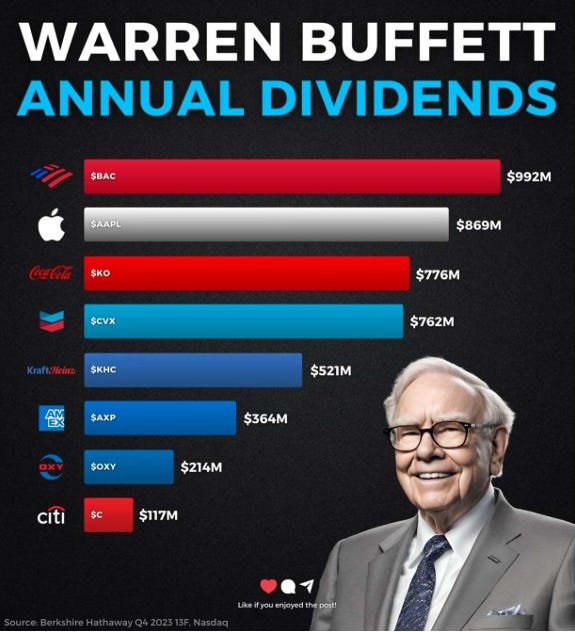

💸 Warren Buffett's Dividends

Every Wednesday it’s Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Warren Buffett’s Dividends

$4.5 billion. That’s how much Warren Buffett collected in dividends last year.

If you ask me, he owns 2 attractive Dividend Aristocrats right now:

Coca-Cola

Chevron

Source: Carbonfinance

We’ll look at all 8 of these companies in Saturday’s article.

2️⃣ $25 per second

Almost $25. That’s how much Coca-Cola pays Warren Buffett in dividends…

… Every second!

Owning dividend stocks can be very rewarding.

Source: carbonfinance

3️⃣ A dividend quote

Buffett likes companies that pay a dividend, but he also likes growth.

Management has to decide the best way to allocate capital.

"If managers can't think of anything else to do with their money they should pay dividends. If they have good places to invest it, that's much better." - Philip Carret

4️⃣ A dividend primer

Middlefield is a private Canadian company specializing in income-producing assets.

Here’s their Dividend Investing Primer:

5️⃣ Example of a dividend stock

A Dividend King is a company that has increased its dividend for the past 50 (!) years.

There are only 53 of them in the market.

W.W. Grainger is one of them. It’s a company that sells maintenance, repair, and operating supplies to businesses.

Examples include tools, industrial parts, cleaning supplies, and safety equipment.

Profit Margin: 11%

Forward PE: 23.5x

Dividend Yield: 0.86%

Payout Ratio: 20.7%

Look at how steadily they’ve increased the dividend payments.

This is something we love to see!

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

The most important section in the Dividend Investment Primer by Middlefield posted here is on page 4. It is titled, "Do not Chase Yield".

I did not fully understand this concept when I started my investment journey. Actually, there were many things I didn't understand back then but that could be a different topic! 🤣 I chased yield without realizing. My thought was, "Why not go for the highest yield?" The dividends did come in for a number of months without any problems. But, I noticed that my initial investment (my principal) was decaying by amounts larger than the dividend payments! Then inflation and rising interest rates came. Soon after came a dividend cut! ✂️ 😮 Ahh, that didn't feel good at all. Nope.

There's usually a trade off between dividend payment (including sustainability and growth) and principle appreciation. Any dividend paid out is that much less a company has to invest in itself for growth like new products and new services. Very rarely can you find a company that can do both at exceedingly high levels. The question every investor needs to ask is what do they want more? Do they want growth of their principle or do they want dividend cash in hand to live off potentially? No wrong answer here.