💸 Wall Street’s Favorite Dividend Myth

👋 Howdy Partner!

I've spent decades analyzing businesses and investment opportunities, and there's one argument I hear over and over that’s just wrong...

"Dividends don't pay you. The stock just drops by the same amount."

This tired line is parroted by people who've never signed the front of a paycheck or built a business from scratch. And it's a theory that falls apart in the real world where you and I actually live and invest.

Today, I'll show you why this is a myth and show you why dividends remain the most reliable path to sustainable wealth in the stock market.

The Academic Fantasy vs. Your Financial Reality

This anti-dividend nonsense stems from Miller & Modigliani's 1961 "dividend irrelevance" theory.

The simplified version you'll hear from finance professors is that "a $1 dividend just means the stock drops $1 - nothing gained, nothing lost."

First of all, the market isn’t that efficient and it doesn’t happen in the real world, and second… that's not even what these academics actually said.

Their real theory was more nuanced:

"The higher the dividend payout in any period, the more new capital that must be raised from external sources to maintain any desired level of investment."

Read that carefully and you’ll see that they’re assuming the company doesn’t make enough profits to be able to grow and pay a dividend.

More importantly, they admitted their theory wouldn't hold for what they called an "extreme case":

Internally financed companies where "dividend policy is indistinguishable from investment policy."

What do they mean by internally financed companies?

Companies who generate enough cash to finance their own growth.

In 1961, most companies had to raise capital to grow - they were industrial companies with low profits that needed a lot of capital to build new factories or plants.

What the professors dismissed as an "extreme case" in 1961 describes the vast majority of today's profitable public companies!

The theoretical foundation for dividend irrelevance was built on assumptions that have never existed in the real world:

No taxes

No fees

No inflation

No financial stress

No emotions

No need to ever withdraw money

In other words: a fantasyland where no investor has ever lived.

The Five Choices Every Business Faces

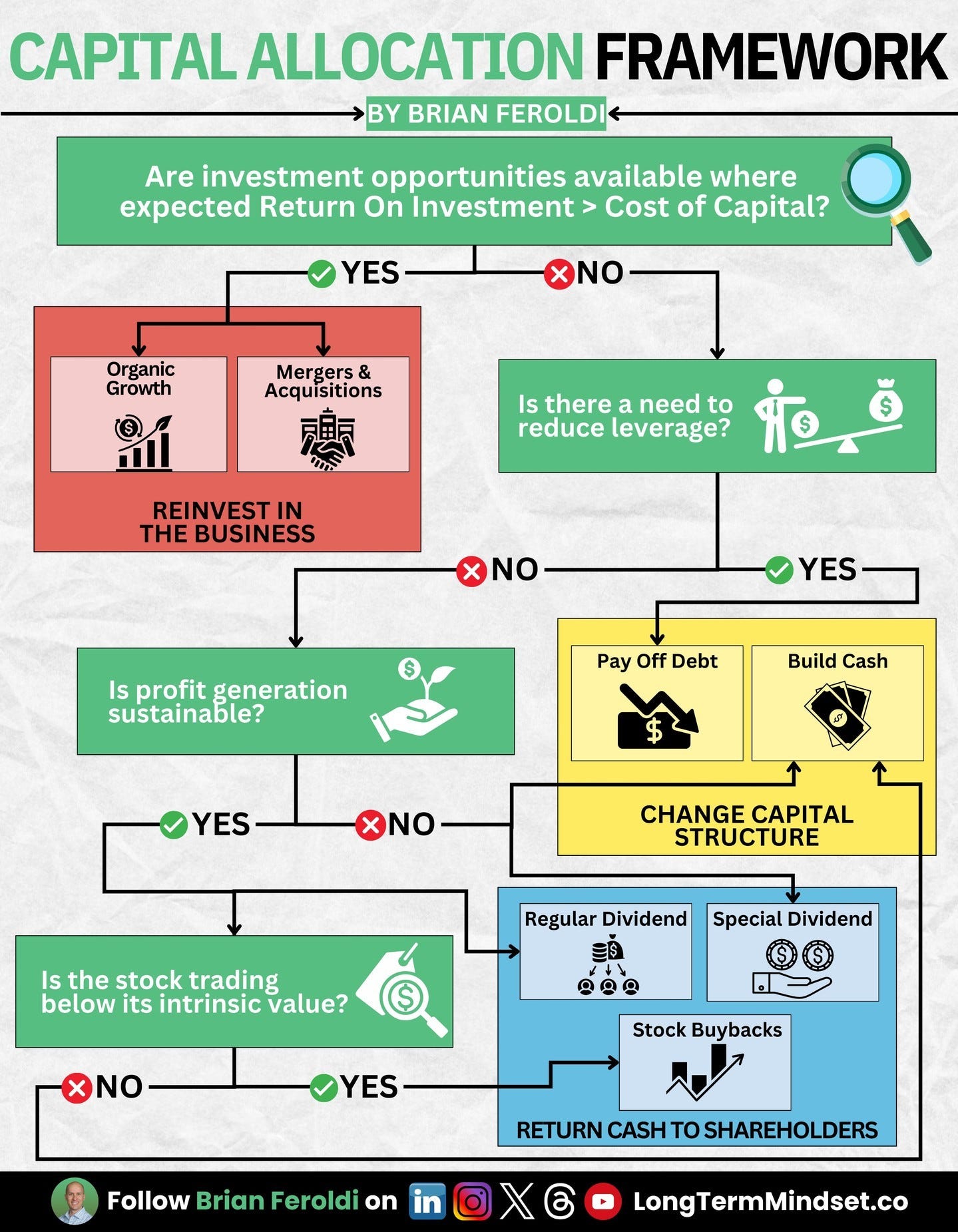

In the real world that you and I live in, dividends are simply a capital allocation decision. Management has five fundamental choices:

Reinvest in the core business

Acquire another business

Build up cash reserves

Pay down debt

Return capital to shareholders (dividends or buybacks)

The test for a management team is crystal clear: Can they reinvest your capital at high returns?

Here’s a great visual showing how management should work through the decision:

If they can get a good return, reinvest. If not, pay it out.

But never, ever forget - it's YOUR capital. And you should demand to get paid when the numbers make sense.

Your Barber Gets It

Let me bring this down to earth. I have a barber, Donny. He’s a bit more expensive than others in town, but he’s great. And his cuts are worth it.

He owns the shop, cuts hair, and keeps the books.

If I walked in and told him: "Dave, don't pay yourself. Buy a fourth chair. Hire more barbers. Reinvest everything!"

He'd laugh me out of the shop.

Why? Because Dave didn't open a barbershop to eventually sell it to someone else at a higher price. He opened it to generate income - to get paid.

That's what business is: turning time, risk, and capital into cash for the owner.

And if you never get paid? You're not an owner. You're a speculator hoping someone else will buy your business for a big price someday.

The Retirement Death Trap

Here's the danger of ignoring dividends: You become completely dependent on market sentiment.

When you need money in a market downturn (and downturns always come), you're forced to sell shares at the worst possible time.

This "sequence of return risk" is precisely how retirees go broke.

Dividends protect you. They:

Provide cash without forcing you to sell

Buy you time during market crashes

Reduce your reliance on market timing

Give you financial freedom when you need it most

Yes, the stock price might adjust downward when a dividend is paid. But over time? Dividend payers - especially consistent dividend growers - have dominated the market.

They signal financial strength, management discipline, and real profits. And they pay you while you wait for capital appreciation.

The Bottom Line

Dividends aren't a magic bullet. They're a capital allocation tool that, in the hands of great managers, can be one of the most powerful wealth-building forces in the market.

Cash in your hand will always be worth more than theory on a chalkboard.

If you wouldn't run a business without paying yourself, why would you own a stock that never pays you?

One Dividend At a Time,

TJ

P.S. - Take a look at how our dividends have grown over the last 10 years

And the share prices? They grew at a 14% CAGR over the same time period:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

The "sequence of returns" simulations are always interesting to play with. It brings up the "4% rule". The idea is people ought to count on at least a 7% growth rate of their portfolio. Selling down 4% of the account leaves 3% of the growth untouched and available for compounding. That works fine during good years. What happens during the down years when a portfolio can sink 20%, 30%, or even 50%? The dot-com bubble brought the NASDAQ down 80%. Way more shares will need to be sold off at lower prices to get the same funds as before. Dividends, distributions, and coupon payments from bonds can provide a steady-eddy flow of income without needing to sell anything down.

It's true that dividends can be cut and suspended. That's where intelligent diversification and a cash reserve can help. An example of diversification would be 20 streams of income consisting of stocks, CEFs, and bonds. It's unlikely all 20 streams will get whacked at once in the same way. A doomsday example could be 5 streams are frozen, 5 streams are cut, and the other 10 keep marching along. The difference could be made up by pulling from cash reserves.

Dividends definitely have their place in a portfolio. Understand what they can and cannot do and everything will be just fine. 👍