What If I Don’t Have 30 Years to Compound?

How Dividend Investors Near Retirement Can Still Build a Reliable Income Stream

I got an email from a reader last week with a question:

“This is great and all - but what about seniors who don’t have decades to let their dividends compound?”

It’s not the first time I’ve heard this.

Anytime I write about the power of compounding over 20 or 30 years, someone pushes back. And it’s a valid question.

A 65-year-old doesn’t care what their income looks like in 2055.

They care about this year. And maybe next.

Let’s tackle this head-on.

A Hard Truth

If you’re nearing retirement and haven’t saved enough, dividends won’t bail you out.

It doesn’t matter if your portfolio yields 6% or grows income at 15% per year - if you haven’t built a large enough base, the income just won’t be enough.

In that case, the options are limited - but they do exist:

You might need to work a few more years

Cut spending or delay big expenses

Save more aggressively in the short-term

Or shift part of your portfolio into high-yield dividend stocks or ETFs for immediate income

Each of these comes with trade-offs, but they’re better than pretending the math will magically work out.

The High-Yield Trade-Off

High-yield investing can work. There are portfolios, ETFs, and even bonds out there offering 5%, 6%, or even more in upfront yield.

But here's the trade-off: many of those don’t grow their dividends much - or at all.

If your dividends don't grow faster than inflation, then each year you’ll lose a little bit of purchasing power.

You might get a bigger paycheck today… but the raises might be few and far between. And with lower-quality companies or loans in your portfolio, you’ll also have to stomach the occasional cut to your income.

That’s why we think it’s important to strike a balance.

What We Aim For

In Our Portfolio, we’re focused on growing income, not just chasing high yield.

And we’ve built something I wish more retirees knew was possible:

Our portfolio has a 3.3% yield on cost

That’s as good as or better than many “high-yield” ETFs like:

Vanguard’s High-Yield ETF (VYM) at 2.86%

Federated Hermes’ dividend-focused (FDV) at 3.12%

WisdomTree U.S. High Dividend Fund (DHS) at 3.50%

But more importantly, our portfolio includes companies growing their dividends over 15% per year over the past 5 years on average.

For comparison, SCHD - a favorite among dividend growth investors - has grown its dividend 10.8% per year over the last 5 years. That’s excellent.

Let’s look at a few more 5-year dividend growth rates of “dividend growth” ETFs:

Vanguard Dividend Appreciation Index Fund ETF (VIG): 9.60%

iShares Core Dividend Growth ETF (DGRO): 7.62%

ProShares S&P 500 Dividend Aristocrats ETF (NOBL): 6.35%

By focusing on individual companies with strong fundamentals, good management and long growth runways, we’ve built a portfolio with a higher starting yield than many “high yield” funds, and a higher growth rate than many “dividend growth” funds.

The “Hidden” Time in Retirement

Now, here’s something most people overlook:

Just because you’re 60 or 65 doesn’t mean you don’t have decades left.

Sure, maybe you’re drawing income right now, or plan to be soon.

But if you’re retiring at 60 and live to 85 or 90, that’s 25–30 years.

And unless you're planning to spend down your entire portfolio in 5–10 years, some of your investments will have time to keep compounding well into the future.

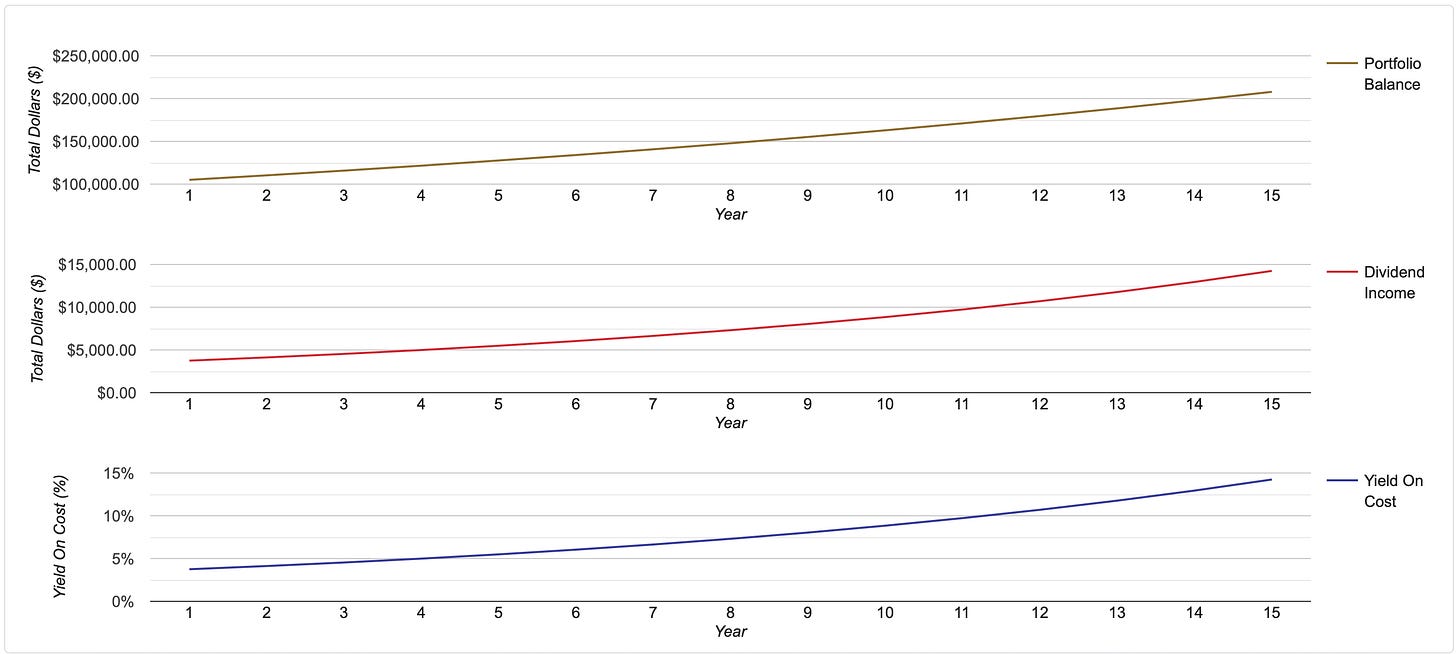

Let’s do some quick math:

Start with a 3.3% yield (like our portfolio)

Grow dividends at 10% per year (lower than what our companies have done)

In 7 years, your income nearly doubles

In 14 years, it nearly quadruples - and your yield on cost is approaching 15%

Reinvest your dividends and it will grow even faster.

And you’re still only in your mid-70s.

The key is starting with a reasonable yield and getting consistent dividend growth from high-quality businesses.

Final Thoughts

If you’re nearing retirement, it’s not too late. But it is time to be realistic:

If you haven’t saved enough, you may need to sacrifice, save more, or supplement with higher-yield strategies

If you have saved enough, you can still use compounding to your advantage - even in retirement

And if you can blend a healthy starting yield with solid dividend growth, you may be shocked at how much your income can grow in just 10–15 years

Dividend investing isn’t just for the young.

It’s for anyone who wants to turn their savings into a growing stream of income - whether you’re 30, 60, or somewhere in between.

One Dividend At A Time

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Starwood Property Trust is a good example of a high yield stock whose dividend hasn't been raised since 2014. The company is a mREIT. It provides financing (mortgages) to other REITs that own property.

The dividend yield is a bit over 9% as I write this comment. It has oscillated between 7% and 11% over the past 10 years. Let's not count the massive spike during the COVID years when everything was tanking.

For those who feel they don't have a long runway, this may look like an attractive stock to purchase for an income stream. Just know that whatever income you get is whatever income you will have. It might as well be a bond. The only way this could turn into something that looks like a dividend grower is to spend way less than the income this stock provides and reinvest that amount. Or, if you have a large sum of cash, like $5M, then 9% will give you $450k. You ought to be able to live a really nice life on that kind of money and have plenty left over to reinvest into more stock. Otherwise, it's "money in" and "money out".