Walmart Might Be Worth More Than You Think

It looks expensive at first glance, but Walmart has some serious growth opportunities ahead of it

👋 Howdy Partner,

Today we’re taking a look at some of the less well-known parts of a very well-known company.

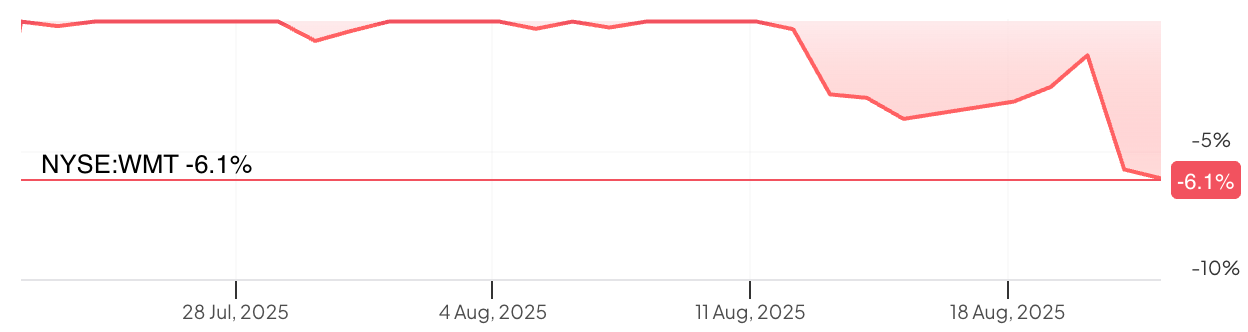

Walmart reported Q2 earnings earlier this week. They missed earnings estimates, causing the stock to fall.

To be fair, we’re not talking about a massive crash - we’re talking about a few percentage points.

But the small change in stock price isn’t the most interesting part of Walmart’s most recent reporting.

What’s interesting about Walmart is the parts of the business that are seeing growth rates that you wouldn’t expect. I’m talking about growth rates like 17%, 25%, and even 46%.

How can a company the size of Walmart have segments growing that quickly?

And more important, can they drive real growth in the overall company?

That’s what we’re going to talk today

Company Overview

You’re likely familiar with Walmart Inc. ($WMT) - it’s a global retail giant operating a huge network of discount stores, supercenters, and e-commerce platforms.

Walmart’s promise is to deliver everyday low prices and a wide product assortment. They serve millions of customers across the United States, Mexico, and other international markets.

There are several businesses housed within Walmart Inc.:

Walmart U.S.

Physical stores: Supercenters, discount stores, and Neighborhood Markets

Grocery, apparel, electronics, household goods, and more

Walmart International

Stores and e-commerce in countries like Mexico, Canada, and others

Similar retail offerings tailored to local markets

Sam’s Club

Membership-based warehouse clubs

Bulk products, groceries, electronics, and business supplies

E-commerce

Online shopping platforms for Walmart and Sam’s Club

Grocery delivery, pickup services, and third-party marketplace

Other Services

Financial services, health and wellness clinics, and advertising solutions

Financial Performance

Before we get into the really interesting pieces within Walmart, let’s take a look at the business as a whole.

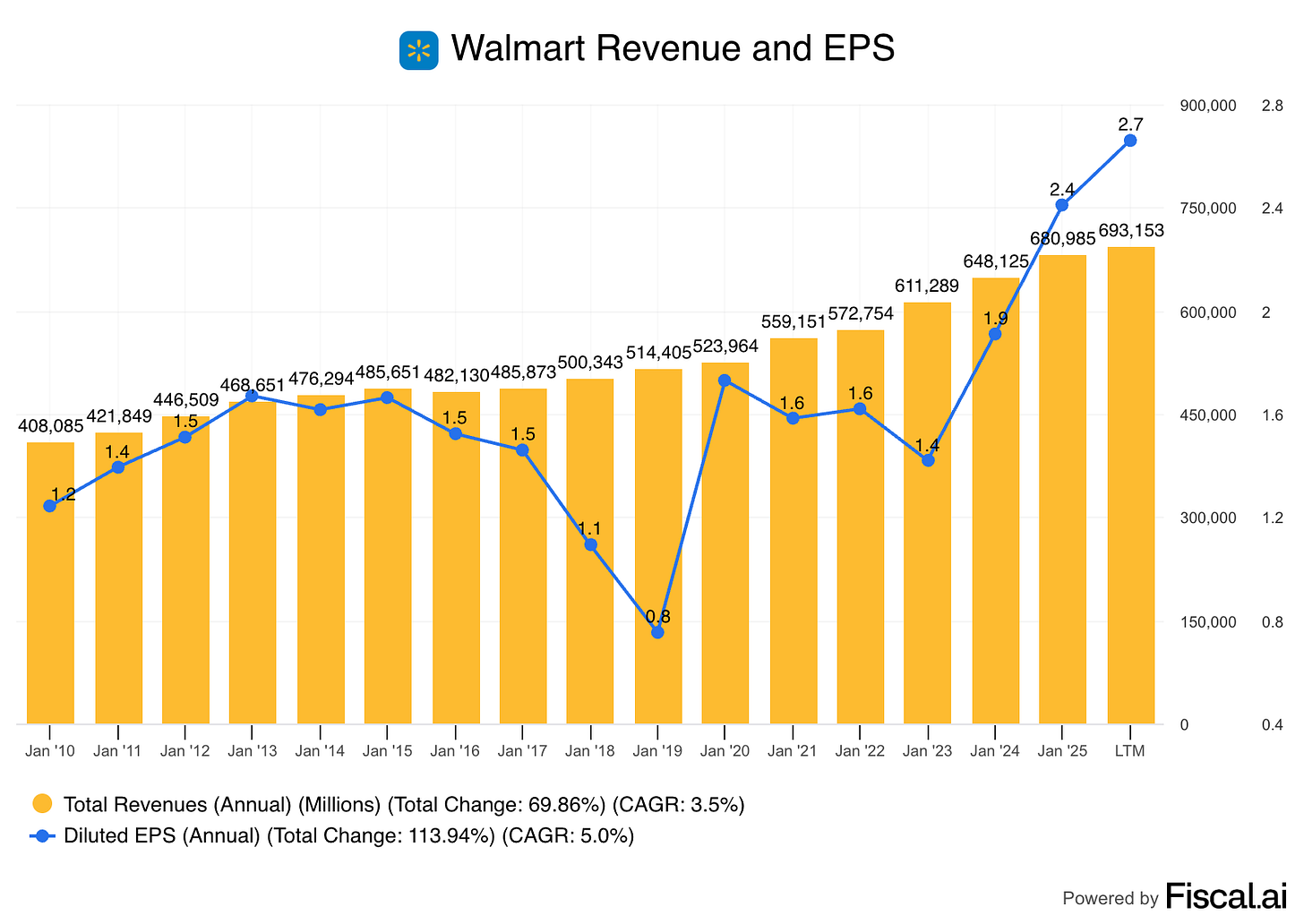

Revenue and EPS

Walmart has consistently grown revenue, although not at a fast rate - about 3.5% per year over the past 15 years.

EPS tends to grow a bit faster at about 5%.

This is mainly due to buybacks - Walmart tends to operate on low net margins - 2.5% to 3%, and the low price model doesn’t encourage margin expansion.

Instead, Walmart has traditionally focused on selling more volume at low prices.

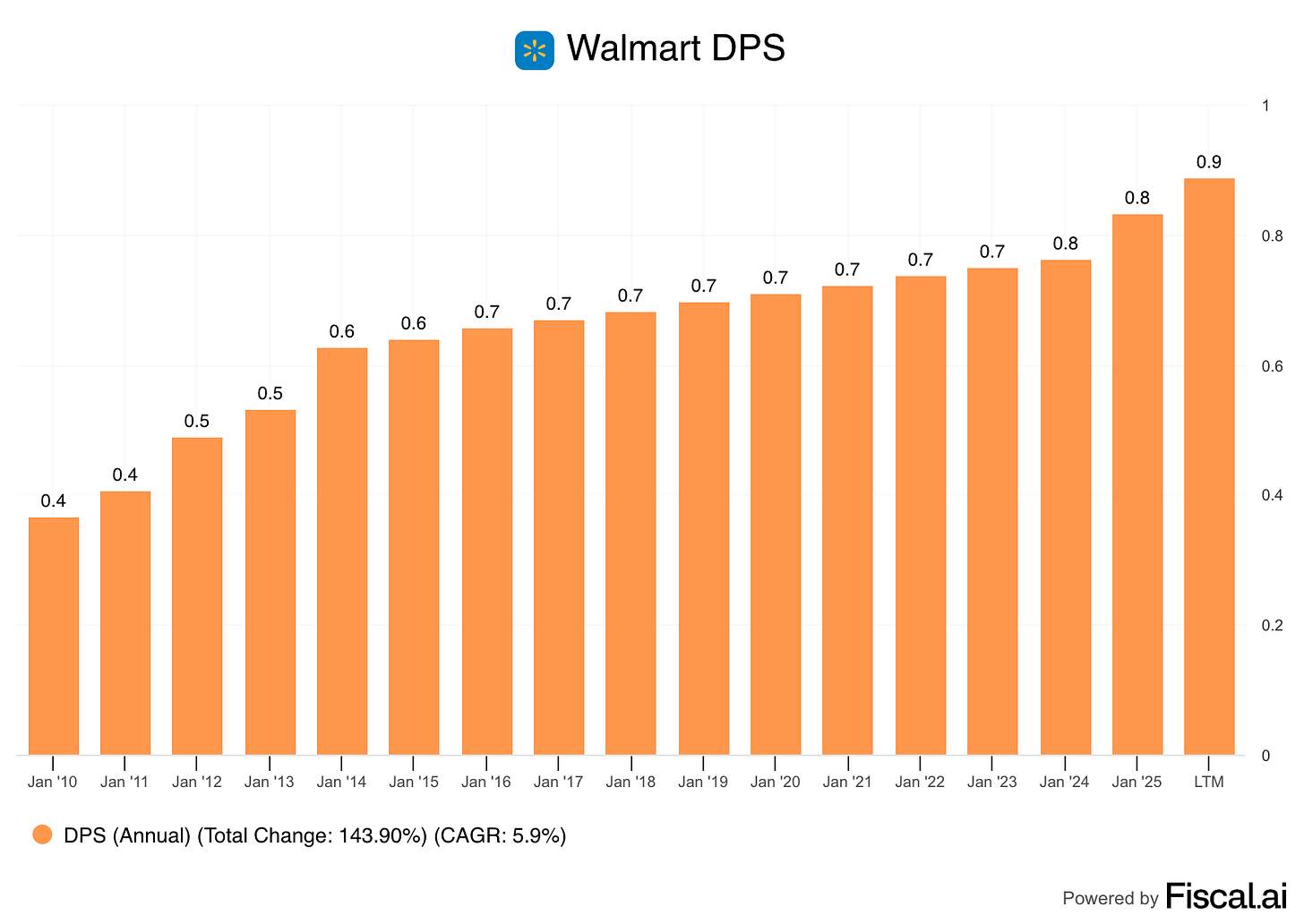

Dividend per Share

Walmart is a Dividend King with 53 years of dividend increases.

The dividend has tended to grow at about the same rate as EPS - 5.9% per year since 2010.

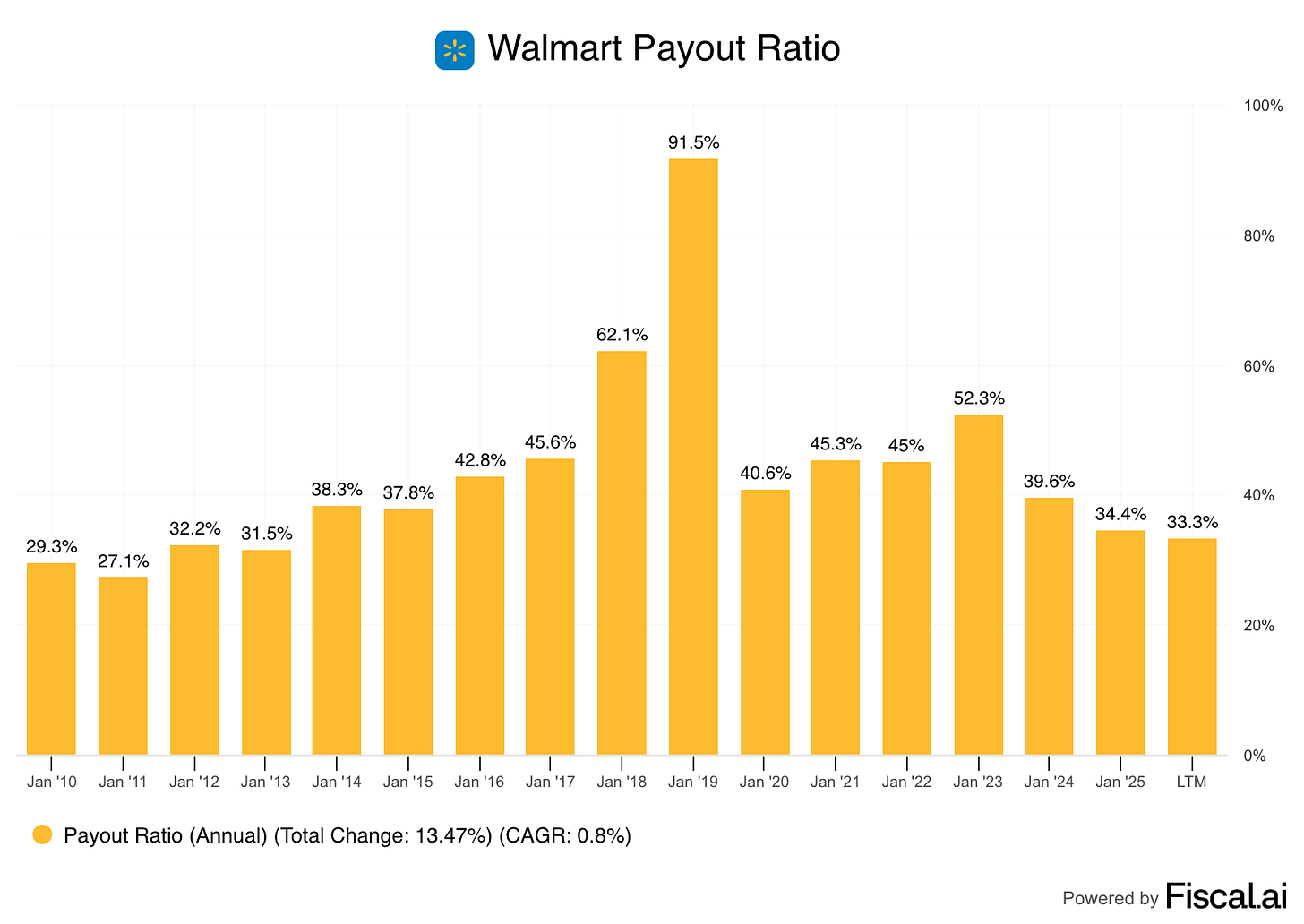

Payout Ratio

Payments to shareholders tend to be well-covered by earnings.

So overall, the business looks like a slow, steady grower, with a great dividend history.

The Parts of Walmart You Might Not Know

Let’s dive into the really interesting parts of Walmart - what’s growing at double digit rates?

E-Commerce

E-Commerce has been a strong growth segment for Walmart.

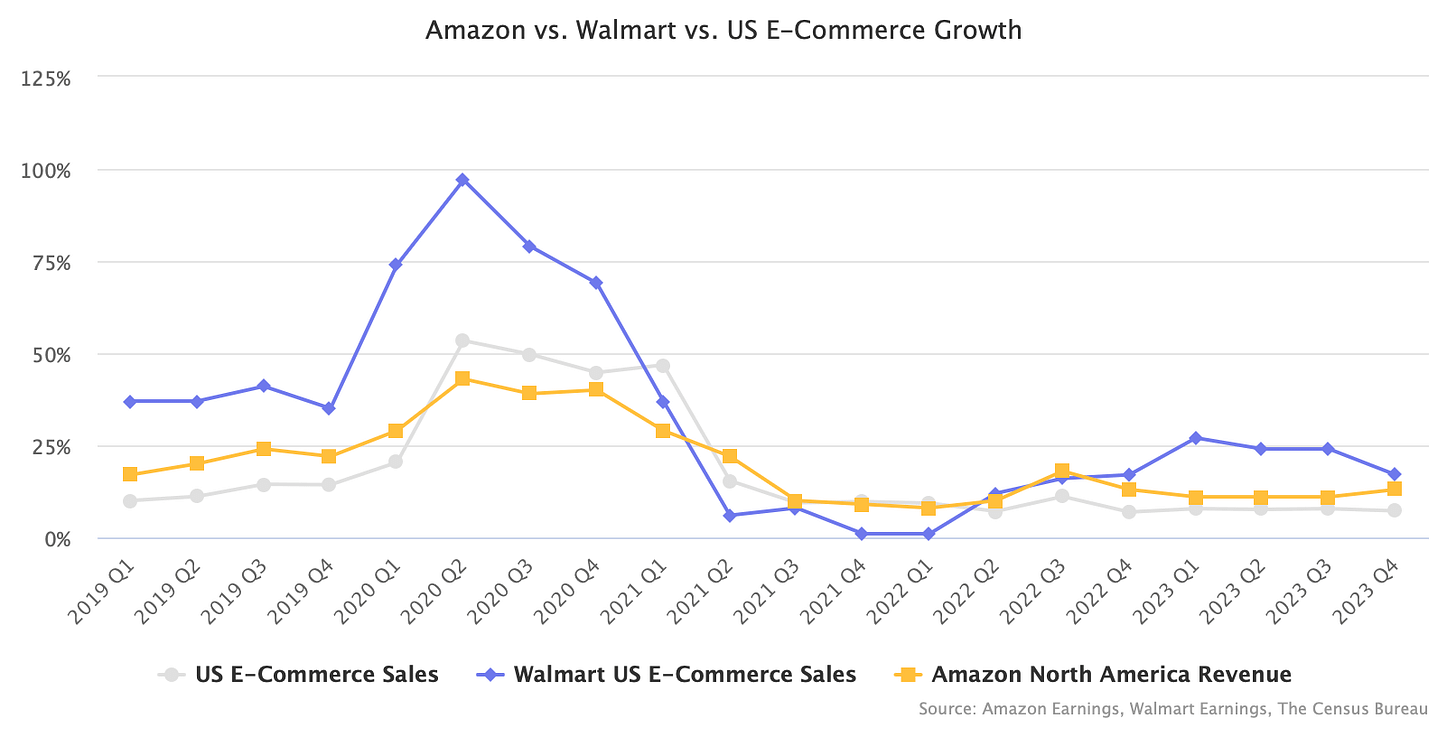

Beginning in 2022 they started to grow their e-commerce sales faster than the U.S. in general. You can even see quarters where they outpaced Amazon:

In Q2, global e-commerce grew by 25%:

Walmart has some big advantages when it comes to e-commerce.

They’ve already built out a world-class supply chain, including warehouses, inventory tracking, trucking, etc.

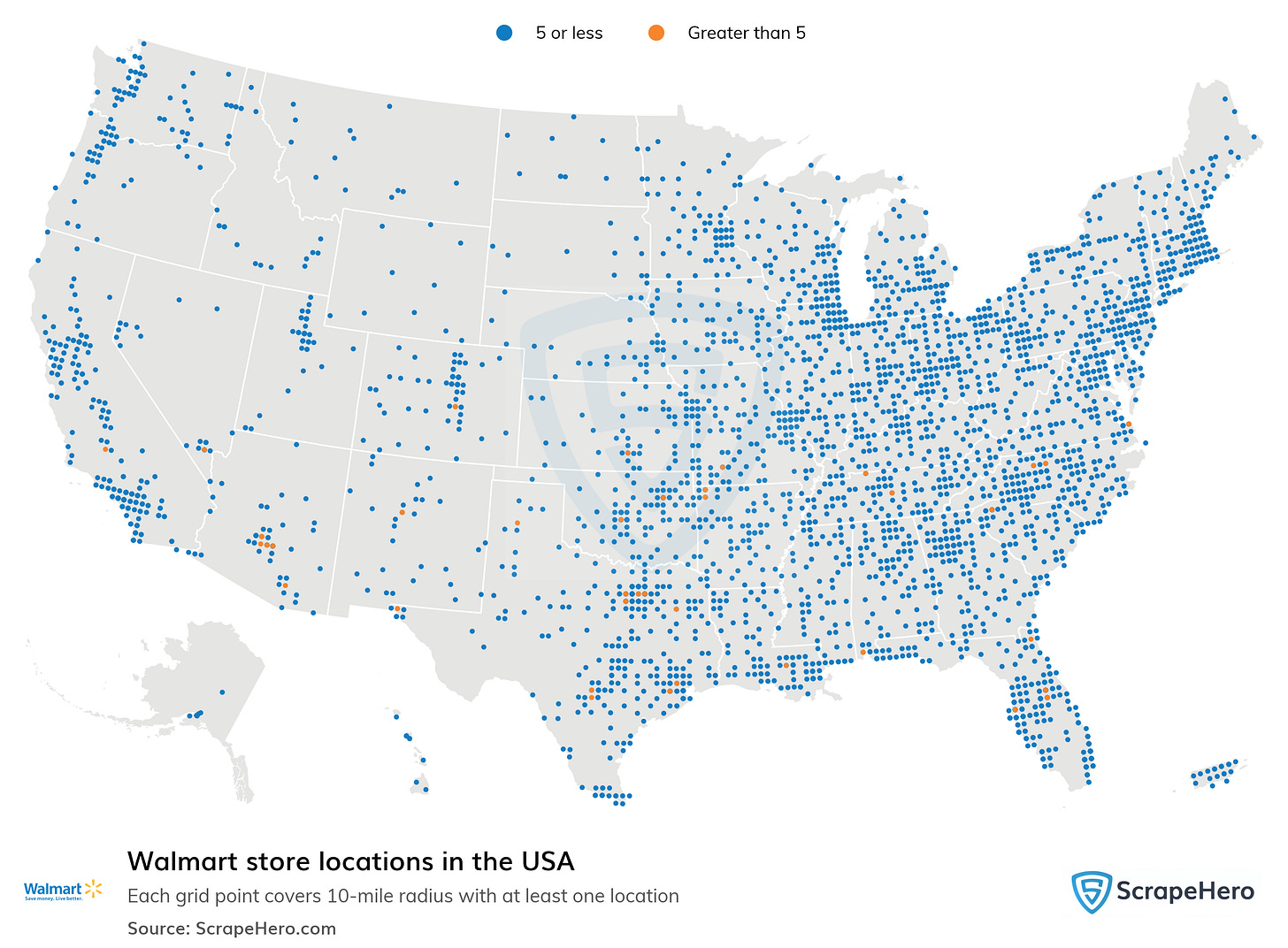

But the biggest e-commerce advantage Walmart has is their store network.

Walmart has more than 4,600 stores in the US, and close to 11,000 worldwide.

Each one of those stores can function as a distribution hub for online orders.

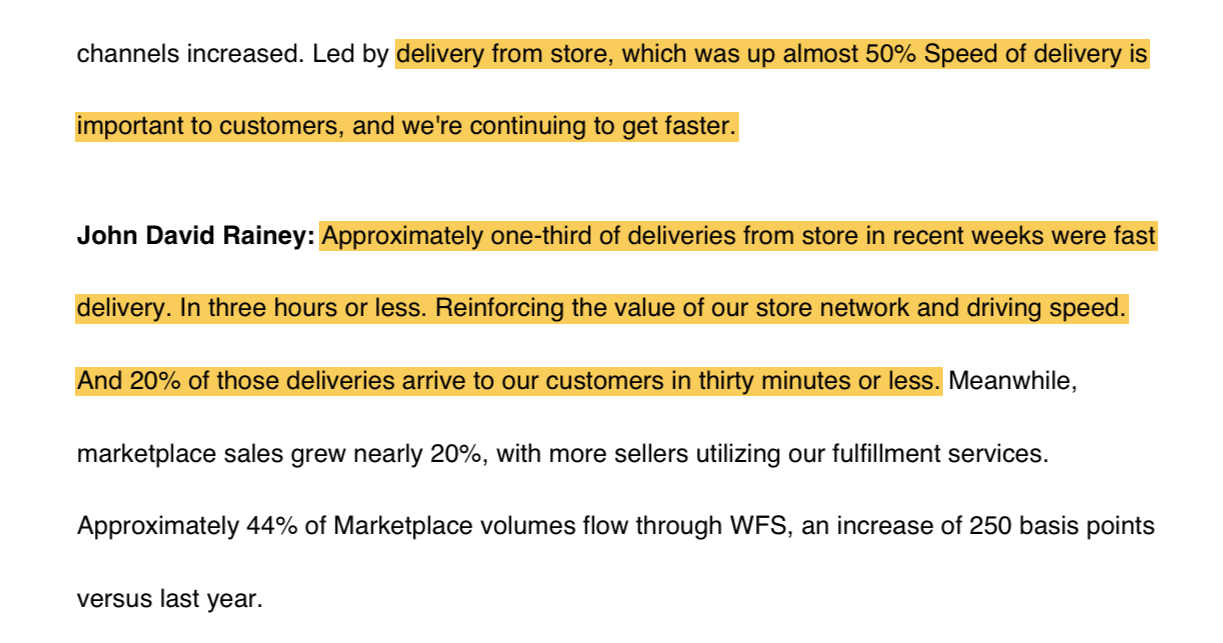

This allows Walmart to deliver orders fast.

Just look at the number of Walmart locations in the U.S.

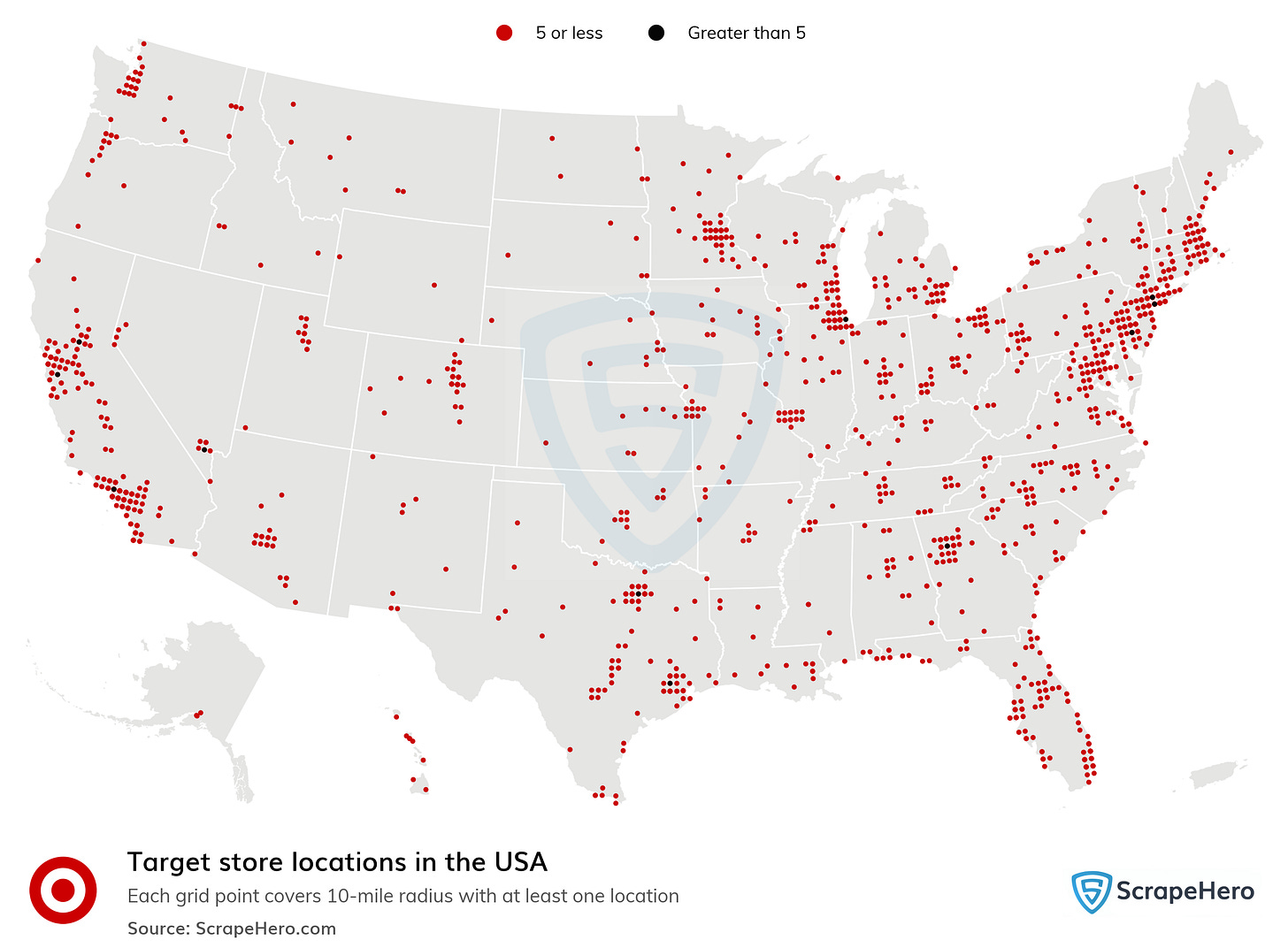

Compare Walmart with Target:

It’s not even close. That’s why Walmart thinks they can deliver to 95% of U.S. households within 3 hours by the end of this year.

And it’s not just in the U.S. that Walmart can deliver quickly:

Under an hour in China and under 15 minutes in India - not many companies can match that.

Another advantage Walmart has over a lot of retailers when it comes to e-commerce and delivery - the other things they can deliver.

When a customer has one thing delivered, they often add other things to the order - so what does Walmart deliver that a lot of the competition doesn’t?

Medications:

How about Sam’s Club pizzas and rotisserie chicken:

The ability to sell online, and deliver quickly is a big advantage for Walmart.

It also drives 2 other growing areas of their business:

Walmart marketplace - lets other sellers list and sell their products on Walmart’s website. Walmart handles the website and checkout, while the sellers manage inventory and shipping. This expands Walmart’s product selection without needing to stock everything themselves.

Walmart+ - a membership program that offers customers benefits like unlimited free delivery on groceries and other items, discounts on fuel, and exclusive deals

In Q2, Marketplace grew 17% and membership grew 15%.

Advertising

Walmart’s fastest-growing business isn’t selling groceries, or online, it’s selling ads.

Total advertising revenue grew 46%.

Walmart Connect, the company’s advertising arm, grew revenue 31% last quarter in the U.S. excluding Vizio (the TV maker Walmart bought).

Sam’s Club U.S. grew advertising revenue grew 24%

Flipkart - an e-commerce platform mainly in India grew ad revenue 15%

Last year, Walmart generated $4.4 billion in advertising revenue.

Brands are willing to pay up because Walmart controls both the shelf space in-store and the data on how people actually shop.

With 4,600 stores and 285 million weekly customers in the U.S., Walmart has unmatched insight into what people actually buy, both in-store and online.

Compared to Amazon’s $56 billion ad business, Walmart’s is still small, but it’s scaling fast and carries much higher margins than retail.

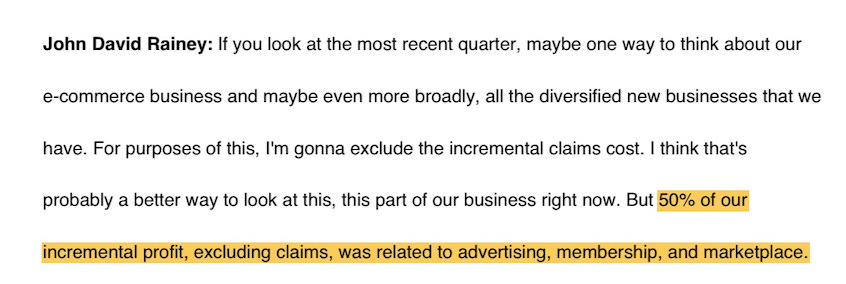

Walmart Is Now 2 Businesses

Walmart is now the traditional retail business that you typically think of - the Sam’s Clubs and Supercenters.

But it’s now also a business selling advertising, memberships, and online.

And that second business has much better margins than the first.

I think this is a really interesting example of how the management team managed to take a very strong existing business, and used it to build into new areas, making the whole company stronger.

And the new businesses are starting to drive serious profit:

Summary and Valuation

Walmart’s Q2 earnings showed more than just a slight miss on estimates.

Beneath the headline numbers, parts of the business are growing at rates you wouldn’t expect from a company this size.

E-commerce sales: 25%

Marketplace sales: 17%

Membership: 15%

Advertising revenue: 46%

Together, these segments are transforming Walmart from a low-margin retailer into a two-part business: the traditional store network and a high-growth, high-margin digital ecosystem.

That shift raises an important question for investors: is the market still valuing Walmart like a slow-moving grocery store, or is it starting to price in the faster-growing, higher-margin engine under the hood?