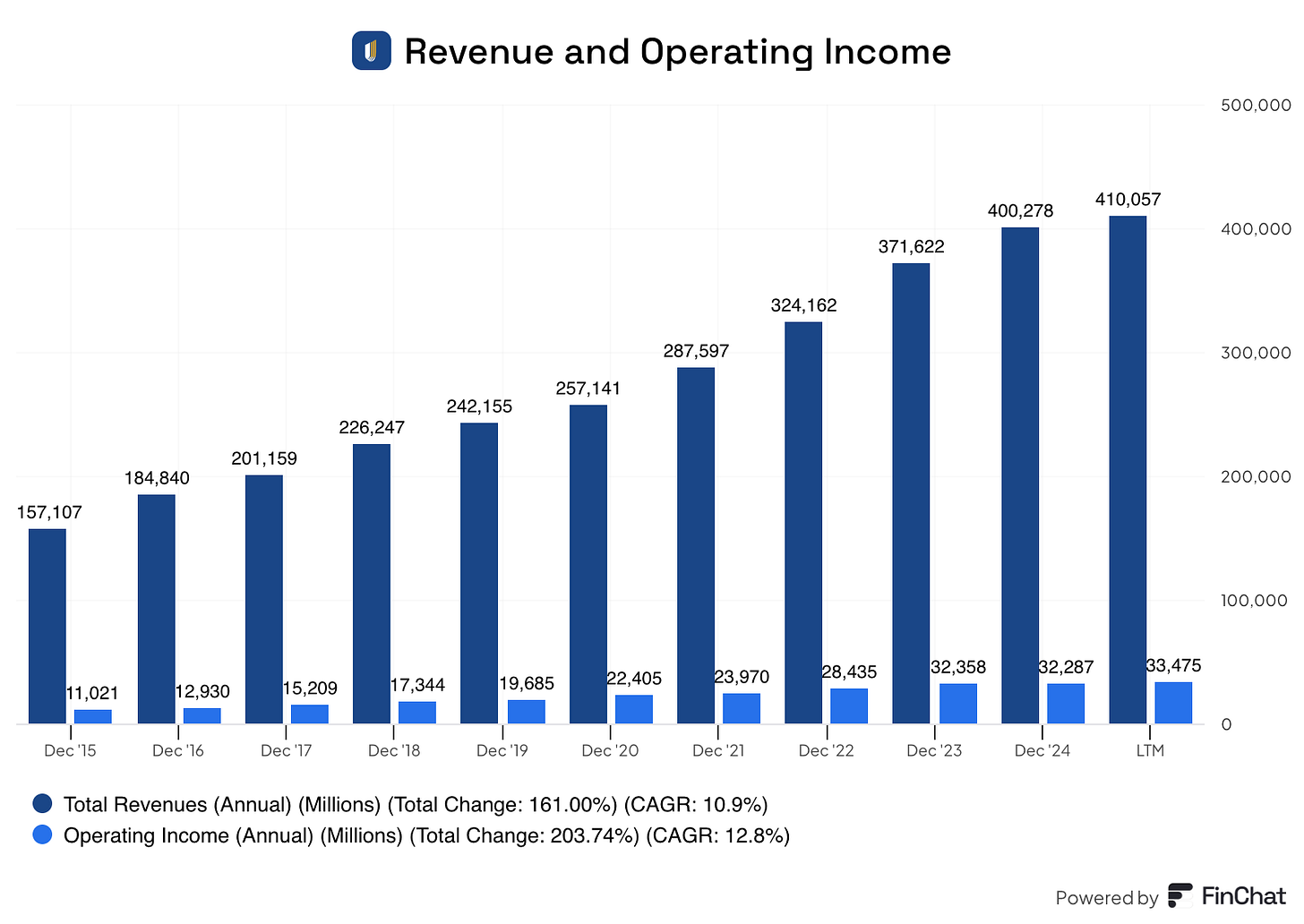

Revenue and Operating Income

UNH consistently grows revenue and income.

Revenue has grown at about 11% per year

Operating income at nearly 13%

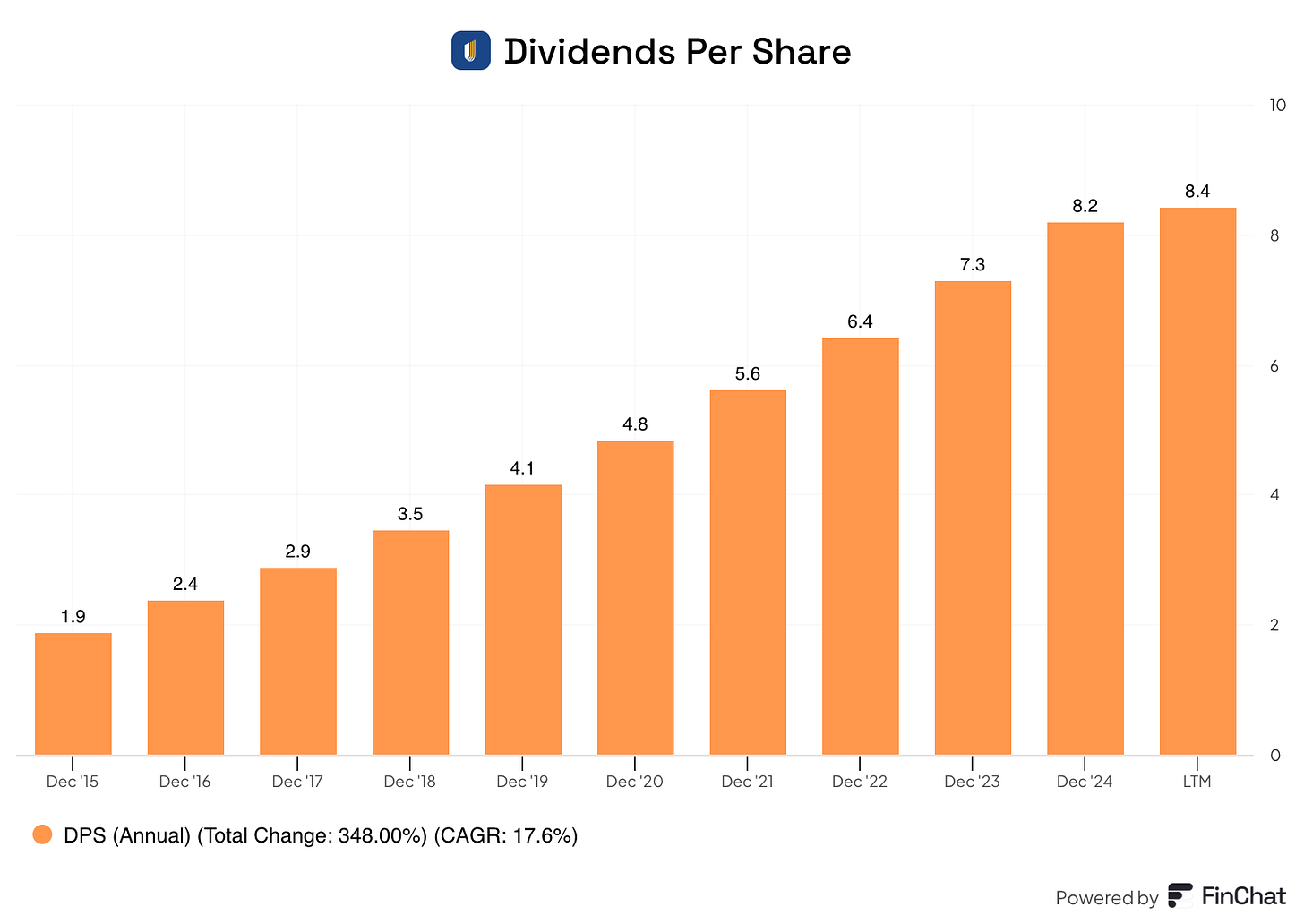

Dividends

The comapany has paid a growing dividend for the past 15 years.

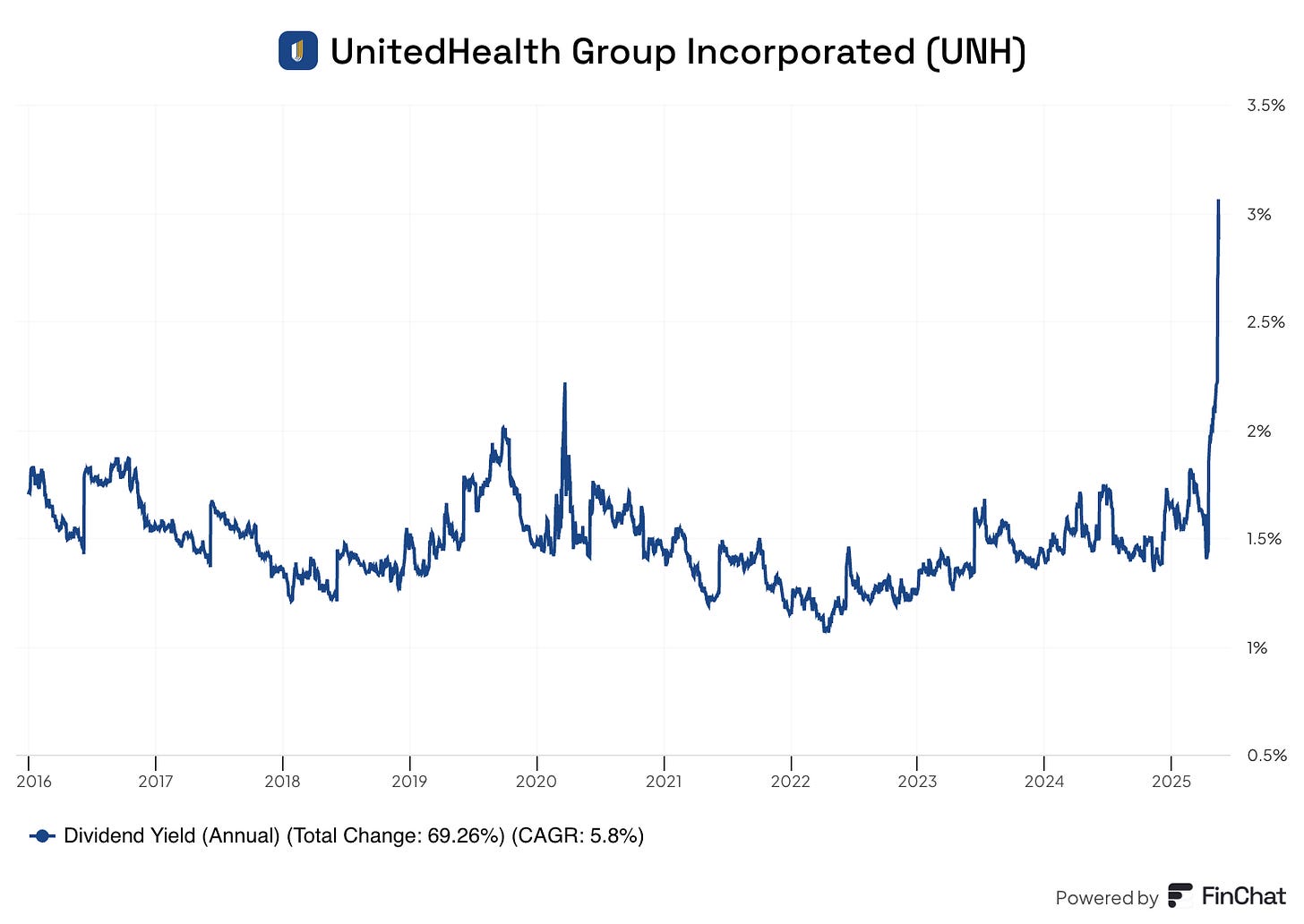

Current Yield: 2.8%

Payout Ratio: 35%

5-year CAGR: 14.2%

Because of the share price drop, the yield is much higher than the historical average:

So far we have a profitable company that reliably grows at attractive rates.

But that was the past.

Now we have a CEO that’s stepped down, suspended guidance due to rising costs, and a potential criminal investigation.

What’s That Mean For The Future?